Mercer, a business of Marsh McLennan (NYSE: MMC) and a global

leader in helping clients realize their investment objectives,

shape the future of work and enhance health and retirement outcomes

for their people, released results from its 2024 National Survey of

Employer-Sponsored Health Plans.

The survey found that the average per-employee cost of

employer-sponsored health insurance reached $16,501 in 2024, an

increase of about 5% year over year, with employers expecting an

increase of about 6% in 2025.

“Employers doubled down on strategies to manage cost growth

while finding ways to improve key benefits to support employees and

their families in 2024, including expanded coverage for GLP-1

medications and fertility treatments,” said Ed Lehman, Mercer’s US

Health Leader.

The fastest-growing component of health benefit cost continues

to be prescription drugs. Pharmacy benefit cost rose 7.7% in 2024,

following an increase of 8.4% in 2023. One driver of this spend is

the growing utilization of GLP-1 drugs for diabetes and weight

loss.

While nearly all health plans cover GLP-1 drugs for diabetes,

that is not the case for obesity treatment. However, in 2024,

coverage for obesity drugs rose to 44% of all large employers

(those with 500 or more employees), up from 41% last year. Of the

largest employers (20,000 or more employees), 64% now offer

coverage, up sharply from 56% in 2023.

“GLP-1 medications may turn the tide on the obesity epidemic and

positively impact downstream medical costs,” said Tracy Watts,

Mercer’s National Leader for US Health Policy. “Cost is clearly a

concern, and employers are adding authorization requirements to

ensure the medications are used by members who will benefit the

most.”

Employers are also managing the rising cost of specialty drugs,

including expensive gene and cell therapies for conditions such as

hemophilia and sickle cell disease. The most common strategy to

curb costs is working with medical carriers and pharmacy benefit

managers to implement clinical management programs for

patients.

Addressing affordability with more medical plan

choices

Concerns about affordability have led employers to add medical

plan choices that accommodate different financial and medical

needs. This year, 65% of large employers offered three or more

choices to employees, up from 60% in 2023, with the largest

employers providing an average of five options.

One lower-cost option is an Exclusive Provider Organization

(EPO) plan, which uses a closed provider network to help keep cost

down. In 2024, 12% of all large employers and 29% of the largest

employers offered an EPO option. Notably, about a third of these

plans do not require a deductible, which is rare among Preferred

Provider Organization (PPO) plans and not permitted for Health

Savings Account (HSA) eligible plans. Currently, 5% of all covered

US employees are enrolled in an EPO.

Promoting higher quality care

Many of the EPO plans offered by the largest employers (40%)

incorporate a high-performance provider network, in which providers

are selected based on quality and cost metrics, as do 10% of the

PPO plans. “By steering employees to providers of demonstrated

quality and cost efficiency, better outcomes and cost savings

result, a win for both employees and the plan sponsor,” said Ms.

Watts.

Another way to guide employees to higher quality, cost-efficient

care is by providing specialized health navigation or advocacy

services. Nearly half of all large employers (49%) have contracted

a specialized vendor or purchased enhanced services from their

health plan to provide assistance beyond standard customer

service.

Family-forming benefits

Coverage for fertility treatment is becoming increasingly

common, with in vitro fertilization (IVF) now covered by 47% of all

large employers, up from 45% last year. Of the largest employers,

70% cover IVF, up from 62%. Elective egg freezing and elective

sperm freezing are covered by 21% and 20% of all large employers,

respectively.

Most large employers offering fertility benefits (64%) say that

they are intended to be inclusive, meaning eligibility is not

limited to those meeting the clinical definition of infertile.

“Fertility benefits have become table stakes for employers wanting

to offer comprehensive, inclusive benefits,” added Ms. Watts.

Cancer support and other benefit enhancements

Employers are increasingly providing specialized support to

employees dealing with cancer, including prevention and early

detection campaigns, Centers of Excellence, case management,

caregiver resources and workplace support. Two-thirds of large

employers now provide at least one of these resources, with 20% of

the largest employers having a robust cancer strategy and another

24% actively developing one.

Virtual primary care, offering convenient, low-cost access to

physicians via text messaging, is a popular benefit that can

enhance healthcare accessibility. In 2024, 20% of all large

employers and 27% of the largest employers provided this

service.

About Mercer’s National Survey of Employer-Sponsored Health

Plans

Now in its 39th year, Mercer’s National Survey of

Employer-Sponsored Health Plans included 2,194 employers in 2024.

Results are weighted to represent all US health plan sponsors with

50 or more employees. Results are examined separately for employers

with 500 or more employees (“large” employers) and those with

20,000 or more employees (“largest” employers). The survey was

fielded from June 12 through August 16, 2024.

About Mercer

Mercer, a business of Marsh McLennan (NYSE: MMC), is a global

leader in helping clients realize their investment objectives,

shape the future of work and enhance health and retirement outcomes

for their people. Marsh McLennan is a global leader in risk,

strategy and people, advising clients in 130 countries across four

businesses: Marsh, Guy Carpenter, Mercer and Oliver Wyman. With

annual revenue of $23 billion and more than 85,000 colleagues,

Marsh McLennan helps build the confidence to thrive through the

power of perspective. For more information, visit mercer.com, or

follow on LinkedIn and X.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241120305316/en/

Media: Ashleigh Jang Mercer +1 212-345-3965

Ashleigh.Jang@mercer.com

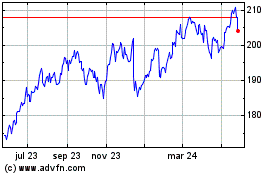

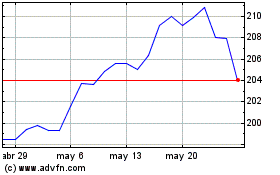

Marsh and McLennan Compa... (NYSE:MMC)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Marsh and McLennan Compa... (NYSE:MMC)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024