TIDMCAM

RNS Number : 4564K

Camellia PLC

02 September 2021

CAMELLIA PLC

INTERIM RESULTS

Camellia Plc (AIM:CAM) announces its interim results for the six

months ended 30 June 2021.

Malcolm Perkins, Chairman of Camellia, stated:

"As anticipated, the first half of 2021 has been exceptionally

challenging operationally. Increased tea production and improved

pricing in India and Bangladesh helped offset the impact of the

oversupply of tea in Kenya and higher wages in Assam. The pandemic

continues to have a direct impact on our engineering and food

services businesses in the UK.

Notwithstanding these challenges, we have made good strategic

progress, particularly with the acquisition of Bardsley England and

the sale of our aerospace businesses.

Once again I should like to thank all our staff across the world

for their continuing contributions both to the business and their

local communities in extremely difficult circumstances."

Operational highlights

-- Tea production up 5% with strong performances and increased

average prices in India and Bangladesh offset by declines

in African prices and the margin impact from the significant

Assam wage increases

-- Macadamia production volumes expected to be up 20% though

average selling prices are lower

-- Avocado production expected to be significantly lower than

last year though prices are expected to be marginally better

-- Speciality crops generally enjoyed a strong first half

-- Mixed performance from other businesses with improved results

from Associates offset by increases in losses in Engineering

and Food Service

Strategic highlights

-- Acquisition in July of an 80% interest in Bardsley England,

the UK's second largest grower of apples

-- Sale of the Aerospace interests in August

-- Further progress made on geographic and crop diversification

-- First Tanzanian avocado planting complete

-- First major blueberry crop harvesting underway in Kenya

-- Continued commitment to ESG principles with particular focus

on securing and conserving water resources to mitigate climate

impacts

-- Camellia remains financially strong with significant liquid

resources

Financial highlights

Six months Six months Year ended

ended ended 31 December

30 June 30 June 2020 2020

2021

GBP'm GBP'm GBP'm

----------- -------------- -------------

Revenue - continuing operations 105.5 114.9 291.2

----------- -------------- -------------

Underlying (loss)/profit before

tax* (7.3) (6.0) 16.0

----------- -------------- -------------

Significant separately disclosed

items and provision releases (0.5) (6.9) (8.2)

----------- -------------- -------------

(Loss)/profit before tax for

the period (7.8) (12.9) 7.8

----------- -------------- -------------

(Loss) after tax for the period (6.1) (12.1) (0.8)

----------- -------------- -------------

(Loss)/earnings per share (220.9)p (456.2)p (181.0)p

----------- -------------- -------------

Dividend per share for the

period 44p 102p 144p

----------- -------------- -------------

Net cash and cash equivalents

net of borrowings 62.1 72.8 90.1

----------- -------------- -------------

Investment portfolio market

value 51.3 45.8 50.6

----------- -------------- -------------

* Underlying profit before tax is profit before tax from

continuing operations excluding separately disclosed significant

items (eg provision releases, impairments, costs relating to legal

claims, profit on disposal of property)

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) No. 596/2014.

The interim report will be available to download from the

investor relations section of the Company's website

www.camellia.plc.uk

Enquiries:

Camellia Plc 01622 746655

Tom Franks, CEO

Susan Walker, CFO

Panmure Gordon 0207 886 2500

Nominated Advisor

and Broker

Emma Earl

Erik Anderson

Maitland/AMO

PR

William Clutterbuck 07785 292617

CHAIRMAN'S STATEMENT

Due to the normal seasonality in our business, we are reporting

a first half loss before tax of GBP7.8 million (2020 H1: GBP12.9

million loss) which is significantly lower than that of the

corresponding period of 2020 reflecting the high level of legal

costs incurred and impairments in H1 2020. The underlying loss

before tax for the first half was GBP7.3 million (2020 H1: GBP6.0

million loss). However H1 2020 also included an underlying profit

before tax of GBP3.6 million from Horizon Farms and therefore, on a

like for like basis, the underlying loss in H1 2021 was

significantly smaller.

Our tea volumes in the period were 5% higher and we also saw

significant improvements in our average selling prices in India and

Bangladesh. However, the benefit of these was in large part o set

by the significant increases in wages in Assam. Despite e orts

being made by both the industry and governments around the world,

the global tea market remains over-supplied and poorly priced and

this can be seen most starkly in the prices achieved for our

African teas. The reduced avocado crop and the extension of

lockdown restrictions have also been unhelpful. Our associates, in

particular BF&M, have made a substantial contribution to our

performance in H1.

Strategy

As announced in the AGM statement in June, the Board of Camellia

is undertaking a series of measures aimed at re-balancing the

Group's portfolio of investments in order to take better advantage

of its strengths, and thereby to improve profitability and share

price performance. These measures include accelerating our

agricultural diversification and divesting of certain assets which

we consider to be non core.

In line with this and as announced in July, we have completed

the acquisition of an 80% stake in Bardsley England, the UK's

second largest apple grower, and disposed of our interests in the

aerospace sector with the sales of Abbey Metal Finishing and

Atfin.

Other strategic developments are included in the Operating

review.

Outlook

Our full year outcome is expected to reflect lower underlying

profit before tax from Agriculture (after adjusting for Horizon

Farms GBP4.5 million full year underlying profit before tax in

2020) and from Engineering due in large part to a softening of

activity in the oil and gas markets and the impact of Covid on the

markets previously served by our aerospace business. This is

expected to be o set in part by improved performance from Food

Service and our associates. As always, our financial results remain

largely dependent on Agriculture where the majority of harvesting

and sales take place in the second half of the year. It is

therefore too early to give a firm indication of the likely results

for 2021.

Dividend

The Board is pleased to declare an interim dividend of 44p per

share (2020 H1: nil) payable on 8 October 2021 to shareholders

registered at the close of business on 10 September 2021 and will

consider the overall dividend in respect of 2021 when the year is

complete.

Board

It is with great sadness that we announced last month the death

of our Deputy Chairman, Senior Independent Director and Chairman of

the audit committee, Chris Relleen. Chris joined the Board in 2006

as a non-executive director, and we will remember Chris's

contribution to the Board and miss his wise counsel, humility and

humour.

The Board has today appointed William Gibson as Senior

Independent Director and Gautam Dalal as Chairman of the audit

committee. Simon Turner will join the nomination and remuneration

committees.

People

Once again, I would like to thank all of our sta around the

world for their continuing e orts in extremely di cult

circumstances.

Malcolm Perkins

Chairman

1 September 2021

OPERATING REVIEW

COVID-19 AND TRADING UPDATE

People

The first half has been very tough for all of our sta and their

communities. The virulent re-emergence of the pandemic in India and

Bangladesh combined with further lockdowns in most of our

production centres and markets have created a demanding operating

environment. Vaccine roll-outs across most of our operating

countries have been slow and di cult, and it is against that

background that I would once again like to thank all of our sta for

their e orts.

Trading

Full details of the trading results for the first half are set

out below but in summary all of our businesses are operational,

albeit in modified ways to take account of social distancing.

The key features that have impacted the first half of this year

relative to H1 2020 have been:

-- A 5% increase in our total tea production volumes, higher

average tea selling prices in India and Bangladesh, o set

in part by the significant wage increase in Assam

-- Continuing over-supply of the tea market and the consequential

impact on prices for Kenya and Malawi

-- Significantly lower avocado volumes coming out of Kenya

but at marginally better prices

-- Increased macadamia volume expectations coupled with lower

average price expectations

-- Slow growth in UK demand for Engineering and Food Service

as a result of the prolonged lockdown

-- No profits from Horizon Farms which was sold in 2020

Additional detail on the first half results is set out

below.

Acquisitions and Disposals

Following the end of the first half we completed three important

strategic transactions. First, we acquired an 80% share in Bardsley

England for GBP15.7 million and have also made a loan to Bardsley

of GBP9.3 million. Bardsley is a major fruit farming business and

the UK's second largest apple grower. The farming operation covers

850 hectares in Kent and grows apples, pears, cherries, plums and

strawberries as well as having a large grading, packing and storage

facility. Bardsley is an innovator in the use of agritech and

regenerative agriculture. Customers include major supermarkets in

the UK.

Bardsley's focus on perennial agriculture, its UK base,

innovative thinking and prospects for immediate and exciting growth

makes this a significant acquisition for the Group.

We also took the decision to dispose of our two interests in the

aerospace sector which had been hit very hard by the downturn in

air travel resulting from the pandemic. We believe that the capital

required to maintain the operations in an uncertain environment

could be better deployed in our core business.

Financial Position

The Group has a strong balance sheet with substantial liquidity

which amounted to GBP62.1 million in cash and cash equivalents net

of borrowings as at 30 June 2021. In order to part fund the

Bardsley acquisition, disposals of easily liquidated assets were

made from the investment portfolio amounting to GBP14.2 million.

The Group may sell certain less liquid, non income generating

assets in order to fund strategically important acquisitions.

FIRST HALF OPERATING RESULTS

Agriculture

The revenue and underlying trading (loss)/profit by crop during

the period is set out below. The Appendix at the end of this

interim report includes details of the revenues and underlying

trading profits for the last 5 financial years.

H1 2021 H1 2020 Full year 2020

GBP'm GBP'm GBP'm

Revenue

Tea 71.7 74.2 198.4

Macadamia 4.5 4.4 13.0

Avocado 1.1 2.6 16.8

Other 7.1 10.5 19.0

------- ------- --------------

84.4 91.7 247.2

------- ------- --------------

Underlying trading (loss)/profit

Tea (7.0) (10.6) 7.9

Macadamia (0.5) 0.3 1.0

Avocado 1.0 1.1 3.9

Other 1.3 3.5 5.5

------- ------- --------------

(5.2) (5.7) 18.3

------- ------- --------------

Note: Please see note 5 for further segmental information and

note 6 for details of the adjustments made to trading profit in

arriving at underlying trading (loss)/profit for the Agriculture

division.

Tea

Overall tea production in the first half was up 5% at 44.1mkg

(H1 2020: 42.0mkg), though di erent regions experienced markedly di

erent conditions. Pricing has been mixed with continued weakening

of average prices in Africa but in India and Bangladesh CTC prices

have firmed while Orthodox prices declined over the same period

last year.

H1 2021 H1 2020 Full year 2020

Volume Volume Volume

mkg mkg mkg

India 8.1 6.7 26.1

Bangladesh 3.5 2.8 12.5

Kenya 7.4 7.9 15.8

Malawi 13.2 11.6 16.8

------- ------- --------------

Total own estates 32.2 29.0 71.2

Bought leaf production 9.6 10.4 23.5

Managed client production 2.3 2.6 4.8

------- ------- --------------

Total made tea produced 44.1 42.0 99.5

------- ------- --------------

India: The Covid situation in India remains deeply concerning

despite the extensive e orts made to keep all our sta safe,

including restricting workforce deployment to 50% in West Bengal.

Production in the first half of the year was 17% up on the same

period last year largely due to less severe lockdowns in the

current year o set in part by the impact of very dry weather early

in the season.

Prices for CTC teas in both the Dooars and Assam have been

higher than H1 2020. Pricing for Assam orthodox teas which

constitute most of our production in that region, are significantly

lower than in H1 2020. As previously announced, wages in Dooars

increased 14.8% for 2021 and in Assam increased 22.75% e ective

from 23 February 2021 which will have a substantial impact on

profitability of tea. It is still very early in the India tea sales

cycle (around 70-75% of sales are made in the second half of the

year) which makes predicting prices for the remainder of the year

inherently uncertain even without the impact of Covid.

Bangladesh: Despite a dry hot start to the season, favourable

weather thereafter led to a record June crop and production was up

25% on H1 2020. Average pricing has also been significantly better

(up 63% in H1).

Kenya: In Kenya, benign weather continues to result in high

volumes of tea production nationally, although below the record

levels of last year. Our estate production for the first half was

11% below that of the same period of 2020 with average prices down

approximately 2%. We continue to see a risk of further downward

price pressure for the remainder of the year.

The low prices continue to have political repercussions and the

implications of the new regulations for the tea sector, published

by the Kenyan Government, remain uncertain. It is hoped the

legislation will restrain production and improve prices.

Malawi: Estate production was approximately 14% higher than the

same period last year due to better growing conditions but sales

have been delayed due to the uncertainty created by the Malawi

Revenue Authority's investigation into the applicability of VAT to

certain tea sales, as reported in our 2020 annual report. This is

expected to be a timing issue as between H1 and H2 sales. Average

tea prices were 2% higher than H1 2020 but due to oversupply in the

Kenyan market, we expect lower prices in the second half.

Macadamia

We estimate that our combined macadamia harvest will be

approximately 21% higher than that of 2020 at 1.3mkg despite the

pest damage in Malawi that we previously reported. Higher volumes

were achieved by all operations, particularly South Africa.

Although the kernel market is active with both demand and prices

improving as the year continues, we expect our average prices to be

16% below those of last year due to the adverse grade mix and the

low value stock lines carried forward from 2020.

Avocado

Production volumes of our estate Hass crop in H1 were down 18%

against H1 2020. The season is well underway and thus far logistics

have generally worked well despite the challenges presented by the

pandemic. The avocado tree has a natural tendency towards alternate

bearing, widely know as 'on' and 'o ' years and 2021 is an 'o '

year. We anticipate total production of estate Hass for the full

year to be approximately 30% below 2020.

Pricing in H1 2021 has been marginally ahead of that of the same

period in 2020. However, European markets are currently over

supplied with avocados and it is too soon to predict prices with

any certainty for the remainder of the year. It is however unlikely

that prices will improve su ciently to o set the lower yield.

Speciality Crops

Our speciality crops have generally had a good first half and

the following is worth noting:

-- In Brazil the soya crop was up 8%, driven by favourable growing

conditions. Prices achieved were up 58%, assisted in part by

the devaluing Real. There has been a highly unusual but severe

incidence of frost on the farm from the end of June which has

a ected the maize, sorghum and wheat crops. The extent of the

impact is not clear other than volumes of sorghum and wheat

will be significantly lower than anticipated. However prices

for maize and sorghum are likely to offset this shortfall.

-- Blueberry volumes are in line with our expectation so far. A

combination of domestic as well as regional markets are being

supplied.

Strategic developments

The following strategic developments in the agriculture division

should be noted:

-- Acquisition of Bardsley England as described above.

-- In Tanzania we have now completed all the legal steps necessary

to acquire the farm at Mgagoa. 50Ha of avocado have been planted

with another 92Ha expected to be planted over the coming months.

-- In South Africa, the first 40Ha of avocado will be planted at

Beja later this year with an additional 40Ha due to be planted

at the start of 2022.

Engineering

The oil and gas services market in Aberdeen has seen some

softening of demand for AJT's Engineering division with a

consequent reduction in margins, while the Site Services division,

which is focused on the renewables sector, has seen a significant

increase in activity over H1 2020.

As previously announced, the sales of Abbey Metal Finishing and

its subsidiary Atfin were completed in the first week of August.

Revenues from these businesses up to that date were disappointing

at GBP1.7 million with losses before taxation at GBP0.8 million. A

further impairment of GBP0.5 million has been recorded as a

consequence of the continued deterioration of their trading

conditions prior to disposal.

Food Service

After a di cult start to the year, ACS&T is showing signs of

improvement as the lockdown is lifted.

Jing Tea has been largely closed throughout the lockdown, with

only the on-line trading platform remaining busy. Recovery for Jing

remains dependent on the recovery of the hotel, restaurant and

tourism sectors.

Investments and Associates

Our investment portfolio, which consists principally of listed

equities, at 30 June 2021 was valued at GBP51.3 million (31

December 2020: GBP50.6 million). Following the disposal programme

during July, the value of the investment portfolio was GBP37.4

million at 31 July 2021.

Our share of profits from associates amounted to GBP3.8 million

(H1 2020: GBP2.5 million) reflecting strong operating results from

BF&M. BF&M recorded net income up 42% at $15.1 million

(2020 H1: $10.6 million) due to a 15% uplift in gross premiums

written in the period compared to H1 of the prior year. This was

driven by increased property premiums in the Caribbean and from

health & annuities premiums in Bermuda. Short term claims and

adjustment expenses increased by 64% and life and health policy

benefits decreased by 43% to $33.7 million.

Pensions

The UK defined benefit scheme is now in surplus by GBP6.6

million (31 December 2020: deficit GBP7.0 million) due to a

combination of better asset returns than projected and higher

discount rates. The deficit on the Group's defined benefit pension

and post employment benefit schemes overall now amounts to GBP4.8

million at 30 June 2021 (31 December 2020: GBP16.6 million).

Safeguarding and Stewardship Committee

We are pleased to report good progress from the newly formed

Safeguarding and Stewardship Committee formed following the human

rights allegations last year and in particular the appointment of

an additional external member, Vinita Singh Phougat. Vinita is

based in India and has extensive experience in empowering

individuals and workers within supply chains across a variety of

sectors, and in helping businesses to understand how they can

contribute to improving working conditions. In addition, Malcolm

Perkins has also joined the committee.

Summary

2021 to date has been an important time for the Group especially

in respect of progress with the implementation of our strategy. The

on-going impact of the pandemic and the continuing weakness in the

price of tea globally, has led the Board to accelerate its plans.

Diversifying our interests in agriculture where we have scale and

expertise and disinvesting those businesses where we have fewer

long-term strategic advantages are key priorities and we have taken

significant steps in their implementation.

The Board believes that the actions that we are taking now will

enhance the long-term value of the Group and provide additional

opportunities for its success.

Tom Franks

Chief Executive

1 September 2021

INTERIM MANAGEMENT REPORT

The Chairman's statement and Operating review form part of this

report and include important events that have occurred during the

six months ended 30 June 2021 and their impact on the financial

statements set out herein.

Principal risks and uncertainties

The Report of the Directors in the statutory financial

statements for the year ended 31 December 2020 (available on the

Company's website: www.camellia.plc.uk) highlighted risks and

uncertainties that could have an impact on the Group's businesses.

As these businesses are widely spread both in terms of activity and

location, it is unlikely that any one single factor could have a

material impact on the Group's performance. These risks and

uncertainties continue to be relevant for the remainder of the

year. In addition, the Chairman's Statement included in this report

refers to certain specific risks and uncertainties that the Group

is presently facing.

Statement of directors' responsibilities

The Directors confirm that these condensed consolidated

financial statements have been prepared in accordance with IAS 34

'Interim Financial Reporting', and that the interim management

report herein includes a fair review of the information required by

sections 4.2.7 and 4.2.8 of the Disclosure and Transparency Rules

of the United Kingdom's Financial Conduct Authority.

The Directors of Camellia Plc are listed in the Camellia Plc

statutory financial statements for the year ended 31 December 2020.

As reported on 6 August 2021, Senior Independent non-executive

Director Chris Relleen, sadly passed away. There have been no other

subsequent changes of Directors and a list of current Directors is

maintained on the Group's website at www.camellia.plc.uk.

By order of the Board

Malcolm Perkins

Chairman

1 September 2021

CONDENSED CONSOLIDATED INCOME STATEMENT

for the six months ended 30 June 2021

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2021 2020 2020

Continuing operations Notes GBP'm GBP'm GBP'm

Revenue 5 105.5 114.9 291.2

Cost of sales (91.5) (98.8) (227.7)

---------- ---------- -----------

Gross profit 14.0 16.1 63.5

Other operating income 1.7 0.8 3.0

Distribution costs (5.3) (6.2) (16.2)

Administrative expenses (21.7) (25.0) (59.5)

---------- ---------- -----------

Trading loss 5 (11.3) (14.3) (9.2)

Share of associates' results 7 3.8 2.5 6.1

Profit on disposal of property,

plant and equipment - - 14.4

Impairment of intangible assets

and investment properties,

plant and equipment (0.5) (3.4) (6.5)

Profit on disposal of financial

assets 0.1 0.1 0.2

---------- ---------- -----------

Operating (loss)/profit (7.9) (15.1) 5.0

Investment income 0.4 0.4 0.6

---------- ---------- -----------

Finance income 0.9 1.5 2.3

Finance costs (0.7) (0.8) (1.6)

Net exchange (loss)/gain (0.2) 1.3 2.2

Employee benefit expense (0.3) (0.2) (0.7)

---------- ---------- -----------

Net finance (cost)/income 8 (0.3) 1.8 2.2

---------- ---------- -----------

(Loss)/profit before tax (7.8) (12.9) 7.8

------------------------------------------------------ ----- ---------- ---------- -----------

Comprising

- underlying (loss)/profit

before tax 6 (7.3) (6.0) 16.0

- profit on disposal of property,

plant and equipment 6 - - 14.4

- costs related to group claims 6 - (3.5) (16.1)

* impairment of intangible assets and property,

plant

and equipment 6 (0.5) (3.4) (6.5)

---------- ---------- -----------

(7.8) (12.9) 7.8

------------------------------------------------------ ----- ---------- ---------- -----------

Taxation 9 1.7 0.8 (8.6)

---------- ---------- -----------

Loss for the period (6.1) (12.1) (0.8)

---------- ---------- -----------

(Loss)/profit attributable

to:

Owners of Camellia Plc (6.1) (12.6) (5.0)

Non-controlling interests - 0.5 4.2

---------- ---------- -----------

(6.1) (12.1) (0.8)

---------- ---------- -----------

Loss per share - basic and

diluted 11 (220.9 )p (456.2 )p (181.0 )p

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

for the six months ended 30 June 2021

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2021 2020 2020

GBP'm GBP'm GBP'm

Loss for the period (6.1) (12.1) (0.8)

---------- ---------- -----------

Other comprehensive (expense)/income:

Items that will not be reclassified

subsequently to profit or loss:

Financial assets at fair value through

other comprehensive income:

Fair value adjustment released on disposal (0.9) (0.8) (1.1)

Profit on disposal 1.6 0.6 0.8

---------- ---------- -----------

0.7 (0.2) (0.3)

Changes in the fair value of financial

assets (0.4) (2.7) 2.3

Deferred tax movement in relation to

fair value adjustments - 0.4 (0.7)

Remeasurements of post employment benefit

obligations 12.9 (7.3) 4.3

Deferred tax movement in relation to

post employment benefit obligations (1.5) - 0.6

---------- ---------- -----------

11.7 (9.8) 6.2

---------- ---------- -----------

Items that may be reclassified subsequently

to profit or loss:

Foreign exchange translation di erences (4.2) 13.1 (22.6)

Share of other comprehensive income

of associates - 0.1 0.3

---------- ---------- -----------

(4.2) 13.2 (22.3)

---------- ---------- -----------

Other comprehensive income/(expense)

for the

period, net of tax 7.5 3.4 (16.1)

---------- ---------- -----------

Total comprehensive income/(expense)

for the period 1.4 (8.7) (16.9)

---------- ---------- -----------

Total comprehensive income/(expense)

attributable to:

Owners of Camellia Plc 2.1 (10.3) (16.6)

Non-controlling interests (0.7) 1.6 (0.3)

---------- ---------- -----------

1.4 (8.7) (16.9)

---------- ---------- -----------

CONDENSED CONSOLIDATED BALANCE SHEET

at 30 June 2021

30 June 30 June 31 December

2021 2020 2020

Notes GBP'm GBP'm GBP'm

ASSETS

Non-current assets

Intangible assets 6.4 6.9 6.6

Property, plant and equipment 12 189.4 218.6 198.3

Right-of-use assets 12.8 18.5 16.6

Investment properties 21.0 18.9 19.1

Biological assets 12.3 14.3 12.7

Investments in associates 69.2 72.3 67.6

Deferred tax assets - 0.2 -

Financial assets at fair value

through other comprehensive

income 42.7 37.6 42.6

Financial asset at fair value

through profit or loss 5.9 5.2 5.3

Financial assets at amortised

cost 2.7 3.0 2.7

Other investments - heritage

assets 9.8 9.8 9.8

Retirement benefit surplus 16 6.6 0.5 0.1

Trade and other receivables 2.6 2.7 2.4

------- ------- -----------

Total non-current assets 381.4 408.5 383.8

------- ------- -----------

Current assets

Inventories 61.5 61.3 47.5

Biological assets 5.9 3.6 7.1

Trade and other receivables 31.6 42.1 43.7

Current income tax assets 3.5 3.4 1.7

Cash and cash equivalents (excluding

bank overdrafts) 73.2 82.9 98.5

------- ------- -----------

175.7 193.3 198.5

Assets classified as held for

sale 13 6.2 9.8 -

------- ------- -----------

Total current assets 181.9 203.1 198.5

------- ------- -----------

30 June 30 June 31 December

2021 2020 2020

Notes GBP'm GBP'm GBP'm

LIABILITIES

Current liabilities

Financial liabilities - borrowings 14 (7.0) (6.9) (5.7)

Lease liabilities (1.7) (1.4) (1.2)

Trade and other payables (52.8) (53.0) (50.9)

Current income tax liabilities (2.7) (5.3) (10.3)

Employee benefit obligations 16 (1.5) (0.9) (1.1)

Provisions 15 (13.7) (13.0) (19.0)

------- ------- -----------

(79.4) (80.5) (88.2)

Liabilities related to assets

classified as held for sale 13 (3.0) - -

------- ------- -----------

Total current liabilities (82.4) (80.5) (88.2)

------- ------- -----------

Net current assets 99.5 122.6 110.3

------- ------- -----------

Total assets less current liabilities 480.9 531.1 494.1

------- ------- -----------

Non-current liabilities

Financial liabilities - borrowings 14 (4.1) (3.2) (2.7)

Lease liabilities (7.7) (11.6) (10.3)

Deferred tax liabilities (36.8) (45.2) (39.5)

Employee benefit obligations 16 (9.9) (29.7) (15.6)

------- ------- -----------

Total non-current liabilities (58.5) (89.7) (68.1)

------- ------- -----------

Net assets 422.4 441.4 426.0

------- ------- -----------

EQUITY

Called up share capital 0.3 0.3 0.3

Share premium 15.3 15.3 15.3

Reserves 359.3 369.8 361.0

------- ------- -----------

Equity attributable to owners

of Camellia Plc 374.9 385.4 376.6

Non-controlling interests 47.5 56.0 49.4

------- ------- -----------

Total equity 422.4 441.4 426.0

------- ------- -----------

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

for the six months ended 30 June 2021

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2021 2020 2020

Notes GBP'm GBP'm GBP'm

Cash (used in)/generated from

operations

Cash flows from operating activities 17 (13.5) (3.1) 19.3

Interest received 0.9 1.5 2.4

Interest paid (1.0) (0.8) (1.6)

Income taxes paid (9.2) (3.2) (7.2)

---------- ---------- -----------

Net cash flow from operating

activities (22.8) (5.6) 12.9

---------- ---------- -----------

Cash flows from investing activities

Purchase of intangible assets - - (0.3)

Purchase of property, plant

and equipment (4.9) (6.6) (13.5)

Proceeds from sale of non-current

assets 0.3 0.3 0.5

Proceeds from sale of non-current

assets - non recurring - - 21.6

Additions to investment property (0.2) (0.6) (0.9)

Biological assets: non-current

- disposals 0.3 0.5 0.7

Investment in associates - (0.3) (0.3)

Dividends received from associates 1.8 1.3 3.2

Purchase of investments (4.8) (4.9) (12.4)

Proceeds from sale of investments 4.0 6.0 9.1

Income from investments 0.4 0.4 0.6

---------- ---------- -----------

Net cash flow from investing

activities (3.1) (3.9) 8.3

---------- ---------- -----------

Cash flows from financing activities

Equity dividends paid - - (2.8)

Dividends paid to non-controlling

interests (1.2) (2.3) (7.0)

New loans 1.4 - 1.9

Loans repaid (1.9) (0.3) (3.6)

Payments of lease liabilities (0.6) (0.5) (0.9)

---------- ---------- -----------

Net cash flow from financing

activities (2.3) (3.1) (12.4)

---------- ---------- -----------

Net (decrease)/increase in cash

and cash equivalents (28.2) (12.6) 8.8

Cash and cash equivalents at

beginning of period 94.9 89.4 89.4

Exchange (losses)/gains on cash (0.4) 2.7 (3.3)

---------- ---------- -----------

Cash and cash equivalents at

end of period 18 66.3 79.5 94.9

---------- ---------- -----------

For the purposes of the cash flow statement, cash and cash

equivalents are included net of overdrafts repayable on demand.

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

for the six months ended 30 June 2021

Attributable to the owners of Camellia

Plc

Non-

Share Share Treasury Retained Other Controlling Total

capital premium shares earnings reserves Total interests equity

GBP'm GBP'm GBP'm GBP'm GBP'm GBP'm GBP'm GBP'm

At 1 January 2020 0.3 15.3 (0.4) 358.6 21.9 395.7 56.7 452.4

Total comprehensive

(expense)/income

for the period - - - (18.7) 8.4 (10.3) 1.6 (8.7)

Dividends - - - - - - (2.3) (2.3)

------- ------- -------- -------- -------- ----- ----------- ------

At 30 June 2020 0.3 15.3 (0.4) 339.9 30.3 385.4 56.0 441.4

------- ------- -------- -------- -------- ----- ----------- ------

At 1 January 2020 0.3 15.3 (0.4) 358.6 21.9 395.7 56.7 452.4

Total comprehensive

income/(expense)

for the period - - - 0.3 (16.9) (16.6) (0.3) (16.9)

Dividends - - - (2.8) - (2.8) (7.0) (9.8)

Share of associate's

other equity

movements - - - 0.3 - 0.3 - 0.3

------- ------- -------- -------- -------- ----- ----------- ------

At 31 December

2020 0.3 15.3 (0.4) 356.4 5.0 376.6 49.4 426.0

Total comprehensive

income/(expense)

for the period - - - 7.6 (5.5) 2.1 (0.7) 1.4

Dividends - - - (4.0) - (4.0) (1.2) (5.2)

Share of associate's

other equity

movements - - - 0.2 - 0.2 - 0.2

------- ------- -------- -------- -------- ----- ----------- ------

At 30 June 2021 0.3 15.3 (0.4) 360.2 (0.5) 374.9 47.5 422.4

------- ------- -------- -------- -------- ----- ----------- ------

NOTES TO THE ACCOUNTS

1 Basis of preparation

These financial statements are the interim condensed

consolidated financial statements of Camellia Plc, a company

registered in England, and its subsidiaries (the "Group") for the

six month period ended 30 June 2021 (the "Interim Report"). The

interim report does not include all the notes of the type normally

included in an annual financial report. Accordingly, this report

should be read in conjunction with the Report and Accounts (the

"Annual Report") for the year ended 31 December 2020.

The financial information contained in this interim report has

not been audited and does not constitute statutory accounts within

the meaning of Section 435 of the Companies Act 2006. A copy of the

statutory accounts for the year ended 31 December 2020 has been

delivered to the Registrar of Companies. The auditors' opinion on

these accounts was unqualified and does not contain an emphasis of

matter paragraph or a statement made under Section 498(2) and

Section 498(3) of the Companies Act 2006.

The interim condensed consolidated financial statements have

been prepared in accordance with International Financial Reporting

Standards ("IFRS") including IAS 34 "Interim Financial Reporting".

For these purposes, IFRS comprise the Standards issued by the

International Accounting Standards Board ("IASB") and

Interpretations issued by the International Financial Reporting

Standards Interpretations Committee ("IFRS IC").

These interim condensed consolidated financial statements were

approved by the Board of Directors on 1 September 2021. At the time

of approving these financial statements, the Directors have a

reasonable expectation that the Company and the Group have adequate

resources to continue to operate for the foreseeable future. They

therefore continue to adopt the going concern basis of accounting

in preparing the financial statements.

2 Changes to accounting policies

These interim condensed financial statements have been prepared

on the basis of accounting policies consistent with those applied

in the financial statements for the year ended 31 December 2020.

Amendments to IFRSs e ective for the financial year ending 31

December 2021 are not expected to have a material impact on the

Group.

3 Going concern

As set out in the Operating review, our businesses are currently

operating broadly as normal. Our experience over the last year has

given us valuable insight into how the pandemic impacts our markets

and businesses. Despite this, it remains di cult to predict with

any certainty the impact of COVID on the Group during the remainder

of this year. Accordingly, we continue to take actions to conserve

cash by focusing on e ciencies, minimising our operating costs and

focusing capital expenditure across the Group.

The Directors considered the impact of the current COVID

environment on the business for the next 15 months. We have

considered several variables which may impact on revenue, profits

and cash flows. In light of the nature of our business and our

experience of trading through the pandemic so far, we expect our

agriculture businesses will continue to operate broadly as

currently. In the UK we have assumed that the food service market

begins to recover gradually over the course of the next two

years.

At 30 June 2021, the Group had cash and cash equivalents of

GBP66.1 million with loans outstanding of GBP4.2 million. In

addition, the Group had undrawn short-term loan and overdraft

facilities of GBP17.9 million and a portfolio of liquid investments

with a fair market value of GBP51.3 million.

We have modelled various severe but plausible scenarios using

assumptions including the combined e ect of reduced tea prices,

reduced avocado pricing and reduced sales volumes for macadamia.

The revenue and operational impact of such reductions across our

operations would have a substantially negative impact on Group

profitability. We have also considered the risk of volume

reductions for our tea, macadamia and avocado crops.

The Directors believe that the Company and the Group are well

placed to manage their financing and other business risks

satisfactorily and have a reasonable expectation that the Company

and the Group will have adequate resources to continue in

operational existence for the foreseeable future. The Directors

therefore continue to adopt the going concern basis in preparing

the financial statements.

4 Cyclical and seasonal factors

Due to climatic conditions the Group's tea operations in India

and Bangladesh produce most of their crop during the second half of

the year. Tea production in Kenya remains at consistent levels

throughout the year but in Malawi the majority of tea is produced

in the first six months.

Soya in Brazil is generally harvested in the first half of the

year. The majority of the macadamia crop in Malawi and South Africa

is harvested in the second half of the year but in Kenya the

majority of macadamia is harvested in the first half. Avocados in

Kenya are mostly harvested in the second half of the year.

There are no other cyclical or seasonal factors which have a

material impact on the trading results.

5 Segment reporting

Agriculture Engineering Food Service Unallocated Consolidated

Six months Six months Six months Six months Six months

ended ended ended ended ended

30 June 30 June 30 June 30 June 30 June

2021 2020 2021 2020 2021 2020 2021 2020 2021 2020

GBP'm GBP'm GBP'm GBP'm GBP'm GBP'm GBP'm GBP'm GBP'm GBP'm

Revenue

External sales 84.4 91.7 8.7 11.0 11.8 11.6 0.6 0.6 105.5 114.9

----- ----- ----- ----- ----- ----- ----- ----- ------ -----

Underlying trading (loss)/profit (5.2) (5.7) (0.9) 0.3 (0.9) 2.4 (3.8) (4.4) (10.8) (7.4)

Separately disclosed items - (3.5) (0.5) (0.2) - (3.2) - - (0.5) (6.9)

----- ----- ----- ----- ----- ----- ----- ----- ------ -----

Trading (loss)/profit (5.2) (9.2) (1.4) 0.1 (0.9) (0.8) (3.8) (4.4) (11.3) (14.3)

Share of associates' results - - - - - - 3.8 2.5 3.8 2.5

Impairment of intangible assets,

investment properties and plant

and equipment - (0.5) (0.2) - (3.2) - - (0.5) (3.4)

Profit on disposal of financial

assets 0.1 0.1 - - - - - - 0.1 0.1

----- ----- ----- ----- ----- ----- ----- ----- ------ -----

Operating loss (5.1) (9.1) (1.9) (0.1) (0.9) (4.0) - (1.9) (7.9) (15.1)

----- ----- ----- ----- ----- ----- ----- ----- ------ -----

Comprising

* underlying operating (loss)/profit before tax (5.1) (5.6) (1.4) 0.1 (0.9) (0.8) - (1.9) (7.4) (8.2)

* costs related to group claims - (3.5) - - - - - - - (3.5)

* impairment of intangible assets and property,

plant

and equipment - - (0.5) (0.2) - (3.2) - - (0.5) (3.4)

----- ----- ----- ----- ----- ----- ----- ----- ------ -----

(5.1) (9.1) (1.9) (0.1) (0.9) (4.0) - (1.9) (7.9) (15.1)

---------------------------------------------------- ----- ----- ----- ----- ----- ----- ----- ----- ------ -----

Investment income 0.4 0.4

Net finance (cost)/income (0.3) 1.8

------ -----

Loss before tax (7.8) (12.9)

Taxation 1.7 0.8

------ -----

Loss after tax (6.1) (12.1)

------ -----

Year Ended 31 December 2020

Food

Agriculture Engineering Service Unallocated Consolidated

GBP'm GBP'm GBP'm GBP'm GBP'm

Revenue

External sales 247.2 19.3 23.6 1.1 291.2

----------- ----------- ------- ----------- ------------

Underlying trading

profit/(loss) 18.3 (1.5) (1.7) (8.2) 6.9

Separately disclosed

items (16.1) - - - (16.1)

----------- ----------- ------- ----------- ------------

Trading profit/(loss) 2.2 (1.5) (1.7) (8.2) (9.2)

Share of associates'

results - - - 6.1 6.1

Profit on disposal

of property,

plant and equipment 14.4 - - - 14.4

Impairment of intangible

assets,

investment properties

and plant

and equipment (0.2) (1.6) (3.7) (1.0) (6.5)

Profit on disposal

of financial assets 0.2 - - - 0.2

----------- ----------- ------- ----------- ------------

Operating profit/(loss) 16.6 (3.1) (5.4) (3.1) 5.0

----------- ----------- ------- ----------- ------------

Comprising

* underlying operating profit/(loss) before tax 18.5 (1.5) (1.7) (2.1) 13.2

* profit on disposal of property, plant and equ

ipment 14.4 - - - 14.4

* costs related to group claims (16.1) - - - (16.1)

* impairment of intangible assets and property,

plant

and equipment (0.2) (1.6) (3.7) (1.0) (6.5)

----------- ----------- ------- ----------- ------------

16.6 (3.1) (5.4) (3.1) 5.0

----------------------------------------------------- ----------- ----------- ------- ----------- ------------

Investment income 0.6

Net finance income 2.2

------------

Profit before tax 7.8

Taxation (8.6)

------------

Loss after tax (0.8)

------------

6 Underlying (loss)/profit

The Group seeks to present an indication of the underlying

performance which is not impacted by exceptional items or items

considered non-operational in nature. This measure of profit is

described as 'underlying' and is used by management to measure and

monitor performance.

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2021 2020 2020

GBP'm GBP'm GBP'm

Operating (loss)/profit (7.9) (15.1) 5.0

Exceptions or items considered non-operational:

Profit on disposal of property, plant

and equipment - - 14.4

Costs related to group claims - (3.5) (16.1)

Impairment of intangible assets and

property, plant and equipment (0.5 ) (3.4 ) (6.5 )

---------- ---------- -----------

Underlying operating (loss)/profit

before tax (7.4) (8.2) 13.2

Investment income 0.4 0.4 0.6

Net finance (cost)/income (0.3) 1.8 2.2

---------- ---------- -----------

Underlying (loss)/profit before tax (7.3) (6.0) 16.0

---------- ---------- -----------

The following items have been excluded from the underlying

measure and have been separately disclosed:

-- A profit from the disposal of the property plant and

equipment owned by Horizon Farms of GBPnil (2020: six

months GBPnil - year GBP14.4 million).

-- Legal and other costs relating to the defence of the

litigation concerning our East African operations including

settlements of GBPnil (2020: six months GBP3.5 million

- year GBP16.1 million).

-- Impairment charges of GBP0.5 million (2020: six months

GBP0.2 million - year GBP1.6 million) in relation to

plant and equipment at Abbey Metal Finishing and at

Atfin and impairment charges of GBPnil (2020: six months

GBP3.2 million - year GBP4.9 million) in relation to

the Jing Tea brand investment properties and elsewhere

in the UK.

7 Share of associates' results

The Group's share of the results of associates is analysed

below:

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2021 2020 2020

GBP'm GBP'm GBP'm

Profit before tax 4.1 2.8 6.7

Taxation (0.3) (0.3) (0.6)

---------- ---------- -----------

Profit after tax 3.8 2.5 6.1

---------- ---------- -----------

8 Finance income and costs

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2021 2020 2020

GBP'm GBP'm GBP'm

Finance costs - interest payable on

loans and bank overdrafts (0.4) (0.4) (0.9)

Interest payable on leases (0.3) (0.4) (0.7)

---------- ---------- -----------

Finance costs (0.7) (0.8) (1.6)

Finance income - interest income on

short-term bank deposits 0.9 1.5 2.3

Net exchange (loss)/gain on foreign

currency balances (0.2) 1.3 2.2

Employee benefit expense (0.3) (0.2) (0.7)

---------- ---------- -----------

Net finance (cost)/income (0.3) 1.8 2.2

---------- ---------- -----------

9 Taxation on (loss)/profit on ordinary activities

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2021 2020 2020

GBP'm GBP'm GBP'm

Current tax

Overseas corporation tax 1.0 2.4 13.2

Deferred tax

Origination and reversal of timing di

erences

United Kingom (1.6) - (0.7)

Overseas deferred tax (1.1) (3.2) (3.9)

---------- ---------- -----------

Tax on (loss)/profit on ordinary activities (1.7) (0.8) 8.6

---------- ---------- -----------

Tax on (loss)/profit on ordinary activities for the six months

to 30 June 2021 has been calculated on the basis of the estimated

annual e ective rate for the year ending 31 December 2021.

10 Equity dividends

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2021 2020 2020

GBP'm GBP'm GBP'm

Amounts recognised as distributions

to equity holders in the period:

Final dividend for the year ended 31

December 2020 of 144p (2019: nil) per

share 4.0 - -

---------- ----------

Special Interim dividend for the year

ended 31 December 2020 of 102p per share 2.8

-----------

2.8

-----------

Dividends amounting to GBP0.1 million (2020: six months GBPnil

million - year GBP0.1 million) have not been included as group

companies hold 62,500 issued shares in the company. These are

classified as treasury shares.

Proposed interim dividend for the year

ended

31 December 2021 of 44p per share 1.2

---

Proposed special interim dividend for

the year ended

31 December 2020 of 102p per share 2.9

---

The proposed interim dividend was approved by the Board of

Directors on 1 September 2021 and has not been included as a

liability in these financial statements.

11 Earnings/(loss) per share (EPS)

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2021 2020 2020

Loss EPS Loss EPS Loss EPS

GBP'm Pence GBP'm Pence GBP'm Pence

Attributable to ordinary

shareholders (6.1) (220.9) (12.6) (456.2) (5.0) (181.0)

----- ------ ----- ------ ----- ------

Basic and diluted earnings per share are calculated by dividing

the earnings attributable to ordinary shareholders by the weighted

average number of ordinary shares in issue of 2,762,000 (2020: six

months 2,762,000 - year 2,762,000), which excludes 62,500 (2020:

six months 62,500 - year 62,500) shares held by the Group as

treasury shares.

12 Property, plant and equipment

During the six months ended 30 June 2021 the Group acquired

assets with a cost of GBP4.9 million (2020: six months GBP6.6

million - year GBP13.5 million). Assets with a carrying amount of

GBP0.3 million were disposed of during the six months ended 30 June

2021 (2020: six months GBP0.3 million - year GBP7.7 million).

Assets with a carrying amount of GBP2.1 million were classified as

held for sale as at 30 June 2021 (2020: six months GBP7.2 million -

year GBPnil).

13 Assets classified as held for sale/Liabilities related to

assets classified as held for sale

At 30 June 2021, the assets and related liabilites of Abbey

Metal Finishing Company Limited and its subsidiary Atfin GmbH were

classified as held for sale. These companies have subsequently been

sold. In addition, two London properties owned by the Group are

currently marketed for sale and have also been classified as held

for sale.

14 Borrowings

Borrowings (current and non-current) include loans of GBP4.2

million (loans 2020: six months GBP6.7 million - year GBP4.8

million) and bank overdrafts of GBP6.9 million (2020: six months

GBP3.4 million - year GBP3.6 million). The following loans were

repaid during the six months ended 30 June 2021:

GBP'm

Balance at 1 January 2021 4.8

Exchange di erences (0.1)

Repayments (1.9)

New loans 1.4

-----

Balance at 30 June 2021 4.2

-----

15 Provisions

Wages

and Legal

salaries claims Others Total

GBP'm GBP'm GBP'm GBP'm

At 1 January 2020 7.7 - 1.2 8.9

Exchange di erences 0.3 - - 0.3

Utilised in the period (1.6) - (0.5) (2.1)

Provided in the period 5.5 - 0.4 5.9

-------- ------ ------ -----

At 30 June 2020 11.9 - 1.1 13.0

-------- ------ ------ -----

At 1 January 2020 7.7 - 1.2 8.9

Exchange di erences (0.5) - - (0.5)

Utilised in the period (7.3) - (0.3) (7.6)

Provided in the period 10.5 8.2 0.2 18.9

Unused amounts reversed in

period (0.7) - - (0.7)

-------- ------ ------ -----

At 31 December 2020 9.7 8.2 1.1 19.0

Exchange di erences (0.2) (0.1) - (0.3)

Utilised in the period (2.6) (6.5) (0.3) (9.4)

Provided in the period 3.8 - 0.6 4.4

-------- ------ ------ -----

At 30 June 2021 10.7 1.6 1.4 13.7

-------- ------ ------ -----

Current:

At 30 June 2021 10.7 1.6 1.4 13.7

-------- ------ ------ -----

At 31 December 2020 9.7 8.2 1.1 19.0

-------- ------ ------ -----

At 30 June 2020 11.9 - 1.1 13.0

-------- ------ ------ -----

The wages and salaries provisions are in respect of ongoing wage

and bonus negotiations in India, Kenya and Bangladesh.

Legal claims related to the expected cost of the defence of the

litigation concerning our East African operations, including

settlements and progressive measures.

Others relate to provisions for claims and dilapidations.

16 Employee benefit obligations

The UK defined benefit pension scheme and the overseas pension,

gratuity and medical benefit schemes operated in Group subsidiaries

located in Bangladesh and India for the purpose of IAS 19 have been

updated to 30 June 2021 from the valuations as at 31 December 2020

by the actuaries and the movements have been reflected in this

interim statement.

An actuarial gain of GBP12.9 million was realised in the period

in relation to the Group's employee obligations of which GBP13.7

million related to the UK defined benefit pension scheme. In

relation to the UK defined benefit pension scheme a gain of GBP2.5

million was realised in relation to the scheme assets and a gain of

GBP11.2 million was realised in relation to changes in the

underlying actuarial assumptions. The assumed discount rate has

increased to 1.80% (31 December 2020: 1.25%), the assumed rate of

inflation (CPI) has increased to 2.30% (31 December 2020 2.05%)

There has been no change in the mortality assumptions used.

17 Reconciliation of (loss)/profit to cash flow

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2021 2020 2020

GBP'm GBP'm GBP'm

(Loss)/profit from operations (7.9) (15.1) 5.0

Share of associates' results (3.8) (2.5) (6.1)

Depreciation and amortisation 6.1 8.2 15.5

Depreciation of right-of-use assets 0.5 0.6 1.0

Impairment of assets and provisions 0.5 3.4 6.5

Realised movements on biological assets

- non-current - - (0.4)

Financial assets fair value through

profit or loss - gain - - (0.1)

(Profit)/loss on disposal of non-current

assets (0.1) (0.1) 0.1

Profit on disposal - non recurring

items - - (14.4)

Profit on disposal of financial assets (0.1) (0.1) (0.2)

Movements in provisions (5.0) 3.8 10.8

Increase in working capital (5.0) (1.8) 6.3

Di erence between employee benefit

obligations funding contributions and

cost charged 1.3 0.5 (4.7)

---------- ---------- -----------

Cash (used in)/generated from operations (13.5) (3.1) 19.3

---------- ---------- -----------

18 Cash and cash equivalents

For the purposes of the cash flow statement cash and cash

equivalents comprise:

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2021 2020 2020

GBP'm GBP'm GBP'm

Cash and cash equivalents 73.2 82.9 98.5

Overdrafts repayable on demand (included

in current liabilities - borrowings) (6.9) (3.4) (3.6)

---------- ---------- -----------

66.3 79.5 94.9

---------- ---------- -----------

19 Contingent liabilities

In Malawi the Revenue Authority (MRA) recently indicated that it

intended to collect VAT on sales made at auction and under private

treaty for export, in the period since 2017. Tea sales intended for

the export market were subject to an industry wide agreement with

the MRA and the Reserve Bank of Malawi reached at the time the

auction was established, resulting in these deemed exports being

zero rated for VAT. The MRA has raised an assessment for VAT

against Eastern Produce Malawi in connection with this which has

been appealed in light of the historic agreement and

long-established custom and practice of the industry. Following

discussions between the Malawi government, the MRA and the tea

industry, the MRA has undertaken to investigate the sales process

for export teas and to consider the implications of this on the VAT

treatment of these deemed export sales. Pending conclusion of the

review, the MRA has given permission for the auction to continue

with teas deemed as export zero rated for VAT and the assessment

raised against Eastern Produce Malawi has been suspended. Eastern

Produce Malawi's estimated contingent liability for VAT on these

deemed export sales, excluding any penalties and interest, is

approximately GBP7.5 million.

In India, assessments have been received for excise duties of

GBP3.5 million, sales and entry tax of GBP0.9 million and of GBP1.0

million for income tax matters. These are being contested on the

basis that they are without technical merit.

In India, a long running dispute between our local subsidiaries

and the Government of West Bengal over the payment of a land tax,

locally called "Salami", remains unresolved. Lawyers acting for the

Group have advised that payment of Salami does not apply,

accordingly no provisions have been made. The sum in dispute,

excluding fines and penalties, amounts to GBP1.2 million.

The Group operates in certain countries where its operations are

potentially subject to a number of legal claims. When required,

appropriate provisions are made for the expected cost of such

claims.

20 Related party transactions

During the period the Group received rental income from The

Camellia Foundation of GBP18,000 (2020: six months GBP18,000 - year

GBP36,000).

21 Subsequent events

Subsequent to the period end, the Group purchased an 80% stake

in Bardsley England for GBP15.7 million. The Group has also made a

loan to Bardsley of GBP9.3 million. Bardsley is a major fruit

farming business and the UK's second largest apple grower. The

consideration, which was satisfied from existing resources,

consists of GBP12.7 million which was paid at completion, with the

balance of GBP3 million deferred and payable by July 2022.

Subsequent to the period end, the Group sold a significant

portion of its financial assets at fair value through other

comprehensive income consisting mainly of Japanese and other

international equities. Total consideration received is

approximately GBP14.2 million and the profit on disposal realised

through other comprehensive income is approximately GBP9.2 million.

No tax is expected to be payable on these gains.

Subsequent to the period end, the Group completed the sale of

its interests in Abbey Metal Finishing Company Limited and its

subsidiary Atfin GmbH in Germany.

APPENDIX

Agriculture track record

For the year ending

2020 2019 2018 2017 2016

GBP'm GBP'm GBP'm GBP'm GBP'm

Revenue

Tea 198.4 194.0 198.8 198.4 170.2

Macadamia 13.0 15.9 15.3 10.2 9.7

Avocado 16.8 14.2 15.6 13.6 13.6

Other 19.0 14.6 15.6 17.2 13.6

----- ----- ----- ----- -----

Segment Total 247.2 238.7 245.3 239.4 207.1

----- ----- ----- ----- -----

Underlying trading profit

Tea 7.9 6.7 24.9 25.8 22.7

Macadamia 1.0 5.5 5.3 0.4 0.2

Avocado 3.9 5.3 2.1 5.2 5.4

Other 5.5 1.5 4.3 4.2 1.6

----- ----- ----- ----- -----

Segment Total 18.3 19.0 36.6 35.6 29.9

----- ----- ----- ----- -----

Notes

Underlying trading profit is profit before impairments, profit

on disposals of financial and other assets and before exceptional

items or items considered non-operational in nature.

To be consistent with the statutory accounts for the relevant

year, the following items have been excluded in arriving at the

above underlying trading profit:

- Legal and other costs relating to the defence of the

litigation concerning our East African operations.

- Release of provisions for wage increases relating to prior

years following progress on negotiations.

- A charge in relation to workers profit participation in

Bangladesh which mainly related to prior years obligations.

- The release of provisions in Bangladesh for post-employment

benefit obligations from which the tea industry was exempted.

- Impairments of intangible assets and property, plant and equipment.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR LBMFTMTJMBBB

(END) Dow Jones Newswires

September 02, 2021 02:00 ET (06:00 GMT)

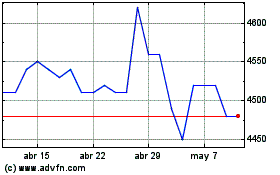

Camellia (LSE:CAM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Camellia (LSE:CAM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024