CYBA PLC Issue of Equity (5157Y)

13 Mayo 2021 - 1:17AM

UK Regulatory

TIDMCYBA

RNS Number : 5157Y

CYBA PLC

13 May 2021

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS STIPULATED

UNDER THE UK VERSION OF THE MARKET ABUSE REGULATION NO 596/2014

WHICH IS PART OF ENGLISH LAW BY VIRTUE OF THE EUROPEAN (WITHDRAWAL)

ACT 2018, AS AMENDED. ON PUBLICATION OF THIS ANNOUNCEMENT VIA A

REGULATORY INFORMATION SERVICE, THIS INFORMATION IS CONSIDERED TO

BE IN THE PUBLIC DOMAIN.

13 May 2021

CYBA plc ("CYBA" or the "Company")

Placing to raise GBP2 Million

CYBA plc ("CYBA" or the "Company") has completed a placement of

100 million ordinary shares of 0.0001p each ("Ordinary Shares") at

a price of 2p per ordinary share to raise GBP2 million (the

"Placing"), before expenses to new and existing shareholders of

Cyba plc. The Placing is conditional on admission of the Ordinary

Shares to trading on the standard listing segment of the Official

List maintained by the FCA and to the London Stock Exchange's main

market for listed securities ("LSE"). The broker to the Placing was

Tennyson Securities.

The Board are considering and actively pursuing certain

transaction opportunities to grow the Company. The potential

transactions are in line with the stated strategy of the Company at

the time of admission earlier this year. The Placing funds will be

used to pay additional costs to be incurred as the Company

accelerates this acquisition strategy. The Board will have a

further update for shareholders on the progress soon.

Application has been made for the 100 million new Ordinary

shares being issued in connection with the Placing to be admitted

to trading to LSE, which is expected to occur on Monday 17 May

2021.

Following admission of the new Ordinary Shares, the Company's

enlarged issued share capital will comprise 624,525,000 Ordinary

Shares with voting rights. The Company has no shares held in

Treasury. This figure of 624,525,000 Ordinary Shares may be used by

shareholders in the Company as the denominator for the calculations

by which they will determine if they are required to notify their

interest in, or a change in their interest in, the share capital of

the Company under the FCA's Disclosure Guidance and Transparency

Rules.

ENDS

For further information on the Company please visit

www.cybaplc.com, with the Company's Prospectus to be found at

www.cybaplc.com/investor-relations/corporate-documents or

contact:

Robert Mitchell CYBA Tel: +44 (0) 20 3468

2212

Peter Krens Tennyson Securities Tel: +44 (0)207 186

9030

-------------------- -----------------------------

Catherine Leftley / St Brides Partners Tel: +44 (0)207 236

Frank Buhagiar Ltd, 1177

Financial PR info@stbridespartners.co.uk

-------------------- -----------------------------

About CYBA plc

CYBA plc ("CYBA") is a special purpose acquisition company

("SPAC") seeking suitable acquisition targets in the Cyber Security

sector.

CYBA intends to implement its strategy focussed on building a

group capable of offering Cyber and Cybersecurity solutions in the

US and globally.

The Company intends to leverage the deep industry knowledge of

its board and associates to undertake due diligence on the

commercial attributes of a target entity's business.

Further information in respect of the Company and its business

interests is provided on the Company's website at

www.cybaplc.com

Forward-looking statements

Certain statements in this announcement constitute

"forward-looking statements". Forward-looking statements include

statements concerning the plans, objectives, goals, strategies and

future operations and performance of the Company and the

assumptions underlying these forward-looking statements. The

Company uses the words "anticipates", "estimates", "expects",

"believes", "intends", "plans", "may", "will", "should", and any

similar expressions to identify forward-looking statements. Such

forward-looking statements involve known and unknown risks,

uncertainties and other important factors that could cause the

Company's actual results, performances or achievements to be

materially different from any future results, performances or

achievements expressed or implied by such forward-looking

statements. Such forward-looking statements are based on numerous

assumptions regarding present and future business strategies and

the environment in which the Company will operate in the future.

These forward-looking statements speak only as at the date of this

announcement. The Company is not obliged, and does not intend, to

update or to revise any forward-looking statements, whether as a

result of new information, future events or otherwise except to the

extent required by any applicable law or regulation. All subsequent

written or oral forward-looking statements attributable to the

Company, or persons acting on behalf of the Company, are expressly

qualified in their entirety by the cautionary statements contained

throughout this announcement. As a result of these risks,

uncertainties and assumptions, a prospective investor should not

place undue reliance on these forward-looking statements.

Information to distributors

Solely for the purposes of Paragraph 3.2.7R regarding the

responsibilities of UK Manufacturers under the Product Governance

requirements contained within Chapter 3 of the FCA Handbook Product

Intervention and Product Governance Sourcebook (the "UK Product

Governance Requirements"), and disclaiming all and any liability,

whether arising in tort, contract or otherwise, which any

"manufacturer" (for the purposes of the UK Product Governance

Requirements) may otherwise have with respect thereto, the new

Ordinary shares have been subject to a product approval process,

which has determined that the new Ordinary shares are: (i)

compatible with an end target market of (a) retail investors, (b)

investors who meet the criteria of professional clients and (c)

eligible counterparties, each as defined in UK Product Governance

Requirements; and (ii) eligible for distribution through all

distribution channels as are permitted by UK Product Governance

Requirements (the "Target Market Assessment"). Notwithstanding the

Target Market Assessment, distributors should note that: the price

of the Placing Shares may decline and investors could lose all or

part of their investment; the Placing Shares offer no guaranteed

income and no capital protection; and an investment in the Placing

Shares is compatible only with investors who do not need a

guaranteed income or capital protection, who (either alone or in

conjunction with an appropriate financial or other adviser) are

capable of evaluating the merits and risks of such an investment

and who have sufficient resources to be able to bear any losses

that may result therefrom. The Target Market Assessment is without

prejudice to the requirements of any contractual, legal or

regulatory selling restrictions in relation to the Placing.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOESFDSMDEFSEFI

(END) Dow Jones Newswires

May 13, 2021 02:17 ET (06:17 GMT)

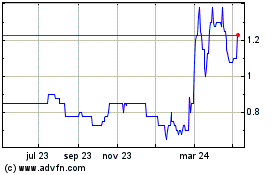

Narf Industries (LSE:NARF)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

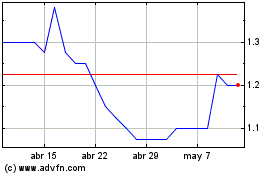

Narf Industries (LSE:NARF)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024