NexPoint Hospitality Trust (TSXV: NHT.U) (“NHT”) and Condor

Hospitality Trust, Inc. (NYSE American: CDOR) (“Condor”) today

announced the execution of a definitive agreement (the “Merger

Agreement”), under which NHT’s operating partnership, NHT Operating

Partnership, LLC (“NHT OP”), will acquire all of the outstanding

equity interests of Condor and its operating partnership by merger.

The total consideration payable pursuant to the transaction is

approximately US$318 million, which will be satisfied by a

combination of cash and debt, including the assumption of certain

debt.

Transaction Highlights

- In line with NHT’s growth strategy, NHT will acquire 15

select-service and extended stay hospitality properties,

representing 1,908 guestrooms across eight U.S. states (the

“Portfolio”).

- The transaction will expand NHT’s geographic footprint into

Georgia, Kansas, Kentucky, Maryland, Mississippi and South Carolina

and increase its presence in Florida and Texas.

- Following closing of the transaction, NHT’s gross asset value

is expected to increase to approximately US$700 million.

- The merger consideration of US$11.10 per share to be paid to

holders of shares of common stock represents a premium of

approximately 34% over Condor’s unaffected share price of US$8.27

as of July 19, 2019, the most recent trading day before the public

announcement of the proposal to acquire Condor.

A presentation further detailing the merits of the proposed

transaction can be found under “News & Presentations” in the

Investor Relations section of NHT’s website

(http://www.nexpointhospitality.com).

“We’re excited about NexPoint Hospitality Trust’s strategic

merger with Condor Hospitality Trust. The transaction instantly

expands NHT’s geographical footprint and balances NHTs strategic

value-add portfolio with durable, core, extended-stay hotels.”

stated NHT’s Chief Executive Officer, Jim Dondero. “We believe the

future for quality extended-stay and select-service hotels remains

bright.”

Bill Blackham, Condor’s Chief Executive Officer, commented: “We

are pleased with our strategic alternatives process concluding with

a transaction we believe is attractive for our shareholders. NHT is

acquiring our very high quality portfolio of outperforming select

service hotels and Condor shareholders are receiving a liquidity

event at an attractive premium to our unaffected share price prior

to the transaction announcement.”

Key Transaction Terms

- Completion of the transaction, which is expected to occur in

the fourth quarter of 2019, is subject to customary closing

conditions, including the approval of Condor’s common and preferred

shareholders. There can be no assurances that any such conditions

will be satisfied or waived or that the acquisition of the

Portfolio will be completed.

- NHT OP has entered into voting agreements with certain

shareholders of Condor that hold approximately 53% of the

outstanding common shares and 100% of the preferred shares of

Condor, pursuant to which, such holders have agreed to vote their

shares of Condor in favor of the transaction.

- The transaction is not contingent on receipt of financing. NHT

OP has entered into an equity commitment letter with NexPoint

Advisors, L.P. (“NexPoint”), pursuant to which NexPoint has agreed

to provide equity financing for the purchase price payable under

the Merger Agreement (the “Equity Financing”). In addition to the

Equity Financing, NHT will assume approximately US$8.65 million of

in-place property level mortgage financing and expects to obtain

secured financing to finance a portion of the purchase price and

refinance certain debt of Condor.

- Upon closing of the transaction, holders of common stock of

Condor would receive US$11.10, without interest thereon, per share,

holders of 6.25% Series E Preferred Stock of Condor would receive

US$10.00 per share and limited partners of Condor’s operating

partnership, Condor Hospitality Limited Partnership (“Condor OP”),

would receive US$0.21346 per Condor OP partnership interest.

- The transaction is an arm’s length transaction and no non-arm’s

length party of NHT holds any interest in Condor or its

assets.

- NHT expects to maintain its current quarterly dividend of

US$0.075 per unit or US$0.300 per unit on an annualized basis.

Advisors

KeyBanc Capital Markets, Inc. is acting as financial advisor to

Condor. Winston & Strawn LLP and Goodmans LLP are acting as

legal counsel to NHT and McGrath North Mullin & Kratz, PC LLO

is acting as legal counsel to Condor.

Neither TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in policies of the TSX Venture

Exchange) accepts responsibility for the adequacy or accuracy of

this release.

About NexPoint Hospitality Trust

NexPoint Hospitality Trust (TSXV: NHT.U) is a publicly traded

real estate investment trust focused on acquiring, owning and

operating well-located hospitality properties in the United States

that offer a high current yield and in many cases, that are

underperforming assets with the potential to increase in value

through investments in capital improvements, a market-based

recovery, brand repositioning, revenue enhancements, operational

improvements, reducing expense inefficiencies, and exploiting

excess land or underutilized space. NHT owns 11 branded properties

sponsored by Marriott, Hilton and InterContinental Hotels Group,

located across the U.S., specifically in the Seattle, Portland,

Dallas, Nashville and St. Petersburg markets. NHT is externally

advised by NexPoint Real Estate Advisors VI, L.P., an affiliate of

Highland Capital Management, L.P., a leading global alternative

asset manager and an SEC-registered investment adviser. For more

information, visit www.nexpointhospitality.com.

About Condor Hospitality Trust, Inc.

Condor Hospitality Trust, Inc. (NYSE American: CDOR) is a

self-administered real estate investment trust that specializes in

the investment and ownership of upper midscale and upscale,

premium-branded, select-service, extended-stay, and limited-service

hotels in the top 100 Metropolitan Statistical Areas (“MSAs”) with

a particular focus on the top 20 to 60 MSAs. Condor currently owns

15 hotels in eight states. Condor’s hotels are franchised by a

number of the industry’s most well-regarded brand families

including Hilton, Marriott, and InterContinental Hotels Group.

Cautionary Statement Regarding Forward-Looking

Statements

This news release (including statements about the expected

timing, completion and effects of the mergers and the other

transactions contemplated by the Merger Agreement) may contain

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995 and applicable Canadian

securities laws. Forward-looking statements include all statements

that are not historical facts, and in some cases, can be identified

by the use of forward-looking terminology such as “may,” “will,”

“expect,” “intend,” “anticipate,” “estimate,” “believe,”

“continue,” “project”, “plan”, the negative version of these words

or other similar expressions. Readers are cautioned not to place

undue reliance on any such forward-looking statements.

All forward-looking statements speak only as of the date hereof

and are based on current expectations and involve a number of

assumptions, risks and uncertainties that could cause the actual

results to differ materially from such forward-looking statements.

They are not guarantees of future performance and involve risks and

uncertainties that are difficult to control or predict. NHT and

Condor may not be able to complete the proposed transaction on the

terms described herein or other acceptable terms or at all because

of a number of factors, including without limitation, the

following: (i) the occurrence of any event, change or other

circumstances that could give rise to the termination of the Merger

Agreement; (ii) unknown, underestimated or undisclosed commitments

or liabilities; (iii) the inability to complete the proposed

transaction due to the failure to obtain the approval of Condor’s

shareholders for the proposed transaction or the failure to satisfy

the other closing conditions to the proposed transaction; (iv)

risks related to disruption of management’s attention from NHT’s

and Condor’s ongoing business operations due to the proposed

transaction; (v) the effect of the announcement of the proposed

transaction on the ability of the parties to retain and hire key

personnel, maintain relationships with their franchisors,

management companies and suppliers, and maintain their operating

results and business generally; (vi) the risk that certain

approvals or consents will not be received in a timely manner or

that the proposed transaction will not be consummated in a timely

manner; (vii) adverse changes in U.S. and non-U.S. governmental

laws and regulations; and (viii) the risk of litigation, including

shareholder litigation in connection with the proposed transaction,

and the impact of any adverse legal judgments, fines, penalties,

injunctions or settlements.

Actual results may differ materially from those indicated by

such forward-looking statements. In addition, the forward-looking

statements represent NHT’s and Condor’s views as of the date on

which such statements were made. NHT and Condor anticipate that

subsequent events and developments may cause those views to change.

These forward-looking statements should not be relied upon as

representing NHT’s or Condor’s views as of any date subsequent to

the date hereof. NHT and Condor expressly disclaim a duty to

provide updates to forward-looking statements, whether as a result

of new information, future events or other occurrences.

Additional factors that may affect Condor’s business or

financial results are described in the risk factors included in

Condor’s filings with the Securities and Exchange Commission

(“SEC”), including its Annual Report on Form 10-K for the fiscal

year ended December 31, 2018, and subsequent Quarterly Reports on

Form 10-Q and Current Reports on Form 8-K.

Additional Information and Where to Find It

The Merger Agreement will be filed with the SEC within four

business days following the execution of the Merger Agreement and

can be obtained free of charge from the sources indicated below.

The Merger Agreement will also be available under NHT’s issuer

profile on the SEDAR website at www.sedar.com within ten days

following the date of this press release.

The proposed transaction will be submitted to Condor’s

shareholders for their consideration. In connection with the

proposed transaction, Condor will file relevant materials with the

SEC, including a proxy statement on Schedule 14A. The definitive

proxy statement will be mailed to Condor’s shareholders. This

communication is not a substitute for the Proxy Statement or for

any other document that Condor may file with the SEC and send to

Condor’s shareholders in connection with the proposed transaction.

BEFORE MAKING ANY VOTING OR INVESTMENT DECISION WITH RESPECT TO THE

PROPOSED TRANSACTION. INVESTORS AND SECURITY HOLDERS OF CONDOR ARE

URGED TO READ THE PROXY STATEMENT AND OTHER DOCUMENTS FILED WITH

THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE

BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED

TRANSACTION. Investors and security holders will be able to obtain

free copies of the proxy statement (if and when it becomes

available), any amendments or supplements thereto and other

relevant materials, and any other documents filed by Condor with

the SEC through the website maintained by the SEC at

http://www.sec.gov. In addition, copies of the documents filed by

Condor with the SEC will be available free of charge on Condor’s

website at www.condorhospitality.com, or by contacting Condor at

Investor Relations by phone at 402-371-2520 or by email at

investors@trustcondor.com. You may also read and copy any reports,

statements and other information filed by the Company with the SEC

at the SEC public reference room at 450 Fifth Street, N.W. Room

1200, Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330

or visit the SEC’s website for further information on its public

reference room.

Participants in the

Solicitation

Condor and its directors and certain of its executive officers

may be considered “participants” in the solicitation of proxies

with respect to the proposed transaction under the rules of the

SEC. Additional information regarding the “participants” in the

proxy solicitations and a description of their direct and indirect

interests, by security holdings or otherwise, will also be included

in the preliminary and definitive proxy statements when filed with

the SEC and other relevant materials to be filed with the SEC in

connection with the proposed transaction when they become

available. Information about the directors and executive officers

of Condor is set forth in its Annual Report on Form 10-K for the

year ended December 31, 2018, which was filed with the SEC on March

11, 2019, its proxy statement for its 2019 annual meeting of

shareholders, which was filed with the SEC on April 23, 2019 and in

subsequent documents filed with the SEC.

No Offer or Solicitation

This communication does not constitute an offer to sell or the

solicitation of an offer to buy any securities, nor shall there be

any sale of securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such jurisdiction.

No offering of securities shall be made except by means of a

prospectus meeting the requirements of Section 10 of the Securities

Act of 1933, as amended.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190722005197/en/

NHT Contact: Jackie Graham Investor Relations Manager

NexPoint Hospitality Trust Tel: 972-419-6213 Fax: 972-628-4147

Condor Contact: Arinn Cavey Chief Financial Officer Tel:

402-371-2520

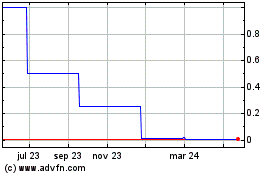

Nexpoint Hospitality (TSXV:NHT.U)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Nexpoint Hospitality (TSXV:NHT.U)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024