TIDMCPX

RNS Number : 3018N

CAP-XX Limited

29 September 2021

Dissemination of a Regulatory Announcement that contains inside

information for the purposes of Regulation 11 of the Market Abuse

(Amendment) (EU Exit) Regulations 2019/310 .

29 September 2021

CAP-XX Limited

("CAP-XX" or the "Company")

Audited results for the year ended 30 June 2021

CAP-XX Limited, a world leader in the design and manufacture of

supercapacitors and energy management systems, is pleased to

announce its audited results for the year ended 30 June 2021.

Key highlights

-- Revenue up 14% on the previous year

-- Product sales revenue up 30% on last year

-- Adjusted EBITDA loss* of A$0.4 million, reduced from the previous year (A$1.6 million)

-- Commissioning of ex-Murata coating, DMF and DMT lines successfully completed within budget

-- Capacity and yield from these lines continue to increase in accordance with plan

-- CAP-XX continues to pursue patent infringement action against

Maxwell Technologies, now a wholly owned subsidiary of Tesla

Inc.

-- CAP-XX is pursuing a licensee for underpayment of royalties

-- CAP-XX continues to develop new IP around supercapacitors and energy storage

-- Cash reserves as at 30 June 2021 were A$0.2 million before

the post period end receipt of proceeds from exercise of employee

options and capital raising. A further R&D Tax rebate is

anticipated later this calendar year

-- The cash reserves at 30 June 2021 were lower than expected

due to underpayment of royalties by a licencee, delays in the sale

of the employee share options, and an increase in legal expenses in

the last quarter related to patent infringement and licencing

-- The new financial year has started well. Trading is in line with market expectations

* Adjusted to exclude net Murata project expenses, legal

expenses for patent infringement and expenses for a one off bad

debt provision.

Anthony Kongats, Chief Executive of CAP-XX said:

"We are pleased to be able to report a year of successful

transition, during which we have significantly expanded production

at our relocated headquarters in Sydney, while increasing revenues.

The major focus for CAP-XX remains to become profitable and

cashflow positive as soon as possible, by leveraging the recently

installed Murata production equipment to raise product sales. We

look forward to the future with increasing confidence."

Electronic copies of CAP-XX's audited annual report and accounts

for the year ended 30 June 2021 will shortly be available from the

Company's website: www.cap-xx.com

For further information contact:

CAP-XX Limited

Anthony Kongats (Chief Executive Officer) +61 (0) 2 9428 0139

Kreab (Financial PR)

Robert Speed +44 (0) 20 7074 1800

Allenby Capital (Nominated Adviser and Joint Broker)

David Hart / Alex Brearley (Corporate Finance) +44 (0) 20 3328 5656

Tony Quirke (Equity Sales)

Cenkos Securities plc (Joint

Broker)

Neil McDonald / Pete Lynch +44 (0) 13 1220 6939

More information is available at www.cap-xx.com

Notes to Editors:

CAP-XX (LSE: CPX) is a world leader in the design and

manufacture of thin, flat supercapacitors and energy management

systems used in portable and small-scale electronic devices, and to

an increasing extent, in larger applications such as automotive and

renewable energy. The unique feature of CAP-XX supercapacitors is

their very high power density and high energy storage capacity in a

space-efficient prismatic package. These attributes are essential

in power-hungry consumer and industrial electronics, and deliver

similar benefits in automotive and other transportation

applications. For more information about CAP-XX, visit

www.cap-xx.com

Chairman's Report

It has been a very busy but ultimately highly successful year

for CAP-XX, with progress in a broad range of areas setting the

Company on a path to achieving sustained and growing profitability.

I am pleased to report that the commissioning of the ex-Murata

Coating, DMF and DMT production lines in Sydney has been

successfully completed on budget. Efforts to build sales are

bearing fruit, with product sales up 30% year-on-year and the sales

order book has increased by more than 160% from July 2020 to July

2021. All of this was achieved against a backdrop of a very

challenging global environment as we work hard to mitigate the

negative impact of the COVID-19 pandemic. The new financial year

has started well. Trading is in line with market expectations.

The Board remains of the view that the installation of the

additional production facilities at the Seven Hills facility will

be transformational for the Company's sales and profitability. At

full capacity, the lines will be able to produce around 4.8 million

DMF or DMT products per year and more than 2.4 million DMH products

per year, all at a much lower unit cost than the prismatic parts

which the Company currently manufactures in Malaysia. While full

production capacity of the coating, DMF and DMT production lines

has not yet been reached, the Board is very pleased with the demand

expressed by both pre-existing Murata customers and new

customers.

Demand from the top 10 potential customers already exceeds the

annual capacity of the production lines at the Seven Hills facility

Orders and shipments for these products continue to increase. As

the Board expected, the early product shipments have been to former

Murata customers. The Board expects that more than 75% of Murata's

former customers by value will be retained. These early sales have

been for smart meters, security products and medical devices.

Importantly, we are increasing new business in consumer products

and Internet of Things (IoT) sensor applications. As demand builds,

the Board will look at how to best grow sales, potentially by

adding new capacity and/or new product lines, in line with the

Company's plan. This includes the DMH line which is scheduled to be

commissioned in 2022 subject to customer pull and available CAP-XX

resources. Customer enquiries for DMH products are primarily for

applications such as gaming, tracking, electronic shelf labels,

medical devices, IoT sensors and smart credit cards.

During the year ended 30 June 2021 and subsequently, CAP-XX has

announced a number of commercial engagements where customers,

including Spire Health, RGM SpA, Sensys Networks, Everactive, Jack

(a start-up of AGC Automotive Europe), VAIMOO, Portal Instruments

and Epishine, have selected its supercapacitors for healthcare,

automotive, monitoring and solar end-use applications.

Like most businesses, the Company has experienced impacts due to

COVID-19. Local lockdowns in the Sydney area have meant that all

non-essential staff have had to work from home for most of the

year. The Company has also had to close production at Seven Hills

for short periods of time to reduce the risk of the spread of

COVID-19. Pleasingly, our production staff have now received at

least their first vaccination, and many have received their second.

Recruitment of engineers and technicians in Sydney has been delayed

due to Public Health Orders banning travel by candidates, which has

in turn delayed some production initiatives. Production efficiency

and output from Malaysia has been impacted by COVID-19. The ban on

CAP-XX engineers travelling to Malaysia; the compulsory shut down

of businesses there and a ban on bringing additional labour into

the country, have negatively impacted the Company's output. This

has also delayed production of our 3 Volt products, which requires

CAP-XX staff on site. On the demand side, a small but reducing

number of former Murata customers have advised the Company that

they are still holding large inventories of our products, due to

the combination of a short-term reduction in end customer demand

for their products, coupled with large final purchases made from

Murata before the production lines were closed for transfer.

Nevertheless, the Board believes that the Company has weathered

these impacts relatively well with product sales up 30% on the

previous year.

Licensing is also an important revenue stream for CAP-XX and the

Company continues to vigorously defend its intellectual property.

During the year, the Company investigated its options to recover

the US$4.95 million damages, plus legal fees awarded to the Company

against Ioxus, Inc. Ultimately, the Board decided that the

prospects for any recovery from the bankruptcy of Ioxus, Inc. or

related parties was very remote and didn't warrant further

expenditure. However, we will be alert for any breaches of the

Company's intellectual property by the new owner of the Ioxus

assets. CAP-XX continues to pursue a similar patent infringement

action against Maxwell Technologies, now a wholly owned subsidiary

of Tesla Inc., with the court-ordered mediation expected to

commence in the next few months. During the year the Company also

signed a licence agreement with Panasonic covering two expired

patents for a one-off fee. The level of the royalty payment

received from Panasonic was commensurate with Panasonic's modest

sales of supercapacitors and the royalty rates for other CAP-XX

licence agreements granted. The Company is now additionally in

dispute with one of its licencees over underpayment of royalties.

The Company is steadfast in its goal to be paid the royalties it

believes it is entitled to and will continue to pursue payment as

an integral part of vigorously defending its intellectual property.

In the meantime, the Company continues to develop new intellectual

property concerning supercapacitors and energy storage devices.

Total Company sales revenue for the year to 30 June 2021

increased by 14% to A$4.1 million (2020: A$3.6 million).

Pleasingly, product sales were up 30% from FY 2020, which is a

direct result of the strong pipeline of opportunities which have

been commented upon in prior year reports, recent trading updates

and the various announcements the Company has made. Licensing and

royalty revenues were down for the reasons mentioned above. The

reported EBITDA loss for the year to 30 June 2021 was a loss of

A$2.5 million (2020: loss of A$4.2 million), which includes the

amortisation of share-based payment expenses, Murata project

expenses, legal expenses for patent infringement and the adoption

of AASB16 in the prior year. When adjusted for these one-off

factors, the like for like comparison is an adjusted EBITDA Loss of

A$0.4 million (2020: loss of A$1.6 million).

During the year, 15 million employee share options were due to

expire. These options were all held in a single holding by the

Trustee of the Company's Employee Option Plan. This trust structure

had been set up in 2015 to provide legitimate tax benefits to the

Company's employees. At the expiry date, the Company's share price

was close to the option exercise price. As a result, the Trustee

and the employees agreed to exercise and sell the resulting shares

to minimise any cash calls on employees. In the process of

marketing the new shares resulting from the exercise of the

employee share options, the Company's joint broker, Cenkos,

identified extra demand for the Company's shares from institutional

investors. As a consequence, the Company agreed, following the

period end and in conjunction with the sale of the new shares

resulting from the exercise of options, to raise an additional

GBP2.6 million (net of expenses) through a placing of additional

shares. The funds from this placing will be used to commission the

DMH line, for new product development, new supply chain capability

and legal fees associated with patent infringement and

licencing.

The Board is confident that the successful commissioning of the

former Murata production lines will transform the Company's sales

and cash flow position.

Patrick Elliott

Chairman

29 September 2021

Business Review

Review of Operations and Activities

The Reported EBITDA loss for the year to 30 June 2021 was a loss

of A$2.5 million (2020: loss of A$4.2 million), which includes the

amortisation of share-based payment expenses. This loss also

includes A$2.8 million in Murata project expenses (a net figure of

A$1.6 million after the expected incremental R&D tax rebate)

(2020: A$2.1 million), A$0.3 million in legal expenses for patent

infringement, and approximately A$0.2 million for a one-off

increase in the bad debt provision. When adjusted for these one-off

factors, the like for like comparison was an adjusted EBITDA loss

of A$0.4 million (2020: loss of A$1.6 million).

Cash reserves as at 30 June 2021 were A$0.2 million, down from

A$2.9 million as at 30 June 2020.

The cash reserves were lower than expected due to underpayment

of royalties by a licencee, the sale of the employee share options

being delayed to after 30(th) June 2021, and an increase in legal

expenses in the last quarter related to patent infringement and

licencing. The 2021 year end cash position excludes the proceeds

after expenses of the recent capital raise (GBP2.6 million net of

expenses) and cash receipts following the exercise of employee

share options (GBP0.4 million). In addition, the Board anticipates

that the Company will be in receipt of a Federal Government R&D

tax rebate of approximately A$3.0 million, with these funds

expected to be received before the end of the current calendar

year. The Company continues to explore options to use a debt

facility to fund the Company's growth. However, in the current

climate the Board considers that many available debt-funding

options are too expensive. The Company does have a revolving line

of credit secured by the R&D tax rebate. There was A$1.4

million of this line of credit outstanding as at 30 June 2021, with

the proceeds from the recent capital raising being used to pay down

this facility.

As disclosed last year, two accounting adjustments need to be

taken into account when analysing the financial results for FY

2021. The first relates to the Company adopting AASB 16 from 1 July

2019. This standard replaces AASB 117 and for lessees eliminates

the classifications of operating leases and finance leases.

Straight-line operating lease expense recognition has been replaced

with a depreciation charge for the right-of-use assets (included in

operating costs) and an interest expense on the recognised lease

liabilities (included in finance costs). A full explanation of this

adjustment can be found in Note 6 in the Notes to the Financial

Statements within this announcement. The second adjustment relates

to the higher than historical Research and Development expenditure,

which is a direct result of the costs incurred in the relocation

and commissioning of the acquired Murata plant and equipment. A

material percentage of the expenditure incurred can be claimed as

eligible Research and Development expenditure under the current

Australian Taxation Office guidelines and is subject to a rebate.

The amount of eligible Research and Development expenditure for FY

2021 totalled A$7.0 million (2020: A$7.4 million) which will

generate an expected Government rebate of approximately A$3.0

million (2020: A$3.2 million) which is anticipated to be received

before the end of the current calendar year.

The Company's sales pipeline is robust with many of the

opportunities being converted to sales orders. The outstanding

sales order book as at 30 June 2021 was more than 160% higher than

at the same time in the previous year. Total product sales revenue

for the year to 30 June 2021 was A$3.5 million (2020: A$2.7

million) which represents a 30% year-on-year increase. The

contributing factors underlying this increase were sales of DMF and

DMT products manufactured by CAP-XX at Seven Hills and sales of

cylindrical can supercapacitors. These increases offset the

contribution from Licensing and Royalties which was down from the

previous year.

Operational expenditure, excluding the direct costs of the

Murata project, decreased by 10% from A$6.7 million to A$6.0

million. The decrease in expenditure is attributable to lower

travel expenses across all departments due to the COVID-19

restrictions and a decrease in legal expenses principally

associated with patent infringement cases.

Research and Development expenditure has been held steady in FY

2021, with the focus being the development of new intellectual

property around supercapacitors, energy storage and related

applications.

Business Environment

The Board believes that CAP-XX's technology provides a

significant competitive advantage over existing supercapacitor

manufacturers such as TDK Corporation, Skeleton, Eaton, LSMtron,

Nippon Chemicon Corporation and other Chinese and Korean

competitors. The Board believes that these companies are unable to

match the CAP-XX technology in terms of thinness, power density,

energy density and reliability. Most of the Company's competitors

only manufacture higher-capacity cylindrical cells used in large

package modules and focus on applications where the combination of

thinness, energy density and power density are not important

considerations for the customer. These competitor products usually

prove unsuitable for the various markets collectively labelled the

Internet of Things (IoT) market, which is the key area that CAP-XX

is targeting with the former Murata products and CAP-XX's existing

prismatic products.

As reported previously, IoT applications, one of the fastest

growing segments of the electronics market, provide one of the

greatest opportunities for CAP-XX's products. Driven by customer

requests, manufacturers are constantly moving to new wireless

protocols and adding to the functions and applications available on

IoT enabled devices. Some of these new functions require high

electrical power within the actual IoT device. Examples are

e-locks, drug dispensing, facial recognition, and haptic feedback.

Other devices are powered by energy harvesting and are

battery-less. Others use low power batteries such as 3 Volt coin

cell batteries. All of this means that power management continues

to be an increasingly important consideration. The other important

factor is size, as devices have tended to become smaller whilst

their electrical power demands have increased. The Company has been

successful in winning new business from a range of these markets,

such as industrial actuators, e-locks, agricultural sensors,

wireless displays, smart-meters, payment and handheld terminals,

medical wearables, automotive dashcams and communication

systems.

In the past, CAP-XX has faced competition in various markets

from cheaper cylindrical supercapacitors where our thin form

factor, high power and long life are not valued as highly as lower

initial cost components from competitors. To counteract this, the

Company released a range of cylindrical cells. Modest sales revenue

for these products was first recorded during FY 2019. Since then,

sales have continued to grow strongly on a year-on-year basis, with

the Company being successful in winning a number of large volume

orders. Several new large volume opportunities are currently being

evaluated by customers.

As previously articulated, automotive applications such as

truckStart, Stop-Start systems, regenerative energy capture or KERS

(Kinetic Energy Recovery Systems), distributed power, hybrid

electric vehicles and electric vehicles still present substantial

opportunities for large supercapacitors. A number of CAP-XX's

competitors are active in these markets, and the Board believes

that the Company has significant advantages over the competition in

certain applications. However, because of the significant resources

that each project requires and the long time lag between product

evaluation and mass production, the Board has taken the decision to

focus the Company's resources on IoT applications and take a lower

risk, longer-term, more patient approach to the opportunities for

large supercapacitors with the focus being on a small number of key

automotive projects.

Opportunities

The overall direct sales pipeline for CAP-XX's supercapacitors

continues to be large in quantum and varied in terms of the

targeted markets. The key IoT target markets remain similar to the

previous year, with IoT wearables, health, automotive, security,

smart-metering, energy harvesting and consumer products having the

most appeal and presenting the largest volume opportunities. While

many applications are strictly confidential and cannot be

disclosed, the Company has, over the last year, announced details

of several customers applications with the approval of those

customers.

Our customers' markets are constantly evolving as new products

and technologies threaten the incumbents. In this environment,

CAP-XX needs to always remain alert and be flexible to changing

business conditions and market needs. This creates opportunities to

offer products that address what our markets want.

CAP-XX is continuing to refine the products that it offers for

the various IoT applications and other markets. The Company has

introduced the Murata range of DMF and DMT thin prismatic

supercapacitors to address the space-constrained and/or

power-hungry needs of many IoT products. These products are already

being shipped from the Company's new Seven Hills factory. The

Company plans to commission and commence shipments of the very thin

DMH supercapacitor by next year. At only 400 microns in thickness,

the Board believes that this is the best performing supercapacitor

in its class.

The Company also plans to use its 3 Volt chemistry in certain

models of supercapacitors currently made in Malaysia. Assuming that

sales of these 3 Volt products are as expected, the Company will

eventually look to produce 3 Volt products on the DMF line at Seven

Hills. The development of the 3 Volt product has been targeted to

meet demand for small, inexpensive, energy efficient power

solutions for thin wearables, key FOBs and other IoT devices,

especially those using 3 Volt coin cell lithium ion batteries, such

as the CR2032 battery.

In the future, there is an opportunity to migrate this same 3

Volt technology into larger prismatic supercapacitors, automotive

modules and other products for high-energy, high-power

applications. As already noted, CAP-XX is concentrating on a small

number of automotive opportunities. To further increase the

Company's likelihood of success, the Board is investigating a

strategy of partnering with automotive and military Tier-1/Tier-2

suppliers, through either a new license agreement or a joint

venture, to supply the automotive markets. The Board believes that

such partnerships will be beneficial for all parties involved.

The Company intends to continue using its intellectual property

to develop additional substantial and recurring income. A

significant benefit of the existing licencing agreements is that

they validate CAP-XX's technology leadership in the field of

supercapacitors and energy storage, and the potential for

supercapacitors as a mainstream consumer electronics technology.

Our licensees' product lines and sales activities are also

increasing our exposure to markets and customers that were

previously beyond the Company's reach. It is also important to note

that the strategy of our licensees is to offer product ranges

targeted at certain end markets. As such, none of them meet the

product type or size requirements for all markets and all

applications, leaving scope for CAP-XX to supply these other

markets directly using products made by CAP-XX and its contract

manufacturers.

There remain several additional opportunities for the Company to

pursue new licencing arrangements. Some of these are at differing

stages of discussions. Others may require the Company to enforce

its patent rights through court action, as already noted in the

Chairman's statement.

Strategies for Growth

Given the increasing levels of market interest in CAP-XX's

technology and its high-performance supercapacitors, the Company

believes that the IoT markets, in particular, offer significant

opportunities for growth and to reach the key strategic objective

of CAP-XX achieving profitability and positive cashflow.

The Company continues to engage in discussions aimed at securing

business in the IoT space with a significant number of global

original equipment manufacturers (OEMs). CAP-XX is strengthening

its relationships with these organisations and has regular

engineering meetings with design teams, manufacturing groups and

contract manufacturers. The Company is unable to comment on

specific clients, but the Board is pleased with the overall

progress and is confident that the available market for

supercapacitors is increasing as manufacturers become more familiar

with the technology.

Over the last year, the Company has aligned its marketing

activities to specifically focus on a number of different IoT

markets, such as asset tracking, automotive, e-locks, medical

devices, handheld terminals, smart meters, wearables and wireless

sensors. The efforts to date have produced a significant increase

in visits to the Company's webpages and sales enquiries. The Board

expects for this growth to continue. CAP-XX's strong environmental

credentials, which have been recognised by the London Stock

Exchange providing the Company with its Green Economy Mark, are

consistent with this strategy.

The Company will continue to monitor new opportunities to

increase its sales, through its current distributors, via direct

sales to customers and new product offerings. These offerings may

take the form of complementary energy storage devices and modules.

The Company is also increasing the size of its own sales force and

adding new distributors to ensure that global coverage and

penetration is maximised.

It is important that the Company is able to benefit from the

large investment made over many years in building its patent

portfolio. Where third parties are found to be infringing these

patent rights, the Company has and will continue to vigorously

defend its rights, even if this means pursuing legal action as it

did successfully against Ioxus.

Research and Development

The markets in which the Company operates are competitive and

are characterised by rapid technological change. CAP-XX has a

strong competitive position in prismatic supercapacitors in all of

its target markets as a result of its capability to produce

supercapacitors with a high energy and power density in a small,

conveniently sized, flat package. CAP-XX's devices are also

lightweight, work over a broad temperature range and have an

operating lifetime measured in years.

To stay ahead of the competition, the Company is developing a

strong pipeline of new products to follow the 3 Volt products

already discussed. CAP-XX's R&D efforts are focused on a mix of

short, medium and long-term opportunities, covering new products,

cost reductions and improved product performance. CAP-XX has a

research facility within its Seven Hills site in Sydney, Australia,

where a team of six scientists work to maintain CAP-XX's leading

technology position in electrodes, separators and electrolyte

materials and their assembly into supercapacitor devices. This team

is supported by 12 engineers. During 2021, significant progress has

been made in a number of key areas including improvements on the

ex-Murata coating, DMF and DMT lines, new cell chemistries,

improving the life of cells, developing new packaging concepts,

reducing the cost per cell and developing new electronics to

optimise the performance of the Company's modules. CAP-XX has also

signed numerous collaboration agreements with leading research

institutions, whilst the Company's Scientific Advisory Board

provides CAP-XX with clear direction on commercially relevant

technologies for its ongoing R&D programme.

The Company's success depends on its ability to protect and

prevent any infringements of its intellectual property. To protect

this important asset, the Company has considerable intellectual

property embodied in its patents covering the design, manufacture

and use of its high-performance supercapacitors. The CAP-XX patent

portfolio currently consists of nine patent families, with 19

granted national patents with an additional four patent

applications pending in various jurisdictions. The Company's

intellectual property strategy has been to build value by focusing

on opportunities to capture market share and exclude competition,

with an IP portfolio capable of generating licensing revenue. The

Directors believe that comprehensive embodiments and interlocking

patent groups, combined with a 'quick to file, quick to abandon'

policy, have given the Company a strong and focused IP

portfolio.

Outlook

The major focus for CAP-XX continues to be to become profitable

and cashflow positive as soon as possible by leveraging the

successful commissioning of the newly installed former Murata

production equipment to facilitate increased product sales.

CAP-XX Limited

Consolidated statement of profit or loss

For the year ended 30 June 2021

Consolidated

2021 2020

Currency: Australian Dollars Notes $ $

Revenue from continuing operations 1 4,100,853 3,587,957

Cost of sales 2 (2,341,474) (1,721,152)

------------ -------------

Gross Profit 1,759,379 1,866,805

Other revenue 1 522 24,075

Other income 3 3,435,402 3,692,290

General and administrative

expenses (2,385,905) (2,819,282)

Process and engineering expenses (576,825) (906,693)

Selling and marketing expenses (902,950) (884,646)

Research and development expenses (1,484,203) (1,496,001)

Project expenses (2,766,537) (3,728,633)

Share based payments expense (105,113) (279,886)

Other expenses 4 (504,588) (376,744)

------------ -------------

Loss before income tax (3,530,818) (4,908,715)

------------ -------------

Income tax benefit - -

Net loss for the year (3,530,818) (4,908,715)

------------ -------------

Loss attributable to owners

of CAP-XX Limited (3,530,818) (4,908,715)

============ =============

Earnings per share for loss

attributable to the ordinary

equity holders of the Company Cents Cents

Basic loss per share 5 (0.8) (1.3)

Diluted loss per share 5 (0.8) (1.3)

CAP-XX Limited

Consolidated statement of comprehensive income

For the year ended 30 June 2021

Consolidated

2021 2020

Currency: Australian Dollars Notes $ $

Loss for the year (3,530,818) (4,908,715)

Other comprehensive income

Items that may be reclassified

subsequently to profit or loss

Exchange differences on translation

of foreign operations 38,766 (22,894)

Other comprehensive loss for

the year, net of tax 38,766 (22,894)

Total comprehensive loss for

the year attributable to owners

of CAP-XX Limited (3,492,052) (4,931,609)

CAP-XX Limited

Consolidated statement of financial position

As at 30 June 2021

Consolidated

June 30, 2021 June 30, 2020

Currency: Australian Dollars Notes $ $

ASSETS

Current assets

Cash and cash equivalents 182,601 2,895,482

Receivables 802,299 576,665

Inventories 1,066,265 1,290,248

Other 3,196,976 3,613,230

--------------- -----------------

Total current assets 5,248,141 8,375,625

--------------- -----------------

Non-current assets

Property, plant and equipment 3,039,208 1,557,015

Right of use assets 2,906,473 3,198,340

Other 204,808 204,808

--------------- -----------------

Total non-current assets 6,150,489 4,960,163

--------------- -----------------

Total assets 11,398,630 13,335,788

--------------- -----------------

LIABILITIES

Current liabilities

Payables 980,708 1,720,179

Lease liabilities 165,852 135,272

Provisions 734,051 641,358

Interest bearing liabilities 1,400,000 -

--------------- -----------------

Total current liabilities 3,280,611 2,496,809

--------------- -----------------

Non-current liabilities

Lease liabilities 2,414,646 2,524,557

Provisions 746,734 727,268

-----------------

Total non-current liabilities 3,161,380 3,251,825

--------------- -----------------

Total liabilities 6,441,991 5,748,634

--------------- -----------------

Net assets 4,956,639 7,587,154

=============== =================

EQUITY

Contributed equity 108,766,530 108,010,106

Reserves 6,433,864 6,289,985

Accumulated losses (110,243,755) (106,712,937)

-----------------

TOTAL EQUITY 4,956,639 7,587,154

=============== =================

Consolidated statement of cash flows

For the year ended 30 June 2021

Consolidated

2021 2020

Currency: Australian Dollars $ $

Cash flows from operating activities

Receipts from customers (inclusive

of goods and services tax) 3,892,287 3,645,279

Payments to suppliers and employees

(inclusive of goods and services

tax) (10,044,227) (9,822,550)

------------ -----------

(6,151,940) (6,177,271)

Tax credit received 3,142,561 1,590,983

Grants Received 387,902 207,904

Interest paid on lease liabilities (229,010) (102,220)

Interest received 522 24,075

------------ -----------

Net cash (outflow) from operating

activities (2,849,965) (4,456,529)

============ ===========

Cash flows from investing activities

Payments for property, plant

and equipment (1,708,614) (1,083,862)

Net cash (outflow) from investing

activities (1,708,614) (1,083,862)

============ ===========

Cash flows from financing activities

Proceeds from issue of shares

(net of costs) 613,224 6,094,441

Proceeds from borrowings 1,329,530

Principal repayments for lease

liability (135,822) (64,830)

Net cash inflow from financing

activities 1,806,932 6,029,611

============ ===========

Net increase/(decrease) in

cash and cash equivalents (2,751,647) 489,220

Cash and cash equivalents at

the beginning of the financial

year 2,895,482 2,429,156

Effects of exchange rate changes

on cash and cash equivalents 38,766 (22,894)

------------ -----------

Cash and cash equivalents at

the end of the financial year 182,601 2,895,482

============ ===========

Notes to the financial statements

Basis of preparation

The financial information included in this announcement does not

constitute statutory accounts within the meaning of the Australian

Corporations Act 2001. Whilst the financial information has been

computed in accordance with Australian equivalents to International

Financial Reporting standards and other authoritative

pronouncements of the Australian Accounting Standards Board, Urgent

Issues Group Interpretations and the Corporations Act 2001, this

announcement does not itself contain sufficient information to

comply with those requirements.

Note 1 Revenue Consolidated

2021 2020

$ $

Sale of Goods 3,516,344 2,708,697

License Fees & Royalties 584,509 879,260

4,100,853 3,587,957

--------- ---------

Other revenue

Interest 523 24,075

--------- ---------

523 24,075

--------- ---------

Note 2 Cost of Sale of Goods Consolidated

2021 2020

$ $

Direct materials and labour 2,155,076 1,575,024

Indirect manufacturing expenses 186,398 146,128

2,341,474 1,441,927

------------ ---------

Note 3 Other income Consolidated

2021 2020

$ $

Foreign Exchange Gains - (net) - 161,809

R&D Tax Incentive 3,047,500 3,324,481

Miscellaneous Income 387,902 206,000

----------------------------------- ----------

3,435,402 1,600,033

----------------------------------- ----------

Note 4 Other Expenses Consolidated

2021 2020

$ $

Provision for Withholding

Tax Diminution 16,615 48,094

Foreign Exchange Losses -

(net) 24,923 -

Provision for expected credit

loss 103,664 109,817

Provision for make good on

premises - 116,613

Interest - lease liabilities 232,666 102,220

Interest - R&D Advance 126,720 0

504,588 376,744

--------------- ------------------

Note 5 Loss per share Consolidated

2021 2020

$ $

Net loss (3,530,818) (4,908,715)

Loss per share - undiluted ($0.008) ($0.012)

Weighted Average Shares in

Issue during the year 449,700,290 381,242,863

Note 6 AASB16 Reconciliation Consolidated

2021 2020

$ $

Adoption of AASB 16 as at

1 July 2020 - 45,707

Balance from previous year 2,659,829 -

Additions 56,491 2,678,952

Interest on lease liabilities 229,010 102,220

Repayments on lease liabilities (364,832) (167,050)

Balance as at 30 June 2021 2,580,498 2,659,829

Consolidated

Note 7 EBITDA Calculation

2021 2020

$ $

Net loss - Reported (3,530,818) (4,908,715)

Net Project Expenditure 1,563,093 2,106,678

Patent Infringement expenses 315,421 667,344

AASB 16 - Lease expenses - 88,330

------------- --------------------

Bad Debt Provision 210,000

------------- --------------------

Net Loss - Adjusted (1,442,304) (2,813,395)

Depreciation 574,779 206,183

Share based payments 105,113 279,886

Interest expense 359,386

Interest Income (522) (24,075)

Adjusted EBITDA (403,548) (1,584,369)

------------- --------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR UWUORAUUKUUR

(END) Dow Jones Newswires

September 29, 2021 02:00 ET (06:00 GMT)

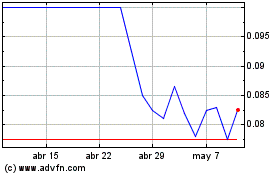

Cap-xx (LSE:CPX)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Cap-xx (LSE:CPX)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024