TIDMCHLL

RNS Number : 2958K

Chill Brands Group PLC

31 August 2021

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF REGULATION 11 OF THE MARKET ABUSE (AMMENT) (EU EXIT) REGULATIONS

2019/310

For immediate release 31 August 2021

Chill Brands Group PLC

("Chill", the "Company" or the "Group")

Preliminary Results for the Year Ended 31 March 2021

Chill Brands Group PLC (LSE: CHLL), the international CBD group,

is pleased to announce its unaudited preliminary results for the

year ended 31 March 2021. The Company's audited report and accounts

for the year ended 31 March 2021, including all notes to the

financial statements, are now expected to be announced and

published in September.

CHILL BRANDS GROUP PLC

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

YEARSED 31 MARCH 2021 & 2020

Notes Year ended 31 March 2021 GBP Year ended 31 March 2020 GBP

------ ----------------------------- -----------------------------

Revenue 320,875 92,606

Cost of sales (361,517) (56,684)

----------------------------- -----------------------------

Gross profit (loss) (40,642) 35,922

Administrative expenses (4,658,159) (1,884,955)

Other Expense 3 (1,200,000) -

----------------------------- -----------------------------

Operating Loss (5,898,801) (1,849,033)

Finance income 1,762 1,904

----------------------------- -----------------------------

Loss on ordinary activities

before taxation (5,897,039) (1,847,129)

Taxation on loss on ordinary

activities 4 - -

----------------------------- -----------------------------

Loss for the period from

continuing activities (5,897,039) (1,847,129)

Loss for the period from

discontinued activities (49,762) (5,231,384)

Loss for the period (5,946,801) (7,078,513)

Other comprehensive income

Items that may be re-classified

subsequently to profit or loss:

Foreign exchange adjustment on

consolidation 231,644 723,568

Total comprehensive loss for the

period attributable to the

equity holders (5,715,157) (6,354,945)

----------------------------- -----------------------------

Earnings per share (basic and

diluted) attributed to the

equity holders:

Attributable to continuing

activities (3.05) p (1.27) p

Attributable to discontinued

activities (0.03) p (3.60) p

----------------------------- -----------------------------

Total (3.07) p (4.87) p

----------------------------- -----------------------------

CHILL BRANDS GROUP PLC

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AT 31 MARCH 2021 & 2020

Notes At 31 March 2021 GBP At 31 March 2020 GBP

------ ------------------------ ------------------------

Non-Current Assets

Tangible assets 54,597 83,002

Intangible assets - -

Total Noncurrent Assets 54,597 83,002

Current Assets

Inventories 5 1,238,779 1,167,736

Trade and other receivables 6 136,093 1,437,132

Assets held for sale - 301,891

Cash and cash equivalents 333,176 349,006

Total Current Assets 1,708,048 3,255,765

Total Assets 1,762,645 3,338,767

======================== ========================

Non-Current Liabilities

Loans, excluding current maturities 72,042 -

------------------------ ------------------------

Total Noncurrent Liabilities 72,042 -

Current Liabilities

Current maturities of loans 8,382 -

Trade and other payables 7 661,653 1,227,385

Accrued liabilities 3 1,244,750 -

Total Current Liabilities 1,914,785 1,227,385

Total Liabilities 1,986,827 1,227,385

------------------------

Net Assets (224,182) 2,111,382

------------------------ ------------------------

Equity

Share capital 8 2,020,700 1,729,200

Share premium account 8 4,698,441 3,020,616

Share based payments reserve 8 1,431,686 54,171

Foreign currency translation reserve 532,646 301,002

Retained loss (8,907,655) (2,993,607)

------------------------

Total Equity (224,182) 2,111,382

======================== ========================

CHILL BRANDS GROUP PLC

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

YEARSED 31 MARCH 2021 & 2020

Share Based Payment Foreign Currency Translation

Share Capital GBP Share Premium Account GBP Reserve GBP Reserve GBP Retained Loss GBP Total GBP

-------------------------- ------------------------------- --------------------------- --------------------------------- ------------------------- ---------------------

At 31 March

2019 1,364,831 1,276,611 793,128 (422,566) 3,305,124 6,317,128

---------------- -------------------------- ------------------------------- --------------------------- --------------------------------- ------------------------- ---------------------

Comprehensive

income for the

period

Loss for the

period - - - - (7,078,513) (7,078,513)

Other -

comprehensive

income - - - - -

Translation

adjustment - - - 723,568 - 723,568

-------------------------- ------------------------------- --------------------------- --------------------------------- ------------------------- ---------------------

Total

comprehensive

loss for the

period

attributable

to the equity

holders - - - 723,568 (7,078,513) (6,354,945)

Issue of

warrant and

options - - 40,825 - - 40,825

Lapse of

warrants - - (247,825) - 247,825 -

Exercise of

warrants 300,500 1,377,000 (531,957) - 531,957 1,677,500

Shares issued

in the period 63,869 390,130 - - - 453,999

Cost relating

to share

issues - (23,125) - - - (23,125)

---------------- -------------------------- ------------------------------- --------------------------- --------------------------------- ------------------------- ---------------------

At 31 March

2020 1,729,200 3,020,616 54,171 301,002 (2,993,607) 2,111,382

---------------- -------------------------- ------------------------------- --------------------------- --------------------------------- ------------------------- ---------------------

Comprehensive

income for the

period

Loss for the

period - - - - (5,946,801) (5,946,801)

Other -

comprehensive

income - - - - -

Translation

adjustment - - - 231,644 - 231,644

-------------------------- ------------------------------- --------------------------- --------------------------------- ------------------------- ---------------------

Total

comprehensive

loss for the

period

attributable

to the equity

holders - - - 231,644 (5,946,801) (5,715,157)

Issue of

warrant and

options - - 1,410,268 - - 1,410,268

Staff options

reassigned - - 20,094 - (20,094) -

Lapse of

warrants - - (52,847) - 52,847 -

Exercise of

warrants 75,000 475,000 - - - 550,000

Shares issued

in the period 216,500 1,230,000 - - - 1,446,500

Cost relating

to share

issues - (27,175) - - - (27,175)

---------------- -------------------------- ------------------------------- --------------------------- --------------------------------- ------------------------- ---------------------

At 31 March

2021 2,020,700 4,698,441 1,431,686 532,646 (8,907,655) (224,182)

---------------- -------------------------- ------------------------------- --------------------------- --------------------------------- ------------------------- ---------------------

CHILL BRANDS GROUP PLC

CONSOLIDATED STATEMENT OF CASH FLOWS

YEARSED 31 MARCH 2021 & 2020

2021 GBP 2020 GBP

----------------------------------- -----------------------------------

Cash Flows From Operating Activities

Loss for the period (5,946,801) (7,078,513)

Adjustments for:

Depreciation and amortization

charges 20,677 330,315

Impairment provision 206,685 4,401,185

Loss on disposal of tangible

and intangible assets - 194,625

Share based payments 2,506,768 -

Charge in respect of grant of

options - 40,826

Foreign exchange translation

adjustment 193,717 500,680

Operating cash flow before working

capital movements (3,018,954) (1,610,882)

----------------------------------- -----------------------------------

Increase in inventories (275,743) (1,167,376)

Decrease in trade and other

receivables 1,301,039 940,182

Decrease in trade and other

payables (235,732) (416,985)

Increase in accrued expenses 1,244,750 -

Net Cash outflow from

Operating Activities (984,640) (2,255,061)

----------------------------------- -----------------------------------

Cash Flows From Investing Activities

Proceeds from sale of assets held

for sale 301,891 -

Purchase of tangible fixed assets (1,352) (162,625)

Net Cash generated from/(used in)

Investing Activities 300,539 (162,625)

----------------------------------- -----------------------------------

Cash Flows From Financing Activities

Net proceeds from issue of shares 542,825 2,108,374

Loans made by the Company 80,424 (1,190,500)

Convertible loan notes issued by the

Company - 330,000

Net Cash Generated from Financing

Activities 623,249 1,247,874

----------------------------------- -----------------------------------

Net increase (decrease) in cash and cash equivalents

As above (60,852) (1,169,812)

Cash and cash equivalents at

beginning of period 349,006 1,508,649

Foreign exchange adjustment on

opening balances 45,022 10,169

Cash and cash equivalents at end of

period 333,176 349,006

=================================== ===================================

Notes to the Financial Statements

Basis of preparation

Chill Brands Group plc (the 'Company') is a public limited

company, which is listed on the London Stock Exchange and

incorporated and domiciled in the UK. The registered office of the

Company is 27/28 Eastcastle Street, London W1W 8DH.

The preliminary results (unaudited) (referred to as the

'preliminary results') include the results of the Company and its

subsidiaries (together referred to as the 'Group'). The preliminary

results of the Group have been prepared on the basis of the

accounting policies set out in the statutory financial statements

for the year ended 31 March 2020. Whilst the financial information

included in this announcement has been computed in accordance with

the recognition and measurement requirements of international

accounting standards in conformity with the requirements of the

Companies Act 2006 and international financial reporting standards

adopted pursuant to Regulation (EC) No. 1606/2002 as it applies in

the European Union, this announcement does not itself contain

sufficient disclosures to comply with IFRS.

The information for the year ended 31 March 2021 does not

constitute statutory accounts for the purposes of section 435 of

the Companies Act 2006. A copy of the accounts for the year ended

31 March 2020 was delivered to the Registrar of Companies. The

auditors' report on those accounts was not qualified and did not

contain statements under section 498(2) or 498(3) of the Companies

Act 2006. The audit of the statutory accounts for the year ended 31

March 2020 is not yet complete. These accounts will be finalised on

the basis of the financial information presented by the Directors

in these preliminary results and will be delivered to the Registrar

of Companies following the Company's annual general meeting.

The preliminary results are prepared on the historical cost

basis. The same accounting policies, presentation and methods of

computation are followed in the preliminary results as were applied

in the Group's 2020 annual audited financial statements.

Going Concern

The Directors have considered the financial performance and

position of the Company, the post year end fundraising of GBP6

million, fees settled, as well as the outlook for future financial

years including the distribution agreements signed, post year end

performance and the general market. The Directors have taken these

into consideration and applied them to a variety of scenarios

including a worst case scenario of no sales and a linked reduced

cost base. Based on this the Directors consider it appropriate to

adopt the going concern basis in the preparation of this

preliminary announcement.

1. General Information

Chill Brands Group plc ("the Company") (formerly Zoetic

International plc) and its subsidiaries (together "the Group") are

involved in the development, production and distribution of premium

cannabidiol (CBD) products. The Company, a public limited company

incorporated and domiciled in England and Wales, is the Group's

ultimate parent company. The Company was incorporated on 13

November 2014 with Company Registration Number 09309241 and its

registered office and principal place of business is 27/28

Eastcastle Street, London W1W 8DH.

2. Segment Reporting

In the opinion of the Directors, there were no separate

operational segments to be reported upon during the current or

previous year. The Group's oil and gas activities have been

discontinued in the prior year with the remaining activities of the

Group relate to its CBD business activities in the United States

and UK. Information relating to the CBD activities are shown in the

primary statements.

3. Other Expense

On 9 March 2021, the Group entered into a financing agreement

with LDA Capital Limited which included a termination clause of

GBP1,200,000 to terminate the agreement. On 4 May 2021, the Group

announce the termination of the financing agreement with LDA

Capital Limited and entered into a settlement agreement to pay LDA

Capital GBP1,200,000 to terminate the financing agreement. As of 31

March 2021, the Group accrued GBP1,200,000 to the settlement and

termination of the financing agreement with LDA Capital Limited

with the charge recorded to other expense.

4. Taxation

2021 2020

GBP GBP

------------------------------------------- ------------ ------------

The charge/credit for the period

is made up as follows:

Corporate Taxation on the results

for the period

UK - -

Non-UK - -

------------------------------------------- ------------ ------------

Taxation charge/credit for the period - -

------------------------------------------- ------------ ------------

A reconciliation of the tax charge/credit

appearing in the income statement

to the tax credit that would result

from applying the standard rate of

tax to the results for the period

is:

Loss per accounts (5,946,901) (7,078,513)

-------------------------------------------- ------------ ------------

Tax credit at the standard rate of

corporation tax at a combined rate

of 20% (23.15%): (1,189,360) (1,415,703)

Impact of costs disallowable for - --

tax purposes

Impact of temporary timing differences - --

Impact of unrelieved tax losses carried

forward 1,189,360 1,415,703

-------------------------------------------- ------------ ------------

Taxation credit for the period - -

The Directors consider that there are no material disallowable

costs or timing differences in respect of the current year.

Estimated tax losses of GBP26,000,000 (2020: GBP20,000,000) may

be available for relief against future profits. The deferred tax

asset not provided for in the accounts based on the estimated tax

losses and the treatment of temporary timing differences, is

approximately GBP5,200,000 (2020: GBP4,000,000). Utilization of

these losses in future may or may not be possible depending upon

future profitability within the Group and the continued

availability of the losses due to the change in the Group's core

activities.

5. Inventories

Group 2021 GBP Group 2020 GBP

Finished goods 1,157,960 1,167,736

--------------- ---------------

Raw materials 80,819 -

--------------- ---------------

1,238,779 1,167,736

--------------- ---------------

6. Trade & Other Receivables

Group 2021 GBP Group 2020 GBP

Trade receivables 55,637 217,449

--------------- ---------------

Loans - 1,190,500

--------------- ---------------

Prepayments and other

debtors 80,456 29,183

--------------- ---------------

136,093 1,437,132

--------------- ---------------

All amounts in trade receivables are due within 3 months.

Prepayments & other debtors includes GBPnil (2020: GBPnil)

which is receivable in more than one year.

The Directors consider that the carrying amount of trade and

other receivables approximates to their fair value. Fair values

have been calculated by discounting cash flows at prevailing

interest rates.

Included in Trade and Other receivables were Loan Notes totaling

GBPnil (2020: GBP1,190,500). These arose from the exercise of

23,810,000 warrants in March 2020. In order to facilitate the

exercise of these warrants which would generate funds for the

company of GBP1,190,500, the Company allowed the transfer of the

warrants to a new holder and their immediate exercise, with the

payment of the exercise price being deferred via the Loan Notes.

The loans carry interest at 1% per annum and are secured against

the underlying shares. The loans were repayable in 10 equal monthly

instalments commencing 30 April 2020.

The Group applies the IFRS9 simplified approach to measuring

expected credit losses using a lifetime expected credit loss

provision for trade receivables. To measure expected credit losses

on a collective basis, trade receivables are grouped based on

similar credit risk and ageing. The Group's customer base is of a

similar bracket and share the same characteristics, as such these

have been treated as one population. The expected lifetime losses

are considered to be GBPnil.

7. Trade & Other Payables

Group 2021 GBP Group 2020 GBP

Bank borrowings - 256,929

--------------- ---------------

Trade payables 339,938 109,238

--------------- ---------------

Convertible Loan Notes - 330,000

--------------- ---------------

Accruals & other payables 321,715 531,218

--------------- ---------------

661,653 1,227,385

--------------- ---------------

Bank borrowings represent a loan to a US based subsidiary,

secured on the producing assets of that subsidiary. The loan was

for an initial period of one year but has been extended pending

disposal of the underlying assets, which took place post year end

when the loan was repaid. The loan carried interest at 5% above US

base rate. The net debt of the Group decreased from GBP256,929 at

31 March 2020 to GBPnil at 31 March 2021 as part of the sale of the

oil and gas assets held for sale.

Trade payables and accruals principally comprise amounts

outstanding for trade purchases and continuing costs. The Directors

consider that the carrying amount of trade and other payables

approximates to their fair value. Fair values have been calculated

by discounting cash flows at prevailing interest rates.

8. Equity

2021 2020

GBP GBP

--------------------------------------------------- ----------- -----------

Allotted called up and fully paid:

202,070,034 ordinary 1p shares (2020:172,920,034

ordinary 1p shares) 2,020,700 1,729,200

--------------------------------------------------- ----------- -----------

The Company has only one class of share. All ordinary shares

have equal voting rights and rank pari passu for the distribution

of dividends and repayment of capital.

Number Par value

of shares

issued

GBP

At 31 March 2020 172,920,034 1,729,200

--------------------------------------------- ------------- ------------

3 April 2020 issue of shares at 1p per

share 12,900,000 129,000

6 June 2020 issue of shares at 4p per

share 8,750,000 87,500

28 October 2020 issue shares upon exercise

of warrants at 10p per share 1,000,000 10,000

25 March 2021 issue shares upon exercise

of warrants at 12p per share 1,000,000 10,000

31 March 2021 issue shares upon exercise

of convertible loan at 6p per share 5,500,000 55,000

--------------------------------------------- ------------- ------------

Total issued in the period 29,150,000 291,500

--------------------------------------------- ------------- ------------

Number of shares in issue at 31 March

2021 202,070,034 2,020,700

At 31 March 2021 there were options outstanding over 7,155,000

unissued ordinary shares (2020: 7,405,000). Details of the options

outstanding are as follows:

Issued Exercisable Exercisable Number Outstanding Exercisable

from until price (p)

----------------- --------------- ------------- ------------------- ------------

11 October

12 October 2016 Anytime until 2026 250,000 27.75

8 October 8 October

8 October 2019 2021 2029 5,840,000 10.00

8 October 8 October

8 October 2019 2021 2029 65,000 10.00

8 October

8 October 2019 Anytime Until 2029 1,000,000 10.00

----------------- --------------- ------------- ------------------- ------------

Total 7,155,000

8. Equity continued

Director At 31 March Granted Exercised Lapsed in At 31 March Exercise

2020 in the period in the period the period 2021 Price -

pence

NGS Tulloch 2,000,000 - - (2,000,000) - 10p

---------------- ---------------- ---------------- ---------------- ---------------- ---------

T Taylor - 2,887,500 - - 2,887,500 10p

---------------- ---------------- ---------------- ---------------- ---------------- ---------

A Russo - 2,887,500 - - 2,887,500 10p

---------------- ---------------- ---------------- ---------------- ---------------- ---------

Total 2,000,000 5,775,000 - (2,000,000) 5,775,000

---------------- ---------------- ---------------- ---------------- ---------------- ---------

The options held by N G S Tulloch were exercisable between 8

October 2021 and 8 October 2029. Those options were relinquished in

the current year upon Mr. Tulloch resigning from the Board of

Directors.

The warrants held by T. Taylor and A. Russo are exercisable

until 8 October 2029.

The market price of the shares at the year end was 83.50p per

share.

During the year, the minimum and maximum prices were 4.13p and

104.53p per share respectively.

Share Base payments : In April 2020, options of 12,900,000

shares were vested to both T. Taylor and A. Russo at 8.5p. At 31

March 2021, the Group recorded 1,096,500 in share based

compensation for the vested options.

In October 2020, T. Taylor and A. Russo were granted options of

5,775,000 shares which are vested over three years from the date of

grant in October 2019 subject to continued employment and

performance obligations. At 31 March 2021, the Group recorded

1,410,268 in share based compensation for the granted options.

2021

GBP

--------------------------------- -----------

At 31 March 2020 3,020,616

--------------------------------- -----------

3 April 2020 issue of shares

at 8.5 p per share 967,500

2 June 2020 issue of shares

at 4 p per share 262,500

28 October 2020 issue of shares

upon exercise of warrants at

10 p per share 90,000

25 March 2021 issue of shares

upon exercise of warrants at

12 p per share 110,000

31 March 2021 issue of shares

upon exercise of warrants at

6 p per share 275,000

--------------------------------- -----------

1,705,000

Less: costs relating to share

issues (27,175)

--------------------------------- -----------

Increase in the year 1,677,825

--------------------------------- -----------

At 31 March 2021 4,698,441

-ENDS-

Media enquiries:

Chill Brands plc c/o Buchanan

Trevor Taylor, Co-CEO

Antonio Russo, Co-CEO

Allenby Capital Limited (Financial

Adviser and Broker) +44 (0) 20 3328 5656

Nick Harriss/Nick Naylor (Corporate

Finance)

Kelly Gardiner (Equity Sales)

Buchanan

Henry Harrison-Topham / Jamie Hooper Tel: +44 (0) 20 7466

/ Ariadna Peretz 5000

chillbrands@buchanan.uk.com www.buchanan.uk.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR EAXPFDADFEFA

(END) Dow Jones Newswires

August 31, 2021 13:25 ET (17:25 GMT)

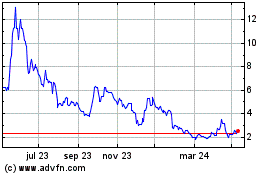

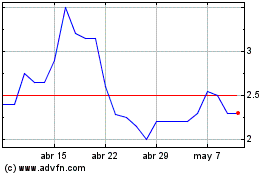

Chill Brands (LSE:CHLL)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Chill Brands (LSE:CHLL)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024