AN OFFERING STATEMENT PURSUANT TO REGULATION

A RELATING TO THESE SECURITIES HAS BEEN FILED WITH THE SECURITIES AND EXCHANGE COMMISSION (“SEC”. INFORMATION CONTAINED IN

THIS PRELIMINARY OFFERING CIRCULAR IS SUBJECT TO COMPLETION OR AMENDMENT. THESE SECURITIES MAY NOT BE SOLD NOR MAY OFFERS TO BUY BE ACCEPTED

BEFORE THE OFFERING STATEMENT FILED WITH THE COMMISSION IS QUALIFIED. THIS PRELIMINARY OFFERING CIRCULAR SHALL NOT CONSTITUTE AN OFFER

TO SELL OR THE SOLICITATION OF AN OFFER TO BUY NOR MAY THERE BE ANY SALES OF THESE SECURITIES IN ANY STATE IN WHICH SUCH OFFER, SOLICITATION

OR SALE WOULD BE UNLAWFUL BEFORE REGISTRATION OR QUALIFICATION UNDER THE LAWS OF SUCH STATE. WE MAY ELECT TO SATISFY OUR OBLIGATION TO

DELIVER A FINAL OFFERING CIRCULAR BY SENDING YOU A NOTICE WITHIN TWO BUSINESS DAYS AFTER THE COMPLETION OF OUR SALE TO YOU THAT CONTAINS

THE URL WHERE THE FINAL OFFERING CIRCULAR OR THE OFFERING STATEMENT IN WHICH SUCH FINAL OFFERING CIRCULAR WAS FILED MAY BE OBTAINED.

PRELIMINARY OFFERING CIRCULAR MARCH 4, 2024

AC PARTNERS, INC.

4053 Southwest Rivers End Way

Palm City, FL 34490

(561) 951-2336

OFFERING SUMMARY

Up to 200,000,000 shares of

Class A Common Stock

Minimum investment 10,000 shares at $1,000

SEE “SECURITIES

BEING OFFERED”

| |

|

Price to Public |

|

Underwriting

discount and

commissions (2) |

|

Proceeds to

issuer (3) |

|

Proceeds to

other persons |

| Per share |

|

$0.100 |

|

$0.00325 |

|

$0.09675 |

|

0 |

| Total Maximum |

|

$20,000,000 |

|

$20,000 |

|

$19,900,000 |

|

0 |

(1) The Preferred

Stock is convertible into Class A Common Stock either at the discretion of the investor or automatically upon effectiveness of registration

of the securities in an initial public offering. The total number of shares of the Class A Common Stock into which the Preferred may

be converted will be determined by dividing the original issue price per share by the conversion price per share. See “Securities

Being Offered” at page 23 for additional details.

(2) The company expects that, not including state

filing fees, the amount of expenses of the offering that we will pay will be approximately $20,000 based on the maximum number of shares

sold in this offering.

This offering (the “Offering”)

will terminate at the earlier of (1) the date at which the Maximum Offering amount has been sold, (2) the date which is one year from

this offering being qualified by the United States Securities and Exchange Commission, or (3) the date at which the offering is earlier

terminated by the company at its sole discretion. The offering is being conducted on a best-efforts basis with no minimum raise. Provided

that an investor purchases shares in the amount of the minimum investment, $1,000 (10,000 shares), there is no minimum number of shares

that needs to be sold in order for funds to be released to the company and for this Offering to close, which may mean that the company

does not receive sufficient funds to cover the cost of this Offering. The company may undertake one or more closings on a rolling basis.

After each closing, funds tendered by investors will be made available to the company. After the initial closing of this offering, we

expect to hold closings on at least a monthly basis.

Initial Closing Timing:

The initial closing of this offering is anticipated

to occur within 30 days of the effective date. After the initial closing, we expect to hold subsequent closings on a monthly basis on

the first business day of the month.

The holders of AC Partners, Inc. preferred

stock (the “Preferred Stock”) are entitled to an aggregate vote of three times all other voting eligible shares on all matters

submitted to a vote of the stockholders. Holders of Preferred Stock will vote together with the holders of Common Stock as a single class

on all matters (including the election of directors) submitted to vote or for the consent of the stockholders of AC Partners. Holders

of the Preferred Stock will continue to hold a majority of the voting power of all of the company’s equity stock at the conclusion

of this Offering and therefore control the board.

THE UNITED STATES SECURITIES AND EXCHANGE

COMMISSION DOES NOT PASS UPON THE MERITS OR GIVE ITS APPROVAL OF ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS

UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO

AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES

OFFERED ARE EXEMPT FROM REGISTRATION

GENERALLY, NO SALE MAY BE MADE TO YOU IN THIS

OFFERING IF THE AGGREGATE PURCHASE PRICE YOU PAY IS MORE THAN 10% OF THE GREATER OF YOUR ANNUAL INCOME OR NET WORTH. DIFFERENT RULES

APPLY TO ACCREDITED INVESTORS AND NON-NATURAL PERSONS. BEFORE MAKING ANY REPRESENTATION THAT YOUR INVESTMENT DOES NOT EXCEED APPLICABLE

THRESHOLDS, WE ENCOURAGE YOU TO REVIEW RULE 251(d)(2)(i)(C) OF REGULATION A. FOR GENERAL INFORMATION ON INVESTING, WE ENCOURAGE YOU TO

REFER TO www.investor.gov.

This offering

is inherently risky. See “Risk Factors” on page 3. THERE

IS NO ASSURANCE THAT THE NECESSARY FUNDS WILL BE RAISED OR THAT THE ISSUER WILL BE ABLE TO DEVELOP THE PROPERTIES DESCRIBED HEREIN.

Sales of these securities will commence approximately

30 days after the approval of this Offering.

The company is following the “Offering

Circular” format of disclosure under Regulation A.

TABLE OF CONTENTS

In this Offering Circular, the term “AC

Partners,” “we,” “us, “our” or “the company” refers to AC PARTNERS, INC., a Nevada corporation.

THIS OFFERING CIRCULAR MAY CONTAIN FORWARD-LOOKING

STATEMENTS AND INFORMATION RELATING TO, AMONG OTHER THINGS, THE COMPANY, ITS BUSINESS PLAN AND STRATEGY, AND ITS INDUSTRY. THESE FORWARD-LOOKING

STATEMENTS ARE BASED ON THE BELIEFS OF, ASSUMPTIONS MADE BY, AND INFORMATION CURRENTLY AVAILABLE TO THE COMPANY’S MANAGEMENT. WHEN

USED IN THE OFFERING MATERIALS, THE WORDS “ESTIMATE,” “PROJECT,” “BELIEVE,” “ANTICIPATE,”

“INTEND,” “EXPECT” AND SIMILAR EXPRESSIONS ARE INTENDED TO IDENTIFY FORWARD-LOOKING STATEMENTS, WHICH CONSTITUTE

FORWARD LOOKING STATEMENTS. THESE STATEMENTS REFLECT MANAGEMENT’S CURRENT VIEWS WITH RESPECT TO FUTURE EVENTS AND ARE SUBJECT TO

RISKS AND UNCERTAINTIES THAT COULD CAUSE THE COMPANY’S ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE CONTAINED IN THE FORWARD-LOOKING

STATEMENTS. INVESTORS ARE CAUTIONED NOT TO PLACE UNDUE RELIANCE ON THESE FORWARD-LOOKING STATEMENTS, WHICH SPEAK ONLY AS OF THE DATE

ON WHICH THEY ARE MADE. THE COMPANY DOES NOT UNDERTAKE ANY OBLIGATION TO REVISE OR UPDATE THESE FORWARD-LOOKING STATEMENTS TO REFLECT

EVENTS OR CIRCUMSTANCES AFTER SUCH DATE OR TO REFLECT THE OCCURRENCE OF UNANTICIPATED EVENTS.

IMAGES CONTAINED IN THIS OFFERING CIRCULAR ARE

ARTIST’S IMPRESSIONS AND THE ACTUAL FACILITIES MAY VARY.

SUMMARY

AC PARTNERS, INC. is an early-stage residential

and light commercial utility and specialty equipment service devoted to expansion in Florida through acquisitions and joint ventures.

The company will focus on companies and operations that have current positive cash flow and a synergy in operation. Main focuses include

high end residential, multitenant buildings, light commercial and office buildings that can be upgraded to green/energy efficient operations

in both air handling and water treatment with additional opportunities including solar electrical generation.

The company will operate under the brand name

“AC Partners” with the consideration given to future name changes due to a diversification of operations outside of the former

business. AC Partners was incorporated in 2000 in Nevada.

AC PARTNERS intends to either form operating

subsidiaries, enter into joint ventures or provide direct investment into operating companies that supply HVAC equipment and services

and water treatment equipment and services to residential and light industrial clients or other operations that provide an opportunity

to improve profitability or operations through the implementation of complementary services and equipment.

AC Partners, Inc. has identified the following

businesses for operations, acquisitions and joint ventures:

Residential equipment service and replacement

of higher end, more energy efficient equipment.

Light commercial operations with HVAC, water

treatment and cooling tower operations.

Revenue Plan

The company has current service operations and

a water treatment joint venture. Both located on the East Coast of Florida with the objective of expanding the service fleet and service

offerings.

The Offering

| Securities offered |

|

Class A Common Stock |

| |

|

|

| Class A Stock Common outstanding before the Offering |

|

200,000,000 shares of Class A Common Stock. |

| |

|

|

| Share Price |

|

$0.100 per share |

| |

|

|

| Minimum Investment |

|

$1,000 |

Use of Proceeds

Proceeds from this Offering will be used to expand

services and acquire other operating assets.

Summary Risk Factors

AC Partners is

still considered a startup. The company was incorporated in 2000 but only started operating in the HVAC industry in 2017. The Company

generates revenues and is profitable at this time and may still not provide a return on investment for approximately 24 months after

this offering. Investing in the Company involves a high degree of risk (see “Risk Factors”).

As an investor, you should be able to bear a complete loss of your investment. Some of the more significant risks include those set forth

below:

| |

· |

This is a very young company. |

| |

|

|

| |

· |

The growth of AC Partners business is dependent on acquisition of specialty

service companies and service personnel that produce revenue at favorable prices. |

| |

|

|

| |

· |

AC Partners operates in a highly competitive yet demanding market. |

| |

|

|

| |

· |

Customer complaints or litigation on behalf of our customers, contractors

or employees may adversely affect our business, results of operations or financial condition. |

| |

|

|

| |

· |

The company’s insurance coverage may not be adequate to cover

all possible losses that it could suffer and its insurance costs may increase. |

| |

|

|

| |

· |

The company may not be able to operate its facilities, or obtain and

maintain licenses and permits necessary for such operation, in compliance with laws, regulations and other requirements, which could

adversely affect its business, results of operations or financial condition. |

| |

|

|

| |

· |

The company’s development and growth strategy depends on its

ability to identify and fund acquisition of other companies operating within the industry in adjacent geographies. |

| |

|

|

| |

· |

The company’s acquisitions may depend on their ability to obtain

favorable financing. |

| |

|

|

| |

· |

AC Partners depends on a small management team and may need to hire

more people to be successful. |

| |

|

|

| |

· |

The Offering price has been arbitrarily set by the company. |

| |

|

|

| |

· |

The officers of AC Partners control the company and the company does

not currently have any independent directors. |

| |

|

|

| |

· |

Investors in this offering may not be entitled to a jury trial with

respect to claims arising under the subscription agreement and claims where the forum selection provision is applicable, which could

result in less favorable outcomes to the plaintiff(s) in any such action. |

| |

|

|

| |

· |

There is currently a thinly traded market for AC Partners’ shares. |

| |

|

|

| |

· |

The interests of AC Partners and the company’s other affiliates

may conflict with your interests. |

RISK FACTORS

The SEC requires the company to identify risks

that are specific to its business and its financial condition. The company is still subject to all the same risks that all companies

in its business, and all companies in the economy, are exposed to. These include risks relating to economic downturns, political and

economic events and technological developments (such as hacking and the ability to prevent hacking). Additionally, early-stage companies

are inherently riskier than more developed companies. You should consider general risks as well as specific risks when deciding whether

to invest.

Risks relating to our business

This is a very young company.

The company was incorporated in Nevada in 2000

but the Company instituted its current strategy in 2018. Despite the time since incorporation the company is still a startup company

that has recently changed its operations to a new business model. The company is initiating the execution of its business plan discussed

herein but its operations have not yet been profitable and the Company has not acquired any additional assets. There is limited history

upon which an evaluation of its past performance and future prospects can be made. Statistically, most startup companies fail.

The growth of AC Partners business is dependent on acquisition

of specialty service companies and service personnel that produce revenue at favorable prices.

AC Partners is a capital-intensive operation

and requires the purchase of equipment, vehicles, tools and make payments. As of the date of this Offering Circular the company has its

own operations in West Palm Beach but has not made any acquisitions. The company does not know whether it will be able to acquire additional

operators at acceptable purchase terms that are favorable. Finally, if this Offering does not raise enough capital to purchase other

operators, the company will need to procure external financing for the purchase of the land and/or construction of the facility.

The company may raise more capital and future fundraising rounds

could result in dilution.

AC Partners may

need to raise additional funds to finance its operations or fund its business plan. Even if the company manages to raise subsequent financing

or borrowing rounds, the terms of those borrowing rounds might be more favorable to new investors or creditors than to existing investors

such as you. New equity investors or lenders could have greater rights to our financial resources (such as liens over our assets) compared

to existing shareholders. Additional financings could also dilute your ownership stake, potentially drastically. See “Dilution”

and the “Management’s Discussion and Analysis of Financial Condition and Results of Operations–

Plan of Operation” for more information.

Success in residential and light commercial services is highly

unpredictable, and there is no guarantee the company’s content will be successful in the market.

The company’s success will depend on its

ability to penetrate the residential and light commercial HVAC and water treatment market in South East Florida. Consumer tastes, trends

and preferences frequently change and are notoriously difficult to predict. If the company fails to anticipate future consumer preferences

in the home, residential or light commercial market, its business and financial performance will likely suffer. The residential and light

commercial infrastructure and utility market is very competitive. The company may not be able to develop customers that are become profitable.

The company may also invest in acquisitions that end up losing money. Even if one of its acquisitions is successful, the company may

lose money in others.

Changes in consumer financial condition, tastes

and preferences, particularly those affecting the residential and light commercial capital expenditures, and other social and demographic

trends could adversely affect its business. Significant periods of recession or similar circumstances could result in situations where

operations and the financial condition of the company are affected. If the company cannot attract customers or retain its existing customers

then its financial condition and results of operations could be harmed.

The COVID-19 pandemic could have material negative effects on

AC Partners’ planned operations, including entry into customers’ facilities.

The impact of COVID-19 on companies seems to

be devolving but its future effects are uncertain. AC Partners’ operations require access to customers’ homes and facilities.

At the current time the Federal Government and local states have lifted restrictions which affected the Company’s operations. Any

future gathering restrictions or the perceived risk by the company’s customer base due to COVID-19 or other potential pandemics

could materially impact the company’s operation and profitability.

AC Partners operates in a highly competitive market.

AC Partners plans to operate in a highly competitive

market and faces intense competition. Competitors will include large national service companies such as Lowes and Home Depot, Lennox,

Trane, Carrier, and other multi-state service companies. Many of the company’s current and potential competitors have greater resources,

longer histories, more customers, and greater brand recognition. Competitors may secure better terms from vendors, adopt more aggressive

pricing and devote more resources to technology, infrastructure, fulfillment, and marketing.

Further, AC Partners’ services will compete

on a local and regional level with small handyman businesses. The number and variety of competitors in this business will vary based

on the location and setting of each operation. Some operations may be situated in intensely competitive areas characterized by numerous

service providers. In addition, in most regions, the competitive landscape is in constant flux as new service providers set up operations.

As a result of these characteristics, the supply in a given region may exceed the demand for such services, and any increase in the number

or quality of service suppliers or the products they provide, in such region could significantly impact the ability of the company’s

properties to attract and retain service personnel, which could harm their business and results of operations.

Customer complaints or litigation on behalf of our customers

or employees may adversely affect our business, results of operations or financial condition.

The company’s business may be adversely

affected by legal or governmental proceedings brought by or on behalf of their residents, customers or employees. Regardless of whether

any claims against the company are valid or whether they are liable, claims may be expensive to defend and may divert time and money

away from operations and hurt our financial performance. A judgment significantly in excess of their insurance coverage or not covered

by insurance could have a material adverse effect on the company’s business, results of operations or financial condition. Also,

adverse publicity resulting from these allegations may materially affect the company.

The company’s insurance coverage may not be adequate to

cover all possible losses that it could suffer and its insurance costs may increase.

The company has acquired insurance. If there

are significant claims then it may not be able to acquire insurance policies that cover future types of losses and liabilities. Further,

insurance policies expire annually and the company cannot guarantee that it will be able to renew insurance policies on favorable terms,

or at all. In addition, if it, or other companies in the industry, sustain significant losses or make significant insurance claims, then

its ability to obtain future insurance coverage at commercially reasonable rates could be materially adversely affected. If the company’s

insurance coverage is not adequate, or it becomes subject to damages that cannot by law be insured against, such as punitive damages

or certain intentional misconduct by their employees, this could adversely affect the company’s financial condition or results

of operations.

The company may not be able to operate its facilities, or obtain

and maintain licenses and permits necessary for such operation, in compliance with laws, regulations and other requirements, which could

adversely affect its business, results of operations or financial condition.

Each facility is subject to licensing and regulation

by the local government, county and/or municipality in which the facility is located. Typically, licenses must be renewed annually and

may be revoked or suspended for cause at any time. In some states, the loss of a license for cause with respect to one facility may lead

to the loss of licenses at all facilities in that state and could make it more difficult to obtain additional licenses in that state.

The failure to receive or retain a license, or any other required permit or license, in a particular location, or to continue to qualify

for, or renew licenses, could have a material adverse effect on operations and the company’s ability to obtain such a license or

permit in other locations.

The company’s development and growth strategy depends

on its ability to identify and fund acquisition of other companies operating within the industry in adjacent geographies.

A key element of the company’s growth strategy

is to acquire other similar or complementary companies. The company has identified a number of acquisition targets but has not formally

entered into any agreements. The acquisition targets are predominantly in adjacent geographies where the company will be able to expand

its customer base and diversity. The company’s ability to acquire, fund, and develop these companies on a timely and cost-effective

basis, or at all, is dependent on a number of factors, many of which are beyond its control, including but not limited to our ability

to:

| |

· |

Find quality acquisition targets. |

| |

|

|

| |

· |

Reach acceptable agreements regarding the acquisition or purchase of

locations, and comply with their commitments under any lease agreements. |

| |

|

|

| |

· |

Comply with applicable zoning, licensing, land use and environmental

regulations. |

| |

|

|

| |

· |

Raise or have available an adequate amount of cash or currently available

financing and mortgage terms for fleet expansion and inventory. |

| |

|

|

| |

· |

Adequately complete acquisition operations. |

| |

|

|

| |

· |

Timely hire, train and retain the skilled technicians, management and

other employees’ necessary to meet staffing needs. |

| |

|

|

| |

· |

Efficiently manage the amount of time and money used to develop and

expand each new acquisition. |

If the company succeeds in acquiring and developing

an expanded geographical operation in a timely and cost-effective basis, the company may nonetheless be unable to attract enough customers

to these new acquisitions because customers may be unfamiliar with the company and its offerings may not appeal to them and the company

may face competition from other service providers.

The company’s acquisitions may depend on their ability

to obtain favorable financing.

The company intends to secure both financing

via this offering and, if necessary for acquisitions and fleet expansion, other financing sources including traditional lending, mortgages

on properties and lines of credit. There is no guarantee that the company will be able to obtain financing on favorable terms. In the

event that the company is unable to obtain such financing it may limit the company’s ability to effectuate its plans and will increase

the costs and expenses of the company, thereby negatively impacting its financial prospects.

AC Partners depends on a small management team and may need

to hire more people to be successful.

The success of AC Partners will greatly depend

on the skills, connections and experiences of the executives, Kenneth Boutilier , Renee Boutilier and Maurice Cohen. AC Partners has

not entered into employment agreements with the aforementioned executives. There is no guarantee that the executives will agree to terms

and execute employment agreements that are favorable to the company. Should any of them discontinue working for AC Partners, there is

no assurance that the company will continue. Further, there is no assurance that the company will be able to identify, hire and retain

the right people for the various key positions.

Risks relating to this Offering and our shares

The Offering price has been arbitrarily set by the company.

AC Partners has set the price of its Common Stock

at $0.100 per share. Valuations for companies at AC Partners stage are purely speculative. The company’s valuation has not been

validated by any independent third party and may fall precipitously. It is a question of whether you, the investor, are willing to pay

this price for a percentage ownership of a start-up company. You should not invest if you disagree with this valuation.

There is no minimum raise which will allow the company to proceed

using dollar one to initiate its plan but could result in AC Partners not raising enough financing through the offer to pay for the offer.

AC Partners has not set any minimum raise amount

in order to obtain access to funds resulting from this offering. If the company fails to raise the amount required to initiate the offering

the company may need to pay for the services out of its operating cash. The investor should read the execution plans to evaluate the

risk of a no minimum raise.

The officers of AC Partners control the Company and the Company

does not currently have any independent directors.

The current Owners are currently the company’s

controlling shareholders. Moreover, they are the company’s executive officers and directors, through their ownership in AC PARTNERS.

This could lead to unintentional subjectivity in matters of corporate governance, especially in matters of compensation and related party

transactions. The company does not benefit from the advantages of having independent directors, including bringing an outside perspective

on strategy and control, adding new skills and knowledge that may not be available within AC Partners, and having extra checks and balances

to prevent fraud and produce reliable financial reports.

Investors in this offering may not be entitled to a jury trial

with respect to claims arising under the subscription agreement and claims where the forum selection provision is applicable, which could

result in less favorable outcomes to the plaintiff(s) in any such action.

Investors in this offering will be bound by the

subscription agreement, which includes a provision under which investors waive the right to a jury trial of any claim they may have against

the company arising out of or relating to the Subscription Agreement which is part of this Offering. The Subscription Agreement does

not limit the subscriber to bring actions under federal and state securities law. Section 27 of the Exchange Act does create exclusive

federal jurisdiction over all suits brought to enforce and duty or liability created by the Exchange Act or the rules and regulations

thereunder. Section 22 of the Securities Act creates a concurrent jurisdiction for federal and state courts over all suits brought to

enforce any duty or liability created by the by the Securities Act or the rules and regulations thereunder.

The subscription agreement terms provide that

the agreement is governed and construed in accordance with the laws of the State of Florida without regard to the principals of conflict

of laws. The subscription agreement also limits the investor’s ability to bring a claim outside of the State of Florida with

regard to the terms of the subscription agreement only. Any provisions that do not fall under the jurisdiction of the State of Florida

then any such action may be brought in any federal court within the State of Florida. These provisions limit the forums in which the

investor may make a claim against the Company. This limitation may increase costs of making a claim against the Company and may discourage

or limit the investor’s ability to bring a claim in a judicial forum they find more favorable. Investors may bring claims outside

of this Offering and the subscription agreement in any court of competent jurisdiction.

If the company opposed a jury trial demand based

on the waiver, a court would determine whether the waiver was enforceable based on the facts and circumstances of that case in accordance

with the applicable state and federal law. To the company’s knowledge, the enforceability of a contractual pre-dispute, jury trial

waiver in connection with claims arising under the state or federal securities laws has not been finally adjudicated by the courts. However,

the company believes that a contractual pre-dispute jury trial waiver provision is generally enforceable. In determining whether to enforce

a contractual pre-dispute jury trial waiver provision, courts will generally consider whether the visibility of the jury trial waiver

provision within the agreement is sufficiently prominent such that a party knowingly, intelligently and voluntarily waived the right

to a jury trial. The company believes that this is the case with respect to the subscription agreement. Investors should consult legal

counsel regarding the jury waiver provision before entering into the subscription agreement.

If an investor brings a claim against the company

in connection with matters arising under the subscription agreement, including claims under federal securities laws, an investor may

not be entitled to a jury trial with respect to those claims, which may have the effect of limiting and discouraging lawsuits against

the company. If a lawsuit is brought against the company under the subscription agreement, it may be heard only by a judge or justice

of the applicable trial court, which would be conducted according to different civil procedures and may result in different outcomes

than a trial by jury would have had, including results that could be less favorable to the plaintiff(s) in such an action.

Nevertheless, if this jury trial waiver provision

is not permitted by applicable law, an action could proceed under the terms of the subscription agreement with a jury trial. No condition,

stipulation or provision of the subscription agreement serves as a waiver by any holder of common shares or by AC Partners of compliance

with any substantive provision of the federal securities laws and the rules and regulations promulgated under those laws.

In addition, when the shares are transferred,

the transferee is required to agree to all the same conditions, obligations and restrictions applicable to the shares or to the transferor

with regard to ownership of the shares, that were in effect immediately prior to the transfer of the shares, including but not limited

to the subscription agreement.

By agreeing to the provisions of the subscription

agreement investors will not be deemed to have waived the Company’s compliance with federal securities laws and the rules and regulations

thereunder.

There is a current market for AC Partners’ shares.

The company is currently listed on OTC Markets

Group, Inc under the trading symbol ACPS. Despite the listing the company is very thinly traded. Shares of the company’s Common

Stock may eventually be traded to the extent any demand and/or trading platform(s) exists. However, there is no guarantee there will

be demand for the shares, or a trading platform that allows you to sell them. Investors should assume that they may not be able to liquidate

their investment or pledge their shares as collateral for some time.

Risks Related to Certain Conflicts of Interest

The interests of AC Partners and the company’s other affiliates

may conflict with your interests.

The company’s Amended and Restated Certificate

of Incorporation, bylaws and Nevada law provide company management with broad powers and authority that could result in one or more conflicts

of interest between your interests and those of the officers and directors of AC Partners. This risk is increased by the affiliated entities

being controlled by AC PARTNERS and all our officers and directors currently have an interest in AC PARTNERS, through ownership, as an

officer or director in AC PARTNERS contractually or any combination thereof. Potential conflicts of interest include, but are not limited

to, the following:

| |

· |

AC PARTNERS and the company’s other affiliates will not be required to disgorge any profits or fees or other compensation they may receive from any other business they own separate from the company, and you will not be entitled to receive or share in any of the profits, return, fees or compensation from any other business owned and operated by the management and their affiliates for their own benefit. |

| |

|

|

|

| |

· |

The company may engage AC PARTNERS, or other companies affiliated with AC Partners to perform services, and determination for the terms of those services will not be conducted at arms’ length negotiations; and |

| |

|

|

|

| |

· |

The company’s officers and directors are not required to devote all of their time and efforts to the affairs of the company. |

| |

|

|

|

| |

· |

Family Relationships: |

| |

|

Renee Boutilier is the wife of Kenneth Boutilier. |

| |

|

Peter Raider is the brother of Renee Boutilier. |

| |

|

|

|

| |

· |

Management Services Agreement and Employment Agreements |

| |

|

No Management Services Agreement is in place with any of the management team. Employment Agreements will be executed and they will include industry standard salaries, benefits and vacations and non-compete agreements. |

| |

|

|

|

| |

· |

Conflicts of Interest: |

| |

|

While there are no specific conflicts of interest to report at this time, we acknowledge the potential for conflicts arising from the familial relationships between officers and directors. These relationships may pose certain risks that could impact decision-making and corporate governance. Some potential risks include:

|

| |

|

|

| |

| 1. | Bias

and Favoritism: There is a risk that familial relationships could lead to biases or favoritism

in decision-making processes, potentially affecting the fair treatment of employees, shareholders,

or business partners. |

| |

| | |

| |

| 2. | Competitive

Advantage: Family members within the organization may have access to privileged information

or opportunities that could provide them with a competitive advantage over other stakeholders. |

| |

| | |

| |

| 3. | Corporate

Governance Issues: The presence of family members in key positions could raise concerns

about the independence and effectiveness of corporate governance practices, particularly

in cases where family dynamics influence decision-making. |

| |

| | |

| |

| 4. | Succession

Planning: Family relationships may complicate succession planning and leadership transitions

within the organization, potentially leading to disputes or instability in executive management. |

| |

| | |

| |

| 5. | Disclosure

Requirements: Failure to adequately disclose potential conflicts of interest related

to familial relationships could result in regulatory scrutiny or legal challenges, impacting

the company's reputation and financial standing. |

DILUTION

Dilution means a reduction in value, control

or earnings of the shares the investor owns.

Immediate dilution

An early-stage company typically sells its shares

(or grants options over its shares) to its founders and early employees at a very low cash cost, because they are, in effect, putting

their “sweat equity” into the company. When the company seeks cash investments from outside investors, like you, the new

investors typically pay a much larger sum for their shares than the founders or earlier investors, which means that the cash value of

your stake is diluted because all the shares are worth the same amount, and you paid more than earlier investors for your shares. If

you invest in our Preferred Stock, your interest will be diluted immediately to the extent of the difference between the Offering price

per share of our Preferred Stock and the pro forma net tangible book value per share of our Preferred Stock after this Offering.

As of January 29, 2024, the net tangible book

value of the Company was $411,572. Based on the number of shares of Common Stock issued and outstanding as of the date of the offering

(1,646,291) that equates to a net tangible book value of approximately ($0.10) per share of Common Stock on a pro forma basis. Based

on the total number of shares of Common Stock that would be outstanding assuming full subscription (201,646,291) at total net proceeds

of $20,164,629, that equates to approximately $0.0816 of tangible net book value per share.

Thus, if the Offering is fully subscribed, the

net tangible book value per share of Common Stock owned by our current stockholders will have immediately decrease by approximately $0.15

without any additional investment on their behalf and the net tangible book value per share for new investors will be immediately diluted

by $0.0016 per share. These calculations do not include the costs of the Offering, and such expenses will cause further dilution. Based

on 100% subscription of 200,000,000 shares at $0.10:

| Offering price per share of Common Stock* | |

$ | 0.10 | |

| Net Tangible Book Value per share of Class A Common Stock Outstanding (based on 1,646,291 shares) | |

$ | 0.44 | |

| | |

| | |

| Increased/Decrease in Net Tangible Book Value per Share Attributable

to Shares Offered in the Offering (based on 200,000,000 shares) | |

$ | (0.3372 | ) |

| Net Tangible Book Value per Share after Offering (based on 20,000,000

shares) | |

$ | 0.1028 | |

| | |

| | |

| Dilution of Net Tangible Book Value per Share to Purchasers in this Offering | |

$ | 0.0028 | |

________________________

*before deduction of Offering expenses.

Future dilution

Another important way of looking at dilution

is the dilution that happens due to future actions by the company. The investor’s stake in a company could be diluted due to the

company issuing additional shares. In other words, when the company issues more shares, the percentage of the company that you own will

go down, even though the value of the company may go up. You will own a smaller piece of a larger company. This increase in number of

shares outstanding could result from a stock offering (such as an initial public offering, another crowdfunding round, a venture capital

round, angel investment), employees exercising stock options, or by conversion of certain instruments (e.g. convertible bonds, preferred

shares or warrants) into stock.

If the company decides to issue more shares,

an investor could experience value dilution, with each share being worth less than before, and control dilution, with the total percentage

an investor owns being less than before. There may also be earnings dilution, with a reduction in the amount earned per share (though

this typically occurs only if the company offers dividends, and most early stage companies are unlikely to offer dividends, preferring

to invest any earnings into the company).

The type of dilution that hurts early-stage investors

most often occurs when the company sells more shares in a “down round,” meaning at a lower valuation than in earlier offerings.

An example of how this might occur is as follows (numbers are for illustrative purposes only):

| |

· |

In June 2014 Jane invests $20,000 for shares that represent

2% of a company valued at $1 million. |

| |

|

|

| |

· |

In December, the company is doing very well and sells $5 million in

shares to venture capitalists on a valuation (before the new investment) of $10 million. Jane now owns only 1.3% of the company but

her stake is worth $200,000. |

| |

|

|

| |

· |

In June 2015, the company has run into serious problems and in order

to stay afloat it raises $1 million at a valuation of only $2 million (the “down round”). Jane now owns only 0.89% of

the company and her stake is worth only $26,660. |

This type of dilution might also happen upon

conversion of convertible notes into shares. Typically, the terms of convertible notes issued by early-stage companies provide that in

the event of another round of financing, the holders of the convertible notes get to convert their notes into equity at a “discount”

to the price paid by the new investors, i.e., they get more shares than the new investors would for the same price. Additionally, convertible

notes may have a “price cap” on the conversion price, which effectively acts as a share price ceiling. Either way, the holders

of the convertible notes get more shares for their money than new investors. In the event that the financing is a “down round”

the holders of the convertible notes will dilute existing equity holders, and even more than the new investors do, because they get more

shares for their money. Investors should pay careful attention to number of convertible notes that the company has issued (and may issue

in the future, and the terms of those notes.

If you are making an investment expecting to

own a certain percentage of the company or expecting each share to hold a certain amount of value, it’s important to realize how

the value of those shares can decrease by actions taken by the company. Dilution can make drastic changes to the value of each share,

ownership percentage, voting control, and earnings per share.

PLAN OF DISTRIBUTION AND

SELLING SECURITYHOLDERS

Plan of Distribution

AC PARTNERS, INC. is offering a maximum of 200,000,000

shares of Common Stock on a “best efforts” basis.

The cash price per share of Common Stock is $0.10.

The company intends to market the shares in this

Offering both through online and offline means. Online marketing may take the form of contacting potential investors through electronic

media and posting our Offering Circular or “testing the waters” materials on an online investment platform.

The offering will terminate at the earliest of:

(1) the date at which the maximum offering amount has been sold, (2) the date which is one year from this offering being qualified by

the Commission, and (3) the date at which the offering is earlier terminated by AC PARTNERS, INC. in its sole discretion.

The company may undertake one or more closings

on an ongoing basis. After each closing, funds tendered by investors will be available to the company. After the initial closing of this

offering, the company expects to hold closings on at least a monthly basis.

The company is offering its securities in only

specified all states.

Incentives

The company intends to offer marketing promotions

to encourage potential investors to invest, which may include offers such as offering a 10% discount on services to AC Partners shareholders.

TAX CONSEQUENCES FOR RECIPIENT (INCLUDING

FEDERAL, STATE, LOCAL AND FOREIGN INCOME TAX CONSEQUENCES) WITH RESPECT TO THE INVESTMENT PURCHASE PACKAGES ARE THE SOLE RESPONSIBILITY

OF THE INVESTOR. INVESTORS MUST CONSULT WITH THEIR OWN PERSONAL ACCOUNTANT(S) AND/OR TAX ADVISOR(S) REGARDING THESE MATTERS.

Minimum Offering Amount

The shares being offered will be issued in one

or more closings. Investors may only purchase shares in minimum increments of $1,000. Potential investors should be aware that there

can be no assurance that any additional funds will be invested in this offering.

Selling Shareholders

No shareholders, as of the date of this filing, have

expressed an intention to sell securities into the offering. However, owners reserve the right to sell up to 15% of the overall amount

raised; all net proceeds after deduction of founders' sale in this offering will go to AC PARTNERS, INC.

Investors’ Tender of Funds

After the Offering Statement has been qualified

by the Securities and Exchange Commission (the “SEC”), the company will accept tenders of funds to purchase the shares. Prospective

investors who submitted non-binding indications of interest during the “test the waters” period will receive an automated

message from us indicating that the Offering is open for investment. (NOTE: AT THIS TIME NO “TEST THE WATER” PRESENTATIONS

HAVE BEEN MADE, NO PROSPECTIVE INVESTIONS HAVE SUBMITTED INDICATIONS OF INTEREST AND NO PRESENTATION MATERIALS ARE AVAILABLE). We will

conduct multiple closings on investments (so not all investors will receive their shares on the same date). Each time the company accepts

funds transferred from the Escrow Agent is defined as a “Closing." The funds tendered by potential investors will be held

by our escrow agent, Prime Trust, LLC (the “Escrow Agent”) and will be transferred to us at each Closing. The escrow agreement

can be found in Exhibit 8 to the Offering Statement of which this Offering Circular is a part.

Process of Subscribing

You will be required to complete a subscription

agreement in order to invest. The subscription agreement includes a representation by the investor to the effect that, if you are not

an “accredited investor” as defined under securities law, you are investing an amount that does not exceed the greater of

10% of your annual income or 10% of your net worth (excluding your principal residence).

If you decide to subscribe for the Stock in this

Offering, you should complete the following steps:

| |

1. |

Go to AC Partners, Inc. Website, click on the "Invest

Now" button; |

| |

|

|

| |

2. |

Complete the online investment form; |

| |

|

|

| |

3. |

Deliver funds directly by check, wire, debit card, or electronic funds

transfer via ACH to the specified account; |

| |

|

|

| |

4. |

Once funds are received an automated AML check will be performed to

verify the identity and status of the investor; |

| |

|

|

| |

5. |

Once AML is verified, investor will electronically receive, review,

execute and deliver to us a Subscription Agreement. |

Any potential investor will have ample time to

review the Subscription Agreement, along with their counsel, prior to making any final investment decision.

If a subscription is rejected, all funds will

be returned to subscribers within thirty days of such rejection without deduction or interest. Upon acceptance by us of a subscription,

a confirmation of such acceptance will be sent to the subscriber. Escrow Agent has not investigated the desirability or advisability

of investment in the shares nor approved, endorsed or passed upon the merits of purchasing the securities.

The company has engaged Mountain Share Transfer,

LLC, a registered transfer agent with the SEC, who will serve as transfer agent to maintain shareholder information on a book-entry basis;

there are no set up costs for this service, fees for this service will be limited to secondary market activity. The company estimates

the aggregate fee due to the transfer agent for the above services to be $35,000 annually.

USE OF PROCEEDS TO ISSUER

The following discussion addresses the use of

proceeds from this Offering. The company currently estimates that, at a per share price of $.10, the net proceeds from the sale of the

200,000,000 shares of Common Stock will likely be $19,900,000 after deducting the estimated offering expenses of approximately $100,000.

The following table breaks down the use of proceeds

into different categories under various funding scenarios:

| |

|

|

25% |

|

|

|

50% |

|

|

|

75% |

|

|

|

100% |

|

| Gross Proceeds |

|

$ |

5,000,000 |

|

|

$ |

10,000,000 |

|

|

$ |

15,000,000 |

|

|

$ |

20,000,000 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Management Team Build-Up |

|

$ |

500,000 |

|

|

$ |

1,000,000 |

|

|

$ |

1,500,000 |

|

|

$ |

2,000,000 |

|

| Acquisitions Preparedness (1) |

|

$ |

3,500,000 |

|

|

$ |

8,000,000 |

|

|

$ |

12,000,000 |

|

|

$ |

16,000,000 |

|

| Operational Enhancements (1) |

|

$ |

1,000,000 |

|

|

$ |

1,000,000 |

|

|

$ |

1,500,000 |

|

|

$ |

2,000,000 |

|

____________________________

| (1) |

Short-Term Financing Needs will be adjusted in accordance with Net Proceeds. Adjustments

will be made to the schedule to prioritize acquisitions and equipment purchases. |

Management Team Build-Up: A portion of

the proceeds will be allocated towards strengthening our management team through strategic hires and talent acquisition efforts, including

compensation for officers or directors as deemed necessary to attract top talent and enhance corporate leadership.

Compensation to Officers or Directors: It

is important to note that funds allocated to the Management Team Build-Up may include compensation for officers or directors, as part

of efforts to attract experienced professionals to key leadership positions.

THE COMPANY’S BUSINESS

AC PARTNERS, INC. is an early-stage residential

and light commercial utility and specialty equipment service devoted to expansion in Florida through acquisitions and joint ventures.

The company will focus on companies and operations that have current positive cash flow and a synergy in operation. Main focuses include

high end residential, multitenant buildings, light commercial and office buildings that can be upgraded to green/energy efficient operations

in both air handling and water treatment with additional opportunities including solar electrical generation.

The company will operate under the brand name

“AC Partners” with the consideration given to future name changes due to a diversification of operations outside of the former

business. AC Partners was incorporated in 2000 in Nevada.

AC PARTNERS intends to either form operating

subsidiaries, enter into joint ventures or provide direct investment into operating companies that supply HVAC equipment and services

and water treatment equipment and services to residential and light industrial clients or other operations that provide an opportunity

to improve profitability or operations through the implementation of complementary services and equipment.

AC Partners, Inc. has identified the following

businesses for operations, acquisitions and joint ventures:

Residential equipment service and replacement

of higher end, more energy efficient equipment.

Light commercial operations with HVAC, water

treatment and cooling tower operations.

MANAGEMENT’S DISCUSSION

AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion includes information

from the unaudited financial statements for the period of FY December 31, 2022 through September 30, 2023 and should be read in

conjunction with our financial statements and the related notes included in this Offering Circular. Financials will be completed in accordance

with the Regulation A requirements upon approval of this filing.

Financial Condition

Balance Sheet Analysis:

| · | Cash

and Equivalents: As of September 30, 2023, our cash and cash equivalents increased by

72.10% compared to the previous year. This significant increase reflects our robust business

growth during the period. By September 30, 2023, the Company had nearly reached the year-end

2022 revenues, contributing to the substantial increase in cash reserves. Additionally, the

acceleration of revenue recognition, with revenues realized in three quarters compared to

the prior year, resulted in reduced payroll expenses, further bolstering our cash position. |

| · | Total

Assets: Our total assets experienced a notable increase of 19.34% as of September 30,

2023, compared to year-end 2022. This growth was primarily driven by increased revenues,

creating more cash influx, and heightened demand for inventory. The combination of higher

revenues and inventory demand contributed to the expansion of our asset base, reflecting

the strength and growth potential of our business operations. |

| · | Liabilities:

The total liabilities decreased by 52.49% compared to the previous year. This significant

decrease was mainly attributable to the resolution of pending sales tax payable at the end

of the year. The successful management of this liability contributed to the overall reduction

in our total liabilities and underscores our commitment to sound financial management practices. |

Results of Operations

Income Statement Analysis:

| · | Revenue:

Our revenue for the period ending September 30, 2023, increased by 24.48% compared to

the same period last year. This robust growth is attributable to the efforts in developing

a strong sales team and forging strategic partnerships in the industry. These initiatives

have enabled us to expand our customer base and capture new market opportunities. |

| · | Cost

of Goods Sold: The cost of goods sold as a percentage of revenue remained relatively

stable, indicating our ability to seek the best prices and leverage increased revenues to

negotiate favorable deals with suppliers. This cost management strategy has contributed to

maintaining healthy profit margins despite the growth in revenue. |

| · | Operating

Expenses: Our operating expenses increased by 32.91% year-over-year, primarily driven

by higher payroll expenses associated with hiring the right employees to support our growth

initiatives. Investing in talent acquisition and retaining skilled professionals is crucial

for sustaining our expansion efforts and driving long-term success. |

Year-over-Year Changes

We have observed several material year-over-year

changes in our consolidated balance sheet accounts:

| · | Cash

and Equivalents: As of September 30, 2023, our cash and cash equivalents increased by

72.10% compared to the previous year, reflecting our robust business growth and improved

cash flow management practices. |

| | | |

| · | Liabilities:

The total liabilities decreased by 52.49% compared to the previous year, mainly attributable

to the resolution of pending sales tax payable at the end of the year. The successful management

of this liability contributed to the overall reduction in our total liabilities and underscores

our commitment to sound financial management practices. |

Conclusion

In conclusion, AC PARTNERS, INC. has demonstrated

strong financial performance and solid growth momentum. The increase in revenue, coupled with effective cost management and strategic

investments in talent acquisition, positions us well for continued success and value creation for our stakeholders.

These projections take into account the aggressive

growth strategy of AC Partners, focusing on truck acquisitions and corresponding financial outcomes. The plan is designed to position

the company as a major player in the HVAC industry while ensuring financial sustainability and profitability.

B. Vision

1. Launching the Employee Associate Partnership Program

AC Partners envisions the implementation of an

innovative initiative - the Employee Associate Partnership Program. This program aims to foster a unique business model where service

trucks operate as independent units, each led by an Associate Partner. Through this program, AC Partners seeks to:

| · | Empower

Associates: Provide a controlled business environment for Associates to operate independently

while benefiting from AC Partners' support. |

| · | Supply

Essential Resources: Offer licensing, insurance, marketing, buying power, training, and management

support to Associates. |

| · | Promote

Ownership: Associates will have the opportunity to share in ownership, fostering a sense

of commitment and accountability. |

2. Managing Both the Back and Front of the Business

AC Partners recognizes the significance of efficient

management in both operational and customer-facing aspects of the business. The vision includes:

| · | Holistic

Management: AC Partners aims to manage both the back and front of the business seamlessly. |

| · | Operational

Excellence: Streamlining internal processes to enhance productivity, reduce costs, and improve

overall efficiency. |

| · | Customer-Focused

Approach: Ensuring a strong focus on customer service, sales, and satisfaction to maintain

a competitive edge. |

3. Focus on Continuous Training for Staff and Reducing Industry

Costs

AC Partners places a strategic emphasis on investing

in its workforce and optimizing industry costs. The vision involves:

| · | Continuous

Training: Implementing state-of-the-art training programs for staff to enhance their skills

and provide the best possible service to customers. |

| · | Reducing

Industry Costs: Strategizing to minimize industry-specific costs, including employee turnover

and theft, which are identified as significant challenges. |

| · | Innovation

and Efficiency: Exploring innovative solutions and technologies to streamline operations

and further reduce overall costs. |

This vision outlines AC Partners' commitment

to a sustainable and growth-oriented business model that not only benefits the company but also empowers its workforce and addresses

industry challenges.

Revenue is derived from contracts with our customers,

revenue also is recognized in accordance with ASC 605. As such, the Company identifies performance obligations and recognizes revenue

over the period through which the Company satisfies those obligations. Any contracts that by nature cannot be broken down by specific

performance criteria will recognize revenue on a straight-line basis over the contractual term of period contract.

Results of Operations

For the 9 months ending September 30, 2023 the

Company had revenues of $1,380,122 compared to the 9 months ending September 30, 2022 revenues of $970,134.

Total operating expenses from for the 9 months

ending September 30, 2023 were $582,640. All expenses came from administrative as well as equipment and maintenance.

As a result of the foregoing, the company generated

a net profit of $102,455 through September 30, 2023.

Monthly Operating Expenses

At the commencement of this Offering, AC Partners

will be responsible for all of its monthly operating expenses.

All monthly expenses will be reported quarterly.

Monthly operating expenses include the following:

| |

· |

salaries and benefits, |

| |

|

|

| |

· |

compensation to contractors, |

| |

|

|

| |

· |

expenses related

to local marketing, promotion and public relations, |

| |

|

|

| |

· |

travel, |

| |

|

|

| |

· |

legal and accounting, and |

| |

|

|

| |

· |

insurance and technology. |

Plan of Operation

Upon completion of this Offering, the company

intends to fund operations with the proceeds from this Offering and use mortgage financing to advance the purchase of the land, construction

of the facility, design of the facility, use of architects, and hiring of employees. Approximate costs for each stage of developing a

facility are as follows:

| |

· |

Acquisitions

Preparedness: up to $16,000,000 |

| |

|

|

| |

· |

Management

Team Build-Up: up to $2,000,000 |

| |

|

|

| |

· |

Operational

Enhancements: up to $2,000,000 |

Launching the Employee Associate Partnership Program

AC Partners envisions the implementation of an

innovative initiative - the Employee Associate Partnership Program. This program aims to foster a unique business model where service

trucks operate as independent units, each led by an Associate Partner. Through this program, AC Partners seeks to:

| · | Empower

Associates: Provide a controlled business environment for Associates to operate independently

while benefiting from AC Partners' support. |

| · | Supply

Essential Resources: Offer licensing, insurance, marketing, buying power, training, and

management support to Associates. |

| · | Promote

Ownership: Associates will have the opportunity to share in ownership, fostering a sense

of commitment and accountability. |

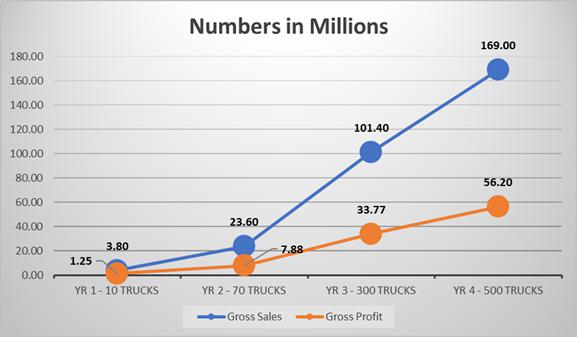

AC Partners aims to acquire a fleet of trucks

strategically over the next four years, aligning with the overall growth strategy. In year 1 they look to acquire 10 trucks, contributing

to gross sales of $3.8 million. Anticipate a gross profit of $1.25 million and a net profit of $780,000.

Liquidity and Capital Resources

As of September 30, 2023, the Company’s

cash on hand was $206,330. For the 9 months ending September 30, 2023, the Company had revenues of $1,380,122 compared to the 9

months ending September 30, 2022, revenues of $970,134. Total operating expenses for the 9 months ending September 30, 2023, were $582,640.

All expenses came from administrative as well as equipment and maintenance. As a result of the foregoing, the company generated

a net profit of $102,455 through September 30, 2023. The Company wished to raise capital through this offering to expedite the expansion

throughout Florida with its business plan that has proven to be profitable.

Indebtedness

| |

· |

As

of the balance sheet date, the company reports no long-term commitments and has no contingencies. There are no significant contractual

obligations extending into the long term, and the company is not currently subject to any potential liabilities or uncertainties

that would require disclosure as contingencies. This information is crucial for stakeholders and investors to understand the company's

financial standing and potential future obligations or risks. |

SHAREHOLDERS, DIRECTORS,

EXECUTIVE OFFICERS AND SIGNIFICANT EMPLOYEES

The table below sets forth the directors of the company.

| Name |

|

Position |

|

Age |

|

Term

of Office

(If

indefinite give date of appointment) |

| Kenneth Boutilier |

|

Director |

|

69 |

|

Feb 2, 2018 |

| Peter Raider |

|

Director |

|

63 |

|

Feb 2, 2018 |

The table below sets forth the officers of AC PARTNERS.

| Name |

|

Position |

|

Age |

|

Term

of Office

(If

indefinite give date of appointment) |

| Kenneth Boutilier |

|

President |

|

69 |

|

Feb 2, 2018 |

| Renee Boutilier |

|

Chief Financial Officer |

|

66 |

|

Feb 2, 2018 |

| Maurice Cohen |

|

Chief Service Officer |

|

77 |

|

Feb 2, 2018 |

| Simeao Paschalides |

|

Manager |

|

66 |

|

Jan 1, 2020 |

Biographies

Management's Business Experience:

Kenneth Boutilier (President and Director)

| · | President

and CEO of AC Partners, Inc. since 2017 |

| · | Managing

Partner of KBJD Homes, LLC since 2017 |

| · | Managing

Partner of M & K Investments of Palm Beach, LLC since 2012 |

| · | Experience

in HVAC, management, and real estate operations |

Renee Boutilier (Chief Financial Officer)

| · | Chief

Financial Officer of AC Partners, Inc. since 2017 |

| · | Managing

Partner of RR Development of PB, LLC since 2016 |

| · | President

of Renee Boutilier PA since 2017 |

| · | Licensed

realtor in the State of Florida since 2003 |

| · | Experience

in the financial industry and real estate management |

Maurice Cohen (Chief Service Officer)

| · | Chief

Service Officer of AC Partners, Inc. since 2021 |

| · | President

and Director of Efficient Services, Inc. since 1982 |

| · | Over

42 years of experience in commercial HVAC |

| · | Former

member of M & K Investments of Palm Beach, LLC (retired in 2023) |

Simeao Paschalides (Manager)

| · | Manager

of Coventina Builders, LLC since 2013 |

| · | Experienced

in planning, establishing, construction, maintenance, and operations |

Peter Raider (Director)

| · | Director

of AC Partners since 2017 |

| · | Over

30 years of experience in buying and selling businesses, real estate, and materials |

| · | Expertise

in marketing, negotiation, networking, and training |

Donald R. Keer, P.E., ESQ. (Corporate Attorney)

Mr. Keer is an attorney and a professional engineer

who spent the first half of his career as a construction project manager working for Fluor Corporation and then local developers in New

Jersey and Pennsylvania. Mr. Keer has also been an expert witness for various construction issues including delay damages, building code

standards, construction technologies and insurance claims.

For the past 25 years Mr. Keer has represented

business clients working on construction projects, real estate development, mergers and acquisitions and publicly traded companies to

ensure their businesses and construction projects move forward in a timely manner. He is a sole practitioner and has had his own law

practice for 25 years.

COMPENSATION OF DIRECTORS

AND EXECUTIVE OFFICERS

| Name |

|

Position |

|

Annual

Compensation |

|

| Kenneth Boutilier |

|

President |

|

$ |

26,000 |

|

| Renee Boutilier |

|

Chief Financial Officer |

|

$ |

13,000 |

|

| Maurice Cohen |

|

Chief Service Officer |

|

$ |

N/A |

|

| Simeao Paschalides |

|

Manager |

|

$ |

N/A |

|

| Peter Raider |

|

Director |

|

$ |

N/A |

|

All compensation will be on behalf of the company

by AC Partners, Inc. and allocated to the subsidiaries.

In the future,

the company will have to pay its officers, directors and other employees, which will impact the company’s financial condition and

results of operations, as discussed in “Management’s Discussion and Analysis of Financial Condition

and Results of Operations.” The company may choose to establish an equity compensation plan for

its management and other employees in the future. Further, as the company grows, the company intends to add additional executives.

SECURITY OWNERSHIP OF MANAGEMENT

AND CERTAIN SECURITYHOLDERS

GENERALLY

AC PARTNERS, INC. is authorized to issue 500,000,000

shares of common stock, $0.001 par value per share, in the Company and 50,000,000 shares of preferred stock. As of September 30, 2023,

1,646,291 shares of common stock, 494,000 shares of Series A Preferred Stock have been issued and outstanding. No additional stock issuances

have been made since November 24, 2019. See “Principal Shareholders.”

We have reserved 200,000,000 shares of common

stock for this issuance under AC PARTNERS, INC.’s private placement. The Company has not issued any options.

COMMON STOCK

Holders of outstanding shares of common stock

are entitled to one vote per share on all matters submitted to a vote of the shareholders. Except as may be required by applicable law,

holders of outstanding shares of common stock vote together as a single class. Holders of a majority of the outstanding shares of common

stock constitute a quorum at any meeting of shareholders.

SERIES A PREFERRED STOCK

For preferred stock, describe the dividend, voting,

conversion, and liquidation rights as well as redemption or sinking fund provisions. NO DIVIDEND RIGHTS AND NO SINKING FUND

PROVISIONS

Voting Rights:

| a. | If at

least one share of Series A Preferred Stock is issued and outstanding, then the total aggregate issued shares

of Series A Preferred Stock at any given time, regardless of their number shall have voting rights equal to

three (3) times the sum of: |

| | i. |

The

total number of shares of Common Stock which are issued and outstanding at the time of voting,

plus, |

| | ii. |

The

total number of votes granted to any preferred stock series which are issued and outstanding

at the time of voting. |

| b. | Each

individual share of Series A Preferred Stock shall have the voting rights equal to three times the sum of

all shares of Common Stock issued and outstanding all the time of voting plus the cumulative voting rights

of all preferred stock series issued and outstanding at the time of voting divided by the number of shares

of Series A Preferred Stock issued and outstanding at the time of voting. |

Conversion

The holder of the Series A Preferred Stock shall

have the right, from time to time, to convert shares of Series A Preferred Stock at the conversion ration of one hundred shares (100)

share of Common Stock for each single (1) share of Series A Preferred Stock. Shares of Series A Preferred Stock are anti-dilutive to

reverse splits, and therefore in the case of a reverse split, are convertible to the number of Common Shares after the reverse split

as would have been equal to the ratio herein prior to the reverse split. The conversion rate of the Series A Preferred Stock would increase

proportionally in the case of forward splits, and my not be diluted.

Restricted Securities

Principal Shareholders

| Title of Class |

Name and Address of beneficial

owner (1) |

Amount

and

Nature of

beneficial

ownership |

Amount

and

Nature of

beneficial

ownership

acquirable (2) |

Percent

of

class (3) |

| Series A Preferred |

Kenneth Boutilier; Palm City, FL |

494,000 |

|

100% |

The following table sets out, as of January 29,

2024 AC Partners voting securities that are owned by our executive officers, directors and other persons holding more than 10% of the

company’s voting securities.

| Name |

Common Shares |

Series A Preferred Shares |

| Kenneth Boutilier (1) |

1,600,000 |

494,000 |

| Peter Raider (1) |

286 |

|

______________________

(1) Shares issued to founders

INTEREST OF MANAGEMENT

AND OTHERS IN CERTAIN TRANSACTIONS

Family Relationships:

Renee Boutilier is the wife of Kenneth Boutilier.

Peter Raider is the brother of Renee Boutilier.

Management Services Agreement and Employment

Agreements

No Management Services Agreement is in place

with any of the management team. Employment Agreements will be executed and they will include industry standard salaries, benefits and

vacations and non-compete agreements.

Conflicts of Interest:

While there are no specific conflicts of interest

to report at this time, we acknowledge the potential for conflicts arising from the familial relationships between officers and directors.

These relationships may pose certain risks that could impact decision-making and corporate governance. Some potential risks include:

| 1. | Bias and Favoritism: There

is a risk that familial relationships could lead to biases or favoritism in decision-making

processes, potentially affecting the fair treatment of employees, shareholders, or business

partners. |

| 2. | Competitive Advantage: Family

members within the organization may have access to privileged information or opportunities

that could provide them with a competitive advantage over other stakeholders. |

| 3. | Corporate Governance Issues:

The presence of family members in key positions could raise concerns about the independence

and effectiveness of corporate governance practices, particularly in cases where family dynamics

influence decision-making. |

| 4. | Succession Planning: Family

relationships may complicate succession planning and leadership transitions within the organization,

potentially leading to disputes or instability in executive management. |

| 5. | Disclosure Requirements: Failure

to adequately disclose potential conflicts of interest related to familial relationships

could result in regulatory scrutiny or legal challenges, impacting the company's reputation

and financial standing. |

SECURITIES BEING OFFERED

AC Partners, Inc. is offering Common Stock in

this Offering. The company is qualifying up to 200,000,000 shares of Common Stock under this Offering Statement, of which this Offering

Circular is part.

AC Partners authorized capital stock consists

of 500,000,000 shares of Common Stock (the “Common Stock”), at $0.001 par value, of which 1,646,291 shares are Common Stock

are issued, and 494,000 share of Series A Preferred Stock, at $0.001 par value, of which 494,000 shares are issued

The following is a summary of the rights of AC

Partners’ capital common stock as provided in its Amended and Restated Certificate of Incorporation, and Bylaws, which have been

filed as exhibits to the Offering Statement of which this Offering Circular is a part.

Common Stock

Shares of our common stock have the following

rights, preferences and privileges:

Voting

Each holder of common stock is entitled to one

vote for each share of common stock held on all matters submitted to a vote of stockholders. Any action at a meeting at which a quorum

is present will be decided by a majority of the voting power present in person or represented by proxy, except in the case of any election

of directors, which will be decided by a plurality of votes cast. There is no cumulative voting.

Dividends

Holders of our common stock are entitled to receive