TIDMCMRS

RNS Number : 9846M

Caerus Mineral Resources PLC

27 September 2021

27 September 2021

Caerus Mineral Resources PLC

('Caerus' or the 'Company')

Interim Results

Caerus Mineral Resources plc (LON:CMRS), the exploration and

resource development company focused on developing mineral

resources in Europe to support the global 'Clean Energy' initiative

is pleased to announce its unaudited interim results for the six

months ended 30 June 2021.

Highlights in H1 2021:

-- Admission to the LSE in March 2021 with a cash raise of 2.2m GBP

-- Increase of licences in portfolio to 16 through 2 targeted acquisitions

o Acquisition of PR Ploutonic Resources Limited ("Ploutonic" or

"PRL")

o Acquisition of Gold Mines (Cyprus) Limited ("GMCL")

-- Successful due diligence drill programme over a number of newly acquired assets

-- Option Agreements signed with both Jubilee Metals Group PLC

(AIM: JBL) ("Jubilee Metals") and Bezant Resources PLC (AIM:BZT)

("Bezant") to accelerate development towards production via joint

ventures

Post Period:

-- Announcement of a Placing and Subscription to raise a further

1.5m GBP (gross) to fund developments within these new licences

-- Sale of non-core licences and assets

-- Commencement of a diamond drill programme for NI 43-101

Mineral Resource Estimation for the Troulli and Kokkinapetra

Licences

Commenting on the Interim Results, Chief Executive Officer

Martyn Churchouse said " Over the past six month the Company has

made considerable progress since our Listing in London, and is well

on its way to achieving its strategic objectives. Our dual

programme of developing of hard rock copper-gold resources and

building a resource of metal-bearing surface material within dumps,

stockpiles and tailings has quickly gathered momentum. This

activity has been bolstered by the acquisition of prospective

licences, many of which host broadly defined copper-gold resources

and have already shown indicated some prospective targets for

future exploration.

Since the signing of the agreement we have and continue to work

closely with Jubilee Metals and look forward to the results of

on-going metallurgical test work aimed at developing an optimised

mineral processing design as we move forward with our projects. We

recently raised additional funds specifically to provide the

necessary means to ensure that new acquisitions can be advanced

quickly and brought in-line with the current development status of

existing projects. This is important to be able to deliver relevant

technical information and samples to our prospective future JV

Partner if they are to optimise plant design. We are also working

closely with Bezant with forward-looking design discussions

focusing on the most likely production scenarios for priority

projects including plant throughput, feedstock-type scheduling and

general logistics.

Caerus's exploration team continues to impress, particularly

its' ability to adapt exploration programmes to fit the "Waste to

Revenue" model and parallel hard rock resource development

programme. Acutely aware of the economics of surface material

reprocessing alongside traditional hard rock mining practices means

the Team is focused on the important elements of exploration,

improving delivery to our potential JV Partners and thereby

bringing future cash flow generation that much closer"

CAERUS MINERAL RESOURCES PLC

INTERIM REPORT - SIX MONTHSED 30 JUNE 2021

Chairman's Review of Year to date

Caerus has delivered an exceptional performance for the

six-month period under review, significantly expanding its asset

base whilst building important strategic alliances alongside the

fast-tracking of its resource development programmes.

Our exploration team has been able to continue work despite the

on-going Covid-19 pandemic due in part to our key personnel being

residents of Cyprus. The wealth of local knowledge gives Caerus a

competitive advantage when it comes to identifying opportunities in

the Country which is reflected in the additions, we have made to

the licence portfolio during the short period since Listing.

The acquisition of Ploutonic was seen as a natural expansion of

our licence portfolio due to its brownfield status, hosting a

sizeable metal-bearing surface material resource together with

known high-grade near-surface hard rock mineralisation. The Troulli

Project has become a priority for the Company with diamond drilling

for NI - 43-101 Mineral Resource estimation having already

commenced.

The GMCL acquisition has provided three further licences, two

with broadly delineated resources that can potentially be

incorporated into existing project hubs for future development.

The Company's "Waste to Revenue" strategy, focusing on the

reprocessing of large quantities of metal-bearing surface materials

continues to identify resources suitable for treatment. This

programme underpins the parallel assessment and development of hard

rock copper and gold resources that are expected to be treatable in

a common processing plant design.

Caerus's recent association with Jubilee demonstrates our

commitment to using the best possible expertise available to the

Company. As an industry leader in reprocessing of surface

materials, Jubilee is an ideal potential partner for our "Waste to

Revenue" ambitions.

The proposed future joint venture with Bezant reflects our

confidence that we will, in the shortest possible timeframe, be in

a position to start the process of mine planning and development,

and a mining partner provides an opportunity to share the capital

cost burden and reduce Shareholder exposure to mining risks.

I am delighted by the progress made in the six months since

Listing and look forward to updating Shareholders in the near

future as our Mineral Resource estimation programmes start to

generate results alongside the on-going routine exploration of our

greenfield licences and the building of value through the

accumulation of dump resources suitable for low-cost reprocessing

and metal recovery.

Financials

During the period the Group made a pre-tax loss of 415,553 GBP

(six months ended 30 June 2020: loss of 41,844 GBP). The total

assets of the Group increased from 1,369,184 GBP as of 31 December

2020 to 4,137,791 GBP.

During the period, the net cash outflow from operating

activities was 540,316 GBP and the net cash position increased by

1,730,815 GBP to 1,868,721 GBP.

Directors' Responsibility Statement

The Directors confirm that, to the best of their knowledge, the

interim financial statements have been prepared in accordance with

International Accounting Standards 34, Interim Financial Reporting,

as adopted by the United Kingdom and the LSE Rule for Companies,

and that the interim results give a true and fair view of the

assets, liabilities, financial position and loss of the Group.

The interim report was approved by the Board of Directors and

the above responsibility statement was signed on its behalf by:

Michael Johnson

Non- Executive Chairman

27 September 2020

Condensed Consolidated Statement of Profit or Loss and Other

Comprehensive Income

Six months Six months

to 31 June to 31 May

2021 (unaudited) 2020 (unaudited)

Note GBP GBP

Administrative expenses 3 (414,543) (41,844)

Finance costs (1,010) -

------------------- -------------------

Operating loss and loss before

taxation (415,553) (41,844)

Income tax expense - -

------------------- -------------------

Loss after taxation (415,553) (41,844)

Loss for the period (415,553) (41,844)

Items that may be reclassified

subsequently to profit and loss:

Exchange differences on translation 7,252 -

of foreign operations

------------------- -------------------

(408,301) (41,844)

Total comprehensive loss attributable

to:

Owners of Caerus Mineral Resources

plc (403,761) (41,844)

Non-controlling interests (4,540) -

Earnings per share:

Basic and diluted (GBP) 8 (0.0105) (0.004)

All activities relate to continuing operations.

The above condensed Consolidated Statement of Profit or Loss and

Other Comprehensive Income should be read in conjunction with the

accompanying notes.

Condensed Consolidated Statement of Financial Position

As at As at

30 June 31 December

2021 2020

Note GBP GBP

ASSETS

Non-current assets

Intangible assets 4 2,619,820 1,690,536

Property, plant and equipment 1,892 -

Total non-current assets 2,621,712 1,690,536

Current assets

Cash and cash equivalents 1,868,721 137,906

Other receivables 155,499 10,709

Total current assets 2,024,220 148,615

Total assets 4,645,932 1,839,151

------------ -------------

LIABILITIES

Non-current liabilities

Borrowings (515) (539)

Deferred tax liabilities (209,611) (125,801)

Financial liability - contingent

consideration (174,688) (174,688)

------------ -------------

Total non-current liabilities (384,814) (301,028)

Current liabilities

Trade and other payables (123,327) (168,939)

------------

Total current liabilities (123,327) (168,939)

Total liabilities (508,141) (469,967)

Net assets 4,137,791 1,369,184

============ =============

EQUITY

Share capital 6 537,113 239,000

Shares to be issued - 100,000

Share premium 6 4,524,135 1,627,665

Foreign exchange reserve (6,913) (14,165)

Warrants reserve 7 87,185 -

Retained earnings (1,106,643) (691,090)

------------ -------------

Capital and reserves attributable

to owners of Caerus Mineral Resources

plc 4,034,877 1,261,410

------------ -------------

Non-controlling interests 102,914 107,774

------------ -------------

Total equity 4,137,791 1,369,184

============ =============

The above Condensed Consolidated Financial Statements should be

read in conjunction with the accompanying notes.

The Financial Statements were approved and authorised for issue

by the Board on 27 September 2021 and were signed on its behalf

by:

Martyn Churchouse, Director

Condensed Consolidated Statement of Changes in Equity

Shares Foreign

Share Share paid not Warrant Retained exchange

capital premium issued reserve earnings reserve Total

GBP GBP GBP GBP GBP GBP GBP

---------------------- --------- ----------- ---------- --------- ------------ ---------- -----------

Balance as at 30

November 2019 94,000 322,665 - - ( 582,757) - (166,092)

---------------------- --------- ----------- ---------- --------- ------------ ---------- -----------

Comprehensive income

Loss for the 7 months - - - - (41,844) - (41,844)

Total comprehensive

income for the 7

months - - - - (41,844) - (41,844)

Transactions with

owners recognised - - - - - - -

directly in equity

Balance as at 31

May 2020 94,000 322,665 - - ( 624,601) - (207,936)

---------------------- --------- ----------- ---------- --------- ------------ ---------- -----------

Comprehensive income

Loss for the 7 months - - - - (66,489) - (66,849)

Exchange differences

on translation of

foreign operations - - - - - (14,165) (14,165)

---------------------- --------- ----------- ---------- --------- ------------ ---------- -----------

Total comprehensive

income for the 7

months - - - - (66,489) (14,165) (80,654)

Transactions with

owners recognised

directly in equity

Issue of shares 145,000 1,305,000 - - - - 1,450,000

Shares paid but

not issued - - 100,000 - - - 100,000

Balance as at 31

December 2020 239,000 1,627,665 100,000 - (691,090) (14,165) 1,261,410

Comprehensive income

Loss for the 6 months - - - - (415,553) - (415,553)

Exchange differences

on translation of

foreign operations - - - - - 7,252 7,252

---------------------- --------- ----------- ---------- --------- ------------ ---------- -----------

Total comprehensive

income for the 6

months - - - - (415,553) 7,252 (408,301)

Transactions with

owners recognised

directly in equity

Issue of shares 298,113 3,101,887 (100,000) - - - 3,300,000

Cost of shares issued - (205,417) - - - - (205,417)

Issue of Warrants - - - 87,185 - - 87,185

Balance as at 30

June 2021 537,113 4,524,135 - 87,185 (1,106,643) (6,913) 4,034,877

Condensed Consolidated Statement of Cash Flows

6 month 6 month

period ended period ended

30 June 31 May

2021 2020

Notes GBP GBP

Cash flow from operating activities

Loss for the period before taxation (415,553) (41,844)

Adjustments for:

Interest expense 1,010 -

Share based payment expense 3 69,388 -

Foreign exchange gain on financial

assets - (2,317)

--------------

Operating cash flows before

movements in working capital (345,155) (44,161)

(Increase) in receivables (144,790) -

(Decrease)/increase in accounts

payable and accrued liabilities (50,371) 41,352

-------------- ---------------

Net cash used in operating activities (540,316) (2,809)

Cash flow from investing activities

Expenditure on intangible assets (88,347) -

Expenditure on tangible assets (1,892) -

-------------- ---------------

Net cash used in investing activities (90,239) -

Cash flow from financing activities

Interest paid (1,010) -

Proceeds from the issue of equity 6 2,550,000 -

Share issue costs 6 (187,620) -

Net cash inflow from financing 2,361,370 -

activities

Net increase/(decrease) in cash

and cash equivalents 1,730,815 (2,809)

============== ===============

Cash and cash equivalent at

beginning of the half year 137,906 3,492

-------------- ---------------

Cash and cash equivalent at

end of the half year 1,868,721 683

============== ===============

Significant non-cash transactions

The only significant non-cash transactions were the issue of

shares detailed in note 6.

The above condensed Consolidated Statement of Cash Flows should

be read in conjunction with the accompanying notes

Notes to the condensed interim financial statements

1. General information

The principal activity of the Company and its subsidiaries (the

Group) is in mineral exploration and the development of appropriate

exploration projects. The Company's registered office is at

Eccleston Yards, 25 Eccleston Place, London, SW1W 9NF. Its shares

are listed on the Main Market of the London Stock Exchange under

the Standard Segment of the Official List under the ticker

"LSE:CMRS".

2. BASIS of PREPARATION

These condensed interim financial statements are for the six

months ended 30 June 2021 and have been prepared in accordance with

the accounting policies adopted in the Group's most recent annual

financial statements for the year ended 31 December 2020, except

for the new accounting policy noted below.

Share-based compensation

The Group issued warrants in the period which were accounted for

as equity settled share based payment transactions with employees.

The fair value of the employees services received in exchange for

these warrants is recognised as an expense in the profit and loss

account with a corresponding increase in equity in the Warrants

Reserve. As there are no vesting conditions for these warrants the

expense was recognised immediately and will not be subsequently

revisited. Fair value is determined using Black-Scholes option

pricing models.

Share-based payments

The Group has two types of share based payments other than

employee compensation.

Warrants issued for services rendered which are accounted for in

accordance with IFRS 2 recognising either the cost of the services

if it can be reliably measured or the fair value of the warrants

(using Black-Scholes option pricing models).

Warrants issued as part of share issues have been determined as

equity instruments under IAS 32. Since the fair value of the shares

issued at the same time is equal to the price paid, these warrants,

by deduction are considered to have been issued at nil value.

The Group have chosen to adopt IAS 34 "Interim Financial

Reporting" in preparing this interim financial information. They do

not include all the information required in annual financial

statements, and they should be read in conjunction with the

consolidated financial statements for the year ended 31 December

2020 and any public announcements made by Caerus Mineral Resources

Plc ("CMR") during the interim reporting period.

The business is not considered to be seasonal in nature.

The functional currency for each entity in the Group is

determined as the currency of the primary economic environment in

which it operates. The functional currency of the parent company

CMR is Pounds Sterling (GBP) as this is the currency that finance

is raised in. The functional currency of NCC, TDL and PRL is the

Euro as this is the currency that mainly influences labour,

material and other costs of providing services. The Group has

chosen to present its consolidated financial statements in Pounds

Sterling (GBP), as the Directors believe it is a more convenient

presentational currency for users of the consolidated financial

statements. Foreign operations are included in accordance with the

policies set out in the Annual Report and Accounts.

The condensed interim financial statements have been approved

for issue by the Board of Directors on 27 September 2021.

New standards, amendments and interpretations adopted by the

Group.

During the current period the Group adopted all the new and

revised standards, amendments and interpretations that are relevant

to its operations and are effective for accounting periods

beginning on 1 January 2021. This adoption did not have a material

effect on the accounting policies of the Group.

New standards, amendments and interpretations not yet adopted by

the Group.

The standards and interpretations that are relevant to the

Group, issued, but not yet effective, up to the date of these

interim Financial Statements have been evaluated by the Directors

and they do not consider that there will be a material impact of

transition on the financial statements.

Going concern

The condensed interim financial statements have been prepared on

the assumption that the Group will continue as a going concern.

Under the going concern assumption, an entity is ordinarily viewed

as continuing in business for the foreseeable future with neither

the intention nor the necessity of liquidation, ceasing trading or

seeking protection from creditors pursuant to laws or regulations.

In assessing whether the going concern assumption is appropriate,

the Directors take into account all available information for the

foreseeable future, in particular for the twelve months from the

date of approval of the condensed interim financial statements.

Following the review of ongoing performance and cash flows, the

Directors have a reasonable expectation that the Group has adequate

resources to continue operational existence for the foreseeable

future. The Board have also considered the consequences of Covid-19

and other events and conditions, and it has determined that they do

not create a material uncertainty that casts significant doubt upon

the entity's ability to continue as a going concern.

Risks and uncertainties

The Directors continuously assess and monitor the key risks of

the business. The key risks that could affect the Group's

medium-term performance and the factors that mitigate those risks

have not substantially changed from those set out in the Group's

most recent annual financial statements for the year ended 31

December 2020.

Critical accounting estimates

The preparation of condensed interim financial statements

requires management to make estimates and assumptions that affect

the reported amounts of assets and liabilities at the end of the

reporting period. Significant items subject to such estimates are

set out in Group's most recent annual financial statements for the

year ended 31 December 2020. The nature and amounts of such

estimates have not changed during the interim period.

3. ADMINISTRATIVE EXPENSES

Current period expenses include legal costs of GBP86,849, audit

fees of GBP32,830, regulatory fees of GBP25,351, foreign exchange

costs of GBP19,747, Directors fees of GBP77,669 and share based

payment charges for warrants of GBP69,388. These costs were

significantly increased due to the process of Listing.

4. INTANGIBLE ASSETS

The intangible assets held by the Group increased primarily as a

result of the acquisition of PR Ploutonic

Resources Limited. See note 5 for further information.

Exploration

and Evaluation

assets

GBP

Cost and carrying amount

At 31 December 2020 1,690,536

Exploration and evaluation assets acquired

at fair value (note 5) 838,562

Additions to exploration assets 90,722

----------------

At 30 June 2021 2,619,820

================

5. ACQUISITION OF SUBSIDIARY

On 11 June 2021 CMR acquired 100% of the issued share capital in

PR Ploutonic Resources Ltd ("PRL"), an exploration and production

of copper, gold and other minerals company, for consideration of

GBP750,000. The acquisition provides CMR with the opportunity to

expand its mineral exploration programme.

On acquisition, the Company paid a purchase price of GBP750,000

which was satisfied by the issue of consideration shares. The

consideration shares were fair valued, at the Volume Weighted

Average Price ("VWAP") based on 30 trading days following the

announcement of the acquisition on 6 April 2021.

The amounts recognised in respect of the identifiable assets

acquired and liability assumed as a result of the acquisition are

as follows:

Net book Fair value Fair value

value of adjustments of assets

assets acquired acquired

GBP GBP GBP

Intangible assets 84,270 754,292 838,562

Financial liabilities (4,752) - (4,752)

Deferred tax liability - (83,810) (83,810)

----------------- ------------- -----------

Total identifiable assets

acquired and liabilities

assumed 79,518 670,482 750,000

----------------- ------------- -----------

Fair Value of Consideration

Paid:

Shares issued 750,000

Total consideration 750,000

-----------

Under IFRS 3, a business must have three elements: inputs,

processes and outputs. PRL is an early stage exploration company

and has no mineral reserves and no plan to develop a mine. PRL does

have titles to mineral properties but these could not be considered

inputs because of their early stage of development. PRL has no

processes to produce outputs and has not completed a feasibility

study or a preliminary economic assessment on any of its properties

and no infrastructure or assets that could produce outputs.

Therefore, the Directors conclusion is that the transaction is an

asset acquisition and not a business combination. The fair value

adjustment to intangible assets of GBP670,482 represents the excess

of the purchase consideration of GBP750,000 over the excess of the

net assets acquired (net assets of GBP79,518) and a deferred tax

liability of GBP83,810.

During the period since acquisition, PRL contributed a loss of

GBPnil to the Group. If the acquisition had occurred on 1 January

2020, consolidated pro-forma loss for the half-year ended 30 June

2021 would have been GBP80,166.

6. SHARE CAPITAL AND SHARE PREMIUM

Number of Share Capital Share Premium Total

shares - GBP

Ordinary GBP

GBP

----------------------- ----------- ------------- ------------- ----------

As at 31 May 2020 9,400,000 94,000 322,665 416,665

------------------------ ----------- ------------- ------------- ----------

Issued 29 September

2020 8,500,000 85,000 765,000 850,000

Issued 13 November

2020 6,000,000 60,000 540,000 600,000

------------------------ ----------- ------------- ------------- ----------

As at 31 December

2020 23,900,000 239,000 1,627,665 1,866,665

------------------------ ----------- ------------- ------------- ----------

Issued 19 March

2021 26,500,000 265,000 2,385,000 2,650,000

Issued 11 June 2021 3,311,258 33,113 716,887 750,000

Cost of shares issued - - (205,417) (205,417)

------------------------ ----------- ------------- ------------- ----------

As at 30 June 2021 53,711,258 537,113 4,524,135 5,061,248

------------------------ ----------- ------------- ------------- ----------

On 19 March 2021, the Company completed a placing of 21,000,000

new Ordinary shares at 10p, a Subscription Agreement for an

aggregate 1,500,000 new Ordinary Shares at 10p and issued a further

4,000,000 shares to EV Metals Limited in return for a further

GBP400,000 investment in the Company.

On 11 June 2021, the Company issued 3,311,258 new Ordinary

shares of GBP0.01 each at a deemed price of GBP0.23 per share to

the owners of PRL as part of the consideration for the acquisition

of said company.

7. WARRANTS

The Group has issued the following warrants, which are still in

force at the balance sheet date.

Date of Reason for issue No. of warrants Exercise price Life in

Issue pence per years

share

------------ ---------------------------------------- --------------- -------------- -------

Founder warrants - dated from

25/01/2018 Admission 2,100,000 5.0 3

Seed/investor warrants - dated

25/01/2018 from Admission 3,300,000 5.0 2

19/03/2021 Broker warrants - Share Issue 3,360,000 12.5 2

19/03/2021 Bonus warrants - Employee Compensation 2,000,000 12.5p 2

Performance warrants- Employee

16/06/2021 Compensation 2,000,000 25.0p 1.75

Introduction warrants - Cost

16/06/2021 of Services 441,174 17.0p 1.75

The Founder and Seed/Investor warrants have been determined as

equity instruments under IAS 32 and as such have been issued at nil

cost.

The Broker warrants have been fair valued at GBP17,797 in

accordance with IFRS 2 and are measured at the fair value of the

services received. This amount is attributable to the cost of

shares issued and therefore has been accounted for in the Share

Premium reserve.

The remaining warrants are valued in accordance with IFRS 2, as

equity settled share based payment transactions. GBP51,158 has been

recognised as the fair value of employee compensation and GBP18,230

as the fair value of Broker Introduction services received during

the period.

8. EARNINGS PER SHARE

The calculation for basic earnings per Ordinary Share is based

on the profit after income tax attributable to equity Shareholder

for the period and is as follows:

Six months to Six months to

30 June 2021 31 May 2020

Loss attributable to equity

Shareholders (GBP) (415,553) (41,844)

-------------- --------------

Weighted average number of

Ordinary shares 39,413,411 9,400,000

-------------- --------------

Loss per Ordinary share (GBP) (0.0105) (0.004)

-------------- --------------

Earnings per Ordinary share are calculated using the weighted

average number of Ordinary shares in issue during the period. A

loss was made during the period and diluted EPS are therefore equal

to undiluted EPS.

9. RELATED PARTY TRANSACTIONS

During the half-year ended 30 June 2021, CMR acquired PRL, one

of the owners of this company is the Director Andrew Daniels who

was issued 1,931,457 shares, fair valued at GBP444,235 for his

58.33% ownership in this company.

10. SUBSEQUENT EVENTS

On 9 August 2021, the Company announced the completion of its

acquisition of GC Gold Mines (Cyprus) Ltd ("GMCL"). This was

acquired for a total cash consideration of GBP300,000, which was

funded through the disposal of the Black Pine nickel-cobalt project

and associated licences as announced on 29 July 2021.

On 22 September 2021, the Company announced a proposed Placing

of up to 7.2 million shares at a price of 20p per ordinary share to

raise GBP1.44m. A parallel subscription of 300k shares to raise

GBP60k has also been completed with a single subscriber under the

same terms and condition as the Placing. For every 2 Placing and

Subscription shares a warrant will be issued, exercisable for two

years from completion at a price of 30p per new ordinary share.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BQLLLFKLFBBD

(END) Dow Jones Newswires

September 27, 2021 02:00 ET (06:00 GMT)

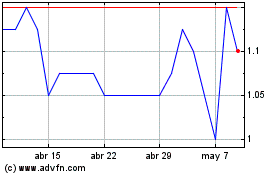

Critical Mineral Resources (LSE:CMRS)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Critical Mineral Resources (LSE:CMRS)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024