TIDMCOG

RNS Number : 3792M

Cambridge Cognition Holdings PLC

21 September 2021

21 September 2021

Cambridge Cognition Holdings Plc

("Cambridge Cognition", the "Company" or the "Group")

Interim Results for the six months ended 30 June 2021

Cambridge Cognition Holdings Plc (AIM: COG), which develops and

markets digital solutions to assess brain health, is pleased to

announce its unaudited interim results for the six months ended 30

June 2021.

The Company had a strong and profitable first half, delivering

revenues of GBP4.5 million, a 50% year-on-year growth. Order intake

was above the Board's expectations at GBP8.6 million and this

included two substantial orders outside the Company's core area of

focus that totalled GBP3.6 million.

The Company is now delivering more clinical trial contracts than

at any time in its history, which is reflected in a contracted

order book at 30 June 2021 of GBP15.2 million, up 36% from 31

December 2020 and more than double the value at 30 June 2020. The

order book contains contracts for clinical trials in which revenue

will be recognised over one to six years, further increasing the

long-term revenue base for the Company. The forward order pipeline

provides a good platform for growth, though at this time does not

include the unusually large orders seen in the last two half-year

periods.

The direct impact of COVID-19 on the Company's operations has

been minimal and the Company continued to deliver high levels of

customer service while operating in a remote manner. The pandemic

has accelerated interest in virtual clinical trials, with testing

performed at home rather than in-clinic, and, as a result, orders

for home testing solutions grew. We expect this trend to persist

after the pandemic.

Looking forward, the Board believes the Company to be well

positioned as a digital technology solutions provider, underpinned

by a strong cash position. The Company will continue to take

advantage of the growth in interest in developing new

pharmaceuticals for Central Nervous Systems ("CNS") disorders and

the market shift to virtual clinical trials, continuing to focus on

commercial execution and investment in new products to expand the

product offer for future growth.

Financial highlights

-- 50% year-on-year revenue growth to GBP4.5 million (H1 2020:

GBP3.0 million)

-- Gross margin maintained at 80% (H1 2020:81%)

-- Profit for the period GBP0.1 million (H1 2020: GBP0.4 million

loss)

-- 0.3p basic and diluted earnings per share (H1 2020: 1.5p loss

per share)

-- Strong cash generation with cash balance of GBP4.2 million

(31 December 2020: GBP3.0 million)

Operational highlights

-- Increase in sales orders of 74% to GBP8.6 million (H1 2020:

GBP4.9 million)

-- Contracted order book of GBP15.2 million, up 36% since 31 December

2020 and more than double the value at 30 June 2020 (31 December

2020: GBP11.2 million, 30 June 2020: GBP7.4 million)

-- Launch of NeuroVocalix(TM), a digital voice cognition solution,

ready for clinical trials

-- Completed successful spin-out and venture financing of Monument

Therapeutics

Commenting on the results Matthew Stork, Chief Executive Officer

of Cambridge Cognition, said: "I am delighted with our performance

over the first half of the year. We have continued to execute our

growth strategy, achieving a number of firsts, including the

highest order intake in a six-month period. The Company is well

positioned to serve pharmaceutical companies, whose needs are

changing as the benefits of virtual clinical trials are embraced

globally. We continue to attract interest from a wide range of

customers and remain confident in the outlook for the year."

Enquiries:

Cambridge Cognition Holdings Plc Tel: 01223 810 700

Matthew Stork, Chief Executive Officer press@camcog.com

Michael Holton, Chief Financial Officer

finnCap Ltd (Nomad and Joint Broker) Tel: 020 7220 0500

Geoff Nash / Simon Hicks (Corporate Finance)

Alice Lane / Charlotte Sutcliffe (Corporate Broking)

Dowgate Capital Limited (Joint Broker) Tel: 020 3903 7715

David Poutney / James Serjeant

IFC Advisory Ltd (Financial PR and Tel: 020 3934 6630

IR)

Tim Metcalfe / Graham Herring / Zach cog@investor-focus.co.uk

Cohen

The information communicated in this announcement contains

inside information for the purposes of Article 7 of the Market

Abuse Regulation (EU) No. 596/2014.

CHIEF EXECUTIVE OFFICER'S REVIEW

Overview

The Company delivered an exceptionally strong financial and

operational performance in the first half of 2021, with a further

considerable increase in secured orders and successful delivery of

new contracts won in 2020 and early 2021. Progress against our

strategy to focus on commercialisation of existing and newly

developed products continues to be delivered.

Orders received totalled GBP8.6 million (H1 2020: GBP4.9

million). These contracts included a number of major wins for

CANTAB(TM) cognitive assessment software, many for at-home use.

This is in line with our expectations of a market shift to virtual

trials catalysed by the COVID-19 pandemic.

Around two-thirds of the Company's clinical trial orders came

from existing customers, reflecting excellent customer service and

the benefits of the Company's focus on commercialisation. These

sales orders cover a range of cognitive assessments across various

clinical trial phases, demonstrating the Company's ability to

deliver against a spectrum of client needs with a broader

portfolio.

As well as a record sales orders achievement in the first half,

I am pleased to report more firsts for Cambridge Cognition in the

period. These include:

-- The achievement of a strategic goal by securing an evergreen

contract for post-marketing support for a newly licensed pharmaceutical

with a top twenty pharma company

-- Contract wins in a number of new therapeutic areas; examples

include a COVID-19 study measuring the impact of the virus

on cognition and an oncology study measuring the neurological

effects of brain metastases and chemotherapy agents

-- The Company's largest funded clinical trial, assessing many

thousands of patients at home with a mixture of longer web-based

assessments and high-frequency, quick assessments on mobiles

-- The provision of NeuroVocalix(TM), a unique digital voice solution

that can conduct common verbal cognitive tests on our regulatory-compliant

clinical trial platform

Cambridge Cognition is focused on successful operational

delivery to meet today's customer needs, while investing, as is

critical for a growing technology business, to meet their future

requirements. During the period, the business continued to invest

through R&D initiatives and increased headcount across the

business to deliver against an increased sales order book whilst

looking to drive future growth.

Financial results

Sales orders of GBP8.6 million (H1 2020: GBP4.9 million)

contributed to further growth in the Company's contracted order

book, which has more than doubled from GBP7.4 million at 30 June

2020 to GBP15.2m at 30 June 2021. The contracted order book

represents confirmed orders that are not yet recognised as

revenue.

Revenue, which is recognised as software products and associated

services are used, grew to GBP4.5 million (H1 2020: GBP3.0

million), a 50% increase and ahead of our initial forecasts for H1

2021. This represents further good growth from GBP2.2 million in H1

2019, a period not impacted by the pandemic.

The key components of revenue are shown in the table below:

Revenue (GBPm) H1 2021 H1 2020 H1 2019

Software & services 4.3 2.9 2.2

-------- -------- --------

Hardware 0.2 0.1 -

-------- -------- --------

Total 4.5 3.0 2.2

-------- -------- --------

Software & services revenue increased by 47% to GBP4.3

million due to the increased number and value of contracts being

delivered. Hardware revenue remains a small proportion of the sales

mix, though may increase over time as it is possible that the

Company supports more trials using wearables.

Gross profit rose by GBP1.1 million to GBP3.6 million (H1 2020:

GBP2.5 million) and the gross profit margin of 80% was broadly in

line with the prior year (H1 2020: 81%).

Administrative expenses increased by GBP0.7 million to GBP3.6

million (H1 2020: GBP2.9 million). Excluding the impact of foreign

currency, administrative expenses increased by GBP0.4 million to

GBP3.4 million (H1 2020: GBP3.0 million), reflecting investment in

personnel and increased activity. Focused R&D remains important

to continue to position the Company at the forefront of the sector,

with R&D investment of GBP0.8 million remaining broadly in line

with the prior year (H1 2020: GBP0.7 million) and reducing slightly

as a percent of revenue.

The rise in gross profit, partially offset by increased

administrative expenses, resulted in a profitable first half.

Profit before tax, Profit for the period and EBITDA all rose by

GBP0.5 million. Consequently, basic and diluted earnings per share

improved to 0.3p (H1 2020: 1.5p loss on a basic and diluted

basis).

The excellent sales order performance combined with higher level

of revenues contributed to strong cash generation, with net cash

inflow from operations of GBP1.2 million (H1 2020: GBP0.2 million

outflow). This led to an overall improvement in cash to GBP4.2

million as at 30 June 2021.

Operational review

The Company's above expectation sales orders performance in H1

2021 demonstrated continued strong commercial execution. Over the

period, the business expanded its marketing and sales team to

increase coverage and support sales of the growing product

offering.

As with most technology businesses, continued R&D investment

in products is essential to support further growth in the future.

Progress has been good through the first half of 2021 with

developments in:

-- Prototypes of new tests designed for use primarily on mobile

phones

-- Services supporting multiple clinical trials with wearable

devices, providing richer data for clients

-- Platform development to enable the delivery of a solution for

a newly licensed pharmaceutical

-- The production release, further development and planned clinical

validation of NeuroVocalix(TM)

-- Movement of our infrastructure to Amazon Web Services in multiple

geographies

Providing a high level of customer service remains an important

element of our offering. Making operational improvements has been

important over the period and we have continued to deliver projects

on time for customers and received excellent customer feedback. We

are now working on over 30% more projects with a 20% increase in

service staff compared to June 2020.

Corporate development

During the period, the Company completed the spin-out of

Monument Therapeutics Limited ("Monument"), a drug development

company applying digital phenotyping to CNS disorders which

Cambridge Cognition had been incubating since 2018, with

early-stage research supported by two Innovate UK grants. Monument

applies a novel drug development strategy, leveraging digital

assessments of cognition, to match patients with new pharmaceutical

treatments.

To develop these programmes as an independent company, Monument

secured GBP2.6 million in funding from a consortium of investors

led by Catapult Ventures and Neo Kuma Ventures. Cambridge Cognition

retained a 36.9% shareholding and agreed a licence for the use of

several of the Company's gold-standard cognitive assessments,

including CANTAB(TM), for patient stratification. Upon successful

commercialisation of its drug development programmes, Monument will

pay royalties to Cambridge Cognition.

Cambridge Cognition is yet to finalise the accounting treatment

for Monument. Costs incurred by Cambridge Cognition prior to the

spin-out have been disclosed as "Investment" and "Cost of

investment" in the balance sheet and cash flow, respectively, for

the purposes of this Report.

Board changes

As previously announced, Michael (Mick) Holton, CFO, was

appointed as a Board Director at the AGM. Nick Walters, former CFO,

continued as an Executive Director until the AGM to conduct a

handover with Mick. We are pleased to have Mick on board and are

grateful to Nick for seven years' dedicated service.

Outlook

The clinical trials market that the Company serves is large and

evolving rapidly, with many drivers of change supporting potential

future growth. The market for electronic clinical outcomes

assessments is estimated at over US$1bn p.a. and growing at 15%, a

trajectory which may increase in pace as a result of:

-- a catalytic effect of the COVID-19 pandemic, with growing evidence

that this is likely to be accelerating a move to more virtual

clinical trials; and

-- technological innovation enabling real-world testing and data

capture, which often has meaningful advantages over testing

and data captured in-clinic

Cambridge Cognition's core strength is in supporting clinical

trials for CNS disorders, though the Company, at times, wins

contracts in other therapy areas based on its technology,

reputation and levels of service. Pharmaceutical companies are

investing more in therapeutics for CNS disorders, with a 20%

increase in number of industry sponsored clinical trials from 2020

to 2021, likely underpinned by exciting new drug developments and

the approval of a new drug for Alzheimer's disease.

The Company remains firmly on track and we continue to trade in

line with market expectations. We continue to see potential for

growth for both clinic-based and virtual assessments for cognition,

whether for recognised solutions such as CANTAB(TM), or for newer

high-frequency digital or voice-based assessments and for

electronic Clinical Outcomes Assessment solutions for CNS disorders

in clinical trials.

With increasing investment in commercial activities, continued

product development, a rising cash balance and supportive

shareholder base, the Company is well positioned for further

revenue growth. We remain excited about the potential for the

future.

Matthew Stork

Chief Executive Officer

21 September 2021

CONDENSED CONSOLIDATED COMPREHENSIVE INCOME STATEMENT

For the six months ended 30 June 2021

6 months 6 months Year to

to 30 June to 30 June 31 December

2021 2020 2020

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

------------ ------------ -------------

Revenue 5 4,500 3,010 6,741

Cost of sales (885) (559) (1,324)

------------ ------------ -------------

Gross profit 3,615 2,451 5,417

Administrative expenses (3,529) (2,900) (6,093)

Other income - 26 32

Finance costs (2) (5) (5)

------------ ------------ -------------

Profit / (loss) before tax 84 (428) (649)

Tax - 4 211

------------ ------------ -------------

Profit / (loss) for the period 84 (424) (438)

============ ============ =============

Earnings / loss per share (pence) 6

Basic 0.3 (1.5) (1.5)

Diluted 0.3 (1.5) (1.5)

All amounts are attributable to equity holders in the

parent.

Profit / (loss) for the period 84 (424) (438)

Other comprehensive income - items

that may be reclassified subsequently

to profit or loss:

Exchange differences on translation

of foreign operations 51 (153) 93

---- ------ ------

Total comprehensive income / (expense)

for the period 135 (577) (345)

==== ====== ======

Consolidated statement of financial position

At 30 June 2021

At 30 June At 30 June At 31 December

2021 2020 2020

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

----------- ----------- ---------------

Assets

Non-current assets

Intangible assets 376 382 379

Property, plant and equipment 105 69 138

Investment 7 49 - -

Total non-current assets 530 451 517

Current assets

Inventories 138 47 51

Trade and other receivables 5,025 2,529 2,648

Cash and cash equivalents 4,168 1,959 3,047

----------- ----------- ---------------

Total current assets 9,331 4,535 5,746

----------- ----------- ---------------

Total assets 9,861 4,986 6,263

=========== =========== ===============

Liabilities

Current liabilities

Trade and other payables 9,600 5,163 6,206

Total liabilities 9,600 5,163 6,206

----------- ----------- ---------------

Equity

Share capital 312 312 312

Share premium 11,151 11,151 11,151

Other reserves 6,162 5,865 6,111

Own shares (78) (81) (78)

Retained earnings (17,286) (17,424) (17,439)

----------- ----------- ---------------

Total equity / (shareholders'

deficit) 261 (177) 57

----------- ----------- ---------------

Total liabilities and equity 9,861 4,986 6,263

=========== =========== ===============

Consolidated statement of changes in equity

Share Share Other Own Retained

capital premium reserve shares earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------ --------- --------- --------- -------- ---------- --------

Balance at 1 January

2020 242 9,943 6,018 (81) (17,066) (944)

Loss for the period - - - - (424) (424)

Other comprehensive

expense - - (153) - - (153)

--------- --------- --------- -------- ---------- --------

Total comprehensive

expense for the

period - - (153) - (424) (577)

--------- --------- --------- -------- ---------- --------

Issue of new share

capital 70 1,330 - - - 1,400

Share issue costs - (122) - - - (122)

Credit to equity

for share-based

payments - - - - 66 66

--------- --------- --------- -------- ---------- --------

Transactions with

owners 70 1,208 - - 66 1,344

--------- --------- --------- -------- ---------- --------

Balance at 30 June

2020 312 11,151 5,865 (81) (17,424) (177)

Balance at 1 July

2020 312 11,151 5,865 (81) (17,424) (177)

Loss for the period - - - - (14) (14)

Other comprehensive

income - - 246 - - 246

--------- --------- --------- -------- ---------- --------

Total comprehensive

income / (expense)

for the period - - 246 - (14) 232

--------- --------- --------- -------- ---------- --------

Transfer on allocation

of shares held

in trust - - - 3 (3) -

Credit to equity

for share-based

payments - - - - 2 2

--------- --------- --------- -------- ---------- --------

Transactions with

owners - - - 3 (1) 2

--------- --------- --------- -------- ---------- --------

Balance at 31 December

2020 312 11,151 6,111 (78) (17,439) 57

------------------------ --------- --------- --------- -------- ---------- --------

Balance at 1 January

2021 312 11,151 6,111 (78) (17,439) 57

Profit for the

period - - - - 84 84

Other comprehensive

income - - 51 - - 51

--------- --------- --------- -------- ---------- --------

Total comprehensive

income for the

period - - 51 - 84 135

Credit to equity

for share-based

payments - - - - 69 69

--------- --------- --------- -------- ---------- --------

Transactions with

owners - - - - 69 69

--------- --------- --------- -------- ---------- --------

Balance at 30 June

2021 312 11,151 6,162 (78) (17,286) 261

--------- --------- --------- -------- ---------- --------

Consolidated statement of cash flows

For the 6 months ended 30 June 2021

6 months 6 months Year to

to 30 June to 30 June 31 December

2021 2020 2020

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

------------ ------------ -------------

Net cash flows from operating activities 8 1,236 (163) 1,010

Investing activities

Interest on bank deposits - 2 4

Purchase of property, plant and

equipment (38) (22) (42)

Cost of investment 7 (49) - -

------------ ------------ -------------

Net cash flow used in investing

activities (87) (20) (38)

Financing activities

Proceeds from the issue of share

capital net of costs - 1,278 1,278

Lease payments (36) (57) (113)

------------ ------------ -------------

Net cash flows from financing activities (36) 1,221 1,165

Net increase in cash and cash equivalents 1,113 1,038 2,137

Cash and cash equivalents at start

of period 3,047 901 901

Exchange differences on cash and

cash equivalents 8 20 9

------------ ------------ -------------

Cash and cash equivalents at end

of period 4,168 1,959 3,047

============ ============ =============

NOTES TO THE INTERIM FINANCIAL STATEMENTS

1. General information

Cambridge Cognition Holdings Plc (the "Company") and its

subsidiaries (together, 'the Group') develops and markets digital

solutions to assess brain health for sale worldwide, principally in

the UK, the US and Europe.

The Company is a public limited company quoted on the AIM market

of the London Stock Exchange (symbol COG) and is incorporated and

domiciled in the UK. The address of its registered office is

Tunbridge Court, Tunbridge Lane, Bottisham, Cambridge, CB25

9TU.

The condensed consolidated interim financial statements were

approved by the Board of Directors for issue on 21 September 2021.

The condensed consolidated interim financial statements do not

comprise statutory accounts within the meaning of section 434 of

the Companies Act 2006.

Statutory accounts of the Group for the year ended 31 December

2020 were approved by the Board of Directors on 27 May 2021 and

delivered to the Registrar of Companies. The report of the auditors

on those accounts was unqualified, did not contain an emphasis of

matter paragraph and did not contain any statement under section

498 of the Companies Act 2006.

The condensed consolidated interim financial statements together

with the comparative information for the six months ended 30 June

2020 have not been audited.

2. Basis of preparation

Going concern basis

The Group's forecasts and projections, taking account of

reasonably possible changes in trading performance, support the

conclusion that there is a reasonable expectation that the Group

has adequate resources to continue in operational existence for the

foreseeable future, a period of not less than twelve months from

the date of this report. The Directors also believe that the Group

is able to survive the consequences of reasonably forecastable

impacts of a resurgence of the COVID-19 pandemic. The Group

therefore continues to adopt the going concern basis in preparing

its condensed consolidated interim financial statements.

3. Accounting policies

The accounting policies adopted in the preparation of the

condensed consolidated interim financial statements are consistent

with those followed in the preparation of the Group's consolidated

financial statements for the year ended 31 December 2020.

4. Critical accounting judgments and key sources of estimation

uncertainty

In the application of the Group's accounting policies the

Directors are required to make judgments, estimates and assumptions

about the carrying amounts of assets and liabilities that are not

readily apparent from other sources. The estimates and associated

assumptions are based on historical experience and other factors

that are considered to be relevant. Actual results may differ from

these estimates.

The estimates and underlying assumptions are reviewed on an

ongoing basis.

The following are the critical judgments that the Directors have

made in the process of applying the Group's accounting

policies.

Revenue recognition

Judgments may be required in recognising revenue and cost. These

judgments include:

-- The extent to which, and the way in which, contracts are separated

into their component parts and the values attributed to those

parts;

-- Whether software licences are granted to allow the customer

the benefit of use of our intellectual property over a period

of time (including benefitting from future maintenance and

improvements) or whether that right is given as the intellectual

property exists at the point of time the licence is granted.

In the case of the former, software is recognised over the

period of use, for the latter revenue is recognised when the

licence commences and the customer is able to use the software;

-- The adoption of the portfolio approach for lower value sales

and the recognition criteria applied;

-- Where performance obligations are satisfied over time, the

length of time remaining for performance, and whether this

needs revising over time; and

-- The length of time for performance also dictates the initial

deferral and subsequent recognition of commissions in cost

of sales.

Goodwill

The Group reviews the carrying value of its goodwill balances by

carrying out impairment tests on at least an annual basis. These

tests require estimates to be made of the value in use of its CGUs

which are dependent on estimates of future cash flows and long-term

growth rates of the CGUs.

Capitalisation of development costs

The point at which development costs meet the criteria for

capitalisation is critically dependent on management judgment of

the probability of future economic benefits.

Recovery of deferred tax assets

Deferred tax assets have not been recognised for deductible

temporary differences, share options and tax losses as management

considers that there is not sufficient certainty that future

taxable profits will be available to utilise those temporary

differences and tax losses.

5. Segmental information

The analysis of revenue by product type is as follows:

6 months

to 30 June 6 months to Year to 31 December

2021 30 June 2020 2020

GBP'000 GBP'000 GBP'000

Software 1,374 1,310 2,751

Services 2,882 1,583 3,679

Hardware 244 117 311

4,500 3,010 6,741

============ ============== ====================

6. Earnings per share

Calculation of earnings / (loss) per share is based on the

following profit / (loss) and numbers of shares:

6 months 6 months Year to

to 30 June to 30 June 31 December

2021 2020 2020

GBP'000 GBP'000 GBP'000

Earnings

Earnings for the purposes of basic and

diluted earnings per share being net profit

/ (loss) attributable to owners of the

Company 84 (424) (438)

'000 '000 '000

Number of shares

Weighted average number of ordinary shares

for the purposes of basic EPS 31,097 28,429 29,776

Effect of dilutive share options 2,177 - -

------------ ------------ -------------

Weighted average number of ordinary shares

for the purposes of diluted EPS 33,274 28,429 29,776

------------ ------------ -------------

Pence Pence Pence

Earnings / (loss) per share

Basic 0.3 (1.5) (1.5)

Diluted 0.3 (1.5) (1.5)

The basic weighted average number of shares excludes shares held

by an Employee Benefit Trust. Fully diluted earnings per share is

calculated after showing the effect of outstanding options in

issue.

In prior periods presented, the effect of the options would be

to reduce the loss per share, and hence the diluted loss per share

is the same as the basic loss per share.

The number of shares in issue at 30 June 2021 was 31,170,903 (31

December 2020: 31,170,903).

7. Investment

On 30 June 2021, the Company completed the spin-out of Monument

Therapeutics Limited ("Monument"). Monument secured GBP2.6 million

in funding from a consortium of investors led by Catapult Ventures

and Neo Kuma Ventures. Cambridge Cognition retained a 36.9%

shareholding.

Cambridge Cognition is yet to finalise the accounting treatment

for Monument. Costs incurred by Cambridge Cognition prior to the

spin-out have been disclosed as "Investment" and "Cost of

investment" in the balance sheet and cash flow, respectively, for

the purposes of this Report.

8. Reconciliation of operating result to operating cash

flows

6 months 6 months

to 30 June to 30 June Year to 31

2021 2020 December 2020

GBP'000 GBP'000 GBP'000

Profit / (loss) before tax 84 (428) (649)

Adjustments for:

Depreciation of property, plant

and equipment 70 70 132

Amortisation of software licences 3 3 6

Share-based payments charge 69 66 68

Finance costs 2 5 9

Interest received - (2) (4)

Operating cash flows before

working capital movements 228 (286) (438)

Change in inventories (86) 6 2

Change in trade and other receivables (2,416) (917) (1,010)

Change in trade and other payables 3,512 1,027 2,243

------------ ------------ ---------------

Cash generated / (used) by operations 1,238 (170) 797

Taxation (paid) / received (2) 7 213

------------ ------------ ---------------

Net cash flows from operations 1,236 (163) 1,010

------------ ------------ ---------------

9. Copies of interim financial statements

Copies of the interim financial statements are available from

the Company at its registered office at Tunbridge Court, Tunbridge

Lane, Bottisham, Cambridge, CB25 9TU. The interim financial

information document will also be available on the Company's

website www.cambridgecognition.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFETAVIIFIL

(END) Dow Jones Newswires

September 21, 2021 02:00 ET (06:00 GMT)

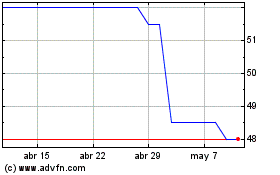

Cambridge Cognition (LSE:COG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Cambridge Cognition (LSE:COG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024