TIDMGCAT

RNS Number : 3368L

Caracal Gold PLC

10 September 2021

Caracal Gold plc / EPIC: GCAT / Market: Main / Sector:

Mining

10 September 2021

Caracal Gold plc ('Caracal' or the 'Company')

Operations Update

Caracal Gold plc, the gold producer with operations in East

Africa, is pleased to announce an update on operations at its

producing Kilimapesa Gold Mining and Processing Operations in

Kenya, where it is advancing a phased mine optimisation

strategy.

HIGHLIGHTS

-- Connecting mains power to the processing plant within the

next eight weeks, dramatically reducing operating costs by approx.

US$100/oz and providing significant ESG benefits

-- Continuing to increase processing plant throughput, with the

redesigned plant operating more efficiently and at increased

rates

-- New Mine Plan being successfully implemented and supported by

a strengthened geological team, which is gaining a deeper

understanding of the structural geology

-- Appointment of additional exploration geologist, who is

expediting the Company's broader exploration plans at Kilimapesa,

including commencement of an extended trenching programme ahead of

two new RC and DD drills that have been acquired by the Company and

are due to arrive on site this quarter

-- Corporate Office opened in Nairobi and listing on the Nairobi

Securities Exchange progressing

-- Advanced negotiations on the potential acquisition of several

previously identified, complementary and strategically located gold

mine and development projects in East Africa

Robbie McCrae, CEO of Caracal, said, "Having listed at the end

of August 2021, we've hit the ground running across every aspect of

our gold mining and exploration business. Ex cellent progress is

being made at our flagship asset, the Kilimapesa Gold Mine in

Kenya, where we are fast-tracking a mid-term optimisation plan

focused on increasing gold production to 25,000oz p.a.

"A key accomplishment has been the agreement to connect the

plant to the grid power; not only does this deliver major cost

savings and improved economics, but it also strengthens our ESG

credentials given Kenya's advanced stance on the use of renewable

energy. Additionally, our exploration programmes aimed at

increasing our JORC compliant resources to +2Moz are also making

headway, with initial trenching of shallow open pit areas

initiated, the acquisition of our own RC and DD drills, and

in-house drilling teams established to allow us to accelerate our

exploration activities. Furthermore, discussions regarding the

potential acquisition of previously identified major gold assets in

East Africa are progressing at pace.

"We are delighted with the market reception since listing at the

end of August and look forward to proactive engagement with

shareholders as we rapidly advance our strategy of becoming a

+50,000oz p.a. producer and building a JORC compliant resource base

of +3Moz within 12-18 months across our East African focussed gold

mining and exploration activities."

DETAILS

Since listing at the end of August 2021, the Company continues

to build on its position as an emerging East African-focused gold

producer, growing both production and resources organically and

through strategic acquisitions. To this end, it is advancing a

phased mine optimisation strategy at its first asset, the

Kilimapesa Gold Mining and Processing Operations, where there is

significant expansion potential and ability to increase gold

production to 25,000oz p.a. and the resource to +2Moz in the

mid-term.

As part of its optimisation strategy, the Company has signed an

agreement to connect grid power to the processing plant; this is

expected to be completed within the next eight weeks. Not only will

this dramatically reduce its diesel consumption and operating costs

by approximately US$100/oz, but the connection will also provide

significant ESG benefits given the electric power sector in Kenya

relies largely on renewable energy sources such as hydropower and

geothermal sources of energy.

Throughput at the mine is continuing to increase, with the

redesigned plant operating more efficiently and at increased rates.

Activities include:

-- The commissioning of the screening plant in July, which is

operating efficiently and is successfully screening previously

low-grade material into 3 size fractions with the smaller 2 size

fractions, which carry most of the grade, being processed directly

through the mill;

-- The commencement of construction of a test heap leach pad,

following the successful recovery of gold from low-grade material

in laboratory test work; a decision on construction of a full-scale

heap leach pad will made within next 90 days based on results from

the test pad; and

-- The completion of substantial improvements/upgrades to the

mine laboratory, which can now handle all the assay work from

sampling from the mine, the process plant and can complete all the

sample prep for the samples that will come from the soon to be

commenced drilling programme.

The Kilimapesa Underground Mine and the implementation of a new

Mine Plan is also operating well, and is supported by the Company's

strengthened geological team, which is gaining a deeper

understanding of the structural geology and controls.

The Company remains committed to implementing its broad gold

exploration programmes in Kenya and has further strengthened its

geological team with the appointment of a highly experienced

exploration geologist, who has extensive gold exploration

experience in Kenya and is now expediting a new exploration

programme. An initial trenching programme has begun across various

targets within the Company's exploration licence and at the

Kilimapesa Mine on the Company's Mining License. Additionally, the

Company has acquired two new drill rigs (a RC - Reverse Circulation

- and a DD - Diamond Drill rig), which will be shipped shortly to

site with drilling expected to commence in Q1 2022. The acquisition

of both of these drill rigs provides the Company with much

increased flexibility and significant costs savings as it looks to

accelerate its gold exploration activities in East Africa.

On the corporate front, the Company has opened an office in

Nairobi and continues to advance a listing on the Nairobi

Securities Exchange with its local broker, Faida Investment Bank.

Furthermore, discussions regarding several complementary and

strategically located gold mining and development projects in East

Africa, which the Company previously identified, are underway;

further details will be disclosed as these advance.

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Regulation 11 of the Market Abuse (Amendment) (EU Exit)

Regulations 2019/310 ("MAR"). With the publication of this

announcement via a Regulatory Information Service, this inside

information is now considered to be in the public domain.

S

For further information visit www.caracalgold.com or contact the

following:

Caracal Gold plc info@caracalgold.com

Gerard Kisbey-Green

Jason Brewer

Novum Securities Ltd crowbury@novumsecurities.com

Joint Broker

Colin Rowbury

-----------------------------

VSA Capital Ltd ipo@vsacapital.com

Financial Adviser and Joint

Broker

Andrew Raca / James Deathe

-----------------------------

St Brides Partners Ltd info@stbridespartners.co.uk

Financial PR

Isabel de Salis / Oonagh Reidy

/ Isabelle Morris

-----------------------------

DGWA, the German Institute for info@dgwa.org

Asset and

Equity Allocation and Valuation

European Investor and Corporate

Relations Advisor

Stefan Müller / Katharina

Löckinger

-----------------------------

Notes

Caracal Gold plc is an emerging East African focused gold

producer with a clear path to grow production and resources both

organically and through strategic acquisitions. Its aim is to

rapidly increase production to +50,000ozs p.a. and build a JORC

compliant resource base of +3Moz within 12-18 months from its

listing in August 2021. To this end, it is progressing a

well-defined mine optimisation strategy at its 100% owned

Kilimapesa Gold Mine in Kenya, where there is significant mid-term

expansion potential and ability to increase gold production to

25,000oz p.a. and the resource to +2Moz (current JORC compliant

resources of approx. 671,000oz). Additionally, its experienced

team, with proven track record in successfully developing and

operating mining projects throughout Africa, is reviewing other

complementary and strategically located gold mine and development

projects in East Africa.

Caracal is a responsible mining and exploration company and

supports the positive social and economic change that it

contributes to the communities in the regions that it operates. It

is a proudly East African-focused company: it buys locally, employs

locally, and protects the environment and its employees and their

families' health, safety, and wellbeing.

Caracal's shares are quoted on the Main Market of the London

Stock Exchange (LON: GCAT) and on the Frankfurt Stock Exchange

(FSE: 6IK); a listing on the Nairobi Securities Exchange is

underway.

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDFLFLAALIAIIL

(END) Dow Jones Newswires

September 10, 2021 02:00 ET (06:00 GMT)

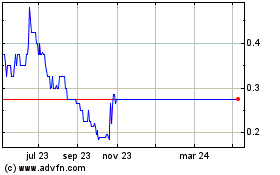

Caracal Gold (LSE:GCAT)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Caracal Gold (LSE:GCAT)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024