Chrysalis Investments Limited Update on Performance Fee Arrangements (8009T)

29 Noviembre 2021 - 1:00AM

UK Regulatory

TIDMCHRY

RNS Number : 8009T

Chrysalis Investments Limited

29 November 2021

The information contained in this announcement is restricted and

is not for publication, release or distribution in the United

States of America, any member state of the European Economic Area

(other than professional investors in Belgium, Denmark, the

Republic of Ireland, Luxembourg, the Netherlands, Norway and

Sweden), Canada, Australia, Japan or the Republic of South

Africa.

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 as amended by The

Market Abuse (Amendment) (EU Exit) Regulations 2019.

29 November 2021

Chrysalis Investments Limited (the "Company")

Update on Performance Fee Arrangements

The Company announces that it has, today, entered into an

agreement with its investment manager, Jupiter Unit Trust Managers

Limited ("Jupiter") to settle 54 per cent. of the performance fee

amount that will be payable to the investment manager in respect of

the period to 30 September 2021 in ordinary shares issued by the

Company. The remaining 46 per cent. of the performance fee amount

will be settled in cash.

The issue price of those shares is expected to be 267p per share

(being the closing share price on 30 September 2021) which is a 9.4

per cent. premium to the share price as at close of business on 26

November 2021 and a 6 per cent. premium to the unaudited net asset

value per share as at 30 September 2021. To the extent that the

audited 30 September 2021 net asset value per share is greater than

267 pence per share, the issue price will be increased to an amount

equal to the audited 30 September 2021 net asset value per

share.

The shares are expected to be issued on the date of publication

of the Company's audited financial statements for the year ended 30

September 2021, which is anticipated to be in January 2022. They

will be issued on a non-preemptive basis utilising the Company's

existing authority to issue shares.

The shares issued to Jupiter are intended to be used by Jupiter

as part of the deferred remuneration arrangements of its staff,

including the Company's portfolio managers, and will be subject to

Jupiter's usual vesting conditions which incrementally release

shares to the qualifying staff over a three year period.

The Company's chair, Andrew Haining, commented:

"The Board is pleased to have accepted this proposal and

material commitment by Jupiter on behalf of the fund managers and

other staff members, which further increases their alignment with

shareholders in pursuing long-term success for Chrysalis."

-ENDS-

For further information, please contact:

Media

Montfort Communications +44 (0) 7542 846 844

Charlotte McMullen / Georgia chrysalis@montfort.london

Colkin / Lesley Kezhu Wang

Jupiter Asset Management:

Magnus Spence +44 (0) 20 3817 1325

Liberum:

Chris Clarke / Darren Vickers

/ Owen Matthews +44 (0) 20 3100 2000

Numis:

Nathan Brown / Matt Goss +44 (0) 20 7260 1000

Maitland Administration (Guernsey)

Limited:

Elaine Smeja / Aimee Gontier +44 (0) 1481 749364

LEI: 213800F9SQ753JQHSW24

A copy of this announcement will be available on the Company's

website at:

https://www.chrysalisinvestments.co.uk/

This announcement is for information purposes only and is not an

offer to invest. All investments are subject to risk. Past

performance is no guarantee of future returns. Prospective

investors are advised to seek expert legal, financial, tax and

other professional advice before making any investment decision.

The value of investments may fluctuate. Results achieved in the

past are no guarantee of future results. Neither the content of the

Company's website, nor the content on any website accessible from

hyperlinks on its website for any other website, is incorporated

into, or forms part of, this announcement nor, unless previously

published by means of a recognised information service, should any

such content be relied upon in reaching a decision as to whether or

not to acquire, continue to hold, or dispose of, securities in the

Company.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDBCBDBDXDDGBI

(END) Dow Jones Newswires

November 29, 2021 02:00 ET (07:00 GMT)

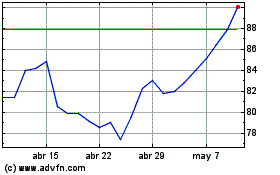

Chrysalis Investments (LSE:CHRY)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

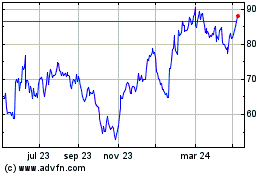

Chrysalis Investments (LSE:CHRY)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024