TIDMCPX

RNS Number : 2718Q

CAP-XX Limited

25 February 2021

Dissemination of a Regulatory Announcement that contains inside

information for the purposes of Regulation 11 of the Market Abuse

(Amendment) (EU Exit) Regulations 2019/310 .

25 February 2021

CAP-XX Limited

("CAP-XX" or the "Company")

Interim Results for the half-year ended 31 December 2020

CAP-XX Limited, a world leader in the design and manufacture of

thin, flat supercapacitors and energy management systems, is

pleased to announce its interim results for the half-year ended 31

December 2020.

Key highlights

-- Adjusted EBITDA profit was A$0.32 million compared to the

corresponding half-year loss of A$(0.44 million)*.

-- EBITDA loss of A$0.9 million* (2019: loss of A$0.8 million*)

is in line with the corresponding half-year period to 31 December

2019, but does include the Murata Project expenditure of A$2.0

million (2019: Nil).

-- Total Sales Revenue of A$2.1 million (2019: A$1.9 million) up 10%

-- Product Revenue of A$1.7 million (2019: A$1.4 million) is up 26%

-- Royalty and license fees were A$0.4 million (2019: A$0.6 million)

-- Project to transfer the former Murata manufacturing assets

has made excellent progress with key project deliverables and

milestones on track

-- Order book double the level as at the same time last year

driven by IoT markets. Customer demand building. Potential demand

already exceeds annual capacity

-- Increasing interest from global multinational companies.

Design win achieved with Tier 1 Auto supplier. Approved as supplier

to global smart phone manufacturer

-- Vigorously pursuing several companies for patent infringement

-- Operating expenses of A$2.5 million (2019: A$ 2.8 million),

excluding share-based payments expense and Murata project expenses,

reduced due to lower patent infringement expenses and overseas

travel

-- Cash reserves at the end of December 2020 were A$0.5 million

(2019: A$1.8 million) which does not include the proceeds of the

R&D Tax Rebate of A$3.1 million received in January 2021

* EBITDA excludes amortisation of employee share options.

Adjusted EBITDA excludes amortisation of employee share options,

Murata project costs and any related R&D tax rebate, patent

infringement expenses and AASB16 lease costs

Anthony Kongats, CEO of CAP-XX said:

"We are delighted with both the progress of the Murata project

and the strength of the underlying business, against the

unprecedented background resulting from Covid-19. We enter the

second half of the year with a strong order book and rising enquiry

levels as we raise production levels at our newly installed

manufacturing facility."

Electronic copies of CAP-XX's interim results for the half-year

ended 31 December 2020 will shortly be available from the Company's

website: www.cap-xx.com .

For further information contact:

CAP-XX Limited

Anthony Kongats (Chief Executive Officer) +61 (0) 2 9428 0139

Kreab (Financial PR)

Robert Speed +44 (0) 20 7074 1800

Allenby Capital (Nominated Adviser and Broker)

David Hart / Alex Brearley (Corporate Finance +44 (0) 20 3328 5656

Tony Quirke (Sales and Corporate Broking)

More information is available at www.cap-xx.com

Notes to Editors:

CAP-XX (LSE: CPX) is a world leader in the design and

manufacture of thin, flat supercapacitors and energy management

systems used in portable and small-scale electronic devices, and to

an increasing extent, in larger applications such as automotive and

renewable energy. The unique feature of CAP-XX supercapacitors is

their very high power density and high energy storage capacity in a

space-efficient prismatic package. These attributes are essential

in power-hungry consumer and industrial electronics, and deliver

similar benefits in automotive and other transportation

applications. For more information about CAP-XX, visit

www.cap-xx.com

Chairman's statement

The first half of the current financial year has been characterised

by strong sales demand. Product sales at A$1.7m are up 26% on the

corresponding period last year (A$1.4m) and the order book at the

end of December 2020 was 75% higher than at the same time last year.

Furthermore, since the period end the order book has continued to

grow and as at the end of January stood at over 100% higher than

at the end of January 2020. Pleasingly, the growth in the order

book is well spread, coming from all geographic regions and from

different Internet of things (IoT) related market segments. Conversely,

Royalty payments from AVX and Murata have stagnated. Total revenue

was up 10% at A$2.1m compared to A$1.9m. The reported Net Loss for

the period was A$(1.2m) including Murata project expenses of A$2.0m.

This compared to a Net Loss of A$(1.0m) for the corresponding period

last year. If project costs and their related R&D tax rebate, patent

infringement expenses, amortisation of employee share options and

AASB16 lease expenses are excluded, then the adjusted EBITDA profit

was A$0.32m compared to a loss of A$(0.44m) for the corresponding

period last year. Cash at the end of December 2020 was A$0.5m before

the receipt of the A$3.1m R&D tax rebate in early January 2021.

Our sales and marketing focus on IoT market segments has delivered

good results. The Board believes that demand for both non-cellular

and cellular IoT devices is growing rapidly. Sales for automotive

accessories, electronic locks and battery-less energy harvesting

products have been particularly strong. At the same time, the Company

achieved several new design wins in wearables, consumer, medical

and automotive products. Pleasingly, the Company is seeing increasing

interest in its products from global multinational companies. The

Company has notably achieved a design win with a global Tier-1 automotive

component supplier for passenger vehicle door locking and climate

control applications and is working on a second project related

to data logging with the same Tier-1 supplier as it completes the

formal supplier accreditation process. This Tier-1 supplier was

previously a customer of Murata. In addition, CAP-XX has been approved

as a supplier by a leading global smart phone manufacturer. In the

area of energy harvesting, the Company is working with Epishine

of Sweden and ePeas of Belgium to introduce battery-less solutions

for a range of IoT products. The three companies will be jointly

hosting a training webinar for prospective customers next month.

Announcements of other collaborations are expected over the coming

months.

As previously reported, the global pandemic has continued to impact

the Company most noticeably in our various manufacturing activities.

The Company had planned and agreed to bring in a number of Japanese

engineers and experts to assist it with the commissioning of the

new production lines at Seven Hills. However, global travel restrictions,

limited international flights and mandatory hotel quarantine requirements,

made this impossible. Subsequently, the Company's engineers, with

the assistance of Murata and other Japanese equipment suppliers,

revised the plans for the commissioning of the production lines

to continue under remote assistance and guidance from Japan. It

is a credit to everyone involved that the Company was still able

to complete the commissioning of the production lines and construction

of the new 3,300 sq. metre facility within the original budget proposed,

which was set well before the start of the pandemic.

The electrode, DMF and DMT production lines are now commissioned

and operational, with product shipping to customers. The current

output and key performance metrics are currently tracking in line

with our expectations. As expected at this stage of production,

the Company is continuing to address small incremental improvements

and is hiring additional staff for the Seven Hills facility. We

expect to see steady improvement over the remainder of 2021. The

Board is confident that target outputs and other key performance

metrics will be reached by the end of 2021 as initially planned.

The commissioning of the fourth production line, the DMH line, is

still planned for the latter half of 2021, with production expected

to start in early 2022 as time and resources allow and subject to

customer demand.

CAP-XX's Malaysian operations have also been impacted by the pandemic.

Various Malaysian government mandated lockdowns have restricted

the Company's ability to increase output as fast as management would

have liked in response to the growing sales order book. Most noticeably,

we have faced delays in recruiting additional staff and have been

unable to travel from Seven Hills to Malaysia to oversee pre-production

manufacturing of new products and processes. Nevertheless, CAP-XX

has successfully increased output and expects output to increase

further over the coming months.

R&D activities continue to progress and promising developments in

new intellectual property were made to reduce supercapacitor production

costs, increase cell voltage and improve product performance, using

new materials.

Licensing remains an important revenue stream for CAP-XX and the

Company continues to defend its intellectual property. CAP-XX continues

to vigorously pursue its patent infringement action against Maxwell

Technologies, now a wholly owned subsidiary of Tesla Inc. and other

companies. The same Delaware court which ruled in favour of CAP-XX

against Ioxus is also hearing the case against Maxwell Technologies

and has issued a timetable for resolution of this matter. Court

mediation is scheduled for September 2021 and if the matter is not

resolved trial is scheduled for October 2022. The Board remains

optimistic of the Company's prospects in this matter. CAP-XX is

continuing to pursue Ioxus for the payment of the awarded damages.

However, it remains unclear whether Ioxus will be capable of paying.

The Company is also in discussions with other companies about licencing

opportunities.

The Board is confident that the commissioning of the Murata production

lines will transform the Company's revenue position with a consequential

benefit to cash flow and the cash position of the Company.

Patrick Elliott

Chairman

CAP-XX Limited

Consolidated statement of profit or loss

For the half-year ended 31 December 2020

Consolidated

Half-year 2020 Half-year 2019

Currency: Australian Dollars $ $

Revenue from sale of goods and

services 2,126,564 1,932,591

Cost of sale of goods and services (1,158,340) (862,558)

------------------- ----------------

Gross margin (loss) on sale of

goods and services 968,224 1,070,033

Other revenue 501 9,964

Other income 2,292,781 941,678

General and administrative expenses (944,949) (1,205,098)

Process and engineering expenses (229,994) (478,521)

Selling and marketing expenses (437,791) (404,326)

Research and Development expenses (740,021) (746,771)

Project expenses (2,017,614) -

Share based payments (68,192) (173,774)

Other expenses (67,250) (42,127)

------------------- ----------------

(Loss) before income tax (1,244,305) (1,028,942)

------------------- ----------------

Income tax benefit/(expense) - -

Net loss after income tax for

the half year (1,244,305) (1,028,942)

------------------- ----------------

(Loss) attributable to members

of CAP-XX Limited (1,244,305) (1,028,942)

=================== ================

L oss per share attributable Cents Cents

to the ordinary equity holders

of the company

Basic loss per share (0.28) (0.32)

Diluted loss per share (0.28) (0.32)

CAP-XX Limited

Consolidated statement of comprehensive income

For the half year ended 31 December 2020

Consolidated

2020 2019

Currency: Australian Dollars $ $

Loss for the half year (1,244,305) (1,028,942)

Other comprehensive income

Items that may be reclassified

subsequently to profit or loss

Exchange differences on translation

of foreign operations 102,943 (13,919)

Other comprehensive loss for

the half year, net of tax 102,943 (13,919)

Total comprehensive loss for

the half year attributable

to owners of CAP-XX Limited (1,141,362) (1,042,861)

CAP-XX Limited

Consolidated statement of financial position

As at 31 December 2020

Consolidated

31 December 31 December

2020 2019

Currency: Australian $ $

Dollars

ASSETS

Current assets

Cash and cash equivalents 469,472 1,751,424

Receivables 455,454 466,152

Inventories 1,041,169 1,503,159

Other 5,698,264 1,629,358

------------------- ------------------

Total current assets 7,664,359 5,350,093

------------------- ------------------

Non-current assets

Property, plant and

equipment 2,624,744 1,110,317

Right of Use Assets 3,059,608 -

------------------- ------------------

Other 204,808 236,507

------------------- ------------------

Total non-current assets 5,889,160 1,346,824

------------------- ------------------

TOTAL ASSETS 13,553,519 6,696,917

------------------- ------------------

LIABILITIES

Current liabilities

Payables 1,489,078 546,399

Lease Liabilities 268,051 -

Advance payments -

Current 1,442,900

Provisions 1,401,354 833,431

Total current liabilities 4,601,383 1,379,830

------------------- ------------------

Non-current liabilities

Lease Liabilities 2,241,620

Provisions 53,332 41,738

Total non -current

liabilities 2,294,952 41,738

------------------- ------------------

TOTAL LIABILITIES 6,896,335 1,421,568

------------------- ------------------

NET ASSETS 6,657,184 5,275,349

=================== ==================

EQUITY

Contributed equity 108,153,306 101,915,665

Reserves 6,461,120 6,192,848

Accumulated losses (107,957,242) (102,833,164)

------------------

TOTAL EQUITY 6,657,184 5,275,349

=================== ==================

CAP-XX Limited

Consolidated statements of changes in equity

For the half-year ended 31 December 2020

Consolidated

Contributed Accumulated

Equity Reserve losses Total

$ $ $ $

Balance at 1 July

2019 101,915,665 6,032,993 (101,804,222) 6,144,436

--------------- -------------------------- ------------------ ---------------

Loss for the period

as reported in the

2019 financial statements - (4,908,715) (4,908,715)

--------------- -------------------------- ------------------ ---------------

Other comprehensive

loss - (22,894) - (22,894)

Transactions with

owners in their capacity

as owners:

Contributions of equity,

net of transaction

costs and tax 6,094,441 6,094,441

Employee share options

-- value of employee

services - 279,886 - 279,886

Balance at 30 June

2020 108,010,106 6,289,985 (106,712,937) 7,587,154

--------------- -------------------------- ------------------ ---------------

Profit for the period

as reported in the

2020 interim financial

statements - - (1,244,305) (1,244,305)

Other comprehensive

income - 102,943 - 102,943

Transactions with

owners in their capacity

as owners:

Contributions of equity,

net of transaction

costs and tax 143,200 - - 143,200

Employee share options

-- value of employee

services - 68,192 - 68,192

Balance at 31 December

2020 108,153,306 6,461,120 (107,957,242) 6,657,184

--------------- -------------------------- ------------------ ---------------

CAP-XX Limited

Consolidated Statement of Cash Flows

For the half-year ended 31 December 2020

Consolidated

Half-year 2020 Half-year 2019

Currency: Australian Dollars $ $

Cash flows from operating activities

Receipts from customers (inclusive

of goods and services tax) 2,460,431 1,913,899

Payments to suppliers and employees

(inclusive of goods and services

tax) (5,397,193) (3,642,199)

------------------- -------------------

(2,936,762) (1,728,300)

Tax credit received - 1,592,042

Interest received 501 9,964

------------------- -------------------

Net cash (outflow) from operating

activities (2,936,261) (126,294)

=================== ===================

Cash flows from investing activities

Payments for property, plant

and equipment (1,178,792) (537,519)

Net cash (outflow) from investing

activities (1,178,792) (537,519)

=================== ===================

Cash flows from financing activities

Proceeds from issue of shares 143,200 -

Advance payments 1,442,900 -

Net cash inflow from financing

activities 1,586,100 -

=================== ===================

Net (decrease) in cash and cash

equivalents (2,528,953) (663,813)

Cash and cash equivalents at

the beginning of the half-year 2,895,482 2,429,156

------------------- -------------------

Effects of exchange rate changes

on cash and cash equivalents 102,943 (13,919)

=================== ===================

Cash and cash equivalents at

the end of the half-year 469,472 1,751,424

=================== ===================

This general purpose interim financial report, for the half-year

reporting period ended 31 December 2020, has been prepared in

accordance with Australian equivalents to International Financial

Reporting Standards (AIFRSs), other authoritative pronouncements of

the Australian Accounting Standards Board, Urgent Issues Group

Interpretations and the Corporations Act 2001. This general purpose

interim financial report, for the half-year reporting period ended

31 December 2020, is unaudited.

-ENDS-

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR TIMTTMTATTAB

(END) Dow Jones Newswires

February 25, 2021 02:00 ET (07:00 GMT)

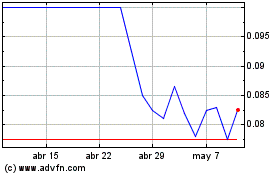

Cap-xx (LSE:CPX)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Cap-xx (LSE:CPX)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024