TIDMCGW

RNS Number : 8740T

Chelverton Growth Trust PLC

30 March 2021

Chelverton Growth Trust PLC

LEI: 213800I86P8BAE6UVI83

Half Yearly Report

For the six months ended 28 February 2021

The Directors announce the unaudited Half Yearly Report for the

period 1 September 2020 to 28 February 2021.

Investment Objective and Policy

The Company's objective is to provide capital growth through

investment in companies listed on the Official List and traded on

the Alternative Investment Market ("AIM") with a market

capitalisation at the time of investment of up to GBP50 million,

which the Manager believes to be at a "point of change". The

Company will invest in unquoted investments where it is believed

that there is a likelihood of the shares becoming listed or traded

on AIM or the investee company being sold. Its investment objective

is to increase the net asset value per share at a higher rate than

other quoted smaller company trusts and the MCSI Small Cap UK

Index.

It is the Company's policy not to invest in any listed

investment companies (including listed investment trusts).

At the Annual General Meeting held on 12 December 2019,

Shareholders voted to amend the Company's Investment Policy to

state that the Company:

-- may participate in a CEPS placing (if it were to have one);

-- will liquidate its various other investments when it is felt appropriate to do so;

-- will repay the outstanding Jarvis Loan; and

-- will pay all outstanding liabilities.

Investment Strategy

Investments are selected for the portfolio only after extensive

research which the Investment Manager believes to be key. The whole

process through which equity must pass in order to be included in

the portfolio is very rigorous. Only a security where the

Investment Manager believes that the price will be significantly

higher in the future will pass the selection process. The

Investment Manager believes the key to successful stock selection

is to identify the long-term value of a company's shares and to

have the patience to hold the shares until that value is

appreciated by other investors. Identifying long-term value

involves detailed analysis of a company's earnings prospects over a

five-year time horizon.

The Company's Investment Manager is Chelverton Asset Management

Limited ("CAM"), an investment manager focusing exclusively on

achieving returns for investors based on UK investment analysis of

the highest quality. The founder and employee owners of CAM include

experienced investment professionals with strong investment

performance records who believe rigorous fundamental research

allied to patience is the basis of long-term investment

success.

Chairman's Report

Since my last Chairman's Report, in October last year, there has

been a marked upturn in both the fortunes of our Company and,

through the vaccine roll-out, in the health and welfare of the

Nation.

At the start of the first wave of the Covid-19 pandemic,

approximately a year ago, the stock market suffered a disastrous

period of what can only be described as a "Great Panic". Since the

summer, trading, performance and finally value have gradually

returned to the larger UK companies and this recovery has started

to "trickle down" the market capitalisation scale. As the Company's

portfolio is made up of small AIM traded and unquoted companies

this is the last area to see the signs of the improvement.

I previously stated that we would put forward plans in 2022 on

how we proposed to return value to Shareholders. Although the last

year has effectively been one of "furlough" for the economy, the

Board still feels that it will be able to follow this timetable.

Our problem has been that following the prolonged Referendum,

Brexit Arguments and Free Trade Agreement period ("RBF"), UK

Equities and in particular small, UK centric companies, fell deeply

out of favour. The Board, aware of the significant improvement

potential in the underlying investments, is not prepared to give up

this opportunity for the convenience of resolving the immediate

future of this Company.

I am grateful to Chelverton Asset Management, the Investment

Manager of the Company, who is waiving its management fee in its

entirety and to ISCA, the Company Secretary and Administrator of

the Company, who has waived part of its fee and who has also

assisted at times on the liquidity of the Company. Ian Martin and I

have also waived part of our fees. The collective effect of these

actions means that the expense ratio, whilst still high due to the

very small size of the Company, is much smaller that it would have

been.

Financial Performance

I am pleased to report that over the last six months, the Net

Asset Value ("NAV") per share of the Company has increased by

22.14% from 40.61p to 49.60p. Whilst in general, the performance of

the underlying investments has been encouraging, the sentiment

towards UK publicly quoted equites, and in particular the small

companies and micro-cap value companies, has by no means recovered

to previous historic levels.

Over the same period, the AIM All-share index has risen by

22.74% whilst the Company's comparative index, the MSCI Small Cap

UK index has risen by 19.65%. The share price has increased from

30p to 34p and the shares were therefore trading at a discount of

31.45% at the period end.

Since the period end the NAV per share has increased further and

continues to confirm the Board's view that over the next period

there is potential to see a significant increase in value.

Investments

CEPS is the largest investment in the Company, and is a

diversified AIM traded holding company that owns majority

shareholdings in three subsidiaries and a significant minority in a

fourth. Our Investment Manager and fellow Board member, David

Horner is chairman of the company and has a similar sized

shareholding as the that of our Company. CEPS is being built up by

the organic growth of the underlying companies and by strategic

"bolt-on" acquisitions.

In the last period, there has been some significant positive

developments. Aford Awards, a trophy, medal and engraving business,

has been strengthened by the introduction of a new and ambitious

management team. One of the strategic drivers of this business in

the future will be the acquisition and consolidation of small

businesses operating in the sector from people looking to

retire.

The final loss-making subsidiary has been "rightsized" and has

been merged with a complementary business approximately twice its

size; CEPS has ended up with a 33% shareholding in the enlarged

business. Hickton Group, a fast-growing property services group,

has announced the acquisition of a complementary business,

Millington Lord, from its parent company, which was in

administration.

Whilst all of the CEPS' businesses have been affected by the

various lockdown restrictions, they are all looking forward to

building back over the next few months as things gradually ease and

in so doing, to producing a very strong second six months of the

year. This diversified holding group has proved resilient in the

past 12 months and, with reduction of costs and improved processes,

will drive higher profits once trading returns to normal.

Touchstar has made some positive announcements in the past six

months following its period of reorganisation. Petards is some way

behind, but should, in the course of the next 12 months, evidence

the positive impact of the remedial work it has been undergoing. In

both cases, once trading picks up, operational gearing should drive

profits forward.

On the unquoted side Chelverton Asset Management (CAM), the

manager of this Company, had a strong recovery after the market

collapse in March 2020 and has successfully grown funds under

management and paid an increased dividend. CAM's Employee Share

Option Trust made another tender offer to acquire shares in the

company. This Company sold its remaining shareholding, and I am

very pleased to report that it received GBP339,000 for the 1,000

shares owned which originally cost GBP1,000. On 2 March 2021, the

proceeds were partly used to repay GBP220,000 of the GBP320,000

loan from Jarvis Securities plc. It is our intention to repay the

remaining balance of the loan over the next year from

realisations.

The saga at Main Dental Partners continues with a date for the

appeal being brought by the previous managing director, now set for

September of this year. It is hoped that the result of the original

case is upheld and with all of the surgeries now reopened and

operating under new protocols, the performance of the business will

begin to improve, such that we can look forward to having the loan

stock repaid.

On a continuing brighter note La Salle Education ("La Salle"), a

business involved in supplying schools with the modern mathematics

teaching via the internet has been deeply involved in providing

services to many schools. La Salle raised GBP910,000 at 70p, having

been initially aiming to raise GBP750,000. This means that it can

accelerate its development to take advantage of the opportunities

currently available. The share valuation has been moved up from 50p

to the latest fundraising valuation of 70p.

Pedalling Forth (trading as Velovixen) an internet retailer of

woman's cycling clothing has also enjoyed a continuing uplift in

sales, and it is to be hoped that this will be sustained going

forward.

Outlook

It is impossible to make any kind of forecast at this time other

than to say that gradually the economy and society will move

towards a settled outcome. This new situation will resemble what

the position was before the arrival of Covid-19, however it will

almost certainly not be the same.

The UK economy seems to be poised to "bounce back" once the

Covid restrictions are progressively eased and all parts of the

economy are able to operate without constraint.

In time, the Free Trade Agreement with the EU will be properly

implemented and will be adjusted by agreement, to the benefit of

all parties.

It remains the Board's intention to return funds to

Shareholders. By the same token, the oft repeated annual tenders

can only be carried out in a meaningful and cost-effective manner

when the Company has significant cash resources. At this time, as

explained above, the Company is fully invested and so the ninth

tender offer will be delayed until we believe the share price

better reflects the underlying value of the investments and

significant sums have been realised from one or more

investments.

Kevin Allen

Chairman

29 March 2021

Interim Management Report

The important events that have occurred during the period under

review and the key factors influencing the Financial Statements are

set out in the Chairman's Report. The Board considers that the

principal risks and uncertainties facing the Company remain the

same as those disclosed in the Annual Report for the year ended 31

August 2020 on pages 15 and 16 and pages 56 and 57. These risks

include, but are not limited to, market risk, discount volatility

risk, regulatory risk, financial risk and liquidity risk.

Responsibility S tatement

The Directors are responsible for preparing the unaudited Half

Yearly Report in accordance with applicable law and regulations.

The Directors confirm that to the best of their knowledge:

The condensed set of Financial Statements for the six months to

28 February 2021, has been prepared in accordance with FRS 104

"Interim Financial Reporting", gives a fair view of the assets,

liabilities, financial position and profit of the Company; and

this Half Yearly Report includes a fair review of the

information required by;

rule 4.2.7R of the Disclosure and Transparency Rules being an

indication of important events that have occurred during the first

six months of the financial year and their impact on the condensed

set of Financial Statements; and a description of the principal

risks and uncertainties for the remaining six months of the year;

and

rule 4.2.8R of the Disclosure and Transparency Rules, being

related party transactions that have taken place in the first six

months of the current financial year and that have materially

affected the financial position or performance of the Company

during that period; and any changes in the related party

transactions described in the last Annual Report that could do

so.

This Half Yearly Report was approved by the Board of Directors

on 29 March 2021 and the above Responsibility Statement was signed

on its behalf by:

Kevin Allen

Chairman

Portfolio Review

as at 28 February 2021

The Company's portfolio is set out below.

Investment Sector Valuation % of

GBP'000 total

portfolio

AIM Traded

CEPS Support Services 1,316 50.6

Trading holding company for a number of

companies supplying services and products

Petards Group Support Services 250 9.6

Development, provision and maintenance

of advance security systems and related

services

Technology Hardware &

Touchstar Equipment 552 21.3

Software systems for warehousing and distribution

Universe Group Support Services 21 0.8

Provision of credit fraud prevention, loyalty

and retail systems

Fully Listed

Zenith Energy Oil & Gas Producers 25 1.0

International energy production and exploration

company

Nasdaq Traded

Touchpoint Group Support Services

Holdings - -

Provider of mobile satellite communications

equipment and airtime

---------- ----------

2,164 83.3

Unquoted

La Salle Education Support Services 182 7.0

A UK based company dedicated to improving

mathematics education

P edalling Forth General Retailers 240 9.2

Internet retailer of cycling clothing for

women

Healthcare Equipment

Redecol & Services 12 0.5

A medical device company focused on the

development of asthma monitoring

Portfolio Valuation 2,598 100.0

---------- ----------

Portfolio Holdings

as at 28 February 2021

28 February 2021 31 August 2020

Valuation % of total Valuation % of total

Investment GBP'000 portfolio GBP'000 portfolio

CEPS 1,316 50.6 1,113 46.5

Touchstar 552 21.3 459 19.2

Petards Group 250 9.6 150 6.3

Pedalling Forth 240 9.2 240 10.0

La Salle Education 182 7.0 130 5.4

Zenith Energy 25 1.0 12 0.5

Universe Group 21 0.8 34 1.4

Redecol 12 0.5 12 0.5

Touchpoint Group Holdings - - - -

Chelverton Asset Management

Holdings* - - 245 10.2

---------- ----------- ---------- -----------

Total 2,598 100.0 2,395 100.0

---------- ----------- ---------- -----------

* Sold during the period

Portfolio breakdown by sector and by index

as at 28 February 2021

Sector distribution % of total

Support Services 68.0

Technology Hardware & Equipment 21.3

General Retailers 9.2

Oil & Gas Producers 1.0

Healthcare Equipment & Services 0.5

Index distribution % of total

AIM 82.3

Unquoted 16.7

Fully listed 1.0

Income Statement (unaudited)

for the six months to 28 February 2021

Six months to Year to Six months to

28 February 2021 31 August 2020 29 February 2020

(unaudited) (audited) (unaudited)

Revenue Capital Total Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Gains/(losses)

on investments

at fair value

(note 4) - 542 542 - (102) (102) - 159 159

Income (note

2) 9 - 9 39 - 39 24 - 24

Investment

management

fee* - - - (4) (14) (18) (3) (8) (11)

Other expenses (56) (5) (61) (128) (19) (147) (71) (12) (83)

--------- -------- -------- --------- --------- --------- --------- -------- --------

Net (loss)/

return on

ordinary

activities

before taxation (47) 537 490 (93) (135) (228) (50) 139 89

Taxation

on ordinary

activities - - - - - - - - -

--------- -------- -------- --------- --------- --------- --------- -------- --------

Net (loss)/return

on ordinary

activities

after taxation (47) 537 490 (93) (135) (228) (50) 139 89

Revenue Capital Total Revenue Capital Total Revenue Capital Total

pence pence pence pence pence pence pence pence pence

(Loss)/return

per Ordinary

share** (0.86) 9.83 8.97 (1.70) (2.47) (4.17) (0.91) 2.54 1.63

The total column of this statement is the Statement of Total

Comprehensive Income of the Company prepared in accordance with

Financial Reporting Standards ("FRS"). The supplementary revenue

return and capital return columns are prepared in accordance with

the Statement of Recommended Practice issued in October 2019 by the

Association of Investment Companies ("AIC SORP").

All revenue and capital items in the above statement derive from

continuing operations.

The revenue column of the Income Statement includes all income

and expenses. The capital column includes the realised and

unrealised profit or loss on investments and 75% of the management

fee and finance costs charged to capital.

* With effect from 1 November 2019, the Investment Management

fee was reduced from 1.0% per annum of gross assets to 0.5% per

annum of gross assets. With effect from 1 September 2020, the

Investment Manager agreed to waive the entitlement to a fee for a

period of six months through to 28 February 2021.

** The return per Ordinary share is based on 5,460,301 (31

August 2020: 5,460,301; 29 February 2020: 5,460,301) shares, being

the weighted average number of shares in issue during the

period.

Statement of Changes in Equity (unaudited)

for the six months to 28 February 2021

Called Capital

up share Special Capital redemption Revenue

capital reserve* reserve reserve reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Six months to 28 February 2021

1 September 2020 55 787 976 134 266 2,218

Net return/( loss)

after taxation for

the period - - 537 - (47) 490

---------- ----------- ---------- ------------ ---------- ----------

28 February 2021 55 787 1,513 134 219 2,708

---------- ----------- ---------- ------------ ---------- ----------

Year to 31 August 2020

1 September 2019 55 787 1,111 134 359 2,446

Net loss after taxation

for the year - - (135) - (93) (228)

---------- ----------- ---------- ------------ ---------- ----------

31 August 2020 55 787 976 134 266 2,218

---------- ----------- ---------- ------------ ---------- ----------

Six months to 29 February 2020

1 September 2019 55 787 1,111 134 359 2,446

Net return/( loss)

after taxation for

the period - - 139 - (50) 89

---------- ----------- ---------- ------------ ---------- ----------

29 February 2020 55 787 1,250 134 309 2,535

---------- ----------- ---------- ------------ ---------- ----------

*The Special reserve was created by the cancellation of the

share premium account by order of the High Court on 20 January

2016.

Distributable reserves: The Special reserve and Revenue reserve

can be used for the repurchase of the Company ' s Ordinary

shares.

Statement of Financial Position (unaudited)

as at 28 February 2021

As at 28 As at 31 August As at 29 February

February 2021 2020 2020

(unaudited) (audited) (unaudited)

GBP'000 GBP'000 GBP'000

Fixed assets

Investments at fair

value

(note 4) 2,598 2,395 2,967

Current assets

Debtors 142 150 150

Cash and cash

equivalents 348 39 42

------------------------------ -------------------------------- ----------------------------------

490 189 192

------------------------------ -------------------------------- ----------------------------------

Creditors - amounts falling due within one year

Creditors (60) (46) (24)

Short-term loans

(note 5) (320) (320) (600)

------------------------------ -------------------------------- ----------------------------------

(380) (366) (624)

------------------------------ -------------------------------- ----------------------------------

Net current

assets/(liabilities) 110 (177) (432)

------------------------------ -------------------------------- ----------------------------------

Net assets 2,708 2,218 2,535

------------------------------ -------------------------------- ----------------------------------

Share capital and reserves

Called up share

capital 55 55 55

Special reserve 787 787 787

Capital reserve 1,513 976 1,250

Capital redemption

reserve 134 134 134

Revenue reserve 219 266 309

------------------------------ -------------------------------- ----------------------------------

Equity S hareholders'

funds 2,708 2,218 2,535

------------------------------ -------------------------------- ----------------------------------

Net asset value per

Ordinary

share (note 6) 49.60p 40.61p 46.43p

------------------------------ -------------------------------- ----------------------------------

Statement of Cash Flows (unaudited)

for the six months to 28 February 2021

Six months

to Year to Six months

28 February 31 August to 29 February

2021 2020 2020

(unaudited) (audited) (unaudited)

GBP' 000 GBP' 000 GBP' 000

Cash flows used in operating activities

Net return/(loss) on ordinary

activities 490 (228) 89

Adjustment for:

Net capital (return)/loss (537) 135 (139)

Expenses charged to capital (5) (33) (20)

Interest paid 6 26 16

Increase/(decrease) in creditors 14 14 (8)

Decrease/(increase) in debtors 8 (5) (5)

Cash used in operations (24) (91) (67)

--------------- ------------- -------------------

Cash flows from investing activities

Proceeds from sale of investments 339 311 -

--------------- ------------- -------------------

Net cash from investing

activities 339 311 -

--------------- ------------- -------------------

Cash flows used in financing activities

Capital repayment of loan - (280) -

Interest paid (6) (26) (16)

--------------- ------------- -------------------

Net cash used in financing

activities (6) (306) (16)

--------------- ------------- -------------------

Net increase/(decrease)

in cash 309 (86) (83)

--------------- ------------- -------------------

Cash at the beginning of

the period 39 125 125

--------------- ------------- -------------------

Cash at the end of the period 348 39 42

--------------- ------------- -------------------

1 Accounting Policies

a) Statement of compliance

The Company's Financial Statements for the period ended 28

February 2021 have been prepared under UK Generally Accepted

Accounting Practice (UK GAAP) and the Statement of Recommended

Practice, 'Financial Statements of Investment Trust Companies and

Venture Capital Trusts' issued in October 2019 ('the SORP') by the

Association of Investment Companies.

The Financial Statements have been prepared in accordance with

the accounting policies set out in the statutory accounts for the

year ended 31 August 2020.

b) Financial information

The financial information contained in this report does not

constitute statutory accounts as defined in Section 434 of the

Companies Act 2006. The financial information for the period ended

28 February 2021 and 29 February 2020 have not been audited or

reviewed by the Company's Auditor pursuant to the Auditing

Practices Board guidance on such reviews. The information for the

year to 31 August 2020 has been extracted from the latest published

Annual Report and Financial Statements, which have been lodged with

the Registrar of Companies, contained an unqualified auditors'

report and did not contain a statement required under Section 498

(2) or (3) of the Companies Act 2006.

c) Going concern

The Company's assets consist mainly of equity shares in

companies which, in most circumstances are realisable within a

short timescale. The Directors believe that the Company has

adequate resources to continue in operational existence for the

foreseeable future. Accordingly, they continue to adopt the going

concern basis in preparing the accounts. In assessing the Company's

ability to continue as a going concern, the Board has fully

considered the impact of the current Covid-19 pandemic.

2 Income

Six months Year to Six months

to to

28 February 31 August 29 February

2021 2020 2020

GBP'000 GBP'000 GBP'000

Income from investments

UK net dividend income 14 26 16

Loan stock interest (5) 13 8

Total income 9 39 24

------------ --------------- -----------------

3 Taxation

The tax charge for the six months to 28 February 2021 is nil

(year to 31 August 2020: nil; six months to 29 February 2020:

nil).

The Company has an effective tax rate of 0% for the year ending

31 August 2021. The estimated effective tax rate is 0% as

investment gains are exempt from tax owing to the Company's status

as an Investment Trust and there is expected to be an excess of

management expenses over taxable income.

4 Investments

28 31 29

February August February

Fully AIM 2021 2020 2020

listed quoted Unquoted NASDAQ Total Total Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Opening book

cost 118 3,696 773 166 4,753 5,293 5,293

Opening

investment

holding losses (106) (1,940) (146) (166) (2,358) (2,485) (2,485)

------------ ----------------------- -------------- ------------ -------------- ------------- --------------

12 1,756 627 - 2,395 2,808 2,808

Movements in

the period:

Sales proceeds - - (339) - (339) (311) -

Gains/|(losses)

on sales - - 338 - 338 (229) -

Movement in

investment

holding losses 13 383 (192) - 204 127 159

------------ ----------------------- -------------- ------------ -------------- -------------

Closing

valuation 25 2,139 434 - 2,598 2,395 2,967

------------ ----------------------- -------------- ------------ -------------- ------------- --------------

Closing book

cost 118 3,696 772 166 4,752 4,753 5,293

Closing

investment

holding losses (93) (1,557) (338) (166) (2,154) (2,358) (2,326)

------------

Closing

valuation 25 2,139 434 - 2,598 2,395 2,967

------------

Analysis of capital gains

and losses

Realised

gains/(losses)

on sales - - 338 - 338 (229) -

Movement in

fair value

of investments 13 383 (192) - 204 127 159

------------ ----------------------- -------------- ------------ -------------- ------------- --------------

13 383 146 - 542 (102) 159

------------ ----------------------- -------------- ------------ -------------- ------------- --------------

Fair value hierarchy

In accordance with FRS 102 and FRS 104 the Company must disclose

the fair value hierarchy of financial instruments.

The fair value hierarchy consists of the following three classifications:

Level 1 - Valued using quoted prices in active markets for

identical assets or liabilities. This is usually the bid price.

Level 2 - Valued by reference to valuation techniques using

observable inputs other than quoted prices which are included

within Level 1.

Level 3 - Valued by reference to valuation techniques using

inputs that are not based on observable market data.

Details of the Company's financial instruments are shown in the

Portfolio Review including financial instruments which fall into

Level 3 shown under the section heading "Unquoted". A summary

reconciliation of the fair value movements of Level 3 investments

is shown in the table above.

Financial assets at fair value through profit or loss;

Level 1 Level 2 Level 3 Total

GBP'000 GBP'000 GBP'000 GBP'000

At 28 February

2021

Investments 2,164 - 434 2,598

-------- -------- -------- --------

Total 2,164 - 434 2,598

-------- -------- -------- --------

At 31 August 2020

Investments 1,768 - 627 2,395

-------- -------- -------- --------

Total 1,768 - 627 2,395

-------- -------- -------- --------

At 29 February

2020

Investments 2,327 - 640 2,967

-------- -------- -------- --------

Total 2,327 - 640 2,967

-------- -------- -------- --------

5 Short term loans

On 4 June 2018, the Company entered in to a GBP600,000 loan

agreement with Jarvis Securities plc. Interest is payable monthly

in arrears at the rate of 4.5% above the Bank of England base

rate.

On 11 May 2020, following the disposal of MTI Wireless Edge, the

Company repaid GBP280,000 of its GBP600,000 loan from Jarvis

Securities plc leaving a balance of GBP320,000 outstanding at the

period end. As disclosed in note 8 a further GBP220,000 was repaid

on 2 March 2021.

6 Net asset value

The basic net asset value per Ordinary share is based on net

assets of GBP2,708,000 (31 August 2020: GBP2,218,000; 29 February

2020: GBP2,535,000) and on 5,460,301 Ordinary shares (31 August

2020: 5,460,301; 29 February 2020: 5,460,301) being the number of

Ordinary shares in issue at the period end. No shares are held in

Treasury.

7 Related party transactions

Under the terms of the agreement dated 28 June 2001, the Company

has appointed Chelverton Asset Management Limited to be the

Investment Manager. Mr Horner, a Director of the Company, is also a

director of Chelverton Asset Management Limited and chairman of

CEPS in which the Company holds an investment as set out above. Mr

Martin is the chairman of Touchstar in which the Company holds an

investment as set out above.

At 28 February 2021, there was GBPnil (31 August 2020: GBP2,200;

29 February 2020: GBP1,300) payable to the Investment Manager.

The three Directors also have individual holdings in Chelverton

Asset Management Holdings, a company which has Mr Horner as a

director and in which the Company had a direct holding until 26

February 2021. The Directors' holdings are detailed below.

Percentage of

Ordinary shares Ordinary shares

held held

GBP' 000 %

K J Allen 1 1.00

D A Horner* 55 55.25

I P Martin 2 2.00

* Director and connected persons total holdings.

8 Post balance sheet events

On 2 March 2021, following the disposal of its holding in

Chelverton Asset Management Holdings, the Company repaid GBP220,000

of its loan from Jarvis Securities plc leaving a balance of

GBP100,000 outstanding.

Information about the Company can be obtained at the Investment

Manager's website at www.chelvertonam.com. Neither the contents of

the manager's website nor the contents of any website accessible

from hyperlinks on this announcement (or any other website

incorporated into, or forms part of this announcement.

An investment company as defined under Section 833 of the Companies Act 2006.

REGISTERED IN ENGLAND No 02989519

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BRGDXCUDDGBC

(END) Dow Jones Newswires

March 30, 2021 02:00 ET (06:00 GMT)

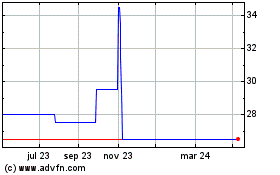

Chelverton Growth (LSE:CGW)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Chelverton Growth (LSE:CGW)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024