TIDMCAML

RNS Number : 9832X

Central Asia Metals PLC

11 January 2022

11 January 2022

CENTRAL ASIA METALS PLC

('CAML' or the 'Company')

2021 Operations Update

Central Asia Metals plc (AIM: CAML) today provides a Q4 and full

year 2021 operations update for the Kounrad dump leach, solvent

extraction and electro-winning ('SX-EW') copper recovery plant in

Kazakhstan ('Kounrad') and the Sasa zinc-lead mine in North

Macedonia ('Sasa').

Recent Kazakhstan disturbances

The CAML Board and management team are closely monitoring the

recent unrest in Kazakhstan, which currently appears to have

stabilised. To date, there has been no disruption to Kounrad's

operations, and 2022 copper production is in line with

expectations.

2021 summary

- Zero lost time injuries ('LTIs') at Kounrad and four LTIs at Sasa during 2021

- 2021 copper production at Kounrad above guidance range

o 14,041 tonnes produced

- 2021 zinc and lead production at Sasa marginally below guidance range

o Zinc in concentrate production of 22,167 tonnes

o Lead in concentrate production of 27,202 tonnes

- Cash in the bank on 31 December 2021 of $59.2 million

- Gross debt as at 31 December 2021 of $33.0 million (including

drawn North Macedonian overdraft facilities totalling $9.6

million)

o 2021 Group corporate debt repayments of $48.4 million

2022 production guidance

- Copper, 12,500 to 13,500 tonnes

- Zinc in concentrate, 20,000 to 22,000 tonnes

- Lead in concentrate, 27,000 to 29,000 tonnes

CAML production summary

Metal production (tonnes) Q4 2021 2021 2020

Copper 3,680 14,041 13,855

-------- ------- -------

Zinc 5,133 22,167 23,815

-------- ------- -------

Lead 6,469 27,202 29,742

-------- ------- -------

Nigel Robinson, Chief Executive Officer, commented:

"We are following closely the recent events in Kazakhstan. We

can confirm that our operations at Kounrad have so far been

unaffected and our 2022 copper production to date is in line with

our expectations. Most importantly, our employees remain safe and

well. We will of course make any necessary announcements should it

become appropriate to do so.

"We are pleased with our 2021 base metal output as, at Kounrad,

we exceeded our guidance, producing over 14,000 tonnes of copper

cathode into a strong pricing environment. We faced some challenges

at Sasa during the year, which reinforce our decision to transition

to the Cut and Fill mining method, and I am proud of our team's

hard work and effort to deliver this credible, albeit below

original guidance, zinc and lead production result.

"We enter 2022 in a net cash position and with robust copper,

zinc and lead commodity prices. Our 2021 annual results are

scheduled to be released on 29 March 2022, when our final dividend

for 2021 will also be announced."

Health and Safety

There were no LTIs at Kounrad during Q4 2021 and one LTI at

Sasa. While this Sasa injury was clearly a disappointment, it was a

relatively minor injury, and the employee is now fully recovered.

There were no medical treatment injuries ('MTIs') at either

operation and therefore one Group total recordable injury ('TRI')

during the quarter.

During 2021, there were zero TRIs at Kounrad and, to 31 December

2021, there has been 1,324 days since the last LTI at Kounrad. At

Sasa, there were four LTIs and zero MTIs during the year, equating

to four TRIs for the Company for 2021.

COVID-19 remains a risk to the welfare of CAML employees and

contractors and there have been cases of the virus at both Kounrad

and Sasa during the reported period. Despite this, the Company is

confident that its COVID-19 procedures at both operations will be

sufficient to protect the welfare of its employees, meet respective

government guidance and maintain production.

Kounrad

Kounrad Q4 2021 copper production of 3,680 tonnes brings output

for 2021 to 14,041 tonnes.

Copper sales during Q4 2021 were 3,854 tonnes, bringing the

total for 2021 to 14,051 tonnes.

Sasa

In Q4 2021, mined and processed ore were 203,802 tonnes and

203,803 tonnes respectively, bringing the total for 2021 to 818,609

tonnes of ore mined and 830,709 tonnes of ore processed. The

average head grades for the quarter were 3.00% zinc and 3.45% lead,

and for the year were 3.14% and 3.52% respectively. The average

2021 metallurgical recoveries were 84.9% for zinc and 93.1% for

lead.

Sasa produces a zinc concentrate and a separate lead

concentrate. In Q4 2021, 10,380 tonnes of concentrate containing

49.5% zinc and 9,037 tonnes of concentrate containing 71.8% lead

were produced. Total production for 2021 was 44,383 tonnes of zinc

concentrate at an average grade of 49.9% and 37,893 tonnes of lead

concentrate at an average grade of 71.8%.

Challenging ground conditions coupled with an enhanced approach

to underground safety risks resulted in short term reductions in

flexibility of working areas, leading to a 1% shortfall in ore

mined versus guidance and, in some cases, increased dilution which

led to reduced zinc and lead head grades versus expected metal

content.

Sasa typically receives from smelters approximately 84% of the

value of its zinc in concentrate and approximately 95% of the value

of its lead in concentrate. Accordingly, Q4 2021 payable production

of zinc was 4,303 tonnes and of lead was 6,145 tonnes, bringing

total 2021 payable production to 18,616 tonnes of zinc and 25,842

tonnes of lead.

Payable base metal in concentrate sales from Sasa in Q4 2021

were 4,432 tonnes of zinc and 6,247 tonnes of lead and for 2021

were 18,586 tonnes of zinc and 25,877 tonnes of lead.

During Q4 2021, Sasa sold 85,314 ounces of payable silver to

Osisko Gold Royalties and during 2021 sold 323,849 ounces, in

accordance with its streaming agreement.

Units Q4 2021 2021 2020

Ore mined t 203,802 818,609 826,421

--------- -------- -------- --------

Plant feed t 203,803 830,709 820,215

--------- -------- -------- --------

Zinc grade % 3.00 3.14 3.37

--------- -------- -------- --------

Zinc recovery % 84.0 84.9 86.1

--------- -------- -------- --------

Lead grade % 3.45 3.52 3.85

--------- -------- -------- --------

Lead recovery % 92.0 93.1 94.3

--------- -------- -------- --------

Zinc concentrate t (dry) 10,380 44,383 47,583

--------- -------- -------- --------

* Grade % 49.5 49.9 50.0

--------- -------- -------- --------

* Contained zinc t 5,133 22,167 23,815

--------- -------- -------- --------

Lead concentrate t (dry) 9,037 37,893 41,289

--------- -------- -------- --------

* Grade % 71.8 71.8 72.0

--------- -------- -------- --------

* Contained lead t 6,469 27,202 29,742

--------- -------- -------- --------

2022 guidance

CAML targets 2022 Kounrad copper production of between 12,500

and 13,500 tonnes of cathode.

Prior to the 2023 transition to cut and fill mining at Sasa,

which will create a safer and sustainable underground mining

operation for the long term, CAML cautiously allows for continued

ground support challenges in its 2022 guidance and will maintain

its enhanced approach to underground safety risks. The Company

therefore targets ore mined of between 790,000 and 810,000 tonnes.

This should result in zinc in concentrate production of between

20,000 and 22,000 tonnes and lead in concentrate production of

between 27,000 and 29,000 tonnes. The Sasa team is also working on

the development of an increased number of sub-levels to enhance

flexibility. This will enable a greater number of potential working

faces in the event of further support being required in some

areas.

Given the Sasa Cut and Fill Project underway, CAML expects Group

2022 capital expenditure of between $28 million and $30 million, of

which between $11 million and $13 million is expected to be

committed to sustaining capex. Overall 2021 and 2022 Sasa Cut and

Fill Project capital expenditure incorporates costs for the paste

backfill plant and associated reticulation pipework, the dry-stack

tailings plant and the purchase of equipment necessary to develop

the Central Decline, as well as decline portal costs, that are in

line with initial 2020 estimates. The Group expects additional

capitalised development costs associated with progressing the

decline during 2022. As the team's understanding of the factors

involved in construction of an appropriate landform to store the

dry tailings has advanced, CAML is also including costs for this

element of the project in its capital expenditure guidance.

Cash and debt

As of 31 December 2021, CAML had cash in the bank of $59.2

million and gross debt of $33.0 million, inclusive of drawn North

Macedonian overdraft facilities totalling $9.6 million.

For further information contact:

Central Asia Metals Tel: +44 (0) 20 7898 9001

Nigel Robinson, CEO

Gavin Ferrar, CFO

Louise Wrathall, Director of Corporate louise.wrathall@centralasiametals.com

Relations

Peel Hunt (Nominated Advisor and Tel: +44 (0) 20 7418 8900

Joint Broker)

Ross Allister

David McKeown

BMO Capital Markets (Joint Broker) Tel: +44 (0) 20 7236 1010

Thomas Rider

Pascal Lussier Duquette

Blytheweigh (PR Advisors) Tel: +44 (0) 20 7138 3204

Tim Blythe

Megan Ray

Rachael Brooks

Note to editors:

Central Asia Metals, an AIM-listed UK company based in London,

owns 100% of the Kounrad SX-EW copper project in central Kazakhstan

and 100% of the Sasa zinc-lead mine in North Macedonia.

For further information, please visit www.centralasiametals.com

and follow CAML on Twitter at @CamlMetals and on LinkedIn at

Central Asia Metals Plc

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDURRBRUOUAAAR

(END) Dow Jones Newswires

January 11, 2022 02:00 ET (07:00 GMT)

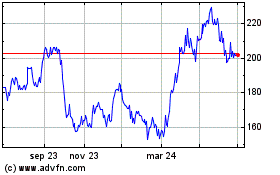

Central Asia Metals (LSE:CAML)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

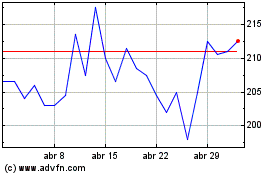

Central Asia Metals (LSE:CAML)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024