Filed by Amcor plc

Pursuant to Rule 425 of the Securities Act

of 1933

and deemed filed pursuant to Rule 14a-12

of the Securities Exchange Act of 1934

Subject Company: Berry Global Group, Inc.

Commission File No.: 001-35672

Explanatory Note: The following is

a script for a pre-recorded video message from Peter Konieczny and Kevin J. Kwilinski to employees of Berry Global Group, Inc.

that was released on November 21, 2024.

November 21, 2024

PK and Kevin Pre-Recorded Message

Script to Berry Employees

Kevin Kwilinski:

Hi everyone. I’m thrilled to speak with you

today following the recent news we made regarding our agreement to merge with Amcor. I’m joined by Peter Konieczny, Amcor’s

CEO, or as many folks call him, PK.

Let me begin by saying that by combining with Amcor

we are creating a company that is even better positioned to grow and thrive. Together, we will be a global leader in consumer and healthcare

packaging solutions. Our complementary businesses, unprecedented innovation capabilities and scale will enable us to accelerate growth

and solve customers’ and consumers’ sustainability needs in ways neither company could achieve on their own. It’s really

a great example of 1 plus 1 equaling 3.

PK and I have been working closely throughout this

process to achieve the best for both organizations. With decades of industrial and packaging experience, PK is a true expert in the industry

and has demonstrated a clear commitment to building a culture of collaboration, innovation and execution. He has approached this transaction

as a true partnership from the very beginning, and I am confident in his leadership as we take this next step.

As we were discussing the opportunities ahead for

us, we both felt it was important that you hear directly from him. So, let me turn it over to PK to share a bit of background on himself

and why he is so excited about our combination.

Peter Konieczny:

Thank you, Kevin and hello, Berry team! It’s

great to be here and speak with all of you about this exciting announcement. Amcor and Berry are two great companies with very complementary

businesses, and we are confident we will be stronger together. I would like to start by thanking Kevin for his kind introduction and,

most importantly, for his fantastic job steering Berry to where it is today: a world-class leader with immensely talented people, unique

capabilities and loyal customers. Under Kevin’s leadership, Berry has reshaped its portfolio and gained strong momentum. The progress

made in just over a year is remarkable.

As a brief introduction, I’ve been fortunate

to be a member of the Amcor family for the past 14 years and was appointed Chief Executive in September. I’ve loved my time here

and I hope today I can give you a glimpse of what it means to be part of the Amcor family. We have a truly diverse, global team –

a friend in every continent – with a pretty unique culture. It is rare to find Amcor’s mix of warm, human, down-to-earth

style combined with a deep drive, a passion to accomplish really special things.

And that drive is deeply rooted in purpose –

in keeping each other safe, helping the people and companies who use our products and, of course, advancing sustainability. And this

combination doubles down on our purpose and accelerates our capabilities at a time when we have a unique opportunity to change how the

world thinks about packaging.

There are areas where Berry has more advanced innovation and capabilities

than Amcor, and vice versa. Combined, we will be able to do more, faster and better. Ultimately, we’ll be able to achieve breakthrough

solutions for global challenges that are simply out of reach for our individual companies today.

And, by combining our capabilities, footprints and

offerings, we will be far better positioned to help global and local customers grow faster and operate more efficiently. Together, our

companies have an exciting opportunity to combine our talents and resources to accelerate the possible, right now, elevating brands,

shaping lives and protecting the Earth in ways neither of our companies could do alone.

Kevin Kwilinski:

Well said, PK. Importantly, both of our companies are

deeply committed to safety and delivering for our customers at an exceptional level with innovative products that improve daily life for

consumers everywhere. This merger will position us well in fast-growing categories as our teams pioneer the solutions our customers are

striving for.

While our merger announcement is a significant milestone,

it is just the first step in bringing our companies together.

We want to stress that it’s business as usual

for our two separate companies while we go through the regulatory clearance and closing process. I’m counting on everyone at Berry

to stay focused and deliver for our customers so we can continue to be strong. There are no immediate changes to roles, responsibilities

or reporting structures. We’re committed to sharing more information as soon as we have it available.

Peter Konieczny:

That’s right. In the coming weeks, we will be

connecting with Kevin and the Berry leadership team to determine how best to bring our two organizations together.

You are all hugely important in this process, and I

hope to meet many of you as we begin this integration process. In the meantime, I want you to know one of the reasons I am so excited

about this combination is the talent and passion both teams bring to the table. I have no doubt the future is bright for each of our companies…

but together, we can take things to a whole new level. I’m really looking forward to it, I hope you share my excitement for

our bright future together.

Kevin Kwilinski:

I want to conclude by saying it truly continues to

be an honor to serve as your CEO, and I look forward to working with all of you to drive Berry forward during the coming months. Let’s

stay focused and keep performing, as we head toward the next chapter with Amcor.

I am inspired by all of you that make Berry exceptional.

As you heard today, PK and I are excited to join forces

and become even better together.

Important Information

for Investors and Shareholders

This communication

does not constitute an offer to sell or the solicitation of an offer to buy or exchange any securities or a solicitation of any vote

or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. It

does not constitute a prospectus or prospectus equivalent document. No offering or sale of securities shall be made except by means of

a prospectus meeting the requirements of Section 10 of the US Securities Act of 1933, as amended, and otherwise in accordance with

applicable law.

In connection with

the proposed transaction between Amcor plc (“Amcor”) and Berry Global Group, Inc. (“Berry”),

Amcor and Berry intend to file relevant materials with the Securities and Exchange Commission (the “SEC”), including,

among other filings, an Amcor registration statement on Form S-4 that will include a joint proxy statement of Amcor and Berry that

also constitutes a prospectus of Amcor with respect to Amcor’s ordinary shares to be issued in the proposed transaction, and a

definitive joint proxy statement/prospectus, which will be mailed to shareholders of Amcor and Berry (the “Joint Proxy Statement/Prospectus”).

Amcor and Berry may also file other documents with the SEC regarding the proposed transaction. This document is not a substitute for

the Joint Proxy Statement/Prospectus or any other document which Amcor or Berry may file with the SEC. INVESTORS AND SECURITY HOLDERS

OF AMCOR AND BERRY ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER DOCUMENTS THAT WILL BE FILED WITH THE SEC, AS

WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL

CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and security holders will be able to obtain

free copies of the registration statement and the Joint Proxy Statement/Prospectus (when available) and other documents filed with the

SEC by Amcor or Berry through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by

Amcor will be available free of charge on Amcor’s website at amcor.com under the tab “Investors” and under the heading

“Financial Information” and subheading “SEC Filings.” Copies of the documents filed with the SEC by Berry will

be available free of charge on Berry’s website at berryglobal.com under the tab “Investors” and under the heading “Financials”

and subheading “SEC Filings.”

Certain Information

Regarding Participants

Amcor, Berry, and

their respective directors and executive officers may be considered participants in the solicitation of proxies from the shareholders

of Amcor and Berry in connection with the proposed transaction. Information about the directors and executive officers of Amcor is set

forth in its Annual Report on Form 10-K for the year ended June 30, 2024, which was filed with the SEC on August 16, 2024

and its proxy statement for its 2024 annual meeting, which was filed with the SEC on September 24, 2024. Information about the directors

and executive officers of Berry is set forth in its Annual Report on Form 10-K for the year ended September 30, 2023, which

was filed with the SEC on November 17, 2023, its proxy statement for its 2024 annual meeting, which was filed with the SEC on January 4,

2024, and its Current Reports on Form 8-K, which were filed with the SEC on February 12, 2024, April 11, 2024, September 6,

2024 and November 4, 2024. To the extent holdings of Amcor’s or Berry’s securities by its directors or executive officers

have changed since the amounts set forth in such filings, such changes have been or will be reflected on Initial Statements of Beneficial

Ownership on Form 3 or Statements of Beneficial Ownership on Form 4 filed with the SEC. Information about the directors and

executive officers of Amcor and Berry, including a description of their direct or indirect interests, by security holdings or otherwise,

and other information regarding the potential participants in the proxy solicitations, which may be different than those of Amcor’s

shareholders and Berry’s stockholders generally, will be contained in the Joint Proxy Statement/Prospectus and other relevant materials

to be filed with the SEC regarding the proposed transaction. You may obtain these documents (when they become available) free of charge

through the website maintained by the SEC at http://www.sec.gov and from Amcor’s or Berry’s website as described above.

Cautionary Statement

Regarding Forward-Looking Statements

This communication

contains certain statements that are “forward-looking statements” within the meaning of Section 27A of the Securities

Act and Section 21E of the Exchange Act. Some of these forward-looking statements can be identified by words like “anticipate,”

“approximately,” “believe,” “continue,” “could,” “estimate,” “expect,”

“forecast,” “intend,” “may,” “outlook,” “plan,” “potential,”

“possible,” “predict,” “project,” “target,” “seek,” “should,”

“will,” or “would,” the negative of these words, other terms of similar meaning or the use of future dates. Such

statements, including projections as to the anticipated benefits of the proposed transaction, the impact of the proposed transaction

on Amcor’s and Berry’s business and future financial and operating results and prospects, the amount and timing of synergies

from the proposed transaction, the terms and scope of the expected financing in connection with the proposed transaction, the aggregate

amount of indebtedness of the combined company following the closing of the proposed transaction and the closing date for the proposed

transaction, are based on the current estimates, assumptions and projections of the management of Amcor and Berry, and are qualified

by the inherent risks and uncertainties surrounding future expectations generally, all of which are subject to change. Actual results

could differ materially from those currently anticipated due to a number of risks and uncertainties, many of which are beyond Amcor’s

and Berry’s control. None of Amcor, Berry or any of their respective directors, executive officers, or advisors, provide any representation,

assurance or guarantee that the occurrence of the events expressed or implied in any forward-looking statements will actually occur,

or if any of them do occur, what impact they will have on the business, results of operations or financial condition of Amcor or Berry.

Should any risks and uncertainties develop into actual events, these developments could have a material adverse effect on Amcor’s

and Berry’s businesses, the proposed transaction and the ability to successfully complete the proposed transaction and realize

its expected benefits. Risks and uncertainties that could cause results to differ from expectations include, but are not limited to,

the occurrence of any event, change or other circumstance that could give rise to the termination of the merger agreement; the risk that

the conditions to the completion of the proposed transaction (including shareholder and regulatory approvals) are not satisfied in a

timely manner or at all; the risks arising from the integration of the Amcor and Berry businesses; the risk that the anticipated benefits

of the proposed transaction may not be realized when expected or at all; the risk of unexpected costs or expenses resulting from the

proposed transaction; the risk of litigation related to the proposed transaction; the risks related to disruption of management’s

time from ongoing business operations as a result of the proposed transaction; the risk that the proposed transaction may have an adverse

effect on the ability of Amcor and Berry to retain key personnel and customers; general economic, market and social developments and

conditions; the evolving legal, regulatory and tax regimes under which Amcor and Berry operate; potential business uncertainty, including

changes to existing business relationships, during the pendency of the proposed transaction that could affect Amcor’s and/or Berry’s

financial performance; and other risks and uncertainties identified from time to time in Amcor’s and Berry’s respective filings

with the SEC, including the Joint Proxy Statement/Prospectus to be filed with the SEC in connection with the proposed transaction. While

the list of risks presented here is, and the list of risks presented in the Joint Proxy Statement/Prospectus will be, considered representative,

no such list should be considered to be a complete statement of all potential risks and uncertainties, and other risks may present significant

additional obstacles to the realization of forward-looking statements. Forward-looking statements included herein are made only as of

the date hereof and neither Amcor nor Berry undertakes any obligation to update any forward-looking statements, or any other information

in this communication, as a result of new information, future developments or otherwise, or to correct any inaccuracies or omissions

in them which become apparent. All forward-looking statements in this communication are qualified in their entirety by this cautionary

statement.

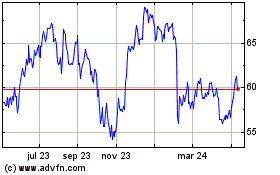

Berry Global (NYSE:BERY)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

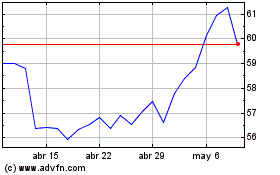

Berry Global (NYSE:BERY)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024