AIM Schedule One - CML Microsystems PLC (6034H)

05 Agosto 2021 - 2:00AM

UK Regulatory

TIDMCML

RNS Number : 6034H

AIM

05 August 2021

ANNOUNCEMENT TO BE MADE BY THE AIM APPLICANT PRIOR TO ADMISSION

IN ACCORDANCE WITH RULE 2 OF THE AIM RULES FOR COMPANIES ("AIM

RULES")

COMPANY NAME:

CML Microsystems Plc ("CML" or the "Company" or the "Group")

COMPANY REGISTERED OFFICE ADDRESS AND IF DIFFERENT, COMPANY

TRADING ADDRESS (INCLUDING POSTCODES) :

Oval Park, Langford, Maldon, Essex CM9 6WG

COUNTRY OF INCORPORATION:

England and Wales

COMPANY WEBSITE ADDRESS CONTAINING ALL INFORMATION REQUIRED

BY AIM RULE 26:

http://www.cmlmicroplc.com

COMPANY BUSINESS (INCLUDING MAIN COUNTRY OF OPERATION) OR,

IN THE CASE OF AN INVESTING COMPANY, DETAILS OF ITS INVESTING

POLICY). IF THE ADMISSION IS SOUGHT AS A RESULT OF A REVERSE

TAKE-OVER UNDER RULE 14, THIS SHOULD BE STATED:

The Company principally operates in the UK, but has subsidiaries

in the People's Republic of China, the USA and Singapore and

sells its products worldwide.

CML develops mixed-signal, RF and microwave semiconductors

for global communications markets. The Group utilises a combination

of outsourced manufacturing and in-house testing with trading

operations in the UK, Asia and USA. CML targets sub-segments

within Communication markets with strong growth profiles and

high barriers to entry. It has secured a diverse, blue chip

customer base, including some of the world's leading commercial

and industrial product manufacturers.

The spread of its customers and diversity of the product range

largely protects the business from the cyclicality usually

associated with the semiconductor industry. Growth in its end

markets is being driven by factors such as the appetite for

data to be transmitted faster and more securely, the upgrading

of telecoms infrastructure around the world and the growing

prevalence of private commercial wireless networks for voice

and/or data communications linked to the industrial internet

of things (IIoT).

DETAILS OF SECURITIES TO BE ADMITTED INCLUDING ANY RESTRICTIONS

AS TO TRANSFER OF THE SECURITIES (i.e. where known, number

and type of shares, nominal value and issue price to which

it seeks admission and the number and type to be held as treasury

shares):

16,596,685 ordinary shares of 5 pence each ("Ordinary Shares").

No restrictions on the transferability of the Ordinary Shares.

In addition to these 16,596,685 ordinary shares, the total

number of treasury shares held is 638,467, which do not carry

voting rights.

CAPITAL TO BE RAISED ON ADMISSION (AND/OR SECONDARY OFFERING)

AND ANTICIPATED MARKET CAPITALISATION ON ADMISSION:

Capital to be raised on admission: n/a.

Anticipated market capitalisation on admission: c.GBP70 million

based upon the market capitalisation of the Company on the

date of this notification.

PERCENTAGE OF AIM SECURITIES NOT IN PUBLIC HANDS AT ADMISSION:

4,624,075 Ordinary Shares or 26.83% of the issued share capital

of the Company

DETAILS OF ANY OTHER EXCHANGE OR TRADING PLATFORM TO WHICH

THE AIM SECURITIES (OR OTHER SECURITIES OF THE COMPANY) ARE

OR WILL BE ADMITTED OR TRADED:

None

FULL NAMES AND FUNCTIONS OF DIRECTORS AND PROPOSED DIRECTORS

(underlining the first name by which each is known or including

any other name by which each is known):

Nigel Graham Clark (Executive Chairman)

Chris topher Arthur Joseph Gurry (Group Managing Director)

Geof frey Frederick Barnes (Senior Independent Non-executive

Director)

James ("Jim") Andrew Lindop (Independent Non-executive Director)

FULL NAMES AND HOLDINGS OF SIGNIFICANT SHAREHOLDERS EXPRESSED

AS A PERCENTAGE OF THE ISSUED SHARE CAPITAL, BEFORE AND AFTER

ADMISSION (underlining the first name by which each is known

or including any other name by which each is known):

Shareholder Anticipated percentage of the

Ordinary Shares before and

after admission*

Premier Miton Investors 11.7%

------------------------------

Otus Capital Management 9.5%

------------------------------

June M Gurry 9.4%

------------------------------

Herald Investment Management 6.5%

------------------------------

Liontrust Asset Management 6.6%

------------------------------

Ruffer 6.0%

------------------------------

Michael I Gurry 5.8%

------------------------------

Chris topher AJ Gurry 5.5%

------------------------------

Tina MR Dean 5.4%

------------------------------

Schroder Investment Management 3.6%

------------------------------

*Excluding the 638,467 shares held in treasury

NAMES OF ALL PERSONS TO BE DISCLOSED IN ACCORDANCE WITH SCHEDULE

2, PARAGRAPH (H) OF THE AIM RULES:

None

(i) ANTICIPATED ACCOUNTING REFERENCE DATE

(ii) DATE TO WHICH THE MAIN FINANCIAL INFORMATION IN THE ADMISSION

DOCUMENT HAS BEEN PREPARED (this may be represented by unaudited

interim financial information)

(iii) DATES BY WHICH IT MUST PUBLISH ITS FIRST THREE REPORTS

PURSUANT TO AIM RULES 18 AND 19:

(i) 31 March

(ii) n/a - existing issuer moving from the Official List

(iii) 31 March 2022 (in respect of the half yearly report to

30 September 2021)

30 September 2022 (in respect of the annual report to 31 March

2022)

31 March 2023 (in respect of the half yearly report to 30 September

2022)

EXPECTED ADMISSION DATE:

3 September 2021

NAME AND ADDRESS OF NOMINATED ADVISER:

Shore Capital and Corporate Limited

Cassini House

57 St James's Street

London

SW1A 1LD

NAME AND ADDRESS OF BROKER:

Shore Capital Stockbrokers Limited

Cassini House

57 St James's Street

London

SW1A 1LD

OTHER THAN IN THE CASE OF A QUOTED APPLICANT, DETAILS OF WHERE

(POSTAL OR INTERNET ADDRESS) THE ADMISSION DOCUMENT WILL BE

AVAILABLE FROM, WITH A STATEMENT THAT THIS WILL CONTAIN FULL

DETAILS ABOUT THE APPLICANT AND THE ADMISSION OF ITS SECURITIES:

N/A - quoted applicant

THE CORPORATE GOVERNANCE CODE THE APPLICANT HAS DECIDED TO

APPLY

The UK Corporate Governance Code

DATE OF NOTIFICATION:

5 August 2021

NEW/ UPDATE:

New

QUOTED APPLICANTS MUST ALSO COMPLETE THE FOLLOWING:

THE NAME OF THE AIM DESIGNATED MARKET UPON WHICH THE APPLICANT'S

SECURITIES HAVE BEEN TRADED:

Standard listing segment of the Official List and the Main

Market

THE DATE FROM WHICH THE APPLICANT'S SECURITIES HAVE BEEN SO

TRADED:

July 1996

CONFIRMATION THAT, FOLLOWING DUE AND CAREFUL ENQUIRY, THE APPLICANT

HAS ADHERED TO ANY LEGAL AND REGULATORY REQUIREMENTS INVOLVED

IN HAVING ITS SECURITIES TRADED UPON SUCH A MARKET OR DETAILS

OF WHERE THERE HAS BEEN ANY BREACH:

The Company has adhered to the legal and regulatory requirements

applicable to companies admitted to the Official List and the

Main Market.

AN ADDRESS OR WEB-SITE ADDRESS WHERE ANY DOCUMENTS OR ANNOUNCEMENTS

WHICH THE APPLICANT HAS MADE PUBLIC OVER THE LAST TWO YEARS

(IN CONSEQUENCE OF HAVING ITS SECURITIES SO TRADED) ARE AVAILABLE:

http://www.cmlmicroplc.com

DETAILS OF THE APPLICANT'S STRATEGY FOLLOWING ADMISSION INCLUDING,

IN THE CASE OF AN INVESTING COMPANY, DETAILS OF ITS INVESTING

STRATEGY:

CML believes that in today's world 'connected everything' is

propelling exponential increases in data consumption - driving

growth across wireless communications markets globally.

The Group's strategy is to deliver customer advantage through

the timely development of technologically innovative semiconductor

solutions built upon proprietary intellectual property.

CML seeks to expand its total addressable market by focussing

on applications within the mega trends of Industrial Internet

of Things (IIoT), 5G and Industry 4.0, developing its product

portfolio to support emerging and evolving customer requirements

for size, cost & performance.

CML's vision is to be the first-choice semiconductor partner

to technology innovators, together transforming how the world

communicates.

A DESCRIPTION OF ANY SIGNIFICANT CHANGE IN FINANCIAL OR TRADING

POSITION OF THE APPLICANT, WHICH HAS OCCURRED SINCE THE

OF THE LAST FINANCIAL PERIOD FOR WHICH AUDITED STATEMENTS HAVE

BEEN PUBLISHED:

There has been no significant change in the financial or trading

position of CML since 31 March 2021, being the end of the last

financial period for which audited financial statements have

been published.

A STATEMENT THAT THE DIRECTORS OF THE APPLICANT HAVE NO REASON

TO BELIEVE THAT THE WORKING CAPITAL AVAILABLE TO IT OR ITS

GROUP WILL BE INSUFFICIENT FOR AT LEAST TWELVE MONTHS FROM

THE DATE OF ITS ADMISSION:

The Directors of CML have no reason to believe that the working

capital available to the

Company or its group will be insufficient for at least 12 months

from the date of its

admission.

DETAILS OF ANY LOCK-IN ARRANGEMENTS PURSUANT TO RULE 7 OF THE

AIM RULES:

None

A BRIEF DESCRIPTION OF THE ARRANGEMENTS FOR SETTLING THE APPLICANT'S

SECURITIES:

Settlement will continue to be through the CREST system for

dealings in ordinary shares held in uncertificated form. Ordinary

Shares can also be dealt in certificated form.

A WEBSITE ADDRESS DETAILING THE RIGHTS ATTACHING TO THE APPLICANT'S

SECURITIES:

http://www.cmlmicroplc.com

INFORMATION EQUIVALENT TO THAT REQUIRED FOR AN ADMISSION DOCUMENT

WHICH IS NOT CURRENTLY PUBLIC:

See the Appendix to this Schedule One announcement, available

at: http://www.cmlmicroplc.com

A WEBSITE ADDRESS OF A PAGE CONTAINING THE APPLICANT'S LATEST

ANNUAL REPORT AND ACCOUNTS WHICH MUST HAVE A FINANCIAL YEAR

END NOT MORE THEN NINE MONTHS PRIOR TO ADMISSION AND INTERIM

RESULTS WHERE APPLICABLE. THE ACCOUNTS MUST BE PREPARED IN

ACCORDANCE WITH ACCOUNTING STANDARDS PERMISSIBLE UNDER AIM

RULE 19:

http://www.cmlmicroplc.com

THE NUMBER OF EACH CLASS OF SECURITIES HELD IN TREASURY:

638,467 Ordinary Shares

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

PAAUPUUWRUPGGCC

(END) Dow Jones Newswires

August 05, 2021 03:00 ET (07:00 GMT)

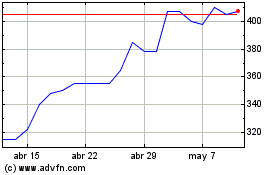

Cml Microsystems (LSE:CML)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Cml Microsystems (LSE:CML)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024