Mitchell Cohen, President and Chief Executive Officer of Urbanfund

Corp. (TSX VENTURE: UFC) (the "Company"), confirmed today that the

Company has filed financial results for the three and six month

periods ended June 30, 2011 under International Financial Reporting

Standards (IFRS), as summarized below.

For the three month period ended June 30, 2011, the Company

reported earnings before other items and income taxes of $164,885

on revenues of $924,632 compared to earnings before other items and

income taxes of $146,430 on revenues of $846,179 for the

corresponding period in 2010.

Revenues increased during the three month period ended June 30,

2011 as a result of continued improvement in leasing at the

Company's Richmond Property along with the collection of common

area maintenance costs from certain commercial tenants.

Rental expenses for the three month period ended June 30, 2011

increased to $362,400 compared to $345,326 for the corresponding

period in 2010. The increase is a result of increases in real

estate taxes and the application of Harmonized Sales Tax.

Funds From Operations for the three and six month periods ended

June 30, 2011 are as follows:

----------------------------------------------------------------------------

6 Months 6 Months 3 Months 3 Months

Ended ended Ended Ended

June 30, June 30, June 30, June 30,

2011 2010 2011 2010

----------------------------------------------------------------------------

Earnings (Loss) before

income tax $3,979,577 $1,019,878 $214,759 $163,403

----------------------------------------------------------------------------

Adjust for:

Interest income ($14,415) ($29,189) ($7,749) ($16,973)

----------------------------------------------------------------------------

Dividend income ($16,221) - ($6,750) -

----------------------------------------------------------------------------

Gain on sale of

securities ($2,716) - - -

----------------------------------------------------------------------------

Unrealized gain on

securities ($35,375) - ($35,375)

----------------------------------------------------------------------------

Fair value gain ($3,484,794) ($634,222) - -

----------------------------------------------------------------------------

Funds from Operations

(FFO) $426,056 $356,467 $164,885 $146,430

----------------------------------------------------------------------------

FFO increased during the six month period ended June 30, 2011 to

$426,056 from $356,467 for the corresponding six month period ended

June 30, 2010. During the three month period ended June 30, 2011,

FFO increased to $164,885 from $146,430 for the corresponding

period ended June 30, 2010.

Funds from Operations ("FFO") is a non-IFRS measure and should

not be construed as an alternative to net income determined in

accordance with IFRS. However, FFO is an operating performance

measure which is widely used by the real estate industry and the

Company has calculated FFO in accordance with the recommendations

of the Real Property Association of Canada ("REALpac").

Financing costs decreased slightly during the three month period

ended June 30, 2011 to $254,586 from $266,552 for the corresponding

period ended June 30, 2010. Administrative costs increased to

$142,761 during the three month period ended June 30, 2011 from

$87,871 for the corresponding period ended June 30, 2010. This

increase in Administrative costs is a result of the implementation

of International Reporting Financial Standards (IFRS) and a slight

increase in property management fees.

For comprehensive disclosure of the Company's performance for

the period ended June 30, 2011 and its financial position as at

such date, reference should be made to: (i) the Company's unaudited

consolidated financial statements as at and for the period ended

June 30, 2011 and the notes thereto; and (ii) management's

discussion and analysis of financial condition at, and results of

operations for the period ended June 30, 2011, which have been

filed with applicable securities regulators on SEDAR at

www.sedar.com.

Urbanfund Corp. is a Toronto-based real estate development and

operating company. Urbanfund Corp. is a TSX Venture exchange listed

real estate company based in Toronto. The Company's common shares

trade under the symbol UFC on the TSX Venture Exchange. Urbanfund's

focus is to identify, evaluate and invest in real estate or real

estate related projects. The Company's assets are located in

Belleville, London and Toronto, Ontario. The Company's strategy

going forward remains committed to seek accretive real estate or

real estate-related opportunities.

FORWARD LOOKING STATEMENTS

This press release contains certain forward-looking statements,

which reflect Management's expectations regarding the Company's

growth, results of operations, performance and business

prospects and opportunities. Statements about the Company's

future plans and intentions, results, levels of activity, cash flow

from operations, performance, goals or achievements or other future

events constitute forward-looking statements. Wherever possible,

words such as "may", "will", "should", "could", "expect", "plan",

"intend", "anticipate", "believe", "estimate", "predict" or

"potential" or the negative or other variations of these words, or

similar words or phrases, have been used to identify these

forward-looking statements. These statements reflect Management's

current beliefs and are based on information currently available to

management as at the date hereof.

Forward-looking statements involve significant risk,

uncertainties and assumptions. Many factors could cause actual

results, performance or achievements to differ materially from the

results discussed or implied in the forward-looking statements.

These factors should be considered carefully and readers should not

place undue reliance on the forward-looking statements. Although

the forward-looking statements contained in this press release are

based upon what management believes to be reasonable assumptions,

the Company cannot assure readers that actual results will be

consistent with these forward-looking statements. These

forward-looking statements are made as of the date of this press

release, and the Company assumes no obligation to update or revise

them to reflect new events or circumstances, except as required by

law. Many factors could cause the actual results, performance or

achievements of the Company to be materially different from any

future results, performance or achievements that may be expressed

or implied by such forward-looking statements, including: general

economic and market segment conditions, interest rates, costs

outside of the Company's control such as Real Estate Taxes and

utilities, the ability of tenants to satisfy their contractual rent

obligations and any unforeseen repair, maintenance or replacement

of the Company's assets. More detailed assessment of the risks that

could cause actual results to materially differ than current

expectations is contained in the "Risks and Uncertainties" section

of the Company's most recent Management's Discussion and

Analysis.

Neither TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Contacts: Urbanfund Corp. Mitchell Cohen President & CEO

(416) 703-1877 x1025

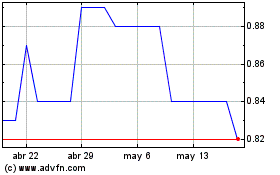

Urbanfund (TSXV:UFC)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Urbanfund (TSXV:UFC)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024