TIDMCBOX

RNS Number : 5733R

Cake Box Holdings PLC

08 November 2021

Cake Box Holdings plc

("Cake Box", "the Company" or "the Group")

Unaudited Half Year Results for the six months ended 30

September 2021

Record first half performance with further strong growth and

strategic progress

Cake Box Holdings plc, the specialist retailer of fresh cream

cakes, today announces its half year results for the six months

ended 30 September 2021 ("H1 FY22").

Financial Highlights

Half year ended Half year ended Change

30 September 2021 30 September

2020

(H1 FY22) (H1 FY21) (2)

-------------------

Revenue GBP16.47m GBP8.59m +91.8%

------------------- ---------------- --------

Gross profit GBP7.61m GBP4.16m +83.1%

------------------- ---------------- --------

EBITDA (1) GBP4.14m GBP1.98m +109.1%

------------------- ---------------- --------

Pre-tax profit GBP3.70m GBP1.66m +122.2%

------------------- ---------------- --------

Net cash GBP4.15m GBP3.80m +9.2%

------------------- ---------------- --------

Cash at Bank GBP5.57m GBP5.34m +4.3%

------------------- ---------------- --------

Earnings per share 7.46p 3.45p +116.2%

------------------- ---------------- --------

Interim dividend 2.50p 1.85p +35.1%

------------------- ---------------- --------

-- Strong growth across all financial metrics

-- For the four months to 30 September 2021 (3) , when the full

store estate had reopened in FY21:

o Revenues up 50.5% to GBP11.2m (four months to 30 September

2020: GBP7.4m)

o Gross profit up 48.0% to GBP5.5m (four months to 30 September

2020: GBP3.7m)

o Pre-tax profit up 56.7% to GBP2.6m (four months to 30

September 2020: GBP1.65m)

-- Balance sheet and cash generation remain strong

o Cash from operations of GBP2.4m (H1 FY21: GBP2.0m)

o GBP4.15m net cash (H1 FY21: GBP3.80m)

-- Interim dividend of 2.50p per share up 35.1% (H1 FY21: 1.85p)

Operational highlights

-- 174 franchise stores in operation at 30 September 2021 (30 September 2020: 139)

-- 20 new franchise stores added in the period (H1 FY21: six new franchise stores)

-- Successful trial of seven kiosks in Asda

-- No disruption to operations from supply chain

-- Continued successful launch of new product ranges, including "naked cake" range

Franchisee Store highlights

-- Like-for-like sales growth of 13.3% in franchise stores in

the four months to 30 September 2021 (4) (H1 FY21: 12.1%)

-- Franchisee total turnover up 73.2% to GBP29.5m (H1 FY21:

GBP17.0m); four months to 30 September 2021 up 31.6% to GBP19.4m

(H1 FY21: GBP14.8m)

-- Franchisee online sales up 68.1% to GBP6.7m (H1 FY21:

GBP4.0m); four months to 30 September 2021 up 37.0% to GBP4.6m (H1

FY21: GBP3.4m)

Current trading

-- Three new stores opened in the five weeks since the half year end

-- Trading remains strong with franchisee like for like sales at

14.4% in October and online sales up 46.6% in October

-- Four new kiosks opened in Asda stores following the successful trial in seven locations

-- Intention for further roll out of Asda kiosks during the remainder of FY22

-- Targeting 32 new franchise store openings in FY22 underpinned

by record number of deposits from prospective franchisees and

openings to date during the year

-- Supply chain remains robust, with several months of ingredients in stock

-- Confident in meeting full year expectations

(1) EBITDA is calculated as operating profit before

depreciation

(2) FY21 half year includes six weeks during which all stores

were closed which impacted first 2 months

(3) Four months June-September 2020 excludes the impact of the

March 2020 lockdown and associated store closures to provide a more

relevant comparable period

(4) Like-for-like: Stores trading for at least one full

financial year prior to 30 September 2021

Sukh Chamdal, Chief Executive Officer, commented:

"I'm delighted to report another strong performance over the

last six months, demonstrating the continued appeal of Cake Box's

unique offering. Our fantastic franchisees, supported by their

dedicated team members, have helped us deliver record first half

store openings, revenues, profits and dividends, while making

further significant strategic progress that gives us momentum into

the second half.

Our proven franchisee model continues to deliver and we now plan

to open up to 32 new franchise stores this year, helping more

entrepreneurs than ever build their own businesses and serve their

local communities.

Despite continued uncertainty in the wider environment, it's

clear that our unique customer proposition remains highly

attractive as more customers choose our delicious, egg-free cakes

to celebrate important occasions or simply satisfy their appetites

for a tasty treat.

We look ahead with confidence in meeting full year expectations

and making further progress in the years ahead."

Analyst presentation

There will be a presentation for analysts this morning at

09:30am at the offices of MHP Communications. If you would like to

attend in person or virtually, please contact cakebox@mhpc.com

For further information, please contact:

Cake Box Holdings plc

Sukh Chamdal, CEO

Pardip Dass, CFO +44 (0) 20 8050 2026

Shore Capital (Broker and NOMAD)

Stephane Auton

Patrick Castle

Fiona Conway - Corporate Broking +44 (0) 20 7408 4090

MHP Communications (Financial PR)

Oliver Hughes

Simon Hockridge

Charlie Barker

Pete Lambie +44 (0) 20 3128 8570

Operational Review

Another strong half year performance

We delivered another pleasing performance in the first half of

the year, with strong trading across the Group's store estate and

online delivery channels, as customers continued to respond well to

the core Cake Box product proposition and its brand marketing

through local store marketing and social media.

This performance is testament to the continued dedication and

hard work of the entire Cake Box Family, with over 90 fantastic

franchisees and their staff members continuing their

entrepreneurial journeys and serving their local communities.

This translated into strong growth across key financial metrics,

with revenues up 92% to GBP16.4m (H1 FY21: GBP8.6m) and pre-tax

profits more than doubling to GBP3.70m (H1 FY21: GBP1.7m). Looking

at the four months to 30 September 2021, which excludes the impact

of the March 2020 lockdown and associated store closures, r evenues

were up over 50% at GBP11.2m (4 months H1 FY21: GBP7.4m) and

pre-tax profits up 56.7% to GBP2.6m over the same period. Total

franchisee sales up 13.3% on a like-for-like* basis to GBP19.4m

Exceptional growth of the Group's store estate

The Group opened 20 new franchise stores in the period

(excluding kiosk openings), with the total number of stores at 30

September 2021 being 174 (H1 2020: 139). New locations added in the

period include Fulham (London), Stevenage and Hull. The Group

continuously evaluates the financial and quality standards of the

franchise store estate and as a result three stores were closed

during the period.

The appeal of the Group's franchise proposition is reflected in

the current pipeline of new potential franchisees, with a record 62

deposits held at period end.

Continued strategic progress

We made further progress on our strategic initiatives to

complement our franchise store estate growth and give the brand an

even bigger reach. These initiatives are designed to enable new and

existing franchisees to grow their businesses and our brand through

new channels such as kiosks and online delivery through third party

platforms, as well as our own delivery platform.

Accordingly, the Group has continued the roll out of its kiosk

offer from existing franchise stores, with a net three new shopping

centre kiosks opened in the period, including in the Arndale and

Trafford centres in Manchester, taking the total to 19.

The successful trial of kiosks with the Asda supermarket chain

expanded in the period, with two new kiosks opened, taking the

total number of supermarket kiosks to seven.

Continuing to refresh the Group's core celebration cake range

remains an important element of the Group's differentiated product

offering. New launches during the period include the "naked cake"

collection, which customers have responded well to.

We also continued to invest in future proofing the business and

providing ourselves with the infrastructure to support our ongoing

growth. We opened our new Coventry warehouse and distribution

facility in April 2021 - our third warehouse and distribution

facility, with sponge production capability that enables us to

continue to reduce our existing distribution costs and provide a

back up to our other production facilities in Enfield and Bradford.

This has also created skilled employment opportunities in the area

and reduced food delivery miles, supporting our goal of mitigating

our environmental impact.

In addition, we have continued to invest in other areas of the

business to position us for further growth. We have strengthened

our internal IT capabilities by appointing an experienced IT

Director and further invested in our IT systems. We have also

appointed BDO to assist with implementing improved internal audit

practices.

Further investments in people include the appointment of a

Procurement manager and, in the second half, at a senior management

level, we expect to create a new Head of Marketing role and to add

a very senior hire in the Group's Operations function.

2020 data breach announced during H1

During the period, Cake Box announced that it had experienced a

data breach in 2020. The Company is confident with all the actions

it has taken in relation to the matter and that the exceptional

provision of GBP486k as detailed in the full year results will be

sufficient to cover all costs relating to the matter.

Balance Sheet and Cashflow

The Group's balance sheet remains strong, underpinned by the

highly cash generative nature of our business model. Cash at period

end was GBP5.6m, 4.3% higher than at the same point last year. The

Group's net cash position also increased, by 9.2% to GBP4.15m (H1

FY21: GBP3.80m).

Dividend

In line with our progressive dividend policy to reflect the cash

generation and earnings of the Group, today we are declaring an

interim dividend of 2.5 pence per share representing an increase of

35.1% from last year.

The interim dividend will be paid on 10(th) December 2021 to

those shareholders on the register at the close of business on

19(th) November 2021. The ex-dividend date is therefore 18(th)

November 2021.

Outlook

Trading momentum has continued during the first five weeks of

the second half, with three new franchise stores opened across

various UK locations in Penge and Chingford in London and Shirley

in the West Midlands.

The franchise store estate traded well in October, with

like-for-like sales increasing by 14.4% and online sales continuing

to grow strongly, up 46.6% in the five weeks since the end of

September versus the same period last year.

The Group's supply chain remains robust, with several months of

ingredients on hand and no disruption to supply to date.

With more deposits for new franchise stores held than ever

before and 23 new franchise stores already opened during the

financial year to date, we are now targeting up to 32 franchise

stores openings for FY22.

Alongside this, we have partnered with Asda supermarket and

following the successful trial of 7 kiosks we have added a further

4 kiosks since 30 September 2021 and have the intention to roll out

more kiosks in Asda during the remainder of FY22.

Despite continued uncertainty in the operating environment, it's

clear that our unique proposition for customers and new and

existing franchisees remains highly attractive, while more and more

customers choose our cakes to celebrate important moments or

satisfy their appetite for a tasty treat.

Looking ahead, the Board is confident of making further progress

in the second half and meeting full year expectations.

CAKE BOX HOLDINGS PLC

UNAUDITED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTHSED 30 SEPTEMBER 2021

6 months 6 months 12 months

to 30 September to 30 September to 31 March

2021 2020 2021

(unaudited) (unaudited) (audited)

Note GBP GBP GBP

Revenue 2 16,471,577 8,586,565 21,910,862

Cost of sales (8,863,477) (4,431,487) (10,978,993)

----------------- ----------------- -------------

Gross profit 7,608,100 4,155,078 10,931,869

Administrative expenses (3,889,519) (2,470,351) (6,685,300)

Operating profit 3,718,581 1,684,727 4,246,569

Net finance costs (19,202) (19,501) (37,299)

----------------- ----------------- -------------

Profit before income tax 3,699,379 1,665,226 4,209,270

Income tax expense (717,333) (285,502) (842,362)

----------------- ----------------- -------------

PROFIT AFTER INCOME TAX 2,982,046 1,379,724 3,366,908

OTHER COMPREHENSIVE INCOME

FOR THE PERIOD

Revaluation of freehold property - - 24,901

Deferred tax on revaluation

of freehold property - - (4,731)

----------------- ----------------- -------------

TOTAL COMPREHENSIVE PROFIT

FOR THE PERIOD 2,982,046 1,379,724 3,387,078

================= ================= =============

EARNINGS PER SHARE

Basic 4 7.46p 3.45p 8.42p

Diluted 4 7.46p 3.45p 8.42p

The notes on pages 11-13 form part of these interim financial

statements.

CAKE BOX HOLDINGS PLC

UNAUDITED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 30 SEPTEMBER 2021

30 September 30 September 31 March

2020

2021 (unaudited) 2021

(unaudited) (audited)

Note GBP GBP GBP

ASSETS

Non-current assets

Property, plant and equipment 7,457,374 7,155,002 7,251,602

Other financial assets 564,194 4,000 656,004

Deferred tax asset 95,447 65,169 95,447

------------- ------------- -----------

8,117,015 7,224,171 8,003,053

------------- ------------- -----------

Current assets

Inventories 2,111,194 1,369,819 1,902,171

Trade and other receivables 2,861,845 1,603,392 2,490,217

Other financial assets 237,994 - 382,808

Cash and cash equivalents 5,565,501 5,335,601 5,125,808

10,776,534 8,308,812 9,901,060

------------- ------------- -----------

TOTAL ASSETS 18,893,549 15,532,983 17,904,113

============= ============= ===========

EQUITY AND LIABILITIES

Share capital and reserves

Issued share capital 4 400,000 400,000 400,000

Capital redemption reserve 40 40 40

Revaluation reserve 1,609,592 1,589,422 1,609,592

Share option reserve 488,596 342,996 488,596

Retained earnings 10,145,461 7,396,231 8,643,415

------------- ------------- -----------

TOTAL EQUITY 12,643,689 9,728,689 11,141,643

------------- ------------- -----------

Current liabilities

Trade and other payables 3,313,081 3,423,785 3,353,749

Short-term borrowings 167,754 167,754 167,754

Current tax payable 740,415 309,081 903,469

Provisions 243,100 - 486,319

------------- ------------- -----------

4,464,350 3,900,620 4,911,291

Non-current liabilities

Borrowings 1,252,336 1,371,179 1,318,005

Deferred tax liabilities 533,174 532,495 533,174

------------- ------------- -----------

1,785,510 1,903,674 1,851,179

TOTAL LIABILITES 6,249,860 5,804,294 6,762,470

------------- ------------- -----------

TOTAL EQUITY & LIABILITIES 18,893,549 15,532,983 17,904,113

============= ============= ===========

The notes on pages 11-13 form part of these interim financial

statements.

CAKE BOX HOLDINGS PLC

UNAUDITED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHSED 30 SEPTEMBER 2021

Share capital Capital Share Revaluation Retained Total

redemption option reserve earnings

reserve reserve

GBP GBP GBP GBP GBP GBP

B a la n c e at 1 April

2 0 20 400,000 40 198,368 1,589,422 7,296,507 9,484,337

T o ta l c omp r e h

e nsi ve income - - - - 1,379,724 1,379,724

Share based payments - - 144,628 - - 144,628

Dividends paid - - - - (1,280,000) (1,280,000)

B a la n c e at 30 September

2 020 400,000 40 342,996 1,589,422 7,396,231 9,728,689

------------- ----------- -------- ----------- ----------- -----------

T o ta l c omp r e h

e nsi ve income - - - - 1,987,184 1,987,184

Share based payments - - 143,372 - - 143,372

Deferred tax on share-based

payments - - 2,228 - - 2,228

Revaluation of freehold

property - - - 24,901 - 24,901

Deferred tax on revaluation

of freehold properties - - - (4,731) - (4,731)

Dividends paid - - - - (740,000) (740,000)

------------- ----------- -------- ----------- ----------- -----------

B a la n c e at 31 March

2 0 21 400,000 40 488,596 1,609,592 8,643,415 11,141,643

------------- ----------- -------- ----------- ----------- -----------

T o ta l c omp r e h

e nsi ve income - - - - 2,982,046 2,982,046

Dividends paid - - - - (1,480,000) (1,480,000)

B a la n c e at 30 September

2 021 400,000 40 488,596 1,609,592 10,145,461 12,643,689

============= =========== ======== =========== =========== ===========

CAKE BOX HOLDINGS PLC

UNAUDITED CONSOLIDATED CASH FLOW STATEMENT

FOR THE SIX MONTHSED 30 SEPTEMBER 2021

6 months to 6 months to 12 months

to

30 September 30 September 31 March

2021 2020 2021

(unaudited) (unaudited) (audited)

GBP GBP GBP

Cash from operating activities:

Profit before income tax 3,699,379 1,665,226 4,209,270

Adjusted for:

Depreciation 425,833 292,529 670,333

Exceptional items - - 486,319

Profit on disposal of tangible

fixed assets (13,515) (7,141) (18,972)

(Increase)/Decrease in inventories (209,023) 26,415 (505,936)

(Increase) in trade and other

receivables (371,630) (144,160) (1,172,047)

(Decrease)/Increase in trade

and other payables (283,886) 650,435 1,860,396

Share based payment charge - 144,628 288,000

Finance income (1,021) (2,314) (4,087)

Finance costs 20,223 21,815 41,386

-------------- -------------- --------------

Cash generated by operations 3,266,360 2,647,433 5,854,662

Taxation paid (880,387) (652,422) (646,995)

Net cash inflow

from operating

activities 2,385,973 1,995,011 5,207,667

-------------- -------------- --------------

Cash flows from investing activities

Proceeds from sale of property,

plant and equipment 16,375 9,848 26,446

Purchase of property, plant

and equipment (634,466) (250,690) (704,959)

Interest received 1,021 2,314 4,087

Issue of loans to franchisees (41,000) - (1,016,813)

Repayment of franchisee loans 277,626 - 123,063

-------------- -------------- --------------

Net cash flows

used in

investing

activities (380,444) (238,528) (1,568,176_

-------------- -------------- --------------

Cash flows from financing activities:

Repayment of borrowings (65,669) (75,109) (128,283)

Dividends paid (1,480,000) - (2,020,000)

Interest paid (20,223) (21,815) (41,586)

-------------- -------------- --------------

Net cash flows used in financing

activities (1,565,892) (96,924) (2,189,869)

Net increase in cash and cash

equivalents 439,637 1,659,559 1,449,822

Cash and cash equivalents brought

forward 5,125,864 3,676,042 3,676,042

-------------- -------------- --------------

Cash and cash equivalents carried

forward 5,565,501 5,335,601 5,125,864

============== ============== ==============

For the purposes of the cash flow statement, cash and cash

equivalents comprise the following:

Cash at bank and in hand 5,565,501 5,335,601 5,125,864

========== ========== ==========

CAKE BOX HOLDINGS PLC

NOTES TO THE INTERIM ACCOUNTS

FOR THE SIX MONTHS ENDED 30 SEPTEMBER 2021

1. Notes to the Interim Report

B a s is of preparation

T h e co ns olidated half-yearly fin a ncial state men t s do n

ot con stit ute s tatuto ry accou n ts wit h in t he meaning of

Section 434 of t he C o m p a nies Act 2006. T he statuto ry accou

nts f or t he year en ded 31 March 2021 have been filed with t he

Regis t rar of Co m panies at C o m panies Hou se. T he au ditor's

report on t he statuto ry accou n ts f or the year en ded 31 March

2020 was u n q ualified, did not include any matters to which the

auditor drew attention by way of emphasis and did n ot co ntain a

ny state men ts un der Section 498 (2) or ( 3) of the C o m panies

Act 2006.

The published financial statements for the year ended 31 March

2021 were prepared in accordance with International Financial

Reporting Standards as adopted for use in the EU ("IFRS").

T h e co ns olidated annual fin a ncial state men t s of Cake

Box Holdings Plc f or the year en ded 31 March 2022 w ill be prepar

ed in accordance w ith UK adopted I F RS. Accordin g l y, these

inter im f i nan cial state ments h a ve been prepared us i ng

accou nti ng policies con siste nt with t h o se w hich will be

adopted by t he Gro up in t he f i nancial statements for the year

ended 31 March 2022 but do not contain all the information

necessary for full compliance with UK adopted IFRS.

The consolidated half-yearly financial statements have been

prepared under the going concern assumption and historical cost

convention as modified by fair value for property, plant and

equipment.

B a s is of cons olidation

The Group consolidated half-yearly financial statements

consolidates the company and its subsidiaries. All intra-group

transactions, balances, income and expenses are eliminated on

consolidation.

2. Segment reporting

Components reported to the chief operating decision maker, the

board of directors, are not separately identifiable. The group

makes varied sales to its customers, but none are a separately

identifiable component. The following information is disclosed:

6 months 6 months to 12 months to

to

30 September 30 September 31 March

2021

(unaudited) 2020 2021

(unaudited) (audited)

GBP GBP GBP

Sale of goods 14,179,845 7,898,916 19,213,915

Sale of services 2,291,732 687,649 2,696,947

16,471,577 8,586,565 21,910,862

---------------- --------------- --------------

3. Dividends

6 months 6 months 12 months

to 30 September to 30 September to 31 March

2021 2020 2021

(unaudited) (unaudited) (audited)

GBP GBP GBP

Dividends paid 1,480,000 - 2,020,000

================= ================= ===================

No interim dividend (H1 FY20 1.85 per share) was declared.

4. Share Capital

6 months 6 months 12 months

to 30 September to 30 September to 31 March

2021 2020 2021

(unaudited) (unaudited) (audited)

GBP GBP GBP

40,000,000 Ordinary shares

of GBP0.01 each 400,000 400,000 400,000

================= ================= =============

On the 21 September 2021, the Group granted share options for

114,784 shares with an exercise price of GBP3.48 per share. The

options' vesting conditions are based on financial performance over

three years. An option pricing model was used to determine the

value of these options at the reporting date.

E a rnings per share

The basic earnings per share is calculated by dividing the

earnings attributable to equity shareholders by the weighted

average number of shares in issue. In calculating the diluted

earnings per share, share options outstanding have been taken into

account where the impact of these is dilutive.

6 months 6 months 12 months to

to 30 September to 30 September 31 March

2021 2020 2021

(unaudited) (unaudited) (audited)

GBP GBP GBP

Basic earnings per share 7.46p 3.45p 8.42p

Diluted earnings per share 7.46p 3.45p 8.42p

----------------- ----------------- -------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FFFIILALDIIL

(END) Dow Jones Newswires

November 08, 2021 02:00 ET (07:00 GMT)

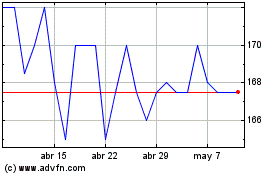

Cake Box (LSE:CBOX)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Cake Box (LSE:CBOX)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024