TIDMCOBR

RNS Number : 6563D

Cobra Resources PLC

30 June 2021

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF THE MARKET ABUSE REGULATION (EU) 596/2014 AS IT

FORMS PART OF UK DOMESTIC LAW BY VIRTUE OF THE EUROPEAN UNION

(WITHDRAWAL) ACT 2018 ("UK MAR"), AND IS DISCLOSED IN ACCORDANCE

WITH THE COMPANY'S OBLIGATIONS UNDER ARTICLE 17 OF uk MAR. UPON THE

PUBLICATION OF THIS ANNOUNCEMENT, THIS INSIDE INFORMATION (AS

DEFINED IN UK MAR) IS NOW CONSIDERED TO BE IN THE PUBLIC

DOMAIN.

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY IN OR INTO THE UNITED STATES,

AUSTRALIA, CANADA, JAPAN, THE REPUBLIC OF SOUTH AFRICA OR ANY OTHER

JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE

RELEVANT LAWS OF SUCH JURISDICTION.

30 June 2021

Cobra Resources plc

("Cobra" or the "Company")

Result of Annual General Meeting

Cobra, the gold explorer focused on the Wudinna Gold Project in

South Australia, announces that at the Annual General Meeting of

the Company held at 9.30 a.m. on 30 June 2021, all of the

resolutions were duly passed. The results of the poll, including

the proxy voting, will be available shortly on the Company's

website, www.cobraplc.com .

For the purposes of UK MAR, the person responsible for arranging

the release of this announcement on behalf of the Company was Greg

Hancock, Chairman.

Enquiries:

Cobra Resources plc Via Vigo Consulting

Craig Moulton (Australia) +44 (0)20 7390 0234

Dan Maling (UK)

SI Capital Limited (Joint Broker)

Nick Emerson

Sam Lomanto +44 (0)1483 413 500

Peterhouse Capital Limited (Joint Broker)

Duncan Vasey

Lucy Williams +44 (0)20 7469 0932

Vigo Consulting (Financial Public Relations)

Ben Simons

Fiona Hetherington +44 (0)20 7390 0234

About Cobra

Cobra's Wudinna Gold Project is located in the Gawler Craton

which is home to some of the largest IOCG discoveries in Australia

including Olympic Dam, as well as Prominent Hill and Carrapateena.

Cobra's Wudinna tenements contain extensive orogenic gold

mineralisation and are characterised by potentially open-pitable,

high-grade gold intersections, with ready access to nearby

infrastructure. In total Cobra has over 22 orogenic gold prospects,

with grades of between 16 g/t up to 37.4 g/t outside of the current

211,000 oz JORC resource, as well as one copper-gold prospect, and

four IOCG targets.

Wudinna Project Description

The Eyre Peninsula Gold Joint Venture comprises a 1,928 km(2)

land holding in the Gawler Craton. The Wudinna Gold Project within

the Joint Venture tenement holding comprises a cluster of gold

prospects which includes the Barns, White Tank and Baggy Green

deposits.

Chairman's statement

INTRODUCTION

2020 will be remembered as a challenging year, profoundly

impacting the lives of many people. The pandemic also impacted both

equity and commodity markets, resulting in strong demand for

safehaven commodities such as gold and copper, reflected through

strong support for precious and base metals explorers on the London

Stock Exchange. During the year, Cobra raised sufficient funds to

conduct three detailed soil programmes, and then test priority

targets via a significant Reverse Circulation (RC) drilling

programme. The results of this drilling, particularly at Clarke,

were spectacular, realising one of the largest high-grade

intercections in the Wudinna Gold Projects' history.

BACKGROUND

Cobra Resources began life as publicly listed company with the

aim of finding suitable precious, base or energy metals exploration

or mining projects in either Australia or Africa. During 2019 the

Board identified several potentially suitable projects, which were

reviewed in detail to evaluate their strengths, growth potential

and likely longer-term value to shareholders.

Following an extensive due diligence process, the Wudinna Gold

Project was identified as the most compelling opportunity primarily

due to its technical and commercial merits which could be

efficiently explored and grown with Cobra's infrastructure and

skilled resources. This included having an existing gold resource

of over 200,000 ounces with significant upside potential, being

located in a jurisdiction that was stable, with low sovereign risk,

and having a large number of prospects which could be efficiently

explored and expanded with Cobra's infrastructure and skilled

resources.

The Group has retained a team with the core competencies

required to deliver on its strategic objectives. During the course

of 2020, the Company sought to strengthen the existing board with

the appointment of two new members:

-- David Clarke - Non-Executive Director. David is an eminent

and renowned geologist, responsible for the discovery of

Tuckabianna amongst others. David is tasked with providing

technical oversight.

-- Daniel Maling - Non-Executive Director. Daniel has extensive

commercial and business development experience in the oil &

gas, mining and technology sectors.

OPERATIONAL REVIEW

The Company's articulated strategy to utilise staged geochemical

sampling to identify priority targets as a means to reduce risk was

demonstrably successful during the 2020 exploration campaign. These

initial three programmes focused on:

Programme 1 : Calibration of surface and drillhole geochemistry

to characterise primary immobile pathfinder elements directly

associated with mineralisation.

Programme 2 : Collection of surface samples and re-analysis of

historic surface and drillhole pulps to charaterise the orientation

and extension of existing brownfields resources.

Programme 3 : Re-analysis of historic surface pulps to

charaterise priority areas for greenfields discoveries.

In total 5,185 samples were analysed for a broad multi-element

suite, with this extensive dataset providing excellent information

to target priority drilling areas. With increased confidence in the

planned drilling targets gained from this pathfinder strategy, the

Company then raised GBP1.5m to progress the drilling during the

second half of 2020.

Drilling commenced at Wudinna on 23(rd) September 2020 . Four

primary drilling areas were planned, focusing on testing the

orientation and continuity of mineralisation at the Baggy Green,

Clarke, Laker and Barns deposits. Unfortunately access conditions

meant that the Laker drilling did not proceed, and was

deferred.

The total drilling programme of included 41 holes for 6,090

metres and was completed by 14th November 2020. Following some

assay laboratory and Christmas holiday delays the company was able

to report the following signature intersections post year end:

1. CBRC009 31m @ 3.06g/t from 69m inc. 15m @ 5.25 g/t

2. CBRC008 16m @ 1.37g/t from 43m inc. 4m @ 4.19 g/t

3. CBRC027 37m @ 1.38g/t from 151m inc. 13m @ 3.25g/t

4. CBRC026 6m @ 2.3g/t from 85m inc. 1m @ 8.72g/t

The drilling programme satisfied the Stage 1 Earn In obligations

such that Cobra now holds a 50% beneficial interest in the Wudinna

Gold Project.

POST PERIOD EVENTS

On 11 January 2021, the Company issued a total of 32,383,152 new

ordinary shares pursuant to completion of Stage 1 earn-in of the

Wudinna Gold Project, with 31,049,819 shares at 2.4 pence per share

being issued in accordance with the acquisition agreement to the

vendors of Lady Alice Trust and Lady Alice Mines Pty Ltd, and

1,333,333 shares at 1.5 pence per share issued to the Company's CEO

in accordance with the terms of his service agreement.

On 28 January 2021, the Company issued 1,934,800 new ordinary

shares pursuant to the exercise of warrants, with 934,800 shares at

a price of 3 pence per share and 1,000,000 shares at a price of 2

pence per share.

On 18 and 19 of February 2021, the Company issued 2,333,334 new

ordinary shares and 1,666,667 new ordinary shares respectively, at

2 pence per share, pursuant to the exercise of warrants.

On 29 April 2021, the Company issued a total of 7,110,053 new

ordinary shares, with 5,664,340 shares being issued at 1 pence per

share to the vendors of Lady Alice Trust and Lady Alice Mines Pty

Ltd in accordance with the acquisition agreement for the Wudinna

Gold Project, and 1,445,713 shares at 2.3 pence per share to a

drilling contractor in settlement of a contractual agreement in

respect of the provision of service.

COVID-19

On 11 March 2020, the World Health Organisation declared the

Coronavirus outbreak to be a pandemic in recognition of its rapid

spread across the globe, with over 200 countries now affected. Many

governments are taking increasingly stringent steps to help contain

or delay the spread of the virus and as a result there is a

significant increase in economic uncertainty.

For the Group's 31 December 2020 financial statements, the

Coronavirus outbreak and the related impacts are considered

non-adjusting events. Consequently, there is no impact on the

recognition and measurement of assets and liabilities. Due to the

uncertainty of the outcome of current events, the Group cannot

reasonably estimate the impact these events will have on the

Group's financial position, results of operations or cash flows in

the future.

CONCLUSION

Despite the challenges presented in 2020, the Company has

delivered some very strong progress over the course of the period

that position us for a hugely exciting next phase which is now

underway. I thank my fellow directors for their contribution

throughout the year, Craig Moulton our Managing Director for his

commitment, and our shareholders generally for their support. We

look forward to a period of significant activity which lies in

front of us.

Greg Hancock

Chairman

29 June 2021

CONSOLIDATED INCOME STATEMENT

For the year ended 31 December 2020

Notes 31 December 31 December

2020 2019

GBP GBP

Other Income 50,280 -

Other Expenses (895,684) (544,500)

IPO expenses - (124,400)

Operating loss 2 (845,404) (668,900)

Finance income and costs - -

Change in estimate of contingent consideration 13 (161,346) -

Loss before tax (1,006,750) (668,900)

Taxation 5 - -

Loss for the year attributable to equity holders (1,006,750) (668,900)

=========== ===========

Earnings per ordinary share

Basic and diluted loss per share attributable (GBP0.0035) (GBP0.0099)

to owners of the Parent Company 6

=========== ===========

All operations are considered to be continuing.

The accompanying notes are an integral part of these financial

statements.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the year ended 31 December 2020

31 December 31 December

2020 2019

GBP GBP

( 668,900

Loss for the year (1,006,750) )

Other Comprehensive income

Items that may subsequently be reclassified

to profit or loss:

* Exchange differences on translation of foreign

operations 66,916 (1,461 )

Total comprehensive loss attributable ( 670,361

to equity holders of the Parent Company (939,834) )

=========== ===========

The accompanying notes are an integral

part of these financial statements.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

31 December 2020

Notes

2020 2019

GBP GBP

Non-current assets

Intangible Fixed Assets 8 1,495,519 612,242

Property, plant and equipment 9 2,400 3,428

Total non-current assets 1,497,919 615,670

----------- -----------

Current assets

Trade and other receivables 10 69,408 37,433

Cash and cash equivalents 11 1,338,851 7,675

----------- -----------

Total current assets 1,408,259 45,108

----------- -----------

Non-current liabilities

Deferred consideration 13 (322,691) (350,066)

----------- -----------

Current liabilities

Trade and other payables 12 (169,314) (436,553)

Deferred consideration 13 (188,721) (215,486)

Total current liabilities (358,035) (652,039)

----------- -----------

Net assets/(liabilities) 2,225,451 (341,327)

=========== ===========

Capital and reserves

Share capital 14 2,829,566 672,335

Share premium account 564,173 160,992

Share based payment reserve 1,006,239 69,038

Retained losses (2,239,982) (1,242,231)

Foreign currency reserve 65,456 (1,461)

----------- -----------

Total equity 2,225,451 (341,327)

=========== ===========

The accompanying notes are an integral part of these financial

statements.

These financial statements were approved and authorised for

issue by the Board of Directors on 29 June 2021.

Signed on behalf of the Board of Directors

Craig Moulton , Executive Director , Company No. 11170056

COMPANY STATEMENT OF FINANCIAL POSITION

31 December 2020

Notes

2020 2019

GBP GBP

Non-current assets

Investment in subsidiary 7 432,260 432,260

Property, plant and equipment 9 2,400 3,428

Intangible Fixed Assets 8 33,251 -

Total non-current assets 467,910 435,688

----------- -----------

Current assets

Trade and other receivables 10 1,636,477 241,518

Cash and cash equivalents 11 834,164 1,749

----------- -----------

Total current assets 2,470,641 243,267

----------- -----------

Non-current liabilities

Deferred consideration 13 (322,691) (350,066)

----------- -----------

Total Non-current liabilities 2,470,641 243,267

--------- ------- (322,691) (350,066)

----------- -----------

Current liabilities

Trade and other payables 12 (95,636) (422,560)

Deferred consideration 13 (188,721) (215,486)

Total current liabilities (284,357) (638,046)

----------- -----------

Net assets/(liabilities) 2,331,502 (309,157)

=========== ===========

Capital and reserves

Share capital 14 2,829,566 672,335

Share premium account 564,173 160,992

Share based payment reserve 1,006,239 69,038

Retained losses (2,068,475) (1,211,522)

Equity shareholders' funds 2,331,502 (309,157)

=========== ===========

The Company has taken advantage of the exemption allowed under

section 408 of the Companies Act 2006 and has not included its own

income statement and statement of comprehensive income in these

financial statements. The Company's loss for the period amounted to

GBP878,753 (2019: GBP638,190 loss).

The accompanying notes are an integral part of these financial

statements.

These financial statements were approved and authorised for

issue by the Board of Directors on 29 June 2021.

Signed on behalf of the Board of Directors

Craig Moulton, Executive Director, Company No. 11170056

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the year ended 31 December 2020

Share Share Share based Retained Foreign Total

capital premium payment losses currency

reserve reserve

GBP GBP GBP GBP GBP GBP

As at 1 January 2019 672,335 160,992 69,038 (573,332) - 329,034

Loss for the year - - - (668,900) - (668,900)

Translation differences - - - - (1,461) (1,461)

--------- ----------- ----------- ----------- -------- --------------

Comprehensive loss for the year - - - (668,900) (1,461) (670,361)

--------- ----------- ----------- ----------- -------- --------------

At 31 December 2019 672,335 160,992 69,038 (1,242,232) (1,461) (341,327)

Loss for the year - - - (1,006,750) - (1,006,750)

Translation differences - - - - 66,917 66,917

--------- ----------- ----------- ----------- -------- --------------

Comprehensive loss for the year - - - (1,006,750) 66,917 (939,834)

Shares issued 2,157,231 1,537,142 - - - 3,694,373

Share based payment expired - - (3,833) 3,833 - -

Exercise of options & warrants - - (17,967) 5,167 - (12,800)

Cost of share issue - (1,133,961) - - - (1,133,961)

Share warrant charge - - 947,000 - - 947,000

Share option charge - - 12,000 - - 12,000

At 31 December 2020 2,829,566 564,173 1,006,238 (2,239,982) 65,456 2,225,451

--------- ----------- ----------- ----------- -------- --------------

The following describes the nature and purpose of each reserve

within equity:

Share capital: Nominal value of shares issued

Share premium: Amount subscribed for share capital in excess of

nominal value, less share issue costs

Share based payment reserve: Cumulative fair value of warrants and options granted

Retained losses: Cumulative net gains and losses, recognised in

the statement of comprehensive income

Foreign currency reserve: Gains/losses arising on translation of

foreign controlled entities into pounds sterling.

The accompanying notes are an integral part of these financial

statements.

COMPANY STATEMENT OF CHANGES IN EQUITY

For the year ended 31 December 2020

Share Share Share based Retained Total

capital premium payment losses

reserve

GBP GBP GBP GBP GBP

At 1 January 2019 672,335 160,992 69,038 (573,332) 329,034

Loss for the year - - - (638,190) (638,190)

Translation differences - - - - -

--------- ----------- ----------------- ----------- -----------

Comprehensive loss for the period - - - (638,190) (638,190)

--------- ----------- ----------------- ----------- -----------

At 31 December 2019 672,335 160,992 69,038 (1,211,522) (309,157)

Loss for the year - - - (878,753) (878,753)

Translation differences - - - - -

Shares issued 2,157,231 1,537,142 - - 3,694,373

Share based payment expired - - (3,833) 3,833 -

Exercise of options & warrants - - (17,967) 17,967 -

Cost of share issue - (1,133,961) - - (1,133,961)

Share warrant charge - - 947,000 - 947,000

Share option charge - - 12,000 - 12,000

At 31 December 2020 2,829,566 564,173 1,006,238 (2,068,475) 2,331,502

--------- ----------- ----------------- ----------- -----------

The following describes the nature and purpose of each reserve

within equity:

Share capital: Nominal value of shares issued

Share premium: Amount subscribed for share capital in excess of

nominal value, less share issue costs

Share based payment reserve: Cumulative fair value of warrants and options granted

Retained losses: Cumulative net gains and losses, recognised in

the statement of comprehensive income

The accompanying notes are an integral part of these financial

statements.

CONSOLIDATED CASH FLOW STATEMENT

For the year ended 31 December 2020

Notes 31 December 31 December

2020 2019

GBP GBP

Cash flows from operating activities

Loss before tax (1,006,750) (668,900)

Equity settled share based payments 265,189 -

Depreciation 9 1,028 979

Foreign exchange 66,916 5,950

Change in estimate of contingent consideration 13 161,346 -

(Decrease) / Increase in trade and other receivables 10 (31,975) (9,286)

Increase in trade and other payables 12 (482,725) 313,519

Share warrant charge - -

Net cash used in operating activities (1,026,971) (357,738)

----------- -----------

Cash flows from investing activities

Payments for exploration and evaluation activities 8 (883,277) (5,660)

Payment for acquisition of subsidiary, net of cash acquired 17 - 11,645

Payments for tangible fixed assets 9 - (4,407)

Net cash used in investing activities (883,277) 1,578

----------- -----------

Cash flows from financing activities

Proceeds from the issue of shares 3,428,384 35,700

Cost of shares issued (186,961) -

Net cash generated from financing activities 3,241,423 35,700

----------- -----------

Net increase/(decrease) in cash and cash equivalents 1,331,176 (320,460)

Cash and cash equivalents at beginning of year 7,675 328,135

Cash and cash equivalents at end of year 11 1,338,851 7,675

=========== ===========

-- During the year, Shares worth GBP168,819 were issued to the

previous Lady Alice Mines unit holders as per the sale

agreement.

-- During the year, Liabilities (Broker Fees) worth GBP186,960

were offset against share proceeds.

-- During the year, Shares worth GBP96,370 were issued to Directors in Lieu of fees.

The accompanying notes are an integral part of these financial

statements

COMPANY CASH FLOW STATEMENT

For the year ended 31 December 2020

Notes 31 December 31 December

2020 2019

GBP GBP

Cash flows from operating activities

Loss before tax (878,753) (638,190)

Equity settled share based payments 265,189 -

Depreciation 9 1,028 979

Foreign exchange loss/gain 12,801 -

Change in estimate of contingent consideration 13 161,346 -

Increase in trade and other receivables 10 (1,394,958) (4,958)

Increase in trade and other payables 12 (542,410) 359,611

Share warrant charge - -

Net cash used in operating activities (2,375,757) (282,558)

----------- -----------

Cash flows from investing activities

Payments for tangible fixed assets 9 - (4,407)

Payments for Intangible fixed assets (33,251) -

Investment in subsidiary 7 - (535)

Net cash used in investing activities (33,251) (4,942)

----------- -----------

Cash flows from financing activities

Proceeds from the issue of shares 3,428,384 35,700

Cost of shares issued (186,961) -

Loan to subsidiary company 10 - (74,586)

Net cash (used in)/generated from financing activities 3,241,423 (38,886)

----------- -----------

Net increase/(decrease) in cash and cash equivalents 832,415 (326,386)

Cash and cash equivalents at beginning of year 1,749 328,135

Cash and cash equivalents at end of year 11 834,164 1,749

=========== ===========

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

RAGDKKBPCBKKDAN

(END) Dow Jones Newswires

June 30, 2021 06:03 ET (10:03 GMT)

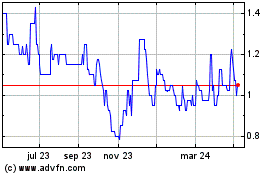

Cobra Resources (LSE:COBR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

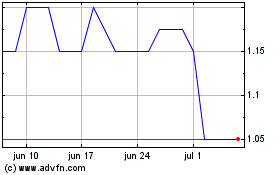

Cobra Resources (LSE:COBR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024