TIDMCKT

RNS Number : 9259L

Checkit PLC

16 September 2021

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF UK MARKET ABUSE REGULATION . UPON THE PUBLICATION OF THIS

ANNOUNCEMENT THIS INSIDE INFORMATION IS NOW CONSIDERED TO BE WITHIN

THE PUBLIC DOMAIN.

16 September 2021

Checkit plc

("Checkit" or the "Group")

Interim results for the six months ended 31 July 2021

Checkit plc (AIM: CKT) announces its unaudited results for the

six months ended 31 July 2021 (the "Period" or "H1 FY22") .

Highlights

-- Annual recurring revenue ("ARR") run rate of GBP6.6m at period end

-- Recurring revenue increased by 31%* to GBP3.1m (H1 FY21:

GBP2.4m), reflecting the Group's focus on SaaS (software as a

service) growth

-- Total revenue from continuing operations increased by 13%* to GBP7.9m (H1 FY21: GBP7.0m*)

-- Operating loss before non-recurring or special items of

GBP(1.7)m (H1 FY21: GBP(1.5)m), reflecting increased investment in

sales, marketing and product development

-- Cash at 31 July 2021 of GBP8.5m (31 January 2021: GBP11.5m)

-- Acquisition of Tutela Monitoring Systems LLC ("Tutela")

completed during the period, accelerating the Group's US

expansion

-- The Board remains confident about the prospects for the business

* The prior period's revenue has been normalised to illustrate

sales that would have been included in the Group's financial

results had Tutela, which was acquired on 4 February 2021, been

fully owned by the Group throughout both periods. Excluding the

acquisition of Tutela, Group revenue for the comparative period

last year was GBP6.4m.

Checkit plc

www.checkit.net

Kit Kyte (Chief Executive Officer)

Greg Price (Chief Financial Officer) +44 (0) 1223 643 313

Singer Capital Markets (Nominated Adviser

and Broker)

Shaun Dobson / Rachel Hayes / George

Tzimas +44 (0) 207 496 3000

Chief Executive Officer's Statement

I am pleased to present our H1 FY22 results, my first financial

report as CEO. In this report, you'll read about the seismic global

potential for intelligent operations to change the world of work

for a vast population of hundreds of millions of deskless workers

and to bring smart people, smart assets and smart buildings into a

single platform. We will be at the vanguard of the next phase of

digital transformation, leading a market that analysts value at

billions of dollars [1] .

This is only the beginning of Checkit's journey towards becoming

an industry leading SaaS business. The immediate target is to not

only surpass our first-half growth in ARR but also, as we emerge

from the global pandemic, to rapidly accelerate our expansion with

new and existing clients as we capitalise on the deskless worker

opportunity.

Bringing operations out of the dark

Reducing costs; retaining staff; cutting out waste; hitting

compliance targets and adapting to changing customer expectations:

these are some of the key issues keeping leaders awake at

night.

Dig deeper and you'll find that the activity of deskless workers

is crucial to addressing these challenges. But there's a problem

here. Deskless workers are operating in the dark. Their essential

everyday work - providing food, running supply chains, caring for

the sick and keeping buildings safe (to give a few examples) - is

often lost in a jumble of paperwork, spreadsheets and outdated

tech. Deskless workers are digitally disconnected, giving rise to

what we call 'dark operations'.

Organisations are exposed to risks they can't see and blind to

growth opportunities that go missing. Our expansion strategy

centres on our ability to address the global challenge of dark

operations.

Customers across food retail, healthcare, hospitality and other

industries can realise value from the Checkit platform in as little

as one month.

By digitising manual processes using digital assistants and

automating the reporting on essential assets and buildings through

advanced sensor networks, the Checkit platform can reduce staff

costs by as much as one shift per week, per site. The loss of

essential stock, such as food and medicine through wastage, is

dramatically reduced whilst further sales opportunities are

increased through algorithmically optimised product allocations

across sites. Our customers also report maintenance efficiencies,

reduced engineer visits and increased uptime.

Checkit improves staff training, engagement and retention. One

of our clients onboarded 7,500 staff with the Checkit platform in

less than four weeks.

Checkit strengthens compliance reporting and audits with online

data to reduce risk.

Above all, Checkit's advanced analytics provides insights for

both the mid and senior enterprise leadership level and enables

data-driven decision-making. Clients can build more agile and

resilient operating models whilst unlocking new sources of cost

reduction and improved customer experience.

One powerful platform

Checkit's technology vision unites people, assets and buildings

in one enterprise-class platform, creating an end-to-end solution

for operational excellence.

Digital assistants prompt, guide and capture essential activity,

helping staff to do the right thing at the right time, regardless

of their skill level or experience in the job. Evolving sensor

technology enables a large proportion of previously manual

equipment checks to be automated, liberating employees from

repetitive tasks such as fridge and freezer temperature readings.

Factor in smart building solutions which monitor and assist with

energy utilisation and asset optimisation (e.g. desk occupancy;

pipe monitoring; toilet cleanliness) and you have a complete

platform with powerful analytics providing a constant stream of

actionable insight.

The defining characteristic of the deskless industries we serve

is that they never stand still. And nor do we. In the current

financial year, we are adding a series of new features to our

platform:

Event-Driven Actions enable users of Checkit's monitoring

technology to feed sensor alerts from equipment or buildings

directly into a corrective workflow for rapid remediation and

action by frontline employees. With event-driven actions, the

platform delivers a step-by-step workflow direct to frontline staff

via their mobile device to guide them through the remedial action

they need to take. This ensures a rapid response to preserve stored

inventory, repair equipment and maintain safety, as well as

creating an audit report of corrective action.

Job Sharing is a tool for collaborative working that increases

frontline flexibility while capturing a single record of action

taken. It allows multiple staff to collaborate on a single

activity. The new feature means a particular set of activities,

ranging from laboratory opening procedures, to cleaning and food

safety checks, are not only assigned to one individual but can be

picked up by colleagues. This will be useful if a task is not

completed before a shift handover, or if remote teams want to

communicate and divide ad-hoc tasks between them to get work done

faster.

Checkit Franchise Edition allows common workflows such as food

safety procedures, site inspections, equipment maintenance and

opening/closing checks to be stored as templates in an online

library. This enables franchisors and other organisations to

implement consistent brand standards and safety routines across

their entire network of sites and apply benchmarks for measurement

against KPIs.

Revenue growth

Over the first half of the year, we have delivered new logo wins

across multiple geographies, whilst expanding our global footprint

with some of our strategic enterprise accounts. We have quadrupled

our pipeline of new business since the start of the year and have

advanced engagements with enterprise customers across retail,

healthcare, facilities management, franchise and pharmaceutical

industries. The conversations we are engaged in reveal a clear and

growing appetite to apply comprehensive digital solutions to their

operations.

H1 FY22 revenue from continued operations is shown below by

business unit (on a normalised basis).

Overall Group revenue grew 13% and recurring revenue by 31%

compared to the prior year on a normalised basis. 39% of revenue

was recurring, +5% vs H1 FY21 and reflects the shift towards a pure

SaaS business model.

ARR saw an increase of GBP0.9m (+16%) in the half year to close

at a run rate of GBP6.6m, predominantly driven by new subscription

contracts going live with customers.

Revenue (GBP'm): Six months to (HY)

30 July 30 July % Change

2021 2020*

Checkit Connect:

Recurring 2.9 2.2 +32%

(35)

Non-recurring 0.6 0.9 %

Total Checkit Connect 3.5 3.1 +12%

Checkit Connect US (Tutela)**:

Recurring 0.2 0.2 +13%

Non-recurring 0.7 0.7 (7) %

Total US 0.9 0.9 (2) %

Total Checkit BEMS (Non-recurring) 3.5 3.0 +19%

Checkit Group:

Recurring 3.1 2.4 +31%

Non-recurring 4.8 4.6 +4%

Total Group 7.9 7.0 +13%

* The prior period's revenue has been normalised to illustrate

sales that would have been included in the Group's financial

results had Tutela, which was acquired on 4 February 2021, been

fully owned by the Group throughout both periods. Excluding the

acquisition of Tutela, Group revenue for the comparative period

last year was GBP6.4m

Checkit Connect grew by 12% to GBP3.5m (H1 FY21: GBP3.1m).

Recurring revenues accounted for all this growth (+32% on a

normalised basis) and reflect the benefits of year-on-year ARR

growth realised in the half year.

Increased spending on the Group's sales, marketing and product

has reinforced Checkit's value proposition, particularly in the

healthcare and food retail industries, where Checkit is seeing

early signs of success in terms of pipeline growth and new customer

bookings as COVID-19 restrictions ease.

The decline in non-recurring revenue compared to the first half

of FY21 is primarily driven by timing and the on-going

repositioning towards a subscription-based pricing model adopted

across the Group during FY21.

Checkit Connect US has been introduced for FY22 reporting

purposes and reflects the performance of the newly created US based

business unit incorporating the acquisition in Q1 of Tutela LLC. It

should be regarded as a subsegment of Checkit Connect.

While US revenue declined slightly by 2% in the first half, this

included 13% growth in recurring revenue, which was driven by new

subscriptions. The US market is starting to scale up by recording

net new business success in the healthcare sector and through

on-going pricing conversions of existing customers into a

subscription-based model. The food retail and reviving hospitality

sectors are a focus for new business.

Checkit BEMS sales grew by 19% compared to the prior period.

This was due to a one-off significant project delivered in Q1. Its

revenues are expected to decline in the second half as a result of

the Group being more selective in pricing contracts. The Board

considers that its traditional projects and maintenance business

(which has historically generated low margins) has peaked as a

percentage of revenue.

The focus of this business unit will increasingly be on smart

building technology through the Checkit Connect platform and when

its transformation is complete, it is expected that this business

unit will be merged with Checkit Connect.

Operating performance

Gross profit increased from GBP2.3m to GBP3.5m representing

growth of over 50% compared with the prior period, reflecting the

overall increase in recurring revenue as a percentage of total

revenues. The Group will restate its reporting of gross profit at

the year end to exclude labour costs in line with industry standard

practice.

Operating costs (excluding non-recurring or special items)

increased by GBP1.4m to GBP5.2m. This was the result of increased

investment across the business to support its expansion, especially

in sales and marketing, as well as the effect of lapping the

measures put in place in the first half of last year to reduce

costs in response to the COVID-19 pandemic (including a salary

reduction programme and furlough scheme participation).

Costs increased from the introduction of the Checkit US business

unit, including the acquisition of Tutela. Investment in this

business unit resulted in additional costs of GBP0.6m, in line with

the Group's objective to reinvest to accelerate growth in the

region.

The business remains committed to investing in product

development. In total, GBP1.5m was invested in the product in H1

FY22 (H1 FY21: GBP1.0m), of which GBP0.6m was capitalised.

Overall, operating losses before non-recurring or special items

for H1 FY22 were GBP(1.7)m, an increase of GBP0.2m compared to H1

FY21 (GBP(1.5)m).

Cash

Cash at 31 July 2021 closed at GBP8.5m (vs. GBP11.5m at 31

January 2021). This reduction in cash was driven by operating

losses in the period, as well as an overall investment in business

activities of GBP1.3m. This reflects the acquisition of Tutela for

GBP0.4m (consideration of GBP0.6m, less cash acquired in the

business of GBP0.2m), as well as the capitalisation of development

costs of GBP0.6m and software costs relating to the digital

transformation programme of GBP0.3m.

Non recurring or special items

Non recurring or special items in the six months to 31 July 2021

related to the amortisation of acquired intangible assets and

restructuring and integration costs arising as the Group completes

its transformation programme to set itself up for growth.

People

The recruitment of high-calibre individuals has been a highlight

of the year to date.

In line with the company's aggressive growth agenda, Checkit's

sales and marketing teams doubled in size during the first half of

the year. Recent senior appointments include a new Global Vice

President of Sales (with a strong SaaS background), supported by a

rapidly growing sales team including top-performing enterprise

technology partners and strategic account managers with specialism

in IoT, retail digitisation and entrepreneurial business

development.

The growing geographical reach of Checkit has resulted in an

expansion of the US-based team. The US sales team has been

bolstered with the addition of specialists in technology for

healthcare and quick-service restaurants.

New senior appointments in the Product Engineering team include

a new Head of Delivery and a Head of Development Operations, both

of whom bring considerable experience in scaling and transforming

teams and a wealth of knowledge and experience from product focused

SaaS companies.

These new hires bring significant skills and expertise into

Checkit. As part of our own digital transformation, we are aligning

functional teams and technology to create an even stronger

springboard for future growth. In addition, an exciting product

roadmap has been developed to evolve our solution in line with the

current and future needs of the key industries we serve.

Outlook

Checkit is accelerating out of the COVID-19 crisis. We continue

to scale our growth through increased investment in sales and

marketing and product development. We believe the world has hit an

inflection point in the way in which people work and the pandemic

has only increased the urgency and pace of digital adoption by

enterprise level customers, who are seeking to solve the challenges

faced by their deskless workforces. We believe that Checkit is

uniquely positioned to lead a market that is estimated to include

2.7 billion frontline and deskless workers [2] . We are now

expanding our global footprint with both existing and new customers

as they uncover further benefits and business use cases that can be

powered by the Checkit software platform and sensor ecosystem.

We are excited about the future. We are confident that our focus

is in the right place and we will continue to invest cash wisely in

order to deliver upon our aggressive growth ambitions. The Board

remains confident about the outlook for the current year.

Consolidated statement of comprehensive income

unaudited interim results to 31 July 2021

Restated*

Unaudited Unaudited

Half Half Audited

year year Year

to to to

31 July 31 July 31 January

2021 2020 2021

GBPm GBPm GBPm

------------------------------------------------ --------- ---------- -----------

Revenue (Note 2) 7.9 6.4 13.2

Cost of sales (4.4) (4.1) (8.5)

------------------------------------------------ --------- ---------- -----------

Gross profit 3.5 2.3 4.7

Operating expenses

------------------------------------------------ --------- ---------- -----------

Net operating expenses (excluding non-recurring

or special items) (5.2) (3.8) (7.8)

Operating loss before non-recurring or

special items (1.7) (1.5) (3.1)

Non-recurring or special items (Note

3) (1.0) (1.2) (2.2)

------------------------------------------------ --------- ---------- -----------

Total operating expenses (6.2) (5.0) (10.0)

------------------------------------------------ --------- ---------- -----------

Operating loss (2.7) (2.7) (5.3)

Finance income - - -

------------------------------------------------ --------- ---------- -----------

Loss before taxation (2.7) (2.7) (5.3)

Taxation (Note 4) 0.1 0.1 0.3

------------------------------------------------ --------- ---------- -----------

Loss from continuing operations (2.6) (2.6) (5.0)

Profit from discontinued operations (Note

5) - 0.5 0.6

------------------------------------------------ --------- ---------- -----------

Loss for the period attributable to equity

shareholders (2.6) (2.1) (4.4)

------------------------------------------------ --------- ---------- -----------

Other comprehensive expense

Exchange differences on translation of - -

foreign operations -

Total other comprehensive income - - -

------------------------------------------------ --------- ---------- -----------

Total comprehensive expense for the period

attributable to equity shareholders (2.6) (2.1) (4.4)

------------------------------------------------ --------- ---------- -----------

Loss per share (Note 7)

Continuing (4.2)p (4.3)p (8.3)p

Discontinued - 0.8p 1.0p

------------------------------------------------ --------- ---------- -----------

The accompanying notes form an integral part of this

consolidated interim financial information.

* See Note 8.

Consolidated balance sheet

unaudited at 31 July 2021

Restated*

Unaudited Unaudited Audited

31 July 31 July 31 January

2021 2020 2021

GBPm GBPm GBPm

-------------------------------------- --------- ---------- -----------

Assets

Non-current assets

Goodwill arising on acquisition 4.5 4.3 4.3

Capitalised development costs 0.6 - -

Other intangible assets 1.7 2.3 1.7

Property, plant and equipment 0.7 0.9 0.8

-------------------------------------- --------- ---------- -----------

Total non-current assets 7.5 7.5 6.8

-------------------------------------- --------- ---------- -----------

Current assets

Inventories 1.4 1.6 1.1

Trade and other receivables 3.8 3.9 4.9

Cash and cash equivalents 8.5 13.4 11.5

-------------------------------------- --------- ---------- -----------

Total current assets 13.7 18.9 17.5

-------------------------------------- --------- ---------- -----------

Total assets 21.2 26.4 24.3

-------------------------------------- --------- ---------- -----------

Current liabilities

Trade and other payables 5.3 5.1 5.6

Lease liabilities 0.2 0.4 0.3

-------------------------------------- --------- ---------- -----------

Total current liabilities 5.5 5.5 5.9

-------------------------------------- --------- ---------- -----------

Non-current liabilities

Long-term provisions 0.3 0.2 0.3

Lease liabilities 0.2 0.3 0.2

Deferred tax 0.2 0.5 0.3

-------------------------------------- --------- ---------- -----------

Total non-current liabilities 0.7 1.0 0.8

-------------------------------------- --------- ---------- -----------

Total liabilities 6.2 6.5 6.7

-------------------------------------- --------- ---------- -----------

Net assets 15.0 19.9 17.6

-------------------------------------- --------- ---------- -----------

Equity attributable to equity holders

of the parent

Called-up share capital 3.1 3.1 3.1

Share premium 5.4 5.4 5.4

Capital redemption reserve 6.4 6.4 6.4

Other reserves 0.1 0.1 0.1

Retained earnings - 4.9 2.6

-------------------------------------- --------- ---------- -----------

Total equity 15.0 19.9 17.6

-------------------------------------- --------- ---------- -----------

The accompanying notes form an integral part of this

consolidated interim financial information.

* See Note 8.

Consolidated statement of changes in equity

unaudited interim results to 31 July 2021

Capital

Share Share redemption Own Other Retained

capital premium reserve Shares* reserves earnings Total

GBPm GBPm GBPm GBPm GBPm GBPm GBPm

-------------------------- -------- -------- ----------- -------- --------- --------- -----

At 1 February 2020

(as reported) 3.1 5.4 6.4 (0.7) - 0.1 14.3

Restatement of Intangible

Assets - - - - - 7.1 7.1

-------------------------- -------- -------- ----------- -------- --------- --------- -----

At 1 February 2020

(as restated) 3.1 5.4 6.4 (0.7) - 7.2 21.4

Loss for the period

(as reported) - - - - - (1.1) (1.1)

Restatement of Intangible

Assets - - - - - (1.0) (1.0)

-------------------------- -------- -------- ----------- -------- --------- --------- -----

Total comprehensive

income for the period - - - - - (2.1) (2.1)

Share-based payments - - - - 0.1 - 0.1

Correction of reserve

classification - - - 0.2 - (0.2) -

Own shares sold* - - - 0.5 - - 0.5

-------------------------- -------- -------- ----------- -------- --------- --------- -----

Transactions with

owners - - - 0.7 0.1 (0.2) 0.6

-------------------------- -------- -------- ----------- -------- --------- --------- -----

At 31 July 2020 (as

reported) 3.1 5.4 6.4 - 0.1 (1.2) 13.8

Restatement of Intangible

Assets - - - - - 6.1 6.1

-------------------------- -------- -------- ----------- -------- --------- --------- -----

At 31 July 2020 (as

restated) 3.1 5.4 6.4 - 0.1 4.9 19.9

Loss for the period - - - - - (2.3) (2.3)

-------------------------- -------- -------- ----------- -------- --------- --------- -----

Total comprehensive

income/(expense)

for the period - - - - - (2.3) (2.3)

At 1 February 2021 3.1 5.4 6.4 - 0.1 2.6 17.6

Loss for the period - - - - - (2.6) (2.6)

-------------------------- -------- -------- ----------- -------- --------- --------- -----

Total comprehensive

income for the period - - - - - (2.6) (2.6)

-------------------------- -------- -------- ----------- -------- --------- --------- -----

At 31 July 2021 3.1 5.4 6.4 - 0.1 - 15.0

-------------------------- -------- -------- ----------- -------- --------- --------- -----

The accompanying notes form an integral part of this

consolidated interim financial information.

* The own shares were held by the Elektron Technology 2012

Employee Benefit Trust. All of the own shares were sold by the

trust during the prior period, resulting in a gain.

Consolidated statement of cash flows

unaudited interim results to 31 July 2021

Restated*

Unaudited Unaudited

Half Half Audited

year year Year

to to to

31 July 31 July 31 January

2021 2020 2021

GBPm GBPm GBPm

-------------------------------------------- --------- ---------- -----------

Net cash flows from operating activities

Loss before taxation

- From continuing operations (2.7) (2.7) (5.3)

- From discontinued operations - 0.5 0.6

Adjustments for:

Depreciation charge 0.3 0.4 0.6

Amortisation of other intangibles 0.8 0.7 1.3

Gain on the sale of discontinued operations - (0.5) (0.5)

Share based payments - - 0.1

-------------------------------------------- --------- ---------- -----------

Operating cash flows before working capital

changes (1.6) (1.6) (3.2)

Decrease/(increase) in trade and other

receivables 0.9 0.4 (0.9)

Decrease/(increase) in inventories (0.2) 0.1 0.6

Increase/(decrease) in trade payables (0.7) - 0.6

-------------------------------------------- --------- ---------- -----------

Operating cash flows after working capital

changes (1.6) (1.1) (2.9)

Decrease in provisions - - -

-------------------------------------------- --------- ---------- -----------

Cash (used in)/generated by operations (1.6) (1.1) (2.9)

Tax - - -

-------------------------------------------- --------- ---------- -----------

Net cash flows (used in)/generated by

operating activities (1.6) (1.1) (2.9)

-------------------------------------------- --------- ---------- -----------

Investing activities

Interest received on bank deposits - - -

Purchase of property, plant and equipment (0.2) - (0.3)

Purchase of business (net of cash acquired) (0.4) - -

Capitalisation of development costs (0.6) - -

Capitalisation of other intangible assets (0.3) - -

Disposal of businesses (net of cash sold) 0.2 - 0.3

-------------------------------------------- --------- ---------- -----------

Net cash (used in)/generated by investing

activities (1.3) - -

-------------------------------------------- --------- ---------- -----------

Cash flows from financing activities

Sale of own shares - 0.5 0.5

Repayment of contract lease liabilities (0.1) (0.3) (0.4)

-------------------------------------------- --------- ---------- -----------

Net cash generated by/(used in) financing

activities (0.1) 0.2 0.1

-------------------------------------------- --------- ---------- -----------

Net (decrease)/increase in cash and cash

equivalents (3.0) (0.9) (2.8)

Cash and cash equivalents at the beginning

of the period 11.5 14.3 14.3

-------------------------------------------- --------- ---------- -----------

Cash and cash equivalents at the end

of the period 8.5 13.4 11.5

-------------------------------------------- --------- ---------- -----------

The accompanying notes form an integral part of this

consolidated interim financial information.

* See Note 8.

Notes to the unaudited interim results

to 31 July 2021

1. Accounting policies

The interim financial information has been prepared under

international accounting standards in conformity with the

requirements of the Companies Act 2006. Full details of accounting

policies are included in the Annual Report for the year ended 31

January 2021. Fixed annual charges are apportioned to the interim

period on the basis of time elapsed. Other expenses unless

disclosed otherwise are accrued in accordance with the same

principles used in the preparation of the annual accounts.

2. Segmental reporting - continuing operations

Revenues

The following table presents the different revenue streams of

Checkit:

Half Half

year year Year

to to to

31 July 31 July 31 January

2021 2020 2021

GBPm GBPm GBPm

-------------------------------------- -------- -------- -----------

Recurring revenues from subscription

services 3.1 2.3 5.1

Installation, maintenance and support 4.8 4.1 8.1

-------------------------------------- -------- -------- -----------

Total 7.9 6.4 13.2

-------------------------------------- -------- -------- -----------

The Group considers its operations to be in the following

geographical regions:

Half Half

year year Year

to to to

31 July 31 July 31 January

2021 2020 2021

Geographic GBPm GBPm GBPm

--------------- -------- -------- -----------

United Kingdom 7.0 6.2 12.7

The Americas 0.9 0.2 0.5

--------------- -------- -------- -----------

Total 7.9 6.4 13.2

--------------- -------- -------- -----------

3. Non-recurring or special items

Non-recurring or special items are disclosed separately to

improve visibility of the underlying business performance.

Management has defined such items as costs associated with the

acquisition of businesses, restructuring, site closure costs and

other non-recurring items incurred outside the normal course of

business.

Half Half

year year Year

to to to

31 July 31 July 31 January

2021 2020 2021

GBPm GBPm GBPm

------------------------------------------- -------- -------- -----------

Cash items

Costs of acquisition - - 0.1

Restructuring and integration costs 0.3 0.5 0.8

------------------------------------------- -------- -------- -----------

0.3 0.5 0.9

------------------------------------------- -------- -------- -----------

Non-cash items

Amortisation of acquired intangible assets 0.7 0.7 1.3

------------------------------------------- -------- -------- -----------

0.7 0.7 1.3

------------------------------------------- -------- -------- -----------

Total non-recurring or special items 1.0 1.2 2.2

------------------------------------------- -------- -------- -----------

4. Taxation

The tax credit on the loss from continuing operations before

taxation has been estimated at GBP0.1m (H1 FY21: GBP0.1m; FY21:

GBP0.3m). The Group has in excess of GBP17m of tax losses carried

forward.

5. Discontinued operations

During the prior year, the Group sold assets relating to its

Elektron Eye Technology business. Consequently, the business

continues to be included as discontinued operations.

Half Half

year year Year

to to to

31 July 31 July 31 January

2021 2020 2021

GBPm GBPm GBPm

------------------------------------------------ -------- -------- -----------

Revenues 0.2 0.3 0.3

Expenses (0.2) (0.3) (0.2)

Profit before tax - - 0.1

Attributable tax - - -

------------------------------------------------ -------- -------- -----------

Profit after tax - - 0.1

Gain on disposal on remeasurement to

fair value - - 0.5

Attributable tax to gain on disposal - - -

------------------------------------------------ -------- -------- -----------

Profit from discontinued operation attributable

to equity shareholders - 0.5 0.6

------------------------------------------------ -------- -------- -----------

Foreign currency reserve reclassification - - -

------------------------------------------------ -------- -------- -----------

Other comprehensive income from discontinued

operations - - -

------------------------------------------------ -------- -------- -----------

Elektron Eye Technology

The results of the EET discontinued operation, which have been

included in the consolidated statement of comprehensive income,

were as follows:

Restated

Half Half

year year Year

to to to

31 July 31 July 31 January

2021 2020 2021

GBPm GBPm GBPm

------------------------------------------ -------- -------- -----------

Revenue 0.2 0.3 0.3

Expenses (0.2) (0.3) (0.2)

------------------------------------------ -------- -------- -----------

Profit before tax - - 0.1

Attributable tax - - -

------------------------------------------ -------- -------- -----------

Profit from discontinued operation before

gain on disposal - - 0.1

Remeasurement of assets to fair value - - -

Gain on disposal - 0.5 0.5

Attributable tax to gain - - -

------------------------------------------ -------- -------- -----------

Profit from EET discontinued operation - 0.5 0.6

------------------------------------------ -------- -------- -----------

On 1 July 2020 and 13 January 2021, the Group disposed of assets

relating to its Elektron Eye Technology business for a total net

proceeds of GBP0.9m, payable in 24 monthly instalments. GBP0.4m

remains payable as deferred consideration at the end of the half

year to 31 July 2021.

GBPm

-------------- ----

Consideration 0.9

Assets sold 0.4

-------------- ----

Gain on sale 0.5

-------------- ----

6. Businesses acquired - Tutela Monitoring Systems LLC

On 4 February 2021, the Group acquired 100% of the equity of

Tutela Monitoring Systems LLC ("Tutela"), a US-based business.

Tutela was previously owned by Next Control Systems Limited (now

Checkit UK Limited, a subsidiary of the Group), before Next Control

Systems Limited was acquired by the Group in May 2019. It was sold

to the US management team of Tutela in August 2018.

Tutela, which is based in Florida, provides wireless temperature

monitoring systems for all applications and facilities which store

sensitive inventory for businesses within the healthcare sector.

The Group intends to utilise Tutela as a platform to pursue all

industries and verticals targeted by Checkit.

The acquisition serves to accelerate the Group's US expansion

plans, providing a footprint and an opportunity to add further

scale. The Directors believe that, based on relative population

sizes, the US represents an addressable market around five times

larger than the UK, and therefore believe the acquisition

represents a significant milestone in its growth strategy.

The details of the business combination are as follows:

Fair value of consideration transferred GBPm

Amount Settled in cash 0.6

Deferred consideration outstanding

from 2018 sale 0.1

------------------------------------------- ------

Recognised amounts of identifiable

net assets

Other Intangibles 0.3

------------------------------------------ ------

Total non-current assets 0.3

------------------------------------------- ------

Inventories 0.1

Trade and other receivables 0.1

Cash and cash equivalents 0.2

Total current assets 0.4

------------------------------------------ ------

Trade and other payables (0.2)

Total current liabilities (0.2)

------------------------------------------- ------

Total non-current liabilities -

------------------------------------------- ------

Identifiable net assets 0.5

-------------------------------------------

Goodwill on acquisition 0.2

------------------------------------------- ------

Consideration settled in cash 0.6

Cash and cash equivalents acquired 0.2

------------------------------------------- ------

Net cash outflow on acquisition 0.4

------------------------------------------- ------

Consideration transferred

The acquisition of Tutela was settled in cash amounting to

GBP0.6m. Acquisition related costs amounting to GBP0.1m were

expensed and treated as a non-recurring item. Deferred

consideration of GBP0.1m outstanding from the 2018 sale was

discharged on acquisition.

Identifiable net assets

The fair value of the trade and other receivables acquired as

part of the business combination amounted to GBP0.2m, with a gross

contractual amount also being GBP0.2m. As of the acquisition date,

the Group expected to collect the full balance of the contractual

cashflow.

Separable intangible assets

Two separable intangible assets were identified at acquisition,

being the sole distributorship agreement and the acquired customer

list.

The sole distributorship agreement represents a re-acquired

asset from the 2018 sale, for which a price of $300K was paid at

the time. The asset has been valued on the basis of the remaining

term of the agreement. The useful life has been set as 1.9

years.

The acquired customer list was valued by assessing a discounted

cashflow based on expected customer attrition rates and using a

discount factor of 28.8%. The useful life has been estimated at 3

years.

Goodwill

Goodwill is primarily related to the core growth expectations,

expected future profitability and expected business synergies.

Goodwill has been allocated to the Checkit segment and is not

expected to be deductible for tax purposes.

Tutela's contribution to the Group results

Tutela US LLC generated a profit of less than GBP0.1m for the

period from 04.02.21 to the reporting date. Revenue for the period

to 31 July 2021 was GBP0.9m.

In the year ending 31 December 2020, Tutela's sales were

approximately $2m (GBP1.46m) with profit before tax of $0.27m

(GBP0.20m) and net assets (including cash) amounting to $0.16m

(GBP0.12m). If the businesses had been consolidated during that

period, approximately GBP1 million would have been added to Group

sales per annum after eliminating intercompany sales on

consolidation.

7. Earnings per share

Earnings per share (EPS) is the amount of post-tax profit

attributable to each share (excluding those held by the

Company).

Basic EPS measures are calculated as the Group profit for the

period attributable to equity shareholders divided by the weighted

average number of shares in issue during the period.

Diluted EPS takes into account the dilutive effect of all

outstanding share options priced below the market price, in

arriving at the number of shares used in its calculation. However,

in this case, as set out in IAS 33, the potential ordinary shares

cannot be treated as dilutive as their conversion to ordinary

shares would decrease loss per share from continuing operations,

resulting in basic and diluted measures being the same.

31 July 31 July 31 January

2021 2020 2021

Key Million Million Million

------------------------------------ ---- -------- -------- ----------

Weighted average number of ordinary

shares for the purposes of basic

earnings per share A 62.4 60.9 61.5

------------------------------------ ---- -------- -------- ----------

31 July 31 July 31 January

2021 2020 2021

(Loss)/earnings for the period Key GBPm GBPm GBPm

------------------------------------- ---- ------- ------- ----------

(Loss) for the period B (2.6) (2.1) (4.4)

Profit from discontinued operations,

net of tax C - (0.5) (0.6)

------------------------------------- ---- ------- ------- ----------

Continuing loss for the period D (2.6) (2.6) (5.0)

Total non-recurring or special items

net of tax 0.9 1.1 1.9

Continuing loss adjusted for EPS E (1.7) (1.5) (3.1)

------------------------------------- ---- ------- ------- ----------

31 July 31 July 31 January

Key 2021 2020 2021

--------------------------------- ------ ------- ------- ----------

Continuing EPS measures

Basic and diluted D/A (4.2)p (4.3)p (8.3)p

--------------------------------- ------ ------- ------- ----------

Adjusted continuing EPS measures

Basic and diluted E/A (2.7)p (2.5)p (5.2)p

--------------------------------- ------ ------- ------- ----------

Discontinued EPS measures

Basic and diluted (C)/A - 0.8p 1.0p

--------------------------------- ------ ------- ------- ----------

Total EPS measures

--------------------------------- ------ ------- ------- ----------

Basic and diluted B/A (4.2)p (3.4)p (7.3)p

--------------------------------- ------ ------- ------- ----------

8. Restatement

To align the treatment and valuation of intangible assets and

the associated deferred tax liability as at 31 July 2020 with the

treatment in the audited accounts as at 31 January 2021, goodwill

and intangible assets have been increased by GBP6.6m and deferred

tax liabilities by GBP0.5m. The impact on the net asset position

was an increase of GBP6.1m at 31 July 2020 as a result of this

reclassification.

9. Cautionary statement

This interim financial information has been prepared only for

the shareholders of Checkit plc as a whole and its sole purpose and

use is to assist shareholders to exercise their governance rights.

Checkit plc and its Directors and employees are not responsible for

any other purpose or use or to any other person in relation to this

report.

The report contains indications of likely future developments

and other forward-looking statements that are subject to risk

factors associated with, among other things, the economic and

business circumstances occurring from time to time in the

countries, sectors and business segments in which the Group

operates. Key risks and their mitigation have not changed

materially in the period from those disclosed on pages 32 to 35 of

the annual financial statements for the year ended 31 January

2021.

These and other factors could adversely affect the Group's

results, strategy and prospects. Forward-looking statements involve

risks, uncertainties and assumptions. They relate to events and/or

depend on circumstances in the future which could cause actual

results and outcomes to differ materially from those currently

anticipated. No obligation is assumed to update any forward-looking

statements, whether as a result of new information, future events

or otherwise.

10. Other information

The financial information in this statement does not constitute

statutory accounts within the meaning of Section 434 of the

Companies Act 2006. The financial information in respect of the

year ended 31 January 2021 has been extracted from the statutory

accounts, which have been filed with the Registrar of Companies.

The independent auditor's report on those accounts was unqualified

and did not contain a statement under Sections 498(2) or 498(3) of

the Companies Act 2006.

[1] Emergence Capital - State of Frontline Technology, May 2021

https://www.youtube.com/watch?v=0vNwmEdIU18

[2] Emergence Capital - The State of Technology for the Deskless

Workforce

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BIGDCDBBDGBU

(END) Dow Jones Newswires

September 16, 2021 02:00 ET (06:00 GMT)

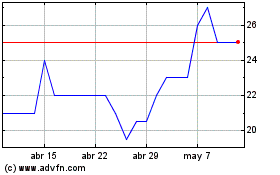

Checkit (LSE:CKT)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Checkit (LSE:CKT)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024