Crescent Point Energy Corp. ("Crescent Point" or the "Company")

(TSX and NYSE: CPG) today announced that it has entered into an

agreement (the “Agreement”) with a syndicate of underwriters co-led

by BMO Capital Markets and RBC Capital Markets (collectively the

“Underwriters”) under which the Underwriters have agreed to

purchase, on a bought deal basis 48,550,000 Crescent Point

common shares (“Common Shares”) at $10.30 per Common Share for

aggregate gross proceeds of approximately CDN$500 million (the

“Offering”).

Crescent Point intends to use the net proceeds

from the Offering to partially fund the cash portion of the

consideration payable in connection with the acquisition of

Hammerhead Energy Inc., an oil and liquids-rich Alberta Montney

producer, which was announced today in a separate news release

issued by Crescent Point (the “Transaction”). Total consideration

for the Transaction is approximately CDN$2.55 billion.

Closing of the Offering is expected to occur on

or about November 10, 2023. Crescent Point has also granted the

Underwriters an over-allotment option (the “Over-Allotment Option”)

to purchase, on the same terms and conditions of the Offering, up

to an additional 15 percent of the Common Shares issued in

connection with the Offering. The Over-Allotment Option is

exercisable, in whole or in part, by the Underwriters at any time

until and including 30 days after closing of the Offering. The

maximum gross proceeds raised under the Offering will be

approximately CDN$575 million, in the event the Over-Allotment

Option is fully exercised.

The closing of the Offering is not conditional

upon the completion of the Transaction. If the Transaction is not

completed, Crescent Point intends to use the net proceeds from the

Offering to reduce existing indebtedness, finance future growth

opportunities including acquisitions, finance its capital

expenditures or for other general corporate purposes.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy any securities, nor

will there be any sale of these securities, in any jurisdiction in

which such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

jurisdiction.

The Common Shares will be offered to the public

through the Underwriters and their affiliates by way of a

prospectus supplement (the "Prospectus Supplement") to Crescent

Point’s short form base shelf prospectus dated November 3,

2023 (the "Prospectus") filed with the securities regulatory

authorities in each of the provinces of Canada and included in its

registration statement on Form F-10 filed with the U.S. Securities

and Exchange Commission (“SEC”). The Offering is made only by the

Prospectus. The Prospectus contains important detailed information

about the securities being offered. Before investing, prospective

purchasers should read the Prospectus Supplement, the Prospectus

and the documents incorporated by reference therein for more

complete information about Crescent Point and the Offering.

A copy of the Prospectus is, and a copy of the

Prospectus Supplement will be, available free of charge on SEDAR+

(http://www.sedarplus.ca) and on the SEC website

(http://www.sec.gov). Alternatively, copies may be obtained upon

request in Canada by contacting BMO Nesbitt Burns Inc. (“BMO

Capital Markets”), Brampton Distribution Centre C/O The Data Group

of Companies, 9195 Torbram Road, Brampton, Ontario, L6S 6H2 by

telephone at 905-791-3151 Ext 4312 or by email at

torbramwarehouse@datagroup.ca, and in the United States by

contacting BMO Capital Markets Corp., Attn: Equity Syndicate

Department, 151 W 42nd Street, 32nd Floor, New York, NY 10036, or

by telephone at 800-414-3627 or by email at bmoprospectus@bmo.com.

Additionally, copies of these documents may be obtained upon

request in Canada from RBC Capital Markets, Attn: Distribution

Centre, RBC Wellington Square, 8th Floor, 180 Wellington St. W.,

Toronto, Ontario, M5J 0C2 at Phone: 416-842-5349; E-mail:

Distribution.RBCDS@rbccm.com and in the United States from RBC

Capital Markets, LLC, 200 Vesey Street, 8th Floor, New York, NY

10281-8098; Attention: Equity Syndicate; Phone: 877-822-4089;

Email: equityprospectus@rbccm.com.

FOR MORE INFORMATION ON CRESCENT POINT ENERGY, PLEASE

CONTACT:

Shant Madian, Vice President, Capital Markets,

orSarfraz Somani, Manager, Investor

RelationsTelephone: (403) 693-0020 Toll-free (US and Canada):

888-693-0020 Fax: (403) 693-0070Address: Crescent Point Energy

Corp. Suite 2000, 585 - 8th Avenue S.W. Calgary AB T2P 1G1

All financial figures are approximate and in Canadian dollars

unless otherwise noted. This press release contains forward-looking

information. Significant related assumptions and risk factors, and

reconciliations are described under the Forward-Looking Statements

sections of this press release.

Forward-Looking Statements

This press release contains "forward-looking statements" within

the meaning of applicable securities legislation, such as section

27A of the Securities Act of 1933 and section 21E of the Securities

Exchange Act of 1934, and contains “forward-looking information”

within the meaning of applicable Canadian securities laws

(collectively, “forward-looking statements”). The forward-looking

statements contained herein include estimates of Crescent Point's

plan in respect of the use of proceeds from the Offering of Common

Shares; the purchase price and consideration to be paid by Crescent

Point in connection with the Transaction; the anticipated timing of

the closing of the Transaction, and other assumptions inherent in

management's expectations in respect of the forward-looking

statements identified herein.

In particular, this press release contains forward-looking

statements pertaining to, among other things, the following:

Crescent Point's intended use of the net proceeds from the

Offering; the Offering's expected closing date; the completion of

the Transaction; and the use of the net proceeds from the Offering,

including in the event the Transaction is not completed.

All forward-looking statements are based on Crescent Point's

beliefs and assumptions based on information available at the time

the assumption was made. Crescent Point believes that the

expectations reflected in these forward-looking statements are

reasonable but no assurance can be given that these expectations

will prove to be correct and such forward-looking statements

included in this press release should not be unduly relied upon. By

their nature, such forward-looking statements are subject to a

number of risks, uncertainties and assumptions, which could cause

actual results or other expectations to differ materially from

those anticipated, expressed or implied by such statements,

including those material risks discussed in the Company's Annual

Information Form for the year ended December 31, 2022 under "Risk

Factors", our Management's Discussion and Analysis for the year

ended December 31, 2022 under the headings "Risk Factors" and

"Forward-Looking Information", and our Management Discussion and

Analysis for the three and nine months ended September 30, 2023,

under the heading "Forward-Looking Information". The material

assumptions are disclosed in the Management's Discussion and

Analysis for the year ended December 31, 2022, under the headings

“Overview”, “Commodity Derivatives”, "Liquidity and Capital

Resources", "Critical Accounting Estimates" and "Guidance" and in

the Management's Discussion and Analysis for the three and nine

months ended September 30, 2023, under the headings "Overview",

"Commodity Derivatives", "Liquidity and Capital Resources" and

"Guidance". In addition, risk factors include: the Offering may not

be completed, or may not be completed in the timeline that is

currently expected and the Transaction may not be completed, or may

not be completed in a timely manner. The impact of any one risk,

uncertainty or factor on a particular forward-looking statement is

not determinable with certainty as these are interdependent and

Crescent Point's future course of action depends on management's

assessment of all information available at the relevant time.

Additional information on these and other factors that could

affect Crescent Point's operations or financial results are

included in Crescent Point's reports on file with Canadian and U.S.

securities regulatory authorities. Readers are cautioned not to

place undue reliance on this forward-looking information, which is

given as of the date it is expressed herein or otherwise. Crescent

Point undertakes no obligation to update publicly or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise, unless required to do so pursuant to

applicable law. All subsequent forward-looking statements, whether

written or oral, attributable to Crescent Point or persons acting

on the Company's behalf are expressly qualified in their entirety

by these cautionary statements.

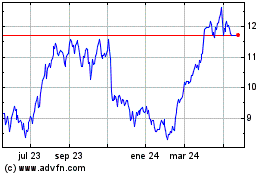

Crescent Point Energy (TSX:CPG)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

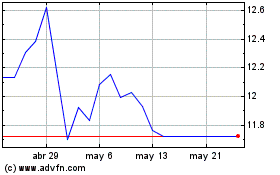

Crescent Point Energy (TSX:CPG)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024