CML Microsystems PLC Result of AGM (6056H)

04 Agosto 2021 - 9:55AM

UK Regulatory

TIDMCML

RNS Number : 6056H

CML Microsystems PLC

04 August 2021

4 August 2021

CML Microsystems Plc

Results of the 2021 Annual General Meeting

CML Microsystems Plc (the "Group" or the "Company"), which

develops mixed-signal, RF and microwave semiconductors for global

communications markets, today held its Annual General Meeting

("AGM") at 11.00am, Wednesday 4 August 2021. All resolutions put to

the shareholders as set out in the Notice of AGM dated 25 June 2021

were passed with the requisite majorities on a show of hands.

Details of the proxy and CREST votes cast are as follows:

Resolution For % Against % Withheld %

1. To receive and adopt the Group's consolidated

financial statements and reports of the Directors

and auditor for the year ended 31(st) March 2021. 13,696,101 100.00 0 0.00 0 0.00

----------- ------- ---------- ------ --------- -----

2. To receive and approve the Directors' Remuneration

Report for the year ended 31(st) March

2021. 11,569,115 84.47 1,914,239 13.98 212,747 1.55

----------- ------- ---------- ------ --------- -----

3. To declare a final dividend of 50.0p per 5p ordinary

share for the year ended 31(st) March

2021. 13,696,101 100.00 0 0.00 0 0.00

----------- ------- ---------- ------ --------- -----

4. To re-appoint J Lindop as Director, who retires from

the Board by rotation. 13,694,625 99.99 1,276 0.01 200 0.00

----------- ------- ---------- ------ --------- -----

5. To send or supply all documents or information

relating to the Company to members by making

them available on a website. 13,694,441 99.99 1,000 0.01 660 0.00

----------- ------- ---------- ------ --------- -----

6. To appoint BDO LLP, as auditor of the Company. 13,695,101 99.99 1,000 0.01 0 0.00

----------- ------- ---------- ------ --------- -----

7. To authorise the Directors to determine the

remuneration of the auditor. 13,695,101 99.99 1,000 0.01 0 0.00

----------- ------- ---------- ------ --------- -----

8. To authorise the Directors to cancel the listing of

the Company on the standard segment

of the Official List of the Financial Conduct Authority

and admission to trading on the London

Stock Exchange plc's Main Market for listed securities

and to apply for admission of the said

ordinary shares to trading on AIM, a market operated by

London Stock Exchange plc 13,692,001 99.97 1,000 0.01 3,100 0.02

----------- ------- ---------- ------ --------- -----

9. To authorise the Directors to allot shares. 13,680,362 99.89 12,639 0.09 3,100 0.02

----------- ------- ---------- ------ --------- -----

10. To disapply the pre-emption provisions of The

Companies Act 2006. 13,680,162 99.88 12,099 0.09 2,840 0.02

----------- ------- ---------- ------ --------- -----

11. To disapply the pre-emption provisions of The

Companies Act 2006 for the purposes of financing

an acquisition or capital investment. 10,980,972 80.18 2,711,289 19.80 2,840 0.02

----------- ------- ---------- ------ --------- -----

12. To renew the authority to the Company to make market

purchases of its own shares. 13,692,185 99.97 276 0.00 2,640 0.02

----------- ------- ---------- ------ --------- -----

In accordance with Listing Rule 9.6.2R, a copy of the

Resolutions passed at the AGM will be submitted to the National

Storage Mechanism where it will shortly be available at

https://www.fca.org.uk/markets/primary-markets/regulatory-disclosures/national-storage-mechanism

.

Following the passing of the resolutions 8, the Group today

expects to make an application to cancel the Company's admission to

the Official List and to trading on the Main Market

("Cancellation") and seek admission to trading on AIM

("Admission"). The Cancellation is expected to become effective at

8.00 a.m. on 3 September 2021 and Admission is expected to become

effective at 8.00 a.m. on the same date, 3 September 2021.

CML Microsystems Plc www.cmlmicroplc.com

Chris Gurry, Group Managing Tel: +44(0)1621 875 500

Director

Nigel Clark, Group Executive

Chairman

Shore Capital Tel: +44(0)20 7408 4090

Edward Mansfield

James Thomas

John More

SP Angel Corporate Finance Tel: +44(0)203 463 2260

LLP

Jeff Keating

Alma PR

Josh Royston Tel: +44 (0)20 3405 0212

Caroline Forde

Robyn Fisher

Andy Bryant

Matthew Young

About CML Microsystems PLC

CML develops mixed-signal, RF and microwave semiconductors for

global communications markets. The Group utilises a combination of

outsourced manufacturing and in-house testing with trading

operations in the UK, Asia and USA. CML targets sub-segments within

Communication markets with strong growth profiles and high barriers

to entry. It has secured a diverse, blue chip customer base,

including some of the world's leading commercial and industrial

product manufacturers.

The spread of its customers and diversity of the product range

largely protects the business from the cyclicality usually

associated with the semiconductor industry. Growth in its end

markets is being driven by factors such as the appetite for data to

be transmitted faster and more securely, the upgrading of telecoms

infrastructure around the world and the growing prevalence of

private commercial wireless networks for voice and/or data

communications linked to the industrial internet of things

(IIoT).

The Group is cash-generative, has no debt and is dividend

paying.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

RAGSSDFLLEFSEIA

(END) Dow Jones Newswires

August 04, 2021 10:55 ET (14:55 GMT)

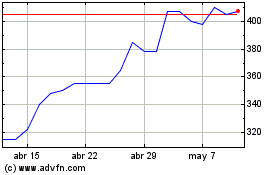

Cml Microsystems (LSE:CML)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Cml Microsystems (LSE:CML)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024