TIDMCOG

RNS Number : 1052T

Cambridge Cognition Holdings PLC

23 March 2021

23 March 2021

Cambridge Cognition Holdings Plc

("Cambridge Cognition", the "Group" or the "Company")

Unaudited preliminary results for the year ended 31 December

2020

Record order backlog and strong balance sheet provide

a platform for sustained growth

Cambridge Cognition Holdings plc, which develops and markets

digital technology to deliver customer-focused solutions to assess

brain health, announces its unaudited preliminary results for the

year ended 31 December 2020.

Highlights

The Company delivered a strong performance in 2020, delivering

on its growth strategy through focusing on commercialising its

existing product range while continuing to invest in next

generation products. Sales order intake totalled GBP12.7m, up 158%

on the previous year.

Revenue increased 34% which, coupled with careful cost control,

delivered a much-reduced loss for the year and a profitable fourth

quarter. The contracted order backlog at the end of the year was

GBP11.2m, up 96% on the prior year, and indicates the potential for

further revenue growth in 2021.

At 31 December 2020 the Company had over GBP3m of cash,

resulting from the increased order flow, reduced spending, and the

successful equity placing of GBP1.4m, before costs, in March

2020.

Financial summary

-- Record sales order intake of GBP12.7m (2019: GBP4.9m)

-- Revenue up 34% to GBP6.7m (2019: GBP5.0m)

-- Gross profit up 39% to GBP5.4m (2019: GBP3.9m)

-- Loss for the year GBP0.4m, a GBP2.5m improvement (2019: GBP2.9m loss)

-- Loss per share 1.5 pence (2019: 12.4 pence loss per share)

-- Cash balance at 31 December 2020 GBP3.0m (31 December 2019: GBP0.9m)

Operational highlights

-- Contracted order backlog at 31 December 2020 of GBP11.2m (31 December 2019: GBP5.7m)

-- Increased commercial focus resulted in increases in sales order volumes, average prices and multi-product sales

-- Growth in sales orders across the entire product portfolio:

CANTAB(TM), electronic Clinical Outcomes Assessment ("eCOA"), and

Digital Health solutions

-- Excellent progress with NeuroVocalix (TM) in customer-funded proof-of-concept contracts

Commenting on the results Matthew Stork, Chief Executive

Officer, said:

"2020 was an excellent year for Cambridge Cognition. We saw

strong growth in sales orders, driven by improved commercial

execution, continued investment in drug discovery in Central

Nervous System disorders and several unusually large orders. The

business operated smoothly throughout the year despite the COVID-19

pandemic and any contract delays caused by the pandemic were

compensated for by winning new contracts. We expect the business to

continue to grow strongly through 2021 and beyond."

Enquiries:

Cambridge Cognition Holdings plc www.cambridgecognition.com

Matthew Stork, Chief Executive Officer Tel: 01223 810 700

Mick Holton , Chief Financial Officer press@camcog.com

finnCap Ltd (NOMAD and Joint Broker)

Tel: 020 7220 0500

Geoff Nash / Simon Hicks (Corporate Finance)

Alice Lane / Charlotte Sutcliffe (Corporate Broking)

Dowgate Capital Limited (Joint Broker)

Tel: 0203 903 7715

David Poutney / James Serjeant

IFC Advisory Ltd (Financial PR and Tel: 0203 934 6630

IR) cog@investor-focus.co.uk

Tim Metcalfe / Graham Herring / Zach

Cohen

The information communicated in this announcement contains

inside information for the purposes of Article 7 of the Market

Abuse Regulation (EU) No. 596/2014 .

CHIEF EXECUTIVE'S REVIEW

Overview

The Company had a successful year in 2020 delivering

considerable sales growth of its digital technology solutions with

a record GBP12.7m of sales orders secured, representing a 158%

increase on 2019. This was a result of the implementation of the

strategy developed in 2019 to increase focus on commercial

activities, while continuing product development and creating

operational resilience and flexibility. The COVID-19 pandemic

accelerated market interest in virtual clinical trials, creating

more opportunities for the Company in 2020 and beyond.

The 31 December 2020 contracted order backlog, which represents

contracts not as yet completed where revenue is yet to be

recognised, stood at GBP11.2m, almost double the figure from 2019.

We anticipate that over GBP6.0m of the year-end contracted order

backlog will be recognised in 2021, which will provide a solid

platform for revenue growth in 2021.

The strong sales order intake helped to generate 34% revenue

growth, bringing revenues for the year to GBP6.7m, and, with

careful cost control, a considerably reduced loss of GBP0.4m and a

net cash inflow from operating activities of GBP1.0m. With steady

revenue growth and continued cost management over the year, the

Company was profitable in the fourth quarter.

We continued to build the breadth of our digital technology

product portfolio, targeted at major pharmaceutical and well-funded

biotechnology companies. Key developments included new outcomes

instruments and application modules for both our electronic

Clinical Outcomes Assessment ("eCOA") and Digital Health solutions.

Progress on our voice-based platform, NeuroVocalix (TM), also

continued apace.

The COVID-19 pandemic initially slowed the conversion of

contracted orders into recognised revenue. After an adjustment

period, the trials that were delayed by the pandemic resumed as

contingency measures were put in place at clinical trial sites.

Overall, the shortfall in our forecasted revenue was covered by

growth in new contracts, some in part due to more spending on

virtual clinical trials prompted by the pandemic.

We were grateful for the support of investors in our fundraise

in the first quarter of 2020, conducted before COVID-19 was

declared as a pandemic. The funds were used to invest in

commercialising our solutions, to further develop our new voice

solution, and to strengthen our balance sheet.

O verall, after a strong performance in 2020 and with a broader

portfolio and a growing market, we are excited about the potential

for further growth in 2021.

Financial Results

Record sales orders of GBP12.7m, a 158% year-on-year increase

(2019: GBP4.9m), arose from increases in both contract volumes and

average prices. This reflects the Company's continuing focus on

improving commercial execution, with more cross selling between

product areas due, in part, to the expanded product portfolio. The

Company won seven large orders of over GBP0.5m each, exceeding

previous years. It should be noted that the 2020 performance was

accentuated by two large one-off orders that, together, totalled

GBP3.1 million. Such large single orders are outside of the scope

of normal business and may not be repeated every year.

Revenue grew by 34% to GBP6.7m (2019: GBP5.0m). Revenue is

recognised over the term of the contracts and so the GBP6.7m

revenue recognised in 2020 was from contracts won both in 2020 and

in prior years:

-- GBP2.6m from the GBP5.7m contracted order backlog at the end of 2019, and

-- GBP4.1m from the GBP12.7m orders contracted during 2020.

We anticipate the GBP11.2m contracted order backlog at the end

of December 2020 will generate at least GBP6.0m of revenue to be

recognised in 2021 with the to balance be recognised in subsequent

years.

Recognised revenue split by type was as follows:

2020 2019 Increase Increase

GBPm GBPm GBPm

Software 2.7 2.5 0.2 9%

------ ------ --------- ---------

Services 3.7 2.3 1.4 57%

------ ------ --------- ---------

Total Software & Services 6.4 4.8 1.6 32%

------ ------ --------- ---------

Hardware 0.3 0.2 0.1 76%

------ ------ --------- ---------

Total Revenue 6.7 5.0 1.7 34%

------ ------ --------- ---------

Service revenue grew by 57% as more implementation and bespoke

development work was carried out. Software revenue grew by a more

modest 9% but, given the time lag between contract signature and

software usage, we would expect this to grow further in 2021.

Hardware sales were a small proportion of revenue in 2020; the

hardware, which is procured from third parties, is only supplied by

Cambridge Cognition when specifically requested by a customer to

support a project. Hardware sales had been expected to decline as

digital devices become ubiquitous, however, we now integrate

wearable devices into our solution and so increased the supply of

these in 2020.

Gross profit was GBP5.4m (80.4% margin) compared with GBP3.9m

(77.2% margin) in 2019. The margin growth was due to a reduction in

third party costs.

Administrative expenses decreased by 13% to GBP6.1m (2019:

GBP7.0m) as a result of two factors:

-- Prior to the pandemic the Company planned and executed a

reduction in operating costs as part of its strategy to reshape the

cost base for its future growth. Subsequently, at the start of the

pandemic, replacement and planned new hires were deferred until

certainty returned to the market (GBP0.6m year-on-year decrease);

and

-- The COVID-19 pandemic meant that key cost areas such as

exhibitions, conferences and travel were greatly reduced (GBP0.3m

year-on-year decrease).

As planned, investment in R&D, which is necessary to

maintain the company's position at the forefront of the sector, was

more targeted in 2020 and this resulted in R&D spend of

GBP1.5m. As a proportion of revenue, this represents a reduction

from 34% in 2019 to 22% in 2020.

The loss before tax was GBP0.6m (2019: GBP3.1m). R&D tax

credits were GBP0.2m (2019: GBP0.2m). The post-tax loss for the

year was GBP0.4m (2019: GBP2.9m), which equates to a loss per share

of 1.5 pence (2019: 12.4 pence loss per share).

Cash inflow from operating activities was GBP1.0m (2019: GBP2.3m

outflow), driven by the high value of sales orders. Sales contracts

for clinical trials typically include an amount of cash billable

upon signing, and as such an invoice is raised (and cash

subsequently collected) as contracts are executed and before

revenue is recognised.

After accounting for the GBP1.3m net received from the equity

placing in Q1 2020, total cash inflow was GBP2.1m, and the year-end

cash balance was just over GBP3.0m, which provides a solid platform

for growth.

Business Strategy

A full strategic review was performed in 2019. The potential to

accelerate the growth of the business was evident and plans were

implemented to take advantage of the opportunities. The aim of the

strategy is to increase market share in two fast growth markets and

to build a substantial, profitable, specialist digital technology

business.

The primary target market is the eCOA market, which is a

US$1.2bn+ market, growing at approximately 15% per annum. 15% of

clinical trials are conducted on Central Nervous System ("CNS")

disorders, which is the Company's core area of expertise, and

pharmaceutical companies continue to invest heavily in CNS drug

development.

The second target market is the Digital Health solutions market

for CNS disorders, which is a US$0.5bn market and is growing at 20%

per annum.

The strategy, outlined in the annual report last year, comprises

five strategic pillars. Progress in the year was as follows:

1. Build a diversified product mix based on four product

categories: CANTAB(TM), eCOA, Digital Health solutions, and

NeuroVocalix(TM). The business made good progress with major growth

in all our production solutions. The development of our

NeuroVocalix(TM) voice platform continued to progress well and has

attracted interest from major pharmaceutical companies.

2. Focus on commercialising products. Record sales order intake,

delivered through increased conversion of opportunities and

increased upselling (especially through multi-product sales), has

been a major success.

3. Build smoother revenues. A deeper contracted order backlog

will naturally begin to smooth revenues. At the same time our

strategy is to target longer-term contracts and long-term licence

deals. We have progressed some exciting opportunities in this

area.

4. Build partnerships to access wider opportunities and

geographies. We have continued to explore partnership opportunities

in Digital Health solutions and Healthcare in large territories

(for example China and India) where direct selling is not an

efficient route to market, with several large Clinical Research

Organisations and a number of major blue chip tech companies. These

are long-term endeavours. The impact has therefore not yet been

factored into our forecasts.

5. Reduce investment in non-strategic activities. R&D spend

was more targeted than in previous years. We have continued to

progress the spin-out of our digital phenotyping business, which is

nearly wholly grant-funded at this time.

Operational Review

Improving commercial execution is an ongoing strategic and

operational goal. The considerable progress made in 2019 has reaped

rewards and the Company continued that focus and progress in

2020.

We built further on the capability and coverage of our sales

team. We hired a new Chief Commercial Officer and expanded the

sales team in the USA later in the year. We ran a focused marketing

programme, which, at the start of the pandemic, was adapted to be

delivered completely online. Consequently we generated considerably

more leads than in 2019.

The volume of orders contracted in the year increased

considerably due to this commercial focus and the broader portfolio

of solutions offered. In addition, cross-selling was successful

with a 52% increase in the number of clinical trial customers

ordering more than one product. As our product development

continues and a broader sales pipeline is established, we will

continue to build long-term resilience and growth within the

business.

We are excited to see our newer products mature and attract more

market interest. In parallel, it is pleasing to report that our

established CANTAB(TM) product is going from strength to strength.

We were delighted to announce our participation in three late phase

schizophrenia trials in September. This is an important disease

area in the neurological space and our involvement is a great

credit to our scientific expertise. Our work on these trials will

deliver revenue of more than GBP2m over the life of the

contracts.

In the eCOA area, we commercialised the major upgrade we

launched in late 2019 and considerably expanded our portfolio of

eCOA instruments. We delivered on the strategy to upsell

CANTAB(TM): approximately half of eCOA orders taken in 2020 were as

an add-on to CANTAB(TM) orders. We also grew our eCOA-only sales

and for the first time took sizeable orders for non-CNS /

non-cognition instruments. We intend to explore the eCOA-only

opportunity further in 2021.

Our catalogue of Digital Health solutions continued to expand

and we demonstrated that these solutions can be scaled effectively.

We delivered three new applications for clinical trials during the

year. With Digital Health solutions being a newer offering, over

the last few years we have taken orders at lower margins with at

least some new software development to satisfy each contract. We

strive to make each new module configurable so it can subsequently

be reused. In late 2020, we achieved an important milestone,

securing a Digital Health contract worth over GBP0.7m that reused

existing modules without any bespoke software development and was

therefore at a high margin.

In 2019, we concluded development of our voice-based platform

prototype, NeuroVocalix(TM). Progress has continued with this

product through 2020 and we are on track to launch a production

version in 2021. Progress is underlined by excellent early results

in ongoing customer funded proof-of-concept clinical trials in

patients using NeuroVocalix(TM).

Operational efficiency improved during 2020 as the number of

clinical trials being implemented increased. Towards the end of the

year, the Company increased the size of the software development

and operational teams to meet the growth in demand, while

continuing to prepare to further improve efficiency in 2021.

As well as the developments mentioned above on our Digital

Health solutions and NeuroVocalix(TM), we continued to build on the

functionality of our core products. For example, we developed a new

cognitive task to measure motor function which helped secure a

large contract that included CANTAB(TM) and eCOA solutions. This

contract will deliver more than GBP1m in revenue over the life of

the contract.

We were also delighted to be part of a successful consortium of

46 academic and industry partners to be awarded an IMI (Innovative

Medicines Initiative) grant. Working with leading industry and

academic partners continues to be an important part of our product

development strategy. The project for which the award was granted

concerns the increasingly important area of fatigue, including

exploring how fatigue plays a role in neurodegenerative disorders

such as Parkinson's disease and Huntingdon's disease.

The Company's strong performance has been underpinned by the

continued excellence of our people who have continued to offer

outstanding customer service in a fast-changing and unprecedented

working environment. I would like to take this opportunity to thank

them for their dedication and tenacity.

Board Changes

As previously announced, Eric Dodd retired from the Board at our

2020 AGM and we are grateful to Eric for his support for the

Company during his tenure.

We were pleased to welcome Richard Bungay to the Board in

September 2020. Richard brings over 25 years' experience in

corporate roles with R&D-based companies in the biotechnology

and pharmaceutical sector. Richard joined the Board as a

Non-Executive Director and is the Chair of the Audit Committee.

We announced in January of this year that Nick Walters is

leaving his position as CFO to pursue other business interests.

Nick has made a major contribution to the Company over seven years

and remains an Executive Director until the forthcoming AGM to

ensure a smooth handover.

Michael (Mick) Holton joined as CFO in January 2021. Mick has

had an extensive career in finance, most recently at Biome

Technologies plc, and previously at Infinis Energy, Alliance Boots

(now Walgreens Boots Alliance) and Kidde plc (now part of United

Technologies Corporation).

COVID-19

COVID-19 brought new challenges to the business. Our first

priority was the safety and welfare of our staff, people in our

local environment, suppliers and customers. The Company adapted

very quickly to working at home and has continued to be fully

operational throughout the pandemic. Our systems are cloud-based,

and supported by remote access to supplementary systems, and so our

business has been uninterrupted.

We have seen a considerable increase in interest in virtual

clinical trials since the start of the pandemic. This has included

some existing trials switching to virtual (out of clinic)

protocols. We are well placed to serve this market, both with our

existing products and our developing technologies.

At the outset of the pandemic, some trials' starts were delayed

and, for others, recruitment was slowed. Clinical trial sites

subsequently put into place contingency measures to allow them to

operate during the pandemic and trials have been running as

expected since then. Uncertainty persists, however, and so we will

continue to carefully monitor the situation and adjust plans as

necessary.

All indications from our scenario planning suggest that our

business can withstand reasonable downside risks from COVID-19. We

are further comforted that the likelihood of these risks

crystallising and their impact appears to be reduced with the

roll-out of vaccinations. We have increased the flexibility of our

cost base leaving us better positioned to respond to changes. Work

on meeting our contractual obligations has continued

unhindered.

Brexit

Over the course of 2020, the Company maintained its readiness

for the ending of the transition period covering the withdrawal of

the UK from the EU and has subsequently continued to trade without

any disruption, other than some minor issues with hardware

shipping. The Company provides primarily IT software and services,

which are not subject to tariffs nor checks. Hardware, procured

from third parties, is only supplied when required by customers.

Early information about additional costs and potential delays was

provided to customers.

Outlook

We believe that our performance in 2020 has affirmed our

position as a leading digital technology company providing

customer-focused solutions primarily for clinical trials. We are

pleased with progress and excited about the potential.

We have a strong pipeline of opportunities that we aim to

convert into orders and revenues in 2021 to add to the GBP6.0m of

contracted order backlog we expect to realise this year.

We were pleased to be profitable in the last quarter of 2020 and

would expect that to continue into 2021. We are anticipating

further revenue growth and plan to continue careful financial

management and targeted investment in research and development.

With a strategy focused on commercial execution, substantial

value anticipated from newer eCOA and Digital Health solutions in

attractive, high growth markets, together with the established

CANTAB(TM) product and the commercial launch of NeuroVocalix(TM)

planned for 2021, we believe that we are well placed to continue to

build substantial, sustainable shareholder value. We look forward

to reporting further exciting progress in 2021.

Matthew Stork

Chief Executive Officer

23 March 2021

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the year to 31 December

Notes Year to Year to

31 December 31 December

2020 2019

Unaudited Audited

GBP'000 GBP'000

Revenue 3 6,741 5,042

Cost of sales (1,324) (1,149)

------------- -------------

Gross profit 5,417 3,893

Administrative expenses (6,093) (7,011)

Other operating income 32 -

------------- -------------

Operating loss (644) (3,118)

Interest received 4 5

Finance costs (9) (4)

------------- -------------

Loss before tax (649) (3,117)

Tax received 211 216

------------- -------------

Loss for the year (438) (2,901)

Other comprehensive income

Items that may subsequently be reclassified

to profit or loss

Exchange differences on translation

of foreign operations 93 87

------------- -------------

Total comprehensive income for the

year (345) (2,814)

============= =============

Earnings per share (pence) 4

Basic and diluted earnings per share (1.5) (12.4)

All items of income are attributable to the equity holders of

the Parent.

The above results relate to continuing operations.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at 31 December

Notes At 31 December At 31 December

2020 2019

Unaudited Audited

GBP'000 GBP'000

Assets

Non-current assets

Intangible assets 379 385

Property, plant and equipment 138 117

Total non-current assets 517 502

--------------- ---------------

Current assets

Inventories 51 53

Trade and other receivables 2,648 1,703

Cash and cash equivalents 3,047 901

Total current assets 5,746 2,657

--------------- ---------------

Total assets 6,263 3,159

=============== ===============

Liabilities

Current liabilities

Trade and other payables 6, 206 4,103

Total liabilities 6,206 4,103

--------------- ---------------

Equity

Share capital 312 242

Share premium 11,151 9,943

Other reserves 6,111 6,018

Own shares (78) (81)

Retained earnings (17,439) (17,066)

--------------- ---------------

Total equity 57 (944)

--------------- ---------------

Total liabilities and equity 6,263 3,159

=============== ===============

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the year to 31 December

Share Share premium Other reserves Own shares Retained

capital earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at

1 January 2019 207 7,707 5,931 (94) (14,277) (526)

Loss for the year - - - - (2,901) (2,901)

Other comprehensive

income - - 87 - - 87

--------- -------------- --------------- ----------- ---------- --------

Total comprehensive

income for the

year - - 87 - (2,901) (2,814)

Issue of new share

capital 35 2,465 - - - 2,500

Share issue costs - (229) - - - (229)

Transfer on allocation

of shares in trust - - - 13 (13) -

Credit to equity

for share based

payments - - - - 125 125

--------- -------------- --------------- ----------- ---------- --------

Transactions with

owners 35 2,236 - 13 112 2,396

Balance at

1 January 2020 242 9,943 6,018 (81) (17,066) (944)

Loss for the year - - - - (438) (438)

Other comprehensive

income - - 93 - - 93

--------- -------------- --------------- ----------- ---------- --------

Total comprehensive

income for the

year - - 93 - (438) (345)

Issue of new share

capital 70 1,330 - - - 1,400

Share issue costs - (122) - - - (122)

Transfer on allocation

of shares in trust - - - 3 (3) -

Credit to equity

for equity-settled

share-based payments - - - - 68 68

--------- -------------- --------------- ----------- ---------- --------

Transactions with

owners 70 1,208 - 3 65 1,346

Balance at

31 December 2020 312 11,151 6,111 (78) (17,439) 57

========= ============== =============== =========== ========== ========

CONSOLIDATED STATEMENT OF CASH FLOWS

For the year ended 31 December

Notes Year to Year to

31 December 31 December

2020 2019

Unaudited Audited

GBP'000 GBP'000

Net cash flows from operating activities 5 1,010 (2,320)

Investing activities

Interest received 4 5

Purchase of property, plant and equipment (42) (15)

Purchase of intangible assets - (40)

Net cash flow used in investing activities (38) (50)

Financing activities

Proceeds from the issue of share

capital 1,400 2,500

Share issue costs (122) (229)

Lease payments (113) (113)

Net cash flow from financing activities 1,165 2,158

Net increase/(decrease) in cash and

cash equivalents 2,137 (212)

Cash and cash equivalents at start

of year 901 1,110

Exchange differences on cash and

cash equivalents 9 3

------------- -------------

Cash and cash equivalents at end

of year 5 3,047 901

============= =============

1. General information

Cambridge Cognition Holdings plc ('the Company') and its

subsidiaries (together, 'the Group') develops and markets digital

solutions to assess brain health.

The Company is a public limited company which is listed on the

AIM market of the London Stock Exchange (symbol: COG) and is

incorporated and domiciled in the UK. The address of its registered

office is Tunbridge Court, Tunbridge Lane, Bottisham, Cambridge,

CB25 9TU.

2. Basis of preparation

The financial information of the Group set out above does not

constitute "statutory accounts" for the purposes of Section 435 of

the Companies Act 2006.

The financial information in this preliminary results

announcement does not constitute the Group's statutory accounts for

the year ended 31 December 2020 or the year ended 31 December 2019.

The information for the year ended 31 December 2020 is based on

accounts that are in the process of being audited and will be

approved by the Board and subsequently filed. Accordingly, the

information for the year ended 31 December 2020 is unaudited. The

information for the year ended 31 December 2019 is based on

accounts that were approved by the Board and subsequently filed in

2020.

The consolidated financial statements have been prepared in

accordance with International accounting standards in conformity

with the requirements of the Companies Act 2006. The accounting

policies adopted are consistent with those followed in the

preparation of the consolidated financial statements for the year

ended 31 December 2019.

At the time of approving the preliminary results statement, and

based on a review of the Group's forecasts and business plan,

including in particular the impact of COVID-19 on order intake,

revenue recognition, costs and cash flow, the Directors have a

reasonable expectation that the Company and the Group have adequate

resources to continue in operational existence for the foreseeable

future. Thus, they continue to adopt the going concern basis of

accounting in preparing the preliminary statement.

3. Segmental information

An analysis of the Group's revenue for each major product and

service category is as follows:

2020 2019

GBP'000 GBP'000

Software 2,751 2,526

Services 3,679 2,339

Hardware 311 177

-------- --------

6,741 5,042

======== ========

4. Earnings per share

The calculation of basic and diluted earnings per share ("EPS")

is based on the following data:

Earnings

2020 2019

GBP'000 GBP'000

Earnings for the purposes of basic and diluted

EPS per share being net loss attributable to

owners of the Company (438) (2,901)

======== ========

Number of shares

2020 2019

'000 '000

Weighted average number of ordinary shares for

the purposes of basic EPS 29,776 23,414

======== ========

Weighted average number of ordinary shares for

the purposes of diluted EPS 29,776 23,414

======== ========

For 2020 and 2019, the effect of options would be to reduce the

loss per share and as such the diluted loss per share is the same

as the basic loss per share.

5. Notes to the cash flow statement

2020 2019

GBP'000 GBP'000

Loss before tax (649) (3,117)

Adjustments for:

Depreciation of property, plant and equipment 132 157

Amortisation of software licences 6 5

Share-based payment expense 68 125

Finance costs 9 4

Interest R

receivable (4) (5)

-------- --------

Operating cash flows before movements in working

capital (438) (2,831)

Decrease/(increase) in inventories 2 (27)

(Increase)/decrease in receivables (1,010) 148

Increase in payables 2,243 110

-------- --------

Cash generated by operations 797 (2,600)

Tax credit received less tax paid 213 280

Net cash from operating activities 1,010 (2,320)

======== ========

Cash and cash equivalents

2020 2019

GBP'000 GBP'000

Cash and bank balances 3,047 901

======== ========

Cash and cash equivalents comprise cash and short-term bank

deposits with an original maturity of three months or less, net of

outstanding bank overdrafts. The carrying amount of these assets is

approximately equal to their fair value.

6. Annual Report & Annual General Meeting

The Company announces its intention to hold the Annual General

Meeting ("AGM ") on 27 May 2021. Details of the nature of the AGM

will be communicated to shareholders via the Company's website and

a Regulatory Information Service as soon as they are known, along

with any practical arrangements. This notice will also include the

date on which the notice of AGM and the Annual Report will be

posted to shareholders.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR SEWFUEEFSEID

(END) Dow Jones Newswires

March 23, 2021 03:00 ET (07:00 GMT)

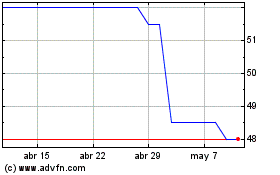

Cambridge Cognition (LSE:COG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Cambridge Cognition (LSE:COG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024