false

0001096275

0001096275

2024-11-14

2024-11-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 14, 2024

WORKSPORT

LTD.

(Exact name of registrant as specified in its

charter)

| Nevada |

|

001-40681 |

|

35-2696895 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

2500

N America Dr

West

Seneca, New York 14224

(Address of principal executive offices) (ZIP Code)

(888)

554-8789

Registrant’s

telephone number, including area code

Not

Applicable

(Former name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbols |

|

Name

of each exchange on which registered |

| Common |

|

WKSP |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b -2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

7.01 Regulation FD Disclosure.

On

November 13 2024, Worksport Ltd. (the “Company”) issued a press release: “Worksport ($WKSP) Reports Significant

581% YoY Revenue Growth in Q3 2024, Eyes Record 2025”. A copy of the press release is attached hereto as Exhibit 99.1.

The

information under Item 7.01 of this Current Report on Form 8-K and the exhibit attached hereto shall not be deemed “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section,

or incorporated by reference into any of the Company’s filings under the Securities Act of 1933, as amended, except as shall be

expressly set forth by specific reference in any such filing.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

WORKSPORT

LTD. |

| |

|

| Date:

November 14, 2024 |

By: |

/s/

Steven Rossi |

| |

Name: |

Steven

Rossi |

| |

Title: |

Chief

Executive Officer

(Principal Executive Officer) |

Exhibit 99.1

Worksport

($WKSP) Reports Significant 581% YoY Revenue Growth in Q3 2024, Eyes Record 2025

Company Announces Consecutive Surge in Quarterly Revenues; Provides Positive Outlook for Fiscal Year 2025; Ongoing Expansion and New Product

Lines Fuel Momentum

West

Seneca, New York, November 13, 2024 — Worksport Ltd. (NASDAQ: WKSP) (“Worksport” or the “Company”),

a U.S.-based manufacturer and innovator of hybrid and clean energy solutions for the light truck, overlanding, and global consumer goods

sectors today announced its Q3 2024 financial results. Worksport shares another consecutive quarter of revenue growth and positive outlook

for financial year-end 2025.

Q3

revenue surged to $3.12 million—a 581% year-over-year increase compared to $458,433 in Q3 2023. This rapid growth reflects

continued scaling of both B2B and B2C channels and the growing demand for Worksport’s innovative products. Following a 275%

revenue increase from Q1 to Q2 2024, Q3 revenue grew another 63% from Q2 2024, underscoring the strength of the Company’s strategic

investments and the success of its recent sales initiatives. Worksport believes it will exceed previous financial

guidance of $6-8M by year-end 2024, and below issues guidance for year-end 2025.

Steven

Rossi, Worksport’s Founder & CEO, stated:

“Our

Q3 results are just the beginning. With our robust product pipeline and aggressive market penetration strategies, we are on a trajectory

for sustained growth. Our goal is to become cash flow positive in 2025, with a keen focus on EPS and EBITA. We are targeting

revenue growth to $25-$34.5 million in 2025. We are excited about the significant impact our products, including the AL4 tonneau

cover, SOLIS solar cover, and COR portable energy system, are expected to have as we enter next year.”

Upcoming

Products & Strategic Path to Profitability:

Worksport

continues to expand its production capacity and expects to meet its next production target of making over 200 tonneau covers per day

within 2025. This increase in capacity should enable the Company to meet growing demand while notably increasing margins, driven

by new high-demand, high-margin product lines. In Q3, the Company maintained an inventory balance of $6.1 million, strategically positioned

to support sustained revenue growth without the need for major capital investments. The Company believes it can increase its ability

to produce beyond 200 covers without significant time or capital investment.

Additional

Highlights Include:

| | ● | B2C

Sales Growth: Online sales increased from $21,599 in Q3 2023 to $1.59 million

in Q3 2024, now making up 51% of total revenue. |

| | ● | Government

Sales Traction: Worksport initiated sales to a U.S. government agency, positioning itself

for potential future business development. |

| | ● | New

Product Launches: The highly anticipated AL4 tonneau cover is set to debut in Q4 this year

and is expected to contribute significantly to revenue growth in 2025, while the SOLIS and COR products are in Alpha testing,

with a full market launch slated for Q2/Q3 next year. |

Strategic

Market Position and Forward Guidance

Worksport

expects to exceed its previously issued revenue guidance of $6-8 million by year-end 2024.

Worksport’s

growth is underpinned by its diversified portfolio, intellectual property, team experience, and its newly launched online presence. With

the pickup truck market continuing to lead vehicle sales and Worksport’s first-to-market solar-integrated tonneau cover SOLIS on

the horizon, the Company believes it is well-positioned to capture market share in both the automotive accessory and clean energy sectors.

Complemented by the COR portable energy system, Worksport’s growth potential continues to become strong in 2025 and beyond.

For

2025, Worksport projects its existing product lines to generate $20 million in revenue, with new product launches, including its AL4

cover and COR and SOLIS systems, contributing up to an additional $18.5 million. Depending on timing and circumstances, these projections

lead to a robust revenue outlook ranging from $25 million to $34.5 million in 2025, a pivotal year anticipated to drive Worksport

towards cash flow positivity.

Worksport

Q3 Earnings Call

For

detailed insights on the quarter, and management commentary, please attend the Q3 2024 Earnings Call. It will occur at 4:30pm ET on Wednesday

November 13, 2024. You may attend with this link: [Worksport Q3 2024 Earnings Call]

The

prepared remarks will also be available at Worksport’s Investor Relations website.

Investor

Inquiries May Be Directed To:

Investor

Relations, Worksport Ltd.

T:

1 (888) 554-8789 x128

W1:

https://investor.worksport.com

W2:

www.worksport.com

E:

investors@worksport.com

Worksport

Quarter 3, 2024 Report, Item 1. Financial Statements

The

Company has included the Financial Statements section below from the ‘Full Worksport Q3 2024’ For Quarterly

Period Ended: September 30, 2024. Investors are encouraged to read the full 10-Q along with the Prepared Remarks, both linked above.

Item

1. Financial Statements

Worksport

Ltd.

Condensed

Consolidated Balance Sheets

| | |

September 30, 2024 | | |

December 31, 2023 | |

| | |

(Unaudited) | | |

| |

| Assets | |

| | | |

| | |

| Current Assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 1,857,685 | | |

$ | 3,365,778 | |

| Accounts receivable, net | |

| 466,442 | | |

| 463,122 | |

| Other receivable | |

| 153,967 | | |

| 165,865 | |

| Inventory (note 4) | |

| 6,138,060 | | |

| 3,631,492 | |

| Related party loan (note 8) | |

| 14,303 | | |

| - | |

| Prepaid expenses and deposits (note 5) | |

| 256,600 | | |

| 1,497,249 | |

| Total Current Assets | |

| 8,887,057 | | |

| 9,123,506 | |

| Investments (note 10) | |

| 90,731 | | |

| 90,731 | |

| Property and Equipment, net (note 6) | |

| 13,966,210 | | |

| 14,483,436 | |

| Right-Of-Use Asset, net (note 11) | |

| 658,152 | | |

| 917,354 | |

| Intangible Assets, net | |

| 1,337,008 | | |

| 1,338,889 | |

| Total Assets | |

$ | 24,939,158 | | |

$ | 25,953,916 | |

| Liabilities and Shareholders’ Equity | |

| | | |

| | |

| Current Liabilities | |

| | | |

| | |

| Accounts payable and accrued liabilities | |

$ | 2,456,000 | | |

$ | 1,451,181 | |

| Payroll taxes payable | |

| 111,591 | | |

| 85,010 | |

| Related party loan (note 8) | |

| - | | |

| 2,192 | |

| Current portion – Long term debt (note 12) | |

| 190,000 | | |

| 5,300,000 | |

| Current lease liability (note 11) | |

| 248,540 | | |

| 328,229 | |

| Total Current Liabilities | |

| 3,006,131 | | |

| 7,166,612 | |

| Long Term – Lease Liability (note 11) | |

| 433,214 | | |

| 608,761 | |

| Long Term Debt (note 12) | |

| 5,136,738 | | |

| - | |

| Total Liabilities | |

| 8,576,083 | | |

| 7,775,373 | |

| | |

| | | |

| | |

| Shareholders’ Equity | |

| | | |

| | |

| Series A & B Preferred Stock, $0.0001 par value, 100,100 shares authorized, 100 Series A and 0 Series B issued and outstanding, respectively (note 7) | |

| - | | |

| - | |

| Common stock, $0.0001 par value, 299,000,000 shares authorized, 30,920,397 and 17,436,805 shares issued and outstanding, respectively (note 7) | |

| 3,092 | | |

| 2,032 | |

| Additional paid-in capital | |

| 72,512,085 | | |

| 64,685,693 | |

| Share subscriptions receivable | |

| (1,577 | ) | |

| (1,577 | ) |

| Share subscriptions payable | |

| 4,034,205 | | |

| 1,814,152 | |

| Accumulated deficit | |

| (60,176,150 | ) | |

| (48,313,177 | ) |

| Cumulative translation adjustment | |

| (8,580 | ) | |

| (8,580 | ) |

| Total Shareholders’ Equity | |

| 16,363,075 | | |

| 18,178,543 | |

| Total Liabilities and Shareholders’ Equity | |

$ | 24,939,158 | | |

$ | 25,953,916 | |

The

accompanying notes form an integral part of these condensed consolidated financial statements. Please click here to download the

full 10-Q.

Worksport

Ltd.

Condensed

Consolidated Statements of Operations and Comprehensive Loss

For

the Three and Nine Months Ended September 30, 2024 and 2023

(Unaudited)

| | |

Three Months ended

September 30, | | |

Nine Months ended September 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

| | |

| | |

| | |

| |

| Net Sales | |

$ | 3,122,359 | | |

$ | 458,483 | | |

$ | 5,556,535 | | |

$ | 690,259 | |

| Cost of Goods Sold | |

| 2,875,186 | | |

| 368,796 | | |

| 4,975,277 | | |

| 541,841 | |

| Gross Profit | |

| 247,173 | | |

| 89,687 | | |

| 581,258 | | |

| 148,418 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating Expenses | |

| | | |

| | | |

| | | |

| | |

| General and administrative | |

| 2,875,255 | | |

| 3,091,488 | | |

| 8,495,959 | | |

| 6,965,901 | |

| Sales and marketing | |

| 661,238 | | |

| 380,847 | | |

| 1,206,807 | | |

| 1,473,910 | |

| Professional fees | |

| 621,728 | | |

| 539,126 | | |

| 2,332,069 | | |

| 2,899,190 | |

| (Gain) loss on foreign exchange | |

| (5,832 | ) | |

| (2,265 | ) | |

| 1,853 | | |

| (2,407 | ) |

| Total operating expenses | |

| 4,152,389 | | |

| 4,009,196 | | |

| 12,036,688 | | |

| 11,336,594 | |

| Loss from operations | |

| (3,905,216 | ) | |

| (3,919,509 | ) | |

| (11,455,430 | ) | |

| (11,188,176 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other Income (Expense) | |

| | | |

| | | |

| | | |

| | |

| Interest expense | |

| (229,701 | ) | |

| (113,838 | ) | |

| (487,463 | ) | |

| (466,830 | ) |

| Interest income | |

| - | | |

| 38,992 | | |

| 3,054 | | |

| 237,598 | |

| Rental income (note 17) | |

| - | | |

| 45,057 | | |

| 76,866 | | |

| 139,892 | |

| Gain on settlement of debt | |

| - | | |

| - | | |

| - | | |

| 7,493 | |

| Total other income (expense) | |

| (229,701 | ) | |

| (29,789 | ) | |

| (407,543 | ) | |

| (81,847 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net Loss | |

$ | (4,134,917 | ) | |

$ | (3,949,298 | ) | |

$ | (11,862,973 | ) | |

$ | (11,270,023 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Loss per Share (basic and diluted) | |

$ | (0.14 | ) | |

$ | (0.23 | ) | |

$ | (0.47 | ) | |

$ | (0.65 | ) |

| Weighted Average Number of Shares (basic and diluted) | |

| 29,432,794 | | |

| 17,429,685 | | |

| 25,540,754 | | |

| 17,252,521 | |

The

accompanying notes form an integral part of these condensed consolidated financial statements. Please click here to download the

full 10-Q.

The

link below will take you to the Worksport Investor Relations Website. You may download the full 10-Q and accompanying earnings call remarks

there: Q3 2024 10 Q & Earnings Call Prepared Remarks - Download Here

Key

2024 Press-Releases:

| | ● | October

29: 200% Growth in B2B Sales; Pre-Order Campaign Initiated For AL4 |

| | ● | October

17: Nasdaq Grants Extension To Regain Compliance |

| | ● | October

17: $2MM+ Projected Savings From New Strategic Initiative |

| | ● | October

3: Commencing U.S Government Sales |

| | ● | September

30: Update On ISO Certification |

| | ● | September

19: Alpha Launch of SOLIS & COR |

| | ● | September

11: Worksport COR as an EV Range Extender for Tesla Model 3 |

| | ● | August

14: Record High Revenues; 275% Q2 Growth |

| | ● | August

1: Impressive SOLIS Solar Cover Test Results |

| | ● | May

8: Worksport Awarded $2.8MM Grant |

Read

all Worksport press releases: [Link to All Press Releases].

Stay

Connected

| | ● | Investor

Newsletter: Investors and customers are invited to follow Worksport’s progress

as it builds on this momentum and strives to redefine industry standards with each new corporate

development. Link to Newsletter |

Investor

Relations, Worksport Ltd. T: 1 (888) 554-8789 -128 W: investors.worksport.com E: investors@worksport.com W: worksport.com

About

Worksport

Worksport

Ltd. (Nasdaq: WKSP), through its subsidiaries, designs, develops, manufactures, and owns the intellectual property on a variety of tonneau

covers, solar integrations, and NP (Non-Parasitic), hydrogen-based true green energy solutions for the sustainable, clean energy, and

automotive industries. Worksport has an active partnership with Hyundai for the SOLIS Solar cover. Additionally, Worksport’s hard-folding

cover, designed and manufactured in-house, is compatible with RAM, Chevrolet, and GMC models from General Motors, as well as Ford, Jeep,

Nissan, and Toyota pickup trucks. Worksport seeks to capitalize on the growing shift of consumer mindsets towards clean energy integrations

with its proprietary solar solutions, mobile energy storage systems (ESS), and NP (Non-Parasitic), Hydrogen-based technology. Terravis

Energy’s website is terravisenergy.com. For more information, please visit investors.worksport.com.

Connect

with Worksport

Please

follow the Company’s social media accounts on X (previously Twitter), Facebook, LinkedIn, YouTube,

and Instagram (collectively, the “Accounts”), the links of which are links to external third party websites, as

well as sign up for the Company’s newsletters at investors.worksport.com. The Company does not endorse, ensure the

accuracy of, or accept any responsibility for any content on these third-party websites other than content published by the

Company.

| Product

social media |

Investor

social media |

| Instagram |

X

(formerly Twitter) |

| Facebook |

LinkedIn |

| YouTube |

Link to Newsletter |

Investors

and others should note that the Company announces material financial information to our investors using our investor relations website,

press releases, Securities and Exchange Commission (“SEC”) filings, and public conference calls and webcasts. The Company

also uses social media to announce Company news and other information. The Company encourages investors, the media, and others to review

the information the Company publishes on social media.

The

Company does not selectively disclose material non-public information on social media. If there is any significant financial information,

the Company will release it broadly to the public through a press release or SEC filing prior to publishing it on social media.

For

additional information, please contact:

Investor

Relations, Worksport Ltd. T: 1 (888) 554-8789 -128 W: investors.worksport.com W: www.worksport.com E: investors@worksport.com

Forward-Looking

Statements

The

information contained herein may contain “forward-looking statements.” Forward-looking statements reflect the current view

about future events. When used in this press release, the words “anticipate,” “believe,” “estimate,”

“expect,” “future,” “intend,” “plan,” “project,” “should,” or

the negative of these terms and similar expressions, as they relate to us or our management, identify forward-looking statements. These

statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations

and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy

and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks

and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual results and financial

condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these

forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those

indicated in the forward-looking statements include, among others, the following: (i) supply chain delays; (ii) acceptance of our products

by consumers; (iii) delays in or nonacceptance by third parties to sell our products; and (iv) competition from other producers of similar

products. More detailed information about the Company and the risk factors that may affect the realization of forward-looking statements

is set forth in the Company’s filings with the SEC, including, without limitation, our Annual Report on Form 10-K and our Quarterly

Reports on Form 10-Q. Investors and security holders are urged to read these documents free of charge on the SEC’s web site at

www.sec.gov. As a result of these matters, changes in facts, assumptions not being realized or other circumstances, the Company’s

actual results may differ materially from the expected results discussed in the forward-looking statements contained in this press release.

The forward-looking statements made in this press release are made only as of the date of this press release, and the Company undertakes

no obligation to update them to reflect subsequent events or circumstances.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

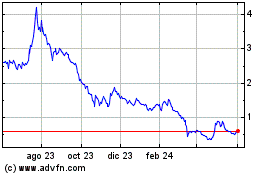

Worksport (NASDAQ:WKSP)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Worksport (NASDAQ:WKSP)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024