Williams Prices $1.5 Billion of Senior Notes

08 Agosto 2024 - 7:25PM

Business Wire

Williams (NYSE: WMB) announced today that it has priced a public

offering of $450 million of its 4.800% Senior Notes due 2029 at a

price of 99.810 percent of par, $300 million of its 5.150% Senior

Notes due 2034 at a price of 99.037 percent of par (the “new 2034

notes”), and $750 million of its 5.800% Senior Notes due 2054 at a

price of 99.784 percent of par. The new 2034 notes are an

additional issuance of Williams’ 5.150% Senior Notes due 2034

issued on January 5, 2024 and will trade interchangeably with the

$1.0 billion aggregate principal amount of such notes outstanding,

resulting in $1.3 billion aggregate principal amount of such notes

outstanding. The expected settlement date for the offering is

August 13, 2024, subject to the satisfaction of customary closing

conditions.

Williams intends to use the net proceeds of the offering to

repay its commercial paper, fund capital expenditures and for other

general corporate purposes, which may include the repayment of its

near-term debt maturities or other obligations.

BofA Securities, Inc., PNC Capital Markets LLC, RBC Capital

Markets, LLC, and SMBC Nikko Securities America, Inc. are acting as

joint book-running managers for the offering.

This news release is neither an offer to sell nor a solicitation

of an offer to buy any of these securities and shall not constitute

an offer, solicitation or sale in any jurisdiction in which such

offer, solicitation or sale is unlawful.

An automatic shelf registration statement relating to the notes

was previously filed with the Securities and Exchange Commission

(the “SEC”) and became effective upon filing. Before you invest,

you should read the prospectus in the registration statement and

other documents Williams has filed with the SEC for more complete

information about Williams and the offering. A copy of the

prospectus supplement and prospectus relating to the offering may

be obtained on the SEC website at www.sec.gov or from any of the

underwriters by contacting:

BofA Securities, Inc. 201 North Tyron Street NC1-022-02-25

Charlotte, North Carolina 28255-0001 Attention: Prospectus

Department Email: dg.prospectus_requests@bofa.com

PNC Capital Markets LLC 300 Fifth Avenue 10th Floor Pittsburgh,

Pennsylvania 15222 Telephone: 1-855-881-0697 Email:

pnccmprospectus@pnc.com

RBC Capital Markets, LLC Brookfield Place 200 Vesey Street, 8th

Floor New York, New York 10281 Toll-Free Number: (866) 375-6829

Email: rbcnyfixedincomeprospectus@rbccm.com Attention: Syndicate

Operations

SMBC Nikko Securities America, Inc. 277 Park Avenue New York,

New York 10172 Attention: Debt Capital Markets Toll Free:

1-888-868-6856 E-mail: prospectus@smbcnikko-si.com

About Williams

Williams (NYSE: WMB) is a trusted energy industry leader

committed to safely, reliably, and responsibly meeting growing

energy demand. We use our 33,000-mile pipeline infrastructure to

move a third of the nation’s natural gas to where it's needed most,

supplying the energy used to heat our homes, cook our food and

generate low-carbon electricity. For over a century, we’ve been

driven by a passion for doing things the right way. Today, our team

of problem solvers is leading the charge into the clean energy

future – by powering the global economy while delivering immediate

emissions reductions within our natural gas network and investing

in new energy technologies.

Portions of this document may constitute “forward-looking

statements” as defined by federal law. Although Williams believes

any such statements are based on reasonable assumptions, there is

no assurance that actual outcomes will not be materially different.

Any such statements are made in reliance on the “safe harbor”

protections provided under the Private Securities Reform Act of

1995. Additional information about issues that could lead to

material changes in performance is contained in Williams’ annual

and quarterly reports filed with the SEC.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240808455950/en/

MEDIA: media@williams.com (800) 945-8723

INVESTOR CONTACTS: Danilo Juvane (918) 573-5075

Caroline Sardella (918) 230-9992

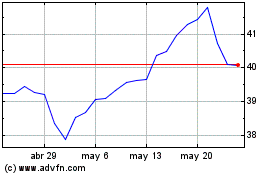

Williams Companies (NYSE:WMB)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

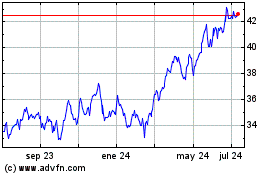

Williams Companies (NYSE:WMB)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024