TIDMCAL

RNS Number : 0662D

Capital & Regional plc

25 June 2021

25 June 2021

CAPITAL & REGIONAL PLC ("Capital & Regional" or "the

Group")

UK company number 01399411

LSE share code: CAL

ISIN: GB00BL6XZ716

LEI: 21380097W74N9OYF5Z25

UPDATE ON TRADING AND PROGRESS WITH BANKING DISCUSSIONS

Capital & Regional, the UK convenience and community focused

shopping centre REIT, today provides an update on trading and rent

collections as well as progress with banking discussions. Further

details will be provided when the Group announces its results for

the half year ended 30 June 2021, on Thursday 9 September 2021.

Lawrence Hutchings, CEO of Capital & Regional said:

" We are continuing to see the benefits of the reopening of the

economy, with 99% of our retailers open and trading . I am pleased

to say that we have seen a positive response from our retailers and

the local communities we serve with essential and non-discretionary

goods and services. Footfall has been robust and many of our

retailers are reporting strong sales and consumer engagement,

despite the fact that we still have to restrict access to stores

and our common areas at peak times to maintain social distancing

which creates additional scope to improve sales and footfall as

restrictions ease further.

"The positive trends we are seeing as the country gradually

emerges from lockdown have led to improving momentum on both

leasing and our rent collection statistics. We have now collected

70 % of 2021 rents due to date and have agreed outline deals with a

number of occupiers which will improve this further. Our 2020

collection figure has also now climbed to 84%. We continue to

support both our smaller and our independent retailers as

necessary, whilst seeking to ensure that larger well capitalised

retailers honour their commitments . Our community centre offering

and affordable rents continue to position us well on a relative

basis for recovery and the ongoing changes driven by long cycle

structural changes in physical retailing.

"We have made considerable progress on our key initiatives

including planning consent for our Walthamstow residential project,

which moves it one step closer to delivery and a capital receipt,

and completing the GBP4.5 million sale of a parade of shops at

Hemel.

"Occupancy remains robust at 89% - factoring in the closure of

the three Debenhams stores - and discussions with a number of

potential occupiers interested in leasing those three units are

progressing well, supported by continued demand from key community

centre retailers, most notably in London. We are continuing to

benefit from our strategic focus on independent retailers with some

38 deals completed to the end of May, in aggregate above previous

passing rent and ERV, and a further 35 currently in solicitors'

hands .

"With confidence returning and light finally appearing at the

end of the tunnel, discussions with our banks have been progressing

well. With the exception of Luton, where we are working towards

extending the covenant waiver beyond the end of July, we have

agreed waivers on all our assets until October and will continue to

work towards finding a more permanent solution against a backdrop

of an improving operational environment .

"Whilst there are many learnings from the past 18 months we are

increasingly confident that both consumers and retailers share a

need for well-located, accessible community retail and services

with affordable occupancy costs, supporting our community centre

strategy and our belief in the 15 minute neighbourhood.

"Thank you as always to our teams for all their hard work,

particularly in ensuring our retailer customers' stores reopened

quickly and safely to serve our local communities."

Operations

-- 99% of our leased units are back open and trading across the

Group's seven shopping centres.

-- Footfall in the eight weeks since the re-opening of

non-essential retail on 12 April 2021 has risen from about 30%

beforehand to the equivalent of approximately 72% of the

corresponding weeks in 2019. The need to maintain social distancing

places restrictions upon capacity at peak times.

-- Occupancy remains robust at 89% at 31 May 2021. The metric

omits the three Debenhams units which are now vacant as those

stores have ceased to trade. We are progressing plans to break up

the Ilford unit across its three floors. We are under offer on one

floor and have strong interest for the other levels from separate

occupiers whose operations are in line with our Community Strategy.

In Blackburn and Luton we have interest from potential occupiers to

let the space in its entirety.

-- In total we have received 70% of the rent due for the year to

date, encompassing the rent billed on or since the 25 December 2020

quarter date up until 18 June 2021. This is an improvement of

approximately 11% on when we updated the market on 28 April 2021.

We are in active discussions with our retailers seeking to reach an

equitable and amicable resolution to the balance of outstanding

arrears.

-- Leasing progress has been encouraging following the

re-opening on 12 April 2021. To the end of May 2021, we had

completed 38 new lettings and renewals for a combined value of

GBP0.9 million, in aggregate above the previous rent and ERV.

Retailers continue to be attracted to our strategy and community

centres in vibrant neighbourhoods, as well as our affordable,

sustainable rents at GBP12-GBP15 psf.

-- At Luton we have handed over a new unit to Lidl, facilitating

an Autumn opening, and are in active discussions with them about

other sites within the portfolio. At Ilford we continue to progress

to finalising the agreement for lease with the NHS for a new

purpose-built community healthcare facility.

-- We have achieved a number of notable milestones towards

securing the residential development in Walthamstow. The principal

terms of the s.106 planning obligations package have now been

agreed and the local authority recommendation to grant planning

consent has been formally ratified by the Greater London Authority.

Our immediate focus now is to formally conclude the s.106 with the

local authority, which will trigger the formal grant of planning

consent, and to conclude the development agreement with the local

authority. In parallel, we continue to work to discharge the

remaining contractual pre-conditions with Long Harbour to

crystalise the c.GBP20 million land receipt and a start on site for

the residential development phase by the end of the year.

-- The Group's three UK Snozone operations recommenced trading

on 12 April 2021, strictly adhering to current government

guidelines, which reduces current slope capacity to approximately

half. The Madrid operation has been able to trade throughout 2021,

although it remains subject to similar social distancing

restrictions that impact upon most of the services that can be

provided.

Liquidity

-- As at 31 May 2021, the Group had total cash on balance sheet

of GBP74.3 million, which is equivalent to more than one year's

gross revenue. Of this approximately GBP58.2 million was held

centrally, outside of the collateral of any of the debt

facilities.

-- The Group's four drawn debt facilities are all non-recourse,

with no cross-default clauses. The earliest contractual maturity on

any of the Group's property loan facilities is February 2023.

-- On The Mall facility we have agreed a further extension of

the existing covenant waivers until the Interest Payment Date in

October 2021 while we continue discussions with the two lenders

over a longer term modification of the debt facility.

-- On Ilford we have signed a waiver of all covenants until

October 2021 during which time we will work to conclude the outline

agreement we have for longer term relaxation linked to the proposed

healthcare facility project which, if it proceeds, the Group will

partially fund from central cash.

-- On Hemel Hempstead, the disposal of the Edmonds Parade block

of assets adjacent to the scheme completed on 7 June 2021. The net

proceeds of approximately GBP4.5 million will primarily be set

against the outstanding GBP26.9 million of debt. We have also

agreed an effective waiver of all covenant tests until the October

Interest Payment Date while we continue to work closely with the

lender to assess all options for this facility and the asset.

-- On Luton we have a waiver of income covenants until the

interest payment date at the end of July 2021 and have commenced

discussions about extending this for a further quarter.

Our overriding priority remains the health, safety and

protection of our colleagues, guests and customers, and throughout

the pandemic we have been implementing the latest official

government guidelines and advice across our portfolio.

-S -

For further information:

Capital & Regional plc 020 7932 8000

Lawrence Hutchings

Stuart Wetherly

FTI Consulting 020 3727 1000

Richard Sunderland

Claire Turvey

capreg@fticonsulting.com

About Capital & Regional plc:

Capital & Regional is a UK focused retail property REIT

specialising in shopping centres that dominate their catchment,

serving the non-discretionary and value orientated needs of the

local communities. It has a strong track record of delivering value

enhancing retail and leisure asset management opportunities across

its portfolio of in-town shopping centres.

Capital & Regional owns seven shopping centres in Blackburn,

Hemel Hempstead, Ilford, Luton, Maidstone, Walthamstow and Wood

Green. Capital & Regional manages these assets through its

in-house expert property and asset management platform.

Capital & Regional is listed on the main market of the

London Stock Exchange (LSE) and has a secondary listing on the

Johannesburg Stock Exchange (JSE)

For further information see capreg.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTEAKKLAENFEFA

(END) Dow Jones Newswires

June 25, 2021 02:00 ET (06:00 GMT)

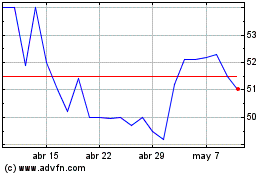

Capital & Regional (LSE:CAL)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Capital & Regional (LSE:CAL)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024