CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus includes “forward-looking statements”, as such term is used within the meaning of the Private Securities Litigation

Reform Act of 1995. These “forward-looking statements” are not based on historical fact and involve assessments of certain

risks, developments, and uncertainties in our business looking to the future. Such forward-looking statements can be identified by the

use of terminology such as “may”, “will”, “should”, “expect”, “anticipate”,

“estimate”, “intend”, “continue”, or “believe”, or the negatives or other variations

of these terms or comparable terminology. Forward-looking statements may include projections, forecasts, or estimates of future performance

and developments. Forward-looking statements contained in this prospectus are based upon assumptions and assessments that we believe

to be reasonable as of the date of this prospectus. Whether those assumptions and assessments will be realized will be determined by

future factors, developments, and events, which are difficult to predict and may be beyond our control. Actual results, factors, developments,

and events may differ materially from those we assumed and assessed. Risks, uncertainties, contingencies, and developments, including

those identified in the “Risk Factors” section of this prospectus, could cause our future operating results to differ

materially from those set forth in any forward-looking statement. There can be no assurance that any such forward-looking statement,

projection, forecast or estimate contained can be realized or that actual returns, results, or business prospects will not differ materially

from those set forth in any forward-looking statement. Given these uncertainties, readers are cautioned not to place undue reliance on

such forward-looking statements. We disclaim any obligation to update any such factors or to publicly announce the results of any revisions

to any of the forward-looking statements contained herein to reflect future results, events or developments.

INDUSTRY

AND MARKET DATA

We

use market data and industry forecasts throughout this prospectus and, in particular, in the section entitled “Business and Property.”

Unless otherwise indicated, statements in this prospectus concerning our industry and the markets in which we operate, including our

general expectations, competitive position, business opportunity and market size, growth and share, are based on information obtained

from industry publications, government publications and third-party forecasts. The forecasts and projections are based upon industry

surveys and the preparers’ experience in the industry. There can be no assurance that any of the projections will be achieved.

We believe that the surveys and market research performed by others are reliable, but we have not independently verified this information.

Accordingly, the accuracy and completeness of the information are not guaranteed.

SUMMARY

This

summary contains basic information about us and this offering. Because it is a summary, it does not contain all of the information that

you should consider before investing. Before you decide to invest in our Units, you should read this entire prospectus carefully, including

the section entitled “Risk Factors”.

Our

Company

We

are an internally managed, diversified real estate investment trust (“REIT”). We invest in a multi-tenant portfolio of commercial

real estate assets comprised of office, industrial, and retail properties and model homes leased back to the homebuilder located primarily

in the western United States. As of December 31, 2021, we owned or had an equity interest in:

| |

● |

office

buildings and industrial buildings (“Office/Industrial Properties”) which total approximately 757,578 rentable square feet, |

| |

|

|

| |

● |

retail

shopping centers (“Retail Properties”) which total approximately 121,052 rentable square feet, and |

| |

|

|

| |

● |

92

model homes owned by five affiliated limited partnerships and one corporation (“Model Home Properties”). |

We

own five commercial properties located in Colorado, four in North Dakota, two in Southern California and one in Texas. Our model home

properties are located in four states. Our commercial property tenant base is highly diversified and consists approximately 139 individual

commercial tenants with an average remaining lease term of approximately 3.1 years as of December 31, 2021. As of December 31, 2021,

three commercial tenants represented more than 5.0% of our annualized base rent, one of which represented 8.0% of our annualized based

rent, while our ten largest tenants represented approximately 36.8% of our annualized base rent. In addition, our commercial property

tenant base has limited exposure to any single industry.

In

addition, we also own interests, through our subsidiaries and affiliated limited partnerships, in model homes primarily located in Texas

and Florida. As of December 31, 2021, there were 92 such model homes. We purchase model homes from established residential

home builders and lease them back to the same home builders on a triple-net basis.

Our

main objective is to maximize long-term stockholder value through the acquisition, management, leasing and selective redevelopment of

high-quality office and industrial properties. We focus on regionally dominant markets across the United States which we believe have

attractive growth dynamics driven in part by important economic factors such as strong office-using employment growth; net in-migration

of a highly educated workforce; a large student population; the stability provided by healthcare systems, government or other large institutional

employer presence; low rates of unemployment; and lower cost of living versus gateway markets. We seek to maximize returns through investments

in markets with limited supply, high barriers to entry, and stable and growing employment drivers. Our model home portfolio supports

the objective of maximizing stockholder value by focusing on purchasing new single-family model homes and leasing them back to experienced

homebuilders. We operate the model home portfolio in markets where we can diversify by geography, builder size, and model home purchase

price.

Our

co-founder, Chairman, President and Chief Executive Officer is Jack K. Heilbron, a 40-year veteran in real estate investing, including

eight years with Excel Realty Trust, Inc. (“Excel REIT”), previously an NYSE-listed retail REIT, and one of its predecessor

companies, The Investors Realty Trust (“IRT”), prior to founding our company. Together with our former Chief Financial Officer

and Treasurer, Kenneth W. Elsberry, Mr. Heilbron founded both our company and Clover Income and Growth REIT, Inc. (“Clover REIT”),

a private REIT focused on retail mixed-use properties. During Mr. Heilbron’s tenure at Excel REIT, IRT and Clover REIT, Mr. Heilbron

oversaw the investment of substantial real estate assets and saw Clover REIT liquidate at a substantial gain to investors. Our senior

management team also includes Gary M. Katz, Steve Hightower, Adam Sragovicz and Ed Bentzen, each of whom has approximately 20 years or

more of diverse experience in various aspects of real estate, including both commercial and residential, management, acquisitions, finance

and dispositions in privately-held and publicly traded companies. We believe this industry experience and depth of relationships provides

us with a significant advantage in sourcing, evaluating, underwriting and managing our investments.

Our

Portfolio

We

own five commercial properties located in Colorado, four in North Dakota, two in Southern California, one in Texas and one in Maryland.

Our model home properties are located in four states, with the majority of properties in Texas. While geographical clustering of real

estate enables us to reduce our operating costs through economies of scale by servicing a number of properties with less staff, it makes

us susceptible to changing market conditions in these discrete geographic areas, including those that have developed as a result of COVID-19.

We do not develop properties but acquire properties that are stabilized or that we anticipate will be stabilized within two or three

years of acquisition. We consider a property to be stabilized once it has achieved an 80% occupancy rate for a full year as of January

1 of such year or has been operating for three years.

Our

policy is to obtain insurance coverage for each of our properties covering loss from liability, fire, and casualty in the amounts and

under the terms we deem sufficient to insure our losses. Under tenant leases on our commercial and retail properties, we require our

tenants to obtain insurance to cover casualty losses and general liability in amounts and under terms customarily obtained for similar

properties in the area.

Commercial

Portfolio

As

of December 31, 2021, our commercial portfolio had a net book value of approximately $104 million, and consisted of the following properties:

| ($

in000’s) Property Location | |

Sq.,

Ft. | | |

Date

Acquired | |

Year

Property Constructed | |

Purchase

Price (1) | | |

Occupancy | | |

Percent

Ownership | | |

Mortgage

On property | |

| Office/Industrial Properties: | |

| | | |

| |

| |

| | | |

| | | |

| | | |

| | |

| Genesis Plaza, San Diego, CA (2) | |

| 57,807 | | |

08/10 | |

1989 | |

| 10,000 | | |

| 85.6 | % | |

| 76.4 | % | |

| 6,169 | |

| Dakota Center, Fargo, ND | |

| 119,538 | | |

05/11 | |

1982 | |

| 9,575 | | |

| 73.5 | % | |

| 100.0 | % | |

| 9,677 | |

| Grand Pacific Center, Bismarck, ND (3) | |

| 93,000 | | |

03/14 | |

1976 | |

| 5,350 | | |

| 56.6 | % | |

| 100.0 | % | |

| 3,620 | |

| Arapahoe Center, Colorado Springs, CO | |

| 79,023 | | |

12/14 | |

2000 | |

| 11,850 | | |

| 100.0 | % | |

| 100.0 | % | |

| 7,771 | |

| West Fargo Industrial, West Fargo, ND | |

| 150,030 | | |

08/15 | |

1998/2005 | |

| 7,900 | | |

| 90.8 | % | |

| 100.0 | % | |

| 4,148 | |

| 300 N.P., West Fargo, ND | |

| 34,517 | | |

08/15 | |

1922 | |

| 3,850 | | |

| 64.8 | % | |

| 100.0 | % | |

| 2,233 | |

One Park Centre, Westminster

CO | |

| 69,174 | | |

08/15 | |

1983 | |

| 9,150 | | |

| 80.5 | % | |

| 100.0 | % | |

| 6,277 | |

| Shea Center II, Highlands Ranch, CO | |

| 122,737 | | |

12/15 | |

2000 | |

| 25,325 | | |

| 91.6 | % | |

| 100.0 | % | |

| 17,495 | |

| Baltimore, Baltimore, MD | |

| 31,752 | | |

12/21 | |

2006 | |

| 8,892 | | |

| 100.0 | % | |

| 100.0 | % | |

| — | |

| Total Office/Industrial Properties | |

| 757,578 | | |

| |

| |

$ | 91,892 | | |

| 82.8 | % | |

| | | |

$ | 57,390 | |

| | |

| | | |

| |

| |

| | | |

| | | |

| | | |

| | |

| Retail Properties: | |

| | | |

| |

| |

| | | |

| | | |

| | | |

| | |

| World Plaza, San Bernardino, CA (4) | |

| 55,810 | | |

09/07 | |

1974 | |

| 7,650 | | |

| 100.0 | % | |

| 100.0 | % | |

| — | |

| Union Town Center, Colorado Springs, CO | |

| 44,042 | | |

12/14 | |

2003 | |

| 11,212 | | |

| 87.4 | % | |

| 100.0 | % | |

| 8,174 | |

| Research Parkway, Colorado Springs, CO | |

| 10,700 | | |

08/15 | |

2003 | |

| 2,850 | | |

| 100.0 | % | |

| 100.0 | % | |

| 1,705 | |

| Mandolin, Houston, TX | |

| 10,500 | | |

08/21 | |

2021 | |

| 4,892 | | |

| 100.0 | % | |

| 61.3 | % | |

| — | |

| Total Retail Properties | |

| 121,052 | | |

| |

| |

$ | 26,604 | | |

| 95.4 | % | |

| | | |

$ | 9,879 | |

| | |

| | | |

| |

| |

| | | |

| | | |

| | | |

| | |

| | |

| 878,630 | | |

| |

| |

$ | 118,496 | | |

| 84.6 | % | |

| | | |

$ | 67,269 | |

| (1) |

Prior

to January 1, 2009, “Purchase Price” includes our acquisition related costs and

expenses for the purchase of the property. After January 1, 2009, acquisition related costs

and expenses were expensed when incurred until ASU 2017-01 was adopted by the Company in

2017. Since then, acquisition related costs for real estate acquisitions that do not meet

the definition of a business, are capitalized.” |

| (2) |

Genesis

Plaza is owned by two tenants-in-common, each of which own 57% and 43%, respectively, and we beneficially own an aggregate of 76.4%,

based on our ownership percentages of each tenant-in-common. |

| (3) |

Property

was listed as held for sale during the February 2022. |

| (4) |

Property

held for sale as of December 31, 2021. |

The

following tables show a list of commercial properties owned by us grouped by state and geographic region as of December 31, 2021:

| State | |

No. of Properties | | |

Aggregate Square Feet | | |

Approximate % of Square Feet | | |

Current Base Annual Rent | | |

Approximate % of Aggregate Annual Rent | |

| California | |

| 2 | | |

| 113,617 | | |

| 12.9 | % | |

$ | 1,805,085 | | |

| 15.6 | % |

| Colorado | |

| 5 | | |

| 325,676 | | |

| 37.1 | % | |

| 5,603,269 | | |

| 48.5 | % |

| Maryland | |

| 1 | | |

| 31,752 | | |

| 3.6 | % | |

| 682,668 | | |

| 5.9 | % |

| North Dakota | |

| 4 | | |

| 397,085 | | |

| 45.2 | % | |

| 3,151,646 | | |

| 27.3 | % |

| Texas | |

| 1 | | |

| 10,500 | | |

| 1.2 | % | |

| 322,875 | | |

| 2.8 | % |

| Total | |

| 13 | | |

| 878,630 | | |

| 100 | % | |

$ | 11,565,543 | | |

| 100 | % |

Model

Home Portfolio

Our

model home division utilizes a newly-built single family model home as an investment vehicle. This division purchases model homes and

leases them back to the homebuilders as commercial tenants. These triple-net investments alleviate a significant amount of the risk normally

associated with holding single family homes for speculative sale or for lease to residential tenants.

As

of December 31, 2021, our model home portfolio had a net book value of approximately $34 million, and is summarized as follows:

| Geographic Region | |

No. of Properties | | |

Aggregate Square Feet | | |

Approximate % of Square Feet | | |

Current Base Annual Rent | | |

Approximate % of Aggregate Annual Rent | |

| Southwest | |

| 88 | | |

| 266,228 | | |

| 95.6 | % | |

$ | 2,501,580 | | |

| 94.0 | % |

| Southeast | |

| 1 | | |

| 2,381 | | |

| 0.9 | % | |

| 22,524 | | |

| 0.8 | % |

| Midwest | |

| 1 | | |

| 3,663 | | |

| 1.3 | % | |

| 57,420 | | |

| 2.2 | % |

| Northeast | |

| 2 | | |

| 6,153 | | |

| 2.2 | % | |

| 80,844 | | |

| 3.0 | % |

| Total | |

| 92 | | |

| 278,425 | | |

| 100 | % | |

$ | 2,662,368 | | |

| 100 | % |

Our

Investment Approach

Our

Commercial Property Investment Approach

We

acquire high-quality commercial properties in overlooked and/or underserved markets, where we believe we can create long-term stockholder

value. Our potential commercial investments are extensively reviewed based on several characteristics, including:

| |

● |

Market

Research. We invest in properties within regionally dominant markets that we believe to be overlooked. We extensively analyze

potential markets for the key indicators that we feel will provide us higher risk adjusted returns. These indicators may include

a net in-migration of highly educated workers, business friendly governmental policies, large university populations, extensive healthcare

systems and available housing. We believe this extensive research will result in property acquisitions in markets with substantially

higher demand for high quality commercial real estate. |

| |

|

|

| |

● |

Real

Estate Enhancement. We typically acquire properties where we believe market demand is such that values can be significantly enhanced

through repositioning strategies such as upgrading common areas and tenant spaces, re-tenanting and leasing vacant space. We expect

that these strategies will increase rent and occupancy while enhancing long-term value. |

| |

|

|

| |

● |

Portfolio

Management. We believe our target markets have benefited from substantial economic growth, which provides us with opportunities

to achieve long-term value and ultimately sell properties and recycle capital into properties offering a higher risk-adjusted return.

Since 2015, we have been selectively selling retail properties and redeploying the capital into other commercial properties. We have

achieved substantial returns in the past from the operation, repositioning, and sale of properties. We seek to continue to actively

manage our properties in the future to maximize the opportunity to recycle capital. |

Our

Model Home Property Investment Approach

Model

homes are single-family dwellings constructed by builders for the purpose of showing each of the builder’s floor plans, elevations,

optional features, and workmanship in the marketing of the development in which the home is located. Each model home is designed to be

held through the end of a minimum lease term after which the Model Home Property is listed for sale at the estimated fair market value.

We seek to purchase model homes, typically at a discount from fair market value, that have a likelihood of appreciation within the expected

three-year term of the lease. Our model home leaseback agreements are triple-net, requiring the homebuilder/commercial tenant to pay

all operating expenses. We seek model homes in a variety of locations, a variety of price ranges, and from a variety of builders and

developers to diversify the risk from economic conditions that may adversely affect a particular development, price point or location.

During

the year ended December 31, 2021, we disposed of 44 model homes for approximately $20.7 million and recognized a gain of approximately

$3.2 million and during the year ended December 31, 2020, we sold 46 model homes for approximately $18.1 million and recognized a gain

of approximately $1.6 million.

Our

Growth Strategy

Our

principal business objective is to provide attractive risk-adjusted returns to our stockholders through a combination of (i) sustainable

and increasing rental income and cash flow that generates reliable, increasing dividends and (ii) potential long-term appreciation in

the value of our properties and securities. Our primary strategy to achieve our business objective is to invest in, own and manage a

diverse multi-tenant portfolio of high-quality commercial properties in promising regionally dominant markets, which we believe will

drive higher tenant retention and occupancy.

Our

Commercial Property Growth Strategy

We

intend to grow our commercial portfolio by acquiring high-quality properties in our target markets. We may selectively invest in industrial,

office, retail, triple net and other properties where we believe we can achieve higher risk-adjusted returns for our stockholders. We

expect that our extensive broker and seller relationships will benefit our acquisition activities and help set us apart from competing

buyers. In addition, we continue to actively manage our portfolio of commercial properties and continue to redeploy capital through the

opportunistic sale of certain commercial properties.

We

typically purchase properties at what we believe to be a discount to the replacement value of the property. We seek to enhance the value

of these properties through active asset management where we believe we can increase occupancy and rent. We typically achieve this growth

through value-added investments in these properties, such as common area renovations, enhancement of amenities, improved mechanical systems,

and other value-enhancing investments. We generally will not invest in ground-up development as we believe our target markets’

rental rates are below those needed to justify new construction.

Our

Model Home Growth Strategy

We

intend to purchase model homes that are in the “move-up market” and in the first-time homebuyer market. The purchase of model

homes will be from builders that have sufficient assets to fulfill their lease obligations and with model homes that offer a good opportunity

for appreciation upon their sale. Sales proceeds from model homes will typically be reinvested to acquire new model homes.

Our

Pipeline

Our

pipeline is comprised of several properties under various stages of review, with individual projected purchase prices ranging from approximately

$5 million to $25 million. The pipeline is composed of triple-net, industrial, general office, needs-based retail, and medical office

properties.

Our

Competitive Strengths

We

believe that our management team’s extensive public REIT and general real estate experience distinguishes us from many other public

and private real estate companies. Specifically, our competitive strengths include, among others:

| |

● |

Experienced

Senior Management Team. Our senior management team has over 75 combined years of experience with public-reporting companies,

including real estate experience with a number of other publicly traded companies and institutional investors. We are the third REIT

to be co-founded by our CEO, providing us with core real estate experience in addition to substantial public market experience. We

have operated as a publicly-reporting company since 2009. |

| |

|

|

| |

● |

Investment

Focus. We believe that our focus on attractive regionally dominant markets provides higher risk-adjusted returns than other public

REITs and institutional investors which are focused on gateway markets and major metropolitan areas, as our target markets provide

less competition resulting in higher initial returns and greater opportunities to enhance value through institutional quality asset

management. |

| |

|

|

| |

● |

Nimble

Management Execution. Our principal focus is on acquiring commercial properties offering immediate yield, combined with identifiable

value-creation opportunities. We operate in niche geographies, targeting acquisitions valued at between $10 million and $30 million

in order to limit competition from larger, better capitalized buyers focused on core markets. We continue to identify and execute

these types and sizes of transactions efficiently, which we believe provides us an advantage over other institutional investors,

including larger REITs that focus on larger properties or portfolios in more competitively marketed investment transactions. |

| |

|

|

| |

● |

Extensive

Broker and Seller Relationships. Our senior management team has developed extensive broker and seller relationships, which remain

vital to our acquisition efforts. Of our 13 acquisitions since 2014, 10 of these transactions were procured either off-market or

through brokers with whom we have a historical relationship. We expect these relationships, as well as our ability to establish such

relationships in new markets, to provide valuable access to an acquisition pipeline. |

Sponsorship

of Special Purpose Acquisition Company

On

January 7, 2022, we announced our sponsorship, through our wholly-owned subsidiary, Murphy Canyon Acquisition Sponsor, LLC (the “Sponsor”),

of a special purpose acquisition company (“SPAC”) initial public offering. The registration statement and prospectus relating

to the initial public offering (“IPO”) of the SPAC, Murphy Canyon Acquisition Corp. (“Murphy Canyon”), was declared

effective by the Securities and Exchange Commission (the “SEC”) on February 2, 2022 and SPAC units, consisting of one share

of Class A common stock, par value $0.0001 per share, of Murphy Canyon and one redeemable warrant, with each whole warrant entitling

the holder thereof to purchase one share of common stock at a price of $11.50 per share, began trading on the Nasdaq Global Market on

February 3, 2022. The common stock and warrants commenced trading separately on March 28, 2022 on the Nasdaq Global Market under the

symbols “MURF” and “MURFW,” respectively, with the units remaining trading under the symbol “MURFU”.

The

Murphy Canyon IPO closed on February 7, 2022, raising gross proceeds for Murphy Canyon of $132,250,000, including the exercise in full

by the underwriters of their over-allotment option. In connection with the IPO, we purchased, through the Sponsor, 754,000 placement

units (the “placement units”) at a price of $10.00 per unit, for an aggregate purchase price of $7,540,000. The Sponsor has

agreed to transfer an aggregate of 45,000 placement units (15,000 each) to each of Murphy Canyon’s independent directors. The common

stock and warrants commenced trading separately on March 28, 2022 on the Nasdaq Global Market under the symbols “MURF” and

“MURFW,” respectively, with the units remaining trading under the symbol “MURFU”.

Immediately

following the IPO, Murphy Canyon began to evaluate acquisition candidates in the real estate industry, including construction, homebuilding,

real estate owners and operators, arrangers of financing, insurance, and other services for real estate, and adjacent businesses and

technologies targeting the real estate space with an aggregate combined enterprise value of approximately $300 million to $1.2 billion.

Murphy Canyon’s goal is to complete its initial business combination (“IBC”) within one year of its IPO. We expect

Murphy Canyon to operate as a separately managed, publicly traded entity following the completion of the IBC, or “De-SPAC”.

Risks

Factor Summary

Our

business is subject to many significant risks. You should read and carefully consider the matters discussed below and in the

“Risk Factors” section beginning on page 20 of this prospectus prior to deciding whether to invest in our securities. If

any of the following risks occur, our business, financial condition, results of operations, cash flows, cash available for

distribution, ability to service our debt obligations and prospects could be materially and adversely affected. In that case, the

market price of our common stock could decline and you may lose some or all of your investment. Some of these risks

include:

| |

● |

Our

management will have broad discretion over the use of the net proceeds from this offering, you may not agree with how we use the

proceeds and the proceeds may not be invested successfully;

|

| |

● |

Your

interest in our company may be diluted as a result of this Rights Offering; |

| |

|

|

| |

● |

The

Warrants may not have any value and holders of the warrants will have no rights as a common stockholder until such holders exercise

their Warrants and acquire shares of our common stock; |

| |

|

|

| |

● |

The

current outbreak of the novel coronavirus (COVID-19), and the resulting volatility it has created, has disrupted our business and

we expect that the COVID-19 pandemic, may significantly and adversely impact our business, financial condition and results of operations

going forward, and other potential pandemics or outbreaks could materially adversely affect our business, financial condition, results

of operations and cash flows in the future; |

| |

● |

The

spread of the COVID-19 outbreak has caused severe disruptions in the U.S. and global economy and financial markets, and could potentially

create widespread business continuity issues of an unknown magnitude and duration; |

| |

|

|

| |

● |

We

face numerous risks associated with the real estate industry that could adversely affect our results of operations through decreased

revenues or increased costs; |

| |

|

|

| |

● |

Disruptions

in the financial markets and uncertain economic conditions could adversely affect the value of our real estate investments; |

| |

|

|

| |

● |

Our

inability to sell a property at the time and on the terms we desire could limit our ability to realize a gain on our investments

and pay distributions to our stockholders; |

| |

|

|

| |

● |

We

may acquire properties in joint ventures, partnerships or through limited liability companies, which could limit our ability to control

or liquidate such holdings; |

| |

|

|

| |

● |

We

may acquire properties “as is,” which increases the risk that we will have to remedy defects or costs without recourse

to the seller; |

| |

|

|

| |

● |

Our

model home business is substantially dependent on the supply and/or demand for single family homes; |

| |

|

|

| |

● |

A

significant percentage of our properties are concentrated in a small number of states, which exposes our business to the effects

of certain regional events and occurrences; |

| |

|

|

| |

● |

We

currently are dependent on internal cash from our operations, financing and proceeds from property sales to fund future property

acquisitions, meet our operational costs and pay dividends to our stockholders; |

| |

|

|

| |

● |

We

depend on key personnel, and the loss of such persons could impair our ability to achieve our business objectives; |

| |

|

|

| |

● |

We

may change our investment and business policies without stockholder consent, and such changes could increase our exposure to operational

risks; |

| |

|

|

| |

● |

Provisions

of Maryland law may limit the ability of a third party to acquire control of us by requiring our Board of Directors or stockholders

to approve proposals to acquire our company or effect a change in control; |

| |

|

|

| |

● |

Our

management faces certain conflicts of interest with respect to their other positions and/or interests outside of our company, which

could hinder our ability to implement our business strategy and to generate returns to our stockholders; |

| |

|

|

| |

● |

We

have significant outstanding indebtedness, which requires that we generate sufficient cash flow to satisfy the payment and other

obligations under the terms of our debt and exposes us to the risk of default under the terms of our debt; |

| |

|

|

| |

● |

Failure

to qualify as a REIT could adversely affect our operations and our ability to pay distributions; |

| |

|

|

| |

● |

As

a REIT, we may be subject to tax liabilities that reduce our cash flow; |

| |

|

|

| |

● |

The

tax imposed on REITs engaging in “prohibited transactions” may limit our ability to engage in transactions that would

be treated as sales for U.S. federal income tax purposes; |

| |

|

|

| |

● |

Our

management team may invest or spend the proceeds received from the exercise of the outstanding Warrants in ways with which you may

not agree or in ways which may not yield a significant return; |

| |

● |

Our

cash available for distributions may not be sufficient to pay distributions on the common stock at expected levels, and we cannot

assure you of our ability to pay distributions in the future. We may use borrowed funds or funds from other sources to pay distributions,

which may adversely impact our operations; |

| |

|

|

| |

● |

A

future issuance of stock could dilute the value of our common stock; |

| |

|

|

| |

● |

Our

sponsorship of the SPAC requires significant capital deployment, entails certain risks and may not be successful, which would likely

have a material adverse effect on our future expansion, revenues, and profits; |

| |

|

|

| |

● |

Certain

of our officers and directors also serve as officers and directors of the SPAC, which could give rise to conflicts of interest; |

| |

|

|

| |

● |

Inflation

may materially and adversely affect our income, cash flow, results of operations, financial condition, liquidity, the ability to

service our debt obligations, the market price of our securities and our ability to pay dividends and other distributions

to our stockholders; |

| |

|

|

| |

● |

Our

management will have broad discretion over the use of the net proceeds from this offering, you may not agree with how we use the

proceeds and the proceeds may not be invested successfully; and

|

| |

● |

Your

interest in our company may be diluted as a result of this Rights Offering if you do not fully exercise your Subscription Rights

or if we sell shares that are otherwise unsubscribed. |

Our

REIT Status

We

elected to be taxed as a REIT for federal income tax purposes commencing with our taxable year ended December 31, 2001. To continue to

be taxed as a REIT, we must satisfy numerous organizational and operational requirements, including a requirement that we distribute

at least 90% of our REIT taxable income to our stockholders, as defined in the Code and calculated on an annual basis. As a REIT, we

are generally not subject to federal income tax on income that we distribute to our stockholders. If we fail to qualify for taxation

as a REIT in any year, our income will be taxed at regular corporate rates, and we may be precluded from qualifying for treatment as

a REIT for the four-year period following our failure to qualify. Even though we qualify as a REIT for federal income tax purposes, we

may still be subject to state and local taxes on our income and property and to federal income and excise taxes on our undistributed

income. For more information, please see “U.S. Federal Income Tax Considerations.”

Distribution

Policy

We

plan to distribute at least 90% of our annual REIT taxable income to our stockholders in order to maintain our status as a REIT.

We

intend to declare quarterly distributions. However, we cannot provide any assurance as to the amount or timing of future distributions.

Our goal is to generate cash distributions from operating cash flow and proceeds from the sale of properties. During the year ended December

31, 2021, we paid four cash dividends to the holders of shares of common stock totaling approximately $4.5 or $0.41 per share.

During the year ended December 31, 2020, we paid a cash dividend totaling approximately $1.0 million or $0.10 per share. During 2018

and 2019, we declared distributions of approximately $1.1 million each year.

Holders

of shares of the Series D Preferred Stock are entitled to receive cumulative cash dividends at a rate of 9.375% per annum of the $25.00

per share liquidation preference (equivalent to $2.34375 per annum per share). Dividends will be payable monthly on the 15th day of each

month (each, a “dividend payment date”), provided that if any dividend payment date is not a business day, then the dividend

that would otherwise have been payable on that dividend payment date may be paid on the next succeeding business day without adjustment

in the amount of the dividend. Pursuant to the terms of our Series D Preferred Stock, since the date of issuance of shares of Series

D Preferred Stock through December 31, 2021, we had declared a dividend of approximately $1.2 million.

To

the extent that we make distributions in excess of our earnings and profits, as computed for federal income tax purposes, these distributions

will represent a return of capital, rather than a dividend, for federal income tax purposes. Distributions that are treated as a return

of capital for federal income tax purposes generally will not be taxable as a dividend to a U.S. stockholder, but will reduce the stockholder’s

basis in its shares (but not below zero) and therefore can result in the stockholder having a higher gain upon a subsequent sale of such

shares. Return of capital distributions in excess of a stockholder’s basis generally will be treated as gain from the sale of such

shares for federal income tax purposes.

We

provide each of our stockholders a statement detailing the distributions paid during the preceding year and their characterization as

ordinary income, capital gain or return of capital. During the year ended December 31, 2021, all dividends to holders of our common stock

were non-taxable as they were considered return of capital to the stockholders. During the year ended December 31, 2020, all dividends

to holders of common stock were taxable as they were considered capital gain to the stockholders.

Organizational

Structure

The

following chart summarizes our current ownership structure:

Corporate

Information

We

were incorporated in the State of California on September 28, 1999 under the name NetREIT, and in June 2010, we reincorporated as a Maryland

corporation. In October 2017, we changed our name to “Presidio Property Trust, Inc.” Our executive offices are located at

4995 Murphy Canyon Road, Suite 300, San Diego, California 92123. Our telephone number is (760) 471-8536. We maintain an internet website

at www.presidiopt.com. Information on, or accessible through, our website is not a part of, and is not incorporated into, this

prospectus or the registration statement of which it forms a part.

OFFERING

SUMMARY

| Securities

Offered |

|

We

are distributing to you, at no charge, one non-transferable Subscription Right to purchase one Unit for every share of

our common stock and July 2021 Warrant that you owned on the Record Date. Each Unit consists of shares of our common stock

and Warrants. The Units will separate upon the closing of the Rights Offering and

the common stock and Warrants will be issued separately, however, they may only be purchased as a Unit, and the Unit will not trade

as a separate security. |

| |

|

|

| Size

of Offering |

|

Units. |

| |

|

|

| Subscription

Price |

|

$

per Unit. |

| |

|

|

| |

|

|

| Warrants |

|

Each

Warrant entitles the holder to purchase one share of our common stock at an exercise price of $ per share, subject to adjustment, from

the date of issuance through its expiration five years from the date of issuance. The Warrants will be exercisable for cash, or, solely

during any period when a registration statement for the exercise of the Warrants is not in effect, on a cashless basis, at any time and

from time to time after the date of issuance. |

| |

|

|

| Record

Date |

|

5:00

p.m., Eastern Time, on , 2022. |

| |

|

|

| Expiration

of the Rights Offering |

|

5:00

p.m., Eastern Time, on , 2022. We may extend the Rights Offering without notice to you. See “Extension, Amendment and Termination.” |

| Basic

Subscription Right |

|

Your

Basic Subscription Right will entitle you to purchase one Unit at the Subscription Price. You may exercise your Basic Subscription Right

for some or all of your Subscription Rights, or you may choose not to exercise your Subscription Rights. If you choose to exercise your

Subscription Rights, there is no minimum number of Units you must purchase. We are distributing Basic Subscription Rights to purchase

an aggregate of Units, but are only selling Units in the Rights Offering. In the event that the Rights Offering is over-subscribed,

rights holders will be entitled to their pro rata portion of the Units. |

| |

|

|

| Over-Subscription

Privilege |

|

If

you exercise your Basic Subscription Rights in full, you may also choose to exercise an over-subscription privilege to purchase a portion

of any Units that are not purchased by our other stockholders or July 2021 warrantholders through the exercise of their Basic Subscription

Rights, subject to proration and stock ownership limitations described elsewhere in this prospectus. The subscription agent will promptly

return any excess payments by mail, without interest or deduction, after expiration of the subscription period. |

| |

|

|

| Payment

Adjustments |

|

If

you send a payment that is insufficient to purchase the number of Units requested, or if the number of Units requested is not specified

in the Rights Certificate, the payment received will be applied to exercise Subscription Rights to the extent of the payment. If the

payment exceeds the amount necessary for the full exercise of your Subscription Rights, including any Over-Subscription Privilege exercised

and permitted, the excess will be promptly returned to you in cash. You will not receive interest or a deduction on any payments refunded

to you under the Rights Offering. |

| |

|

|

| Delivery

of Shares and Warrants |

|

As

soon as practicable after the expiration of the Rights Offering, and within five business days thereof, we expect to close on subscriptions

and for the Subscription Agent to arrange for the issuance of the shares of common stock and Warrants purchased pursuant to the Rights

Offering. All shares and Warrants that are purchased in the Rights Offering will be issued in book-entry, or uncertificated, form meaning

that you will receive a direct registration, or DRS, account statement from our transfer agent reflecting ownership of these securities

if you are a holder of record. If you hold your shares and/or July 2021 Warrant in the name of a bank, broker, dealer, or other nominee,

DTC will credit your account with your nominee with the securities you purchased in the Rights Offering. |

| |

|

|

| Non-transferability

of Subscription Rights |

|

The

Subscription Rights may not be sold, transferred, assigned or given away to anyone. The Subscription Rights will not be listed for trading

on any stock exchange or market. |

| |

|

|

| Transferability

of Warrants |

|

The

Warrants will be separately transferable following their issuance until their expiration. |

| |

|

|

| No

Board Recommendation |

|

Our

board of directors is not making a recommendation regarding your exercise of the Subscription Rights. You are urged to make your decision

to invest based on your own assessment of our business and financial condition, our prospects for the future, the terms of the Rights

Offering, the information in this prospectus and other information relevant to your circumstances. Please see “Risk Factors”

for a discussion of some of the risks involved in investing in our securities. |

| |

|

|

| No

Revocation |

|

All

exercises of Subscription Rights are irrevocable, even if you later learn of information that you consider to be unfavorable to the exercise

of your Subscription Rights. |

| Use

of Proceeds |

|

Assuming

the exercise of Subscription Rights to purchase all Units of the Rights Offering, after deducting fees and expenses and excluding

any proceeds received upon exercise of any Warrants, we estimate the net proceeds of the Rights Offering will be approximately $

million. We intend to use the net proceeds from the exercise of Subscription Rights for general corporate and working capital purposes,

including potential acquisitions of additional properties, as described herein. See “Use of Proceeds.” |

| |

|

|

Material

U.S. Federal Income

Tax

Consequences |

|

For

U.S. federal income tax purposes, we do not believe you should recognize income or loss upon receipt or exercise of a Subscription

Right. You should consult your own tax advisor as to the tax consequences of the Rights Offering in light of your particular circumstances.

See “U.S. Federal Income Tax Considerations.” |

| |

|

| Extension,

Amendment and Termination |

|

Although

we do not presently intend to do so, we may extend the Rights Offering for additional time in our sole discretion for any reason

for up to an additional 45 days. For example, we may decide that changes in the market price of our common stock requires an extension,

or we may decide that the degree of stockholder and/or July 2021 warrantholder participation in the Rights Offering is less than

the level we desire. In the event that we decide to extend the Rights Offering as noted above and you have already exercised your

Subscription Rights, your subscription payment will remain with the Subscription Agent until such time as the Rights Offering closes

or is terminated. We also reserve the right to amend or modify the terms of the Rights Offering, as appropriate. Our board of directors

may for any reason terminate the Rights Offering at any time before the expiration of the Rights Offering. In the event that the

Rights Offering is cancelled, all subscription payments received by the Subscription Agent will be promptly returned, without interest

or deduction. |

| |

|

| Placement

Period |

|

If

the Rights Offering is not fully subscribed following expiration of the Rights Offering, the dealer-manager has agreed to use its

commercially reasonable efforts to place any unsubscribed Units at the Subscription Price for an additional period of up to 45 days.

The number of Units that may be sold by us during this period will depend upon the number of Units that are subscribed for pursuant

to the exercise of Subscription Rights by our stockholders and July 2021 warrantholders. No assurance can be given that any unsubscribed

Units will be sold during this period. |

| |

|

|

| Subscription

Agent |

|

We

retained Direct Transfer, LLC, to serve as the subscription agent. The subscription agent will hold funds received in payment for

Units in a segregated account pending completion of the Rights Offering. The subscription agent will hold this money until the Rights

Offering is completed or is withdrawn and canceled. If the Rights Offering is canceled for any reason, all subscription payments

received by the subscription agent will be promptly returned, without interest or penalty. |

| |

|

| Information

Agent |

|

You

should direct any questions or requests for assistance concerning the method of subscribing for Units or for additional copies of

this prospectus to the information agent, [ ], toll free at [ ], or by mail at [ ]. |

| |

|

| Questions |

|

If

you have any questions about the Rights Offering, please contact the Information Agent, [ ], toll free at [ ],

or by mail at [ ]. |

| |

|

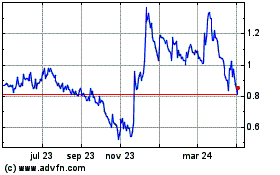

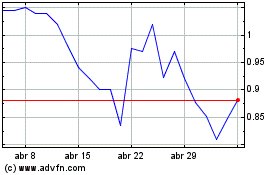

| Market

for Common Stock |

|

Our

common stock is listed on Nasdaq under the symbol “SQFT.” |

| |

|

| Market

for Warrants |

|

The

Warrants are not listed on a national exchange. |

| |

|

| Dealer-Manager

and Placement Agent |

|

The

Benchmark Company LLC will act as dealer-manager for the Rights Offering and placement agent for any unsubscribed Units. |

QUESTIONS

AND ANSWERS RELATING TO THE RIGHTS OFFERING

The

following are examples of what we anticipate will be common questions about this Rights Offering. The answers are based on selected information

included elsewhere in this prospectus. The following questions and answers do not contain all of the information that may be important

to you and may not address all of the questions that you may have about the Rights Offering. This prospectus contains more detailed descriptions

of the terms and conditions of the Rights Offering and provides additional information about us and our business, including potential

risks related to the Rights Offering, the Units offered hereby, and our business. We urge you to read this entire prospectus.

Why

are we conducting the Rights Offering?

We

are conducting the Rights Offering to raise additional capital for general corporate purposes and to fund ongoing operations and expansion

of our business.

What

is a Unit?

Each

Unit consists of one share of our Series A common stock, which we refer to herein as “common stock” and warrants (each, a

“Warrant”), at a subscription price of $ per Unit. No fractional Units will be issued. Each

Warrant entitles you to purchase one share of common stock at an exercise price of $ per share,

from the date of issuance through its expiration five years after the date of issuance. The shares of common stock and Warrants that

comprise each Unit are immediately separable and will be issued separately in this Rights Offering, however, they may only be purchased

as a Unit, and the Units will not trade as a separate security.

What

is the Rights Offering?

We

are distributing, at no charge, to holders of our common stock as of the Record Date, non-transferable Subscription Rights to purchase

Units at a price of $ per Unit. The Subscription Rights will not be tradable. Each Unit consists

of one share of our common stock and Warrants. See “Are there risks in exercising my

Subscription Rights?” below. Each Warrant will be exercisable for one share of our common stock. Upon expiration of the Rights

Offering, the common stock and Warrants will immediately separate. There is no public trading market for the Warrants and we do not intend

that they will be listed for trading on Nasdaq or any other securities exchange or market. The common stock comprising the Units and

the common stock to be issued upon exercise of the Warrants, like our existing shares of common stock, will be traded on the Nasdaq Capital

Market under the symbol “SQFT.” You will receive one Subscription Right for every share of common stock that you owned

as of 5:00 p.m., Eastern Time, on the Record Date. Each Subscription Right entitles the record holder to a Basic Subscription Right and

an Over-Subscription Privilege. The Subscription Rights will expire if they are not exercised by 5:00 p.m., Eastern Time, on

, 2022, unless we extend or earlier terminate the Rights Offering.

What

are the Basic Subscription Rights?

For

every share you owned as of the Record Date, you will receive one Basic Subscription Right, which gives you the opportunity to purchase

one Unit, consisting of one share of our common stock and Warrants, for a price of $ per Unit.

For example, if you owned 100 shares of common stock as of the Record Date, you will receive 100 Subscription Rights and will have the

right to purchase 100 shares of our common stock and Warrants to purchase shares of our common stock for $

per Unit (or a total payment of $ ). You may exercise all or a portion of your Basic

Subscription Rights or you may choose not to exercise any Basic Subscription Rights at all.

If

you are a record holder of our common stock, the number of shares you may purchase pursuant to your Basic Subscription Rights is indicated

on the enclosed Rights Certificate. If you hold your shares of common stock in the name of a broker, dealer, bank or other

nominee who uses the services of the Depository Trust Company, or DTC, you will not receive a Rights Certificate. Instead, DTC will issue

one Subscription Right to your nominee record holder for each share of our common stock that you beneficially own as of the Record Date.

If you are not contacted by your nominee, you should contact your nominee as soon as possible.

What

is the Over-Subscription Privilege?

If

you exercise your Basic Subscription Rights in full, you may also choose to exercise your Over-Subscription Privilege to purchase a portion

of any Units that are not purchased by other stockholders or July 2021 warrantholders and remain available under the Rights Offering.

You should indicate on your Rights Certificate, or the form provided by your nominee if your shares are held in the name of a nominee,

how many additional Units you would like to purchase pursuant to your Over-Subscription Privilege, which we refer to as your Over-Subscription

Request.

Subject

to stock ownership limitations, if enough Units are available, we will seek to honor your Over-Subscription Request in full. If Over-

Subscription Requests exceed the number of Units available, however, we will allocate the available Units pro-rata among the stockholders

and July 2021 warrantholders exercising the Over-Subscription Privilege in proportion to the product (rounded down to the nearest whole

number so that the aggregate number of Units does not exceed the aggregate number offered) obtained by multiplying the number of Units

such stockholder or warrantholder subscribed for pursuant to the Over-Subscription Privilege by a fraction (A) the numerator of which

is the number of unsubscribed Units and (B) the denominator of which is the total number of Units sought to be subscribed for pursuant

to the Over-Subscription Privilege by all holders participating in such over-subscription. See “The Rights Offering- Limitation

on the Purchase of Units” for a description of certain stock ownership limitations.

To

properly exercise your Over-Subscription Privilege, you must deliver to the Subscription Agent the subscription payment related to your

Over-Subscription Privilege before the Rights Offering expires. Because we will not know the total number of unsubscribed Units before

the expiration of the Rights Offering, if you wish to maximize the number of Units you purchase pursuant to your Over-Subscription Privilege,

you will need to deliver payment in an amount equal to the aggregate Subscription Price for the maximum number of Units available, assuming

that no Subscription Rights holder other than you has purchased any Units pursuant to such stockholder’s Basic Subscription

Right and Over-Subscription Privilege. See “The Rights Offering- The Subscription Rights-Over-Subscription Privilege.” To

the extent you properly exercise your Over-Subscription Privilege for an amount of Units that exceeds the number of unsubscribed Units

available to you, any excess subscription payments will be promptly returned to you after the expiration of the Rights Offering, without

interest or deduction.

Direct

Transfer, LLC, our Subscription Agent for the Rights Offering, will determine the allocation of Over-Subscription Requests based on the

formula described above, and will notify Subscription Rights holders of the number of Units allocated to each holder exercising the Over-Subscription

Privilege as promptly as may be practicable after the allocations are completed.

May

the Subscription Rights that I exercise be reduced for any reason?

Yes.

While we are distributing to holders of our common stock one Subscription Right for every share of common stock owned on the Record Date,

we are only seeking to raise $ million dollars in gross proceeds in this Rights Offering.

As a result, based on shares of common stock outstanding as of

, 2022, we would grant Subscription Rights to acquire Units but will only accept subscriptions

for ,000 Units. Accordingly, enough Units may not be available to honor your subscription

in full. If exercises of Basic Subscription Rights exceed the number of Units available in the Rights Offering, we will allocate the

available Units pro-rata among the record holders exercising the Basic Subscription Rights in proportion to the number of shares of our

common stock each of those record holders owned on the Record Date, relative to the number of shares owned on the Record Date by all

record holders exercising the Basic Subscription Right. If this pro-rata allocation results in any record holders receiving a greater

number of Units than the record holder subscribed for pursuant to the exercise of the Basic Subscription Rights, then such record holder

will be allocated only that number of Units for which the record holder subscribed, and the remaining Units will be allocated among all

other record holders exercising their Basic Subscription Rights on the same pro rata basis described above. The proration process will

be repeated until all Units have been allocated. Please also see the discussion under “The Rights Offering-The Subscription Rights-Over-Subscription

Privilege” and “The Rights Offering-Limitation on the Purchase of Units” for a description potential proration as to

the Over-Subscription Privilege and certain stock ownership limitations.

If

for any reason the amount of Units allocated to you is less than you have subscribed for, then the excess funds held by the Subscription

Agent on your behalf will be promptly returned to you, without interest, after the Rights Offering has expired and all prorating calculations

and reductions contemplated by the terms of the Rights Offering have been effected, and we will have no further obligations to you.

What

are the terms of the Warrants?

Each

Warrant entitles the holder to purchase one share of our common stock at an exercise price of $

per share from the date of issuance through its expiration five years from the date of issuance. The Warrants will be exercisable for

cash, or, solely during any period when a registration statement for the exercise of the Warrants is not in effect, on a cashless basis.

Are

the common stock or Warrants listed?

There

is no public trading market for the Warrants and we do not intend that they will be listed for trading on Nasdaq or any other securities

exchange or market. The Warrants will be issued in registered form under a warrant agent agreement with Direct Transfer, LLC, as warrant

agent.

Will

fractional shares be issued upon exercise of Subscription Rights or the exercise of Warrants?

No.

We will not issue fractional shares of common stock in the Rights Offering. We will only distribute Subscription Rights to acquire whole

Units, rounded down to the nearest whole number of underlying shares of common stock giving rise to such Subscription Rights.

Any excess subscription payments received by the Subscription Agent will be promptly returned after expiration of the Rights Offering,

without interest or deduction.

Additionally,

no fractional shares of common stock will be issued as a result of the exercise of Warrants. Instead, for any such fractional share that

would otherwise have been issuable upon exercise of Warrants, the Company will round up such fraction to the next whole share.

What

effect will the Rights Offering have on our outstanding common stock?

Assuming

no other transactions by us involving our capital stock prior to the expiration of the Rights Offering, and if the Rights Offering is

fully subscribed, upon consummation of the Rights Offering we will have shares of common stock issued and outstanding

and Warrants to purchase an additional shares of our common stock issued and outstanding, based

on shares of our common stock outstanding as of ,

2022. The exact number of shares of common stock and Warrants that we will issue in this offering will depend on the number of Units

that are subscribed for in the Rights Offering.

How

was the Subscription Price determined?

In

determining the Subscription Price, the directors considered, among other things, the following factors:

| |

● |

the

current and historical trading prices of our common stock; |

| |

|

|

| |

● |

the

price at which stockholders might be willing to participate in the Rights Offering; |

| |

|

|

| |

● |

the

value of the Warrant being issued as a component of the Unit; |

| |

|

|

| |

● |

our

need for additional capital and liquidity; |

| |

|

|

| |

● |

the

cost of capital from other sources; and |

| |

|

|

| |

● |

comparable

precedent transactions, including the percentage of shares offered, the terms of the subscription rights being offered, the subscription

price and the discount that the subscription price represented to the immediately prevailing closing prices for those offerings. |

In

conjunction with the review of these factors, the board of directors also reviewed our history and prospects, including our past and

present earnings and cash requirements, our prospects for the future, the outlook for our industry and our current financial condition.

The board of directors also believed that the Subscription Price should be designed to provide an incentive to our current stockholders

to participate in the Rights Offering and exercise their Basic Subscription Right and their Over-Subscription Privilege.

The

Subscription Price does not necessarily bear any relationship to any established criteria for value. You should not consider the Subscription

Price as an indication of actual value of our company or our common stock. The market price of our common stock may decline during or

after the Rights Offering. You should obtain a current price quote for our common stock and perform an independent assessment of our

common stock and Warrants before exercising your Subscription Rights and make your own assessment of our business and financial condition,

our prospects for the future, the terms of the Rights Offering, the information in this prospectus and the other considerations relevant

to your circumstances. Once made, all exercises of Subscription Rights are irrevocable. In addition, there is no established trading

market for the common stock or the Warrants to be issued pursuant to this offering, and the common stock and the Warrants may not be

widely distributed.

Am

I required to exercise all of the Basic Subscription Rights I receive in the Rights Offering?

No.

You may exercise any number of your Basic Subscription Rights, or you may choose not to exercise any Basic Subscription Rights. If you

do not exercise any Basic Subscription Rights, the number of shares of our common stock you own will not change. However, if you choose

to not exercise your Basic Subscription Rights in full and other holders of Subscription Rights do exercise, your proportionate ownership

interest in our company will decrease. If you do not exercise your Basic Subscription Rights in full, you will not be entitled to exercise

your Over-Subscription Privilege.

How

soon must I act to exercise my Subscription Rights?

If

you received a Rights Certificate and elect to exercise any or all of your Subscription Rights, the Subscription Agent must receive your

completed and signed Rights Certificate and payment for both your Basic Subscription Rights and any Over-Subscription Privilege you elect

to exercise before the Rights Offering expires on , 2022, at 5:00 p.m., Eastern Time, unless we extend

or earlier terminate the Rights Offering. If you hold your shares of common stock in the name of a broker, dealer, bank

or other nominee, your nominee may establish a deadline before the expiration of the Rights Offering by which you must provide it with

your instructions to exercise your Subscription Rights, along with the required subscription payment.

May

I transfer my Subscription Rights?

No.

The Subscription Rights may be exercised only by the common stockholders to whom they are distributed, and they may not be sold, transferred,

assigned or given away to anyone else, other than by operation of law. As a result, Rights Certificates may be completed only by the

stockholder who receives the certificate. We do not intend to apply for the listing of the Subscription Rights on any securities exchange

or recognized trading market.

Will

our directors and executive officers participate in the Rights Offering?

To

the extent they hold common stock as of the Record Date, our directors and executive officers will be entitled to participate in the

Rights Offering on the same terms and conditions applicable to other Rights holders.

Are

we requiring a minimum subscription to complete the Rights Offering?

There

is no aggregate minimum we must receive to complete the Rights Offering.

Has

the board of directors made a recommendation to stockholders regarding the Rights Offering?

No.

Our board of directors is making no recommendation regarding your exercise of the Subscription Rights. Rights holders who exercise Subscription

Rights will incur investment risk on new money invested. We cannot predict the price at which our shares of common stock will trade after

the Rights Offering. On , 2022, the last reported sale price of our common stock on Nasdaq was $__________ per share. You should make

your decision based on your assessment of our business and financial condition, our prospects for the future, the terms of the Rights

Offering, the information contained in this prospectus and other considerations relevant to your circumstances. See “Risk Factors”

for discussion of some of the risks involved in investing in our securities.

How

do I exercise my Subscription Rights?

If

you are a common stockholder of record (meaning you hold your shares of our common stock in your name and not through a broker, dealer,

bank or other nominee) and you wish to participate in the Rights Offering, you must deliver a properly completed and signed Rights Certificate,

together with payment of the Subscription Price for both your Basic Subscription Rights and any Over-Subscription Privilege you elect

to exercise, to the Subscription Agent before 5:00 p.m., Eastern Time, on , 2022. If you are exercising your Subscription Rights through

your broker, dealer, bank or other nominee, you should promptly contact your broker, dealer, bank or other nominee and submit your subscription

documents and payment for the Units subscribed for in accordance with the instructions and within the time period provided by your broker,

dealer, bank or other nominee.

What

if my shares are held in “street name”?

If

you hold your shares of our common stock in the name of a broker, dealer, bank or other nominee, then your broker, dealer, bank or other

nominee is the record holder of the shares you beneficially own. The record holder must exercise the Subscription Rights on your behalf.

Therefore, you will need to have your record holder act for you.

If

you wish to participate in this Rights Offering and purchase Units, please promptly contact the record holder of your shares. We will

ask the record holder of your shares, who may be your broker, dealer, bank or other nominee, to notify you of this Rights Offering.

What

form of payment is required?

You

must timely pay the full Subscription Price for the full number of Units you wish to acquire pursuant to the exercise of Subscription

Rights by delivering to the Subscription Agent a:

| |

● |

personal

check drawn on a U.S. bank; |

| |

|

|

| |

● |

certified

check drawn on a U.S. bank; |

| |

|

|

| |

● |

U.S.

Postal money order; or |

| |

|

|

| |

● |

wire

transfer. |

If

you send payment by personal uncertified check, payment will not be deemed to have been delivered to the Subscription Agent until the

check has cleared. As such, any payments made by personal check should be delivered to the Subscription Agent no fewer than three business

days prior to the expiration date.

If

you send a payment that is insufficient to purchase the number of Units you requested, or if the number of Units you requested is not

specified in the forms, the payment received will be applied to exercise your Subscription Rights to the fullest extent possible based

on the amount of the payment received.

Will

I receive interest on any funds I deposit with the Subscription Agent?

No.

You will not be entitled to any interest on any funds that are deposited with the Subscription Agent pending completion or cancellation

of the Rights Offering. If the Rights Offering is cancelled for any reason, the Subscription Agent will promptly return this money to

subscribers, without interest or penalty.

When

will I receive my new shares of common stock and Warrants?

As

soon as practicable after the expiration of the Rights Offering, and within five business days thereof, we expect to close on subscriptions

and for the Subscription Agent to arrange for the issuance of the shares of common stock and Warrants purchased in the Rights Offering.

At closing, all prorating calculations and reductions contemplated by the terms of the Rights Offering will have been effected and payment

to us for the subscribed-for Units will have cleared. All shares and Warrants that you purchase in the Rights Offering will be issued

in book-entry, or uncertificated, form meaning that you will receive a direct registration, or DRS, account statement from our transfer

agent reflecting ownership of these securities if you are a holder of record. If you hold your common stock in the name of a broker,

dealer, bank or other nominee, DTC will credit your account with your nominee with the securities you purchase in the Rights Offering.

Direct Transfer, LLC is acting as the warrant agent in this offering.

After

I send in my payment and Rights Certificate to the Subscription Agent, may I cancel my exercise of Subscription Rights?

No.

Exercises of Subscription Rights are irrevocable, even if you later learn information that you consider to be unfavorable to the exercise

of your Subscription Rights. You should not exercise your Subscription Rights unless you are certain that you wish to purchase Units

at the Subscription Price.

How

much will our company receive from the Rights Offering?

Assuming

that all Units are sold in the Rights Offering, we estimate that the net proceeds from the Rights Offering will be approximately $ million,

based on the Subscription Price of $ per Unit, after deducting fees and expenses payable to the dealer-manager, and after deducting other

estimated expenses payable by us and excluding any proceeds received upon exercise of any Warrants. If all Warrants included in the Units

are exercised for cash at the exercise price of $ per share, we will receive an additional $ million. We intend to use the net proceeds

for general corporate purposes and to fund ongoing operations and expansion of our business. See “Use of Proceeds.”

Are

there risks in exercising my Subscription Rights?

Yes.

The exercise of your Subscription Rights involves risks. Exercising your Subscription Rights involves the purchase of shares of our common

stock and Warrants to purchase common stock and you should consider this investment as carefully as you would consider any other investment.

In addition, we do not intend for our Warrants to be listed on Nasdaq and a market for the Warrants does not exist. See “Risk Factors”

for discussion of additional risks involved in investing in our securities.

Can

the board of directors terminate, extend or amend the Rights Offering?

Yes.

Our board of directors may decide to terminate the Rights Offering at any time and for any reason before the expiration of the Rights

Offering. We also have the right to extend the Rights Offering for additional periods in our sole discretion for up to an additional

45 days. We do not presently intend to extend the Rights Offering. We will notify stockholders and the public if the Rights Offering

is terminated or extended by issuing a press release announcing the extension no later than 9:00 a.m., Eastern Time, on the next business

day after the most recently announced expiration date of the Rights Offering. In the event that we decide to extend the Rights Offering

and you have already exercised your Subscription Rights, your subscription payment will remain with the Subscription Agent until such

time as the Rights Offering closes or is terminated.

Our

board of directors also reserves the right to amend or modify the terms of the Rights Offering in its sole discretion. If we should make

any fundamental changes to the terms of the Rights Offering set forth in this prospectus, we will file a post-effective amendment to

the registration statement in which this prospectus is included, offer potential purchasers who have subscribed for rights the opportunity

to cancel such subscriptions and issue a refund of any money advanced by such stockholder and recirculate an updated prospectus after

the post-effective amendment is declared effective by the SEC. In addition, upon such event, we may extend the Expiration Date of the

Rights Offering to allow holders of rights ample time to make new investment decisions and for us to recirculate updated documentation.

Promptly following any such occurrence, we will issue a press release announcing any changes with respect to the Rights Offering and

the new expiration date. The terms of the Rights Offering cannot be modified or amended after the Expiration Date of the Rights Offering.

Although we do not presently intend to do so, we may choose to amend or modify the terms of the Rights Offering for any reason, including,

without limitation, in order to increase participation in the Rights Offering. Such amendments or modifications which are not fundamental

changes to the terms of the Rights Offering, may include a change in the subscription price, a reduction to the exercise price of the

Warrants, or an increase to the number of Warrant issuable upon exercise of a subscription right, although no such change is presently

contemplated.

If

the Rights Offering is not completed or is terminated, will my subscription payment be refunded to me?

Yes.

The Subscription Agent will hold all funds it receives in a segregated bank account until completion of the Rights Offering. If we do

not complete the Rights Offering, all subscription payments received by the Subscription Agent will be promptly returned after the termination

or expiration of the Rights Offering, without interest or deduction. If you own shares in “street name,” it may take longer