TIDMIII

RNS Number : 7699Z

3i Group PLC

27 January 2022

27 January 2022

3i Group plc

FY2022 Q3 performance update

Continued good performance across the Group

* Increase in NAV per share to 1,235 pence (30

September 2021:1,153 pence) despite the negative

translation effect of sterling strengthening in the

quarter (21 pence)

* Total return of 32.6% for the nine months to 31

December 2021, with continued good performance across

both investment portfolios

* Strong sales, EBITDA and cash generation from Action

notwithstanding significant Covid-19 and supply chain

disruption

* Private Equity business completed GBP310 million of

investment in the quarter including new investments

in Dutch Bakery and Mepal, a co-investment in

insightsoftware and two transformational bolt-on

acquisitions for GartenHaus and ten23 health. In

addition, five bolt-on acquisitions were completed

across the portfolio, with no additional funding from

3i and a further two bolt-on acquisitions were signed

* Strong cash generation from the Private Equity

portfolio with combined realised proceeds of GBP491

million from the divestment of Magnitude Software and

partial divestment of Basic-Fit

Simon Borrows, Chief Executive, commented:

" We saw continued, resilient performance from both our

investment portfolios as well as a good level of cash realisations.

There was also further bolt-on activity and several new investments

in the quarter. Action continues to perform very well and delivered

impressive results given the Covid-19 related challenges in 2021.

3i is well set for a strong close to our financial year end in

March."

Private Equity

Portfolio performance and valuation at 31 December 2021

In the 12 months to 2 January 2022, Action generated net sales

growth of 23% (52 week comparison) and added 267 stores, taking its

total to 1,983 stores across nine countries. Provisional 2021

EBITDA, which is still subject to audit, was EUR828 million, 36%

ahead of 2020 (52 week comparison). Net sales (EUR6,834 million)

and EBITDA were 34% and 53% ahead of 2019. Covid-19 restrictions

and store closures affected the group in six out of twelve months

in 2021 with Action experiencing significant closures and

restrictions in the Netherlands, Austria and Germany in the first

quarter of 2021 and in December 2021. Action paid an interim

dividend of EUR325 million in December 2021, and finished the year

with a cash balance of EUR759 million. Action opened its 2,000th

store in Prague last week and all stores are currently open with

trading well ahead of the same period last year.

The broader Private Equity portfolio traded resiliently

notwithstanding ongoing Covid-19 related restrictions, supply chain

challenges and increasing cost inflation. In the quarter we saw

good performance from SaniSure, which is capitalising on a robust

bioprocessing market, WilsonHCG which delivered good performance

driven by continued strength of the US labour market and BoConcept,

which continues to see strong demand despite restrictions remaining

in some of its key markets. Other notable contributions to our

return include WP and AES. We continue to carefully manage and

support our travel companies and following very recent Omicron

developments we are becoming more optimistic about their prospects

in 2022.

Private Equity investments

Private Equity Investment

investment Type Business description Date GBPm

----------------- ------------------- ------------------------------------------------ --------------- -----------

ten23 health Further Pharmaceutical product CDMO October 2021 61

Digital platform for garden and house projects

GartenHaus Further across Europe October 2021 45

Industrial bakery group specialised in home

Dutch Bakery New bake-off bread and snack products October 2021 46

Audley Travel Further Provider of experiential tailor-made travel October 2021 25

Provider of financial reporting and enterprise

New performance management software for the Office

insightsoftware co-investment of the CFO November 2021 37

Christ Further German retailer of jewellery and watches November 2021 12

Dutch lifestyle consumer brand known for

Mepal New storing and serving food and drinks December 2021 87

----------------- ------------------- ------------------------------------------------ --------------- -----------

Total Q3 FY2022 new and further investment 313

---------------------------------------------------------------------------------------- --------------- -----------

Provider of digital solutions in the DACH

MAIT Return of funding region October 2021 (3)

----------------- ------------------- ------------------------------------------------ --------------- -----------

Total Q3 FY2022 return of funding (3)

---------------------------------------------------------------------------------------- --------------- -----------

Total Q3 FY2022 investment 310

---------------------------------------------------------------------------------------- --------------- -----------

H1 FY2022 investment 58

-------------------------------------- ---------------------------------------------------------------- -----------

Total investment as at 31 December 2021 368

---------------------------------------------------------------------------------------- --------------- -----------

In the period, we completed new investments in Mepal (GBP87

million) and Dutch Bakery (GBP46 million). We also completed

transformational bolt-on acquisitions for ten23 health, investing

GBP61 million of our proprietary capital to support growth

initiatives including the scale up and expansion of the Basel

formulation and drug development operations, as well as and the

acquisition of Swissfillon, a drug product fill and finish CDMO,

and GBP45 million in GartenHaus to support the acquisition of

Outdoor Toys, a UK-based online retailer of outdoor garden toys.

After the period end, we invested in Yanga Sports Water to support

its international growth and expansion into North America.

Several of our portfolio companies completed bolt-on

acquisitions in the quarter funded by the portfolio company's

balance sheet. Evernex completed its acquisition of Emcon-IT, a US

leading player in the third-party hardware maintenance industry,

and Dutch Bakery acquired GoodLife Foods Deurne in an asset

transaction, representing a strategic acquisition for Dutch Bakery

in the Benelux market. AES acquired JAtech Services, a Canada-based

asset condition monitoring specialist, Hans Anders acquired the

Belgian franchisee for eyes+more and SaniSure acquired GL

Engineering, a manufacturer of single-use filling needles for use

in the fill & finish stage of production . Also in the quarter,

Royal Sanders agreed to acquire Otto Cosmetics, a leading German

manufacturer of private label and contract manufacturing products

for the personal care industry and MAIT agreed to acquire

Infolutions, a Swiss-based managed services provider with a focus

on infrastructure monitoring.

In the period, we completed a GBP37 million co-investment in

insightsoftware, the company that acquired Magnitude Software,

invested a further GBP25 million in Audley Travel to support its

recovery from the pandemic, and GBP12 million in Christ as part of

its debt refinancing and extension of facilities.

Private Equity realisations

Private Equity Realisation proceeds

Realisations GBPm

------------------------------------------------ ---------------------

Magnitude Software 345

Basic-Fit 146

Total Q3 FY2022 realised proceeds 491

H1 FY2022 realised proceeds 118

------------------------------------------------ ---------------------

Total realised proceeds as at 31 December 2021 609

------------------------------------------------ ---------------------

In the period, we recognised total realised proceeds of GBP491

million. We received GBP345 million from the full divestment of

Magnitude Software, achieving a sterling money multiple of 2.5x and

an IRR of 44%. We also received GBP146 million from a partial sale

of Basic-Fit shares. We retain a 5.7% holding in the business

valued at GBP133 million at 31 December 2021.

Infrastructure

3iN's underlying portfolio continues to perform well, generating

a good level of portfolio income, and 3iN's share price performed

strongly in the quarter, closing up 16% at 354 pence at 31 December

2021 (30 September 2021: 304 pence), valuing 3i's 30% stake at

GBP953 million (30 September 2021: GBP817 million). We also

recognised GBP14 million of dividend income from 3iN in the

period.

In the period, our US infrastructure team completed a GBP146

million investment in EC Waste, the largest vertically integrated

provider of federally compliant solid waste services in Puerto

Rico, representing the third platform investment for our US

infrastructure portfolio and, including portfolio company bolt-ons,

our seventh US infrastructure investment.

Scandlines

Scandlines performed well in the period, with strong freight

volumes ahead of 2019 levels. Leisure has also continued to recover

however volumes were impacted by the emergence of the Omicron

variant and so remained below 2019 levels in the period. As a

result of good cash management throughout the pandemic, Scandlines

was able to resume its cash distributions in December 2021, and 3i

recognised GBP13 million of dividend income in the quarter.

Top 10 investments by value at 31 December 2021

Valuation Valuation

Valuation Valuation Sep-21 Dec-21

basis currency GBPm GBPm Activity in the quarter

---------------- ----------- ----------- ---------- ---------- --------------------------------------------------

Action Earnings EUR 6,100 6,542 Received a cash dividend of GBP144 million in

December 2021

----------- ----------- ---------- ---------- --------------------------------------------------

3iN Quoted GBP 817 953 Recognised a dividend of GBP14 million in

November 2021

----------- ----------- ---------- ---------- --------------------------------------------------

Cirtec Medical Earnings USD 488 489

----------- ----------- ---------- ---------- --------------------------------------------------

Scandlines DCF EUR 469 471 Received a cash dividend of GBP13 million in

December 2021

----------- ----------- ---------- ---------- --------------------------------------------------

Luqom Earnings EUR 453 440

----------- ----------- ---------- ---------- --------------------------------------------------

Tato Earnings GBP 412 406 Received a cash dividend of GBP4 million in

October 2021

----------- ----------- ---------- ---------- --------------------------------------------------

Hans Anders Earnings EUR 323 316

----------- ----------- ---------- ---------- --------------------------------------------------

Royal Sanders Earnings EUR 295 289

----------- ----------- ---------- ---------- --------------------------------------------------

Evernex Earnings EUR 283 287

----------- ----------- ---------- ---------- --------------------------------------------------

WP Earnings EUR 265 281

----------- ----------- ---------- ---------- --------------------------------------------------

The 10 investments in the table above comprise 78% (30 September

2021: 78%) of the total Proprietary Capital portfolio value of

GBP13,413 million (30 September 2021: GBP12,784 million).

Total return and NAV position

We recognised a GBP201 million loss on foreign exchange, net of

hedging, in the quarter, as sterling strengthened against the euro

and US dollar. As at 31 December 2021, 71% of the Group's net

assets were in euro and 15% were in US dollar. Based on that, a 1%

movement in the euro and US dollar would result in a net total

return movement of GBP84 million and GBP18 million respectively.

The diluted NAV per share increased to 1,235 pence (30 September

2021: 1,153 pence) or 1,215.75 pence after deducting the 19.25

pence per share first FY2022 dividend, which was paid on 12 January

2022.

Balance sheet

At 31 December 2021, gross debt was GBP975 million (30 September

2021: GBP975 million), net debt was GBP709 million and gearing

5.9%. The first FY2022 dividend of GBP186 million (or 19.25 pence

per share) was paid on 12 January 2022. Liquidity, including our

undrawn RCF, was GBP766 million at 31 December 2021.

- ENDS -

Notes

1. Balance sheet values are stated net of foreign exchange translation. Where applicable, the

GBP equivalents at 31 December 2021 in this update have been calculated at a currency exchange

rate of EUR1.1913: GBP1 and $1.3546: GBP1 respectively.

2. At 31 December 2021 3i had 969 million diluted shares.

3. Action was valued using a post discount run-rate EBITDA multiple of 18.5x based on its LTM

run-rate earnings to 2 January 2022 of EUR921 million. The LTM run-rate earnings used include

our normal adjustment to reflect stores opened in the year, as well as the add back of EUR10

million of exceptional Covid-19 related costs incurred in Action's first quarter of 2021.

For further information, please contact:

Silvia Santoro

Group Investor Relations Director

Tel: 020 7975 3258

Kathryn van der Kroft

Communications Director

Tel: 020 7975 3021

About 3i Group

3i is a leading international investment manager focused on

mid-market Private Equity and Infrastructure. Our core investment

markets are northern Europe and North America. For further

information, please visit: www.3i.com .

All statements in this performance update relate to the

three-month period ended 31 December 2021 unless otherwise stated.

The financial information is unaudited and is presented on 3i's

non-GAAP Investment basis in order to provide users with the most

appropriate description of the drivers of 3i's performance. Net

asset value ("NAV") and total return are the same on the Investment

basis and on an IFRS basis. Details of the differences between 3i's

consolidated financial statements prepared on an IFRS basis and

under the Investment basis are provided in the 2021 Annual report

and accounts. There have been no material changes to the financial

position of 3i from the end of this quarter to the date of this

announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFLFSTLEIRFIF

(END) Dow Jones Newswires

January 27, 2022 02:00 ET (07:00 GMT)

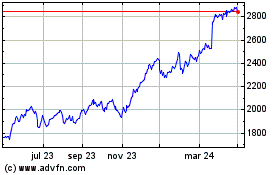

3i (LSE:III)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

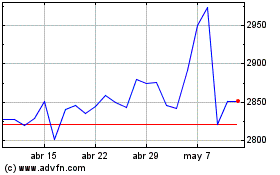

3i (LSE:III)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024