Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

16 Septiembre 2024 - 8:50AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

16 September 2024

Commission File Number: 001-10691

DIAGEO plc

(Translation of registrant’s name into English)

16 Great Marlborough Street, London, United Kingdom, W1F 7HS

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F þ Form 40-F ¨

This report on Form 6-K shall replace Exhibit 97.1 to the Annual Report on Form 20-F for the fiscal year June 30, 2024, filed with the SEC on August 3, 2024, and shall be deemed to be filed and incorporated by reference in the registration statement on Form F-3 (File No. 333-269929) and registration statements on Form S-8 (File Nos. 333-223071, 333-206290, 333-182315, 333-169934, 333-162490, and 333-153481) and to be a part thereof from the date on which this report is furnished, to the extent not superseded by documents or reports subsequently filed or furnished.

This report is comprised of the following:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Diageo plc

(Registrant)

Date: 16 September 2024

By: /s/ James Edmunds

James Edmunds

Deputy Company Secretary

A50533063/7.0/09 Oct 2023 7 APPENDIX: DIAGEO GROUP NYSE COMPENSATION RECOVERY POLICY – AS APPLICABLE TO EXECUTIVE COMMITTEE MEMBERS1 Approved by the Remuneration Committee: 18th October 2023 1 PURPOSE 1.1 The purpose of this policy is to set out the basis for the mandatory recovery of erroneously awarded Incentive-Based Compensation (as defined below) from the Executives (as defined below) of Diageo (the “Company”) and any of its subsidiaries (the “Group”) in the event of an accounting restatement. 1.2 The Remuneration Committee (the “RemCo”) of the board of the Company (the “Board”) has adopted this policy (the “Recovery Policy”) in accordance with the requirements of Section 303A.14 of the New York Stock Exchange’s (“NYSE’s”) Listed Company Manual, which was mandated by Rule 10D-1 of the Securities Exchange Act of 1934. 1.3 The Recovery Policy may be amended from time to time by the RemCo pursuant to any laws, regulations or rules of any stock exchange or other applicable regulatory authority applicable to the Company (“Applicable Rules”). Executives will be made aware of any significant amendments and how this may impact their remuneration. 2 APPLICABILITY 2.1 The Recovery Policy applies to current and former members of the executive committee of the Company (or its equivalent from time to time), as well as any other person(s) (if any) as the Company may determine also constitute "executive officers" as defined in Section 303A.14(e) of the NYSE Listed Company Manual (each an “Executive”). 2.2 Compensation shall be subject to recovery pursuant to this Recovery Policy where: (i) the RemCo determines that such compensation constitutes Incentive-Based Compensation; and (ii) the compensation was Received by an Executive: 2.2.1 After beginning their services as an Executive; 2.2.2 Who served as an Executive at any time during the performance period for that Incentive-Based Compensation; 2.2.3 While the Company has a class of securities listed on the NYSE or another national securities exchange or a national securities association in the United States; and 2.2.4 During the Recovery Period (as defined below), provided that this Recovery Policy shall only apply to compensation Received (as defined below) on or after 2 October 2023 (the “Effective Date”). 2.3 The Recovery Policy will continue to apply to an Executive following any termination of their employment. 1 This Recovery Policy also applies to any other person(s) if any as the Company may determine also constitute "executive officers" as defined in Section 303A.14(e) of the NYSE Listed Company Manual.

A50533063/7.0/09 Oct 2023 8 2.4 The Recovery Policy will be notified to Executives through any means determined by the RemCo and, where applicable, requiring Executives to agree to the terms when accepting Incentive-Based Compensation or via a clause in their employment contract. 3 RECOVERY OF ERRONEOUSLY AWARDED INCENTIVE-BASED COMPENSATION 3.1 In the event that the Company is required to prepare an accounting restatement due to the material noncompliance of the Company with any financial reporting requirement under Applicable Rules, including any required accounting restatement to correct an error in previously issued financial statements that is material to the previously issued financial statements, or that would result in a material misstatement if the error were corrected in the current period or left uncorrected in the current period (“Recoverable Event”),2 the Group shall recover the amount of Incentive-Based Compensation Received by an Executive in the Recovery Period (as defined below) that exceeds the amount of Incentive-Based Compensation that otherwise would have been received had it been determined based on the restated amounts, computed without regard to any taxes paid (“Recoverable Amount”). Whether any relevant noncompliance is material for the purposes of this Recovery Policy shall be determined by the RemCo, which shall be permitted to rely on any decision in this respect of the Board or any other authorised committee thereof (including without limitation the audit committee of the Board). 3.2 The Recovery Period shall mean the period of three full fiscal years preceding the Restatement Date (as defined below) and any transition period that results from a change in the Company’s financial year within or immediately following such period3. 3.3 For Incentive-Based Compensation based on share price or total shareholder return, where the amount of erroneously awarded compensation is not subject to mathematical recalculation directly from the information in an accounting restatement, the Recoverable Amount will be determined by the RemCo, based on the RemCo’s estimate of the effect of the accounting restatement on the share price or total shareholder return upon which the Incentive-Based Compensation was received.4 3.4 Following a Recoverable Event, the RemCo shall: 3.4.1 Determine the Recoverable Amount. 3.4.2 To the extent the Recoverable Amount has been Received by an Executive, instruct the Company to recover the full Recoverable Amount in accordance with paragraph 3.5 below. 2 The following do not constitute an accounting restatement for purposes of the Recovery Policy: (i) the correction of an error in the current period consolidated financial statements (commonly referred to as an out-of-period adjustment) when the error is immaterial to the previously issued consolidated financial statements and the correction of the error is also immaterial to the current period; (ii) the retrospective application of a change in accounting policy; (iii) a retrospective revision of reportable segment information due to a change in the structure of the Group’s internal organization; (iv) a retrospective reclassification due to a discontinued operation; (v) the retrospective application of a change in reporting entity, such as from a reorganization of entities under common control; and (vi) a retrospective revision for a share split, reverse share split, share dividend or other changes in capital structure. 3 A transition period between the last day of the Company’s previous financial year end and the first day of its new financial year that comprises a period of nine to 12 months will be deemed a full financial year, and as such will count as one of the relevant three financial years (rather than be in addition to them). 4 In addition, the RemCo will maintain documentation of the determination of that reasonable estimate and provide such documentation to the NYSE.

A50533063/7.0/09 Oct 2023 9 3.4.3 To the extent the Recoverable Amount has not been Received, but is otherwise owed to an Executive, cancel the right of the Executive to receive the Recoverable Amount. 3.5 Any Recoverable Amount may be recovered by all legal means available, including by requiring the Executive to repay such amount to the Company or any other member of the Group; by requiring any compensation owing by the Company or any member of the Group to the Executive (including any salary or any unvested or unexercised remuneration) to be immediately withheld, forfeited and/or irrevocably cancelled to compensate for the Recoverable Amount or any unrecovered portion thereof; and/or by any other means or taking any other actions against the Executive which the RemCo may deem necessary or advisable to recover the Recoverable Amount. 3.6 Recoupment of the Recoverable Amount under this Recovery Policy will be initiated by the Company as soon as practicable following the written request of the RemCo. 3.7 All amounts recoverable or payable by an Executive to the Company pursuant to this Recovery Policy shall be payable to the Company (or as the Company directs), and shall be payable on demand. 3.8 For purposes of this Recovery Policy: 3.8.1 “Incentive-Based Compensation” means any compensation that is determined by the RemCo, to be granted, earned, or vested based wholly or in part5 upon the attainment of a Financial Reporting Measure (as defined below) (“Incentive-Based Compensation”). This includes, but is not limited to: (i) non-equity incentive plan awards earned based wholly or in part on satisfying a Financial Reporting Measure performance goal; (ii) bonuses paid from a “bonus pool”, the size of which is determined based wholly or in part on satisfying a Financial Reporting Measure performance goal; (iii) other cash awards based wholly or in part on satisfying a Financial Reporting Measure performance goal; (iv) restricted shares, restricted share units, performance share units, stock options and stock appreciation rights that are granted or become vested based wholly or in part on satisfying a Financial Reporting Measure performance goal; and (v) proceeds received upon the sale of shares acquired through an incentive plan that were granted or vested based wholly or in part on satisfying a Financial Reporting Measure performance goal. Incentive- Based Compensation includes compensation Received by Executives under the Annual Incentive Plan (“AIP”) and the Diageo 2014 Long Term Incentive Plan and/or the Diageo 2023 Long Term Incentive Plan (“DLTIP”) or any other variable remuneration structures operated by the Company from time to time under which awards are wholly or in part based upon the attainment of a Financial Reporting Measure. 3.8.2 Incentive-Based Compensation shall not include: (i) an Executive’s salary;6 (ii) bonuses paid solely at the discretion of the RemCo or the Board that are not paid from a “bonus pool” that is determined by satisfying a Financial Reporting Measure performance goal; (iii) bonuses paid solely upon satisfying one or more subjective standards (e.g. demonstrated leadership) and/or completion of a specified 5 Where Incentive-Based Compensation is based only in part on the achievement of a Financial Reporting Measure performance goal, RemCo shall first determine the portion of the original Incentive-Based Compensation based on or derived from the Financial Reporting Measure that was restated. RemCo shall then recalculate the affected portion based on the Financial Reporting Measure as restated. 6 To the extent that an Executive receives a salary increase earned wholly or in part based on the attainment of a financial reporting measure performance goal, such a salary increase is subject to recovery.

A50533063/7.0/09 Oct 2023 10 employment period); (iv) non-equity incentive plan awards earned solely upon satisfying one or more strategic measures (e.g., consummating a merger or divestiture), or operational measures (e.g., completion of a project, increase in market share); and (v) equity awards for which the grant is not contingent upon achieving any Financial Reporting Measure performance goal and vesting is contingent solely upon completion of a specified employment period and/or attaining one or more nonfinancial reporting measures. 3.8.3 “Financial Reporting Measure” means any measure that is determined and presented in accordance with the accounting principles used to prepare the Group’s financial statements, and any measure derived wholly or in part from such measure, including non-IFRS financial measures (as well as other measures, metrics and ratios that are non-IFRS measures). The term Financial Reporting Measure includes stock price and total shareholder return. Financial Reporting Measures may be presented outside the Company’s financial statements. 3.8.4 “Received” means, with respect to any Incentive-Based Compensation, the time when the Financial Reporting Measure specified in the Incentive-Based Remuneration award is attained, even if the payment or grant occurs after the end of the financial period in which the award is attained. In the case of awards subject to multiple conditions, not all conditions must be satisfied for the Incentive-Based Remuneration to be deemed received. The RemCo shall have the discretion to determine when the Incentive-Based Remuneration was Received, and such determination need not be uniform across the type of Incentive-Based Compensation or for all Executives. 3.8.5 “Restatement Date” means the date on which the Company is required to prepare a Restatement, which is the earlier of: (i) the date on which the Board or a committee of the Board concludes, or reasonably should have concluded, that the Company is required to prepare an accounting restatement due to the material non-compliance of the Company with any financial reporting requirement under Applicable Rules; or (ii) the date a court, regulator or other legal authorised body directs the Company to prepare an accounting restatement. 4 IMPRACTICABILITY EXCEPTION TO RECOVERY OBLIGATION 4.1 Notwithstanding the provisions of Section 3 of this Recovery Policy, the Group shall recover the Recoverable Amount except only that the RemCo may (but shall not be obliged to) determine that it will not apply recovery pursuant to this Recovery Policy to the extent that the RemCo determines, in its sole discretion, that pursuit of the recovery would be impracticable. 4.2 The RemCo may determine that a recovery is impracticable only if: 4.2.1 Following a reasonable attempt to recover the Recoverable Amount, the RemCo determines that in its opinion the direct expense that would need to be paid to a third

A50533063/7.0/09 Oct 2023 11 party to assist in enforcing this Recovery Policy would exceed the Recoverable Amount; or 4.2.2 If applicable, the RemCo determines that in its opinion the recovery would jeopardise the qualified status of a U.S. tax-qualified retirement plan. 4.3 In determining whether a recovery would be impracticable due to costs in accordance with 4.2.1 above, the only criteria that the RemCo may consider is whether the direct costs, such as reasonable legal expense and consulting fees, amongst others, paid to a third party to assist in enforcing recovery would exceed the Recoverable Amount. Indirect costs, such as reputational concerns or the effect on hiring of new Executives, amongst others, may not be considered when determining whether recovery is impracticable. 5 INDEMNIFICATION AND INSURANCE 5.1 The Group is prohibited from indemnifying any Executive against the loss of erroneously awarded compensation as set forth in this Recovery Policy. If an Executive purchases a third-party insurance policy to fund potential recovery obligations, the Company is prohibited from paying or reimbursing the Executive for premiums for such an insurance policy. 6 OTHER RECOVERY RIGHTS 6.1 Any right of recovery under this Recovery Policy applies in addition to (and without limiting) any other remedies and/or rights to reduce, cancel or recover any elements of compensation (or similar) that may be available to any member of the Group pursuant to any remuneration policy (including any further malus and clawback policies) operated by any member of the Group, the terms of any incentive plans or awards operated by any member of the Group, any employment agreement and/or any other terms and conditions applicable to any Executive, in each case from time to time in force, and/or pursuant to any other legal remedies available to any member of the Group. Recovery (or similar) may be applied pursuant to both this Recovery Policy and any such other policies, terms or similar in respect of the same award of compensation, provided that there shall be no duplication of recovery. 7 DISCLOSURE 7.1 In the event of any Recoverable Event, the Company shall, to the extent required by Applicable Rules, disclose the recovery amounts and circumstances, including any required details of amounts subject to recovery that remain outstanding, for the relevant fiscal year in its annual report on Form 20-F and otherwise pursuant to any other annual reporting it is obligated to prepare. In addition, this Recovery Policy shall be filed as an exhibit to the Company’s annual report on Form 20-F. 8 ADMINISTRATION AND OPERATION 8.1 The RemCo has the exclusive power and authority to: (i) administer this Recovery Policy, including, without limitation, the right and power to interpret the provisions of this Recovery Policy; (ii) make all determinations deemed necessary or advisable in applying this Recovery Policy (which in every case shall be made at the RemCo’s absolute discretion, without this being limited by references in certain clauses but not others to a discretion being absolute), including, without limitation, determinations as to: (a) what constitutes Incentive-Based Compensation, a Recoverable Amount or other compensation; (b) when a Recoverable Event has occurred; and (c) whether a recovery is impracticable; and (iii) delegate any power

A50533063/7.0/09 Oct 2023 12 or discretion under this Recovery Policy to such person or persons as it may determine (and in which case this Recovery Policy shall be apply accordingly). 8.2 Any action, interpretation or determination taken or made by the RemCo pursuant to this Recovery Policy will be final, conclusive and binding. 9 GENERAL 9.1 Any provision in this Recovery Policy can apply even if the Executive was not responsible for the event in question or if it took place before the grant and/or vesting of any compensation which is subject to recovery. 9.2 Recovery can be applied in different ways for different Executives in relation to the same or different events. 9.3 An Executive will not be entitled to any compensation in respect of any application of this Recovery Policy. 9.4 The terms of this Recovery Policy shall apply regardless of any agreement, undertaking or suggestion (or similar), whether or not contractual, that any compensation shall not be subject to recovery. 9.5 The invalidity or unenforceability of any provision of this Recovery Policy shall not affect the validity or enforceability of any other provision. 9.6 References in this Recovery Policy to the phrase “including” (or similar) shall not limit or prejudice the generality of the following words (without this being limited by such references in some clauses but not others).

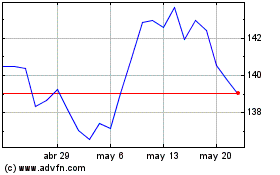

Diageo (NYSE:DEO)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

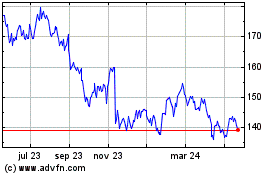

Diageo (NYSE:DEO)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024