TIDMCHF

RNS Number : 9978D

Chesterfield Resources PLC

02 July 2021

NOT FOR PUBLICATION, DISTRIBUTION OR RELEASE DIRECTLY OR

INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES OF

AMERICA, CANADA, AUSTRALIA, NEW ZEALAND, THE REPUBLIC OF SOUTH

AFRICA OR JAPAN OR IN ANY OTHER JURISDICTION IN WHICH OFFERS OF

SALES WOULD BE PROHIBITED BY APPLICABLE LAW. THIS ANNOUNCEMENT IS

NOT AN OFFER TO SELL OR A SOLICITATION TO BUY SECURITIES IN ANY

JURISDICTION, INCLUDING THE UNITED STATES OF AMERICA, CANADA,

AUSTRALIA, NEW ZEALAND, THE REPUBLIC OF SOUTH AFRICA OR JAPAN.

NEITHER THIS ANNOUNCEMENT NOR ANYTHING CONTAINED HEREIN SHALL FORM

THE BASIS OF, OR BE RELIED UPON IN CONNECTION WITH, ANY OFFER OR

COMMITMENT WHATSOEVER IN ANY JURISDICTION.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF REGULATION 2014/596/EU AS IT FORMS PART OF THE LAW

OF ENGLAND AND WALES BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL)

ACT 2018. IN ADDITION, MARKET SOUNDINGS WERE TAKEN IN RESPECT OF

THE MATTERS CONTAINED IN THIS ANNOUNCEMENT, WITH THE RESULT THAT

CERTAIN PERSONS BECAME AWARE OF SUCH INSIDE INFORMATION. UPON THE

PUBLICATION OF THIS ANNOUNCEMENT, THIS INSIDE INFORMATION IS NOW

CONSIDERED TO BE IN THE PUBLIC DOMAIN AND SUCH PERSONS SHALL

THEREFORE CEASE TO BE IN POSSESSION OF INSIDE INFORMATION.

2(nd) July 2021

Chesterfield Resources Plc/ EPIC: CHF / Market: LSE / Sector:

Mining

Result of Placing

Chesterfield Resources plc ("Chesterfield Resources" or the

"Company") is pleased to announce the successful completion of the

Placing announced on 1 July 2021, which has raised GBP800,000,

upsized from the original GBP750,000 previously announced.

A total of 8,000,000 new ordinary shares in the capital of the

Company ("Placing Shares") have been placed with new and existing

investors at a placing price of 10 pence per Placing Share.

The new ordinary shares to be issued pursuant to the Placing

will represent 7.8 per cent. of the issued ordinary share capital

of the Company prior to the Placing. The Company will apply for

admission of the Placing Shares to listing on the standard listing

segment of the Official List of the FCA and to trading on the main

market for listed securities of the London Stock Exchange

("Admission"). Subject to, inter alia, the publication of a

prospectus, as approved by the Financial Conduct Authority, in

connection with the Placing and the acquisition of the Adeline

copper project announced on 19 May and 16 June 2021 (the

"Prospectus"), and the Placing Agreement between the Company and

Panmure Gordon (UK) Limited not being terminated in accordance with

its terms , it is expected that Admission of the Placing Shares

will occur at 8:00 am on or around 12 July 2021.

In accordance with the provision of the Disclosure Guidance and

Transparency Rules of the FCA ("DTRs"), the Company confirms that,

following Admission, and assuming issue of the Consideration Shares

in respect of the Acquisition (both as defined in the previous

announcement), its issued share capital will comprise 120,000,311

Ordinary Shares, each of which carries the right to vote, with no

Ordinary Shares held in treasury. This figure may be used by

Shareholders as the denominator for the calculations by which they

will determine if they are required to notify their interest in, or

a change to their interest in, the Company under the DTRs.

About Chesterfield Resources

Chesterfield Resources is a copper-focussed exploration company

with a project in Cyprus and the proposed new Adeline copper

project in Labrador, Canada, contingent, among other things, upon

the publication of a prospectus. Upon completion of the acquisition

of the Adeline project, Altius will become a strategic partner,

with a 10% holding in the Company, and a 20p warrant over a further

10% of the Company (both holdings calculated prior to dilution

through the Placing).

The exploration team is led by two highly experienced industry

geologists Neil O'Brien, formally SVP Exploration & New

Business Development, Lundin Mining, and Dave Cliff, previously

Head of Exploration Europe, Rio Tinto.

The Adeline copper project is located within the western half of

the Central Mineral Belt, a 260 km long metal-rich belt located in

Central Labrador, eastern Canada. The Adeline property is comprised

of ten contiguous mineral licenses totalling 29,725 ha (297.25

km2), covering the full extent of the Seal Lake basin,

approximately 40km long by 10 km wide geological structure which

contains some 250 copper prospects. The project is close to the

regional service hub of Goose Bay. The province is well-served by

infrastructure and is considered low risk for the mining industry

with good ESG credentials.

The Seal Lake basin has seen extensive regional exploration over

the years resulting in a rich exploration database. Trenching and

channel sampling has established the presence of laterally

continuous high-grade copper beds. However there has been

relatively little drill testing, largely due to the lack of road

access. Where sulphide mineralization becomes massive the grades

are extremely high, commonly 10-30% Cu due to the high tenor of

chalcocite-bornite.

An initial field season is already being planned to investigate

prospects and more specific field-based targeting methods based

upon a re-evaluation and re-modelling of the regional exploration

datasets with the latest visualization software tools and with

expert consultants who have decades of experience in this belt.

This is expected to generate a significant pipeline of quality

drill targets to test for significant extents of high-grade

copper-silver mineralized grey beds.

In Cyprus the Company holds the largest mineral exploration

licence area of any operator on the island. Cyprus is regarded as a

high-quality exploration location. It is a member of the EU, and

its legal system is based on English common law. An opportunity

exists because there has been minimal exploration activity on the

island in the last 46 years since the invasion by Turkey in 1974

put a halt to what had been a very active mining industry.

The current focus of exploration is in the Troodos West group of

licences belonging to the Company, with around 30 defined targets

in an area measuring 10km by 10km. The objective is to discover

several VMS (volcanogenic massive sulphide) deposits in close

proximity to each other to create a mining project with a

centralised processing unit.

While copper is the main exploration target, it is noteworthy

that gold was not historically exploited in Cyprus . Gold has been

encountered in several locations in the exploration target area and

is an important part of the exploration objective.

In December 2020, Polymetal International, the FTSE100 mining

group, made a 23% investment in Chesterfield Resources via a

placing of new shares, as strategic backing for the Company's

project in Cyprus.

The Company announced high grade polymetallic results from its

late season 2020 drilling campaign and is now engaged in an

enlarged integrated 2021 geophysics, percussion and diamond

drilling exploration campaign. The Company will commence its

diamond drill programme this week.

Chesterfield Resources is committed to world-class environmental

standards in all of its operations to mine copper, which is

essential to developing clean technology projects worldwide. The

Company hopes to develop

industry and opportunities for the benefit of Canada and the Republic of Cyprus.

Chesterfield Resources has embarked on a strategy of acquisition

to take advantage of the mega-trend of electrification and copper

demand. The company has a strategy to make further acquisitions to

enlarge its exploration footprint.

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014 until the release of this

announcement.

**S**

For further information, please visit

www.chesterfieldresourcesplc.com or contact:

Chesterfield Resources plc:

Martin French, Executive Chairman Tel: +44(0) 7901 552277

Panmure Gordon (UK) Limited (Joint Tel: +44 (0)207 886 2500

Broker):

John Prior & Hugh Rich

Fox-Davies Capital Limited (Joint

Broker): Tel: +44 ( 0)20 3884 8450

Daniel Fox-Davies

IMPORTANT NOTICES

No action has been taken by the Company, Panmure Gordon, or any

of their respective affiliates, that would, or which is intended

to, permit a public offer of the Placing Shares in any jurisdiction

or the possession or distribution of this Announcement or any other

offering or publicity material relating to the Placing Shares in

any jurisdiction where action for that purpose is required. Any

failure to comply with these restrictions may constitute a

violation of the securities laws of such jurisdictions. Persons

into whose possession this announcement comes shall inform

themselves about, and observe, such restrictions.

THIS ANNOUNCEMENT, INCLUDING THE INFORMATION CONTAINED HEREIN,

IS FOR INFORMATION PURPOSES ONLY, IS NOT INTED TO AND DOES NOT

CONSTITUTE OR FORM PART OF ANY OFFER OR INVITATION TO PURCHASE OR

SUBSCRIBE FOR, UNDERWRITE, SELL OR ISSUE OR THE SOLICITATION OF AN

OFFER TO PURCHASE OR SUBSCRIBE, SELL, ACQUIRE, DISPOSE OF THE

PLACING SHARES OR ANY OTHER SECURITY IN THE UNITED STATES OF

AMERICA, CANADA, AUSTRALIA, NEW ZEALAND, THE REPUBLIC OF SOUTH

AFRICA OR JAPAN OR IN ANY JURISDICTION IN WHICH, OR TO ANY PERSONS

TO WHOM, SUCH OFFERING, SOLICITATION OR SALE WOULD BE UNLAWFUL.

Panmure Gordon, which is authorised and regulated in the United

Kingdom by the FCA, is acting as broker and sole bookrunner to the

Company in relation to the Placing and is not acting for any other

persons in relation to the Placing and Admission. Panmure Gordon is

acting exclusively for the Company and for no one else in relation

to the matters described in this Announcement and is not advising

any other person and accordingly will not be responsible to anyone

other than the Company for providing the protections afforded to

clients of Panmure Gordon, or for providing advice in relation to

the contents of this Announcement or any matter referred to in

it.

No representation or warranty, express or implied, is or will be

made as to, or in relation to, and no responsibility or liability

is or will be accepted by Panmure Gordon or the Company or any of

their respective affiliates or any of their respective directors,

officers, employees, advisers or representatives (collectively,

"Representatives") as to or in relation to the accuracy or

completeness of this announcement or any other written or oral

information made available to or publicly available to any

interested party or its advisers, and any liability therefor is

expressly disclaimed.

None of the Group, Panmure Gordon, or their respective

directors, officers, employees, agents, affiliates and advisers, or

any other party undertakes or is under any duty to update this

announcement or to correct any inaccuracies in any such information

which may become apparent or to provide you with any additional

information, other than any requirements that the Group may have

under applicable law. To the fullest extent permissible by law,

such persons disclaim all and any responsibility or liability,

whether arising in tort, contract or otherwise, which they might

otherwise have in respect of this Announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEKZGGNNZLGMZG

(END) Dow Jones Newswires

July 02, 2021 04:03 ET (08:03 GMT)

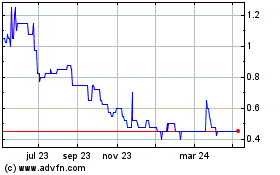

Chesterfield Resources (LSE:CHF)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

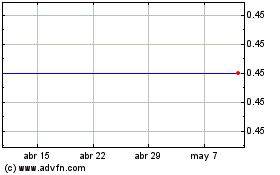

Chesterfield Resources (LSE:CHF)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024