TIDMBRBY

RNS Number : 8769Y

Burberry Group PLC

19 January 2022

19 January 2022

Burberry Group plc

Third Quarter Trading Update

Momentum builds

"Full-price sales continued to grow at a double-digit percentage

compared with two years ago, accelerating from the previous quarter

and reflecting a higher quality business. Our focus categories

outerwear and leather goods performed strongly as we continued to

attract new, younger consumers to the brand. Despite the ongoing

challenges of the external environment, we are confident of

finishing the year strongly and providing an excellent platform on

which to build when our new CEO Jonathan Akeroyd joins in April."

Gerry Murphy, Chair

-- Strong underlying revenue performance in the third quarter,

building on the progress made in H1:

o Acceleration in full-price comparable store sales up 26% vs

LLY** (Q2 FY22 +10%), driven by ongoing strength in the Americas

and a material improvement in Asia Pacific and EMEIA

o Comparable store sales down 3% vs LLY (Q2 FY22 flat) on

planned exit of markdown

-- Quarter achieved highest level of earned reach to date on

Instagram driven by brand activations including pop-up on Jeju

Island coupled with strong momentum on TikTok

-- Strengthened our position with new consumers driving

double-digit full-price sales growth vs LLY across all product

categories

-- Ongoing full-price strength on digital channels with sales up high double-digits vs LLY

-- New store concept transforming how our customers experience

our brand and product with 31 stores in the new design including

flagship Plaza 66, Shanghai

-- Continued to embed ESG across the business; announced

refinancing of Revolving Credit Facility to GBP300m Sustainability

Linked Loan with funding linked to our industry-leading ambition to

be Climate Positive by 2040

-- GBP150m share buyback well advanced and on course for completion before year end

Retail revenue 13 weeks ended 25 December

25 Dec 26 Dec % change

GBP million 2021 2020 Reported FX CER

------------------------------ ------------------ ------ --------------- ---

Retail revenue 723 688 5% 8%

Comparable store sales* +7% (-3% vs LLY) -9%

Full-price comparable +15% (+26% vs LLY) n/a

store sales**

------------------------------ ------------------ ------ --------------- ---

*See page 4 for definition, **LLY is compared with Q3 FY20

Outlook

Assuming no further changes in the external environment, we

expect current year adjusted operating profit to grow in the region

of 35% at CER*** compared with the prior year. In addition, the

currency headwind is now expected to be GBP79m (from c.GBP100m) on

revenue and GBP27m (from c.GBP40m) on adjusted operating profit. We

maintain our medium-term guidance for high single-digit top line

growth and meaningful margin accretion at CER****.

*** including the impact of the 53(rd) week ****See Appendix

The financial information contained herein is unaudited

Business review

Against an ongoing challenging backdrop, full-price sales

accelerated significantly in the third quarter, increasing 26% vs

LLY on a comparable basis. Total comparable store sales fell 3% vs

LLY impacted by our planned exit of markdown across mainline and

digital as we enhanced the quality of our revenues.

We continued to strengthen our position with new, younger

consumers, with new customers driving double-digit full-price sales

growth across all product categories. Regionally, full-price

comparable store sales were driven by continued strong performance

in the Americas, a material sequential improvement in Asia Pacific

as COVID-19 restrictions eased and improving trends in EMEIA

despite an ongoing lack of tourism.

In terms of brand activity, we continued to drive engagement

with consumers through distinctive and meaningful storytelling and

experiences. In the quarter, we launched our first dedicated

outerwear campaign celebrating our iconic outerwear offer with an

inspirational brand film unlocking the themes of freedom and

exploration, which achieved record views across digital media, and

launched activations across physical and digital channels. We

engaged with customers through innovative, luxury experiences

including large-scale, immersive brand activations at Plaza 66,

Shanghai and the biggest of its kind for Burberry in South Korea on

Jeju Island. This was amplified globally through 24 pop-ins and 10

pop-ups, as well as throughout key social media including our first

branded TikTok sky filter and achieving our highest level of earned

reach to date on Instagram.

In product, we made further progress in our focus categories

outerwear and leather goods. Full-price outerwear sales grew 38% vs

LLY supported by the campaign and new elevated check range in Birch

Brown colourway. Leather goods also strengthened over the prior

period, with full-price sales up 29% vs LLY as we extended the Lola

family with the introduction of the crossbody, tote and SLG

versions as part of our Winter collection. As we enter our final

quarter of FY22 we are excited about the recent launch of our Lunar

New Year campaign celebrating the year of the Tiger with a bespoke

product capsule and dedicated fashion campaign.

At the same time, we continue to elevate the customer experience

with the roll out of our new store concept. In total, we now have

31 stores in the new design including our second flagship Plaza 66,

Shanghai, and we remain on track to deliver around 50 new concept

stores by the end of the financial year. The new store concept is

transforming how our customers experience our brand and product and

is supporting revenue growth.

Digital innovation remains a key driver of growth for the

business with digital full-price sales up high double digits vs

LLY. We are seeing strong and increasing engagement with customers

globally buying online as an outcome of enhancements we have made

to the online purchase journey including greater personalisation.

We are also seeing strong adoption by customers of omnichannel

solutions, including booking store appointments, which we are

expanding across more stores and countries. We created an immersive

travelling trench experience inspired by the Trench Room in our

social retail store in Shenzhen and brought it to stores across

Mainland China where it generated strong engagement, traffic and

sales. Building on our partnerships with digital innovators, as

part of our outerwear activation on Jeju Island in South Korea, we

designed an immersive experience, including Augmented Reality

technology that was powered by TikTok and supported strong

engagement with our customers.

We continue to embed ESG across our operations and remain on

track to complete our 2017-2022 Responsibility goals this year. We

announced the refinancing of our Revolving Credit Facility to a

GBP300m Sustainability Linked Loan with funding linked to the

achievement of key ESG targets as part of our ambition to become

Climate Positive by 2040. This includes accelerating emissions

reductions across our extended supply chain (Scope 3) by 46% by

2030 and becoming net-zero by 2040, 10 years ahead of the 1.5degC

pathway set out in the Paris Agreement. It also involves investing

in nature-based projects with carbon benefits that restore and

protect natural ecosystems and enhance the livelihoods of global

communities.

We continued our support for young people, extending our

partnership with international footballer and youth advocate Marcus

Rashford MBE to help disadvantaged children in the UK develop their

literacy skills. We also provided funding for new libraries and

books in underserved communities in the U.S., Japan and Hong Kong

S.A.R., China.

We continue to deliver on our Global D&I Strategy, including

launching 'Demonstrating Allyship' workshops which will be

rolled-out to all colleagues globally over the next 12 months. On

World Mental Health Day we also launched a new Global Bereavement

Policy, leaders' guide and colleague support site, which includes

paid time off for all colleagues who suffer a bereavement,

including pregnancy loss.

We celebrated our first year of working with The Valuable 500

and Business Disability Forum on International Day of Persons with

Disabilities. As part of our commitment to building a more

inclusive future, we are working to improve accessibility across

our stores, manufacturing sites and offices.

Financial performance

FY22 vs LY FY22 vs LLY

Q1 Q2 H1 Q3 Q1 Q2 H1 Q3

----- ---- ----

Comparable store

sales growth 90% 6% 37% 7% 1% flat 1% -3%

Comparable full-price

sales growth 121% 10% 49% 15% 26% 10% 18% 26%

----- ---- ---- ---- ---- ----- ----

Our underlying performance was strong with full-price comparable

store sales up 26% vs LLY (+15% vs LY) accelerating materially from

the previous quarter (Q2 full-price +10% vs LLY). Total comparable

store sales declined 3% vs LLY (+7% vs LY) in the quarter with the

strong full-price growth offset by a low double-digit (mid-single

digit vs LY) headwind from the planned exit markdown and reduced

trade in outlets.

Space growth contributed 1% to retail sales in the quarter vs LY

while FX was a 3% headwind. In total reported retail sales grew 5%

YoY.

FY22 vs Comparable store sales Comparable full-price

LLY growth sales growth

Q1 Q2 H1 Q3 Q1 Q2 H1 Q3

------ ------ ------ ----- ------

Group 1% flat 1% -3% 26% 10% 18% 26%

Asia Pacific 7% 3% 5% flat 23% 5% 14% 22%

EMEIA -38% -25% -31% -17% -33% -27% -30% -4%

Americas 34% 42% 38% 8% 114% 81% 98% 72%

------ ------ ------ ----- ------ ------ ------ ----

Asia Pacific comparable store sales were flat vs LLY with

full-price comparable store sales materially accelerating from

Q2:

-- Mainland China comparable store sales grew 15% with

full-price comparable store sales up 37% vs LLY, an improvement

over the prior quarter due to reduced COVID-19 disruption.

-- South Korea outperformed with comparable store sales up 28%

vs LLY with continued strength in full-price comparable store

sales, 62% ahead of pre pandemic levels.

-- Japan and South Asia Pacific improved quarter on quarter as

COVID-19 related restrictions eased however performance remains

soft due to limited tourist traffic.

EMEIA improved significantly quarter on quarter with comparable

store sales down 17% vs LLY and full-price comparable store sales

falling only 4%. We are very encouraged by the performance given

the ongoing drag from the lack of tourists, which accounted for

around 40% of pre-pandemic revenues in the region.

Americas saw continued strong performance in full-price

comparable store sales up 72% vs LLY driven by new customers.

Comparable store sales grew 8% vs LLY with the region being most

impacted in the quarter by the exit of markd own.

Enquiries

Investors and analysts 020 3367 4458

Julian Easthope VP, Investor Relations Julian.Easthope@burberry.com

Media 020 3367 3764

Andrew Roberts SVP, Corporate Relations Andrew.Roberts@burberry.com

---------------------------------------- ----------------------------

-- There will be a conference call for investors and analysts to

discuss this update today at 9am (UK time). The conference call can

be accessed live on the Burberry corporate website,

www.burberryplc.com with a replay available later in the day.

-- Burberry will announce its Preliminary results for the 53

weeks ending 2 April 2022 on 18 May 2022

Certain statements made in this announcement are forward-looking

statements. Such statements are based on current expectations and

are subject to a number of risks and uncertainties that could cause

actual results to differ materially from any expected future

results in forward-looking statements. Burberry Group plc

undertakes no obligation to update these forward-looking statements

and will not publicly release any revisions it may make to these

forward-looking statements that may result from events or

circumstances arising after the date of this document. Nothing in

this announcement should be construed as a profit forecast. All

persons, wherever located, should consult any additional

disclosures that Burberry Group plc may make in any regulatory

announcements or documents which it publishes. All persons,

wherever located, should take note of these disclosures. This

announcement does not constitute an invitation to underwrite,

subscribe for or otherwise acquire or dispose of any Burberry Group

plc shares, in the UK, or in the US, or under the US Securities Act

1933 or in any other jurisdiction.

Notes to editors

-- Burberry is a global luxury brand with a distinctly British attitude.

-- At 25 December 2021, globally Burberry had 218 retail stores,

150 concessions, 58 outlets and 39 franchise stores, excluding pop

up stores.

-- Burberry is listed on the London Stock Exchange (BRBY.L) and

is a constituent of the FTSE 100 index. Its ADR symbol is

OTC:BURBY.

-- BURBERRY, the Equestrian Knight Device, the Burberry Check

and the Thomas Burberry Monogram and Print are trademarks belonging

to Burberry.

Constant exchange rates (CER) removes the effect of changes in

exchange rates compared to the prior period. This takes into

account both the impact of the movement in exchange rates on the

translation of overseas subsidiaries' results and also on foreign

currency procurement and sales through the Group's UK supply

chain.

Comparable store sales is the year-on-year change in sales from

stores trading over equivalent time periods and measured at

constant foreign exchange rates. It also includes online sales. The

measurement of comparable sales has not excluded stores temporarily

closed as a result of the COVID-19 outbreak.

Full price sales is sales from items sold at full retail price

in our own mainline retail and online network. We have described

the change in full price sales based on the year-on-year change and

measured at constant foreign exchange rates.

Markdown sales is from items that are sold at a discount to the

full retail price in our own mainline retail and online

network.

Certain financial data within this announcement have been

rounded.

APPENDIX

Detailed guidance for FY22*

Item Financial impact

Markdown policy As guided, we have exited markdowns in digital

and mainline stores in FY22, leading to a mid-single

digit headwind against our comparable store sales

in FY22 vs LY and high single digit % v LLY

------------------------------------------------------

Wholesale Full year wholesale is expected to be up high

30s% at CER (mid 30s% previously)

------------------------------------------------------

Impact of retail For the FY, space is expected to contribute low

space on revenues single digit percentage with H2 also up low single

digit percentage on a 52 week basis

------------------------------------------------------

Gross margin To remain stable at 70% YoY at CER

------------------------------------------------------

Tax We expect the adjusted tax rate to be around 22%

------------------------------------------------------

Capex Capex is expected to be in the region of GBP150m

(GBP160m previously) including the cost of around

50 stores being opened/refurbished in the new

concept

------------------------------------------------------

Currency At 24 December spot rates, the impact of year-on-year

exchange rate movements is expected to be a GBP79m

headwind on revenue and GBP27m headwind on adjusted

operating profit

------------------------------------------------------

Calendar Please note that FY22 is a 53 week calendar year

with an extra week in Q4.

------------------------------------------------------

*Guidance assumes constant exchange rates, a stable economic

environment and current tax legislation

Exchange rates Forecast effective rates Actual average exchange

for rates

FY22

GBP1= 24 December 29 October FY21

2021 2021

------------- ------------ ------------------------

Euro 1.17 1.17 1.12

US Dollar 1.36 1.38 1.30

Chinese Yuan 8.74 8.88 8.85

Hong Kong Dollar 10.62 10.75 10.08

Korean Won 1,589 1,602 1,514

------------- ------------ ------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTVVLFFLFLZBBD

(END) Dow Jones Newswires

January 19, 2022 02:00 ET (07:00 GMT)

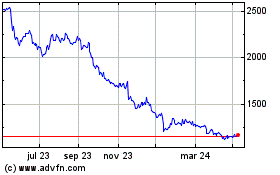

Burberry (LSE:BRBY)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

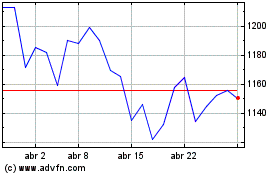

Burberry (LSE:BRBY)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024