BNP Beats Expectations as Trading Business Posts Another Good Performance

03 Noviembre 2020 - 12:35AM

Noticias Dow Jones

By Pietro Lombardi

BNP Paribas SA's trading operations posted another good

performance in the third quarter, helping profits fall less than

expected despite higher provisions against potential losses from

borrowers.

France's largest-listed bank by assets joined other European

peers who also posted better-than-expected results and good

performances of their trading businesses.

Global markets revenue rose almost 32% on year, with

fixed-income revenue up 36%, BNP said Tuesday.

The performance of the trading operations helped revenue remain

roughly stable at 10.89 billion euros ($12.68 billion). This,

coupled with lower operating costs, meant that net profit declined

by just 2.3% to EUR1.89 billion, beating analysts'

expectations.

BNP, one of Europe's largest banks, set aside EUR1.25 billion

for potential loan losses. This is 47% more than the same period

last year but less than it stowed away in the second quarter.

The bank seems to be navigating the coronavirus pandemic better

than it had expected, with profits in the first nine months ahead

of the guidance it has given for the full year, namely a decline in

net profit of between 15% and 20%.

BNP's core Tier 1 capital ratio--a key measure of capital

strength--was 12.6% at the end of September, up from 12.4% in

June.

Write to Pietro Lombardi at pietro.lombardi@dowjones.com;

@pietrolombard10

(END) Dow Jones Newswires

November 03, 2020 01:20 ET (06:20 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

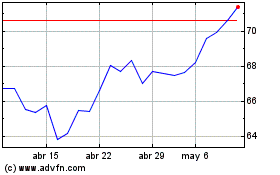

BNP Paribas (EU:BNP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

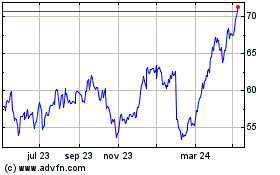

BNP Paribas (EU:BNP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024