TIDMCEG

RNS Number : 7232K

Challenger Energy Group PLC

03 September 2021

3 September 2021

The following amendments have been made to Challenger Energy's

announcement "Saffron Project Update, Funding Update & Share

Issuance" released on 2 September 2021 at 07:00 a.m. under RNS No.

4496K, as follows:

The Company has noticed that in the penultimate paragraph, the

figure of ' 2,270,522' was a typographical error, and should have

read '7,270,522'. However, the figure given in the announcement as

being the total voting rights following Admission, being

796,522,914 Ordinary Shares, is correct. In addition, the defined

term 'BPC' should have been 'CEG'. The intended date for Admission

of the New Shares is now 8 September 2021.

All other details remain unchanged. The full amended

announcement is shown below.

Challenger Energy Group PLC

("Challenger Energy" or the "Company")

Saffron Project Update, Funding Update & Share Issuance -

Replacement

Challenger Energy (AIM: CEG), the Caribbean and Atlantic margin

focused oil and gas company, with production, appraisal,

development and exploration assets across the region, is pleased to

provide the following update in relation to the ongoing clean-up of

the Saffron-2 appraisal well, as well as the timing and funding

plans for the development of the field.

-- The Saffron-2 well production offtake continues to be

optimised as the well cleans up over a range of reservoir zones.

All production currently emanates solely from the Middle Cruse

reservoirs. The Company plans to continue clean-up operations and

to perforate and production test additional zones, so as to

continue to develop the technical understanding of the field's

production capacity whilst at the same time maximising revenues and

cashflow being generated by the Saffron-2 well. A further update as

to ongoing production rates will be provided in due course.

-- With Saffron-2 having proved the presence of moveable

hydrocarbons in the Lower Cruse reservoirs, the Company considers

that these reservoirs can ultimately contribute toward production,

both at Saffron-2 and in future Saffron wells (once engineering

solutions to technical issues encountered in drilling and producing

deeper Saffron-2 zones are implemented). As noted, no production

from the Lower Cruse is currently contributing to overall well

production rates.

-- Based on current production rates from Safffon-2, the Company

considers a development of the Saffron field can be justified

economically - even without assuming production contribution from

the Lower Cruse (and noting that development wells targeting only

the shallower reservoirs will be more cost effective and quicker to

drill than that experienced to date across the Saffron field).

-- In this context, work is underway to incorporate the results

of Saffron-2 into an updated geological and reservoir model leading

to a revised forward development plan for the Saffron field (and

associated revised permitting and approvals). Subject to approval

of a revised field development plan the Company is now targeting a

development of Saffron to commence in H1 2022.

-- The Company and Arena Investors LP continue to discuss

funding options for a Saffron field development, with those

discussions to be further advanced once the revised development

plan for the Saffron field is finalised.

-- In parallel, based on the outcomes of Saffron-2, the Company

has begun investigating options for a farm-out of the Saffron

project, which, if achieved, would present a fundamentally

different approach and risk profile for development of the project

than has been considered to-date. The Company has also begun

investigating various Reserve Based Lending options, as a potential

debt component of any project funding plan.

-- The Company has previously advised of GBP3 million drawn

under its Conditional Convertible Note facility, of which GBP2.5

million was subsequently converted to equity with GBP0.5 million

outstanding (repayable in April 2023 if not converted prior). A

further GBP2 million of Convertible Notes became available to the

Company on an unconditional basis on 14 June 2021. Pending the

results of the Saffron-2 well the Company elected not to avail of

this funding and has managed working capital needs and reduced

overhead costs materially so to avoid the costs associated with

draw-down under this facility (and given that, if drawn, funds

would be senior secured and thus would in any case need to be

immediately repaid in the event of any other funding being

secured). In the absence of imminent Saffron development drilling,

and in view of other funding alternatives currently being

considered, the Company does not at this time expect to issue any

further Convertible Notes under this facility, which otherwise

expired in July 2021.

The Company further notes that it will be issuing 7,270,522 new

ordinary shares in aggregate (representing less than 0.025% of the

total shares in issues), to certain advisors of the Company in

settlement of fees owing as well as to some legacy creditors in

Trinidad in full settlement of amounts owing (the "New Shares"),

with 1.2 million unlisted warrants issued alongside, to subscribe

for new Ordinary Shares at the 3.5 pence per share, valid for a

period of 48 months . Application has been made for the New Shares

to be admitted to trading on the AIM market of the London Stock

Exchange and it is expected that admission will take place on or

around 8 September 2021 at 08:00 a.m. Following admission of the

New Shares , CEG's issued share capital will consist of 796,522,914

ordinary shares, with each ordinary share carrying the right to one

vote. The Company does not hold any ordinary shares in treasury.

This figure of 796,522,914 ordinary shares may therefore be used by

shareholders in the Company, as the denominator for the

calculations by which they will determine if they are required to

notify their interest in, or a change in their interest in, the

share capital of the Company under the FCA's Disclosure Guidance

and Transparency Rules.

Eytan Uliel, Chief Executive Officer, commented:

" On 25 August 2021, Challenger Energy advised of initial

production test results at the Saffron-2 appraisal well in

Trinidad's South West Peninsula. Testing is ongoing, but we have

since received queries as to the implication of the well results so

far for the project as a whole, in response to which I'd make two

general comments: one, Saffron-2 has told us that a project at

Saffron is likely viable, but two, it will not look the same as the

project we had envisaged pre-drill. Specifically, we now know that

a project based solely on shallower, cheaper wells targeting just

the Middle Cruse can stand on its own, and we are working on

revising technical models and development plans accordingly. We

also now know that there are moveable hydrocarbons in the Lower

Cruse, although more work is needed to figure out how to get

sustained production from those zones, which has the potential to

then expand the scope of any development over time. And finally,

what we have learned from Saffron-2 will allow us to systematically

revisit all available financing options, plus there is a body of

work to be done in terms of updating relevant regulatory and

planning requirements. The important point is that based on the

results of Saffron-2 we believe Saffron is a commercial project,

and so we are doing the work needed to advance to a development as

soon as possible, until which time we will continue to maximise

cashflow from the

Saffron-2 well itself. We will keep shareholders appraised of developments. "

For further information, please contact:

Challenger Energy Group PLC Tel: +44 (0) 1624

Eytan Uliel, Chief Executive Officer 647 882

Strand Hanson Limited - Nomad Tel: +44 (0) 20 7409

Rory Murphy/James Spinney/Rob Patrick 3494

Shore Capital Stockbrokers Limited Tel: +44 (0) 207

- J oint Broker 408 4090

Jerry Keen/Toby Gibbs

Investec Bank Plc - J oint Broker Tel: +4 4 (0) 207

Chris Sim/Jarrett Silver 597 5970

Gneiss Energy Limited - Financial Tel: +44 (0) 20 3983

Adviser 9263

Jon Fitzpatrick/Paul Weidman/Doug

Rycroft

CAMARCO Tel: +44 (0) 020 3757

Billy Clegg/James Crothers/Hugo Liddy 4980

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014, which forms part of United

Kingdom domestic law by virtue of the European (Withdrawal) Act

2018.

Notes to Editors

Challenger Energy is a Caribbean and Atlantic margin focused oil

and gas company, with a range of exploration, appraisal,

development and production assets and licences, located onshore in

Trinidad and Tobago, and Suriname, and offshore in the waters of

The Bahamas and Uruguay. In Trinidad and Tobago, Challenger Energy

has five (5) producing fields, two (2) appraisal / development

projects and a prospective exploration portfolio in the South West

Peninsula. In Suriname, Challenger Energy has on onshore appraisal

/ development project. Challenger Energy's exploration licence in

each of Uruguay and The Bahamas are highly prospective, and offer

high-impact value exposure within the overall portfolio value.

Challenger Energy is quoted on the AIM market of the London

Stock Exchange.

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFLFFFAVIVIIL

(END) Dow Jones Newswires

September 03, 2021 08:27 ET (12:27 GMT)

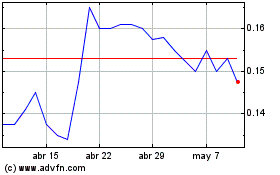

Challenger Energy (LSE:CEG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Challenger Energy (LSE:CEG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024