TIDMCIZ

RNS Number : 4568N

Cizzle Biotechnology Holdings PLC

30 September 2021

30 September 2021

Cizzle Biotechnology Holdings Plc

("Cizzle", the "Company" or the "Group")

Interim results for the six months ended 30 June 2021

Cizzle Biotechnology Holdings PLC (LSE: CIZ), the UK based

diagnostics developer, is pleased to announce its results for the

six months ended 30 June 2021.

Highlights

-- Completed the acquisition of Cizzle Biotechnology Limited

("CBL") on 14 May 2021 and admission to trading on the London Stock

Exchange by way of a Standard Listing, raising gross proceeds of

GBP2,200,000 before expenses from the issue of new shares.

-- Change of the company name from Bould Opportunities plc to Cizzle Biotechnology Holdings plc.

Post Period Highlights

-- Significant progress has been made to establish the

foundations of the Group in its ambition to commercialise and

realise the potential of its proprietary CIZ1B biomarker technology

that has been developed by Professor Dawn Coverley and her team at

the University of York for the early detection of lung cancer.

-- A collaboration agreement was signed with FairJourney

Biologics to develop proprietary antibodies for early lung cancer

detection tests. This important step will not only enable the

Company to develop its early ELISA hospital laboratory test, but

also provide reagents that can be produced and licensed to

commercial partners and facilitate adoption with key clinical

opinion leaders worldwide.

-- A Memorandum of Understanding ("MOU") was completed with St

George Street Capital ("SGSC"), to collaborate together to develop

a companion diagnostic platform for certain therapeutic assets

licensed to SGSC from one of the world's largest pharmaceutical

companies, Astra Zeneca. This seeks to address unmet clinical needs

in a wide variety of autoimmune diseases which will significantly

broaden the Company's product pipeline and for which SGSC will pay

up to GBP1 million in development fees.

-- A full commercial royalty sharing agreement announced with

SGSC grants the Company potential future royalty payments of up to

GBP5 million from the commercialisation of SGSC's therapeutic

asset, AZD1656 for the treatment of COVID 19 in vulnerable diabetic

patients. Under the terms of the agreement the Company will pay to

SGSC GBP135,000 in addition to GBP65,000 it paid on signing the

MOU.

-- A new research agreement was signed with the University of

York, a member of the Russell Group of research-intensive

universities and one of the world's premier institutions for

inspirational and life-changing research, for the development and

validation of molecular tests with potential applications in cancer

diagnosis and therapy.

Commenting Allan Syms, Chairman of Cizzle Biotechnology, said

:

"The Group's focus on providing pivotal and diagnostic products

for the early detection of cancer and other life-threatening

illnesses took a major step forward following the acquisition of

CBL, which is developing a product for the early detection of lung

cancer that has the potential to decisively help front line

physicians detect lung cancer in the clinic. For too long, their

diagnostic choices have had to rely on increasing invasive

procedures that in many cases are unnecessary. Given the rapid

advances in biologics and endoscopy, there is an urgent need now

for earlier stages of lung cancer to be reliably found where

survival is meaningfully improved for the patient. The Group

believes that is has the potential to be part of that step wise

change through the development of a product for the early detection

of lung cancer. This is proceeding well and in accordance with our

business plan.

"The collaboration with FairJourney Biologics represents a

significant step and in addition to providing the key antibodies

for our hospital test, provides the opportunity to licence these

proprietary key reagents to other global manufacturers to ensure

that we help facilitate early cancer detection everywhere and help

improve patient prognosis as widely as we can.

"Our next steps will be to consider how we can broaden the use

of our technology for widescale screening in doctor's office

testing. We also are keen to broaden the scope of our tests beyond

lung cancer so we can address the challenge of early diagnosis in

other cancers with unmet needs. Our continuing commitment to

research at the University of York will play an important part in

that potential being realised.

"Clearly early diagnosis is a vital tool in enabling early

clinical intervention and improving patient outcomes for a wide

range of diseases, notably lung cancer. In addition, diagnostic

products can be used to identify which patients may prove most

likely to respond to new drugs with the least side effect burden to

patients. Such companion diagnostics are a key part of treatments

for cancer, and other serious illnesses. Our new partnership with

SGSC opens doors for the Group to apply its expertise and products

in this regard, initially focussed on tests involved in autoimmune

disease. That the Group can now benefit from attractive potential

royalty streams from new therapeutics, as well as associated

companion diagnostics, and is expected to benefit from near term

revenues from development fees, is important to the Group's

long-term ambitions."

Executive Chairman's statement

Operational and strategic overview

The major event during the period was the completion of the

acquisition of CBL on 14 May 2021 and admission to trading on the

London Stock Exchange by way of a Standard Listing. As part of the

listing process the Company raised gross proceeds of GBP2,200,000,

before expenses, from the issue of new shares. Following the

acquisition, the Group's principal activity is now focussed on

realising and commercialising, through systematic development,

CBL's technology for the early detection of cancer.

CBL, a spin-out from the University of York, founded in 2006 by

Professor Coverley, is developing a blood test for the early

detection of lung cancer. CBL's technology is based on the ability

to detect the CIZ1B variant of the C1Z1 protein, which is a

naturally occurring cell nuclear protein involved in DNA

replication. The targeted C1Z1B variant is a stable plasma

biomarker that is highly correlated with early-stage lung cancer.

CBL's proof-of-concept prototype test is based on the ability to

detect CIZ1B in patient's blood. Peer-reviewed published research

led by Professor Coverley has demonstrated that CIZ1B can be

measured via a simple ELISA test, which should allow for its

incorporation into established hospital high-throughput testing

platforms. We believe that this development overcomes an important

barrier to further clinical development of this blood test, and

should allow for the detection of lung cancer at a stage when the

disease still bears a good prognosis.

Cizzle Biotechnology's goal is to help front line clinicians in

their diagnostic decision making by providing a test that can

quickly and accurately give another perspective on whether a

patient should be sent forward for more invasive testing. For the

majority of patients fortunate enough to have presented with benign

radiological findings, such a test would avoid the need for

intrusive follow up testing, which can include repeated CT scanning

and/or tissue biopsies, which are both costly to the NHS, health

providers and medical insurers and stressful to patients.

The Board intends for the Company's initial product to be a

diagnostic immunoassay that can be readily performed by hospitals

and reference laboratories, but a potential follow-on product could

be a point of care test provided by a primary health care provider

e.g. for doctor's office testing. The Board is currently focussed

on the development of the C1Z1B biomarker test through to CE

marking and/or FDA 510(k) clearance and will additionally consider

broadening its product range into screening tests and tests for

other forms of cancer. Significant progress has been made since the

acquisition to establish the foundations of the Group in its

ambitions as a developer and supplier of innovative clinical

diagnostic tests, and to commercialise the CIZ1B biomarker

technology.

The collaboration agreement with FairJourney Biologics to

develop proprietary antibodies is a key milestone in achieving our

goals and will provide important tools that can be used to build

not only our own range of hospital and doctor's office tests, but

also provide proprietary licensing opportunities with commercial

and clinical partners worldwide. Our new research agreement with

the University of York for the development and validation of these

molecular tests will strengthen those ambitions.

Post period end, in June 2021, a Memorandum of Understanding

("MOU") was completed with SGSC, to collaborate on the development

of a companion diagnostic, which is a clinical test used to support

the safe and effective use of a corresponding drug in appropriate

patient populations. This relates to certain therapeutic assets

(AZD16560) licensed to SGSC by Astra Zeneca which has been shown to

affect the immune system at sites of damaging inflammation which

can be typical in autoimmune disease and hence seeks to address

unmet clinical needs in autoimmune disease.

SGSC is a biomedical research charity founded to fast-track

clinical trials to get new treatments as quickly as possible to the

people who need them. The charity brings together a powerful mix of

expertise, from investors and business managers to academics and

clinicians, and has formed a long-term strategic relationship with

Cizzle where we can each benefit from strategically aligned skill

sets, building a complimentary portfolio of diagnostic and

therapeutic products.

In September this year, SGSC reported encouraging results from

its ARCADIA clinical trial. The trial was initiated from an

existing collaboration between SGSC and AstraZeneca and funded by

international investment through Excalibur Medicines Ltd and an HM

Government grant through the UKRI/Innovate UK programme. Cizzle has

secured royalty sharing rights for AZD1656 for treating COVID 19

and additional disease indications,.

During September 2021 a royalty sharing agreement was announced

with SGSC to grant the Company potential future royalty payments

from the commercialisation of AZD1656, of up to GBP5 million. Under

the terms of the agreement the Company has paid GBP135,000 to SGSC

in addition to the GBP65,000 it paid on signing the MOU. The

Company intends, in due course to execute our collaboration

agreement, whereby SGSC will, in addition, pay the Group fees of up

to GBP1m for the development of a companion diagnostic.

Financial overview

During the six months ended 30 June 2021, the Company

transformed itself from a cash shell into an operating group that

is a focussed healthcare diagnostics developer. The Group consists

of Cizzle Biotechnology Holdings PLC as the parent company with

wholly owned subsidiaries, Cizzle Biotechnology Ltd ("CBL") and

Cizzle Biotech Ltd (formerly Enfis Ltd).

The financial results for the six months to 30 June 2021 are

summarised as follows:

-- Corporate expenses, before exceptional items, H1: GBP119,000 (H1 2020, CBL: GBP8,000).

-- Exceptional corporate expenses relating to the acquisition of

CBL, H1: GBP3,219,000 (H1 2020, CBL: GBPNil) which include

transaction costs of GBP304,000 and a non-cash share-based expense

of GBP2,815,000. The share-based expense of GBP2,815,000 arises as

these interim financial statements have been prepared using the

reverse acquisition methodology of consolidation. Rather than

recognising goodwill this expense represents the equity value given

up by CBL's shareholders and the share of the fair value of net

liabilities gained by CBL's shareholders. This is recognised as a

share-based payment on reverse acquisition and represents in

substance the cost of acquiring a London Stock Exchange

listing.

-- Total comprehensive loss in H1 2021: GBP3,238,000 (H1 2020, CBL loss of GBP8k).

-- Loss per share in H1 2021: (3.79)p, (H1 2020, CBL: loss of (0.004)p).

-- Cash balances as at 30 June 2021: GBP1,425,000 (30 June 2020 CBL: GBP10,000).

Responsibility Statement

We confirm that to the best of our knowledge:

-- the interim financial statements have been prepared in

accordance with International Accounting Standards 34, Interim

Financial Reporting;

-- give a true and fair view of the assets, liabilities,

financial position and loss of the Company;

-- the Interim report includes a fair review of the information

required by DTR 4.2.7R of the Disclosure and Transparency Rules,

being an indication of important events that have occurred during

the first six months of the financial year and their impact on the

set of interim financial statements; and a description of the

principal risks and uncertainties for the remaining six months of

the year; and

-- The Interim report includes a fair review of the information

required by DTR 4.2.8R of the Disclosure and Transparency Rules,

being the information required on related party transactions.

The interim report was approved by the Board of Directors and

the above responsibility statement was signed on its behalf by

Allan Syms on 29 September 2021.

Enquiries:

Cizzle Biotechnology Holdings Via IFC Advisory

plc

Allan Syms (Executive Chairman)

Allenby Capital Limited +44(0) 20 33285656

John Depasquale

Alex Brearley

Novum Securities Limited +44(0) 20 7399 9400

Colin Rowbury

Jon Bellis

IFC Advisory Limited +44(0) 20 3934 6630

Tim Metcalfe

Florence Chandler

About Cizzle Biotechnology

Cizzle Biotechnology is developing a blood test for the early

detection of lung cancer. Cizzle Biotechnology is a spin- out from

the University of York, founded in 2006 around the work of

Professor Coverley and colleagues . Its proof-of-concept prototype

test is based on the ability to detect a stable plasma biomarker, a

variant of CIZ1 known as CIZ1B. CIZ1 is a naturally occurring cell

nuclear protein involved in DNA replication, and the targeted CIZ1B

variant is highly correlated with early-stage lung cancer.

For more information please see

https://cizzlebiotechnology.com

You can also follow the Company through its twitter account

@CizzlePlc and on LinkedIn.

Consolidated Statement of Comprehensive Income

For the six months ended 30 June 2021

CBL CBL

Group Six months Year ended

Six months ended 30 31 December

ended June

2021 2020 2020

Unaudited Unaudited Unaudited

Notes GBP'000 GBP'000 GBP'000

Revenue - - -

Cost of Sales - - -

Gross Profit - - -

Administrative Expenses

(119) (8) (14)

* On-going administrative costs (304) - -

3 (2,815) - -

* Transaction costs

* Reverse acquisition expenses

--------------------- ----------------------- ------------------------

Total administrative expenses

including exceptional items (3,238) (8) (14)

--------------------- ----------------------- ------------------------

Operating (Loss) and (loss)

before income tax (3,238) (8) (14)

Taxation 4 - - -

--------------------- ----------------------- ------------------------

(Loss) and total comprehensive

income for the period attributable

to the equity shareholders of

the parent (3,238) (8) (14)

--------------------- ----------------------- ------------------------

Earnings per share (Loss)- basic

and diluted - pence 5 (3.79)p (0.004)p (0.007)p

Consolidated Statement of Financial Position

as at 30 June 2021

Group CBL CBL

30 June 30 June 31 December

2021 2020 2020

Notes Unaudited Unaudited Unaudited

GBP'000 GBP'000 GBP'000

Non-Current Assets

Property, Plant & Equipment - - -

Intangible Assets - - -

Total Non-Current Assets - - -

------------ ---------- ---------------------------

Current Assets

Trade & Other Receivables 99 1 3

Cash & Cash Equivalents 1,425 10 7

------------ ---------- ---------------------------

Total Current Assets 1,524 11 10

------------ ---------- ---------------------------

Total Assets 1,524 11 10

------------ ---------- ---------------------------

Equity

Ordinary Share Capital 3,493 3 3

Share premium 31,521 1,585 1,585

Share capital reduction reserve 10,081 - -

Share option reserve 13 - -

Reverse acquisition reserve 3 (38,953) - -

Retained losses (4,833) (1,589) (1,596)

Equity 1,322 (1) (8)

------------ ---------- ---------------------------

Liabilities

Current Liabilities

Trade & Other Payables 202 12 8

Borrowings - - 10

Total Current Liabilities 202 12 18

------------ ---------- ---------------------------

Non-Current Liabilities

Deferred Tax Liabilities - - -

Total Liabilities - - -

------------ ---------- ---------------------------

Total Equity and Liabilities 1,524 11 10

------------ ---------- ---------------------------

Consolidated Statement of Cash Flows

For the six months ended 30 June 2021

Group CBL CBL

6 Months 6 Months Year

Ended Ended Ended

30 June 30 June 31 December

2021 2020 2020

Unaudited Unaudited Unaudited

GBP'000 GBP'000 GBP'000

Cash flow from operating activities Notes

Operating (loss) before tax (3,238) (8) (14)

Adjustment for:

Reverse acquisition share based

expense 3 2,815 - -

Operating cash flow before working

capital movements (423) (8) (14)

(Increase) / decrease in trade and

other receivable (49) 3 1

(Decrease) / increase in trade and

other payables (116) 2 (3)

------------------------- ------------ --------------

Net cash (outflow) from operating

activities (588) (3) (16)

------------------------- ------------ --------------

Cash flow from investing activities

Cash acquired in acquisition of

subsidiary 46 - -

Proceeds from the issue of capital

net of issue costs 1,970 - -

------------------------- ------------ --------------

Net cash inflow from investing activities 2,016 - -

------------------------- ------------ --------------

Cash flow from financing activities

Borrowings received - - 10

Borrowings repaid (10) - -

------------------------- ------------ --------------

Net cash (outflow) / inflow from

financing activities (10) - 10

------------------------- ------------ --------------

Net increase/ (decrease) in cash

and cash equivalents 1,418 (3) (6)

Cash and cash equivalents at the

start of the period 7 13 13

------------------------- ------------ --------------

Cash and cash equivalents at the

end of the period 1,425 10 7

------------------------- ------------ --------------

Consolidated Statement of Changes in Equity

For the six months ended 30 June 2021 (unaudited)

Ordinary Capital Share Reverse

Share Share Redemption Option Acquisition Retained

Group Capital Premium Reserve Reserve Reserve Losses Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 January 2021 - - - - - (1,595) (1,595)

Recognition of plc

equity

at acquisition date 3,470 8,852 10,081 - (38,953) - (16,550)

Issue of shares for

acquisition of

subsidiary 21 20,610 - - - - 20,631

Issue of shares for

cash 2 2,198 - - - - 2,200

Issue of shares in

settlement

of fees - 32 32

Issue of warrants - (13) - 13 - - -

Cost of share issue - (158) - - - - (158)

Comprehensive Loss for

the Period - - - - - (3,238) (3,238)

At 30 June 2021 3,493 31,521 10,081 13 (38,953) (4,833) 1,322

-------- -------- ------------ -------- ---------------------- --------- -------------

For the six months ended 30 June 2020 (unaudited)

Ordinary

Share Share Retained

CBL Capital Premium Losses Total

GBP'000 GBP'000 GBP'000 GBP'000

At 1 January 2020 3 1,585 (1,582) 6

Comprehensive loss for

the period - - (7) (7)

At 30 June 2020 3 1,585 (1,589) (1)

----------- ---------- ----------- ---------

For the year ended 31 December 2020 (unaudited)

Ordinary

Share Share

Capital Premium Retained

CBL Losses Total

GBP'000 GBP'000 GBP'000 GBP'000

At 1 January 2020 3 1,585 (1,582) 6

Comprehensive loss for

the period - - (14) (14)

At 31 December 2020 3 1,585 (1,596) (8)

----------- ---------- ----------- ---------

Notes to the financial statements

For the six months ended 30 June 2021 (unaudited)

1. Basis of preparation

These interim financial statements have been prepared in

accordance with IAS 34 - Interim Financial Reporting using the

recognition and measurement principles of International Accounting

Standards, International Financial Reporting Standards and

Interpretations adopted for use in the European Union (collectively

"Adopted IFRS").

The principal accounting policies used in preparing these

interim financial statements are those expected to apply to the

Group's Consolidated Financial Statements for the year ending 31

December 2021.

The results for the six-months ended 30 June 2021 are the Group

results following the acquisition of Cizzle Biotechnology Limited

("CBL") on 14 May 2021. The results for the period to 30 June 2020

and 31 December 2020 are the results of CBL prior to the creation

of the new Group.

The financial information for the six months ended 30 June 2021,

30 June 2020 and 31 December 2020 is unaudited and does not

constitute statutory financial statements for those periods.

2. Continuing and discontinued operations

The Group is considered to have one class of business which is

focused on the early detection of lung cancer via the development

of an immunoassay test for the CIZ1B biomarker.

3. Reverse acquisition

On 14 May 2021 the Company acquired through a share for share

exchange the entire share capital of CBL whose principal activity

is the early detection of lung cancer through the development of

tests to detect CIZ1 variant protein.

Although the transaction resulted in CBL becoming a wholly owned

subsidiary of the Company, the transaction constitutes a reverse

acquisition as the previous shareholders of CBL own a substantial

majority of the shares of the Company.

In substance the shareholders of CBL acquired a controlling

interest in the Company and the transaction has therefore been

accounted for as a reverse acquisition. As the Company's activities

prior to the acquisition were purely the maintenance of the AIM

listing, acquiring CBL and raising equity finance to provide the

required funding for the operations of the acquisition it did not

meet the definition of a business combination in accordance with

IFRS 3.

Accordingly, this reverse acquisition does not constitute a

business combination and was accounted for in accordance with IFRS

2 "Share-based Payments" and associated IFRIC guidance. Although

the reverse acquisition is not a business combination, the Company

has become a legal parent and is required to apply IFRS 10 and

prepare consolidated financial statements. The directors have

prepared these financial statements using the reverse acquisition

methodology, but rather than recognise goodwill, the difference

between the equity value given up by the CBL shareholders is

charged to the statement of comprehensive income as a share-based

payment on reverse acquisition, and represents in substance the

cost of acquiring a quoted company.

In accordance with the reverse acquisition principles, these

consolidated financial statements represent a continuation of the

consolidated statements of Cizzle Biotechnology Holdings Plc and

its subsidiaries and include:

- The assets and liabilities of CBL at their pre-acquisition

carrying value amounts and the results for all periods reported;

and

- The assets and liabilities of the Company as at 14 May 2021

and its results from the date of reverse acquisition (14 May 2021)

to 30 June 2021.

On 14 January 2021 the Company issued 206,310,903 ordinary

shares to acquire the 313,932 ordinary shares of CBL Limited. At 14

January 2021 the valuation of the investment in CBL was

GBP21,600,000.

Because the legal subsidiary, CBL, was treated on consolidation

as the accounting acquirer and the legal parent company, Cizzle

Biotechnology Holdings Plc, was treated as an accounting

subsidiary, the fair value of the shares deemed to be issued by CBL

was calculated at GBP2,598,000 based on an assessment of the

purchase consideration for a 100% holding of Cizzle Biotechnology

Holdings plc.

The fair value of the net liabilities of Cizzle Biotechnology

Holdings Plc at acquisition was as follows:

GBP'000

Cash and cash equivalents 46

Other assets 47

Liabilities (310)

--------

Net (Liabilities) (217)

--------

The difference between the deemed cost of GBP2,598,000 and the

fair value of the net liabilities noted above of GBP(217,000)

resulted in GBP2,815,000 being expensed as "reverse acquisition

expenses" in accordance with IFRS2, Share- based Payments,

reflecting the economic cost to CBL shareholders of acquiring a

quoted entity.

The reverse acquisition reserve which arose from the reverse

takeover is made up as follows:

GBP'000

Pre-acquisition equity(1) (21,563)

CBL share capital at acquisition(2) 1,588

Investment in CBL(3) (21,703)

Reverse acquisition expense(4) 2,815

---------

(38,993)

---------

1. Recognition of pre-acquisition equity of Cizzle Biotechnology Holdings PLC at 14 May 2021.

2. CBL had issued share capital and share premium of

GBP1,588,000. As these financial statements represent the capital

structure of the legal parent entity, the equity of CBL is

eliminated.

3. The value of the shares issued by the Company in exchange for

the entire share capital of CBL plus stamp duty expenses. The above

entry is required to eliminate the balance sheet impact of this

transaction.

4. The reverse acquisition expense represents the difference

between the value of the equity issued by the Company, and the

deemed consideration given by CBL to the Group.

4. Income Tax

There was no income tax for the new Group for the six months

ended 30 June 2021. CBL also has no income tax for the six months

ended 30 June 2020 and year ended 31 December 2020.

5. Earnings per share

Group CBL CBL

6 months 6 months Year

ended ended ended

31 December

30 June 2021 30 June 2020 2020

Basic loss per share:

Total comprehensive (loss)

- GBP'000 GBP(3,238) GBP(8) GBP(14)

Weighted number of Ordinary

Shares - '000 85,448 206,625 206,625

(Loss) per share - operations

- pence (3.79p) (0.004p) (0.007p)

The weighted number of shares of CBL for the six months ended 30

June 2020 and year ended 31 December 2020 include 314,000 ordinary

shares of CBL plus 206,311,000 consideration shares issued by the

Company to acquire CBL.

Diluted earnings per share is calculated by dividing the profit

attributable to ordinary shareholders by the weighted average

number of ordinary shares outstanding after adjusting these amounts

for the effects of dilutive potential ordinary shares.

As the Group result for the six months ended 30 June 2020 is a

loss, any exercise of share options or warrants would have an

anti-dilutive effect on earnings per share. Consequently earnings

per share and diluted earnings per share are the same, as

potentially dilutive share options have been excluded from the

calculation.

6. Copies of Interim Report

Copies of this interim report are available upon request to

members of the public from the Company Secretary, SGH Company

Secretaries Limited, 6(th) Floor, 60 Gracechurch Street, London,

EC3V 0HR. This interim report can also be viewed on the Group's

website: https://cizzlebiotechnology.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR VKLFLFKLFBBQ

(END) Dow Jones Newswires

September 30, 2021 02:00 ET (06:00 GMT)

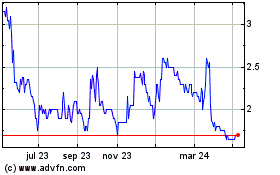

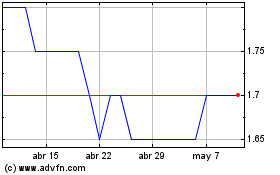

Cizzle Biotechnology (LSE:CIZ)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Cizzle Biotechnology (LSE:CIZ)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024