TIDMCVSG

RNS Number : 6886M

CVS Group plc

23 September 2021

For Immediate Release 23 September 2021

CVS GROUP plc

("CVS", the "Company" or the "Group")

Final results for the year ended 30 June 2021

CVS, one of the UK's leading providers of integrated veterinary

services, is pleased to announce its final results for the year

ended 30 June 2021.

Financial Highlights

GBPm except where stated 2021 2020 Change

%(5)

----------------------------------- ------ ------ -----------

Revenue 510.1 427.8 19.2%

Group like-for-like ("LFL") sales

growth (%)(1) 17.4% 0.7% +16.7 ppts

Adjusted EBITDA (2) 97.5 71.0 37.3%

Adjusted EBITDA(2) margin (%) 19.1% 16.6% +2.5 ppts

Adjusted profit before income tax

(3) 66.2 38.2 73.3%

Adjusted earnings per share (4)

(p) 75.1 42.0 78.8%

Operating profit 40.1 18.5 116.8%

Profit before income tax 33.1 9.9 234.3%

Basic earnings per share (p) 27.3 8.1 237.0%

----------------------------------- ------ ------ -----------

Notes

1. Like-for-like sales are defined as revenue generated from

like-for-like operations compared to the prior year, adjusted for

the number of working days. For example, for a practice acquired in

September 2019, revenue is included in the like-for-like

calculations from September 2020.

2. Adjusted Earnings Before Interest, Tax, Amortisation and

Depreciation ("adjusted EBITDA") is profit before income tax

adjusted for interest (net finance expense), depreciation,

amortisation, costs relating to business combinations and

exceptional items. Adjusted EBITDA is used as a financial metric

that removes the cost of debt, costs relating to depreciation and

amortisation and one-off costs to get a normalised earnings figure

that is not distorted by irregular items or structural

investment.

3. Adjusted profit before income tax is calculated as profit

before amortisation, taxation, costs relating to business

combinations and exceptional items.

4. Adjusted earnings per share is calculated as adjusted profit

before income tax less applicable taxation divided by the weighted

average number of Ordinary shares in issue in the year.

5. Leverage on a bank test basis is drawn bank debt less cash at

bank; divided by adjusted EBITDA annualised for the effect of

acquisitions, including costs relating to business combinations and

excluding share option costs and exceptional items, prior to the

adoption of IFRS 16.

Financial Highlights

-- Revenue increased by 19.2%, to GBP510.1m from GBP427.8m, with

strong group like-for-like(1) growth of 17.4% benefitting from

favourable market dynamics and a continued focus on providing high

quality care to our clients and their animals

-- The Group delivered adjusted EBITDA(2) growth of 37.3%, to

GBP97.5m from GBP71.0m, through an increase in revenue across all

divisions and effective management of costs

-- Profit before income tax increased by 234.3% to GBP33.1m from GBP9.9m

-- Leverage(5) fell to 0.68x from 1.14x as a result of strong

EBITDA growth and reduction in net debt

-- Cash generated from operations decreased to GBP80.3m from

GBP94.8m despite the increase in adjusted EBITDA, due to VAT and

taxes deferred in the prior year due to COVID-19, paid in the

current year

Operational Highlights

-- The last year has provided many challenges across our

industry, but our people have demonstrated resilience and continued

excellence throughout

-- As well as offering first class care to sick or injured

animals we are continually improving the levels of preventative

health care through our Healthy Pet Club

-- Our annual Quality Improvement report reflects our commitment

to patient safety and consistent clinical improvement, and has

gained us significant recognition in the profession, not least by

our regulator the Royal College of Veterinary Surgeons ("RCVS")

-- We are committed to enhancing the clinical services we offer,

particularly in the quality of our facilities and as such we have

completed 13 refurbishments and relocations in FY21

-- We have continued to organically grow our revenues,

supplementing this with nine synergistic acquisitions during the

year

Current trading & Outlook

-- Total sales growth of 17.5% (31 August 2020: 3.5%) in the

first two months of the new financial year (vs same period in

previous year) with like-for-like sales(1) of 14.4% (prior year:

3.9%) benefitting from a further price increase put through in July

2021 in addition to the delayed price increase implemented in

January 2021

-- Strong adjusted EBITDA(2) margin of 19.5% for the two month

period (Prior year equivalent period: 18.7%)

-- Stable vet vacancy rate, averaging 8.8% for the last twelve

months (LTM) to the end of August 2021 (Prior year LTM: 6.8%) with

continued initiatives to attract and retain our talent

including:

o Acceleration of annual pay increase with effect from 1 July

2021 to align with the start of our financial year;

o Remuneration changed in line with feedback focusing more on

fixed income for clinicians and introducing bonus schemes that

reward collaboration across the Group; and

o Additional day's holiday for every year worked at CVS, up to a

maximum of 5 years

-- Continued growth in Healthy Pet Club scheme to 455,000

members at 31 August 2021 (+7.9% compared to 31 August 2020)

-- One new acquisition made since the year end

-- Leverage(5) flat at 0.7x (31 August 2020: 0.8x)

Richard Fairman, Chief Executive Officer commented:

"We have delivered a very strong performance for the year with

credit to every single one of our colleagues for their

extraordinary efforts to provide the best possible service to our

customers and their animals, against a difficult backdrop of

restrictions and evolving regulatory guidance. These results

demonstrate the resilience of our fully integrated veterinary model

and our commitment to providing the very highest standards of

clinical care.

We continue to expand and develop our business, and, alongside

our ongoing investments in high quality facilities and practices,

we have welcomed a number of new vets and nurses to the Group, as

demand for veterinary services continues to increase in light of

rising pet ownership.

We see a number of opportunities to grow the business, through

favourable consumer trends, further improving our specialist

offering and by continuing to make investment in support. Although

management expectations for the full year are not based on

attaining annual growth at the high levels of the first two months,

the very positive start to the new financial year is encouraging.

We remain focused on providing first class veterinary care and look

forward with confidence."

Results webcast

Management will host a live webcast and Q&A for analysts and

investors at 9am GMT this morning. Those wishing to join should

email CVSGroup@mhpc.com for the registration details. For those

unable to join, there will be a playback facility available on the

CVS website later today at

www.cvsukltd.co.uk/investor-centre/investor-presentation .

This announcement is released by CVS Group plc and contains

inside information for the purposes of the retained UK version of

the EU Market Abuse Regulation (EU) 596/2014 ("UK MAR"),

encompassing information relating to trading for the Company's

current financial year, and is disclosed in accordance with the

Company's obligations under UK MAR. This announcement is being made

on behalf of the Company by the directors named below.

An electronic copy of the Annual Report for the year ended 30

June 2021 is being made available on the Company's website at

www.cvsukltd.co.uk/investor-centre/annual-reports

Contacts

CVS Group plc via MHP Communications

Richard Fairman, CEO

Ben Jacklin, COO

Robin Alfonso, CFO

Singer Capital Markets (Nominated Adviser & Broker) +44 20

7496 3000

Aubrey Powell / Rachel Hayes / Jen Boorer

MHP Communications (Financial PR) +44 20 3128 8549

Andrew Jaques / Simon Hockridge / Rachel Mann / Charles

Hirst

About CVS Group plc

CVS Group is a fully integrated provider of veterinary services

in the UK, with practices in the Netherlands and the Republic of

Ireland. CVS is focused on providing high quality clinical services

to its customers and their animals, with outstanding and dedicated

clinical teams and support colleagues at the core of its

strategy.

The Group has 506 veterinary practices across its three markets,

including eight specialist referral hospitals and 34 dedicated

out-of-hours sites. Alongside the core Practices division, CVS

operates Laboratories (providing diagnostic services to CVS and

third parties), Crematoria (providing pet cremation and clinical

waste disposal for CVS and third party practices), Buying Groups

and the Group's online retail business (Animed Direct).

The Group employs c. 7,200 personnel, including c. 2,000

veterinary surgeons and c. 2,500 nurses.

Further information is available via the Company's website, at

www.cvsukltd.co.uk

Chairman's statement

"Well positioned to deliver further growth in shareholder

value"

Introduction

When I wrote to you last year, CVS was emerging from the first

phase of an unprecedented period of disruption caused by the

COVID-19 pandemic. Over the past year, we have continued to face

challenges but have taken a number of appropriate and decisive

actions as a Board. Through this effective leadership, combined

with the ongoing dedication of our colleagues, I am delighted that

CVS has demonstrated the resilience of its business model and has

emerged as a stronger business with excellent growth opportunities

ahead.

The fundamental strength of CVS is our people and this has been

a key factor in our strong performance over the past year. CVS

colleagues have continued to work tirelessly to provide high

quality care to our clients and their patients and, on behalf of

the Board, I would like to take this opportunity to thank them all

for their hard work and commitment.

Strong financial performance

CVS has delivered improved financial performance in the past

financial year as a result of positive momentum in trading across

the group.

We generated revenue growth of 19.2% which reflects strong

organic growth, with like-for-like sales increasing by 17.4% for

the Group. This reflects an increased client base and our continued

focus on delivering high quality clinical care. We completed nine

acquisitions during the financial year and revenue of GBP6.1m was

generated from these (2020: four acquisitions with revenue of

GBP4.3m).

Our adjusted EBITDA increased by 37.3% to GBP97.5m (2020:

GBP71.0m) reflecting good performance across all areas of our

business and close control of expenses. Adjusted EPS increased by

78.8% to 75.1p (2020: 42.0p).

Profit before income tax increased by 234.3% to GBP33.1m (2020:

GBP9.9m). This dual benefit of the increase in revenue and the

careful management of costs has resulted in significant improvement

in returns. Basic EPS increased by 237.0% to 27.3p (2020:

8.1p).

We continued to generate strong cash flow from operations of

GBP80.3m (2020: GBP94.8m), with the year-on-year decrease of 15.3%

due to the repayment of VAT of GBP15.0m to HMRC, which was deferred

from 2020 under the COVID-19 VAT Deferral scheme.

Strategic progress

We have a very clear purpose to provide the best possible care

to animals and this is underpinned by our vision to be the

veterinary company people most want to work for.

In recognition of the essential part our colleagues play in the

success of CVS, we have continued to review reward and benefits

across CVS to ensure we remain well positioned to retain and

attract the very best talent in the profession. We also support

employee shareholding in CVS and, with this in mind, we increased

the discount to 20.0% for our latest employee Save As You Earn

scheme which launched in November 2020.

We continue to expand our colleague base in response to the

increased demand for our integrated veterinary services,

particularly in light of a growing pet population. In the year

ended 30 June 2021, CVS employed an average of 7,241 colleagues

(2020: 6,761) including 1,962 veterinary surgeons (30 June 2020:

1,781) and 2,548 nurses (30 June 2020: 2,359) who we support

through our comprehensive training and development programmes.

We have delivered strong underlying financial performance over

the past year from a focus on organic growth through the delivery

of first class clinical care. We continue to invest in improving

our practice facilities and clinical equipment, completing 13

practice refurbishment and relocation projects in the past

financial year. We have also announced plans to create a

specialist, multi-disciplinary referral hospital in Bristol and

look forward to welcoming our first clients to this new facility in

2022.

Alongside our focus on organic growth and our continued

investment in practice and clinical facilities, we are well placed

to make further acquisitions of first opinion veterinary practices.

Acquisitions can widen our offer of high quality and integrated

veterinary services, whilst augmenting our organic growth,

positioning CVS well to deliver further growth in shareholder value

over the medium term.

Governance and the Board

We remain committed to the highest levels of corporate

governance and, as an AIM-quoted company, we voluntarily adopt the

FRC UK Corporate Governance Code (2018).

We are committed to ensuring we have the right balance of skills

and experience within the Board. In July 2020, we appointed an

additional Non-Executive Director, Richard Gray. Richard is the

Chair of the Nominations Committee.

Our Senior Independent Non-Executive Director, Mike McCollum has

announced his intention to stand down, after serving for eight and

a half years, and will leave CVS at the end of his current service

agreement, which expires on 23 September 2021. On behalf of the

Board, I would like to take this opportunity to thank Mike for his

tremendous service and to wish him every success in the future.

The Nominations Committee is proposing that we appoint David

Wilton as a new Non-Executive Director on 24 September 2021 to

replace Mike McCollum as Audit Committee Chair. David is a

Chartered Accountant and has a wealth of experience in senior

financial roles, most recently as Chief Financial Officer of Sumo

Group plc. In light of Mike McCollum's departure, Deborah Kemp will

become the Senior Independent Director.

On 16 August 2021, we appointed Jenny Farrer as our new Company

Secretary. Jenny is a Chartered Governance Professional and has a

wealth of experience in company secretarial roles.

I am delighted to welcome David and Jenny to CVS.

In the year, we consulted with major shareholders on governance

and other matters and, in light of their feedback and independence

considerations, I stood down from all Board committees with effect

from 30 April 2021.

Dividends

The robust performance delivered over the past year demonstrates

both the resilience of our business and the strength of our

integrated veterinary services model. The Group continues to be

highly cash generative, and despite continuing strong levels of

investment in facilities, equipment and acquisitions in the year,

we reduced our net debt by GBP11.9m over the course of the

year.

In light of the improvements in financial performance and the

continued strong cash generation, the Board is recommending a

return to our progressive dividend policy, with the payment of a

final dividend of 6.5p per share (2020: GBPnil).

Shareholder engagement

During the year, the Directors regularly held one-to-one

meetings and calls with existing and potential new shareholders,

hosted a number of roadshows and attended several virtual broker

conferences.

We appointed MHP Communications as our financial public

relations ("PR") agency in the year and we will continue to develop

our shareholder engagement and reporting in line with best

practice. The Executive Directors held the Group's first ever live

webcast of the Group's interim results presentation in March 2021

and we will continue to present future results in this way, with a

replay facility available.

Outlook

The veterinary sector is undergoing structural growth, through a

number of continuing trends including the humanisation of pets, an

increase in the demand for companion animals accelerated by

COVID-19 restrictions, consumers who are keen to provide the best

possible care to their pets, and clinical enhancements which are

increasing the range of services we can offer to achieve the best

potential outcomes.

Our fully integrated veterinary services model, with

first-opinion veterinary practices supported by specialist referral

hospitals, laboratories, crematoria and our online retail business

all position CVS well to benefit from these favourable sector and

consumer trends. Through our improved financial performance and

strengthened balance sheet, we are well placed to invest further in

our people, our facilities and clinical equipment, and in selective

acquisitions to drive growth and enhanced returns.

As we continue to expand and develop our business, our focus

will rightly remain on attracting and retaining the very best

talent and working as a team to provide the highest quality care to

our clients and their animals.

I look forward with confidence to a successful future.

Richard Connell

Chairman

23 September 2021

Chief Executive Officer's statement

"Care at our Heart"

Introduction

I am pleased to share our 2021 Annual Report and Financial

Statements.

We have delivered a strong performance in the past financial

year. Our business model has proven to be resilient, despite the

difficult backdrop of COVID-19, and we have as rich a proposition

as ever, focused on providing the very highest standards of

clinical care. This is all due to the efforts and collaboration of

our outstanding team of colleagues.

Throughout the past year, we have had to respond to evolving

regulatory guidance and new ways of working in order to provide

ongoing care to animals, whilst keeping our colleagues and clients

safe.

I would like to take this opportunity to thank all CVS

colleagues for their professionalism, sheer hard work and continued

commitment to providing the highest levels of service.

Favourable market and consumer trends

We have seen a continued increase in pet ownership in the past

year and, whilst there is no definitive pet population data

available, results of a recent survey published by the Pet Food

Manufacturers Association indicate that c.3.2 million UK households

have acquired a puppy or kitten since the start of lockdown

restrictions and that there are now over 24 million cats and dogs

in the UK. This is clearly a positive trend for CVS, and whilst

there are short-term benefits from first consultations,

vaccinations and in some cases neutering procedures, we anticipate

the benefits to be recognised over the medium term as these puppies

and kittens reach their mature stages of life and require more

veterinary intervention.

We continue to see a favourable trend of humanisation of pets,

with consumers willing to spend more on looking after their

animals. In many households, pets are seen as a core member of the

family and as with human health, improvements in clinical diets and

advances in clinical treatments available are likely to lead to

increased life expectancy of pets.

Our fully integrated veterinary services model positions CVS

well to benefit from these favourable market and consumer trends.

Our first-opinion practices provide access to advice and clinical

care and our preventative pet health scheme, the Healthy Pet Club,

provides regular vaccinations, check-ups and flea and worming

treatments. Our specialist-led, multi-disciplinary referral

hospitals provide access to advanced procedures where required and

our in-house laboratories provide an increasing range of diagnostic

tests in support of our first-opinion and specialist clinical

teams. Our online retail business provides a large range of pet

food, drugs and other products and our crematoria provide a

compassionate and valued end-of-life service to our clients.

Strong financial performance

We have delivered a strong financial performance in the past

year, with revenue of GBP510.1m representing an increase of 19.2%

over that achieved in the prior year. This reflects a 17.4%

increase in like-for-like sales. Adjusted EBITDA increased to

GBP97.5m, with all divisions contributing to this 37.3% increase

over the prior year.

This improved financial performance coupled with continued good

operational cash conversion led to a reduction in leverage to 0.68x

at 30 June 2021 (30 June 2020: 1.14x).

Strategy

Our purpose is to provide the best possible care to animals and

our integrated veterinary services are key to enabling this. Our

integrated model and our breadth of skills, services and facilities

position us well to provide outstanding care to our clients and

their animals.

Our highly skilled and dedicated team of clinicians and support

colleagues are at the centre of our strategy and our vision is to

be the veterinary company people most want to work for. We are

committed to making CVS a great place to work and have a career and

we continue to develop our reward and benefits to ensure we remain

well positioned in a competitive marketplace. Our leading Learning,

Education and Development team have delivered significant online

training over the past year in support of our colleague

development.

We pride ourselves on our high clinical standards and remain

focused on recommending and providing the best clinical care.

Retaining and attracting the very best veterinary talent is clearly

key to this, but we also recognise the need for continued

investment in our practice facilities and clinical equipment. I am

delighted that we have completed 13 practice

refurbishments/relocations in the past year and we have invested

GBP3.8m in new clinical equipment.

Our focus on delivering organic growth through our existing

operations will continue to be augmented by the selective

acquisition of veterinary practices and the investment in existing

and new facilities. We made nine acquisitions in the past year and

I am delighted to welcome our new colleagues to CVS. We also

announced plans to open a brand new, state of the art

multi-disciplinary referral hospital in Bristol and I look forward

to the opening of this new facility in 2022. This new facility will

allow us to continue to provide specialist support to our clients

and their animals for more complex cases, complementing the

first-opinion services we provide in CVS. This will also increase

the services we supply to third-party practices.

Recruitment of more clinicians

We have expanded CVS over the past year and in the year ended 30

June 2021 we employed an average of 181 (10.2%) more vets and 189

(8.0%) more nurses than in the year ended 30 June 2020.

Notwithstanding this increase, we are keen to recruit more

clinicians to support our growth and are advertising for a number

of new positions. This has the effect of inflating our veterinary

surgeon vacancy rate which is calculated as the number of vet

vacancies divided by the total number of roles (being both employed

vets and new vacancies).

RCVS consultation on legislative review

We have been proactively engaging with the RCVS as a business

for some time, for changes in legislation that would allow our

highly skilled nurses to perform a greater range of procedures

without the need for vet supervision.

We are delighted that the RCVS undertook consultation on a

number of proposed reforms to the Veterinary Surgeons Act, 1966

('the Act'), including proposals to enable nurses to undertake a

broader range of procedures such as feline castrations. We actively

participated in this consultation process and we broadly support

the RCVS reform recommendations which were formally approved by the

RCVS Council on 10 June 2021. We now encourage the government to

support these reforms so that revised legislation can be

enacted.

Sustainability and ESG

Our focus on providing the very best possible care to our

clients and their animals and our focus on making CVS a great place

to work and have a career are central components of our

strategy.

The Board of CVS is acutely aware that today companies must also

be managed so that wider society benefits from their business

operations and services. Whilst CVS has always taken its broader

societal obligations seriously, we have recently begun the process

of understanding our impact on, and the wider contribution we make

to society, in order to ensure that CVS becomes a truly sustainable

business focussed on delivering value to all of our stakeholders.

This initiative which commenced in the second half of this

financial year, builds on our mission and purpose and will, over

time, evolve into a fully costed and measurable ESG strategy.

We describe this approach as "Care at our Heart", having worked

to identify and articulate the core priorities for all arms of our

business, using internal interviews and analysis. The concept of

"care" resonated strongly across these discussions - we are, of

course, a business that provides best-in-class clinical care. But

care, in its broader sense, goes to the very heart of what we

do.

As a Company, we strive to reflect this in the work we do. Care

is in our DNA, and it is the foundation of our ESG strategy.

-- We care deeply about protecting the wellbeing of our

colleagues, and equipping them with the support, resources,

training and access to personal development opportunities that they

need.

-- We care about driving standards of clinical excellence in the

profession and providing the best possible health care for

animals.

-- We care about making a positive impact in the communities in which we work.

-- We care about doing our job in a way that is sustainable and

that doesn't compromise the natural environment.

-- We care about delivering value for our investors by doing good.

As a business we have made a number of changes to progress our

sustainability agenda, and we are extremely committed to further

development in the future. I am delighted that our stakeholders are

equally committed to making demonstrable changes and through

working together, I am confident that we will deliver meaningful

improvements across all aspects of ESG within CVS.

We have outlined some of our progress in the FY21 Annual Report

and I look forward to sharing further developments in due

course.

Wellbeing and mental health

As a caring employer, we are committed to supporting our

colleagues in their wellbeing and mental health. Given the

challenges over the past 18 months to our working and personal

lives from the COVID-19 pandemic, wellbeing and mental health

support is more important than ever.

We continue to develop ways to support all colleagues and we now

have over 300 'First Aiders for Mental Health' across CVS who are

actively championing wellbeing and positive mental health across

our business.

We launched a range of new initiatives over the past year

supported by our wellbeing ambassador, Sally Gunnell OBE.

Outlook

With our improved financial performance in the past year,

continued strong cash flow and strengthened balance sheet, CVS is

well positioned for further growth and to benefit from the

favourable market and consumer trends.

We will continue to focus on organic growth through providing

great care to our clients and animals and through further

investment in our people, our clinical facilities and our

practices. This organic growth can be augmented by further

acquisitions and we have acquired a further eight practice sites

since the financial year end.

Our highly skilled and dedicated team of colleagues are key to

our business and with their continued support and dedication, I

look forward to sharing further success in the future.

Richard Fairman

Chief Executive Officer

23 September 2021

Operational review

"Delivering outstanding clinical care despite challenging

circumstances"

During the last twelve months we have faced many challenges, but

the way in which our colleagues have stepped up to protect animal

welfare and continued to deliver the best possible care has been

nothing short of remarkable. We owe our colleagues an enormous debt

of gratitude and therefore I would like to thank every one of them

for their continued hard work.

Our purpose is to give the best possible care to animals, which

we are delivering through our clear vision to be the veterinary

company people most want to work for. This financial year has seen

us make significant strides forward despite the challenging

environment. Our focus on the critical KPIs of our colleague

satisfaction and our vet vacancy rate are a reflection of this

vision. Beneath our purpose and vision, as we introduced in our

FY20 Annual Report, are our four strategic pillars:

-- we recommend and provide the best clinical care every time;

-- we are great place to work and have a career;

-- we provide great facilities and equipment; and

-- we take our responsibilities seriously.

Alongside the strong growth we have seen during the year I am

delighted to have seen a significant number of new clinical

positions created over the year, and on average in the year ended

30 June 2021 we employed 10.2% (181) more vets than we did in the

year ended 30 June 2020. We have also seen more roles filled by

internal candidates, promoting great careers within CVS, as well as

through our highly successful refer a friend scheme during the

year. As a result of the continued expansion of our practices, we

have advertised for more clinical roles than ever, which has had

the effect of increasing our vet vacancy rate across the year to

8.3%. Critically, and in stark contrast to the higher vet vacancy

rate experienced several years ago, these vacancies are the result

of our expansion ambitions, as we seek to add new clinical roles

across the company to capitalise on an expanding market. Our annual

clinical attrition rates and employee Net Promotor Scores both

remain improved on prior years as we continue to strive to be the

veterinary company people most want to work for.

We have also made some changes to remuneration since the end of

the financial year in response to survey data and feedback,

focusing more on fixed income for clinicians and introducing bonus

schemes that reward collaboration across the Group and the delivery

of the best possible clinical care. We also recognise the intense

demands of clinical roles in the veterinary profession, not least

during the last 18 months, and have introduced an enhanced holiday

scheme to give colleagues an extra day of annual leave for each

year of CVS service, up to a maximum of five years. This is

additional to our buy and sell holiday scheme, both of which are

aimed at ensuring our colleagues get the right balance of time away

from work.

We remain committed to being a great place to work and have a

career. This year, we have partnered with the University of

Nottingham to deliver a unique four-year accredited graduate

program which launched in autumn 2020. Supporting and mentoring a

pipeline of talented graduates is a central tenet to our ongoing

commitment to supporting long and successful careers for our

clinicians within CVS. We have also introduced our first graduate

summer camp to the graduate intake programme. This helps our newly

qualified vets to develop their core practical skills, increase

their knowledge and understanding of surgery and consulting, and be

'practice ready' as they begin their careers with us. Additionally,

we have partnered with the University of Bristol to deliver final

year clinical rotations for their veterinary students in our equine

clinics and hospitals. This now means all students at Bristol

Veterinary School will experience at least one rotation within CVS

before they graduate, exposing bright and ambitious young talent to

all that CVS has to offer, and enabling us to contribute to the

education of the next generation of veterinary surgeons.

Our efforts to build the best learning education and development

platform in the profession have continued, with the Knowledge Hub -

our online training portal - having an average of 4,200 users per

week during FY21. This platform offers almost 200 live courses and

programs and we had over 10,000 clinical webinar views in the year,

reflecting the critical role that offering continued professional

development has in the retention and recruitment of our talented

colleagues. A limited number of courses are now also available to

third parties, as we begin a rollout of learning opportunities to

the wider profession.

Having great facilities and equipment is critical to us

delivering on our strategy, and as such we have completed 13

refurbishments and relocations in FY21. The quality of practice

facilities is directly related to our ability to recruit vets and

the ability of our clinical teams to deliver the best possible

care; therefore refurbishments and relocations are a fantastic

investment opportunity for us. We are also deploying new

industry-leading techniques across our practices, including dental

radiography and keyhole surgery for neutering, which now is in

operation in 40 practices across the Group.

Veterinary Practices division

Our Veterinary Practices division comprises our companion

animal, referrals, farm animal and equine veterinary practices, as

well as our buying groups, Vet Direct and MiPet Insurance. The

division has performed extremely well during the financial year,

with like-for-like revenue growth of 15.9% and total revenue growth

of 18.0%. We have also generated growth through acquisitions,

having made nine acquisitions comprising 15 practice sites in FY21

and eight practice sites since the financial year-end, mainly

providing companion animal services, as well as complementary farm

and equine animal services. We are pleased to report that this

cohort of new acquisitions have been well integrated into the

Group, and are performing well.

Companion Animal

Our Companion Animal division forms the majority of our

Veterinary Practices division, and has proven resilient in

recovering from the COVID-19 disruption. We have continued to focus

on supporting our clinical teams to deliver the best possible care,

and despite the challenges of the pandemic we have made excellent

progress across a range of areas of clinical development.

Despite reception areas and consultation rooms remaining mainly

closed throughout much of FY21, the division has continued to

deliver high quality clinical service whilst changing the ways of

working within practice. The temporary relaxation of restrictions

by the RCVS allowed for remote prescribing and supported

telemedicine consultations in the very early months of the

pandemic, but throughout the financial year we saw a strong demand

from clients to attend our clinics in person, and the demand for

virtual interactions fell away, reiterating the close ties of our

practices with their communities.

Referrals

Our Referrals division continues to grow strongly, with revenue

increasing 29.3% over the prior year. We have expanded the range of

clinical disciplines we offer in our hospitals, and we have seen

growth of our vet-to-vet telemedicine imaging service, VetOracle.

These services are offered to both our own and third-party

practices across the globe, and we have invested further in systems

to support further growth. We also continue to expand our network

of advanced peripatetic practitioners, who provide advanced

clinical services to our primary care practices entering new

disciplines and geographical locations.

Our Referrals division has worked hard to build relationships

with both internal and external first opinion practices. This has

led to a 31.4% increase in cases being referred during the

financial year compared to FY2020.

Equine

Our Equine division has 20 equine practices across the UK, the

Republic of Ireland and the Netherlands, including five RCVS

accredited referral hospitals in the UK and large referral

hospitals in both the Republic of Ireland and the Netherlands.

The division has performed well in the financial year,

generating internal referrals through supporting collaboration

between practices, providing operational leverage and resulting in

EBITDA growth of 163.1%. We have also implemented further training

for first-opinion equine vets and provided additional equipment,

such as scanning equipment, for use on first visits, contributing

to a 26.2% increase in revenue.

We have continued to expand our out-of-hours service, Equicall,

offering emergency cover to both CVS and third-party practices.

This world-first equine dedicated out-of-hours service has not only

improved access to clinical care for our clients, but has improved

flexibility for our vets by reducing the burden on existing vet

teams.

Farm Animal

Our Farm Animal division consists of 23 farm animal practices

and a large specialist poultry business, Slate Hall. During the

year we have increased both fee and drug revenue via buying groups

and increased incentives for our vets, such as our productivity

bonus scheme.

After launching our first greenfield farm animal practice in

2020, we have continued to advance this model throughout 2021, and

at the end of this financial year we have three greenfield

practices providing opportunities for young and ambitious vets.

International

Our International division comprises 25 practices in the

Netherlands and six practices in the Republic of Ireland.

Internationally we have expanded and improved our out-of-hours

services, to reach more clients and support the best possible

working environment for our clinicians.

We continue to focus on rolling out our people-focused model,

providing the best possible care to animals in all our territories.

Improved collaboration between practices, including referral of

more advanced cases between experienced clinicians remains a good

opportunity for organic growth.

Healthy Pet Club

As well as offering first class care to sick or injured animals

we continue to offer preventative health care through our Healthy

Pet Club scheme, which offers routine flea and worming treatments

and vaccinations, as well as twice yearly health checks. These

clients can spread the cost of accessing the best preventative

health care, as well as allowing our clinicians to identify

diseases and recommend the best diagnostics and treatments. The

scheme membership has grown by 8.4% over the last year to around

450,000 members, representing roughly 40% of our companion animal

active client base. The Healthy Horse Programme has also grown,

with 10,000 members at the end of June 2021.

MiPet products/purchasing

During the year, we have continued our efforts to increase

purchases of our own-brand products rather than third-party branded

pharmaceuticals. As well as providing increased choice for our

clients, this has also resulted in our own-brand spend increasing

to 34.0% of the UK practices' pharmaceutical spend, up from 28.0%

in 2020.

We have continued to improve our warehouse management system,

improving efficiency and increasing our permanent staffing, which

has enabled us to cope with the increase in Online Retail order

volumes as well as successfully complying with social distancing

requirements through effective use of space and adjusted shift

patterns within our warehouse.

Outlook for Veterinary Practice Division

We are optimistic for continued growth within our Veterinary

Practices division, with revenue growth expected to come from an

increased number of clients and our focus on exceptional clinical

care and our desire to be the veterinary company people most want

to work for. Initiatives for the forthcoming year include a focus

on radiography in first-opinion practices, in collaboration with

our specialist VetOracle imaging teams. This will enable

improvements in image acquisition, interpretation, and most

importantly in the quality of diagnoses in pursuit of the best

possible clinical care.

We are also focused on enhancing the role of our veterinary

nurses in our clinics, and have launched a new programme to grow

the number of consultations undertaken by our talented nursing

colleagues. In areas such as these we continue to see significant

opportunity to drive organic growth, by focusing on increasing our

capability in all areas of diagnostics, and then recommending and

delivering the best possible treatments.

We continue to seek high quality independent practices to join

our network and, having put significant effort into our integration

processes over the last two years, we are confident we can drive

value from all acquisitions we make. We are well placed to continue

to improve margins via streamlined referrals, use of our own-brand

products and an increased range of clinical services.

Laboratories

Our Laboratories division provides diagnostic services and

in-practice desktop analysers to both CVS and third-party

practices, and employs a national courier network to facilitate the

collection and timely processing of samples from practices across

the UK. We continue to develop our capability to ensure we can

support the wider Group's focus on growing diagnostic care.

Diagnostic services

Our diagnostic laboratories have grown during the year,

including 20.1% growth in the number of tests provided to external

customers. During the pandemic we also introduced COVID-19 PCR

testing for our colleagues and for third parties, which was

discontinued in March 2021 due to changes in government

regulations.

Analysers

Analyser revenue is driven by a combination of sales of

analysers, leasing agreements and ongoing sales of consumables

throughout the life of the equipment. Revenues from the analyser

business grew by 28.7% over the course of the financial year,

including strong growth within CVS practices aligned to the wider

clinical focus on diagnostics.

Outlook for Laboratories

The Laboratories division has remained resilient despite

increasing consolidation in the veterinary sector resulting in the

loss of some external clients. By increasing the speed and range of

testing we offer in our laboratories, continuing to ensure

field-leading client service, and employing a highly skilled

network of sales teams and engineers, we are optimistic for further

growth in the years to come.

Crematoria

Our Crematoria division provides both individual and communal

cremation services for companion animal and equine clients, as well

as clinical waste disposal services for both CVS and third-party

veterinary practices.

Having successfully trialled our Direct Pet Cremation project in

the first half of the year, this was rolled out across more of our

companion animal practices in the final quarter of the financial

year. This initiative has contributed to the increase in the number

of individual cremations of 20.2% over the prior year.

Direct Pet Cremation Project

Our integrated veterinary platform is demonstrated in action

with our Direct Pet Cremation Project, which sees clients allowed

more time to consider difficult decisions about their beloved pet's

end-of-life and cremation, such as whether to choose individual

cremation, and choices between a range of caskets and other

mementos. Crematoria and practices collaborate to give our clients

time and space, which reduces the emotional pressures of our

clients' decisions and allows our subject matter experts in our

crematoria to discuss the full range of options open to clients

during the most difficult time of all.

Outlook for Crematoria

Our Direct Pet Cremation project has seen great engagement from

our practices and clients, and as we complete the rollout in the

new financial year we expect this to continue, along with our

Crematoria division revenues.

Online Retail Business

Our online pet food and pharmacy retailer, "Animed Direct",

focuses on pet food and prescription and non-prescription

medication, directly to customers. This is supported by the buying

power of the Group as a whole, which ensures the business is able

to provide the best value for customers.

During the financial year, our Online Retail division delivered

revenue growth of 29.9% and adjusted EBITDA growth of 16.0%. The

COVID-19 lockdowns have changed consumer habits towards sourcing

pet food online. Our high levels of customer service have enabled

us to retain a large portion of the new customers that first used

the platform during the COVID-19 lockdowns, despite retail

restrictions having subsequently eased.

We have expanded our range of product lines and continued to

improve our website, prescription management system and customer

service management system, which contributes to our consistent

five-star Trustpilot rating.

Outlook for Online Retail Business

The continual improvements and expansion to our product range as

well as the increasing changes in customers' shopping habits

towards online shopping for convenience is expected to continue to

deliver revenue growth in our Online Retail business in the coming

years. We continue to develop our website to improve user

experience, further increasing revenue growth opportunities.

Head office

Central administration costs include those of the central

finance, IT, human resource, purchasing, legal and property

functions. Total costs were GBP15.7m (2020: GBP12.1m) representing

3.1% of revenue (2020: 2.8%). The increased spend reflects business

growth during the period as well as investment in people and

processes in support of further scalability, whilst maintaining a

high standard of internal and external service.

As a percentage of revenue, the spend on support functions has

increased, particularly in the areas of IT and Human Resources.

This represents our continued investment in support areas, ensuring

that we continue to have suitable systems to appropriately support

the trading divisions. This overall increase in central costs also

reflects health and safety expenditure in relation to COVID-19, for

example, additional personal protective equipment for our

colleagues, amounting to cGBP0.5m. The Group continues to base

support colleagues in regions where possible, so they can easily

provide the close support that the operations teams require.

Ben Jacklin

Chief Operating Officer

23 September 2021

Financial review

"Strong growth in financial performance and well placed for

future investment"

Financial highlights

The Group has recovered well from the COVID-19 pandemic, to

deliver significant growth in revenues and adjusted EBITDA.

Key financial highlights are shown below:

Change

2021 2020 %

------------------------------- ------ ------ -------

Revenue (GBPm) 510.1 427.8 19.2%

Adjusted EBITDA (GBPm)* 97.5 71.0 37.3%

Adjusted profit before income

tax (GBPm)* 66.2 38.2 73.3%

Adjusted earnings per share

(p)* 75.1 42.0 78.8%

Operating profit (GBPm) 40.1 18.5 116.8%

Profit before income tax

(GBPm) 33.1 9.9 234.3%

Basic earnings per share

(p) 27.3 8.1 237.0%

------------------------------- ------ ------ -------

A reconciliation of the difference between the reported

operating profit figure and adjusted EBITDA is shown below:

2021 2020

GBPm GBPm

---------------------------- ----- -----

Operating profit 40.1 18.5

Adjustments for:

Amortisation, depreciation

and impairment(1) 48.1 46.4

Costs relating to business

combinations 9.3 0.7

Exceptional items - 5.4

---------------------------- ----- -----

Adjusted EBITDA 97.5 71.0

---------------------------- ----- -----

1. Impairments in the year ended 30 June 2020 are shown in

exceptional items

* Adjusted financial measures (adjusted EBITDA, adjusted profit

before income tax and adjusted earnings per share) are defined

below, and reconciled to the financial measures defined by

International Financial Reporting Standards ("IFRS") on pages 90

and 118 of the FY21 Annual Report and shown below after the

consolidated statement of income and in note 2 to the financial

statements on segmental reporting. Management uses adjusted EBITDA

and adjusted earnings per share ("adjusted EPS") as the basis for

assessing the financial performance of the Group. These figures

exclude costs relating to business combinations and exceptional

items and hence assist in understanding the performance of the

Group. These terms are not defined by IFRS and therefore may not be

directly comparable with other companies' adjusted profit

measures.

Financial performance

Revenue increased by 19.2% to GBP510.1m from GBP427.8m with

strong Group like-for-like growth of 17.4%. The Group continues to

benefit from favourable market dynamics with the trend in

humanisation of pets, increasing pet ownership and the shift in

consumer spending online. Like-for-like growth was underpinned by

the continued focus on our strategy of providing the best clinical

care, and was delivered despite a planned companion animal price

increase being delayed during the year, which was eventually

implemented on 1 January 2021. Revenue also included COVID-19 PCR

testing, which discontinued in March 2021 following a change in

Government guidance.

Adjusted EBITDA increased by 37.3% to GBP97.5m from GBP71.0m. As

a percentage of revenue, adjusted EBITDA increased to 19.1% from

16.6%, benefiting from operating leverage and strong revenue

growth. Adjusted EBITDA also benefitted from GBP2.0m of Research

and Development Expenditure Tax Credits, following the Group's

first claim under this scheme. The Group made nine acquisitions in

the financial year, which in aggregate generated revenue of GBP6.1m

and adjusted EBITDA of GBP1.3m during the period.

Adjusted profit before income tax increased 73.3% to GBP66.2m

from GBP38.2m, benefitting from the increase in adjusted EBITDA and

reduction in finance expense. Adjusted EPS (as defined in note 2 of

the FY21 financial statements) increased 78.8% to 75.1p from 42.0p.

Adjusted profit before income tax and adjusted EPS exclude the

impact of amortisation of intangible assets, costs relating to

business combinations and exceptional items.

Profit before income tax increased by 234.3%, to GBP33.1m from

GBP9.9m, underpinned by the increase in adjusted EBITDA and

reduction in exceptional costs, partially offset by the increase in

costs relating to business combinations, which includes business

combinations costs in respect of prior periods. Basic EPS increased

237.0%, to 27.3p from 8.1p.

Taxation

Income tax expense has increased by GBP9.6m, to GBP13.8m from

GBP4.2m, primarily due to the increase in profit before income tax

and GBP4.3m relating to the re-measurement of deferred tax balances

in respect of UK jurisdictions following the UK Government's

announcement to increase the rate of corporation tax to 25%, from

19%, in April 2023.

The Group's effective tax rate was 41.7% (2020: 42.3%). A

reconciliation of the expected tax charge, at the standard rate, to

the actual charge is shown below:

GBPm %*

Profit before income tax 33.1

----------------------------------------------- ------- --------

Expected tax at UK standard rate of tax 6.3 19.0%

Expenses not deductible for tax purposes 2.4 7.3%

Adjustments to previous year tax charge 1.6 4.8%

Utilisation of brought forward losses (0.1) (0.3%)

Effect of difference between closing deferred

tax rate and current rate (0.7) (2.1%)

Effect of tax rate change on opening deferred

tax balances 4.3 13.0%

----------------------------------------------- ------- --------

Actual charge/effective rate of tax 13.8 41.7%

----------------------------------------------- ------- --------

* percentage of profit before income tax

All of the Group's revenues and the majority of its expenses are

subject to corporation tax. The main expenses that are not

deductible for tax purposes are costs relating to acquisitions and

depreciation on fixed assets that do not qualify for tax relief.

Tax relief for some expenditure, mainly fixed assets, is received

over a longer period than that for which the costs are charged in

the FY21 financial statements.

Financial position

2021 2020

GBPm GBPm

------------------------------- -------- --------

Intangible assets 228.4 229.8

Property, plant and equipment 57.4 51.6

Right-of-use assets 97.2 98.1

Other non-current assets 0.1 1.2

Current assets 101.4 83.6

Current liabilities (98.5) (102.0)

Non-current liabilities (194.9) (195.7)

Equity 191.1 166.6

------------------------------- -------- --------

As at 30 June 2021, intangible assets amount to GBP228.4m (2020:

GBP229.8m), primarily consisting of goodwill, patient data records

and computer software. The net reduction of GBP1.4m relates to

amortisation and impairment in the year of GBP23.8m (2020:

GBP23.2m), net foreign exchange movements on opening balances of

GBP1.0m (2020: GBP0.5m), offset by additions through business

combinations of GBP22.9m (2020: GBP7.2m) and computer software

additions of GBP0.5m (2020: GBP1.3m).

Property, plant and equipment of GBP57.4m (2020: GBP51.6m)

includes freehold land and buildings, leasehold improvements,

fixtures, fittings and equipment and motor vehicles. The net

increase of GBP5.8m primarily relates to additions (including those

arising via business combinations) of GBP16.7m (2020: GBP11.3m),

reflecting our continuing commitment to investing in our

facilities, offset by net disposals of GBP0.5m (2020: GBPnil), net

foreign exchange movements on opening balances of GBP0.1m (2020:

GBPnil) and depreciation in the year of GBP10.3m (2020:

GBP10.7m).

Right-of-use-assets of GBP97.2m (2020: GBP98.1m) consists of

property leases for our veterinary practices, specialist referral

centres and support office of GBP95.1m (2020: GBP96.3m) and leases

for vehicles and equipment of GBP2.1m (2020: GBP1.8m). The net

reduction in the year of GBP0.9m relates to the depreciation and

impairment charge in the year of GBP14.0m (2020: GBP14.6m), net

disposals of GBP1.7m (2020: GBPnil), foreign exchange on opening

balances of GBP0.6m (2020: GBP0.1m increase), offset by additions

(including those via business combinations) and re-measurement of

lease terms of GBP15.4m (2020: GBP4.8m).

Other non-current assets of GBP0.1m (2020: GBP1.2m) relates to a

managed investment fund measured at fair value of GBP0.1m (2020:

GBP0.1m) and deferred tax assets of GBPnil (2020: GBP1.1m). In the

current year the deferred tax asset has been offset against

deferred tax liabilities (see note 24 to the FY21 financial

statements for further details).

Current assets of GBP101.4m (2020: 83.6m) comprises inventories

of GBP19.5m (2020: GBP18.7m), trade and other receivables of

GBP48.1m (2020: GBP43.4m), current income tax receivable of GBP0.1m

(2020: GBP0.4m current liability), and cash and cash equivalents of

GBP33.7m (2020: GBP21.5m). The net increase of GBP17.8m mainly

relates to increased cash and cash equivalents and increased trade

receivables in line with the growth in overall revenues.

Current liabilities of GBP98.5m (2020: GBP102.0m) comprise trade

and other payables of GBP86.0m (2020: GBP87.7m), provisions of

GBP3.9m (2020: GBP5.0m), lease liabilities of GBP8.6m (2020:

GBP8.8m), income tax liabilities of GBPnil (2020: GBP0.4m) and

borrowings of GBPnil (2020: GBP0.1m). The net reduction of GBP3.5m

mainly relates to the net movement following the repayment of

GBP15.0m deferred VAT under the COVID-19 VAT Deferral scheme

partially offset by an increase in bonus accruals due to the strong

performance of the Group (included within other payables) and

additional legal fees accrued.

Non-current liabilities of GBP194.9m (2020: GBP195.7m) includes

borrowings of GBP83.9m (2020: GBP83.5m), lease liabilities of

GBP90.2m (2020: GBP89.8m), derivative financial instruments of

GBP0.4m (2020: GBP0.9m) and deferred tax liabilities of GBP20.4m

(2020: GBP21.5m). See below for further details regarding the

Group's borrowings.

Equity of GBP191.1m (2020: GBP166.6m) increased by GBP24.5m as a

result of total comprehensive income of GBP19.0m (2020: GBP5.5m),

new shares issued and shares disposed from the Employee Benefit

Trust ("EBT") of GBP1.5m (2020: GBP1.0m) to settle obligations

under the Group's Save As You Earn ("SAYE") scheme, and

transactions in relation to share-based payments and associated

deferred income tax of GBP4.0m (2020: GBP1.0m). There was no

dividend payment in 2021 (2020: GBP3.9m).

Cash flow and movement in net debt

Net debt decreased by GBP11.9m to GBP50.2m from GBP62.1m. The

movement in net debt is explained as follows:

2021 2020

GBPm GBPm

---------------------------------------------- ------- -------

Cash generated from operations 80.3 94.8

Capital expenditure - maintenance (8.2) (8.7)

Repayment of right-of-use liability (13.0) (14.2)

Taxation paid (13.0) (9.5)

Interest paid (7.1) (7.0)

---------------------------------------------- ------- -------

Free cash flow 39.0 55.4

Capital expenditure - development (8.4) (3.7)

Business combinations (net of cash acquired) (19.4) (7.2)

Loans and borrowings acquired through

business combinations (1.0) -

Dividends paid - (3.9)

Sale of property, plant and equipment 0.6 -

Exceptional items - (0.7)

Proceeds from Ordinary shares 1.2 0.1

Proceeds from sale of Treasury shares 0.3 0.9

Amortisation of debt issuance costs (0.4) (1.0)

---------------------------------------------- ------- -------

Decrease in net debt 11.9 39.9

---------------------------------------------- ------- -------

Cash generated from operating activities decreased by 15.3% to

GBP80.3m from GBP94.8m, despite the increase in adjusted EBITDA.

The decrease primarily relates to GBP15.0m of VAT payments which

were deferred under the COVID-19 VAT Deferral scheme and GBP2.0m of

taxes in the Netherlands deferred from the prior year, paid in the

current year. Cash generated from operations also includes an

additional GBP7.7m of payments for costs relating to business

combinations, which mostly relate to acquisitions in prior

periods.

The analysis of capital expenditure between maintenance and

development in the table above reflects a broad split between

expenditure which we believe will primarily maintain profit, and

that which we expect to increase profit. This split can only ever

be approximate. Development capital expenditure includes new sites,

relocations, significant extensions and significant new equipment.

All other capital expenditure is included as maintenance.

Repayment of right-of-use liabilities of GBP13.0m (2020:

GBP14.2m) consists of liabilities in respect of property leases for

our veterinary practices, specialist referral centres and support

offices and leases for vehicles and equipment.

No corporation tax relief is received on the majority of the

amortisation and transaction costs which are deducted in arriving

at the unadjusted profit before income tax figure. Therefore,

taxation paid moves broadly in line with the adjusted profit before

income tax of the Group. The increase in tax paid in the year is

primarily as a result of the increase in profit generated by the

Group.

The interest payment of GBP7.1m was consistent with the prior

year of GBP7.0m, reflecting the Group's maintenance of low levels

of net debt during the financial year.

Cash available for discretionary expenditure ("free cash flow")

decreased to GBP39.0m from GBP55.4m, primarily as a result of the

deferred VAT payments noted above.

Development capital expenditure of GBP8.4m (2020: GBP3.7m) was

incurred in the year. This investment included relocation of our

practices at the Grove in Fakenham, Barry in Wales, Buttercross in

Nottinghamshire and Rosemullion in Cornwall and refurbishment of

some of our existing sites with significant investment in our sites

at Buchanan in Manchester, Springfield in Rotherham and Newquay in

Cornwall, which is due to complete in October 2021. The level of

investment in the prior year was adversely impacted by action taken

to preserve cash during the first COVID-19 lockdown in March

2020.

Consideration for business combinations, net of cash acquired,

of GBP19.4m was paid for nine practices (15 practice sites) (2020:

GBP7.2m) acquired during the financial year to June 2021. In

addition a further GBP1.0m (2020: GBPnil) was paid to settle loans

transferred as part of the business combinations.

Dividend of GBPnil (2020: GBP3.9m) following the decision not to

declare a dividend in the prior year due to COVID-19 support

received.

Sale of property plant and equipment of GBP0.6m (2020: GBPnil)

relates to sites held not deemed to be in the right location for

future investment.

Exceptional items of GBPnil (2020: GBP0.7m). The prior year

related to amounts paid in relation to Board restructuring

costs.

Proceeds from the sale of Ordinary and Treasury shares of

GBP1.5m (2020: GBP1.0m) arose on the exercise of options under the

Group's approved SAYE scheme, which allows colleagues to save

regular amounts each month over a three-year period and benefit

from increases in the Group's share price over that time.

Amortisation of debt issuance costs of GBP0.4m (2020: GBP1.0m)

in line with our policy.

Net debt and borrowing costs

The Group's net debt comprises the following:

2021 2020

GBPm GBPm

--------------------------- ------- -------

Borrowings repayable:

Within one year - 0.1

After more than one year:

Loan facility 85.0 85.0

Unamortised borrowing

costs (1.1) (1.5)

Total borrowings 83.9 83.6

Cash and cash equivalents (33.7) (21.5)

--------------------------- ------- -------

Net debt 50.2 62.1

--------------------------- ------- -------

The Group has total facilities of GBP175.0m to 31 January 2024,

provided by a syndicate of four banks: NatWest, HSBC, BOI and AIB,

and comprise the following elements:

-- a fixed term loan of GBP85.0m, repayable on 31 January 2024

via a single bullet repayment;

-- a four-year Revolving Credit Facility ("RCF") of GBP85.0m,

that runs to 31 January 2024;

-- an envisaged, but not committed, accordion facility of up to

GBP100.0m, that runs to 31 January 2024; and

-- in addition, the Group has a GBP5.0m overdraft facility,

renewable annually.

The two financial covenants associated with these facilities,

described below, remain unchanged and will continue to be

calculated based on the Group's accounting policies applicable at

30 June 2019 for the duration of the facilities i.e. pre-IFRS

16.

At the year-end, the total borrowings principally consist

of:

-- the GBP85.0m term loan (gross of unamortised issue costs) (2020: GBP85.0m); and

-- GBPnil drawn down under the RCF (gross of unamortised issue costs) (2020: GBPnil)

The two financial covenants associated with the Group's bank

facilities are based on the ratios of net debt to EBITDA and EBITDA

to interest. EBITDA is based on adjusted EBITDA, annualised for the

effect of acquisitions, including costs relating to business

combinations and excluding share option costs, prior to the

adoption of IFRS 16. The EBITDA to interest ratio must not be less

than 4.5x. At 30 June 2021 it was 24.97x.

The covenant levels allow a maximum net debt to EBITDA ratio

("gearing") of 3.25x, although it is not the Group's intention to

operate at this level. The gearing ratio decreased during the year,

to 0.68x at 30 June 2021 from 1.14x at 30 June 2020. This decrease

in ratio reflects both the decrease in net debt and increase in

EBITDA.

The Group manages its banking arrangements centrally. Funds are

swept daily from its various bank accounts into central bank

accounts to optimise the Group's net interest payable position.

Interest rate risk is also managed centrally and derivative

instruments are used to mitigate this risk. On 28 February 2020,

the Group entered into two four-year fixed interest rate swap

arrangements to hedge fluctuations in interest rates on GBP70.0m of

its term loan facility.

Going concern

At the statement of financial position date the Group had cash

balances of GBP33.7m and an unutilised overdraft facility of

GBP5.0m. Total facilities of GBP170.0m are available to support the

Group's organic and acquisitive growth initiatives over the coming

years, comprising a term loan of GBP85.0m and an RCF of GBP85.0m.

The Directors consider that the GBP5.0m overdraft and the GBP170.0m

facility enable the Group to meet its liabilities as they fall due.

Since the year end, the Group has continued to trade profitably and

to generate cash.

After consideration of market conditions, the Group's financial

position (including the level of headroom available within the bank

facilities), financial forecasts for the three years to 30 June

2024, its profile of cash generation and the timing and amount of

bank borrowings repayable, and principal risks, the Directors have

a reasonable expectation that both the Company and the Group will

be able to continue in operation and meet its liabilities as they

fall due over the period, being at least 12 months from the date of

approval of the financial statements. For this reason, the going

concern basis continues to be adopted in preparing the FY21

financial statements.

More information on the Group's viability statement can be found

on page 79 of the FY21 Annual Report.

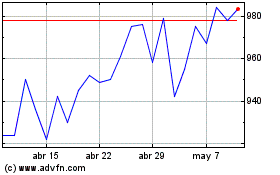

Share price performance

At the year-end the Company's market capitalisation was

GBP1,708.7m (2,415p per share), compared to GBP727.8m (1,030p per

share) at the previous year-end.

Key contractual arrangements

The Directors consider that the Group has only two significant

third-party supplier contracts which are for the supply of

veterinary drugs. In the event that these suppliers ceased trading,

the Group would be able to continue in business without significant

disruption in trading by purchasing from alternative suppliers.

Forward-looking statements

Certain statements and arrangements described in the FY21 Annual

Report and results release are forward looking. Although the Board

is comfortable that the expectations reflected in these

forward-looking statements are reasonable, it can give no assurance

that these expectations will prove to be correct. Because these

statements involve risks and uncertainties, actual results may

differ materially from those expressed or implied by these

forward-looking statements.

Robin Alfonso

Chief Financial Officer

23 September 2021

Key performance indicators

Financial KPIs

The Directors monitor progress against the Group strategy by

reference to the following financial KPIs. Performance during the

year is set out in the table below.

KPI 2021/ Why it's a KPI 2021 performance

2020

(A) Revenue GBP510.1m Revenue is a key

measure of * Overall revenue has increased by GBP82.3m.

GBP427.8m performance

across all

divisions * Like-for-like revenue, adjusted for intercompany

of the Group and sales eliminations, increased GBP72.3m, with

demonstrates our acquisitions in the year and the full year impact of

ability to prior year acquisitions generating additional revenue

attract of GBP10.0m.

and retain

customers.

* The Group has seen significant growth following

recovery from the COVID-19 pandemic, during which

revenue growth had slowed.

----------- ------------------ -----------------------------------------------------------------

(B) Like-for-like 17.4% Like-for-like

sales sales * Like-for-like performance reflects the Group's

0.7% shows revenue recovery from COVID-19, as temporary practice

generated closures during 2020 limited growth in the prior

from year.

like-for-like

operations

compared * Increased pet ownership has also contributed to

to the prior increased like-for-like sales.

year,

adjusted for the

number of working

days. For

example,

for a practice

acquired in

September

2019, revenue is

included from

September

2020 in the

like-for-like

calculations.

This

shows the

underlying

growth in revenue

across all

divisions,

excluding the

impact

of acquisitions.

----------- ------------------ -----------------------------------------------------------------

(C) Adjusted GBP97.5m Adjusted Earnings

EBITDA Before Interest, * The improvement in adjusted EBITDA reflects the

GBP71.0m Taxation, improvement in like-for-like adjusted EBITDA of

Depreciation GBP28.7m, with acquisitions in the year and the full

and Amortisation year impact of prior year acquisitions generating

("EBITDA") additional EBITDA of GBP1.4m.

excludes

costs relating

to business * This is partly offset by an increase in central costs

combinations of GBP3.6m incurred to protect our colleagues and

and exceptional clients and to continually build a foundation for

items and assists further development and expansion of the group.

in understanding

the underlying

performance of

the Group.

----------- ------------------ -----------------------------------------------------------------

(D) Adjusted 75.1p This is profit

EPS before income tax * The increase reflects the increase of GBP28.0m in the

42.0p adjusted for: year in adjusted profit before income tax.

amortisation;

costs relating

to business

combinations;

and exceptional

items, net of the

notional tax

impact

of these, divided

by the weighted

average number

of shares.

Adjusted

EPS is a KPI

because

it assists in

understanding

the underlying

returns generated

for our

shareholders.

----------- ------------------ -----------------------------------------------------------------

(E) Total GBP16.6m This is the total

capex amount spent by * Total capital expenditure has increased GBP4.2m,

GBP12.4m the Group on capital consisting of a GBP0.5m reduction in maintenance

expenditure. Capital capital expenditure, and a GBP4.7m increase in

expenditure is development capital expenditure, with the focus on

incurred on improving client experience and on growing our

refurbishment business. Refer to the financial review on pages 36

and relocation to 40 of the FY21 Annual Report for further detail.

of practice

facilities

and investment

in new equipment

and clinical

facilities.

Investing in our

practices and

clinical

equipment is key

to achievement

of our strategic

goal of providing

great facilities

and equipment.

(F) Gross 76.1% Gross margin

margin before represents * The increase in gross margin is principally due to

clinical 75.5% revenue after our focus on providing great clinical care.

staff costs deducting

the cost of drugs,

laboratory fees

and cremation fees,

and other goods

sold or used by

the business,

expressed

as a percentage

of total revenue.

Gross margin is

a KPI because it

helps us to monitor

and measure our

ability to purchase

drugs at the best

possible price

whilst ensuring

the highest quality.

---------- ---------------------- ---------------------------------------------------------------

(G) Cash GBP80.3m Cash generated

generated from operations * Cash generated from operations has decreased due to

from operations GBP94.8m shows the cash payment in the year of the tax deferred under the

inflows before: COVID-19 tax deferral schemes which were accessed

payments of income across the UK and the Netherlands in the prior year

taxation and .

interest;

business

combinations; * The Board is confident that the cash generated from

purchases of operations is performing in line with its

property, expectations and in a manner which continues to

plant and equipment enable investment.

and intangible

assets; repayment

of right-of-use

assets; payments

of dividends; debt

issue costs;

increase/repayment

of bank loans;

and proceeds from

issue of shares.

Delivery of increased

cash generated

from operations

allows us to invest

in further growth

opportunities across

our business.