Registration

No. 333-

As

filed with the Securities and Exchange Commission on December 30, 2021

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D. C. 20549

FORM

S-8

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

Presidio

Property Trust, Inc.

(Exact

name of registrant as specified in its charter)

|

Maryland

|

|

33-0841255

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

|

(I.R.S.

Employer

Identification No.)

|

4995

Murphy Canyon Road, Suite 300

San

Diego, California 92123

(Address

of Principal Executive Offices and Zip Code)

Presidio

Property Trust, Inc. 2017 Incentive Award Plan

(Full

title of the plan)

Jack

K. Heilbron

Chief

Executive Officer and President

4995

Murphy Canyon Road, Suite 300

San

Diego, CA 92123

(760)

471-8536

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

to:

Avital

Perlman, Esq.

Darrin

Ocasio, Esq.

Sichenzia

Ross Ference LLP

1185 Avenue of the Americas, 31st Floor

New

York, NY 10036

Telephone: (212) 930-9700

Fax:

(212) 930-9725

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large

accelerated filer ☐

|

Accelerated

filer ☐

|

|

Non-accelerated

filer ☒

|

Smaller

reporting company ☒

|

|

|

Emerging

growth company ☐

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION

OF REGISTRATION FEE

|

Title of securities to be registered

|

|

Amount

to be registered (1)

|

|

|

Proposed maximum offering price per

share (2)

|

|

|

Proposed maximum

aggregate offering price (2)

|

|

|

Amount of registration fee (2)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Series A Common Stock,

par value $0.01 per share

|

|

|

416,549

|

(3)

|

|

$

|

3.89

|

|

|

$

|

1,620,375.61

|

|

|

$

|

150.21

|

|

Series A Common Stock,

par value $0.01 per share

|

|

|

586,620

|

(4)

|

|

$

|

3.89

|

|

|

$

|

2,281,951.80

|

|

|

$

|

211.54

|

|

|

Total

|

|

|

1,003,169

|

|

|

$

|

3.89

|

|

|

$

|

3,902,327.41

|

|

|

$

|

361.75

|

|

|

(1)

|

This

Registration Statement also registers an indeterminable number of additional securities to be offered or issued upon adjustments

or changes made to registered securities by reason of any stock splits, stock dividends or similar transactions as permitted by Rule

416(a) and Rule 416(b) under the Securities Act of 1933, as amended, or the Securities Act.

|

|

(2)

|

The

proposed maximum offering price per share and registration fee were calculated in accordance with Rule 457(c) based on the average

of the high and low prices of the Common Stock reported on the Nasdaq Capital Market on December 28, 2021.

|

|

(3)

|

Represents

386,837 and 29,712 shares, respectively, of restricted Common Stock issued to current and former directors, executive officers and

employees of the registrant pursuant to the Presidio Property Trust, Inc. 2017 Equity Incentive Award Plan (the “2017 Plan”)

and the Presidio Property Trust, Inc. 1999 Flexible Incentive Plan (the “1999 Plan”).

|

|

(4)

|

Represents

shares of Common Stock reserved for future issuance pursuant to the 2017 Plan. The 1999 Plan was superseded by the 2017 Plan.

|

EXPLANATORY

NOTE

This

Registration Statement of Presidio Property Trust, Inc. (“we”, “us”, “our”, the “Company,”

or “Registrant”) contains two parts. The first part contains a reoffer prospectus pursuant to Form S-3 (in accordance with

Section C of the General Instructions to the Form S-8), which covers reoffers and resales of “restricted securities” and/or

“control securities” (as such terms are defined in Section C of the General Instructions to Form S-8). This reoffer prospectus

relates to offers and resales by current and former directors, executive officers and employees of shares of restricted Series A Common

Stock, par value $0.01 per share (the “Common Stock”), of the Company that were issued pursuant to the Presidio

Property Trust, Inc. 2017 Equity Incentive Award Plan (the “2017 Plan”) and the Presidio Property Trust, Inc. 1999 Flexible

Incentive Plan (the “1999 Plan” and, together with the 2017 Plan, the “Plans”). This reoffer prospectus may be

used by the selling stockholders for reoffers and resales on a continuous or delayed basis in the future of up to 416,549 shares of Common

Stock issued pursuant to the Plans. The second part of this Registration Statement contains information required in the Registration

Statement pursuant to Part II of Form S-8.

PART

I

INFORMATION

REQUIRED IN THE SECTION 10(a) PROSPECTUS

|

Item

1.

|

Plan

Information.

|

The

documents containing the information specified in Part I, and the Note to Part I of Form S-8 will be delivered to each of the participants

in accordance with Rule 428 under the Securities Act of 1933, as amended (the “Securities Act”), but these documents and

the documents incorporated by reference in this Registration Statement pursuant to Item 3 of Part II of this Registration Statement,

taken together, constitute a Prospectus that meets the requirements of Section 10(a) of the Securities Act.

|

Item

2.

|

Registrant

Information and Employee Plan Annual Information.

|

We

will provide to each recipient of a grant under the Plans a written statement advising of the availability of documents incorporated

by reference in Item 3 of Part II of this Registration Statement (which documents are incorporated by reference in this Section 10(a)

prospectus) and of documents required to be delivered pursuant to Rule 428(b) under the Securities Act without charge and upon written

or oral request by contacting:

Adam

Sragovicz

Chief

Financial Officer

Presidio

Property Trust, Inc.

4995

Murphy Canyon Road, Suite 300

San

Diego, CA 92123

Phone

number: (619) 391-2364

REOFFER

PROPSECTUS

Presidio

Property Trust, Inc.

416,549

Shares of Series A Common Stock

This

reoffer prospectus (“prospectus”) covers the resale of an aggregate of up to 416,549 shares (the “Shares”) of

our Series A Common Stock, $0.01 par value per share (the “Common Stock”), by the selling stockholders listed in this

prospectus (the “Selling Stockholders”), certain of whom are deemed to be our affiliates, as that term is defined in Rule

405 under the Securities Act of 1933, as amended (the “Securities Act”). The Selling Stockholders acquired such shares pursuant

to grants and awards made under the Presidio Property Trust, Inc. 2017 Incentive Award Plan, referred to in this prospectus as the “2017

Plan” and/or under the Presidio Property Trust, Inc. 1999 Flexible Incentive Plan, referred to in this prospectus as the “1999

Plan” and, together with the 2017 Plan, the “Plans”.

We

will not receive any proceeds from sales of the shares of our Common Stock covered by this prospectus by any of the Selling Stockholders.

The shares may be offered, from time to time, by any or all the Selling Stockholders through ordinary brokerage transactions, in negotiated

transactions or in other transactions, at such prices as they may determine, which may relate to market prices prevailing at the time

of sale or be a negotiated price. See “Plan of Distribution.” We will bear all costs, expenses and fees in connection with

the registration of the shares. Brokerage commissions and similar selling expenses, if any, attributable to the offer or sale of the

shares will be borne by the Selling Stockholders.

Each

Selling Stockholder and any broker executing selling orders on behalf of a Selling Stockholder may be deemed to be an “underwriter”

as defined in the Securities Act. If any broker-dealers are used to effect sales, any commissions paid to broker-dealers and, if broker-dealers

purchase any of the shares of Common Stock covered by this prospectus as principals, any profits received by such broker-dealers on the

resales of shares may be deemed to be underwriting discounts or commissions under the Securities Act. In addition, any profits realized

by the Selling Stockholders may be deemed to be underwriting commissions.

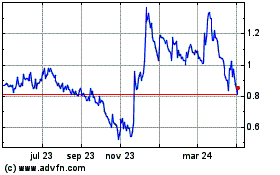

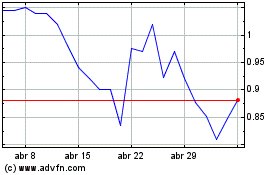

Shares

of our Common Stock are listed on the Nasdaq Capital Market under the symbol “SQFT.” On December 28, 2021, the last

reported sale price of our Common Stock was $3.81 per share.

We

may amend or supplement this reoffer prospectus from time to time by filing amendments or supplements as required. You should read the

entire prospectus, the information incorporated by reference herein and any amendments or supplements carefully before you make your

investment decision.

Investing

in our securities involves a high degree of risk. In reviewing this reoffer prospectus, you should carefully consider the matters described

under the heading “Risk Factors” beginning on page 9.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this reoffer prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this reoffer prospectus is December 30, 2021.

ABOUT

THIS PROSPECTUS

In

this prospectus, the “Company,” “Presidio,” “we,” “us,” “our,” “ours”

and similar terms refer to Presidio Property Trust, Inc. and its consolidated subsidiaries.

Information

on the shares offered pursuant to this reoffer prospectus, as listed below, do not necessarily indicate that the Selling Stockholders

presently intend to sell any or all the shares so listed.

You

should rely only on the information contained in this prospectus or incorporated by reference in this prospectus and in any applicable

prospectus supplement. Neither we nor the Selling Stockholders have authorized anyone to provide you with different information. We and

the Selling Stockholders take no responsibility for and can provide no assurance as to the reliability of, any other information that

others may give you. The information contained in this prospectus, any applicable prospectus supplement and the documents incorporated

by reference herein or therein are accurate only as of the date such information is presented. Our business, financial condition, results

of operations and prospects may have changed since that date. You should also read this prospectus together with the additional information

described under the headings “Incorporation of Certain Information by Reference” and “Where You Can Find More Information.”

This prospectus may be supplemented from time to time to add, update or change information in this prospectus. Any statement contained

in this prospectus will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained

in such prospectus supplement modifies or supersedes such statement. Any statement so modified will be deemed to constitute a part of

this prospectus only as so modified, and any statement so superseded will be deemed not to constitute a part of this prospectus.

The

Selling Stockholders are offering the Common Stock only in jurisdictions where such issuances are permitted. The distribution of this

prospectus and the sale of the Common Stock in certain jurisdictions may be restricted by law. This prospectus does not constitute, and

may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, the Common Stock offered by this prospectus

by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

The

registration statement containing this prospectus, including the exhibits to the registration statement, provides additional information

about us and the securities offered under this prospectus. The registration statement, including the exhibits, can be read on the website

of the Securities and Exchange Commission (the “Commission”) or at the Commission’s offices mentioned under the heading

“Where You Can Find More Information.”

Our

logo and other trade names, trademarks, and service marks of Presidio Property Trust, Inc. appearing in this prospectus are the property

of our Company. Other trade names, trademarks, and service marks appearing in this prospectus are the property of their respective

holders.

The

market data and certain other statistical information used throughout this prospectus and incorporated by reference herein are based

on independent industry publications, government publications and other published independent sources. Although we believe that these

third-party sources are reliable and that the information is accurate and complete, we have not independently verified the information.

Some data is also based on our good faith estimates. While we believe the market data included in this prospectus and the information

incorporated herein and therein by reference is generally reliable and is based on reasonable assumptions, such data involves risks and

uncertainties and is subject to change based on various factors, including those discussed under the heading “Risk Factors”

beginning on page 9 of this prospectus.

PROSPECTUS

SUMMARY

The

following summary highlights material information found in more detail elsewhere in, or incorporated by reference in, this prospectus.

It does not contain all of the information you should consider. As such, before making an investment decision, we urge you to carefully

read the entire prospectus and documents incorporated by reference herein, especially the risks of investing in our securities as discussed

under “Risk Factors” herein and therein.

Overview

We

are an internally managed, diversified real estate investment trust (“REIT”). We invest in a multi-tenant portfolio of commercial

real estate assets comprised of office, industrial, and retail properties and model homes leased back to the homebuilder located primarily

in the western United States. As of September 30, 2021, the Company owned or had an equity interest in:

|

|

●

|

Seven

office buildings and one industrial property (“Office/Industrial Properties”), which total approximately 724,000 rentable

square feet;

|

|

|

●

|

Four

retail shopping centers (“Retail Properties”), which total approximately 121,000 rentable square feet; and

|

|

|

●

|

85

model home residential properties (“Model Homes” or “Model Home Properties”), totaling approximately 255,000

square feet, leased back on a triple-net basis to homebuilders that are owned by six affiliated limited partnerships and one wholly-owned

corporation, all of which we control.

|

We

own five commercial properties located in Colorado, four in North Dakota, two in Southern California and one in Texas. Our model home

properties are located in four states. Our commercial property tenant base is highly diversified and consists of approximately 142 individual

commercial tenants with an average remaining lease term of approximately 3.0 years as of September 30, 2021. As of September 30, 2021,

two commercial tenants represented more than 5.0% of our annualized base rent, while our ten largest tenants represented approximately

35.52% of our annualized base rent. In addition, our commercial property tenant base has limited exposure to any single industry.

In

addition, we also own interests, through our subsidiaries and affiliated limited partnerships, in model homes primarily located in Texas

and Florida. As of September 30, 2021, there were 85 such model homes. We purchase model homes from established residential home builders

and lease them back to the same home builders on a triple-net basis.

Our

main objective is to maximize long-term stockholder value through the acquisition, management, leasing and selective redevelopment of

high-quality office and industrial properties. We focus on regionally dominant markets across the United States which we believe have

attractive growth dynamics driven in part by important economic factors such as strong office-using employment growth; net in-migration

of a highly educated workforce; a large student population; the stability provided by healthcare systems, government or other large institutional

employer presence; low rates of unemployment; and lower cost of living versus gateway markets. We seek to maximize returns through investments

in markets with limited supply, high barriers to entry, and stable and growing employment drivers. Our model home portfolio supports

the objective of maximizing stockholder value by focusing on purchasing new single-family model homes and leasing them back to experienced

homebuilders. We operate the model home portfolio in markets where we can diversify by geography, builder size, and model home purchase

price.

Our

co-founder, Chairman, President and Chief Executive Officer is Jack K. Heilbron, a 40-year veteran in real estate investing, including

eight years with Excel Realty Trust, Inc. (“Excel REIT”), previously an NYSE-listed retail REIT, and one of its predecessor

companies, The Investors Realty Trust (“IRT”), prior to founding our Company. Together with our former Chief Financial

Officer and Treasurer, Kenneth W. Elsberry, Mr. Heilbron founded both our Company and Clover Income and Growth REIT, Inc. (“Clover

REIT”), a private REIT focused on retail mixed-use properties. During Mr. Heilbron’s tenure at Excel REIT, IRT and Clover

REIT, Mr. Heilbron oversaw the investment of substantial real estate assets and saw Clover REIT liquidate at a substantial gain to investors.

Our model home division is led by Larry G. Dubose, a pioneer in the industry who has over 30 years of experience acquiring, financing,

managing, and operating model home sale-leaseback transactions with builders throughout the nation. Our senior management team also includes

Gary M. Katz, Adam Sragovicz, and Ed Bentzen, each of whom has approximately 20 years or more of diverse experience in various aspects

of real estate, including both commercial and residential, management, acquisitions, finance and dispositions in privately-held and publicly

traded companies. We believe this industry experience and depth of relationships provides us with a significant advantage in sourcing,

evaluating, underwriting and managing our investments.

Our

Current Portfolio

Our

commercial portfolio as of September 30, 2021 consisted of 12 properties located in Colorado, North Dakota, California and Texas and

85 model home properties located in four states, with the majority located in Texas and Florida. In August 2021, we acquired a newly-built

franchised national child education provider building located in an affluent area of fast-growing Houston, Texas. This geographical clustering

enables us to minimize operating costs and leverage efficiencies by managing a number of properties utilizing minimal overhead and staff.

Commercial

Portfolio

As

of September 30, 2021, our commercial real estate portfolio consisted of the following properties:

|

Property Location ($ in 000s)

|

|

Sq. Ft.

|

|

|

Date

Acquired

|

|

Year

Property

Constructed

|

|

Purchase

Price (1)

|

|

|

Occupancy

|

|

|

Percent

Ownership

|

|

|

Mortgage

Outstanding

|

|

|

Office/Industrial Properties:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Genesis Plaza, San Diego, CA (2)

|

|

|

57,807

|

|

|

08/10

|

|

1989

|

|

$

|

10,000

|

|

|

|

74.7

|

%

|

|

76.4

|

%

|

|

$

|

6,196

|

|

|

Dakota Center, Fargo, ND

|

|

|

119,434

|

|

|

05/11

|

|

1982

|

|

|

9,575

|

|

|

|

72.3

|

%

|

|

100

|

%

|

|

|

9,734

|

|

|

Grand Pacific Center, Bismarck, ND

|

|

|

93,058

|

|

|

04/14

|

|

1976

|

|

|

5,350

|

|

|

|

56.6

|

%

|

|

100

|

%

|

|

|

3,650

|

|

|

Arapahoe Service Center II, Centennial, CO

|

|

|

79,023

|

|

|

12/14

|

|

2000

|

|

|

11,850

|

|

|

|

100

|

%

|

|

100

|

%

|

|

|

7,812

|

|

|

West Fargo Industrial, West Fargo, ND

|

|

|

150,030

|

|

|

08/15

|

|

1998/2005

|

|

|

7,900

|

|

|

|

89.1

|

%

|

|

100

|

%

|

|

|

4,177

|

|

|

300 N.P., West Fargo, ND

|

|

|

34,517

|

|

|

08/15

|

|

1922

|

|

|

3,850

|

|

|

|

66.8

|

%

|

|

100

|

%

|

|

|

2,243

|

|

|

One Park Centre, Westminster, CO

|

|

|

69,174

|

|

|

08/15

|

|

1983

|

|

|

9,150

|

|

|

|

79.5

|

%

|

|

100

|

%

|

|

|

6,305

|

|

|

Shea Center II, Highlands Ranch, CO

|

|

|

121,301

|

|

|

12/15

|

|

2000

|

|

$

|

25,325

|

|

|

|

96.8

|

%

|

|

100

|

%

|

|

$

|

17,559

|

|

|

Total Office/Industrial Properties

|

|

|

724,334

|

|

|

|

|

|

|

$

|

83,000

|

|

|

|

81.5

|

%

|

|

|

|

|

$

|

57,676

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Retail Properties:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

World Plaza, San Bernardino, CA (3)

|

|

|

55,810

|

|

|

09/07

|

|

1974

|

|

|

7,650

|

|

|

|

100

|

%

|

|

100

|

%

|

|

|

—

|

|

|

Union Town Center, Colorado Springs, CO

|

|

|

44,042

|

|

|

12/14

|

|

2003

|

|

|

11,212

|

|

|

|

75.6

|

%

|

|

100

|

%

|

|

|

8,198

|

|

|

Research Parkway, Colorado Springs, CO

|

|

|

10,700

|

|

|

08/15

|

|

2003

|

|

|

2,850

|

|

|

|

100.0

|

%

|

|

100

|

%

|

|

|

1,720

|

|

|

Mandolin, Houston, TX (4)

|

|

|

10,500

|

|

|

08/21

|

|

2021,

|

|

|

4,892

|

|

|

|

100.0

|

%

|

|

61.3

|

%

|

|

|

—

|

|

|

Total Retail Properties

|

|

|

121,052

|

|

|

|

|

|

|

$

|

26,604

|

|

|

|

91.1

|

%

|

|

|

|

|

$

|

9,918

|

|

|

Total Commercial Properties (5)

|

|

|

845,396

|

|

|

|

|

|

|

$

|

109,604

|

|

|

|

82.9

|

%

|

|

|

|

|

$

|

67,594

|

|

|

|

(1)

|

Prior

to January 1, 2009, “Purchase Price” includes our acquisition related costs and expenses for the purchase of the property.

After January 1, 2009, acquisition related costs and expenses were expensed when incurred.

|

|

|

(2)

|

Genesis

Plaza is owned by two tenants-in-common, each of which 57% and 43%, respectively, and we beneficially own an aggregate of 76.4%.

|

|

|

(3)

|

This

property is held for sale as of September 30, 2021.

|

|

|

(4)

|

A

portion of the proceeds from the sale of Highland Court were used in like-kind exchange transactions pursued under Section 1031 of

the Internal Revenue for the acquisition of our Mandolin property. Mandolin is owned by NetREIT Palm Self-Storage LP, through its

wholly owned subsidiary NetREIT Highland LLC, and the Company is the sole general partner and owns 61.3% of NetREIT Palm Self-Storage

LP.

|

|

|

(5)

|

This

table does not include a commercial building purchased on December 22, 2021 in Baltimore, Maryland, which is wholly owned by the

Company and 100% leased.

|

For

additional information about annual base rent for our commercial properties, please see “Annualized Base Rent Per Square Foot for

Last Three Years” in our “Business and Property” section.

Model

Home Portfolio

Our

model home division utilizes newly-built single family model homes as an investment vehicle. Our model home division purchases model

homes from, and leases them back to, homebuilders as commercial tenants on a triple-net basis. These triple-net investments in which

the commercial homebuilders bear the expenses of operations, maintenance, real estate taxes and insurance (in addition to defraying monthly

mortgage payments), alleviate significant cost and risk normally associated with holding single family homes for speculative sale or

for lease to residential tenants.

The

following table shows a list of our Model Home properties by geographic region as of September 30, 2021:

|

Geographic Region

|

|

No. of

Properties

|

|

|

Aggregate

Square

Feet

|

|

|

Approximate %

of Square

Feet

|

|

|

Current

Base

Annual

Rent

|

|

|

Approximate

of Aggregate

% Annual

Rent

|

|

|

Southwest

|

|

|

79

|

|

|

|

237,416

|

|

|

|

92.4

|

%

|

|

$

|

2,206,128

|

|

|

|

90.0

|

%

|

|

Southeast

|

|

|

3

|

|

|

|

8,201

|

|

|

|

3.0

|

%

|

|

|

61,528

|

|

|

|

3.3

|

%

|

|

Northeast

|

|

|

2

|

|

|

|

6,153

|

|

|

|

2.2

|

%

|

|

|

80,844

|

|

|

|

3.0

|

%

|

|

Midwest

|

|

|

1

|

|

|

|

3,663

|

|

|

|

2.4

|

%

|

|

|

57,420

|

|

|

|

3.7

|

%

|

|

Total

|

|

|

85

|

|

|

|

255,433

|

|

|

|

100

|

%

|

|

$

|

2,405,920

|

|

|

|

100

|

%

|

Our

Investment Approach

Our

Commercial Property Investment Approach

We

acquire high-quality commercial properties in overlooked and/or underserved markets, where we believe we can create long-term stockholder

value. Our potential commercial investments are extensively reviewed based on several characteristics, including:

|

|

●

|

Market

Research. We invest in properties within regionally dominant markets that we believe to be overlooked. We analyze potential markets

for the key indicators that we feel will provide us higher risk adjusted returns. These indicators may include a net in-migration

of highly educated workers, business friendly governmental policies, large university populations, accessible healthcare systems

and available housing. We believe this quantitative approach will result in property acquisitions in markets with substantially higher

demand for high quality commercial real estate.

|

|

|

●

|

Real

Estate Enhancement. We typically acquire properties where we believe market demand is such that values can be significantly enhanced

through repositioning strategies, such as upgrading common areas and tenant spaces, re-tenanting and leasing vacant space. We expect

that these strategies will increase rent and occupancy while enhancing long-term value.

|

|

|

●

|

Portfolio

Management. We believe our target markets have benefited from substantial economic growth, which provides us with opportunities

to achieve long-term value and ultimately sell properties and recycle capital into properties offering a higher risk-adjusted return.

We have achieved substantial returns in the past from the operation, repositioning, and sale of properties. We continue to actively

manage our properties to maximize the opportunity to recycle capital.

|

Our

Model Home Property Investment Approach

Model

homes are single-family homes constructed by builders for the purpose of showcasing floor plans, elevations, optional features, and workmanship

when marketing the development where the homes are located. Each model home is designed to be held for a minimum lease term (usually

three years), after which the model home is listed for sale at the estimated fair market value. Our model home business operates independently

in Houston, Texas, with minimal time commitment by senior management. We seek to purchase model homes, at a 5% to 10% discount, that

have a likelihood of appreciation within the expected three-year term of the lease and anticipate unlevered pro forma returns over 8%

during our holding period and expected lease term. Our model home leaseback agreements are triple-net, requiring the homebuilder/tenant

to pay all operating expenses. We seek model homes in a variety of locations, a variety of price ranges, and from a variety of builders

and developers to diversify the risk from economic conditions that may adversely affect a particular development or location.

During

the nine months ended September 30, 2021, we acquired six model homes for approximately $2.9 million. The purchase price was paid through

cash payments of approximately $0.9 million and mortgage notes of approximately $2.0 million. During the nine months ended September

2021, we disposed of 39 model homes for approximately $19.0 million and recognized a gain of approximately $2.9 million. During the year

ended December 31, 2020, we sold 46 model homes for approximately $18.1 million and recognized a gain of approximately $1.6 million.

During the year ended December 31, 2019, we sold 41 model homes for approximately $14.6 million and recognized a gain of approximately

$1.2 million. We believe that our model home business provides incentives to builders by allowing them to redeploy capital, use sales

proceeds to pay down lines of credit, accelerate their internal rate of return calculations, improve margins and inventory turnover,

and provides diversification of their risk.

Our

Growth Strategy

Our

principal business objective is to provide attractive risk-adjusted returns to our stockholders through a combination of (i) sustainable

and increasing rental income and cash flow that generates reliable, increasing dividends and (ii) potential long-term appreciation in

the value of our properties and securities. Our primary strategy to achieve our business objective is to invest in, own and manage a

diverse multi-tenant portfolio of high-quality commercial properties in promising regionally dominant markets, which we believe will

drive higher tenant retention and occupancy.

Our

Commercial Property Growth Strategy

We

intend to grow our commercial portfolio by acquiring high-quality properties in our target markets. We may selectively invest in industrial,

office, retail, triple net and other properties where we believe we can achieve higher risk-adjusted returns for our stockholders. We

expect that our extensive broker and seller relationships will benefit our acquisition activities and help set us apart from competing

buyers. In addition, we continue to actively manage our portfolio of commercial properties and continue to redeploy capital through the

opportunistic sale of certain commercial properties.

We

typically purchase properties at what we believe to be a discount to the replacement value of the property. We seek to enhance the value

of these properties through active asset management where we believe we can increase occupancy and rent. We typically achieve this growth

through value-added investments in these properties, such as common area renovations, enhancement of amenities, improved mechanical systems,

and other value-enhancing investments. We generally will not invest in ground-up development as we believe our target markets’

rental rates are below those needed to justify new construction.

Our

Model Home Growth Strategy

We

intend to purchase model homes that are in the “move-up market” and in the first-time homebuyer market. The purchase of model

homes will be from builders that have sufficient assets to fulfill their lease obligations and with model homes that offer a good opportunity

for appreciation upon their sale. Sales proceeds from model homes will typically be reinvested to acquire new model homes.

Our

Pipeline

Our

pipeline is comprised of several properties under various stages of review, with individual projected purchase prices ranging from approximately

$5 million to $25 million. The pipeline is composed of triple-net, industrial, general office, needs-based retail, and medical office

properties.

Our

Competitive Strengths

We

believe that our management team’s extensive public REIT and general real estate experience distinguishes us from many other public

and private real estate companies. Specifically, our competitive strengths include, among others:

|

|

●

|

Experienced

Senior Management Team. Our senior management team has over 75 combined years of experience with public-reporting companies,

including real estate experience with a number of other publicly traded companies and institutional investors. We are the third REIT

to be co-founded by our CEO, providing us with core real estate experience in addition to substantial public market experience. We

have operated as a publicly-reporting company since 2009.

|

|

|

|

|

|

|

●

|

Investment

Focus. We believe that our focus on attractive regionally dominant markets provides higher risk-adjusted returns than other public

REITs and institutional investors which are focused on gateway markets and major metropolitan areas, as our target markets provide

less competition resulting in higher initial returns and greater opportunities to enhance value through institutional quality asset

management.

|

|

|

|

|

|

|

●

|

Nimble

Management Execution. Our principal focus is on acquiring commercial properties offering immediate yield, combined with identifiable

value-creation opportunities. We operate in niche geographies, targeting acquisitions valued at between $10 million and $30 million

to limit competition from larger, better capitalized buyers focused on core markets. We continue to identify and execute these types

and sizes of transactions efficiently, which we believe provides us an advantage over other institutional investors, including larger

REITs that focus on larger properties or portfolios in more competitively marketed investment transactions.

|

|

|

|

|

|

|

●

|

Extensive

Broker and Seller Relationships. Our senior management team has developed extensive broker and seller relationships, which remain

vital to our acquisition efforts. Of our 12 acquisitions since 2014, nine of these transactions were procured either off-market or

through brokers with whom we have a historical relationship. We expect these relationships, as well as our ability to establish such

relationships in new markets, to provide valuable access to an acquisition pipeline.

|

Our

REIT Status

We

elected to be taxed as a REIT for federal income tax purposes commencing with our taxable year ended December 31, 2001. To continue to

be taxed as a REIT, we must satisfy numerous organizational and operational requirements, including a requirement that we distribute

at least 90% of our REIT taxable income to our stockholders, as defined in the Code and calculated on an annual basis. As a REIT, we

are generally not subject to federal income tax on income that we distribute to our stockholders. If we fail to qualify for taxation

as a REIT in any year, our income will be taxed at regular corporate rates, and we may be precluded from qualifying for treatment as

a REIT for the four-year period following our failure to qualify. Even though we qualify as a REIT for federal income tax purposes, we

may still be subject to state and local taxes on our income and property and to federal income and excise taxes on our undistributed

income. For more information, please see “U.S. Federal Income Tax Considerations.”

Organizational

Structure

The

following chart summarizes our current ownership structure:

Distribution

Policy

We

plan to distribute at least 90% of our annual REIT taxable income to our stockholders in order to maintain our status as a REIT.

We

intend to declare quarterly distributions. To be able to pay such dividends, our goal is to generate cash distributions from operating

cash flow and proceeds from the sale of properties. During 2020, 2019, and 2018, we declared distributions on our Series A Common Stock

of approximately $1.0 million each year. During the nine months ended September 30, 2021, the Company paid three cash dividends to the

holders of shares of Series A Common Stock of approximately $1.0 million or $0.101 per share, approximately $1.0 million or $0.102 per

share, and approximately $1.03 million or $0.103 per share. On November 23, 2021, the Company announced that it would pay a cash dividend

of approximately $0.104 per share, on December 20, 2021 to all stockholders of record as of the close of business on December 6, 2021.

Additionally, pursuant to the terms of our Series D Preferred Stock, since the date of issuance of shares of Series D Preferred Stock

through September 30, 2021, we have declared a dividend of approximately $539,000. Of that amount, $455,000 was paid during the three

months ended September 30, 2021. We paid dividends on the Series D Preferred Stock of $179,685 on each of October 15, 2021 and December

15, 2021. However, we cannot provide any assurance as to the amount or timing of future distributions. For example, our distributions

were suspended for the periods from the third quarter of 2017 through the third quarter of 2018 and from the second quarter of 2019 through

the third quarter of 2020.

To

the extent that we make distributions in excess of our earnings and profits, as computed for federal income tax purposes, these distributions

will represent a return of capital, rather than a dividend, for federal income tax purposes. Distributions that are treated as a return

of capital for federal income tax purposes generally will not be taxable as a dividend to a U.S. stockholder, but will reduce the stockholder’s

basis in its shares (but not below zero) and therefore can result in the stockholder having a higher gain upon a subsequent sale of such

shares. Return of capital distributions in excess of a stockholder’s basis generally will be treated as gain from the sale of such

shares for federal income tax purposes.

We

provide each of our stockholders a statement detailing distributions paid during the preceding year and their characterization as ordinary

income, capital gain or return of capital. During the year ended December 31, 2020, all dividends were non-taxable as they were considered

return of capital to the stockholders. During the year ended December 31, 2019, all dividends were taxable as they were considered capital

gain to the stockholders.

Additional

Information

Additional

information about us can be obtained from the documents incorporated by reference herein. See “Where You Can Find More Information.”

Our

Contact Information

Our

executive offices are located at 4995 Murphy Canyon Road, Suite 300, San Diego, California 92123. Our telephone number is (760) 471-8536.

We maintain an internet website at www.presidiopt.com. Information on, or accessible through, our website is not a part of, and

is not incorporated into, this prospectus or the registration statement of which it forms a part.

RISK

FACTORS

An

investment in shares of our Common Stock is highly speculative and involves a high degree of risk. We face a variety of risks that may

affect our operations or financial results and many of those risks are driven by factors that we cannot control or predict. Before investing

in our Common Stock, you should carefully consider the risks below and set forth under the caption “Risk Factors” in our

Annual Report on Form 10-K for the fiscal year ending December 31, 2020, which are incorporated by reference herein, and subsequent reports

filed with the Commission, together with the financial and other information contained or incorporated by reference in this prospectus.

If any of these risks occur, our business, prospects, financial condition and results of operations could be materially adversely affected.

In that case, the trading price of our Common Stock would likely decline and you may lose all or a part of your investment. Only those

investors who can bear the risk of loss of their entire investment should invest in our Common Stock.

We

could be prevented from paying cash dividends on the Common Stock due to prescribed legal requirements.

Holders

of shares of Common Stock will not receive dividends on such shares unless authorized by our Board of Directors and declared by us. Under

Maryland law, cash dividends on stock may only be paid if, after giving effect to the dividends, our total assets exceed our total liabilities,

and we are able to pay our indebtedness as it becomes due in the ordinary course of business. Unless we operate profitably, our ability

to pay cash dividends on the Common Stock may be negatively impacted. Our business may not generate sufficient cash flow from operations

to enable us to pay dividends on the Common Stock when payable. Further, even if we meet the applicable solvency tests under Maryland

law to pay cash dividends on the Common Stock described above, we may not have sufficient cash to pay dividends on the Common Stock.

Furthermore,

no dividends on Common Stock shall be authorized by our Board of Directors or paid, declared or set aside for payment by us at any time

when the authorization, payment, declaration or setting aside for payment would be unlawful under Maryland law or any other applicable

law. Holders of the Series D Preferred Stock will be entitled to receive cumulative cash dividends at a rate of 9.375% per annum of the

$25.00 per share liquidation preference (equivalent to $2.34375 per annum per share). We will not pay dividends on our Common Stock,

unless and until, we pay the required dividend to our Series D Preferred Stock holders.

Our

bylaws provide that, unless we consent in writing to the selection of an alternative forum, the Circuit Court for Baltimore City, Maryland,

or, if that court does not have jurisdiction, the United States District Court for the District of Maryland, Baltimore Division, will

be the sole and exclusive forum for certain actions, which could limit our stockholders’ ability to obtain a favorable

judicial forum for disputes with the Company.

Our

bylaws provide that, unless we consent in writing to the selection of an alternative forum, the Circuit Court for Baltimore City, Maryland,

or, if that court does not have jurisdiction, the United States District Court for the District of Maryland, Baltimore Division, will

be the sole and exclusive forum for (a) any derivative action or proceeding brought on our behalf, (b) any action asserting a claim of

breach of any duty owed by any of our directors, officers or other employees to us or to our stockholders, (c) any action asserting a

claim against us or any of our directors, officers or other employees arising pursuant to any provision of the MGCL or our charter or

bylaws or (d) any action asserting a claim against us or any of our directors, officers or other employees that is governed by the internal

affairs doctrine. This forum selection provision in our bylaws may limit our stockholders’ ability to obtain a favorable judicial

forum for disputes with us or any our directors, officers or other employees.

If

the Common Stock is delisted from Nasdaq, the ability to transfer or sell shares of the Common Stock may be limited and the market value

of the Common Stock will likely be materially adversely affected.

Our

Common Stock does not contain provisions that are intended to protect investors if our Common Stock is delisted from Nasdaq. If the Common

Stock is delisted from Nasdaq, investors’ ability to transfer or sell shares of the Common Stock will be limited and the market

value of the Common Stock will likely be materially adversely affected. Moreover, since the Common Stock has no stated maturity date,

investors may be forced to hold shares of the Common Stock indefinitely while receiving stated dividends thereon when, as and if authorized

by our Board of Directors and paid by us with no assurance as to ever receiving the liquidation value thereof.

Market

interest rates may have an effect on the value of the Common Stock.

One

of the factors that will influence the price of the Common Stock will be the distribution yield on the Common Stock (as a percentage

of the market price of the Common Stock) relative to market interest rates. An increase in market interest rates, which are currently

at low levels relative to historical rates, may lead prospective purchasers of the Common Stock to expect a higher distribution yield

(and higher interest rates would likely increase our borrowing costs and potentially decrease funds available for distribution payments).

Thus, higher market interest rates could cause the market price of the Common Stock to decrease and reduce the amount of funds that are

available and may be used to make distribution payments.

In

the event of a liquidation, you may not receive the full amount of your liquidation preference.

In

the event of our liquidation, the proceeds will be used first to repay indebtedness and then to pay holders of shares of any class or

series of our stock ranking senior to the Common Stock as to liquidation, including our 9.375% Series D Cumulative Redeemable Perpetual

Preferred Stock, $0.01 par value per share (the “Series D Preferred Stock”), in an amount of each holder’s liquidation

preference and accrued and unpaid distributions through the date of payment, prior to any payment being made to holders of our Common

Stock. In the event we have insufficient funds to make payments in full to holders of the shares of the Common Stock and any other class

or series of our stock ranking on parity with the Common Stock as to liquidation, such funds will be distributed ratably among such holders

and such holders may not realize the full amount of their liquidation preference.

The

market price of the Common Stock could be substantially affected by various factors.

The

market price of the Common Stock could be subject to wide fluctuations in response to numerous factors. The price of the Common Stock

that will prevail in the market after this offering may be higher or lower than the offering price depending on many factors, some of

which are beyond our control and may not be directly related to our operating performance.

These

factors include, but are not limited to, the following:

|

|

●

|

prevailing

interest rates, increases in which may have an adverse effect on the market price of the Common Stock;

|

|

|

|

|

|

|

●

|

trading

prices of similar securities;

|

|

|

|

|

|

|

●

|

our

history of timely dividend payments;

|

|

|

|

|

|

|

●

|

the

annual yield from dividends on the Common Stock as compared to yields on other financial instruments;

|

|

|

|

|

|

|

●

|

general

economic and financial market conditions;

|

|

|

|

|

|

|

●

|

government

action or regulation;

|

|

|

|

|

|

|

●

|

the

financial condition, performance and prospects of us and our competitors;

|

|

|

|

|

|

|

●

|

changes

in financial estimates or recommendations by securities analysts with respect to us or our competitors in our industry;

|

|

|

|

|

|

|

●

|

our

issuance of additional preferred equity or debt securities;

|

|

|

|

|

|

|

●

|

actual

or anticipated variations in quarterly operating results of us and our competitors;

|

|

|

|

|

|

|

●

|

actual

or anticipated variations in our quarterly results of operations or distributions, including as a result of the recent COVID-19 pandemic

and its impact on our business, financial condition, results of operations and cash flows;

|

|

|

|

|

|

|

●

|

changes

in our FFO, earnings estimates or recommendations by securities analysts;

|

|

|

|

|

|

|

●

|

publication

of research reports about us or the real estate industry generally;

|

|

|

|

|

|

|

●

|

the

extent of investor interest;

|

|

|

|

|

|

|

●

|

publication

of research reports about us or the real estate industry;

|

|

|

|

|

|

|

●

|

increases

in market interest rates that lead purchasers of our shares to demand a higher yield;

|

|

|

|

|

|

|

●

|

changes

in market valuations of similar companies;

|

|

|

|

|

|

|

●

|

strategic

decisions by us or our competitors, such as acquisitions, divestments, spin-offs, joint ventures, strategic investments or changes

in business strategy;

|

|

|

|

|

|

|

●

|

the

reputation of REITs generally and the reputation of REITs with portfolios similar to ours;

|

|

|

|

|

|

|

●

|

the

attractiveness of the securities of REITs in comparison to securities issued by other entities (including securities issued by other

real estate companies);

|

|

|

|

|

|

|

●

|

adverse

market reaction to any additional debt that we incur or acquisitions that we make in the future;

|

|

|

|

|

|

|

●

|

additions

or departures of key management personnel;

|

|

|

|

|

|

|

●

|

future

issuances by us of our common stock or other equity securities;

|

|

|

|

|

|

|

●

|

actions

by institutional or activist stockholders;

|

|

|

|

|

|

|

●

|

speculation

in the press or investment community;

|

|

|

|

|

|

|

●

|

the

realization of any of the other risk factors presented in this prospectus; and

|

|

|

|

|

|

|

●

|

general

market and economic conditions.

|

As

a result of these and other factors, investors who purchase the Common Stock in this offering may experience a decrease, which could

be substantial and rapid, in the market price of the Common Stock, including decreases unrelated to our operating performance or prospects.

If

a substantial number of shares become available for sale and are sold in a short period of time, the market price of our Common Stock

could decline.

A

large volume of sales of shares of our Common Stock could further decrease the prevailing market price of such shares and could impair

our ability to raise additional capital through the sale of equity securities in the future. Even if sales of a substantial number of

shares of our Common Stock are not effectuated, the perception of the possibility of these sales could depress the market price for such

shares and have a negative effect on our ability to raise capital in the future.

Upon

completion of this offering, we will have 11,898,191 shares of Common Stock outstanding (excluding shares of Common Stock issuable upon

exercise of existing outstanding warrants or warrants that we may issue as dividends pursuant to our Registration Statement on Form S-11

initially filed with the Commission on November 9, 2021, which has not yet been declared effective). If our stockholders sell substantial

amounts of our Common Stock in the public market following this offering, the market price of our Common Stock could decrease significantly.

The perception in the public market that our stockholders might sell shares of Common Stock could also depress our market price. A decline

in the price of shares of our Common Stock might impede our ability to raise capital through the issuance of additional shares of our

Common Stock or other equity securities and could result in a decline in the value of the shares of our Common Stock purchased in this

offering.

Broad

market fluctuations could negatively impact the market price of our Common Stock.

Stock

market price and volume fluctuations could affect the market price of many companies in industries similar or related to ours and that

have been unrelated to these companies’ operating performance. These fluctuations could reduce the market price of our Common Stock.

Furthermore, our results of operations and prospects may be below the expectations of public market analysts and investors or may be

lower than those of companies with comparable market capitalizations. Either of these factors could lead to a material decline in the

market price of our Common Stock.

The

market price of our Common Stock could be adversely affected by our level of cash distributions.

The

market’s perception of our growth potential and our current and potential future cash distributions, whether from operations, sales

or refinancing, as well as the real estate market value of the underlying assets, may cause our Common Stock to trade at prices that

differ from our net asset value per share. If we retain operating cash flow for investment purposes, working capital reserves or other

purposes, these retained funds, while increasing the value of our underlying assets, may not correspondingly increase the market price

of our Common Stock. Our failure to meet the market’s expectations with regard to future earnings and cash distributions likely

would adversely affect the market price of our Common Stock.

Future

offerings of debt, which would be senior to our Common Stock upon liquidation, and any preferred equity securities that may be issued

and be senior to our Common Stock for purposes of dividend distributions or upon liquidation, may adversely affect the market price of

our Common Stock.

In

the future, we may seek additional capital and commence offerings of debt or preferred equity securities, including medium-term notes,

senior or subordinated notes and preferred stock. Upon liquidation, holders of our debt securities and shares of preferred stock, including

our Series D Preferred Stock, and lenders with respect to other borrowings will receive distributions of our available assets prior to

the holders of our Common Stock. Future shares of preferred stock, if issued, could have a preference on liquidating distributions or

dividend payments that could limit our ability to pay a dividend or make another distribution to the holders of our Common Stock.

Our decision to issue securities in any future offering will depend on market conditions and other factors beyond our control, and

consequently, we cannot predict or estimate the amount, timing or nature of our future offerings. Thus, our stockholders bear the risk

of our future offerings reducing the market price of our Common Stock and diluting their stock holdings in us.

A

future issuance of stock could dilute the value of our Common Stock.

We

may sell additional shares of Common Stock, or securities convertible into or exchangeable for such shares, in subsequent public or private

offerings. Upon completion of this offering, there will be 11,898,191 shares of our Common Stock (excluding shares of Common Stock issuable

upon exercise of the existing outstanding warrants and warrants issuable as dividends pursuant to our Registration Statement on Form

S-11 initially filed with the Commission on November 9, 2021, which has not yet been declared effective) and 920,000 shares of our Series

D Preferred Stock issued and outstanding. Those shares outstanding do not include the potential issuance, as of the date of this prospectus,

of approximately 586,620 shares of our Common Stock that will be available for future issuance under the 2017 Plan. Future issuance of

any new shares could cause further dilution in the value of our outstanding shares of Common Stock. We cannot predict the size of future

issuances of our Common Stock, or securities convertible into or exchangeable for such shares, or the effect, if any, that future issuances

and sales of shares of our Common Stock will have on the market price of our Common Stock. Sales of substantial amounts of our Common

Stock, or the perception that such sales could occur, may adversely affect prevailing market prices of our Common Stock.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus and any accompanying prospectus supplement and the documents incorporated by reference herein include forward-looking statements

within the meaning of Section 27A of the Securities Act and Section 21B of the Securities Exchange Act of 1934, as amended, or the Exchange

Act. All statements other than statements of historical fact contained or incorporated by reference in this prospectus are forward-looking

statements. The words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,”

“intend,” “expect,” and similar expressions, as they relate to us, are intended to identify forward-looking statements.

We have based these forward-looking statements on our current expectations and projections about future events and financial trends that

we believe may affect our financial condition, results of operations, business strategy, business prospectus, growth strategy, and liquidity.

These forward-looking statements are subject to a number of known risks, unknown risks, uncertainties and assumptions, and our actual

results could differ materially from those anticipated in forward-looking statements for many reasons, including the factors described

in the “Risk Factors” section of this prospectus, and the sections entitled “Risk Factors” and “Management’s

Discussion and Analysis of Financial Condition and Results of Operation,” in our most recent Annual Report on Form 10-K and Quarterly

Report on Form 10-Q filed with the Commission.

The

forward-looking statements speak as of the date made and are not guarantees of future performance. Actual results or developments may

differ materially from the expectations expressed or implied in the forward-looking statements, and we undertake no obligation to update

any such statements. You should not place undue reliance on these forward-looking statements.

You

should carefully read the factors described in the “Risk Factors” section of any prospectus supplement or other offering

material, as well as any risks described in the documents incorporated by reference into this prospectus for a description of certain

risks that could, among other things, cause our actual results to differ from these forward-looking statements. You should understand

that it is not possible to predict or identify all such factors, and that this list should not be considered a complete statement of

all potential risks and uncertainties. You should also realize that if the assumptions we have made prove inaccurate, or if unknown risks

and/or uncertainties materialize, actual results could vary materially from the views and estimates included or incorporated by reference

in this prospectus.

USE

OF PROCEEDS

We

will not receive any proceeds from sales of the shares of our Common Stock covered by this prospectus by any of the Selling

Stockholders. The proceeds from the sale of the Common Stock covered by this prospectus are solely for the accounts of the Selling

Stockholders.

We

will bear all costs, expenses, and fees in connection with the registration of the shares. Brokerage commissions and similar selling

expenses, if any, attributable to the offer or sale of the shares, will be borne by the Selling

Stockholders.

SELLING

STOCKHOLDERS

This

reoffer prospectus covers the reoffer and resale by the Selling Stockholders listed below

of an aggregate of up to 416,549 shares of our Common Stock previously issued under the Plans and available for resale, which constitute

“restricted securities” or “control securities” within the meaning of Form S-8.

The

following table sets forth, as of December 27, 2021 (the “Date of Determination”), the number of shares beneficially owned

by each current Selling Stockholder to the best of our knowledge. The number of shares in

the column “Shares Beneficially Owned Prior to the Offering” represents the total number of shares that a Selling

Stockholder currently owns or has the right to acquire within sixty (60) days of the Date of Determination. The number of shares

in the column “Number of Shares Being Offered,” represents all the shares that a Selling

Stockholder may offer under this reoffer prospectus. The number of shares in the column “After the Offering” and footnotes

assume that the Selling Stockholders will sell all of the shares listed in the column “Number

of Shares Being Offered Hereby.” However, because the Selling Stockholders may sell

all or some of their shares under this reoffer prospectus from time to time, or in another permitted manner, we cannot assure you as

to the actual number of shares that will be sold by the Selling Stockholders or that will

be held by the Selling Stockholders after completion of any sales. We do not know how long

the Selling Stockholders will hold the shares before selling them. Beneficial ownership

is determined in accordance with Rule 13d-3(d) promulgated by the Commission under the Exchange Act. The Selling

Stockholders have not had a relationship with us within the past three years other than as current or former employees or directors

or as a result of their ownership of our shares or other securities.

Information

concerning the Selling Stockholders may change from time to time and changed information

will be presented in a supplement to this reoffer prospectus, when necessary and required. If, subsequent to the date of this reoffer

prospectus, we grant additional awards to the Selling Stockholders or to other affiliates

under the Plan, we may supplement this reoffer prospectus to reflect such additional awards and the names of such affiliates and the

amounts of securities to be reoffered by them.

We

have based our calculation of the percentage of beneficial ownership prior to this offering on 11,898,191 shares of Common Stock of the

Company outstanding as of December 27, 2021.

The

address of each Selling Stockholder is c/o Presidio Property Trust, Inc., 4995 Murphy Canyon

Road, Suite 300, San Diego, California 92123, unless otherwise indicated.

|

|

|

Prior to the Offering (1)

|

|

|

|

|

|

After the Offering (2)

|

|

|

Name of Selling Stockholder and Position with the Company

|

|

Number of Shares of

Series A

|

|

|

% Of Total Outstanding

|

|

|

Number of Shares being Offered Hereby

|

|

|

Number of Shares of

Series A

|

|

|

% Of Total Outstanding

|

|

|

|

|

Common Stock

|

|

|

Shares

|

|

|

|

|

|

Common Stock

|

|

|

Shares

|

|

|

Jack Heilbron, Chief Executive Officer President

|

|

|

213,540

|

|

|

|

1.79

|

%

|

|

|

98,437

|

|

|

|

213,540

|

|

|

|

1.79

|

%

|

|

Adam Sragovicz, Chief Financial Officer

|

|

|

58,852

|

|

|

|

*

|

|

|

|

42,456

|

|

|

|

58,852

|

|

|

|

*

|

|

|

Gary Katz, Chief Investment Officer

|

|

|

77,747

|

|

|

|

*

|

|

|

|

50,548

|

|

|

|

77,747

|

|

|

|

*

|

|

|

Ed Bentzen, Chief Accounting Officer

|

|

|

—

|

|

|

|

*

|

|

|

|

6,000

|

|

|

|

—

|

|

|

|

*

|

|

|

Larry Dubose, Director, Chief Financial Officer and Director of NetREIT Dubose, and Chief Executive Officer of Dubose Advisors and NetREIT Advisors

|

|

|

123,441

|

|

|

|

1.04

|

%

|

|

|

64,622

|

|

|

|

123,441

|

|

|

|

1.04

|

%

|

|

Dave Bruen, Director

|

|

|

35,743

|

|

|

|

*

|

|

|

|

18,417

|

|

|

|

35,743

|

|

|

|

*

|

|

|

Jennifer Barnes, Director

|

|

|

14,183

|

|

|

|

*

|

|

|

|

18,269

|

|

|

|

14,183

|

|

|

|

*

|

|

|

James Durfey, Director

|

|

|

36,123

|

|

|

|

*

|

|

|

|

26,209

|

|

|

|

36,123

|

|

|

|

*

|

|

|

Sumner Rollings, Director

|

|

|

49,444

|

|

|

|

*

|

|

|

|

22,566

|

|

|

|

49,444

|

|

|

|

*

|

|

|

Kelly Fields

|

|

|

**

|

|

|

|

*

|

|

|

|

3,176

|

|

|

|

**

|

|

|

|

*

|

|

|

Waleska Neris

|

|

|

**

|

|

|

|

*

|

|

|

|

1,966

|

|

|

|

**

|

|

|

|

*

|

|

|

Melissa Jarrell

|

|

|

**

|

|

|

|

*

|

|

|

|

4,661

|

|

|

|

**

|

|

|

|

*

|

|

|

Cyndi Hannigan

|

|

|

**

|

|

|

|

*

|

|

|

|

1,465

|

|

|

|

**

|

|

|

|

*

|

|

|

Kelly Pierce

|

|

|

**

|

|

|

|

*

|

|

|

|

3,000

|

|

|

|

**

|

|

|

|

*

|

|

|

Estefani Nieto

|

|

|

**

|

|

|

|

*

|

|

|

|

812

|

|

|

|

**

|

|

|

|

*

|

|

|

Abby Johnson

|

|

|

**

|

|

|

|

*

|

|

|

|

1,179

|

|

|

|

**

|

|

|

|

*

|

|

|

Bruce Harley

|

|

|

**

|

|

|

|

*

|

|

|

|

5,406

|

|

|

|

**

|

|

|

|

*

|

|

|

Clayton William

|

|

|

**

|

|

|

|

*

|

|

|

|

2,784

|

|

|

|

**

|

|

|

|

*

|

|

|

Steven Foss

|

|

|

**

|

|

|

|

*

|

|

|

|

3,514

|

|

|

|

**

|

|

|

|

*

|

|

|

Lowell Hartkorn

|

|

|

**

|

|

|

|

*

|

|

|

|

4,575

|

|

|

|

**

|

|

|

|

*

|

|

|

Steven Hightower

|

|

|

**

|

|

|

|

*

|

|

|

|

9,425

|

|

|

|

**

|

|

|

|

*

|

|

|

Nancy Davis

|

|

|

**

|

|

|

|

*

|

|

|

|

463

|

|

|

|

**

|

|

|

|

*

|

|

|

Brandy Sharp

|

|

|

**

|

|

|

|

*

|

|

|

|

1,036

|

|

|

|

**

|

|