Obsidian Energy Announces Completion of Oversubscribed $25.9 Million Prospectus Financing

18 Noviembre 2021 - 7:40AM

OBSIDIAN ENERGY LTD. (TSX – OBE, OTCQX – OBELF)

("

Obsidian Energy", the

"

Company", "

we",

"

us" or "

our") is pleased to

announce it has closed its previously announced marketed public

offering of subscription receipts (the "

Subscription

Receipts") at a price of $4.40 per Subscription Receipt

for aggregate gross proceeds of approximately $25.9 million (the

"

Offering"). The Offering was conducted on a "best

efforts" agency basis by Raymond James Ltd. and Stifel Nicolaus

Canada Inc. (together, the "

Agents"). The Agents

exercised in full the 15 percent over-allotment option granted to

them in conjunction with today's closing of the Offering.

Each Subscription Receipt represents the right

to receive one common share of Obsidian Energy (a "Common

Share") without payment of additional consideration or

further action on the part of the holder and upon satisfaction of

the Escrow Release Conditions (as defined below). The Company will

use the net proceeds from the Offering to facilitate financing part

of the purchase price (the "Purchase Price") under

the previously announced proposed acquisition (the

"Acquisition") of the remaining 45 percent

non-operated working interest in the Company's Peace River Oil

Partnership from its partner (the "Vendor")

pursuant to the terms of a definitive agreement entered into

between the parties (the "Acquisition Agreement").

Given that the Offering was oversubscribed, and the over-allotment

option was exercised in full, all of the Purchase Price will be

paid in cash and no Common Shares will be issued to the Vendor.

Subject to the satisfaction of conditions precedent thereto,

closing of the Acquisition is expected to occur on or about

November 24, 2021, and in any event, no later than December 31,

2021. Details of the Acquisition and related matters can be found

in Obsidian Energy's final short form prospectus dated November 12,

2021 (the "Prospectus").

The gross proceeds from the sale of Subscription

Receipts pursuant to the Offering will be held in escrow pending

the completion of the Acquisition. If all conditions to the

completion of the Acquisition are satisfied or waived (other than

facilitating funding the portion of the Purchase Price to be

financed with the net proceeds of the Offering) and Obsidian Energy

has confirmed the same to the Agents before 5:00 p.m. (Calgary

time) on December 31, 2021 (the "Escrow Release

Conditions"), the net proceeds from the sale of the

Subscription Receipts will be released from escrow to Obsidian

Energy or as it may direct. If: (i) the Acquisition is not

completed at or before 5:00 p.m. (Calgary time) on December 31,

2021; (ii) the Acquisition Agreement is terminated in accordance

with its terms; or (iii) the Company advises the Agents or formally

announces to the public by way of a news release or otherwise that

it does not intend to proceed with the Acquisition, then the

purchase price for the Subscription Receipts will be returned pro

rata to subscribers, together with a pro rata portion of interest

earned on the escrowed funds.

It is anticipated that the Subscription Receipts

will be listed and posted for trading on the Toronto Stock Exchange

(the "TSX") under the symbol "OBE.R".

READER ADVISORIES

This news release is not an offer of the

securities for sale in the United States. The securities offered

have not been, and will not be, registered under the

United States Securities Act of 1933, as

amended (the "U.S. Securities Act"), or any U.S. state securities

laws and may not be offered or sold in the United States absent

registration or an available exemption from the registration

requirement of the U.S. Securities Act and applicable U.S. state

securities laws. This news release shall not constitute an offer to

sell or the solicitation of an offer to buy, nor shall there be any

sale of these securities, in any jurisdiction in which such offer,

solicitation or sale would be unlawful.

FORWARD-LOOKING AND CAUTIONARY

STATEMENTS

This news release contains forward-looking

statements and forward-looking information within the meaning of

applicable securities laws. The use of any of the words "expect",

"anticipate", "continue", "estimate", "objective", "ongoing",

"may", "will", "project", "should", "believe", "plans", "intends"

and similar expressions are intended to identify forward-looking

information or statements. More particularly and without

limitation, this news release contains forward-looking statements

and information concerning the issuance of the Common Shares

underlying the Subscription Receipts, the anticipated listing of

the Subscription Receipts on the TSX and the satisfaction of

conditions to and completion of the Acquisition and the timing

thereof.

The forward-looking statements and information

are based on certain key expectations and assumptions made by

Obsidian Energy, including expectations and assumptions concerning

the receipt of all approvals and satisfaction of all conditions to

the completion of the Acquisition. Although Obsidian Energy

believes that the expectations and assumptions on which such

forward-looking statements and information are based are

reasonable, undue reliance should not be placed on the

forward-looking statements and information because Obsidian Energy

can give no assurance that they will prove to be correct. By its

nature, such forward-looking information is subject to various

risks and uncertainties, which could cause the actual results and

expectations to differ materially from the anticipated results or

expectations expressed. These risks and uncertainties include, but

are not limited to, fluctuations in commodity prices, changes in

industry regulations and political landscape both domestically and

abroad, the satisfaction of all conditions to the completion of the

Acquisition or the waiver thereof, foreign exchange or interest

rates, stock market volatility, impacts of the current COVID-19

pandemic and the retention of key management and employees. Readers

are cautioned that the foregoing lists of factors are not

exhaustive. Readers are cautioned that the assumptions used in the

preparation of such information, although considered reasonable at

the time of preparation, may prove to be imprecise and, as such,

undue reliance should not be placed on forward-looking information.

Obsidian Energy gives no assurance that any of the events

anticipated will transpire or occur, or if any of them do, what

benefits Obsidian Energy will derive from them. The forward-looking

statements contained in this news release are expressly qualified

by this cautionary statement. Except as required by law, the

Company does not undertake any obligation to publicly update or

revise any forward-looking statements. Readers should also

carefully consider the matters discussed under the heading "Risk

Factors" in the Prospectus and in Obsidian Energy's annual

information form for the year ended December 31, 2020, both of

which are available under Obsidian Energy's profile on SEDAR at

www.sedar.com.

Obsidian Energy Common Shares are listed on both

the TSX in Canada and the OTCQX Market in the United States under

the symbol "OBE" and "OBELF" respectively.

All figures are in Canadian dollars unless

otherwise stated.

CONTACT

OBSIDIAN

ENERGY

Suite 200, 207 - 9th

Avenue SW, Calgary, Alberta T2P 1K3Phone: 403-777-2500Toll Free:

1-866-693-2707Website: www.obsidianenergy.com;

Investor

Relations:

Toll Free:

1-888-770-2633E-mail: investor.relations@obsidianenergy.com

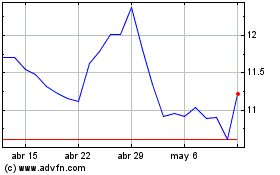

Obsidian Energy (TSX:OBE)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Obsidian Energy (TSX:OBE)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024