Coats Group PLC Trading Statement (1973T)

23 Noviembre 2021 - 1:00AM

UK Regulatory

TIDMCOA

RNS Number : 1973T

Coats Group PLC

23 November 2021

23 November 2021

Coats Group plc

Trading update: 6% organic revenue growth vs 2019, on track for

Full Year expectations

Coats Group plc ('Coats', the 'Company' or the 'Group'), the

world's leading industrial thread manufacturer, today announces a

trading update for the period 1 July 2021 to 31 October 2021 ('the

period'). Given the exceptional circumstances of 2020, we include

2019 detail in this statement.

-- 6% organic growth vs 2019, despite Covid disruption in

Vietnam during the period, which has now subsided

-- Pricing and productivity actions continue to offset inflationary pressures

-- Performance for the year anticipated to be in line with Group expectations

July to October Revenue July to October Revenue

vs 2020 vs 2019

Organic(2) Organic(3)

------------------------ ------------------------

Group 22% 6%

------------------------ ------------------------

Apparel & Footwear 25% 5%

------------------------ ------------------------

Performance Materials 17% 8%

------------------------ ------------------------

All following references are on an organic CER basis.

Strong organic Group revenue performance for the period, up 22%

year-on-year, and up 6% versus 2019 (H1 up 1%).

Strong operational performance, demand recovery, market share

gains and customer wins have continued, despite recent lockdown

impacts in Vietnam which have now subsided. The lessons learnt from

shutdowns around the globe in 2020 mean the Group continues to be

well-placed to manage regional Covid disruption as our global

footprint and organisational agility allow many of our customers to

be supported from other manufacturing sites.

Apparel & Footwear grew 5% vs 2019 (vs flat in the first

half). We continued to see positive end market sentiment across the

US, Europe and Asia. Sports and athleisure continued to perform

well.

Performance Materials grew 8% (organic) vs 2019; all segments

continued to perform strongly apart from US Personal Protection

which has a healthy demand pipeline but continues to be impacted by

US labour availability issues.

Pricing and procurement actions and self-help productivity

programmes continue to offset heightened inflationary pressures in

the supply chain (raw materials, energy, labour and freight

inflation).

Outlook

Given the Group's continued positive trading we anticipate

performance for the Full Year 2021 to be in line with our

expectations.

For the remainder of the year, and into 2022, we will continue

to drive profitable revenue growth by focusing on our strong

customer relationships, our digital, innovation and sustainability

credentials and ongoing pricing and productivity actions.

The Group will release its Full Year 2021 results on 3 March

2022.

Constant Exchange Rate (CER) are 2020 and 2019 results restated

(1) at 2021 exchange rates;

Organic on a CER basis includes like-for-like contributions from

(2) Pharr HP (post acquisition date of February 2020);

Organic on a CER basis includes like-for-like contributions from

(3) Threadsol (post acquisition date of February 2019) and excludes

contribution from Pharr HP (acquired in February 2020)

Appendix:

July to October Revenue July to October Revenue

vs 2020 vs 2019

Reported CER(1) Organic(2) Reported CER(1) Organic(3)

--------- ------- ----------- --------- ------- -----------

Group 22% 22% 22% 9% 11% 6%

--------- ------- ----------- --------- ------- -----------

Apparel & Footwear 25% 25% 25% 4% 5% 5%

--------- ------- ----------- --------- ------- -----------

Performance Materials 16% 17% 17% 26% 29% 8%

--------- ------- ----------- --------- ------- -----------

YTD Revenue vs 2020 YTD Revenue vs 2019

------------------------------- -------------------------------

Reported CER(1) Organic(2) Reported CER(1) Organic(3)

--------- ------- ----------- --------- ------- -----------

Group 31% 30% 29% 6% 8% 3%

--------- ------- ----------- --------- ------- -----------

Apparel & Footwear 35% 34% 34% 0% 2% 2%

--------- ------- ----------- --------- ------- -----------

Performance Materials 20% 20% 18% 24% 26% 6%

--------- ------- ----------- --------- ------- -----------

_________________________________________________________________________________________

Enquiry details

+44 (0)7880 471

Investors Victoria Huxster Coats Group plc 350

Richard Mountain / +44 (0)20 3727

Media Nick Hasell FTI Consulting 1374

_________________________________________________________________________________________

About Coats Group plc

Coats is the world's leading industrial thread company. At home

in some 50 countries, Coats has a workforce of 17,000 people across

six continents. Revenues in 2020 were US$1.2bn. The pioneering

history and innovative culture of Coats ensure it leads the way

around the world. It provides complementary and value-added

products, services and software solutions to the apparel and

footwear industries. It applies innovative techniques to develop

high technology Performance Materials threads, yarns, fabrics and

composites in areas like personal protection, telecoms, energy,

transportation, and household and recreation. Headquartered in the

UK, Coats is a FTSE 250 company, a constituent of the FTSE4Good

Index Series, a participant in the UN Global Compact and a member

of the Ellen MacArthur Foundation. It has also committed to

developing a long-term target to reach net-zero emissions by 2050,

the highest level of ambition on climate under the Science Based

Target initiative.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTDKBBDBBDBDDB

(END) Dow Jones Newswires

November 23, 2021 02:00 ET (07:00 GMT)

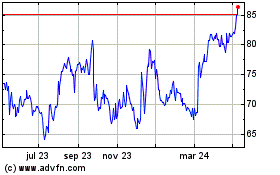

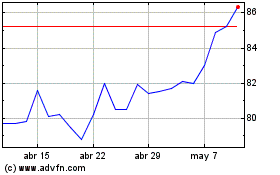

Coats (LSE:COA)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Coats (LSE:COA)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024