0000766829FALSE00007668292024-08-022024-08-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) August 20, 2024

SJW Group

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | |

| Delaware | | 001-8966 | | 77-0066628 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | | | | | | | |

| 110 West Taylor Street, | San Jose, | CA | | 95110 |

| (Address of principal executive offices) | | (Zip Code) |

(408) 279-7800

Registrant’s telephone number, including area code

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | | SJW | | New York Stock Exchange LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter):

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Item 8.01 Other Events

On August 20, 2024, San Jose Water Company (the "Company"), a wholly-owned subsidiary of SJW Group (NYSE: SJW) issued a press release announcing that, together with the Public Advocates Office, it has reached a constructive settlement agreement ("Settlement Agreement") in the Company's 2025 to 2027 general rate case ("GRC") that was filed with the California Public Utilities Commission ("CPUC") on January 2, 2024. The Settlement Agreement, filed on August 19, 2024 with the CPUC for its approval, excludes two policy issues that will be litigated via briefs filed on August 1, 2024. Water Rate Advocates for Transparency, Equity, and Sustainability had agreed to the Settlement Agreement in principle on June 14, 2024, and subsequently determined not to participate in the Settlement Agreement. The CPUC is expected to render a decision on the GRC in the fourth quarter of 2024 with new rates to become effective on January 1, 2025.

Among other matters, the Settlement Agreement authorizes a $450 million three-year capital budget, and

•further aligns actual compared to authorized usage through a lower sales forecast;

•provides for greater revenue recovery through the service charge; and

•approves the recovery of $15.8 million from balancing and memorandum accounts.

A copy of the press release is attached hereto as Exhibit 99.1 and incorporated into this Item 8.01 of Form 8-K by reference.

The information in Item 8.01, including the exhibit, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities under that Section, nor shall it be deemed to be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

| Exhibit Number | | Description of Documents |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | |

| SJW GROUP | |

| | |

Date: August 20, 2024 | /s/ Eric W. Thornburg | |

| Eric W. Thornburg | |

| Chairman of the Board, President and Chief Executive Officer | |

San Jose Water Files Settlement Agreement

in 2025 to 2027 General Rate Case

Constructive agreement provides for $450 million in drinking water infrastructure

investment over three-years.

SAN JOSE, Calif. – (August 20) – San Jose Water (SJW), a wholly-owned subsidiary of SJW Group (NYSE: SJW), today announced that, together with the Public Advocates Office (PAO), it has reached a constructive settlement agreement in its 2025 to 2027 General Rate Case (GRC) that was filed with the California Public Utilities Commission (CPUC) on January 2, 2024. The settlement agreement, filed on August 19, 2024 with the CPUC for its approval, excludes two policy issues which will be litigated via briefs filed on August 1, 2024.

“I am grateful to the PAO for diligently working with us to achieve this constructive agreement that reflects our shared goal of ensuring that customers have high-quality drinking water and reliable service at fair rates,” stated Tanya Moniz-Witten, SJW’s President. “This agreement enables SJW to invest $450 million over three years in drinking water infrastructure in our local service area to support day-to-day water system functions, in addition to supporting fire protection, economic vibrancy, and environmental conservation efforts. We are committed to our daily mission of serving our customers, communities, and the environment at best-in-class levels. The settlement agreement positions us to deliver on this promise more effectively.”

In addition to the $450 million three-year capital budget, the settlement agreement:

•Further aligns actual compared to authorized usage through a lower sales forecast;

•Provides for greater revenue recovery through the service charge; and,

•Approves the recovery of $15.8 million from balancing and memorandum accounts.

The two litigated items relate to including chemical and waste disposal costs in the company’s full cost balancing account, and to adjusting its service charge calculation.

Water Rate Advocates for Transparency, Equity, and Sustainability (WRATES) had originally agreed to the settlement agreement in principle on June 14, 2024. WRATES has since decided to not sign on to the settlement agreement.

Every three years, water utilities regulated by the CPUC are required to submit a filing detailing proposed rate adjustments and the reasons for these adjustments. The CPUC and PAO analyze each aspect of the rate application as part of a transparent public process, which includes public hearings and opportunities to share feedback — all to ensure just and reasonable rates, and safe and reliable infrastructure.

The CPUC is expected to render a decision on the settlement agreement in the fourth quarter of 2024 with new rates effective on January 1, 2025.

About San Jose Water

Founded in 1866, San Jose Water is an investor-owned public utility, and is one of the largest and most technically sophisticated urban water systems in the United States. Serving over one million people in the greater San Jose metropolitan area, San Jose Water also provides services to other utilities including operations and maintenance, billing, and backflow testing. San Jose Water is owned by SJW Group, a publicly traded company listed on the New York Stock

Exchange under the symbol SJW. SJW Group also owns: Connecticut Water Company in Connecticut; Maine Water Company in Maine; and SJWTX, Inc. (dba Texas Water Company) in Texas. To learn more about San Jose Water, visit www.sjwater.com.

Forward-Looking Statements

This release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. Some of these forward-looking statements can be identified by the use of forward-looking words such as “believes,” “expects,” “estimates,” “anticipates,” “intends,” “seeks,” “plans,” “projects,” “may,” “should,” “will,” or the negative of those words or other comparable terminology. These forward-looking statements are only predictions and are subject to risks, uncertainties, and assumptions that are difficult to predict.

These forward-looking statements involve a number of risks, uncertainties and assumptions including, but not limited to, the following factors: (1) the effect of water, utility, environmental and other governmental policies and regulations, including regulatory actions concerning rates, authorized return on equity, authorized capital structures, capital expenditures, PFAS and other decisions; (2) changes in demand for water and other services; (3) unanticipated weather conditions and changes in seasonality including those affecting water supply and customer usage; (4) the effect of the impact of climate change; (5) unexpected costs, charges or expenses; (6) our ability to successfully evaluate investments in new business and growth initiatives; (7) contamination of our water supplies and damage or failure of our water equipment and infrastructure; (8) the risk of work stoppages, strikes and other labor-related actions; (9) catastrophic events such as fires, earthquakes, explosions, floods, ice storms, tornadoes, hurricanes, terrorist acts, physical attacks, cyber-attacks, epidemic, or similar occurrences; (10) changes in general economic, political, business and financial market conditions; (11) the ability to obtain financing on favorable terms, which can be affected by various factors, including credit ratings, changes in interest rates, compliance with regulatory requirements, compliance with the terms and conditions of our outstanding indebtedness, and general market and economic conditions; and (12) legislative, and general market and economic developments. The risks, uncertainties and other factors may cause the actual results, performance or achievements of SJW Group to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements.

Results for a quarter are not indicative of results for a full year due to seasonality and other factors. Other factors that may cause actual results, performance or achievements to materially differ are described in SJW Group’s most recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K filed with the SEC. Forward-looking statements are not guarantees of performance, and speak only as of the date made. SJW Group undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise.

Media Contact:

Liann Walborsky

Director of Corporate Communications

408 918-7247

v3.24.2.u1

Document and Entity Information Document

|

Aug. 02, 2024 |

| Document and Entity Information [Abstract] |

|

| Entity Central Index Key |

0000766829

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 20, 2024

|

| Entity Registrant Name |

SJW Group

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-8966

|

| Entity Tax Identification Number |

77-0066628

|

| Entity Address, Address Line One |

110 West Taylor Street,

|

| Entity Address, City or Town |

San Jose,

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

95110

|

| City Area Code |

(408)

|

| Local Phone Number |

279-7800

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

SJW

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

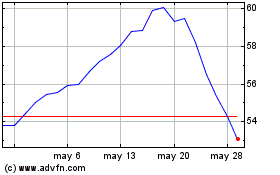

SJW (NYSE:SJW)

Gráfica de Acción Histórica

De Ago 2024 a Sep 2024

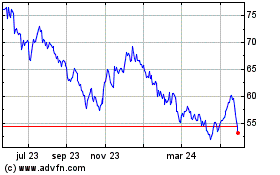

SJW (NYSE:SJW)

Gráfica de Acción Histórica

De Sep 2023 a Sep 2024