TIDMKDNC

RNS Number : 9979H

Cadence Minerals PLC

09 August 2021

Cadence Minerals Plc

("Cadence Minerals", "Cadence")

Macarthur Minerals (TSX-V: MMS, ASX: MIO) Strengthens DSO Export

Position in the Yilgarn Region With Additional Rail Haulage

Deal.

Cadence Minerals (AIM/NEX: KDNC; OTC: KDNCY) is pleased to note

that Macarthur Minerals (TSX-V: MMS) (ASX: MIO) (the "Company" or

"Macarthur") has announced that it has agreed terms with Aurizon

("Aurizon"), for the transport of direct shipment ore (DSO) at a

rate of up to 500,000 tonnes per annum between West Kalgoorlie and

Kwinana.

Macarthur's combined rail position now extends the Company's

potential access to rail haulage capacity in Western Australia to

almost 1 million tonnes over the next 12 months, and up to 2.1

million tonnes in aggregate over 4 years, subject to securing

matching port access.

Increasing Macarthur's aggregated rail access is critical to

accelerating the Company's early revenue objectives. The maximising

of rail capacity is subject to successfully securing matching

capacity at Fremantle and Esperance ports.

The Company's continued incremental approach to building rail

access is both deliberate and strategic as it seeks to maximise

opportunities for the export of iron ore products at the earliest

available opportunity.

Key Agreement Terms

The rail haulage agreement with Aurizon requires the transport

of a minimum of 450,000 tonnes over a term of 12 months and is

subject to satisfaction of certain conditions precedent (which

include Macarthur securing matching port access on commercially

acceptable terms, and Aurizon achieving a number of regulatory

approvals).

Enhancing the Pathway for Export

The agreement with Aurizon increases Macarthur's potential

contracted rail capacity in Western Australia to just under 1

million tonnes over the next 12 months (and up to 2.1 million

tonnes in aggregate over the next 4 years).

Aurizon's Bulk business is the largest transporter of Iron Ore

outside the Pilbara. Rail Capacity is an important link in an

emerging transport solution that will enable Macarthur to take

advantage of the strong iron ore pricing conditions and target

early revenue generation in the current commodity cycle.

Macarthur's early revenue generation targets include the export of

GWR's DSO products whilst the Company completes its planning

mining, production and export of a DSO product from Ularring at the

earliest available opportunity.

DSO and Magnetite Project Financing to be Accelerated

With Macarthur's various production strategies now gaining

material traction, the Company is determined to accelerate its

project financing.

Anticipated cash inflows from Warrants

During the course of September and December this year, a

material number of in-the-money warrants are anticipated to be

exercised. Those warrant holders electing to exercise will be

delivered an opportunity to consolidate their position, and this

will in turn, provide the Company with funds to support the pursuit

of revenue generating activities.

DSO Funding

In response to material milestones being achieved on project and

logistics planning, Macarthur now intends to accelerate

arrangements for project financing to support DSO mining operations

at Ularring. Management has already advanced its pre-planning over

the course of the last several months, and a funding process (at a

yet to be determined future price) to support the debt/equity

capital requirements for the DSO mining operations is being

progressed.

The Company is intending to open formal negotiations for

mandates for the purpose of settling the engagements and

structuring for the raise of required debt/equity funding to

support future DSO mining operations.

Magnetite Funding

Finally, the Company intends to open negotiations for a mandate

(or mandates) to secure an early, conditional equity and debt

funding deal that will enable Macarthur to progress towards first

magnetite production following delivery of the current Feasibility

Study. Part of this funding would be allocated to necessary

pre-production activities to streamline the delivery of the

magnetite project. Opportunities for an early combined funding

solution that can support both the planned DSO mining operations

and financing of magnetite mining operations through to first

production are being actively pursued.

The acceleration of Macarthur's financing strategy is now firmly

in motion as it strengthens its resolve to transition into

production as quickly as possible.

Andrew Bruton, CEO of Macarthur Minerals commented: "This

agreement has the potential to increase Macarthur's overall access

to rail haulage capacity and enhances the foundations for the

Company's ambitions to commence iron ore exports as soon as

possible. It is another pleasing step towards realising our

objective to transition to revenue generating activities and

Macarthur is delighted to be partnering with Aurizon. With

continued diligence, resolve and respectful engagement with key

stakeholders, we remain very optimistic that it is now not a matter

of if, but when, the Company will finally conclude the balance of

the necessary arrangements that will enable it to commence moving

and exporting iron ore products. This is only the beginning of the

next phase of Macarthur's journey - walk with us and discover

something big."

Link here for the full announcement:

https://finance.yahoo.com/news/macarthur-strengthens-dso-export-position-120000481.html

Cadence Minerals Holding in Macarthur

Cadence holds approximately 1% of the issued equity interest in

Macarthur, which is an Australian mining exploration company

focused primarily on iron ore, nickel, lithium and gold in Western

Australia. It also has a lithium project in Nevada, USA.

This news release is not for distribution to United States

Services or for Dissemination in the United States.

- Ends -

For further information: Cadence Minerals plc +44 (0) 7879 584153

Andrew Suckling

Kiran Morzaria

WH Ireland Limited (NOMAD

& Broker) +44 (0) 207 220 1666

James Joyce

James Sinclair-Ford

Novum Securities Limited

(Joint Broker) +44 (0) 207 399 9400

Jon Belliss

Qualified Person

Kiran Morzaria B.Eng. (ACSM), MBA, has reviewed and approved the

information contained in this announcement. Kiran holds a Bachelor

of Engineering (Industrial Geology) from the Camborne School of

Mines and an MBA (Finance) from CASS Business School.

Forward-Looking Statements:

Certain statements in this announcement are or may be deemed to

be forward-looking statements. Forward-looking statements are

identi ed by their use of terms and phrases such as "believe"

"could" "should" "envisage" "estimate" "intend" "may" "plan" "will"

or the negative of those variations or comparable expressions

including references to assumptions. These forward-looking

statements are not based on historical facts but rather on the

Directors' current expectations and assumptions regarding Cadence

Minerals Plc's future growth results of operations performance

future capital and other expenditures (including the amount. nature

and sources of funding thereof) competitive advantages business

prospects and opportunities. Such forward-looking statements re ect

the Directors' current beliefs and assumptions and are based on

information currently available to the Directors. Many factors

could cause actual results to differ materially from the results

discussed in the forward-looking statements including risks

associated with vulnerability to general economic and business

conditions competition environmental and other regulatory changes

actions by governmental authorities the availability of capital

markets reliance on key personnel uninsured and underinsured losses

and other factors many of which are beyond the control of Cadence

Minerals Plc. Although any forward-looking statements contained in

this announcement are based upon what the Directors believe to be

reasonable assumptions. Cadence Minerals Plc cannot assure

investors that actual results will be consistent with such

forward-looking statements.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCGIGDILXGDGBC

(END) Dow Jones Newswires

August 09, 2021 04:39 ET (08:39 GMT)

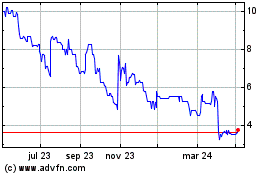

Cadence Minerals (LSE:KDNC)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

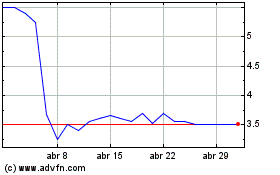

Cadence Minerals (LSE:KDNC)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024