Zoom Video Communications, Inc. (NASDAQ: ZM), today announced

financial results for the second fiscal quarter ended July 31,

2024.

“In Q2, we outperformed our guidance across the

board and grew operating cash flow and free cash flow by 33.7% and

26.2% year over year, respectively, demonstrating our continued

commitment to efficient growth. We also saw strength in large

accounts, with customers contributing more than $100,000 in

trailing 12 months revenue increasing by 7.1% year over year, and

resilience in our Online business, with Online average monthly

churn reaching its lowest ever rate,” said Eric S. Yuan, Zoom

founder, and CEO. “Zoom Contact Center racked up several marquee

customers, including its largest single order deal to-date,

highlighting our ability to win competitive deals for full scale,

customer-facing deployments with our higher-end packages that

utilize advanced AI features to enhance agent performance.”

Second Quarter Fiscal

Year 2025 Financial

Highlights:

-

Revenue: Total revenue for the second quarter was

$1,162.5 million, up 2.1% year over year. Adjusting for foreign

currency impact, revenue in constant currency was $1,166.1 million,

up 2.4% year over year. Enterprise revenue was $682.8 million, up

3.5% year over year, and Online revenue was $479.7 million, flat

year over year.

- Income from

Operations and Operating Margin: GAAP income from

operations for the second quarter was $202.4 million, compared

to GAAP income from operations of $177.6 million in the second

quarter of fiscal year 2024. After adjusting for stock-based

compensation expense and related payroll taxes, acquisition-related

expenses, restructuring expenses, and litigation settlements, net,

non-GAAP income from operations for the second quarter was $455.5

million, compared to non-GAAP income from operations of $461.7

million in the second quarter of fiscal year 2024. For the second

quarter, GAAP operating margin was 17.4% and non-GAAP operating

margin was 39.2%.

- Net Income

and Diluted Net Income Per Share: GAAP net income for the

second quarter was $219.0 million, or $0.70 per share, compared to

GAAP net income of $182.0 million, or $0.59 per share, in the

second quarter of fiscal year 2024.Non-GAAP net income for the

second quarter was $436.4 million, after adjusting for stock-based

compensation expense and related payroll taxes, gains on strategic

investments, net, acquisition-related expenses, restructuring

expenses, litigation settlements, net, and the tax effects on

non-GAAP adjustments. Non-GAAP net income per share was $1.39. In

the second quarter of fiscal year 2024, non-GAAP net income was

$409.6 million, or $1.34 per share.

- Cash and

Marketable Securities: Total cash, cash equivalents, and

marketable securities, excluding restricted cash, as of

July 31, 2024 was $7.5 billion.

- Cash

Flow: Net cash provided by operating activities was $449.3

million for the second quarter, compared to $336.0 million in

the second quarter of fiscal year 2024, up 33.7% year over year.

Free cash flow, which is net cash provided by operating activities

less purchases of property and equipment, was $365.1 million,

compared to $289.4 million in the second quarter of fiscal

year 2024, up 26.2% year over year.

Customer Metrics: Drivers of

total revenue included acquiring new customers. At the end of the

second quarter of fiscal year 2025, Zoom had:

- 3,933 customers

contributing more than $100,000 in trailing 12 months revenue, up

approximately 7.1% from the same quarter last fiscal year.

- Approximately 191,600

Enterprise customers.

- A trailing 12-month

net dollar expansion rate for Enterprise customers of 98%.

- Online average monthly

churn of 2.9% for the second quarter, down 30 bps from the second

quarter fiscal year 2024.

- The percentage of

total Online MRR from Online customers with a continual term of

service of at least 16 months was 74.4%, up 160 bps year over

year.

Financial Outlook: Zoom is

providing the following guidance for its third quarter of fiscal

year 2025 and its full fiscal year 2025.

- Third Quarter Fiscal

Year 2025: Total revenue is expected to be between $1.160 billion

and $1.165 billion and revenue in constant currency is expected to

be between $1.162 billion and $1.167 billion. Non-GAAP income from

operations is expected to be between $438.0 million and $443.0

million. Non-GAAP diluted EPS is expected to be between $1.29 and

$1.31 with approximately 314 million weighted average shares

outstanding.

- Full Fiscal Year 2025:

Total revenue is expected to be between $4.630 billion and $4.640

billion and revenue in constant currency is expected to be between

$4.641 billion and $4.651 billion. Full fiscal year non-GAAP income

from operations is expected to be between $1.790 billion and $1.800

billion. Full fiscal year non-GAAP diluted EPS is expected to be

between $5.29 and $5.32 with approximately 316 million weighted

average shares outstanding. Full fiscal year free cash flow is

expected to be between $1.580 billion and $1.620 billion.

The EPS and share count figures do not include the

impact from $1.062 billion of authorized share repurchase

remaining as of July 31, 2024.

Additional information on Zoom's reported results,

including a reconciliation of the non-GAAP results to their most

comparable GAAP measures, is included in the financial tables

below. A reconciliation of non-GAAP guidance measures to

corresponding GAAP measures is not available on a forward-looking

basis without unreasonable effort due to the uncertainty of

expenses that may be incurred in the future, although it is

important to note that these factors could be material to Zoom's

results computed in accordance with GAAP.

A supplemental financial presentation and other

information can be accessed through Zoom’s investor relations

website at investors.zoom.us.

Zoom Video Earnings Call

Zoom will host a Zoom Video Webinar for investors

on August 21, 2024 at 2:00 p.m. Pacific Time / 5:00 p.m.

Eastern Time to discuss the company’s financial results, business

highlights and financial outlook. Investors are invited to join the

Zoom Video Webinar by visiting: https://investors.zoom.us/

About Zoom

Zoom’s mission is to provide one platform that

delivers limitless human connection. Reimagine teamwork with Zoom

Workplace — Zoom’s open collaboration platform with AI Companion

empowers teams to be more productive. Together with Zoom Workplace,

Zoom’s Business Services for sales, marketing, and customer care

teams, including Zoom Contact Center, strengthen customer

relationships throughout the customer lifecycle. Founded in 2011,

Zoom is publicly traded (NASDAQ:ZM) and headquartered in San Jose,

California. Get more information at zoom.com.

Forward-Looking Statements

This press release contains express and implied

“forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995, including statements

regarding Zoom's financial outlook for the third quarter of fiscal

year 2025 and full fiscal year 2025, Zoom’s market position,

opportunities, and growth strategy, product initiatives,

go-to-market motions and the expected benefits resulting from the

same, market trends, and Zoom's stock repurchase program. In some

cases, you can identify forward-looking statements by terms such as

“anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,”

“might,” “plan,” “project,” “will,” “would,” “should,” “could,”

“can,” “predict,” “potential,” “target,” “explore,” “continue,” or

the negative of these terms, and similar expressions intended to

identify forward-looking statements. By their nature, these

statements are subject to numerous uncertainties and risks,

including factors beyond our control, that could cause actual

results, performance or achievement to differ materially and

adversely from those anticipated or implied in the statements,

including: declines in new customers, renewals or upgrades, or

decline in demand for our platform, difficulties in evaluating our

prospects and future results of operations given our limited

operating history, competition from other providers of

communications platforms, the effect of macroeconomic conditions on

our business, including inflation and market volatility, lengthened

sales cycles with large organizations, delays or outages in

services from our co-located data centers, failures in internet

infrastructure or interference with broadband access, compromised

security measures, including ours and those of the third parties

upon which we rely, and global security concerns and their

potential impact on regional and global economies and supply

chains. Additional risks and uncertainties that could cause actual

outcomes and results to differ materially from those contemplated

by the forward-looking statements are included under the caption

“Risk Factors” and elsewhere in our most recent filings with the

Securities and Exchange Commission (the “SEC”), including our

quarterly report on Form 10-Q for the fiscal quarter ended April

30, 2024. Forward-looking statements speak only as of the date the

statements are made and are based on information available to Zoom

at the time those statements are made and/or management's good

faith belief as of that time with respect to future events. Zoom

assumes no obligation to update forward-looking statements to

reflect events or circumstances after the date they were made,

except as required by law.

Non-GAAP Financial Measures

Zoom has provided in this press release financial

information that has not been prepared in accordance with generally

accepted accounting principles in the United States (“GAAP”). Zoom

uses these non-GAAP financial measures internally in analyzing its

financial results and believes that use of these non-GAAP financial

measures is useful to investors as an additional tool to evaluate

ongoing operating results and trends and in comparing Zoom’s

financial results with other companies in its industry, many of

which present similar non-GAAP financial measures.

Non-GAAP financial measures are not meant to be

considered in isolation or as a substitute for comparable GAAP

financial measures and should be read only in conjunction with

Zoom’s condensed consolidated financial statements prepared in

accordance with GAAP. A reconciliation of Zoom’s historical

non-GAAP financial measures to the most directly comparable GAAP

measures has been provided in the financial statement tables

included in this press release, and investors are encouraged to

review the reconciliation.

Non-GAAP Income from Operations and Non-GAAP

Operating Margin. Zoom defines non-GAAP income from operations as

income from operations excluding stock-based compensation expense

and related payroll taxes, acquisition-related expenses,

restructuring expenses, and litigation settlements, net. Zoom

excludes stock-based compensation expense because it is non-cash in

nature and excluding this expense provides meaningful supplemental

information regarding Zoom’s operational performance and allows

investors the ability to make more meaningful comparisons between

Zoom’s operating results and those of other companies. Zoom

excludes the amount of employer payroll taxes related to employee

stock plans, which is a cash expense, in order for investors to see

the full effect that excluding stock-based compensation expense had

on Zoom's operating results. In particular, this expense is

dependent on the price of our common stock and other factors that

are beyond our control and do not correlate to the operation of the

business. Zoom views acquisition-related expenses when applicable,

such as amortization of acquired intangible assets, transaction

costs, and acquisition-related retention payments that are directly

related to business combinations as events that are not necessarily

reflective of operational performance during a period.

Restructuring expenses are expenses associated with a formal

restructuring plan and may include employee notice period costs,

severance payments, and other related expenses. Zoom excludes these

restructuring expenses because they are distinct from ongoing

operational costs and Zoom does not believe they are reflective of

current and expected future business performance and operating

results. Zoom excludes significant litigation settlements, net of

amounts covered by insurance, that we deem not to be in the

ordinary course of our business. In fact, Zoom believes the

consideration of measures that exclude such expenses can assist in

the comparison of operational performance in different periods that

may or may not include such expenses and assist in the comparison

with the results of other companies in the industry.

Non-GAAP Net Income and Non-GAAP Net Income Per

Share, Basic and Diluted. Zoom defines non-GAAP net income and

non-GAAP net income per share, basic and diluted, as GAAP net

income and GAAP net income per share, basic and diluted,

respectively, adjusted to exclude stock-based compensation expense

and related payroll taxes, acquisition-related expenses,

restructuring expenses, gains/losses on strategic investments, net,

litigation settlements, net, and the tax effects of all non-GAAP

adjustments. Zoom excludes these items because they are considered

by management to be outside of Zoom’s core operating results. These

adjustments are intended to provide investors and management with

greater visibility to the underlying performance of Zoom’s business

operations, facilitate comparison of its results with other

periods, and may also facilitate comparison with the results of

other companies in the industry.

Free Cash Flow and Free Cash Flow Margin. Zoom

defines free cash flow as GAAP net cash provided by operating

activities less purchases of property and equipment. Zoom considers

free cash flow to be a liquidity measure that provides useful

information to management and investors regarding net cash provided

by operating activities and cash used for investments in property

and equipment required to maintain and grow the business.

Revenue in Constant Currency. Zoom defines revenue

in constant currency as GAAP revenue adjusted for revenue reported

in currencies other than United States dollars as if they were

converted into United States dollars using the average exchange

rates from the comparative period rather than the actual exchange

rates in effect during the respective periods. Zoom provides

revenue in constant currency information as a framework for

assessing how Zoom's underlying businesses performed period to

period, excluding the effects of foreign currency fluctuations.

Customer Metrics

Zoom defines a customer as a separate and distinct

buying entity, which can be a single paid user or an organization

of any size (including a distinct unit of an organization) that has

multiple users. Zoom defines Enterprise customers as distinct

business units that have been engaged by either our direct sales

team, resellers, or strategic partners. All other customers that

subscribe to our services directly through our website are referred

to as Online customers.

Zoom calculates net dollar expansion rate as of a

period end by starting with the annual recurring revenue (“ARR”)

from Enterprise customers as of 12 months prior (“Prior Period

ARR”). Zoom defines ARR as the annualized revenue run rate of

subscription agreements from all customers at a point in time. Zoom

calculates ARR by taking the monthly recurring revenue (“MRR”) and

multiplying it by 12. MRR is defined as the recurring revenue

run-rate of subscription agreements from all Enterprise customers

for the last month of the period, including revenue from monthly

subscribers who have not provided any indication that they intend

to cancel their subscriptions. Zoom then calculates the ARR from

these Enterprise customers as of the current period end (“Current

Period ARR”), which includes any upsells, contraction, and

attrition. Zoom divides the Current Period ARR by the Prior Period

ARR to arrive at the net dollar expansion rate. For the trailing 12

months calculation, Zoom takes an average of the net dollar

expansion rate over the trailing 12 months.

Zoom calculates online average monthly churn by

starting with the Online customer MRR as of the beginning of the

applicable quarter (“Entry MRR”). Zoom defines Entry MRR as the

recurring revenue run-rate of subscription agreements from all

Online customers except for subscriptions that Zoom recorded as

churn in a previous quarter based on the customers' earlier

indication to us of their intention to cancel that subscription.

Zoom then determines the MRR related to customers who canceled or

downgraded their subscription or notified us of that intention

during the applicable quarter (“Applicable Quarter MRR Churn”) and

divides the Applicable Quarter MRR Churn by the applicable quarter

Entry MRR to arrive at the MRR churn rate for Online Customers for

the applicable quarter. Zoom then divides that amount by three to

calculate the online average monthly churn.

Public Relations

Colleen RodriguezHead of Global Public

Relationspress@zoom.us

Investor Relations

Charles EveslageHead of Investor

Relationsinvestors@zoom.us

|

Zoom Video Communications, Inc.Condensed

Consolidated Balance Sheets(In

thousands) |

| |

| |

As of |

| |

July 31,2024 |

|

January 31,2024 |

|

Assets |

(unaudited) |

|

|

|

Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

1,539,457 |

|

|

$ |

1,558,252 |

|

|

Marketable securities |

|

5,980,575 |

|

|

|

5,404,233 |

|

|

Accounts receivable, net |

|

528,237 |

|

|

|

536,078 |

|

|

Deferred contract acquisition costs, current |

|

197,502 |

|

|

|

208,474 |

|

|

Prepaid expenses and other current assets |

|

149,374 |

|

|

|

219,182 |

|

|

Total current assets |

|

8,395,145 |

|

|

|

7,926,219 |

|

|

Deferred contract acquisition costs, noncurrent |

|

120,603 |

|

|

|

138,724 |

|

|

Property and equipment, net |

|

347,714 |

|

|

|

293,704 |

|

|

Operating lease right-of-use assets |

|

53,045 |

|

|

|

58,975 |

|

|

Strategic investments |

|

438,529 |

|

|

|

409,222 |

|

|

Goodwill |

|

307,295 |

|

|

|

307,295 |

|

|

Deferred tax assets |

|

718,066 |

|

|

|

662,177 |

|

|

Other assets, noncurrent |

|

126,795 |

|

|

|

133,477 |

|

|

Total assets |

$ |

10,507,192 |

|

|

$ |

9,929,793 |

|

|

Liabilities and stockholders’ equity |

|

|

|

|

Current liabilities: |

|

|

|

|

Accounts payable |

$ |

10,611 |

|

|

$ |

10,175 |

|

|

Accrued expenses and other current liabilities |

|

439,459 |

|

|

|

500,164 |

|

|

Deferred revenue, current |

|

1,391,278 |

|

|

|

1,251,848 |

|

|

Total current liabilities |

|

1,841,348 |

|

|

|

1,762,187 |

|

|

Deferred revenue, noncurrent |

|

15,416 |

|

|

|

18,514 |

|

|

Operating lease liabilities, noncurrent |

|

36,052 |

|

|

|

48,308 |

|

|

Other liabilities, noncurrent |

|

89,129 |

|

|

|

81,378 |

|

|

Total liabilities |

|

1,981,945 |

|

|

|

1,910,387 |

|

| |

|

|

|

|

Stockholders’ equity: |

|

|

|

|

Common stock |

|

308 |

|

|

|

307 |

|

|

Additional paid-in capital |

|

5,298,145 |

|

|

|

5,228,756 |

|

|

Accumulated other comprehensive (loss) income |

|

2,191 |

|

|

|

1,063 |

|

|

Retained earnings |

|

3,224,603 |

|

|

|

2,789,280 |

|

|

Total stockholders’ equity |

|

8,525,247 |

|

|

|

8,019,406 |

|

|

Total liabilities and stockholders’ equity |

$ |

10,507,192 |

|

|

$ |

9,929,793 |

|

|

|

|

|

|

|

|

|

|

Note: The amount of unbilled accounts receivable

included within accounts receivable, net on the condensed

consolidated balance sheets was $119.9 million and $124.8 million

as of July 31, 2024 and January 31, 2024,

respectively.

|

Zoom Video Communications, Inc.Condensed

Consolidated Statements of Operations(Unaudited,

in thousands, except share and per share amounts) |

| |

| |

Three Months Ended July 31, |

|

Six Months Ended July 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Revenue |

$ |

1,162,520 |

|

|

$ |

1,138,676 |

|

|

$ |

2,303,754 |

|

|

$ |

2,244,040 |

|

|

Cost of revenue |

|

285,089 |

|

|

|

266,559 |

|

|

|

558,391 |

|

|

|

530,506 |

|

|

Gross profit |

|

877,431 |

|

|

|

872,117 |

|

|

|

1,745,363 |

|

|

|

1,713,534 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

Research and development |

|

206,756 |

|

|

|

191,802 |

|

|

|

412,314 |

|

|

|

401,073 |

|

|

Sales and marketing |

|

358,770 |

|

|

|

373,373 |

|

|

|

706,778 |

|

|

|

795,877 |

|

|

General and administrative |

|

109,535 |

|

|

|

129,324 |

|

|

|

220,879 |

|

|

|

329,224 |

|

|

Total operating expenses |

|

675,061 |

|

|

|

694,499 |

|

|

|

1,339,971 |

|

|

|

1,526,174 |

|

|

Income from operations |

|

202,370 |

|

|

|

177,618 |

|

|

|

405,392 |

|

|

|

187,360 |

|

|

Gains on strategic investments, net |

|

3,107 |

|

|

|

31,670 |

|

|

|

20,461 |

|

|

|

33,945 |

|

|

Other income, net |

|

87,412 |

|

|

|

41,085 |

|

|

|

159,000 |

|

|

|

72,298 |

|

|

Income before provision for income taxes |

|

292,889 |

|

|

|

250,373 |

|

|

|

584,853 |

|

|

|

293,603 |

|

|

Provision for income taxes |

|

73,874 |

|

|

|

68,399 |

|

|

|

149,530 |

|

|

|

96,185 |

|

|

Net income |

|

219,015 |

|

|

|

181,974 |

|

|

|

435,323 |

|

|

|

197,418 |

|

| |

|

|

|

|

|

|

|

|

Net income per share: |

|

|

|

|

|

|

|

|

Basic |

$ |

0.71 |

|

|

$ |

0.61 |

|

|

$ |

1.41 |

|

|

$ |

0.66 |

|

|

Diluted |

$ |

0.70 |

|

|

$ |

0.59 |

|

|

$ |

1.38 |

|

|

$ |

0.65 |

|

|

Weighted-average shares used in computing net income per

share: |

|

|

|

|

|

|

|

|

Basic |

|

309,137,807 |

|

|

|

299,093,452 |

|

|

|

308,921,610 |

|

|

|

297,281,846 |

|

|

Diluted |

|

314,027,192 |

|

|

|

305,932,596 |

|

|

|

314,696,351 |

|

|

|

305,054,771 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Zoom Video Communications, Inc.Condensed

Consolidated Statements of Cash Flows(Unaudited,

in thousands) |

| |

| |

Three Months Ended July 31, |

|

Six Months Ended July 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Cash flows from operating activities: |

|

|

|

|

|

|

|

|

Net income |

$ |

219,015 |

|

|

$ |

181,974 |

|

|

$ |

435,323 |

|

|

$ |

197,418 |

|

|

Adjustments to reconcile net income to net cash provided by

operating activities: |

|

|

|

|

|

|

|

|

Stock-based compensation expense |

|

237,950 |

|

|

|

261,509 |

|

|

|

467,375 |

|

|

|

543,854 |

|

|

Amortization of deferred contract acquisition costs |

|

71,688 |

|

|

|

65,514 |

|

|

|

139,813 |

|

|

|

138,744 |

|

|

Depreciation and amortization |

|

29,084 |

|

|

|

26,126 |

|

|

|

55,751 |

|

|

|

50,202 |

|

|

Deferred income taxes |

|

(49,914 |

) |

|

|

(7,536 |

) |

|

|

(57,866 |

) |

|

|

13,975 |

|

|

Gains on strategic investments, net |

|

(3,107 |

) |

|

|

(31,670 |

) |

|

|

(20,461 |

) |

|

|

(33,945 |

) |

|

Provision for accounts receivable allowances |

|

5,736 |

|

|

|

6,771 |

|

|

|

12,518 |

|

|

|

22,204 |

|

|

Unrealized foreign exchange (gains) losses |

|

(8 |

) |

|

|

1,367 |

|

|

|

7,229 |

|

|

|

4,683 |

|

|

Non-cash operating lease cost |

|

6,589 |

|

|

|

5,276 |

|

|

|

11,957 |

|

|

|

10,657 |

|

|

Amortization of discount/premium on marketable securities |

|

(18,172 |

) |

|

|

(11,249 |

) |

|

|

(35,840 |

) |

|

|

(18,014 |

) |

|

Other |

|

(1,323 |

) |

|

|

2,056 |

|

|

|

(1,225 |

) |

|

|

(3,415 |

) |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

Accounts receivable |

|

(4,623 |

) |

|

|

42,732 |

|

|

|

7,637 |

|

|

|

13,631 |

|

|

Prepaid expenses and other assets |

|

25,196 |

|

|

|

(77,229 |

) |

|

|

61,035 |

|

|

|

(83,888 |

) |

|

Deferred contract acquisition costs |

|

(70,591 |

) |

|

|

(46,589 |

) |

|

|

(110,719 |

) |

|

|

(92,927 |

) |

|

Accounts payable |

|

(7,009 |

) |

|

|

3,118 |

|

|

|

267 |

|

|

|

4,999 |

|

|

Accrued expenses and other liabilities |

|

(39,025 |

) |

|

|

(83,591 |

) |

|

|

(53,967 |

) |

|

|

(58,951 |

) |

|

Deferred revenue |

|

55,665 |

|

|

|

2,992 |

|

|

|

133,629 |

|

|

|

56,332 |

|

|

Operating lease liabilities, net |

|

(7,817 |

) |

|

|

(5,600 |

) |

|

|

(14,931 |

) |

|

|

(11,101 |

) |

|

Net cash provided by operating activities |

|

449,334 |

|

|

|

335,971 |

|

|

|

1,037,525 |

|

|

|

754,458 |

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

|

Purchases of marketable securities |

|

(1,313,404 |

) |

|

|

(1,057,936 |

) |

|

|

(2,181,315 |

) |

|

|

(1,826,166 |

) |

|

Maturities of marketable securities |

|

867,228 |

|

|

|

983,434 |

|

|

|

1,644,169 |

|

|

|

1,543,120 |

|

|

Purchases of property and equipment |

|

(84,234 |

) |

|

|

(46,600 |

) |

|

|

(102,742 |

) |

|

|

(68,426 |

) |

|

Purchases of strategic investments |

|

(10,500 |

) |

|

|

— |

|

|

|

(13,500 |

) |

|

|

(51,000 |

) |

|

Proceeds from strategic investments |

|

— |

|

|

|

107,244 |

|

|

|

4,654 |

|

|

|

107,244 |

|

|

Cash paid for acquisition, net of cash acquired |

|

— |

|

|

|

(5,502 |

) |

|

|

— |

|

|

|

(204,918 |

) |

|

Net cash used in investing activities |

|

(540,910 |

) |

|

|

(19,360 |

) |

|

|

(648,734 |

) |

|

|

(500,146 |

) |

|

Cash flows from financing activities: |

|

|

|

|

|

|

|

|

Proceeds from exercise of stock options |

|

839 |

|

|

|

3,418 |

|

|

|

1,855 |

|

|

|

7,686 |

|

|

Proceeds from issuance of common stock for employee stock purchase

plan |

|

34,263 |

|

|

|

32,513 |

|

|

|

34,263 |

|

|

|

32,513 |

|

|

Proceeds from employee equity transactions (remitted) to be

remitted to employees and tax authorities, net |

|

(3,722 |

) |

|

|

(1,492 |

) |

|

|

2,859 |

|

|

|

1,259 |

|

|

Cash paid for repurchases of common stock |

|

(287,645 |

) |

|

|

— |

|

|

|

(437,693 |

) |

|

|

— |

|

|

Net cash (used in) provided by financing activities |

|

(256,265 |

) |

|

|

34,439 |

|

|

|

(398,716 |

) |

|

|

41,458 |

|

|

Effect of exchange rate changes on cash, cash equivalents, and

restricted cash |

|

706 |

|

|

|

(1,228 |

) |

|

|

(6,146 |

) |

|

|

(3,781 |

) |

|

Net (decrease) increase in cash, cash equivalents, and restricted

cash |

|

(347,135 |

) |

|

|

349,822 |

|

|

|

(16,071 |

) |

|

|

291,989 |

|

|

Cash, cash equivalents, and restricted cash – beginning of

period |

|

1,896,444 |

|

|

|

1,042,410 |

|

|

|

1,565,380 |

|

|

|

1,100,243 |

|

|

Cash, cash equivalents, and restricted cash – end of period |

$ |

1,549,309 |

|

|

$ |

1,392,232 |

|

|

$ |

1,549,309 |

|

|

$ |

1,392,232 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Zoom Video Communications,

Inc.Reconciliation of GAAP to Non-GAAP

Measures(Unaudited, in thousands, except share and

per share amounts) |

| |

| |

Three Months Ended July 31, |

|

Six Months Ended July 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

GAAP income from operations |

$ |

202,370 |

|

|

$ |

177,618 |

|

|

$ |

405,392 |

|

|

$ |

187,360 |

|

|

Add: |

|

|

|

|

|

|

|

|

Stock-based compensation expense and related payroll taxes |

|

244,111 |

|

|

|

269,320 |

|

|

|

486,985 |

|

|

|

547,368 |

|

|

Litigation settlements, net |

|

(1,750 |

) |

|

|

— |

|

|

|

(1,750 |

) |

|

|

52,500 |

|

|

Acquisition-related expenses |

|

10,811 |

|

|

|

14,928 |

|

|

|

21,512 |

|

|

|

23,779 |

|

|

Restructuring expenses |

|

— |

|

|

|

(187 |

) |

|

|

— |

|

|

|

72,993 |

|

|

Non-GAAP income from operations |

$ |

455,542 |

|

|

$ |

461,679 |

|

|

$ |

912,139 |

|

|

$ |

884,000 |

|

|

GAAP operating margin |

|

17.4 |

% |

|

|

15.6 |

% |

|

|

17.6 |

% |

|

|

8.3 |

% |

|

Non-GAAP operating margin |

|

39.2 |

% |

|

|

40.5 |

% |

|

|

39.6 |

% |

|

|

39.4 |

% |

| |

|

|

|

|

|

|

|

|

GAAP net income |

$ |

219,015 |

|

|

$ |

181,974 |

|

|

$ |

435,323 |

|

|

$ |

197,418 |

|

|

Add: |

|

|

|

|

|

|

|

|

Stock-based compensation expense and related payroll taxes |

|

244,111 |

|

|

|

269,320 |

|

|

|

486,985 |

|

|

|

547,368 |

|

|

Litigation settlements, net |

|

(1,750 |

) |

|

|

— |

|

|

|

(1,750 |

) |

|

|

52,500 |

|

|

Gains on strategic investments, net |

|

(3,107 |

) |

|

|

(31,670 |

) |

|

|

(20,461 |

) |

|

|

(33,945 |

) |

|

Acquisition-related expenses |

|

10,811 |

|

|

|

14,928 |

|

|

|

21,512 |

|

|

|

23,779 |

|

|

Restructuring expenses |

|

— |

|

|

|

(187 |

) |

|

|

— |

|

|

|

72,993 |

|

|

Tax effects on non-GAAP adjustments |

|

(32,659 |

) |

|

|

(24,800 |

) |

|

|

(58,870 |

) |

|

|

(97,297 |

) |

|

Non-GAAP net income |

$ |

436,421 |

|

|

$ |

409,565 |

|

|

$ |

862,739 |

|

|

$ |

762,816 |

|

| |

|

|

|

|

|

|

|

|

Net income per share - basic and diluted: |

|

|

|

|

|

|

|

|

GAAP net income per share - basic |

$ |

0.71 |

|

|

$ |

0.61 |

|

|

$ |

1.41 |

|

|

$ |

0.66 |

|

|

Non-GAAP net income per share - basic |

$ |

1.41 |

|

|

$ |

1.37 |

|

|

$ |

2.79 |

|

|

$ |

2.57 |

|

|

GAAP net income per share - diluted |

$ |

0.70 |

|

|

$ |

0.59 |

|

|

$ |

1.38 |

|

|

$ |

0.65 |

|

|

Non-GAAP net income per share - diluted |

$ |

1.39 |

|

|

$ |

1.34 |

|

|

$ |

2.74 |

|

|

$ |

2.50 |

|

| |

|

|

|

|

|

|

|

|

GAAP and non-GAAP weighted-average shares used to compute net

income per share - basic |

|

309,137,807 |

|

|

|

299,093,452 |

|

|

|

308,921,610 |

|

|

|

297,281,846 |

|

|

GAAP and non-GAAP weighted-average shares used to compute net

income per share - diluted |

|

314,027,192 |

|

|

|

305,932,596 |

|

|

|

314,696,351 |

|

|

|

305,054,771 |

|

| |

|

|

|

|

|

|

|

|

Net cash provided by operating activities |

$ |

449,334 |

|

|

$ |

335,971 |

|

|

$ |

1,037,525 |

|

|

$ |

754,458 |

|

|

Less: Purchases of property and equipment |

|

(84,234 |

) |

|

|

(46,600 |

) |

|

|

(102,742 |

) |

|

|

(68,426 |

) |

|

Free cash flow (non-GAAP) |

$ |

365,100 |

|

|

$ |

289,371 |

|

|

$ |

934,783 |

|

|

$ |

686,032 |

|

|

Net cash used in investing activities |

$ |

(540,910 |

) |

|

$ |

(19,360 |

) |

|

$ |

(648,734 |

) |

|

$ |

(500,146 |

) |

|

Net cash (used in) provided by financing activities |

$ |

(256,265 |

) |

|

$ |

34,439 |

|

|

$ |

(398,716 |

) |

|

$ |

41,458 |

|

|

Operating cash flow margin (GAAP) |

|

38.7 |

% |

|

|

29.5 |

% |

|

|

45.0 |

% |

|

|

33.6 |

% |

|

Free cash flow margin (non-GAAP) |

|

31.4 |

% |

|

|

25.4 |

% |

|

|

40.6 |

% |

|

|

30.6 |

% |

| |

|

|

|

|

|

|

|

| |

Three Months Ended July 31, |

|

Six Months Ended July 31, |

| |

|

2024 |

|

|

|

2024 |

|

| |

Revenue |

|

YoY Revenue Growth (%) |

|

Revenue |

|

YoY Revenue Growth (%) |

|

GAAP revenue |

$ |

1,162,520 |

|

|

|

2.1 |

% |

|

$ |

2,303,754 |

|

|

|

2.7 |

% |

|

Add: Constant currency impact |

|

3,573 |

|

|

|

0.3 |

% |

|

|

5,923 |

|

|

|

0.2 |

% |

|

Revenue in constant currency (non-GAAP) |

|

1,166,093 |

|

|

|

2.4 |

% |

|

|

2,309,677 |

|

|

|

2.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

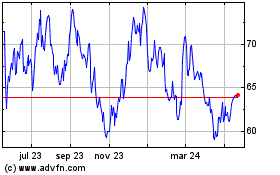

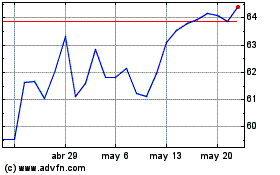

Zoom Video Communications (NASDAQ:ZM)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Zoom Video Communications (NASDAQ:ZM)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024