Cadence Minerals PLC Approval of further Amapa Iron Ore Shipment (4345G)

26 Julio 2021 - 3:50AM

UK Regulatory

TIDMKDNC

RNS Number : 4345G

Cadence Minerals PLC

26 July 2021

Cadence Minerals Plc

("Cadence Minerals", "Cadence" or "the Company")

Approval of the Shipment of a further net US$10 million of Iron

Ore from the Amapa Project.

Cadence Minerals AIM/NEX: KDNC; OTC: KDNCY) is pleased to

announce that DEV Mineração S.A ("DEV") has been permitted to

export a further US$10 million (after the deductions of all

logistical, regulatory, shipping and sale costs) of iron ore from

its stockpiles situated at its port in Santana, Amapa, Brazil

("Second Permission"). This authority is in addition to the first

permission granted to DEV on 10 February 2021, in which it was

permitted to ship an initial US$10 million, net of costs, of iron

ore ("First Permission").

In August, DEV is scheduled to complete its fourth and last

shipment under the First Permission; the four shipments of 58%

beneficiated iron ore has netted approximately US$10 million to

DEV. On completion, DEV will begin the shipments to fulfil the

Second Permission.

The net profit from the sale of the iron ore will be used

primarily for commissioning studies, capital projects and working

capital. As per the First Permission, 10% of the net profits will

be reserved for payment against the amounts owed to the secured

bank lenders ("Bank Creditors").

A separate update as to the operational progress will be

published soon.

Cadence Interest in the Amapa Iron Project

As previously announced, in early September 2020, we announced

that DEV Mineração S.A's ("DEV"), Cadence and Indo Sino Pty Ltd

("the Investors") agreed in principle to the settlement terms

proposed by the Bank Creditors. The principal commercial terms

agreed in 2020 have not varied materially, and at the time of

writing, the final settlement is currently with the Bank Creditors

for comment and/or approval.

The execution of a settlement agreement with the Bank Creditors

would represent the satisfaction of Cadence's remaining major

precondition to make its initial 20% investment in the Amapa

Project. On completion of the conditions and the release of the

Cadence escrow monies, Cadence will become a 20% shareholder in the

Amapá Project via our joint venture company, which will own 99.9%

of DEV.

- Ends -

For further information: Cadence Minerals plc +44 (0) 7879 584153

Andrew Suckling

Kiran Morzaria

WH Ireland Limited (NOMAD

& Broker) +44 (0) 207 220 1666

James Joyce

James Sinclair-Ford

Novum Securities Limited

(Joint Broker) +44 (0) 207 399 9400

Jon Belliss

Qualified Person

Kiran Morzaria B.Eng. (ACSM), MBA, has reviewed and approved the

information contained in this announcement. Kiran holds a Bachelor

of Engineering (Industrial Geology) from the Camborne School of

Mines and an MBA (Finance) from CASS Business School.

Forward-Looking Statements:

Certain statements in this announcement are or may be deemed to

be forward-looking statements. Forward-looking statements are

identi ed by their use of terms and phrases such as "believe"

"could" "should" "envisage" "estimate" "intend" "may" "plan" "will"

or the negative of those variations or comparable expressions

including references to assumptions. These forward-looking

statements are not based on historical facts but rather on the

Directors' current expectations and assumptions regarding the

Company's future growth results of operations performance, future

capital and other expenditures (including the amount. nature and

funding sources), competitive advantages business prospects and

opportunities. Such forward-looking statements re ect the

Directors' current beliefs and assumptions based on information

currently available to the Directors. Many factors could cause

actual results to differ materially from the results discussed in

the forward-looking statements, including risks associated with

vulnerability to general economic and business conditions,

competition environmental and other regulatory changes actions by

governmental authorities, the availability of capital markets

reliance on key personnel uninsured and underinsured losses and

other factors many of which are beyond the control of the Company.

Although any forward-looking statements in this announcement are

based on what the Directors believe to be reasonable assumptions.

The Company cannot assure investors that actual results will be

consistent with such forward-looking statements.

The information contained within this announcement is deemed by

the Company to constitute inside information under the Market Abuse

Regulation (EU) No. 596/2014

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCSEWSAMEFSELW

(END) Dow Jones Newswires

July 26, 2021 04:50 ET (08:50 GMT)

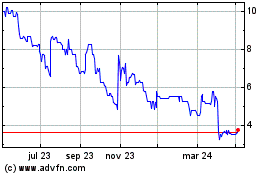

Cadence Minerals (LSE:KDNC)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

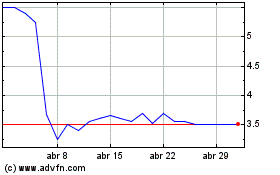

Cadence Minerals (LSE:KDNC)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024