- First in the U.S., Visa Flexible Credential will roll out with

the Affirm Card, a debit card that allows eligible consumers to

easily buy now and pay later right from the Affirm app

- UAE-based Liv, the first digital bank in MENA to debut Visa

Flexible Credential, allows frequent travelers access to multiple

currency accounts from one card, making cross-border payments

simpler than ever

- New flexible payments experiences debuted at Web Summit in

Lisbon

For years, the card didn’t change. Built for an analog world,

one card for one type, debit or credit. The Visa Flexible

Credential has fundamentally changed that, allowing people to pay

from different account funding sources with a single card. Today,

Visa (V: NYSE) announced that the Flexible Credential is expanding

to the U.S. and will be rolling out with Affirm, and in the United

Arab Emirates with Liv, giving millions more people greater choice

and control over how they pay.

“The Visa Flexible Credential all started with a simple idea

that consumers should easily be able to choose how they want to

pay,” said Jack Forestell, Chief Product and Strategy Officer,

Visa. “Working with innovative partners like Affirm, Liv and SMCC

helps us turn that idea into a reality. Together we’re enabling

more ways to pay and adapting to the unique needs of consumers –

wherever they are in the world, or in their financial journey.”

Giving people control over their financial future

Affirm is the first company to leverage Visa’s next-generation

credential for its U.S. consumers with the Affirm Card.

“We’re excited about the partnership we’ve formed with Visa,”

said Max Levchin, CEO of Affirm. “Since our founding, our mission

has remained the same — build honest financial products that

improve lives. Part of building better financial products also

means giving consumers more control and flexibility, which has

always been a key feature of the new Affirm Card. We look forward

to bringing millions more people a product that seamlessly brings

debit and credit together, without late or hidden fees.”

The Affirm Card offers consumers a product with the flexibility

to pay now or pay over time. Affirm Card users can pay in full

anywhere Visa is accepted or request to pay over time for their

purchase in the Affirm app. The Affirm Card is currently used by

over 1.4 million consumers in the U.S. and the company looks

forward to getting it into the hands of more people.

Making cross-border payments simple

Liv, the UAE’s first and largest digital bank launched by

Emirates NBD, is introducing a new way to flex, letting people

access multiple currency accounts from a single card. Recent Visa

data shows that cross-border outbound volumes from the UAE are one

of the fastest growing among Visa’s largest cross-border countries.

1

The Flexible Credential will make regular spending in different

currencies more transparent for consumers and will enable banks to

accelerate the launch of a multi-currency proposition to their

customers.

The Visa Flexible Credential works by automatically routing the

transaction to the account with the appropriate transaction

currency, whether someone is paying online or in-store. Using a

mobile app, cardholders can easily move money between local and

foreign currency accounts, making sure they have the funds to make

a purchase.

The offering will be available to new and existing Liv customers

and support five of the most popular currencies used, including:

U.S. Dollar, British Pound, Euro, Canadian Dollar and Australian

Dollar.

“At Liv we stay true to our promise of providing the most

innovative products to our customers,” said Pedro Sousa Cardoso,

Chief Digital Officer, Retail Banking and Wealth Management,

Emirates NBD. “As the UAE’s first digital bank, we are pleased to

collaborate with Visa to offer our customers a simple, flexible

card solution that better serves their evolving financial

needs.”

Helping small businesses uncomplicate their finances

Since debuting the Olive card in Japan with Sumitomo Mitsui Card

Company, Limited (SMCC) just over a year ago, there are over 3

million Olive account cardholders taking advantage of the Visa

Flexible Credential. Since launch, 70% of Olive account holders are

flexing between different account funding sources like debit,

credit and prepaid, and credit is predominantly used for their

purchases.2

Visa and SMCC have also introduced a new flexible feature

designed specifically to help small businesses access credit and

unlock cash flow. Now, small businesses can switch between business

and personal accounts easily from the same Olive card.

Visa will continue to test the small business feature in Japan

with SMCC and roll it out to other markets around the world.

The Flexible Credential gives consumers more choice and control

over their finances. It also allows financial institutions –

whether a bank or fintech – to establish deeper relationships and

provide better solutions based on the individual needs of their

customers.

Visa continues to work with its partners to bring the next

generation of payments to more consumers around the world.

About Visa

Visa (NYSE: V) is a world leader in digital payments,

facilitating transactions between consumers, merchants, financial

institutions and government entities across more than 200 countries

and territories. Our mission is to connect the world through the

most innovative, convenient, reliable and secure payments network,

enabling individuals, businesses and economies to thrive. We

believe that economies that include everyone everywhere, uplift

everyone everywhere and see access as foundational to the future of

money movement. Learn more at Visa.com.

The Affirm Card is a Visa® debit card issued by Evolve Bank

& Trust, Member FDIC, pursuant to a license from Visa U.S.A.

Inc. You must request and be approved to get the Card. Getting the

Card does not guarantee the ability to pay over time. You must

apply for pay-over-time plans for each purchase in the mobile app.

Pay-over-time plans are subject to eligibility checks and are

provided by affirm.com/lenders. For licenses and disclosures, see

affirm.com/licenses.

1 Visa data for the twelve months ended September 30, 2024

2 VisaNet transaction data Mar 2023 – Sep 2024

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241112887047/en/

Media Contact Conor Febos, Visa Press@Visa.com

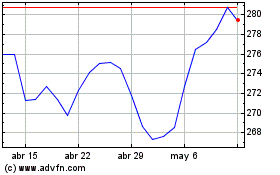

Visa (NYSE:V)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

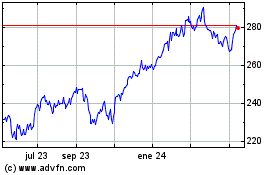

Visa (NYSE:V)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024