TIDMPIER

RNS Number : 7213T

Brighton Pier Group PLC (The)

29 March 2021

29 March 2021

The Brighton Pier Group PLC

(the "Company" or the "Group")

Interim results for the 26 weeks ended 27 December 2020

The Brighton Pier Group PLC today announces its unaudited

results for the 26-week period ended 27 December 2020.

Financial Highlights 26 weeks 26 weeks

ended ended

27 December 29 December

2020 2019

GBPm GBPm

Revenue 8.2 17.3

Group EBITDA before highlighted items 2.6 4.2

Group EBITDA after highlighted items 4.4 4.1

Operating profit before highlighted

items 1.3 2.5

Operating profit after highlighted

items 3.1 2.4

Profit before taxation and highlighted

items 0.8 2.0

Profit before taxation after highlighted

items 2.7 1.8

Net debt at the end of the period 12.5 11.0

Basic earnings per share (with highlighted

items added back) 2.1 4.1p

Basic earnings per share 7.1 3.9p

Diluted earnings per share (with highlighted

items added back) 2.1 4.1p

Diluted earnings per share 7.1 3.9p

*Highlighted items are detailed in note 5 to the financial

statements and relate to gains arising on the extinguishment of

lease liabilities following site disposals (less costs) in the

current period and site pre-opening costs in the prior period.

Commenting on the results, Anne Ackord, Chief Executive Officer,

said:

"We look forward to the reopening of all of our businesses,

following what has been a traumatic time for the whole industry. We

are encouraged by our performance during the relatively short times

when we have been permitted to operate and have full confidence

that the Group is well placed to take advantage of the

opportunities that the anticipated staycation boom will present,

along with the expected pent-up retail spend.

We are pleased to note that the combination of the strong summer

trading in the Pier and Golf coupled with the receipt of interim

business interruption payments have resulted in earnings before tax

44% ahead of the same period last year."

All Company announcements and news are available at

www.brightonpiergroup.com

Enquiries:

The Brighton Pier Group PLC Tel: 020 7376 6300

Luke Johnson, Chairman Tel: 020 7016 0700

Anne Ackord, Chief Executive Officer Tel: 01273 609361

John Smith, Chief Financial Officer Tel: 020 7376 6300

Cenkos Securities plc (Nominated Adviser

and Broker)

Stephen Keys (Corporate Finance) Tel: 0207 397 8926

Callum Davidson (Corporate Finance) Tel: 0207 397 8923

Michael Johnson (Sales) Tel: 0207 397 1933

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014 until the release of this

announcement.

About The Brighton Pier Group PLC

The Brighton Pier Group PLC (the 'Group') owns and trades

Brighton Palace Pier, as well as nine premium bars nationwide and

eight indoor mini-golf sites.

The Group operates as three separate divisions under the

leadership of Anne Ackord, the Group's Chief Executive Officer.

Brighton Palace Pier offers a wide range of attractions

including two arcades (with over 300 machines) and eighteen funfair

rides, together with a variety of on-site hospitality and catering

facilities. The attractions, product offering and layout of the

pier are focused on creating a family-friendly atmosphere that aims

to draw a wide demographic of visitors. The pier is free to enter,

with revenue generated from the pay-as-you-go purchase of products

from the fairground rides, arcades, hospitality facilities and

retail catering kiosks. According to Visit Britain, it is the fifth

most popular free attraction in the UK, with over 4.9 million

visitors in 2019, making it the UK's most visited landmark outside

of London.

The Group's Bars division comprises of nine sites trading under

a variety of concepts including Embargo Republica, Lola Lo, Le Fez,

Lowlander, and Coalition. This division predominantly targets a

customer base of sophisticated students' midweek and stylish

over-21s and professionals at the weekend. This division focuses on

delivering added value to its customers through premium product

ranges, high quality music and entertainment, as well as a

commitment to exceptional service standards.

The Golf division (Paradise Island Adventure Golf) operates

eight indoor mini-golf sites at high footfall retail and leisure

centres. The business capitalises on the increasing convergence

between retail and leisure, offering an accessible and traditional

activity for the whole family. The first unit was opened in

Glasgow, after which followed Manchester, Sheffield, Livingston,

Cheshire Oaks, Derby, Rushden Lakes and Plymouth Drake's Circus

(opened in October 2019). Each site offers two unique 18-hole

mini-golf courses.

Business review

This business review covers the trading results for the 26 weeks

ended 27 December 2020 (2019: 26 weeks ended 29 December 2019).

Overview

The results for the half year were dominated by challenges

presented to the Group following the outbreak of the COVID-19

pandemic in early 2020.

This trading period began during the first national lockdown,

with nearly all of the Group's businesses closed. In July 2020, the

restrictions of the first lockdown were eased such that the Group

was able to partially reopen certain of its businesses. The key

challenge in terms of re-opening was to resume its usual business

activities, having regard on the one hand for the newly-imposed

government restrictions in order to provide a safe environment for

all staff and customers, whilst on the other hand continuing to

entertain visitors in a way that was as familiar and enjoyable as

previously.

The Group was delighted when Brighton Palace Pier, six of the

golf sites and two of the bars reopened on 4 July 2020, with the

remaining two golf sites and soft play on the pier reopening on 24

August 2020. This allowed the Group to trade for most of the summer

period when footfall on the pier is at its peak. This crucial

earnings period for the Group benefited from the warm summer

weather as well as additional support from the government's 'Eat

Out to Help Out' scheme and a reduction in VAT.

Whilst most of the late night bars remained closed, trading for

two open bars, the Pier and Golf divisions continued until the end

of September. Trading for open sites exceeded the Group's

expectations at the time of re-opening, with like-for-like sales at

81% of those during the same 13 weeks in 2019. Splitting this down

by division, the pier traded at 83%, the Golf division at 87% and

the Bars division at 65% compared to the same weeks in the prior

year.

September brought positive news with the High Court judgment

that the Group's 'Marsh resilience' insurance policies in the Bars

and Golf divisions were capable of responding to COVID-19 business

interruption claims. Furthermore, the Group's advisers have

indicated that the Supreme Court ruling on 15 January 2021 does not

change the fundamental principle that these policies can respond to

claims, subject to appropriate discussion and agreement over the

quantum of the arising losses and any applicable policy caps. At

the end of the period, the Group had received from its insurers

interim payments totalling GBP1.4 million in respect of these

losses and these amounts have been recognised in the current period

in other operating income. Whilst these payments do not satisfy the

entirety of the Group's claims, they nevertheless support the

Group's overall liquidity, which continues to be strong and have

contributed to the half-year results. Further payments are expected

as closures continue into the second half of the financial year.

The Group's policies have a maximum indemnity period of 24 months

and are capped at GBP5 million for any one claim, split equally

between the Bars and Golf division.

By the end of September 2020, rising COVID-19 infections

resulted in further restrictions, most notably a 10p.m. 'curfew',

full table service only and mandatory mask wearing. This was then

followed by the introduction of the regional 'Tier' system in

October 2020, which resulted in the closure of both Scottish golf

sites, together with sites in Manchester, Sheffield and Cheshire

Oaks. The 10p.m. terminal hour ensured that the doors of all the

Group's late night bars remained firmly shut, with only Lowlander

in the Bars division still able to trade. The second national

lockdown was then imposed on 5 November for four weeks, with a

brief reopening before Christmas but without the much anticipated

relaxation of restrictions during the Christmas period itself (this

having been withdrawn at the last moment by the government).

The Bars division disposed of three marginal sites during the

period: Smash in Wimbledon and PoNaNa in Bath were both disposed

of, and a third lease for Fez in Cambridge expiring in late

December 2020 was not renewed.

Half year results

Despite the challenges to trading, the Group is pleased to

report profit after highlighted items and before tax up 44% at

GBP2.7 million (2019: GBP1.8 million), benefiting from the income

from business interruption insurance, summer trading (especially at

the pier and golf sites), government support by way of furlough,

grants, rates and VAT reductions, as well as the one-off

extinguishment of lease liabilities from the disposal of three bar

sites.

Group profit before tax and highlighted items was down 59% at

GBP0.8 million (2019: GBP2 million). This excludes the GBP1.9

million of one-off gains arising from disposal of the bar sites.

The year-on-year reduction reflects the impact of COVID-19 closures

across all divisions, mitigated by additional income described

above

Total Group revenue for the period was down 53% at GBP8.2

million (2019: GBP17.3 million).

Revenue for the Pier division was at 73% of the prior period at

GBP5.8 million (2019: GBP7.9 million), trading especially well

given the impact of closures, loss of overseas tourists and only 19

weeks when all the pier's attractions were able to be open. Gross

margin and spend per head were both up, which went some way to

mitigate the impact of COVID-19. With like-for-like sales for the

13-week period to the end of the summer at 81%, the Group is

confident that the pier's trading will return strongly when trading

resumes once again this coming summer.

Revenue for the Bars division was at 11% of the prior period at

GBP0.7 million (2019: GBP6.6 million). With nearly all the Bars

estate closed throughout the period, these sales came from the two

food-led operations. Lowlander in Covent Garden was impacted by the

closure of theatres and non-essential retail, together with the

loss of foreign tourists and many office staff working from home.

However, launches of a take-away offer and a 'Supper Club' were

well received at Lowlander and both initiatives will return once

re-opening is possible in the second half. July 2020 saw the launch

of the new 'La Plage' restaurant on the beach terrace of Coalition

in Brighton, which proved to be a great success throughout the

summer, and this too will be opening again as soon as possible in

the second half.

Revenue for the Golf division was at 59% of the prior period at

GBP1.7 million (2019: GBP2.8 million) despite only five clear weeks

when all its sites were open. Different opening rules in Scotland,

together with Tier rules in the Midlands and North West, all

resulted in many sites being closed. Sales were boosted by the new

site at Plymouth Drake's Circus, which opened for the first time at

the end of October 2019 in the prior year. With like-for-likes

sales on open sites for the 13-week period to the end of the summer

at 87% of the same period last year, the Group is confident the

golf sites will also re-open strongly when able to do so.

Group gross margin for the period increased by 230 basis points

to 86.7% (2019: 84.4%) reflecting the high-margin nature of the

growing Golf division, as well as focus on the pier to improve

margin during the summer trading as a mitigation against reduced

volume, all of which was offset by the continued closure of the

better margin, wet-led late night bars.

Highlighted items totalling GBP1.9 million of gains (2019:

GBP0.1 million of expenses) were recognised during the period.

These gains arise on the extinguishment of lease liabilities

following disposal of three sites in the Bars division: PoNa Na in

Bath, Fez in Cambridge and Smash in Wimbledon. The disposal of

these marginal sites will, in the long run, reduce overhead costs

and improve the profitability of the Bars division.

In summary, for the 26 weeks ended 27 December 2020 (compared to

the equivalent 26-week period ended 29 December 2019):

-- Revenue: GBP8.2 million (2019: GBP17.3 million)

-- Group EBITDA before highlighted items: GBP2.6 million

(2019: GBP4.2 million)

-- Group EBITDA after highlighted items: GBP4.4

million (2019: GBP4.1 million)

-- Operating profit before highlighted items: GBP1.3 million

(2019: GBP2.5 million)

-- Operating profit after highlighted items: GBP3.1

million (2019: GBP2.4 million)

-- Profit before tax and highlighted items: GBP0.8

million (2019: GBP2.0 million)

-- Profit before tax and after highlighted items: GBP2.7

million

(2019: GBP1.8 million)

-- Net debt at the end of the period: GBP12.5

million (2019: GBP11.0 million)

-- Basic earnings per share (with highlighted items added back): 2.1p

(2019: 4.1p)

-- Basic earnings per share: 7.1p (2019: 3.9p)

-- Diluted earnings per share (with highlighted items added back): 2.1p

(2019: 4.1p)

-- Diluted earnings per share: 7.1p (2019: 3.9p)

Principal developments during the period

The Group's key performance indicators are focused on the

continued expansion of the Group to drive revenues, EBITDA and

earnings growth. The impact of closures from COVID-19 were

mitigated by summer trading in the Pier and Golf divisions, as well

as interim business interruption insurance payments received during

the period amounting to GBP0.5 million in the Bars division and

GBP0.9 million in the Golf division.

Group EBITDA after highlighted items is up 8% at GBP4.4 million

(2019: GBP4.1 million).

Basic earnings per share after highlighted items is up 3.2p at

7.1p (2019: 3.2p)

-- Pier division - EBITDA for the 26 weeks is down GBP1.0

million versus the prior period at GBP0.8 million (2019: GBP1.8

million), benefiting from summer trading, the 'Eat Out to Help Out'

scheme and VAT reductions.

-- Bars division - Bars EBITDA for the 26 weeks is down GBP0.8

million versus the prior period at GBP0.5 million (2019: GBP1.3

million), with most of the Bars estate unable to trade, offset by

the receipt during this period of GBP0.5 million of interim

business interruption insurance payments.

-- Golf division - EBITDA for the 26 weeks is up GBP0.2 million

versus the prior period at GBP1.6 million (2019: GBP1.4 million),

benefiting from summer trading and the receipt during this period

of GBP0.9 million of interim business interruption insurance

payments.

Group operating profit before highlighted items was GBP1.3

million (2019: GBP2.5 million) and Group operating profit for the

period after highlighted items was GBP3.1 million (2019: GBP2.4

million).

Results for the half year show that the Group continued to be

cash-generative with an increase of GBP1.6 million (2019: a

reduction of GBP0.5 million) during the period in cash and cash

equivalents.

On 14 August 2020, with the majority of the late night bars

still closed, the Group completed a process to serve notice on all

but essential staff in the Bars division, with most of these

redundancies completed by the end of September 2020. The Group was

forced to take this action because, at that time, the Government

had yet to commit to extending the Coronavirus Job Retention Scheme

beyond its original end date of 31 October.

Cash flow and balance sheet

Net cash flow generated from operations and available for

investment (after interest and tax payments) was GBP2 million

(2019: GBP3.5 million).

In order to conserve cash during the period, there has been

minimal capital expenditure across the Group (2019: GBP1.3

million).

During the period, the Group made net debt repayments of GBP0.1

million (2019: GBP1.6 million).

Total bank debt at the end of the period was GBP16.7 million

(2019: GBP13.2 million), comprising of a GBP11.8 million term loan

and two Coronavirus Business Interruption Loans totalling GBP4.9

million.

At the period end, cash and cash equivalents were GBP4.2 million

(2019: GBP2.2 million).

Net debt at the period end stood at GBP12.5 million (2019:

GBP11.0 million). The Directors continue to take a cautious

approach to net debt levels for the Group.

During the period, the net debt of the business has reduced by

GBP1.7million from GBP14.1 million as at 28 June 2020 to GBP12.4

million as at 27 December 2020.

The Group currently has an undrawn RCF facility of GBP1.75

million, giving cash availability to the Group of GBP6 million as

at the period end.

Outlook

Short to medium term strategy

The closure of all the Group's businesses on Boxing Day will

impact the full year to the end of June 2021 and potentially into

the first half of the next financial year whilst the Bars division

returns to normal.

In the short to medium term, the key aim for the business is to

focus on reopening as soon as the Group is able, in accordance with

the recently announced roadmap, and to return all three divisions

to pre-COVID-19 levels of trade. Planning for this is already well

advanced.

Whilst there may be some significant opportunities over the

summer, with customers who have accumulated savings during the

lockdown periods also expected to take 'staycations' rather than

travel internationally, such opportunities may be tempered by the

pace of reopening if infections start to surge.

Pier division

The Group now expects the outside areas of the pier to reopen

for trade on 12 April 2021. The pier's large outside spaces make it

possible to provide plenty of space for tables serviced from the

restaurant, bars and take-away venues.

Bars division

'Coalition' in Brighton is expected to reopen on 12 April 2021

for take-away, with the external 'La Plage' outside beach terrace

restarting from 17 May 2021.

'Lowlander' in Covent Garden will reopen its doors from 17 May

2021 .

Finally, the remainder of the late night bars are expected to

reopen on 21 June 2021, some 15 months after they closed for the

first lockdown.

New government support for the hospitality and leisure sector,

outlined in the March 2021 budget, will provide much-needed

financial assistance to help the reopening process, with reductions

in VAT, extended rates relief and extended furlough combining with

the existing grants system and new restart grants.

Golf division

The Golf sites are all expected to reopen from 17 May 2021 (it

is expected the Scottish sites will also reopen around this time

but formal confirmation is still pending). The online booking

system introduced last year will continue to assist us with queue

management and customer data collection.

Longer term: new acquisitions and developments

The longer-term strategy of the Group continues to be to

capitalise on its skills to create a growth company operating

across a diverse portfolio of leisure and entertainment assets in

the UK. The Group will achieve this objective by way of organic

revenue growth across the whole estate, together with the active

pursuit of future potential strategic acquisitions of leisure and

entertainment destinations (many of which have been significantly

impacted by the pandemic) that could enhance the Group's portfolio,

realising synergies by leveraging scale. It is the Board's

longer-term strategy to position the Group as a consolidator within

this sector.

INTERIM CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE

INCOME

Unaudited Unaudited Audited

26 weeks 26 weeks 52 weeks

ended ended ended

27 December 29 December 28 June

2020 2019 2020

Notes GBP'000 GBP'000 GBP'000

Revenue 8,199 17,331 22,621

Cost of sales (1,092) (2,713) (3,329)

Gross profit 7,107 14,618 19,292

Operating expenses - excluding highlighted items (7,244) (12,127) (20,329)

Highlighted items 5 1,856 (110) (8,117)

------------------------------------------------------- ------ ------------ ------------ ---------

Total operating expenses (5,388) (12,237) (28,446)

Other operating income 6 1,400 - -

Operating profit/(loss) - before highlighted items 1,263 2,491 (1,037)

Highlighted items 5 1,856 (110) (8,117)

------------------------------------------------------- ------ ------------ ------------ ---------

Operating profit/(loss) 3,119 2,381 (9,154)

Finance income 16 - 18

Finance cost (479) (535) (1,071)

Profit/(loss) before tax and highlighted items 800 1,956 (2,090)

Highlighted items 5 1,856 (110) (8,117)

------------------------------------------------------- ------ ------------ ------------ ---------

Profit/(loss) on ordinary activities before taxation 2,656 1,846 (10,207)

Taxation on ordinary activities 7 - (389) 714

Profit/(loss) for the period 2,656 1,457 (9,493)

Earnings/(loss) per share - Basic* 8 7.1 3.9 (25.5)

Adjusted earnings/(loss) per share - Basic** 8 2.1 4.1 (5.3)

Earnings/(loss) per share - Diluted 8 7.1 3.9 (25.5)

Adjusted earnings/(loss) per share - Diluted 8 2.1 4.1 (5.3)

* 2020 basic weighted average number of shares in issue was 37.29m (Dec 2019: 37.29m)

** Adjusted basic and diluted earnings per share are calculated based on the profit for the

period adjusted for highlighted items

No other comprehensive income was earned during the period (2019: GBPnil ).

INTERIM CONDENSED CONSOLIDATED BALANCE SHEET

As at As at As at

27 December 29 December 28 June

2020 2019 2020

GBP'000 GBP'000 GBP'000

Non current assets

Intangible assets 9,428 12,665 9,467

Property, plant & equipment 25,161 27,753 25,763

Right-of-use assets 16,682 21,402 17,283

Net investment in finance leases 698 - 689

Other receivables due in more than one

year 276 367 367

52,245 62,187 53,569

------------ ------------ --------

Current assets

Inventories 520 648 562

Trade and other receivables 1,587 793 1,926

Cash and cash equivalents 4,246 2,212 2,649

6,353 3,653 5,137

------------ ------------ --------

TOTAL ASSETS 58,598 65,840 58,706

============ ============ ========

EQUITY

Issued share capital 9,322 9,322 9,322

Share Premium 15,993 15,993 15,993

Merger reserve (1,111) (1,111) (1,111)

Other reserve 452 428 452

Retained (deficit)/earnings (7,004) 1,290 (9,660)

Equity attributable to equity shareholders

of the parent 17,652 25,922 14,996

------------ ------------ --------

TOTAL EQUITY 17,652 25,922 14,996

------------ ------------ --------

LIABILITIES

Current liabilities

Trade and other payables 3,716 3,734 3,945

Other financial liabilities - current 2,214 2,823 -

Lease liabilities - current 2,105 1,632 2,250

Income tax payable - 712 35

Provisions - 9 -

8,035 8,910 6,230

------------ ------------ --------

Non-Current liabilities

Other financial liabilities - non-current 14,490 10,342 16,797

Lease liabilities - non-current 18,421 20,240 20,683

Deferred tax liability - 426 -

32,911 31,008 37,480

------------ ------------ --------

TOTAL LIABILITIES 40,946 39,918 43,710

------------ ------------ --------

TOTAL EQUITY AND LIABILITIES 58,598 65,840 58,706

============ ============ ========

INTERIM CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN

EQUITY

Issued

share Other Merger Retained Total shareholders'

capital Share Premium reserves reserve (deficit)/earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------- --------- -------------- ---------- --------- -------------------- --------------------

At 29 June 2020 9,322 15,993 452 (1,111) (9,660) 14,996

------------------- --------- -------------- ---------- --------- -------------------- --------------------

Profit for the

period - - - - 2,656 2,656

As at 27 December

2020 9,322 15,993 - (1,111) (7,004) 17,652

------------------- --------- -------------- ---------- --------- -------------------- --------------------

Issued Retained

share Other Merger (deficit)/ Total shareholders'

capital Share Premium reserves reserve earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------- --------- -------------- ---------- --------- ------------ --------------------

At 1 July 2019 9,322 15,993 407 (1,111) (167) 24,444

---------------------- --------- -------------- ---------- --------- ------------ --------------------

Profit for the

period - - - - 1,457 1,457

Transactions with

owners

Share based payments

charge - - 21 - - 21

As at 29 December

2019 9,322 15,993 428 (1,111) 1,290 25,922

---------------------- --------- -------------- ---------- --------- ------------ --------------------

INTERIM CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

Unaudited Unaudited Audited

26 weeks to 26 weeks to 52 weeks to

27 December 29 December 28 June

2020 2019 2020

GBP'000 GBP'000 GBP'000

Operating activities

Profit/(loss) before tax 2,656 1,846 (10,207)

Net finance costs 463 535 1,053

Amortisation of intangible assets 39 67 84

Impairment of goodwill - - 3,209

Depreciation of property, plant and equipment 625 710 1,528

Impairment of property, plant and equipment - - 1,408

Depreciation of right-of-use assets 625 901 1,860

Impairment of right-of-use assets - - 3,463

Gain on recognition of sub-leased property - - (40)

Gain on extinguishment of lease liabilities (1,896) - -

Gain on waiver of lease liabilities (565)

(Profit)/loss on disposal of property, plant and equipment and assets

held for sale (1) - 10

Share-based payment expense - 21 45

Decrease in provisions and deferred tax - (70) (54)

Decrease/(increase) in inventories 42 (24) 62

Decrease/(increase) in trade and other receivables 447 277 (819)

(Decrease) in trade and other payables (253) (309) 58

Interest paid on borrowings (150) (134) (398)

Interest paid on lease liabilities (28) (331) (673)

Interest received 7 - 1

Income tax paid (52) (29) (28)

Net cash flow from operating activities 1,959 3,460 562

------------ ------------ ------------

Investing activities

Purchase of property, plant and equipment, and intangible assets (36) (1,312) (1,585)

Interest received on finance lease receivables - - 18

Capital element received on finance leases - - 50

Settlement of deferred consideration - (354) (354)

Proceeds from disposal of property, plant and equipment 11 - -

Net cash flows used in investing activities (25) (1,666) (1,871)

------------ ------------ ------------

Financing activities

Proceeds from borrowings - 1,400 6,750

Repayment of borrowings (85) (3,035) (4,785)

Principal paid on lease liabilities (252) (672) (732)

Net cash flows generated used in financing activities (337) (2,307) 1,233

------------ ------------ ------------

Net decrease in cash and cash equivalents 1,597 (513) (76)

Cash and cash equivalents at beginning of period 2,649 2,725 2,725

Cash and cash equivalents at period end date 4,246 2,212 2,649

============ ============ ============

NOTES TO THE INTERIM CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

1. GENERAL INFORMATION

The Brighton Pier Group PLC is a public limited company

incorporated and domiciled in England and Wales. The Company's

ordinary shares are traded on AIM. Its registered address is 36

Drury Lane, London, WC2B 5RR. The Company is the immediate and

ultimate parent of the "Group".

The Brighton Pier Group PLC owns and operates Brighton Palace

Pier, one of the leading tourist attractions in the UK. The Group

is also a leading operator of 9 premium bars, and the operator of 8

indoor adventure golf facilities trading in major towns and cities

across the UK.

The principal accounting policies adopted by the Group are set

out in Note 2.

2. ACCOUNTING POLICIES

The financial information for the six months ended 27 December

2020 and 29 December 2019 does not constitute statutory accounts

for the purposes of section 435 of the Companies Act 2006 and has

not been audited. The Group's latest statutory financial statements

were for the 52 weeks ended 28 June 2020 and these have been filed

with the Registrar of Companies.

Information that has been extracted from the June 2020 accounts

is from the audited accounts included in the annual report,

published in November 2020, on which the auditor gave an unmodified

opinion and did not include a statement under section 498 (2) or

(3) of the Companies Act 2006. A copy of these accounts can be

found on the Group's website, www.brightonpiergroup.com.

The interim condensed consolidated financial statements for the

26 weeks ended 27 December 2020 have been prepared in accordance

with the AIM Rules issued by the London Stock Exchange. They do not

include all the information and disclosures required in the annual

financial statements and should be read in conjunction with the

Group's annual financial statements as at 28 June 2020, which were

prepared in accordance with IFRS as adopted by the European

Union.

The accounting policies used in preparation of the financial

information for the six months ended 27 December 2020 are the same

accounting policies applied to the Group's financial statements for

the 52 weeks ended 28 June 2020. These policies were disclosed in

the 2020 Annual Report and are in accordance with IFRS as adopted

by the European Union.

3. GOING CONCERN

Whilst the COVID-19 restrictions and closures impacted the

Group's operations in the 26 week period ended 27 December 2020,

the cash impact of these restrictions have been mitigated by

positive trading during the summer months in the Golf and Pier

divisions and from business interruption payments totalling GBP1.4

million.

Further closures during the second half of FY2021 have already

taken place. Based on The Prime Minister's 'roadmap' for reopening,

announced on 22 February 2021 , these closures are expected to

continue until 12 April 2021 after which staged relaxations of

restrictions predict some return to normality by the middle of June

2021. After this date, a very large proportion of the UK population

will have been vaccinated and most restrictions are planned to be

lifted. These restrictions will therefore impact trading in the

second half of FY2021 and will impact the Group's remaining late

night bars until they have fully reopened, which is expected to

happen during the first half of FY2022. Further business

interruption insurance payments are expected to offset some of

these impacts.

Despite the closures, the Group generated positive earnings

before interest, tax, depreciation and amortisation ("EBITDA") for

the 26-week period ended December 2020, improving earnings on the

same period last year. The Group has benefited from interim

business interruption insurance payments and one-off gains arising

from the extinguishment of lease liabilities on sites disposed

during the period. The cash available to fund the Group increased

by GBP1.6 million during the period.

The Group's experience from lockdown last summer suggests that

trade in the Pier and Golf divisions may pick up quickly as they

reopen. Reopening of these divisions is expected to take place in

April and May 2021 respectively. The Directors consider that this

busy trading period, albeit below normal levels, together with

existing cash reserves currently held by the business of GBP4.2

million, the availability of the currently undrawn Revolving Credit

Facility of GBP1.75 million and further business interruption

insurance payments will adequately meet the Group's cash

requirements for the next 12 months.

The Directors and management of the business have reviewed the

Group's detailed forecast cash flows for the forthcoming twelve

months from the date of publishing this announcement. The Directors

believe the Group will have sufficient cash resources available to

meet its liabilities as they fall due. These cash flow forecasts

and re-forecasts are prepared regularly as part of the business

planning process. These have been analysed in the light of the

closures since Christmas, subjected to stress testing, scenario

modelling and sensitivity analysis, which the Directors consider

sufficiently robust.

As part of this assessment, the Directors performed a "stress

test" in order to model a scenario to identify the adequacy of the

Group's cash resources as a whole to fund all of the various parts

of the Group for the next twelve months. This scenario modelled the

Pier and Golf divisions reopening in May 2021 and most of Bars

division not re-opening until August 2021 (with the exception of

the two food-led businesses, Lowlander in Covent Garden and

Coalition in Brighton, which are modelled to reopen earlier). This

scenario included other critical assumptions specifically in

relation to the Group including:

That the Pier and Golf divisions;

-- remain closed to the end of April 2021, missing out on the Easter trading period,

-- gradually reopen in May 2021, trading at 85% of normal sales

to the end of June 2021 and then returning to pre-COVID levels from

July 2021 onwards and remaining fully open thereafter,

-- keep most staff on furlough until the end of April 2021

during the period of lockdown except for security and essential

maintenance, with continuing support from the Coronavirus Job

Retention Scheme,

-- receive further business interruption insurance payments in the Golf division, and

-- benefit from no other mitigations to further reduce direct

operational costs or other fixed overheads once reopened.

That the Bars division;

-- late night bars remain closed to the end of July 2021,

reopening in August 2021 at 40% of pre-COVID sales which gradually

return to pre-COVID levels over the following five months to the

end of December 2021,

-- Lowlander reopens in May 2021, trading at 50% through the

summer and thereafter gradually returning to pre-COVID sales levels

by December 2021,

-- Coalition reopens in April 2021 - trading the terrace and

providing takeaway at 50% of pre-COVID sales in April, 50% in May,

60% in June, then 80% through July to September before dropping

back to 60% for the post-summer season and trading in line with the

remaining estate thereafter,

-- retains only essential management who remain on furlough to

the end of July 2021, with continuing support from the Coronavirus

Job Retention Scheme,

-- receives further business interruption insurance payments, and

-- benefits from no further mitigations to further reduce direct

operational costs or other fixed overheads once reopened.

Recent announcements in the budget on the extended rates relief

holiday for hospitality and leisure, continuing VAT reductions to

5% on food and admission income to the end of September 2021,

increasing to 12.5% until the end of March 2022, together with

restart grants will further improve the Group's position over the

coming months.

This stress test shows that the Group as a whole has adequate

resources to continue to trade, despite these extended closures.

Furthermore, until the December 2021 quarter, the Group's bank has

waived all existing covenant tests, and introduced a new monthly

minimum liquidity test that is triggered when the Group's cash

resources fall below GBP1.75 million. Even under the stress test

scenario, the Group's forecast shows significant headroom on the

liquidity test throughout the forecast period to the end of June

2022 and full compliance with all covenants that are currently

scheduled to restart from December 2021 onwards.

These tests, prepared at the time of two new CBIL's in September

2020, assume that all the Group's trading operations will have been

open for the prior twelve months. However, if closures in the Bars

division were to extend beyond the stress test assumptions into

September 2021 or if stages in the roadmap are extended resulting

in delays to the re-opening of the Pier or the Golf, then given the

sensitivity of these covenant tests, it is possible that a breach

could occur in December 2021 if the tests were applied with no

modifications. Even with extended closure of the Bars or delays in

the re-opening roadmap to the end of July 2021, the liquidity test

would not be breached.

Nevertheless, the Directors believe that given the low levels of

leverage, the asset-backed nature of the debt and the level of cash

that is forecast to be available at the end of summer 2021,

renegotiated covenant levels could be agreed with the bank to take

into account the loss of cash flow during the forced extended

closures.

Whilst stress testing the business is important given the

unprecedented nature of the events surrounding COVID-19, the

Directors expect the Group to continue to meet its day-to-day

working capital requirements from the cash flows generated by its

trading activities, loan facilities with its bank as well as cash

resources available to it throughout the three divisions should

they be required. Accordingly, these financial statements have been

prepared on the going concern basis.

4. SEGMENTAL INFORMATION

Management has determined the operating segments based on the

reports reviewed by the Chief Operating Decision Maker ("CODM")

comprising the Board of Directors. During the 26 week period ended

27 December 2020, there have been no changes from prior periods in

the measurement methods used to determine operating segments and

reported segment profit or loss.

The segmental information is split on the basis of those same

profit centres - however, management report only the contents of

the consolidated statement of comprehensive income and therefore no

balance sheet information is provided on a segmental basis in the

following tables.

December

26 week period ended 27 Brighton Total 2020 consolidated

December 2020 Bars Pier Golf segments Overhead total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------------------- -------- --------- -------- ---------- --------- -------------------

Revenue 728 5,811 1,660 8,199 - 8,199

Cost of sales (229) (852) (11) (1,092) - (1,092)

--------------------------------- -------- --------- -------- ---------- --------- -------------------

Gross profit 499 4,959 1,649 7,107 - 7,107

Gross profit % 68% 85% 99% 87% - 87%

Operating expenses (excluding

depreciation and amortisation) (526) (4,141) (904) (5,571) (383) (5,954)

Other income 500 - 900 1,400 - 1,400

Highlighted items 1,856 1,856

Depreciation and amortisation

(excluding right-of-use

assets) (664) (664)

Depreciation of right of

use assets (625) (625)

Net finance cost (excluding

interest on lease liabilities) (135) (135)

Net finance cost arising

on lease liabilities (329) (329)

Profit/(loss) before tax 473 818 1,645 2,936 (280) 2,656

Income tax - - - - - -

--------------------------------- -------- --------- -------- ---------- --------- -------------------

Profit/(loss) after tax 473 818 1,645 2,936 (280) 2,655

EBITDA (before highlighted

items) 473 818 1,645 2,936 (383) 2,553

EBITDA (after highlighted

items) 473 818 1,645 2,936 1,473 4,409

--------------------------------- -------- --------- -------- ---------- --------- -------------------

NOTES to the INTERIM CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS

4. SEGMENTAL INFORMATION (continued)

December

26 week period ended Brighton Total 2019 consolidated

29 December 2019 Bars Pier Golf segments Overhead total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------- ---------- ---------------- ---------------- ---------------- --------- -------------------

Revenue 6,602 7,936 2,793 17,331 - 17,331

Cost of sales (1,373) (1,294) (46) (2,713) - (2,713)

-------------------------- ---------- ---------------- ---------------- ---------------- --------- -------------------

Gross profit 5,229 6,642 2,747 14,618 14,618

Gross profit % 79% 84% 98% 84% 84%

Operating expenses

(excluding depreciation

and amortisation) (3,893) (4,822) (1,301) (10,016) (432) (10,448)

Highlighted items (110) (110)

Depreciation and

amortisation

(excluding right-of-use

assets) (778) (778)

Depreciation of right

of use assets (901) (901)

Net finance cost

(excluding

interest on lease

liabilities) (204) (204)

Net finance cost arising

on lease liabilities (331) (331)

Profit/(loss) before

tax 1,336 1,820 1,446 4,602 (2,756) 1,846

Income tax - - - - (389) (389)

-------------------------- ---------- ---------------- ---------------- ---------------- --------- -------------------

Profit/(loss) after

tax 1,336 1,820 1,446 4,602 (3,145) 1,457

EBITDA (before

highlighted

items) 1,336 1,820 1,446 4,602 (412) 4,190

EBITDA (after highlighted

items) 1,336 1,820 1,446 4,602 (522) 4,080

-------------------------- ---------- ---------------- ---------------- ---------------- --------- -------------------

5. HIGHLIGHTED ITEMS

26 weeks 26 weeks 52 weeks

ended ended ended

27 December 29 December 28 June

2020 2019 2020

GBP'000 GBP'000 GBP'000

------------------------------------------------------- ------------ ------------ ---------

Acquisition and pre-opening costs

Site pre-opening costs - 110 37

Impairment, closure and legal costs

Impairment of goodwill - - 3,209

Impairment of property, plant and equipment - - 1,408

Impairment of right-of-use assets - - 3,463

Gains arising on extinguishment of lease liabilities (1,896) - -

following disposal of site (note 9)

Other disposal costs 40 - -

Total (1,856) 110 8,117

------------------------------------------------------- ------------ ------------ ---------

5. HIGHLIGHTED ITEMS Continued

The above items have been highlighted to give a better

understanding of non-comparable costs included in the consolidated

income statement for this period.

For the period ended 27 December 2020, gains of GBP1,896,000

arising on extinguishment of lease liabilities relate to the

disposal of sites in the Bars division at Wimbledon, Bath and

Cambridge. The right-of-use assets relating to these sites were

impaired to GBPnil during the period ended 28 June 2020 and are

included in highlighted items for that period. Other disposal costs

of GBP40,000 relate to the site in Bath.

6. OTHER INCOME

The High Court Judgement on 15 September 2020 found that the

Group's 'Marsh resilience' insurance policies in the Bars and Golf

divisions were capable of responding to COVID-19 business

interruption claims. Furthermore, the Group's advisers have

indicated that the Supreme Court ruling on 15 January 2021 does not

change the fundamental principle that these policies can respond to

claims, subject to appropriate discussion and agreement over the

quantum of the arising losses and any applicable policy caps.

As at the end of the period the Group has received from its

insurers initial interim payments totalling GBP1.4 million in

respect of these losses. Whilst these payments do not satisfy the

entirety of the Group's claims, they nevertheless support the

Group's overall liquidity. Further payments are expected as

closures continue into the second half, however the timing and

amounts of these remain uncertain.

The Group's policies have a maximum indemnity period of 24

months and are capped at GBP5 million split equally between the

Bars and Golf division for any one claim.

Since the period end (March 2021) the Group has received a

second tranche of payments on account from its insurers of GBP1.55

million in relation to its COVID-19 business interruption claims in

the Group's Bars and Golf divisions.

During the period the Group received income of GBP1.0 million

from the Government furlough scheme. This has been offset against

staff costs within Operating Expenses in the Statement of

Comprehensive Income.

7. TAXATION

The tax charge has been calculated by reference to the expected

effective current and deferred tax rates for the 52 week period to

the 27 June 2021 applied against the profit before tax for the

period ended 27 December 2020. The full year effective tax charge

on the underlying trading profit is estimated to be GBPnil (2019:

GBP0.4 million)

8. EARNINGS PER SHARE

The weighted average number of shares in the period was:

26 weeks to 26 weeks to 52 weeks to

27 December 2020 29 December 2019 28 June

2020

Thousands of shares Thousands of shares Thousands of shares

Ordinary shares 37,286 37,286 37,286

------------------------------------------------ -------------------- -------------------- --------------------

Weighted average number of shares - basic 37,286 37,286 37,286

Dilutive effect on ordinary shares from share

options - - -

------------------------------------------------ -------------------- -------------------- --------------------

Weighted average number of shares - diluted 37,286 37,286 37,286

------------------------------------------------ -------------------- -------------------- --------------------

Basic and diluted earnings per share are calculated by dividing

the profit for the period into the weighted average number of

shares for the year. In order to provide a measure of underlying

performance, management have chosen to present an adjusted profit

for the period, which excludes items that may distort

comparability. Such items arise from events or transactions that

fall within the ordinary activities of the Group but which

management believes should be separately identified to help explain

underlying performance.

8. EARNINGS PER SHARE continued

26 weeks to 26 weeks to

27 December 2020 29 December 2019 52 weeks to

28 June

2020

Earnings per share from profit for the period

Basic (pence) 7.1 3.9 (25.5)

Diluted (pence) 7.1 3.9 (25.5)

-------------------------------------------------------- ----------------- ----------------- ------------

Adjusted earnings per share from profit for the period

Basic (pence) 2.1 4.1 (5.3)

Diluted (pence) 2.1 4.1 (5.3)

-------------------------------------------------------- ----------------- ----------------- ------------

9. LEASE LIABILITIES

The onset of the COVID-19 pandemic prompted the IASB to issue a

practical expedient to provide relief for lessees from lease

modification accounting for rent concessions related to COVID-19.

The practical expedient allows entities to recognise the value of

any agreed rent concessions in the Statement of Comprehensive

Income rather than adjusting the underlying right-of-use asset and

lease liability. The Group has recognised total credits of

GBP152,000 within operating expenses in the Statement of

Comprehensive Income for the period ended 27 December 2020.

The practical expedient can only be used for rent concessions

covering the period to 30 June 2021. In some instances, the Group

has agreed temporary lease variations that extend beyond this date.

These variations amount, in substance, to forgiveness of rent

payable without materially changing the present value of total cash

outflows over the life of the lease. In such circumstances, the

Group de-recognises the appropriate portion of its total liability

in accordance with the provisions of IFRS 9: Financial Instruments.

The value of these extended waivers is recognised in the Statement

of Comprehensive Income. The Group has recognised total credits of

GBP413,000 within operating expenses in the Statement of

Comprehensive Income during the period ended 27 December 2020.

Lease liabilities of GBP1,896,000 were extinguished during the

period as a result of the disposal of sites in Bath, Cambridge and

Wimbledon.

10. RECONCILIATION TO EBITDA

Group profit before tax can be reconciled to Group EBITDA as

follows:

26 weeks to 26 weeks to 52 weeks to

EBITDA Reconciliation 27 December 2020 29 December 2019 28 June 2020

------------------------------------------------------ ----------------- -------------------------- --------------

Profit before tax for the year 2,656 1,846 (10,207)

Add back depreciation (property plant and equipment) 625 710 1,528

Add back depreciation (right-of-use-assets) 625 901 1,860

Add back amortisation 39 67 84

Add back finance costs of lease liabilities 329 331 -

Add back other finance costs 135 204 1,071

Add back share based payment charge - 21 45

Add back highlighted items (1,856) 110 8,117

------------------------------------------------------ --------------

Group EBITDA before highlighted items 2,553 4,190 2,498

Remove highlighted items 1,856 (110) (8,117)

Add back impairments of:

Goodwill - - 3,209

Property, plant and equipment - - 1,408

Right-of-use assets - - 3,463

Group EBITDA after highlighted items 4,409 4,080 2,461

------------------------------------------------------ ----------------- -------------------------- --------------

11. EVENTS AFTER THE REPORTING PERIOD

In March 2021, the Group received a second tranche of payments

on account from its insurers of GBP1.55 million in relation to its

COVID-19 business interruption claims. These receipts also relate

to claims made in the Group's Bars and Golf divisions.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DVLFLFXLBBBF

(END) Dow Jones Newswires

March 29, 2021 02:00 ET (06:00 GMT)

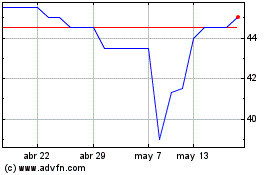

Brighton Pier (LSE:PIER)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Brighton Pier (LSE:PIER)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024