Cairn Homes plc Holding(s) in Company (3819H)

03 Agosto 2021 - 2:21AM

UK Regulatory

TIDMCRN

RNS Number : 3819H

Cairn Homes plc

03 August 2021

Standard Form TR-1

Standard form for notification of major holdings

NOTIFICATION OF MAJOR HOLDINGS (to be sent to the relevant issuer

and to the Central Bank of Ireland)

1. Identity of the issuer or the underlying issuer of existing

shares to which voting rights are attached:

Cairn Homes PLC

2. Reason for the notification (please tick the appropriate box

or boxes):

[X] An acquisition or disposal of voting rights

[ ] An acquisition or disposal of financial instruments

[ ] An event changing the breakdown of voting rights

[ ] Other (please specify):

3. Details of person subject to the notification obligation:

Name: City and country of registered office

The Capital Group Companies, (if applicable):

Inc. Los Angeles, USA

---------------------------------------

4. Full name of shareholder(s) (if different from 3.):

See Box 10

5. Date on which the threshold was crossed or reached:

13 Jul 2021

6. Date on which issuer notified:

29 Jul 2021

7. Threshold(s) that is/are crossed or reached:

The Capital Group Companies, Inc. decreased below 7.00% of total

voting rights outstanding.

8. Total positions of person(s) subject to the notification obligation:

% of voting % of voting rights Total of both Total number

rights attached through financial in % of voting rights

to shares instruments of issuer

(total of (total of 9.B.1 (9.A + 9.B)

9.A) + 9.B.2)

---------------- ------------------- ---------------- ----------------------------------

Resulting

situation

on the date on

which threshold

was crossed or

reached 6.77% 0.00% 6.77% 749,932,223

---------------- ------------------- ---------------- ----------------------------------

Position of

previous

notification

(if applicable) 7.70% 0.00% 7.70%

---------------- ------------------- ---------------- ----------------------------------

9. Notified details of the resulting situation on the date on which

the threshold was crossed or reached:

A: Voting rights attached to shares

Class/type Number of voting rights % of voting rights

of shares

ISIN code

(if possible)

------------------------------------------------------- ----------------------------------

Direct Indirect Direct Indirect

---------------- ------------------------------------- ---------------- ----------------

IE00BWY4ZF18

Common Stock 50,799,200 6.77%

---------------- ------------------------------------- ---------------- ----------------

SUBTOTAL A 50,799,200 6.77%

------------------------------------------------------- ----------------------------------

B 1: Financial Instruments according to Regulation 17(1)(a) of

the Regulations

Type of Expiration Exercise/ Number of voting % of voting

financial date Conversion rights that may be rights

instrument Period acquired if the instrument

is exercised/converted

---------------- ------------------- ---------------------------------- ----------------

N/A

---------------- ------------------- ---------------------------------- ----------------

SUBTOTAL

B.1

---------------------------------- ----------------

B 2: Financial Instruments with similar economic effect according

to Regulation 17(1)(b) of the Regulations

Type of Expiration Exercise/ Physical Number of % of voting

financial date Conversion or cash voting rights rights

instrument Period settlement

---------------- ------------------- ---------------- ---------------- ----------------

N/A

---------------- ------------------- ---------------- ---------------- ----------------

SUBTOTAL

B.2

---------------- ----------------

10. Information in relation to the person subject to the notification

obligation (please tick the applicable box):

[ ] Person subject to the notification obligation is not controlled

by any natural person or legal entity and does not control any

other undertaking(s) holding directly or indirectly an interest

in the (underlying) issuer.

[X] Full chain of controlled undertakings through which the voting

rights and/or the financial instruments are effectively held starting

with the ultimate controlling natural person or legal entity:

Name % of voting rights % of voting rights Total of both

if it equals through financial if it equals

or is higher instruments if or is higher

than the notifiable it equals or than the notifiable

threshold is higher than threshold

the notifiable

threshold

---------------------- -------------------- ----------------------

Capital Research and

Management Company 6.77% 6.77%

---------------------- -------------------- ----------------------

Total 6.77% 6.77%

---------------------- -------------------- ----------------------

11. In case of proxy voting: [name of the proxy holder] will cease

to hold [% and number] voting rights as of [date].

12. Additional information:

Please note that this notification was originally made to the issuer

on 14/07/2021 in the format of a Companies Act filing. After the

issuer informed us that this should have been submitted under the

TR1 regime, we sent them an updated form on 29/07/2021.

The Capital Group Companies, Inc. ("CGC") is the parent company

of Capital Research and Management Company ("CRMC") and Capital

Bank & Trust Company ("CB&T"). CRMC is a U.S.-based investment

management company that serves as investment manager to the American

Funds family of mutual funds, other pooled investment vehicles,

as well as individual and institutional clients. CRMC and its investment

manager affiliates manage equity assets for various investment

companies through three divisions, Capital Research Global Investors,

Capital International Investors and Capital World Investors. CRMC

is the parent company of Capital Group International, Inc. ("CGII"),

which in turn is the parent company of five investment management

companies ("CGII management companies"): Capital International,

Inc., Capital International Limited, Capital International Sàrl,Capital

International K.K, and Capital Group Private Client Services, Inc.CGII

management companies and CB&T primarily serve as investment managers

to institutional and high net worth clients. CB&T is a U.S.-based

investment management company that is a registered investment adviser

and an affiliated federally chartered bank.

Neither CGC nor any of its affiliates own shares of your company

for its own account. Rather, the shares reported on this Notification

are owned by accounts under the discretionary investment management

of one or more of the investment management companies described

above.

Done at Los Angeles on 29 Jul 2021.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

HOLGRGDICBGDGBX

(END) Dow Jones Newswires

August 03, 2021 03:21 ET (07:21 GMT)

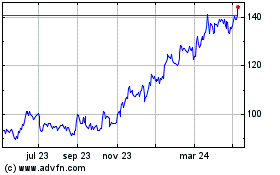

Cairn Homes (LSE:CRN)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Cairn Homes (LSE:CRN)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024