TIDMCYBA

RNS Number : 6449D

CYBA PLC

30 June 2021

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS STIPULATED

UNDER THE UK VERSION OF THE MARKET ABUSE REGULATION NO 596/2014

WHICH IS PART OF ENGLISH LAW BY VIRTUE OF THE EUROPEAN (WITHDRAWAL)

ACT 2018, AS AMED. ON PUBLICATION OF THIS ANNOUNCEMENT VIA A

REGULATORY INFORMATION SERVICE, THIS INFORMATION IS CONSIDERED TO

BE IN THE PUBLIC DOMAIN.

30 June 2021

CYBA plc ("CYBA" or the "Company")

Audited results for nine months ended 31 December 2020

CYBA plc ("CYBA" or the "Company") is pleased to announce its

audited results for the nine-month period ended 31 December

2020.

The Annual Report and Financial Statements will be available on

the Company's website www.cybaplc.com .

S

For further information on the Company please visit

www.cybaplc.com, with the Company's Prospectus to be found at

https://cybaplc.com/investor-relations/corporate-documents or

contact:

Robert Mitchell CYBA Tel: +44 (0) 20 3468

2212

Peter Krens Tennyson Securities Tel: +44 (0)207 186

9030

-------------------- -----------------------------

Catherine Leftley / St Brides Partners Tel: +44 (0)207 236

Frank Buhagiar Ltd, 1177

Financial PR info@stbridespartners.co.uk

-------------------- -----------------------------

About CYBA plc

CYBA plc ("CYBA") is a special purpose acquisition company

("SPAC") seeking suitable acquisition targets in the Cyber Security

sector.

CYBA intends to implement its strategy focussed on building a

group capable of offering Cyber and Cybersecurity solutions in the

US and globally.

The Company intends to leverage the deep industry knowledge of

its board and associates to undertake due diligence on the

commercial attributes of a target entity's business.

Further information in respect of the Company and its business

interests is provided on the Company's website at

www.cybaplc.com

Chairman's Statement

Dear Shareholder,

I have pleasure in presenting the financial statements for the

nine months ended 31 December 2020.

Cyba Plc was formed to acquire a controlling interest in a

company or business operating in the cyber security sector. I

believe we are well under way with that strategy with the recently

announced signing of binding heads of terms with our first target,

Narf. We are very excited to having been able to agree terms as the

Narf business has some very exciting products and serves as a very

good umbrella for future add on acquisitions within this sector. I

hope to update you further on this acquisition as it

progresses.

The Strategy

Our focus during the period under review and beyond has been

two-fold: to leverage the Board's deep industry knowledge to first

identify and then undertake due diligence on the commercial

attributes of a target entity's business, using professional

advisory firms where necessary to carry out legal and financial

assessments; and to put in place a platform with which to acquire

and aggregate businesses.

Narf Industries

Narf operates within the Threat Intelligence Sector carrying out

computer security research and developing and licensing software on

a "software as a service" (SaaS) basis to detect threats to

computer systems. It also provides Incident Response services to

assist its clients to identify and neutralise active threats.

Clients include US governmental agencies and large US

corporates.

Financial

Funding

The Company raised GBP1.9m excluding share issue costs from

investors from its formation on 28 November 2018 through to 31

March 2020. During the nine-month period to 31 December 2020, the

Company raised an additional GBP1.9m. Following the admission onto

LSE in March the Company also recently undertook an interim placing

to secure the deals with its first target as announced earlier this

month. The Company believes that this funding will be sufficient to

meet its working capital requirements for at least the next 12

months on a standalone basis.

Revenue

The Company has generated no revenue during the period. However,

the Company is focusing on acquisition targets that will ultimately

generate revenue for the Company.

Expenditure

During the period the Company concentrated on fund raising to

support its expenditure on its primary objective of evaluating

suitable acquisition targets in the cyber security sector. A number

of targets were considered in this process and the Company's

management was supported in this activity by advisers and

specialist consultants.

As at the date of this document, the Company has GBP2.4m in

cash.

Dividend

The Directors do not intend to declare a dividend in respect of

the period under review.

Outlook

We are positioning Cyba to be the vehicle through which

shareholders will be able to gain exposure to this fast growing and

critical sector. We have the right team, the right strategy, and

the right platform in place to transform the Company into a cyber

and cybersecurity group serving US and International markets and

organisations, one which has the capability to consolidate and

scale up the range of products and solutions it offers to a growing

blue chip customer base. I look forward to reporting our progress

to you over the next period.

Robert Mitchell

Non-Executive Chairman

STATEMENT OF COMPREHENSIVE INCOME

FOR THE NINE MONTHSED 31 DECEMBER 2020

9 month period 16 month

ended 31 period ended

Notes December 31 March

2020 2020

GBP

GBP

Administrative expenses 4 (1,201,272) (1,422,878)

--------------- --------------

Operating loss (1,201,272) (1,422,878)

Finance costs (62) (138)

------------------------------------------- -------- --------------- --------------

Loss on ordinary activities before

taxation (1,201,334) (1,423,016)

Tax on loss on ordinary activities 6 - -

------------------------------------------- -------- --------------- --------------

Loss and total comprehensive income

for the period attributable to the

owners of the company (1,201,334) (1,423,016)

------------------------------------------- -------- --------------- --------------

Earnings per share (basic and diluted)

attributable to the equity holders

(pence) 7 (0.3) (0.8)

The above results relate entirely to continuing activities.

The accompanying notes form part of these financial

statements.

STATEMENT OF FINANCIAL POSITION

AS AT 31 DECEMBER 2020

As at As at

31 December 31 March

Notes 2020 2020

GBP GBP

CURRENT ASSETS

Trade and other receivables 8 24,037 44,486

Cash and cash equivalents 9 1,261,997 552,977

----------------------------- -------- ------------- ------------

1,286,034 597,463

----------------------------- -------- ------------- ------------

TOTAL ASSETS 1,286,034 597,463

----------------------------- -------- ------------- ------------

CURRENT LIABILITIES

Trade and other payables 10 365,746 208,296

----------------------------- -------- ------------- ------------

TOTAL LIABILITIES 365,746 208,296

----------------------------- -------- ------------- ------------

NET ASSETS 920,288 389,167

----------------------------- -------- ------------- ------------

EQUITY

Share capital 11 52,453 30,978

Share premium 11 3,468,048 1,757,068

Warrant reserve 12 24,137 24,137

Retained loss (2,624,349) (1,423,016)

TOTAL EQUITY 920,288 389,167

----------------------------- -------- ------------- ------------

The accompanying notes form part of these financial

statements.

STATEMENT OF CASHFLOWS

FOR THE NINE MONTHSED 31 DECEMBER 2020

Period ended Period ended

31 December 31 March

2020 2020

GBP GBP

Cash flow from operating activities

Loss for the period (1,201,334) (1,423,016)

Adjustments for:

Decrease / (Increase) in trade

and other receivables 20,449 (44,486)

Increase in trade and other

payables 157,450 208,296

Share based payments 24,750 24,137

-------------------------------------- ------------- -------------

Net cash outflow from operating

activities (998,685) (1,235,069)

-------------------------------------- ------------- -------------

Cashflow from financing activities

Proceeds on the issue of shares 1,920,588 1,906,776

Costs related to share issues (212,883) (118,730)

-------------------------------------- ------------- -------------

Net cash inflow from financing

activities 1,707,705 1,788,046

-------------------------------------- ------------- -------------

Net increase in cash and cash

equivalents 709,020 552,977

Cash and cash equivalents at 552,977 -

the beginning of the period

Foreign exchange -

------------------------------------- ------------- -------------

Cash and cash equivalents at

the end of the period 1,261,997 552,977

-------------------------------------- ------------- -------------

There were no cashflows from investing activities during the

period.

STATEMENT OF CHANGES IN EQUITY

FOR THE NINE MONTHSED 31 DECEMBER 2020

Share Capital Share Premium Warrant Retained Total

reserve Loss

GBP GBP GBP GBP GBP

-------------------------- -------------- -------------- --------- ------------ ------------

Balance at incorporation

28 November 2018 2 - - - 2

Total comprehensive

loss for the period - - - (1,423,016) (1,423,016)

Shares issued during

the period 30,976 1,875,798 - - 1,906,774

Costs related to share

issues - (118,730) - - (118,730)

Fair value of warrants

issued in the period - - 24,137 - 24,137

--------------------------- -------------- -------------- --------- ------------ ------------

Balance at 31 March

2020 30,978 1,757,068 24,137 (1,423,016) 389,167

--------------------------- -------------- -------------- --------- ------------ ------------

Total comprehensive

loss for the period - - - (1,201,334) (1,201,334)

Shares issued during

the period 21,475 1,923,863 1,945,338

Costs related to share

issues - (212,883) - - (212,883)

--------------------------- -------------- -------------- --------- ------------ ------------

Balance at 31 December

2020 52,453 3,468,048 24,137 (2,624,349) 920,288

--------------------------- -------------- -------------- --------- ------------ ------------

The accompanying notes form part of these financial

statements.

NOTES TO THE FINANCIAL STATEMENTS

FOR THE NINE MONTHSED 31 DECEMBER 2020

1 GENERAL INFORMATION

The principal activity of Cyba Plc (the "Company") is to

identify potential companies, businesses or asset(s) in the Cyber

Security sector that will increase shareholder value.

The Company is domiciled in the United Kingdom and incorporated

and registered in England and Wales as a public limited company.

The Company's registered office is 5 Fleet Place, London EC4M 7RD.

The Company's registered number is 11701224.

2 ACCOUNTING POLICIES

2.1 Basis of preparation

The Financial Statements of the Company have been prepared in

accordance with International Financial Reporting Standards

("IFRS") and IFRS Interpretations Committee ("IFRS IC") as adopted

by the European Union and the Companies Act 2006 applicable to

companies reporting under IFRS.

The Financial Statements have been prepared under the historical

cost convention unless otherwise stated. The principal accounting

policies are set out below and have, unless otherwise stated, been

applied consistently. The Financial Statements are prepared in

pounds Sterling and presented to the nearest pound.

2.2 Going concern

The financial statements have been prepared on a going concern

basis, which assumes that the Company will continue in operational

existence for the foreseeable future.

The Company had a net cash outflow from operating activities for

the period of GBP998,685 and at 31 December 2020 had cash and cash

equivalents balance of GBP1,261,997. The Directors are confident

that costs will be managed in line with expectations until a target

company is acquired. The Directors have considered the management

forecasts, post period-end fund raises, current working capital

levels and utilisation of funds until an appropriate acquisition

target has been identified, based on these factors the Directors

consider that the entity is a going concern.

The Directors have considered the implications on the going

concern status of the Company should the proposed transaction with

Narf complete in the next 12 months. They have assessed that the

Company would remain a going concern in this event due to the

expected significant funds to be raised in conjunction with the

completion of the transaction ensuring that the Company will have

sufficient cash reserves to meet the enlarged Group's obligations

as they fall due during the going concern period.

The Directors consider that the continued adoption of the going

concern basis is appropriate having reviewed the forecasts for the

12 months from the date of signing the financial statements and the

accounts do not reflect any adjustments that would be required if

they were to be prepared on any basis and assessing the adverse

impact that COVID-19 will have on the global economy. The Directors

believe that the Company is in a strong working capital position

that will mitigate any negative macroeconomic shocks.

2.3 Foreign currency translation

The financial information is presented in Sterling which is the

Company's functional and presentational currency.

Transactions in currencies other than the functional currency

are recognised at the rates of exchange on the dates of the

transactions. At each balance sheet date, monetary assets and

liabilities are retranslated at the rates prevailing at the balance

sheet date with differences recognised in the Statement of

comprehensive income in the period in which they arise.

2.4 Cash and cash equivalents

Cash and cash equivalents comprise cash at hand and current and

deposit balances at banks.

2.5 Trade and other receivables

Due to the short-term nature of the current receivables, their

carrying amount is considered to be the same as their fair

value.

2.6 Trade and other payables

Trade payables are recognised initially at their fair value and

subsequently measured at amortised cost.

2.7 Financial instruments

Initial recognition

A financial asset or financial liability is recognised in the

statement of financial position of the Company when it arises or

when the Company becomes part of the contractual terms of the

financial instrument.

Classification

Financial assets at amortised cost

The Company measures financial assets at amortised cost if both

of the following conditions are met

-- the asset is held within a business model whose objective is

to collect contractual cash flows; and

-- the contractual terms of the financial asset generating cash

flows at specified dates only pertain to capital and interest

payments on the balance of the initial capital.

Financial assets which are measured at amortised cost, are

measured using the Effective Interest Rate Method (EIR) and are

subject to impairment. Gains and losses are recognised in profit or

loss when the asset is derecognised, modified or impaired.

Financial liabilities at amortised cost

Financial liabilities measured at amortised cost using the

effective interest rate method include current borrowings and trade

and other payables that are short term in nature. Financial

liabilities are derecognised if the Company's obligations specified

in the contract expire or are discharged or cancelled.

Amortised cost is calculated by taking into account any discount

or premium on acquisition and fees or costs that are an integral

part of the effective interest rate ("EIR"). The EIR amortisation

is included as finance costs in profit or loss. Trade payables

other payables are non-interest bearing and are stated at amortised

cost using the effective interest method.

Derecognition

A financial asset is derecognised when:

-- the rights to receive cash flows from the asset have expired, or

-- the Company has transferred its rights to receive cash flows

from the asset or has undertaken the commitment to fully pay the

cash flows received without significant delay to a third party

under an arrangement and has either (a) transferred substantially

all the risks and the assets

of the asset or (b) has neither transferred nor held

substantially all the risks and estimates of the asset but has

transferred the control of the asset.

Impairment

The Company recognises a provision for impairment for expected

credit losses regarding all financial assets. Expected credit

losses are based on the balance between all the payable contractual

cash flows and all discounted cash flows that the Company expects

to receive. Regarding trade receivables, the Company applies the

IFRS 9 simplified approach in order to calculate expected credit

losses. Therefore, at every reporting date, provision for losses

regarding a financial instrument is measured at an amount equal to

the expected credit losses over its lifetime without monitoring

changes in credit risk. To measure expected credit losses, trade

receivables and contract assets have been grouped based on shared

risk characteristics.

2.8 Equity

Share capital is determined using the nominal value of shares

that have been issued.

The Share premium account includes any premiums received on the

initial issuing of the share capital. Any transaction costs

associated with the issuing of shares are deducted from the Share

premium account, net of any related income tax benefits.

Equity-settled share-based payments are credited to a warrants

reserve as a component of equity until related options or warrants

are exercised or lapse.

The warrant reserve includes share warrants issued to

shareholders in connection with share capital issues that are

measured at fair value at the date of issue and treated as a

separate component of equity.

Retained earnings includes all current and prior period results

as disclosed in the income statement.

2.9 Earnings per share

Basic earnings per share is calculated by dividing:

The loss attributable to owners of the company, excluding any

costs of servicing equity other than ordinary shares.

By weighting the average number of ordinary shares outstanding

during the financial period.

2.10 Share-based payments

The Company has issued warrants to the initial investors and

certain counter parties and advisers.

Equity-settled share-based payments are measured at fair value

(excluding the effect of non-market based vesting conditions) at

date of grant. The fair value so determined is expensed on a

straight-line basis over the vesting period, based on the Company's

estimate of the number of shares that will eventually vest and

adjusted for the effect of non-market based vesting conditions.

Fair value is measured using the Black Scholes pricing model.

The key assumptions used in the model have been adjusted, based on

management's best estimate, for the effects of non-transferability,

exercise restrictions and behavioural considerations.

2.11 Taxation

Tax currently payable is based on taxable profit for the period.

Taxable profit differs from profit as reported in the income

statement because it excludes items of income and expense that are

taxable or deductible in other years and it further excludes items

that are never taxable or deductible. The Company's liability for

current tax is calculated using tax rates that have been enacted or

substantively enacted by the balance sheet date.

Deferred tax is recognised on differences between the carrying

amounts of assets and liabilities in the financial statements and

the corresponding tax bases used in the computation of taxable

profit and is accounted for using the balance sheet liability

method. Deferred tax liabilities are generally recognised for all

taxable temporary differences and deferred tax assets are

recognised to the extent that it is probable that taxable profits

will be available against which deductible temporary differences

can be utilised. Such assets and liabilities are not recognised if

the temporary difference arises from initial recognition of

goodwill or from the initial recognition (other than in a business

combination) of other assets and liabilities in a transaction that

affects neither the taxable profit nor the accounting profit.

Deferred tax liabilities are recognised for taxable temporary

differences arising on investments in subsidiaries and associates,

and interests in joint ventures, except where the Company is able

to control the reversal of the temporary difference and it is

probable that the temporary difference will not reverse in the

foreseeable future.

The carrying amount of deferred tax assets is reviewed at each

balance sheet date and reduced to the extent that it is no longer

probable that sufficient taxable profits will be available to allow

all or part of the asset to be recovered.

Deferred tax is calculated at the tax rates that are expected to

apply in the period when the liability is settled, or the asset

realised. Deferred tax is charged or credited to profit or loss,

except when it relates to items charged or credited directly to

equity, in which case the deferred tax is also dealt with in

equity.

Deferred tax assets and liabilities are offset when there is a

legally enforceable right to set off current tax assets against

current tax liabilities and when they relate to income taxes levied

by the same taxation authority and the Company intends to settle

its current tax assets and liabilities on a net basis.

2.12 Critical accounting judgements and key sources of estimation uncertainty

In the process of applying the entity's accounting policies,

management makes estimates and assumptions that have an effect on

the amounts recognised in the financial information. Although these

estimates are based on management's best knowledge of current

events and actions, actual results may ultimately differ from those

estimates. The Directors consider that there are no critical

accounting judgements or key sources of estimation uncertainly

relating to the financial information of the Company.

2.13 Standards, amendments and interpretations to existing

standards that are not yet effective

New standards, amendments to standards and interpretations:

Standard Impact on initial Effective date, annual

application period beginning on

or after

IFRS 3 - Business Combinations Definition of a business 1 January 2020

------------------------- -----------------------

IFRS standards (amendments) References to the 1 January 2020

Conceptual Framework

------------------------- -----------------------

IAS 1 & IAS 8 (amendments) Definition of Material 1 January 2020

------------------------- -----------------------

IFRS 9, IAS 39 and IFRS Interest Rate Benchmark 1 January 2020

7 (amendments) Reform

------------------------- -----------------------

IFRS 3 (amendments) Definition of a Business 1 January 2020

------------------------- -----------------------

IFRS standards (amendments) References to the 1 January 2020

Conceptual Framework

------------------------- -----------------------

No new standards, amendments or interpretations, effective for

the first time for the financial period beginning on or after 1

April 2020 have had a material impact on the Company.

Standards issued but not yet effective:

At the date of authorisation of these financial statements, the

following standards and interpretations relevant to the Company and

which have not been applied in these financial statements, were in

issue but were not yet effective. In some cases, these standards

and guidance have not been endorsed for use in the European

Union.

Standard Impact on initial Effective date, annual

application period beginning on

or after

IFRS standards (amendments) Interest rate benchmark 1 January 2021

reform

----------------------------- -----------------------

IFRS 3 (amendments) Business combinations 1 January 2022

----------------------------- -----------------------

IAS 37 (amendments) Onerous contracts 1 January 2022

----------------------------- -----------------------

IFRS standards (amendments) 2018-2020 annual improvement 1 January 2022

cycle

----------------------------- -----------------------

IAS 16 (amendments) Proceeds before intended 1 January 2022

use

----------------------------- -----------------------

IFRS 17 Insurance Contracts 1 January 2023

----------------------------- -----------------------

IFRS 17 (amendments) Insurance contracts 1 January 2023

----------------------------- -----------------------

IAS 1 (amendments) Reclassification of 1 January 2023

liabilities as current

or non-current

----------------------------- -----------------------

The directors are evaluating the impact that these standards

will have on the financial statements of the Company but it is not

anticipated that they will have a material impact on the

company.

2.14 Segmental reporting

Operating segments are reported in a manner consistent with the

internal reporting provided to the chief operating

decision-maker.

The chief operating decision-maker, who is responsible for

allocating resources and assessing performance of the operating

segments, has been identified as the Board as a whole.

Given the current operations of the Company there are no

reportable segments.

2.14 Financial Risk Management Objectives and Policies

The Company does not enter into any forward exchange rate

contracts.

The main financial risks arising from the Company's activities

are market risk, interest rate risk, foreign exchange risk, credit

risk, liquidity risk and capital risk management. Further details

on the risk disclosures can be found in Note 15.

3. REVENUE

There was no revenue generated in the period.

4. ADMINISTRATIVE EXPENSES

This is stated after charging:

31 December 31 March

2020 2020

GBP GBP

Auditor's remuneration

* audit of the Company 15,000 10,000

* non-audit services

taxation compliance services - -

other taxation services - -

corporate finance services 12,500 -

Directors' remuneration 205,900 308,937

Legal, professional and consultancy

fees 355,115 420,549

Other expenses 612,819 683,530

-------------------------------------------- ------------ ---------

5. DIRECTORS AND STAFF COSTS

During the period the only staff of the Company were the

Directors and as such key management personnel. Management

remuneration, other benefits supplied and social security costs to

the Directors during the period was as follows:

31 December 31 March

2020 2020

GBP GBP

Directors' fees 205,900 308,937

------------------ ------------ ---------

205,900 308,937

----------------- ------------ ---------

The average number of staff during the period, including

Directors was 4.

The remuneration and associated social security costs per

Director was all short term in nature and was as follows:

Share Based 31 December

Directors' Payments 2020

Fees GBP

------------ ------------- ------------ ------------

R Mitchell 70,000 - 70,000

S Bassi 32,950 - 32,950

J Herring 32,950 - 32,950

R Heier 70,000 - 70,000

205,900 - 205,900

------------- ------------ ------------

For the comparative period to 31 March 2020:

Share Based 31 March

Directors' Payments 2020

Fees GBP

------------ ------------- ------------ ---------

R Mitchell 111,476 - 111,476

S Bassi 58,452 - 58,452

J Herring 58,452 - 58,452

R Heier 70,500 10,057 80,557

298,880 10,057 308,937

------------- ------------ ---------

6. TAXATION

31 December 31 March

2020 2020

GBP GBP

The charge / credit for the period

is made up as follows:

Corporation taxation on the results - -

for the period

Deferred tax - -

Taxation charge / credit for the - -

period

------------------------------------------ ------------ ------------

A reconciliation of the tax charge

/ credit appearing in the income

statement to the tax that would result

from applying the standard rate of

tax to the results for the period

is:

Loss per accounts (1,201,334) (1,423,016)

------------------------------------------- ------------ ------------

Tax credit at the standard rate of

corporation tax in the UK of 19% (228,253) (270,373)

Impact of costs disallowed for tax

purposes 104,925 107,685

Deferred tax in respect of temporary - -

differences

Impact of unrelieved tax losses carried

forward 123,328 162,688

------------------------------------------- ------------ ------------

- -

------------------------------------------ ------------ ------------

Estimated tax losses of GBP286,016 (31 March 2020: GBP162,688)

are available for relief against future profits. No relating

deferred tax asset has been provided for in the accounts based on

the uncertainty as to when profits will be generated against which

to relieve said asset

Factors affecting the future tax charge

The standard rate of corporation tax in the UK is 19%.

Accordingly, the Company's effective tax rate for the period was

19%.

7. EARNINGS PER SHARE

Basic earnings per share is calculated by dividing the loss

attributable to equity holders of the Company by the weighted

average number of ordinary shares in issue during the period.

31 December 31 March

2020 2020

GBP GBP

Loss from continuing operations attributable

to equity holders of the company (1,201,334) (1,423,016)

----------------------------------------------- ------------ ------------

Weighted average number of ordinary

shares in issue 374,933,182 179,745,588

----------------------------------------------- ------------ ------------

Basic and fully diluted loss per

share from continuing operations

(pence) (0.3) (0.8)

----------------------------------------------- ------------ ------------

The calculation of the earnings per share is based on the loss

for the financial period after taxation of GBP1,201,334 and on the

weighted average of 374,933,182 ordinary shares in issue during the

period.

The warrants outstanding at 31 December 2020 are considered to

be non-dilutive as a loss was made for the period. The diluted loss

per share is therefore equal to the non-diluted loss per share

8. TRADE AND OTHER RECEIVABLES

31 December 31 March

2020 2020

GBP GBP

Prepayments and other receivables 24,037 44,486

24,037 44,486

----------------------------------- ------------ ---------

The Directors consider that the carrying value amount of trade

and other receivables approximates to their fair value.

9. CASH AND CASH EQUIVALENTS

31 December 31 March

2020 2020

GBP GBP

Cash at bank 1,261,997 552,977

--------------- ------------ ---------

1,261,977 552,977

-------------- ------------ ---------

Cash at bank comprises balances held by the Company in current

bank accounts. The carrying value of these approximates to their

fair value. The cash is held in a bank with a BBB credit

rating.

10. TRADE AND OTHER PAYABLES

31 December 31 March

2020 2020

GBP GBP

Accrued liabilities 279,745 127,903

Trade and other payables 86,000 80,392

--------------------------- ------------ ---------

365,746 208,296

-------------------------- ------------ ---------

Trade payables and accruals principally comprise amounts

outstanding for trade purchases and continuing costs. The Directors

consider that the carrying value amount of trade and other payables

approximates to their fair value. Refer Note 15.

11. SHARE CAPITAL / SHARE PREMIUM

Number Share Share

of shares capital premium Total

on issue GBP GBP GBP

------------------------------

Balance on incorporation

as at 28 November 2018 2 2 - 2

Shares issued during the

period (net of issue costs) 309,774,998 30,976 1,756,068 1,788,044

Balance as at 31 March 2020 309,775,000 30,978 1,756,068 1,788,044

------------ --------- ---------- ----------

Shares issued during the

period (net of issue costs) 214,750,000 21,477 1,710,988 1,732,455

------------ --------- ---------- ----------

Balance as at 31 December

2020 524,525,000 52,453 3,468,048 3,597,406

------------ --------- ---------- ----------

The Company has only one class of share. All ordinary shares

have equal voting rights and rank pari passu for the distribution

of dividends and repayment of capital. As at 31 December 2020 the

Company's issued and outstanding capital structure comprised

524,525,000 shares and there were no other securities in issue and

outstanding.

On 28 November 2018 the Company was incorporated and issued 2

ordinary shares of GBP0.001 each.

On 1 December 2018 the Company issued 115,249,998 ordinary

shares of GBP0.0001 each in lieu of consulting fees. The shares

rank pari passu in all respects to the existing ordinary

shares.

From 1 January 2019 to March 2020 the Company issued 190,025,000

ordinary shares of GBP0.0001 each at a place price of GBP0.01 per

placing share. The shares rank pari passu in all respects to the

existing ordinary shares.

On 28 February 2020 the Company issued 4,500,000 ordinary shares

of GBP0.0001 each at a placing price of GBP0.01 per placing share

in settlement of consulting fees of a sum of GBP45,000 owed to a

creditor. The shares rank pari passu in all respects to the

existing ordinary shares.

From 1 April 2020 to 31 December 2020 the Company issued

214,750,000 ordinary shares of GBP0.0001 each at a place price of

GBP0.01 per placing share. The shares rank pari passu in all

respects to the existing ordinary shares.

At 31 March 2020, there were warrants over 12,000,000 unissued

ordinary shares.

12. WARRANT RESERVE

Details of the warrants outstanding are as follows:

Issued Exercisable Expiry date Number outstanding Exercise

from price

20 October 2019 Anytime until 8 March 2022 12,000,000 GBP0.01

31 March 31 December

2020 2020

GBP GBP

--------- ------------

At beginning of period 24,137 -

Fair value of warrants granted and vested

during the period - 24,137

At end of period 24,137 24,137

--------- ------------

The Company issued 12,000,000 warrants during the period on 20

October 2019.

Fair Value Weighted average

Number GBP exercise price

----------- ----------------------- -----------------

At 31 December 2020 12,000,000 24,137 GBP0.01

The estimated fair value of the warrants granted in October 2019

was calculated by applying the Black-Scholes option pricing model.

The assumptions used in the calculation were as follows:

Share price at date of grant 1.00 pence

Exercise price 1.00 pence

Expected volatility 35%

Expected dividend Nil

Vesting criteria Exercisable on date of grant

Contractual life 2 years

Risk free rate 0.70%

Estimate fair value of each warrant 0.20 pence

The warrants outstanding at the period end have a weighted

average remaining contractual life of 1.25 years. The exercise

prices of the warrants are GBP0.01 per share.

13. CAPITAL COMMITMENTS

There were no capital commitments at 31 December 2020.

14. CONTINGENT LIABILITIES

There were no contingent liabilities at 31 December 2020.

15. FINANCIAL INSTRUMENTS AND RISK MANAGEMENT

The Company's financial instruments comprise primarily cash and

various items such as trade debtors and trade payables which arise

directly from operations. The main purpose of these financial

instruments is to provide working capital for the Company's

operations. The Company does not utilise complex financial

instruments or hedging mechanisms.

Financial assets by category

The categories of financial assets are as follows:

31 December 31 March

2020 2020

GBP GBP

Current Assets at amortised cost:

Trade and other receivables - -

Cash and cash equivalents 1,261,997 552,977

1,261,997 552,977

----------------------------------- ------------ ---------

Financial liabilities by category

The categories of financial liabilities are as follows:

31 December 31 March

2020 2020

GBP GBP

Current Liabilities at amortised cost:

Trade and other payables 86,000 80,392

Categorised as financial liabilities

measured at amortised cost 86,000 80,392

----------------------------------------- ------------ ---------

All amounts are short term and payable in 0 to 3 months.

Credit risk

The maximum exposure to credit risk at the reporting date by

class of financial asset was:

31 December 31 March

2020 2020

GBP GBP

Trade and other receivables - -

---------------------------- ------------ ---------

Interest rate risk

The maximum exposure to interest rate risk at the reporting date

by class of financial asset was:

31 December 31 March

2020 2020

GBP GBP

Bank balances 1,261,997 552,977

---------------- ------------ ---------

The nature of the Company's activities and the basis of funding

are such that the Company has significant liquid resources. The

Company uses these resources to meet the cost of operations.

The Company is not financially dependent on the income earned on

these resources and therefore the risk of interest rate

fluctuations is not significant to the business and the Directors

have not performed a detailed sensitivity analysis.

All deposits are placed with main clearing banks to restrict

both credit risk and liquidity risk. The deposits are placed for

the short term, between one and three months, to provide

flexibility and access to the funds.

Credit and liquidity risk

Credit risk is the risk of an unexpected loss if a counter party

to a financial instrument fails to meet its commercial obligations.

The Company's maximum credit risk exposure is limited to the

carrying amount of cash of GBP1,261,997 and trade and other

receivables of GBPnil. Credit risk is managed on a Company basis.

Funds are deposited with financial institutions with a credit

rating equivalent to, or above, the main UK clearing banks. The

Company's liquid resources are invested having regard to the timing

of payment to be made in the ordinary course of the Company's

activities. All financial liabilities are payable in the short term

(between 0 to 3 months) and the Company maintains adequate bank

balances to meet those liabilities.

Currency risk

The Company operates in a global market with income and costs

possibly arising in a number of currencies. The majority of the

operating costs are incurred in GBPGBP. The Company does not hedge

potential future income or costs, since the existence, quantum and

timing of such transactions cannot be accurately predicted. The

Company did not have foreign currency exposure at period end.

16. CAPITAL MANAGEMENT

The Company manages its capital to ensure that it will be able

to continue as a going concern while maximising the return to

shareholders through the optimisation of the balance between debt

and equity.

The capital structure of the Company as at 31 December 2020

consisted of equity attributable to the equity holders of the

Company, totalling GBP920,288.

The Company reviews the capital structure on an on-going basis.

As part of this review, the directors consider the cost of capital

and the risks associated with each class of capital. The Company

will balance its overall capital structure through the payment of

dividends, new share issues and the issue of new debt or the

repayment of existing debt.

17. RELATED PARTY TRANSACTIONS

The compensation payable to Key Management personnel comprised

GBP205,900 paid by the Company to the Directors in respect of

services to the Company. Full details of the compensation for each

Director are provided in the Directors' Remuneration Report. At

period end, an amount of GBP38,804 (31 March 2020: GBP112,903) was

due to the Directors in respect of Directors remuneration.

Rory Heier is the sole Director of Harpers Capital Limited that

received GBP76,500 during the period for the provision of

consulting, marketing and business development services. At the

period end, an amount of GBPNil was due to Harpers Capital

Limited.

Steve Bassi is a Director of Narf Industries LLC, a company that

received $250,000 USD during the period for the agreed payment of

legal and due diligence services in connection with the signed

letter of intent between Narf Industries LLC and Cyba plc. At the

period end, an amount of GBPNil was due to Narf Industries LLC.

18. EVENTS SUBESQUENT TO PERIOD END

On 8 March 2021, the Company commenced trading its ordinary

shares on the Main Market for listed securities of the London Stock

Exchange plc under the TDIM 'CYBA'

On 13 May 2021, the Company completed a placement of 100 million

ordinary shares of 0.0001p each at a price of 2p er ordinary share

to raise GBP2 million before expenses to new and existing

shareholders of Cyba plc.

On 21 June 2021, the Company announced a proposed acquisition of

Narf Industries LLC and Narf Industries PR LLC and has entered into

legally binding heads of agreement to acquire the entire issued

share capital of Narf, an established provider of cutting edge

cyber security R&D to the US Government and Industry, for a

total consideration of US$25.6 million, of which $2.0m is payable

by way of deposit to the sellers.

On 21 June 2021, the Company announced that it had secured an

extension of the exclusivity period set out in the Letter of Intent

entered into on 6 October 2020 in relation n to the Company's

possible acquisition of Swarm Industries Inc. and Swarm

Technologies Inc up to 30 September 2021.

19. CONTROL

In the opinion of the Directors there is no single ultimate

controlling party.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

QRTGZGFVLGVGMZG

(END) Dow Jones Newswires

June 30, 2021 05:30 ET (09:30 GMT)

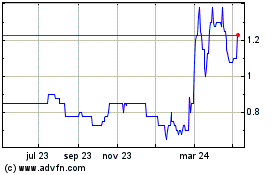

Narf Industries (LSE:NARF)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

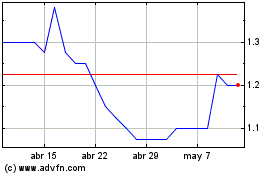

Narf Industries (LSE:NARF)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024