TIDMCHF

RNS Number : 0463N

Chesterfield Resources PLC

27 September 2021

Chesterfield Resources PLC / EPIC: CHF / Market: LSE / Sector:

Mining

27 September 2021

CHESTERFIELD RESOURCES PLC

("Chesterfield" or the "Company")

Interim Results

Chesterfield Resources PLC, the LSE listed mineral exploration

company with projects in Cyprus and Canada, is pleased to announce

its interim results for the six months ended 30 June 2021.

Chairman's review of year to date

2021 thus far has been another busy period for our company, and

we anticipate that the next six months will bring further

significant news and developments.

Major acquisition in Labrador

The highlight for the period was in June when with the

acquisition of a large and prospective new copper exploration

project in Labrador Canada, called Adeline. Copper is the basic

building block of the decarbonisation/electrification revolution

that is unfolding around us. If global emission targets are to be

met then the mining industry needs to discover considerable new

quantities of copper, by some estimates around 10 million tonnes by

2030. This is a mega-trend for our industry. Copper prices are

likely to be robust over the next decade and many large mining

companies are now keen to increase their exposure to copper.

Our new Adeline copper project is highly unusual since it covers

an entire sedimentary basin, some 44km long. There are few such

basins globally and they are known for yielding large copper

discoveries, in locations such as Zambia, Michigan and Siberia.

Should we make a discovery, or even a partial discovery, our

strategy is to attract the attention of one of the major mining

groups, probably via an earn-in deal. This, we expect, would

increase the value of our company considerably.

The project certainly looks promising. It covers nearly 300

KM(2,) which is over three times the size of our project in Cyprus.

A considerable amount of exploration work has been carried out on

the basin over the last 60 years by various groups, including field

work such as mapping and sampling, as well as high quality aerial

surveys and ground geophysics. Around 250 copper showings have been

identified in the basin, at surface or very close to surface. We

own 100% of the project and view it as a potential game-changer for

our company.

Exploration opportunity

The exploration opportunity for the project is that despite the

rich inventory of data, very little drilling has been done on the

project, because there is no road access. Some drilling was

conducted around ten years ago, but is was rather speculative. Our

approach is to re-analyse the large volume of data using modern

technology and improved understanding of this type of geology.

The analysis programme is now almost complete and has been used

to direct a helicopter-supported field programme of additional

mapping and sampling of specific target areas within the basin. To

save time during the warm summer season, we commenced the analysis

and field programme immediately on completion of the transaction.

As a company we like to move things forward quickly.

The vendor of the project was Altius Minerals, a project

generation and royalty company based in Newfoundland. Altius is

highly regarded in Canada. It has now not only become a strategic

shareholder in Chesterfield, but also an operational partner. Its

team has assisted with much of the data preparation and also in

rapidly organising the field programme. In addition, Altius has

also helped bring together a first-class team of specialists and

local experts for the project. The principal objective of the field

work was to design a diamond drill programme for the winter (when

it is easier to access drill locations on the frozen lakes). By

managing to move very quickly on the data programme and field

programme this summer, we have saved a year of the project roll-out

and so potentially provide a much quicker pay-back for our

shareholders.

Exploration boom in Labrador

Not only is the project large, data-rich and highly prospective,

it is also well located. The province of Labrador was recently

voted the eighth best location in the world for mining investment

by the Fraser Institute. At a time when copper explorers are being

driven to increasingly risky corners of the globe, we have acquired

a project that is in one of the most mining-friendly and best

organised jurisdictions in the world. The project is only around 20

minutes helicopter flight from the service hub of Goose Bay. It is

on a similar latitude to the north of England. The lowest average

winder temperatures are about -12 degrees, which are certainly very

manageable for exploration and mining.

Labrador is currently undergoing something of an exploration

boom in Canada, with a number of notable discoveries pushing up the

equity value of listed junior explorers operating there. Next month

we will be starting a programme of investor relations and share

promotion in Canada. We are expecting that the combination of a

large project in Labrador, copper, Altius as a partner and our

rapid programme roll-out will attract the attention of the Canadian

market, which is very knowledgeable about the mining sector. We

also have the advantage that our Director of Exploration is Dr Neil

O'Brien, a Canadian who is based near Toronto. As the former Head

of Exploration for Lundin Mining, Neil is a well-known and

respected figure in Canadian mining circles. We are expecting that

a focus on the Canadian market will provide a whole new base of

investor interest in our shares which we feel is considerably

undervalued. We are also weighing the possibility of a secondary

listing in Canada next year.

Cyprus programme extended

In Cyprus we commenced a new diamond drilling campaign which has

been extended and is still in progress. We have to report that

there is also a log jam in assay labs. The increase in metals

prices over the last year has led to a surge in exploration

drilling, much of which has been compressed into a short window due

to Covid restrictions. With our extended drill programme and delays

at the lab, realistically our Cyprus drill results are going to be

pushed back to November. We will be providing further updates on

our operations there shortly. However, I pleased to report report

that we have just completed our field program in Labrador, and we

will start to bring results and news from that work programme soon

on specific targets there.

Financially the company is in good shape, having topped up our

tanks with a placement in July. We welcome a number of new

investors to our register and also First Equity as a new joint

broker. We have an exciting six months ahead of us with new

corporate and operational developments in planning. We look forward

to providing value growth for our shareholders.

Financials

As is to be expected with an exploration company, for the

six-month period ended 30 June 2021 the Group is reporting a

pre-tax loss of GBP433,538 (six months ended 30 June 2020:

GBP257,465). The Group's net cash balance as at 30 June 2021 was

GBP1,504,973 (six months ended 30 June 2020: GBP316,478).

Responsibility Statement

We confirm that to the best of our knowledge:

-- the interim financial statements have been prepared in

accordance with International Accounting Standards 34, Interim

Financial Reporting, as adopted by the EU;

-- give a true and fair view of the assets, liabilities,

financial position and loss of the Company;

-- the Interim report includes a fair review of the information

required by DTR 4.2.7R of the Disclosure and Transparency Rules,

being an indication of important events that have occurred during

the first six months of the financial year and their impact on the

set of interim financial statements; and a description of the

principal risks and uncertainties for the remaining six months of

the year; and

-- The Interim report includes a fair review of the information

required by DTR 4.2.8R of the Disclosure and Transparency Rules,

being the information required on related party transactions.

The interim report was approved by the Board of Directors and

the above responsibility statement was signed on its behalf by:

Martin French

Executive Chairman

25 September 2021

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014 until the release of this

announcement.

For further information please visit

www.chesterfieldresourcesplc.com or contact:

Chesterfield Resources Martin French, Executive Tel: +44 (0) 7901

plc Chairman 552277

Panmure Gordon (UK) John Prior & Hugh Rich Tel: +44 (0) 207 886

Limited (Broker) 2500

-------------------------- ----------------------

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

6 months 6 months

to 30 June to 30 June

2021 Unaudited 2020 Unaudited

Notes GBP GBP

------------------------------------------------ ------- ----------------- -----------------

Continuing operations

Revenue - -

Administration expenses (433,538) (257,465)

Operating loss (433,538) (257,465)

------------------------------------------------ ------- ----------------- -----------------

Income tax - -

------------------------------------------------ ------- ----------------- -----------------

Loss for the period (433,538) (257,465)

------------------------------------------------ ------- ----------------- -----------------

Other comprehensive income

Items that may be reclassified to profit

or loss

Currency translation differences (75,349) 78,387

Total comprehensive income for the period (508,887) (179,078)

------------------------------------------------ ------- ----------------- -----------------

Total comprehensive income for the period

attributable to equity holders (508,887) (179,078)

Earnings per share from continuing operations

attributable to the equity owners of the

parent

------------------------------------------------ ------- ----------------- -----------------

Basic and diluted 5 (0.425)p (0.416)p

------------------------------------------------ ------- ----------------- -----------------

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at As at As at

30 June 31 December 30 June

2021 Unaudited 2020 Audited 2020 Unaudited

Notes GBP GBP GBP

------------------------------------ --------- ----------------- --------------- -----------------

Non-Current Assets

Property, plant and equipment 29,160 12,707 15,056

Intangible assets 6 2,847,310 2,433,876 1,913,612

------------------------------------ --------- ----------------- --------------- -----------------

2,876,470 2,446,583 1,928,668

------------------------------------ --------- ----------------- --------------- -----------------

Current Assets

Trade and other receivables 154,325 128,498 83,148

Cash and cash equivalents 1,504,973 2,438,856 316,478

------------------------------------ --------- ----------------- --------------- -----------------

1,659,298 2,567,354 399,626

------------------------------------ --------- ----------------- --------------- -----------------

Total Assets 4,535,768 5,013,937 2,328,294

------------------------------------ --------- ----------------- --------------- -----------------

Non-Current Liabilities

Deferred tax liabilities (127,451) (127,450) (127,450)

------------------------------------ --------- ----------------- --------------- -----------------

Current Liabilities

Trade and other payables (162,912) (200,619) (41,895)

Total Liabilities (290,363) (328,069) (169,345)

------------------------------------ --------- ----------------- --------------- -----------------

Net Assets 4,245,405 4,685,868 2,158,949

------------------------------------ --------- ----------------- --------------- -----------------

Capital and Reserves Attributable

to

Equity Holders of the Company

Share capital 199,911 199,711 159,933

Share premium 6,492,731 6,482,931 3,534,597

Other reserves 184,851 201,776 54,026

Retained losses (2,632,088) (2,198,550) (1,589,607)

------------------------------------ --------- ----------------- --------------- -----------------

Total Equity 4,245,405 4,685,868 2,158,949

------------------------------------ --------- ----------------- --------------- -----------------

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN SHAREHOLDERS'

EQUITY

Attributable to owners

of the Parent

------- ---------- --------------------------------------- -----------

Share Share Other Retained Total

capital premium reserves losses equity

Note GBP GBP GBP GBP GBP

---------- -----------

Balance as at 1 January 2020 159,933 3,534,597 (20,003) (1,336,500) 2,338,027

-------------------------------------------- ---------- ----------- ----------- ------------- -----------

Loss for the period - - - (257,465) (257,465)

-------------------------------------------- ---------- ----------- ----------- ------------- -----------

Other comprehensive income

for the year

Items that may be subsequently

reclassified to profit or

loss

----------------------------------- ------- ---------- ----------- ----------- ------------- -----------

Currency translation differences - - 78,387 - 78,387

-------------------------------------------- ---------- ----------- ----------- ------------- -----------

Total comprehensive income

for the year - - 78,387 (257,465) (179,078)

-------------------------------------------- ---------- ----------- ----------- ------------- -----------

Expiry of options - - (4,358) 4,358 -

-------------------------------------------- ---------- ----------- ----------- ------------- -----------

Total transactions with owners,

recognised in equity - - (4,358) 4,358 -

-------------------------------------------- ---------- ----------- ----------- ------------- -----------

Balance as at 30 June 2020 159,933 3,534,597 54,026 (1,589,607) 2,158,949

-------------------------------------------- ---------- ----------- ----------- ------------- -----------

Balance as at 1 January 2021 199,711 6,482,931 201,776 (2,198,550) 4,685,868

-------------------------------------------- ---------- ----------- ----------- ------------- -----------

Loss for the period - - - (433,538) (433,538)

-------------------------------------------- ---------- ----------- ----------- ------------- -----------

Other comprehensive income

for the year

Items that may be subsequently

reclassified to profit or

loss

----------------------------------- ------- ---------- ----------- ----------- ------------- -----------

Currency translation differences - - (75,349) - (75,349)

-------------------------------------------- ---------- ----------- ----------- ------------- -----------

Total comprehensive income

for the year - - (75,349) (433,538) (508,887)

-------------------------------------------- ---------- ----------- ----------- ------------- -----------

Grant of options - - 58,424 - 58,424

-------------------------------------------- ---------- ----------- ----------- ------------- -----------

Option exercise 200 9,800 - - 10,000

-------------------------------------------- ---------- ----------- ----------- ------------- -----------

Total transactions with owners,

recognised in equity 200 9,800 58,424 - 68,424

-------------------------------------------- ---------- ----------- ----------- ------------- -----------

Balance as at 30 June 2021 199,911 6,492,731 184,851 (2,632,088) 4,245,405

-------------------------------------------- ---------- ----------- ----------- ------------- -----------

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

6 months 6 months

to 30 June to 30 June

2021 2020 Unaudited

Notes Unaudited GBP

GBP

-------------------------------------------- --------- ------------- -----------------

Cash flows from operating activities

Loss before taxation (433,538) (257,465)

Adjustments for:

Share based payments 58,424 -

Depreciation 1,147 6,703

Increase/(decrease) in trade and other

receivables 10,473 6,348

Increase in trade and other payables (74,008) (27,061)

Foreign exchange 5,973 6,185

Net cash used in operations (431,529) (265,290)

--------------------------------------------- --------- ------------- -----------------

Cash flows from investing activities

Purchase of property, plant & equipment (18,115) -

Exploration and evaluation activities 6 (494,239) (166,828)

--------------------------------------------- --------- ------------- -----------------

Net cash used in investing activities (512,354) (166,828)

--------------------------------------------- --------- ------------- -----------------

Cash flows from financing activities

Option exercise 10,000 -

-------------------------------------------- --------- ------------- -----------------

Net cash generated from financing

activities 10,000 -

-------------------------------------------- --------- ------------- -----------------

Net decrease in cash and cash equivalents (933,883) (432,118)

Cash and cash equivalents at beginning

of period 2,438,856 748,596

Cash and cash equivalents at end of

period 1,504,973 316,478

--------------------------------------------- --------- ------------- -----------------

NOTES TO THE INTERIM FINANCIAL STATEMENTS

1. General Information

Chesterfield Resources plc is a minerals company exploring

primarily for copper and gold in Cyprus and listed on the Standard

segment of the Main Market of the London Stock Exchange.

The Company is domiciled in the United Kingdom and incorporated

and registered in England and Wales, with registration number

10545738. The Company's registered office is Suite 1, 15 Ingestre

Place, London W1F 0DU, United Kingdom

2. Basis of Preparation

The condensed interim financial statements have been prepared in

accordance with IAS 34 "Interim Financial Statements" as adopted by

the United Kingdom and the Disclosure and Transparency Rules of the

UK Financial Conduct Authority. The condensed interim financial

statements should be read in conjunction with the annual financial

statements for the period ended 31 December 2020, which have been

prepared in accordance with International Financial Reporting

Standards (IFRS) as adopted by the United Kingdom.

The interim financial information set out above does not

constitute statutory accounts within the meaning of the Companies

Act 2006. It has been prepared on a going concern basis in

accordance with the recognition and measurement criteria of

International Financial Reporting Standards (IFRS) as adopted by

the United Kingdom.

Statutory financial statements for the period ended 31 December

2020 were approved by the Board of Directors on 29 April 2021 and

delivered to the Registrar of Companies. The report of the auditors

on those financial statements was unqualified with an emphasis of

matter paragraph in respect of the impact of COVID-19. The

condensed interim financial statements are unaudited and have not

been reviewed by the Company's auditor.

Going concern

The Group is managing the impact of the COVID-19 pandemic on its

business and the uncertainty it creates. The Company has taken

swift pre-emptive action to ensure the safety of its employees,

contractors and supply chain. This includes a full financial and

strategic review designed to safeguard and ensure the stability and

longevity of Chesterfield's activities for the benefit for all its

stakeholders.

The Directors, having made appropriate enquiries, consider that

adequate resources exist for the Company to continue in operational

existence for the foreseeable future and that, therefore, it is

appropriate to adopt the going concern basis in preparing the

condensed interim financial statements for the period ended 30 June

2021. Further to this, the Directors believe the Group is in a

strong position to endure ongoing uncertainty from COVID-19 however

the risk remains for short term market volatility and uncertain

long-term impacts which may affect the Groups ability to raise

further funding in the future.

Risks and uncertainties

The Board continuously assesses and monitors the key risks of

the business. The key risks that could affect the Company's medium

term performance and the factors that mitigate those risks have not

substantially changed from those set out in the Company's 2020

Annual Report and Financial Statements, a copy of which is

available on the Company's website:

www.chesterfieldresourcesplc.com . The key financial risks are

liquidity risk, credit risk, interest rate risk and fair value

estimation.

Critical accounting estimates

The preparation of condensed interim financial statements

requires management to make estimates and assumptions that affect

the reported amounts of assets and liabilities at the end of the

reporting period. Significant items subject to such estimates are

set out in Note 2 of the Company's 2020 Annual Report and Financial

Statements. The nature and amounts of such estimates have not

changed significantly during the interim period.

3. Accounting Policies

Except as described below, the same accounting policies,

presentation and methods of computation have been followed in these

condensed interim financial statements as were applied in the

preparation of the Company's annual financial statements for the

period ended 31 December 2021.

3.1 Changes in accounting policy and disclosures

(a) New and amended standards mandatory for the first time for

the financial year beginning 1 January 2021

The International Accounting Standards Board (IASB) issued

various amendments and revisions to International Financial

Reporting Standards and IFRIC interpretations. The amendments and

revisions were applicable for the period ended 30 June 2021 but did

not result in any material changes to the financial statements of

the Group or Company.

(b) New standards, amendments and Interpretations in issue but

not yet effective or not yet endorsed and not early adopted

The standards and interpretations that are issued, but not yet

effective, up to the date of issuance of the condensed interim

financial statements are listed below. The Company intends to adopt

these standards, if applicable when they become effective.

Standard Impact on initial application Effective date

--------------------- ----------------------------------- ----------------

IFRS 3 Reference to Conceptual Framework 1 January 2022

----------------------------------- ----------------

IAS 37 Onerous contracts 1 January 2022

----------------------------------- ----------------

IAS 16 Proceeds before intended use 1 January 2022

----------------------------------- ----------------

Annual improvements 2018-2020 Cycle 1 January 2022

----------------------------------- ----------------

IAS 8 Accounting estimates 1 January 2023

----------------------------------- ----------------

IAS 1 Classification of Liabilities 1 January 2023

as Current or Non-Current.

----------------------------------- ----------------

*Not yet endorsed by the EU.

The Company is evaluating the impact of the new and amended

standards above. The Directors believe that these new and amended

standards are not expected to have a material impact on the

Company's results or shareholders' funds.

4. Dividends

No dividend has been declared or paid by the Company during the

six months ended 30 June 2020 (six months ended 30 June 2020:

GBPnil).

5. Loss per Share

The calculation of loss per share is based on a retained loss of

GBP433,538 for the six months ended 30 June 2021 ( six months ended

30 June 2020: GBP 257,465 ) and the weighted average number of

shares in issue in the period ended 30 June 2021 of 102,095,642 (

six months ended 30 June 2020: 61,933,334 ).

No diluted earnings per share is presented for the six months

ended 30 June 2021 or six months ended 30 June 2020 as the effect

on the exercise of share options would be to decrease the loss per

share.

6. Intangible fixed assets

The movement in capitalised exploration and evaluation costs

during the period was as follows:

Exploration & Evaluation at Cost and Net Book Value GBP

------------------------------------------------------ -----------

Balance as at 1 January 2021 2,433,876

Additions 494,239

Foreign exchange (80,805)

As at 30 June 2021 2,847,310

------------------------------------------------------ -----------

7. Events after the balance sheet date

On 1 July 2021 the Company acquired 87986 Newfoundland and

Labrador Inc ("the Acquisition"). The consideration for the

Acquisition was satisfied by the issue 10,089,199 ordinary shares

at a price of 10 pence per share and warrants over 11,100,000

Ordinary Shares, exercisable for three years from completion at an

exercise price of GBP0.20 per new Ordinary Shares.

On 2 July 2021 the Company issued 8,000,000 new ordinary shares

in the capital of the Company at a placing price of 10 pence per

share for a total cash value of GBP800,000.

On 2 July 2021 the Company issued 2,400,000 options which vest

immediately, expire in 5 years and with an exercise price of 12

pence per share.

On 8 September 2021 the Company issued 120,000 ordinary shares

for the exercise of options at a price of 5 pence per share for a

total cash value of GBP6,000.

8. Approval of interim financial statements

The Condensed interim financial statements were approved by the

Board of Directors on 26 September 2021.

**ENDS**

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR GIGDCUGDDGBR

(END) Dow Jones Newswires

September 27, 2021 04:15 ET (08:15 GMT)

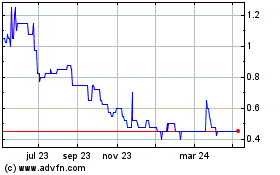

Chesterfield Resources (LSE:CHF)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

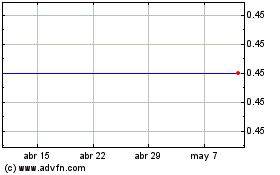

Chesterfield Resources (LSE:CHF)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024