TIDMCORA

RNS Number : 9244L

Cora Gold Limited

16 September 2021

Cora Gold Limited / EPIC: CORA.L / Market: AIM / Sector:

Mining

16 September 2021

Cora Gold Limited ('Cora' or 'the Company')

Interim Results for the Six Months Ended 30 June 2021

Cora Gold Limited, the West African focused gold company, is

pleased to announce its unaudited interim results for the six

months ended 30 June 2021.

Highlights

-- H1 2021 was a period of intense activity with the launch of

an expanded +40,000m drill programme at the Sanankoro Project:

-- Dual focus on targeting resource growth as well as infill

drilling to convert existing Inferred resources to Indicated

category

-- Results to date have been extremely encouraging with good

widths and high-grades in generally shallow oxides ore

-- Previously released drill results include:

-- 49m @15.55g/t Au (incl 8m @ 89.12g/t Au)

-- 19m @ 31.56g/t Au (incl 6m @ 95g/t Au)

-- 2m @ 146.43g/t Au

-- 32m @ 7.83g/t Au (incl 4m @53.86g/t Au)

-- 56m @ 3.54g/t Au (incl 21m @ 8.17g/t Au)

-- 8m @ 19.11g/t Au

-- 32m @ 4.43g/t Au

-- 21m @ 5.57g/t Au

-- 14m @8.54g/t Au

-- 54m @ 2.07g/t Au (incl 2m @ 17.71g/t Au)

-- 66m @ 1.58g/t Au)

-- Advancing updated Mineral Resource Estimate in H2 2021 and

Definitive Feasibility Study in H1 2022

-- Continued strong support from investors and existing

shareholders demonstrated through participation in a fundraising

for in excess of GBP3.13 million in June 2021.

-- Cash at end of June 2021 of US$5.7m

Bert Monro, Chief Executive Officer of Cora, commented: "The

first six months of this year have been particularly active for the

Company, with significant progress made towards our Definitive

Feasibility Study ('DFS') at our flagship Sanankoro Gold Project in

Mali. During the year-to-date, Cora has undertaken its largest ever

drilling campaign at our key Sanankoro asset, which has returned

consistently strong results across all target areas.

"Following the recently updated term sheet with Lionhead

Capital, Sanankoro is further de-risked and its future development

is well supported. The extremely encouraging results from our

drilling at Sanankoro also brings us closer to the updated mineral

resource estimate once all of the results of the campaign are

received later this year. DFS work is now gaining momentum and we

expect to publish this in H1 2022.

"I am incredibly grateful for the efforts of our onsite team in

Mali to deliver these excellent results, and for the support of the

board and management. I would also like to thank our shareholders

for their continued support and I look forward to providing further

updates to the market on our developments over the coming

months.

"This has been a very exciting period for Cora Gold with a

significant number of landmark events achieved as we transition

from explorer to producer over the coming years."

The Company's unaudited interim results for the six months ended

30 June 2021 will be made available on the Company's website at

http://www.coragold.com/category/company-reports .

Market Abuse Regulation ('MAR') Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014, which is part of UK law by virtue of

the European Union (Withdrawal) Act 2018, until the release of this

announcement.

**S**

For further information, please visit http://www.coragold.com or

contact:

+44 (0) 20 3239

Bert Monro / Norm Bailie Cora Gold Limited 0010

Christopher Raggett / Charlie finnCap Ltd +44 (0) 20 7220

Beeson (Nomad & Joint Broker) 0500

Turner Pope Investments +44 (0) 20 3657

Andy Thacker / James Pope (Joint Broker) 0050

St Brides Partners +44 (0) 20 7236

Susie Geliher / Selina Lovell (Financial PR) 1177

Consolidated Statement of Financial Position

as at 30 June 2021 and 2020, and 31 December 2020

All amounts stated in thousands of United States dollar

30 June 30 June 31 December

2021 2020 2020

Note(s) US$'000 US$'000 US$'000

Unaudited Unaudited

Non-current assets

---------- ----------- ----------- ------------

Intangible assets 3 16,974 12,577 13,665

________ ________ ________

---------- ----------- ----------- ------------

Current assets

---------- ----------- ----------- ------------

Trade and other receivables 4 46 72 59

---------- ----------- ----------- ------------

Cash and cash equivalents 5 5,676 3,631 4,514

________ ________ ________

---------- ----------- ----------- ------------

5,722 3,703 4,573

________ ________ ________

---------- ----------- ----------- ------------

Total assets 22,696 16,280 18,238

________ ________ ________

---------- ----------- ----------- ------------

Current liabilities

---------- ----------- ----------- ------------

Trade and other payables 6 (846) (156) (216)

________ ________ ________

---------- ----------- ----------- ------------

Total liabilities (846) (156) (216)

________ ________ ________

---------- ----------- ----------- ------------

Net current assets 4,876 3,547 4,357

________ ________ ________

---------- ----------- ----------- ------------

Net assets 21,850 16,124 18,022

________ ________ ________

---------- ----------- ----------- ------------

Equity and reserves

---------- ----------- ----------- ------------

Share capital 7 22,543 16,207 18,118

---------- ----------- ----------- ------------

Retained deficit (693) (83) (96)

________ ________ ________

---------- ----------- ----------- ------------

Total equity 21,850 16,124 18,022

________ ________ ________

---------- ----------- ----------- ------------

Consolidated Statement of Comprehensive Income

for the six months ended 30 June 2021 and 2020, and the year

ended 31 December 2020

All amounts stated in thousands of United States dollar (unless

otherwise stated)

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2021 2020 2020

Note(s) US$'000 US$'000 US$'000

Unaudited Unaudited

Overhead costs (716) (623) (727)

----------- ----------- -------------

Impairment of intangible assets 3 - - -

________ ________ ________

----------- ----------- ----------- -------------

Loss before income tax (716) (623) (727)

----------- ----------- -------------

Income tax - - -

________ ________ ________

----------- ----------- ----------- -------------

Loss for the period (716) (623) (727)

----------- ----------- -------------

Other comprehensive income - - -

________ ________ ________

----------- ----------- -------------

Total comprehensive loss for the (716) (623) (727)

period ________ ________ ________

----------- ----------- -------------

Earnings per share from continuing

operations attributable to owners

of the parent

----------- ----------- -------------

Basic earnings per share

(United States dollar) 2 (0.0034) (0.0041) (0.0041)

________ ________ ________

------------ ----------- ----------- -------------

Fully diluted earnings per share

(United States dollar) 2 (0.0034) (0.0041) (0.0041)

________ ________ ________

------------ ----------- ----------- -------------

Consolidated Statement of Changes in Equity

for the six months ended 30 June 2021 and 2020,

and the year ended 31 December 2020

All amounts stated in thousands of United States dollar

Retained

Share (deficit) Total

capital / earnings equity

US$'000 US$'000 US$'000

As at 01 January 2020 12,675 493 13,168

________ ________ ________

Loss for the year - (727) (727)

________ ________ ________

----------- ----------- -----------

Total comprehensive loss for the - (727) (727)

year ________ ________ ________

----------- ----------- -----------

Proceeds from shares issued 3,554 - 3,554

----------- ----------- -----------

Issue costs (22) - (22)

----------- ----------- -----------

Proceeds from warrants exercised 1,911 - 1,911

----------- ----------- -----------

Share based payments - share options - 138 138

________ ________ ________

----------- ----------- -----------

Total transactions with owners,

recognised directly in equity 5,443 138 5,581

________ ________ ________

----------- ----------- -----------

As at 31 December 2020 18,118 (96) 18,022

________ ________ ________

----------- ----------- -----------

Unaudited

As at 01 January 2020 12,675 493 13,168

________ ________ ________

Loss for the period - (623) (623)

________ ________ ________

----------- ----------- -----------

Total comprehensive loss for - (623) (623)

the period ________ ________ ________

----------- ----------- -----------

Proceeds from shares issued 3,554 - 3,554

----------- ----------- -----------

Issue costs (22) - (22)

----------- ----------- -----------

Share based payments - share - 47 47

options ________ ________ ________

----------- ----------- -----------

Total transactions with owners,

recognised directly in equity 3,532 47 3,579

________ ________ ________

----------- ----------- -----------

As at 30 June 2020 Unaudited 16,207 (83) 16,124

________ ________ ________

----------- ----------- -----------

Retained

Share (deficit) Total

capital / earnings equity

US$'000 US$'000 US$'000

Unaudited

As at 01 January 2021 18,118 (96) 18,022

________ ________ ________

Loss for the period - (716) (716)

________ ________ ________

----------- ----------- -----------

Total comprehensive loss for the - (716) (716)

period ________ ________ ________

----------- ----------- -----------

Proceeds from shares issued 4,433 - 4,433

----------- ----------- -----------

Issue costs (8) - (8)

----------- ----------- -----------

Share based payments - share options - 119 119

________ ________ ________

----------- ----------- -----------

Total transactions with owners,

recognised directly in equity 4,425 119 4,544

________ ________ ________

----------- ----------- -----------

As at 30 June 2021 Unaudited 22,543 (693) 21,850

________ ________ ________

----------- ----------- -----------

Consolidated Statement of Cash Flows

for the six months ended 30 June 2021 and 2020, and the year

ended 31 December 2020

All amounts stated in thousands of United States dollar

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2021 2020 2020

Note(s) US$'000 US$'000 US$'000

Unaudited Unaudited

Cash flows from operating activities

---------- ----------- ----------- -------------

Loss for the period (716) (623) (727)

---------- ----------- ----------- -------------

Adjustments for:

---------- ----------- ----------- -------------

Share based payments 119 47 138

---------- ----------- ----------- -------------

Decrease in trade and other receivables 13 114 127

---------- ----------- ----------- -------------

Increase / (decrease) in trade and 630 (294) (179)

other payables ________ ________ ________

---------- ----------- ----------- -------------

Net cash generated from / (used) in 46 (756) (641)

operating activities ________ ________ ________

---------- ----------- ----------- -------------

Cash flows from investing activities

---------- ----------- ----------- -------------

Additions to intangible assets 3 (3,309) (1,203) (2,346)

________ ________ ________

---------- ----------- ----------- -------------

Net cash used in investing activities (3,309) (1,203) (2,346)

________ ________ ________

---------- ----------- ----------- -------------

Cash flows from financing activities

---------- ----------- ----------- -------------

Proceeds from shares issued 7 4,433 3,554 5,465

---------- ----------- ----------- -------------

Issue costs 7 (8) (22) (22)

________ ________ ________

---------- ----------- ----------- -------------

Net cash generated from financing 4,425 3,532 5,443

activities ________ ________ ________

---------- ----------- ----------- -------------

Net increase in cash and cash equivalents 1,162 1,573 2,456

---------- ----------- ----------- -------------

Cash and cash equivalents at beginning 5 4,514 2,058 2,058

of period ________ ________ ________

---------- ----------- ----------- -------------

Cash and cash equivalents at end of 5 5,676 3,631 4,514

period ________ ________ ________

---------- ----------- ----------- -------------

Notes to the Condensed Consolidated Financial Statements

for the six months ended 30 June 2021 and 2020, and the year

ended 31 December 2020

All tabulated amounts stated in thousands of United States

dollar (unless otherwise stated)

1. General information

The principal activity of Cora Gold Limited (the 'Company') and

its subsidiaries (together the ' Group ') is the exploration and

development of mineral projects, with a primary focus in West

Africa. The Company is incorporated and domiciled in the British

Virgin Islands. The address of its registered office is Rodus

Building, Road Reef Marina, P.O. Box 3093, Road Town, Tortola

VG1110, British Virgin Islands.

The condensed consolidated interim financial statements of the

Group for the six months ended 30 June 2021 comprise the results of

the Group and have been prepared in accordance with AIM Rules for

Companies. As permitted, the Company has chosen not to adopt IAS 34

'Interim Financial Reporting' in preparing these interim financial

statements.

The condensed consolidated interim financial statements for the

period 01 January to 30 June 2021 are unaudited. In the opinion of

the directors the condensed consolidated interim financial

statements for the period present fairly the financial position,

and results from operations and cash flows for the period in

conformity with generally accepted accounting principles

consistently applied. The condensed consolidated interim financial

statements incorporate unaudited comparative figures for the

interim period 01 January to 30 June 2020 and extracts from the

audited financial statements for the year ended 31 December

2020.

The interim report has not been audited or reviewed by the

Company' s auditor.

The key risks and uncertainties and critical accounting

estimates remain unchanged from 31 December 2020 and the accounting

policies adopted are consistent with those used in the preparation

of its financial statements for the year ended 31 December

2020.

As at 30 June 2021 and 2020, and 31 December 2020 the Company

held:

-- a 100% shareholding in Cora Gold Mali SARL (registered in the

Republic of Mali; the address of its registered office is Rue 224

Porte 1279, Hippodrome 1, BP 2788, Bamako, Republic of Mali);

-- a 100% shareholding in Cora Exploration Mali SARL (the

address of its registered office is Rue 224 Porte 1279, Hippodrome

1, BP 2788, Bamako, Republic of Mali);

-- a 95% shareholding in Sankarani Ressources SARL (the address

of its registered office is Rue 841 Porte 202, Faladiè SEMA, BP

366, Bamako, Republic of Mali); and

-- Cora Resources Mali SARL (registered in the Republic of Mali;

the address of its registered office is Rue 841 Porte 202, Faladiè

SEMA, BP 366, Bamako, Republic of Mali) was a wholly owned

subsidiary of Sankarani Ressources SARL.

The remaining 5% of Sankarani Ressources SARL can be purchased

from a third party for US$1,000,000.

2. Earnings per share

The calculation of the basic and fully diluted earnings per

share attributable to the equity shareholders is based on the

following data:

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2021 2020 2020

US$'000 US$'000 US$'000

Unaudited Unaudited

Net loss attributable to equity shareholders (716) (623) (727)

_______ _______ _______

----------- ----------- -------------

Weighted average number of shares for

the purpose of 210,296 153,076 175,680

basic earnings per share (000's) _______ _______ _______

----------- ----------- -------------

Weighted average number of shares for

the purpose of 210,296 153,076 175,680

fully diluted earnings per share (000's) _______ _______ _______

----------- ----------- -------------

Basic earnings per share

(United States dollar) (0.0034) (0.0041) (0.0041)

_______ _______ _______

----------- ----------- -------------

Fully diluted earnings per share

(United States dollar) (0.0034) (0.0041) (0.0041)

_______ _______ _______

----------- ----------- -------------

As at 30 June 2021 and 31 December 2020 the Company's issued and

outstanding capital structure comprised a number of ordinary shares

and share options (see Note 7).

As at 30 June 2020 the Company's issued and outstanding capital

structure comprised a number of ordinary shares, warrants and share

options (see Note 7).

3. Intangible assets

Intangible assets relate to exploration and evaluation project

costs capitalised as at 30 June 2021 and 2020, and 31 December

2020, less impairment.

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2021 2020 2020

US$'000 US$'000 US$'000

Unaudited Unaudited

As at 01 January 13,665 11,374 11,374

----------- ----------- -------------

Additions 3,309 1,203 2,291

----------- ----------- -------------

Impairment - - -

_______ _______ _______

----------- ----------- -------------

As at period end 16,974 12,577 13,665

_______ _______ _______

----------- ----------- -------------

Additions to project costs during the six months ended 30 June

2021 and 2020, and the year ended 31 December 2020 were in the

following geographical areas:

Six months Six months Year

ended ended ended

30 June 30 June 31 December

2021 2020 2020

US$'000 US$'000 US$'000

Unaudited Unaudited

Mali 3,286 1,008 1,982

----------- ----------- -------------

Senegal 23 195 309

_______ _______ _______

----------- ----------- -------------

Additions to project costs 3,309 1,203 2,291

_______ _______ _______

----------- ----------- -------------

Project costs capitalised as at 30 June 2021 and 2020, and 31

December 2020 related to the following geographical areas:

30 June 30 June 31 December

2021 2020 2020

US$'000 US$'000 US$'000

Unaudited Unaudited

Mali 16,534 12,274 13,248

----------- ----------- ------------

Senegal 440 303 417

_______ _______ _______

----------- ----------- ------------

As at period end 16,974 12,577 13,665

_______ _______ _______

----------- ----------- ------------

4. Trade and other receivables

30 June 30 June 31 December

2021 2020 2020

US$'000 US$'000 US$'000

Unaudited Unaudited

Other receivables 21 49 21

----------- ----------- ------------

Prepayments 25 23 38

_______ _______ _______

----------- ----------- ------------

46 72 59

_______ _______ _______

------------------- ----------- ----------- ------------

5. Cash and cash equivalents

Cash and cash equivalents held as at 30 June 2021 and 2020, and

31 December 2020 were in the following currencies:

30 June 30 June 31 December

2021 2020 2020

US$'000 US$'000 US$'000

Unaudited Unaudited

British pound sterling (GBPGBP) 3,403 3,587 4,456

----------- ----------- ------------

United States dollar (US$) 2,087 9 9

----------- ----------- ------------

CFA franc (XOF) 174 12 30

----------- ----------- ------------

Euro (EUREUR) 12 23 19

_______ _______ _______

----------- ----------- ------------

5,676 3,631 4,514

_______ _______ _______

--------------------------------- ----------- ----------- ------------

6. Trade and other payables

30 June 30 June 31 December

2021 2020 2020

US$'000 US$'000 US$'000

Unaudited Unaudited

Trade payables 434 75 138

----------- ----------- ------------

Other payables and taxes - 55 -

----------- ----------- ------------

Accruals 412 26 78

_______ _______ _______

----------- ----------- ------------

846 156 216

_______ _______ _______

-------------------------- ----------- ----------- ------------

7. Share capital

The Company is authorised to issue an unlimited number of no par

value shares of a single class.

As at 31 December 2019 the Company's issued and outstanding

capital structure comprised:

-- 129,676,567 ordinary shares;

-- warrants to subscribe for 30,714,285 ordinary shares in the

capital of the Company at a price of 10 pence (British pound

sterling) per ordinary share expiring on 30 September 2020;

-- warrants to subscribe for 320,575 ordinary shares in the

capital of the Company at a price of 16.5 pence (British pound

sterling) per ordinary share expiring on 09 October 2020;

-- share options over 1,900,000 ordinary shares in the capital

of the Company exercisable at 16.5 pence (British pound sterling)

per ordinary share expiring on 18 December 2022; and

-- share options over 6,200,000 ordinary shares in the capital

of the Company exercisable at 8.5 pence (British pound sterling)

per ordinary share expiring on 09 October 2023.

On 22 April 2020 the Company closed a subscription for

60,838,603 ordinary shares in the capital of the Company at a price

of 4.75 pence (British pound sterling) per ordinary share for total

gross proceeds of GBPGBP2,889,833.64. Certain directors of the

Company participated in this subscription.

As at 30 June 2020 the Company's issued and outstanding capital

structure comprised:

-- 190,515,170 ordinary shares;

-- warrants to subscribe for 30,714,285 ordinary shares in the

capital of the Company at a price of 10 pence (British pound

sterling) per ordinary share expiring on 30 September 2020;

-- warrants to subscribe for 320,575 ordinary shares in the

capital of the Company at a price of 16.5 pence (British pound

sterling) per ordinary share expiring on 09 October 2020;

-- share options over 1,900,000 ordinary shares in the capital

of the Company exercisable at 16.5 pence (British pound sterling)

per ordinary share expiring on 18 December 2022; and

-- share options over 6,200,000 ordinary shares in the capital

of the Company exercisable at 8.5 pence (British pound sterling)

per ordinary share expiring on 09 October 2023.

Prior to expiry on 30 September 2020 warrants to subscribe for

14,866,989 ordinary shares in the capital of the Company at a price

of 10 pence (British pound sterling) per ordinary share were

exercised for total gross proceeds of GBPGBP1,486,698.90. A

director of the Company participated in this exercise of warrants.

The balance of warrants to subscribe for 15,847,296 ordinary shares

in the capital of the Company at a price of 10 pence (British pound

sterling) per ordinary share expired on 30 September 2020.

Warrants to subscribe for 320,575 ordinary shares in the capital

of the Company at a price of 16.5 pence (British pound sterling)

per ordinary share expired on 09 October 2020.

On 12 October 2020 the board of directors granted and approved

share options over 7,200,000 ordinary shares in the capital of the

Company exercisable at 10 pence (British pound sterling) per

ordinary share expiring on 12 October 2025.

As at 31 December 2020 the Company's issued and outstanding

capital structure comprised:

-- 205,382,159 ordinary shares;

-- share options over 1,900,000 ordinary shares in the capital

of the Company exercisable at 16.5 pence (British pound sterling)

per ordinary share expiring on 18 December 2022;

-- share options over 6,200,000 ordinary shares in the capital

of the Company exercisable at 8.5 pence (British pound sterling)

per ordinary share expiring on 09 October 2023; and

-- share options over 7,200,000 ordinary shares in the capital

of the Company exercisable at 10 pence (British pound sterling) per

ordinary share expiring on 12 October 2025.

On 09 June 2021 the Company closed a subscription for 40,425,000

ordinary shares in the capital of the Company at a price of 7.75

pence (British pound sterling) per ordinary share for total gross

proceeds of GBPGBP3,132,937.50. Certain directors of the Company

participated in this subscription.

With effect from 15 June 2021 Hummingbird Resources plc

(AIM:HUM) was no longer a shareholder of the Company and as a

result share options over 275,000 ordinary shares in the capital of

the Company exercisable at 16.5 pence (British pound sterling) per

ordinary share expiring on 18 December 2022 were cancelled.

Furthermore in June 2021 share options over 100,000 ordinary shares

in the capital of the Company exercisable at 10 pence (British

pound sterling) per ordinary share expiring on 12 October 2025 were

cancelled following cessation of a contract with a service

provider.

As at 30 June 2021 the Company's issued and outstanding capital

structure comprised:

-- 245,807,159 ordinary shares;

-- share options over 1,625,000 ordinary shares in the capital

of the Company exercisable at 16.5 pence (British pound sterling)

per ordinary share expiring on 18 December 2022;

-- share options over 6,200,000 ordinary shares in the capital

of the Company exercisable at 8.5 pence (British pound sterling)

per ordinary share expiring on 09 October 2023; and

-- share options over 7,100,000 ordinary shares in the capital

of the Company exercisable at 10 pence (British pound sterling) per

ordinary share expiring on 12 October 2025.

Movements in capital during the six months ended 30 June 2021

and 2020, and the year ended 31 December 2020 were as follows:

Number of warrants Number of share options

---------------------------- -----------------------------------------

at 16.5 at 10 at 16.5 at 8.5 at 10

pence pence pence pence pence

expiring expiring expiring expiring expiring

Number 09 October 30 September 18 December 09 October 12 October Proceeds

of shares 2020 2020 2022 2023 2025 US$'000

------------ -------------- ------------- ------------ ------------

As at 01 January

2020 129,676,567 320,575 30,714,285 1,900,000 6,200,000 - 12,675

------------ ------------ -------------- ------------- ------------ ------------ ---------

Subscription 60,838,603 - - - - - 3,554

------------ ------------ -------------- ------------- ------------ ------------ ---------

Issue costs - - - - - - (22)

__________ _________ __________ _________ _________ _________ _______

------------ ------------ -------------- ------------- ------------ ------------ ---------

As at 30 June

2020 Unaudited 190,515,170 320,575 30,714,285 1,900,000 6,200,000 - 16,207

------------ ------------ -------------- ------------- ------------ ------------ ---------

Granting of share - - - - - 7,200,000 -

options

------------ ------------ -------------- ------------- ------------ ------------ ---------

Exercise of

warrants 14,866,989 - (14,866,989) - - - 1,911

------------ ------------ -------------- ------------- ------------ ------------ ---------

Warrants expired - (320,575) (15,847,296) - - - -

__________ _________ __________ _________ _________ _________ _______

------------ ------------ -------------- ------------- ------------ ------------ ---------

As at 31 December

2020 205,382,159 - - 1,900,000 6,200,000 7,200,000 18,118

------------ ------------ -------------- ------------- ------------ ------------ ---------

Unaudited

------------ ------------ -------------- ------------- ------------ ------------ ---------

Subscription 40,425,000 - - - - - 4,433

------------ ------------ -------------- ------------- ------------ ------------ ---------

Issue costs - - - - - - (8)

------------ ------------ -------------- ------------- ------------ ------------ ---------

Cancellation of - - - (275,000) - (100,000) -

share options __________ _________ __________ _________ _________ ________ _______

------------ ------------ -------------- ------------- ------------ ------------ ---------

As at 30 June 245,807,159 - - 1,625,000 6,200,000 7,100,000 22,543

2021 Unaudited __________ _________ __________ _________ _________ _________ _______

------------ ------------ -------------- ------------- ------------ ------------ ---------

8. Ultimate controlling party

The Company does not have an ultimate controlling party.

As at 30 June 2021 the Company's largest shareholder was

Brookstone Business Inc ('Brookstone' ) which held 71,260,025

ordinary shares, being 28.99% of the total number of ordinary

shares issued and outstanding. Brookstone is wholly owned and

controlled by First Island Trust Company Limited as Trustee of the

Nodo Trust, a discretionary trust with a broad class of potential

beneficiaries. Patrick Quirk, father of Paul Quirk (Non-Executive

Director of the Company), is a potential beneficiary of the Nodo

Trust.

Brookstone, Key Ventures Holding Ltd ('KVH') and Paul Quirk

(Non-Executive Director of the Company) (collectively the

'Investors'; as at 30 June 2021 their aggregated shareholdings

being 34.55% of the total number of ordinary shares issued and

outstanding) have entered into a Relationship Agreement to regulate

the relationship between the Investors and the Company on an arm's

length and normal commercial basis. In the event that Investors'

aggregated shareholdings becomes less than 30% then the

Relationship Agreement shall terminate. KVH is wholly owned and

controlled by First Island Trust Company Limited as Trustee of The

Sunnega Trust, a discretionary trust with a broad class of

potential beneficiaries. Paul Quirk (Non-Executive Director of the

Company) is a potential beneficiary of The Sunnega Trust.

9. Contingent liabilities

A number of the Company's project areas have potential net

smelter return royalty obligations, together with options for the

Company to buy out the royalty. At the current stage of

development, it is not considered that the outcome of these

contingent liabilities can be considered probable or reasonably

estimable and hence no provision has been recognised in the

financial statements.

10. Capital commitments

On 10 March 2020 the Group entered into a contract with

International Drilling Company Africa for 2,000 metres of drilling

at the Madina Foulb é Permit in eastern Senegal. Drilling was

suspended in April 2020 due to the COVID-19 pandemic. As at the

time of suspension 642 metres of drilling had been completed and in

accordance with the terms of the contract the Group had incurred

expenditure of US$37,360. Drilling is expected to resume when it is

possible and safe to do so.

On 14 April 2020 the Company entered into a contract with Digby

Wells Environmental (Jersey) Limited to conduct an Environmental

and Social Impact Assessment (' ESIA ') for the Sanankoro Gold

Project. Total estimated fees in respect of the ESIA are

approximately US$376,400. As at 30 June 2021 under the terms of the

contract the Company had made payment of US$209,774. The ESIA will

form part of the Definitive Feasibility Study (' DFS ') for the

Sanankoro Gold Project which is expected to be completed in the

first half of 2022.

On 10 February 2021 the Company entered into a contract with

Capital Drilling Mali SARL for 20,000 metres of reverse circulation

drilling and 2,000 metres of diamond drilling at the Sanankoro Gold

Project. As at 30 June 2021 19,793 metres of reverse circulation

drilling and 1,138 metres of diamond drilling had been completed at

a cost of US$1,272,532 including ancillary costs.

On 16 March 2021 the Company entered into a contract with

Geodrill Limited for 10,000 metres of reverse circulation drilling

at the Sanankoro Gold Project. As at 30 June 2021 2,374 metres of

reverse circulation drilling had been completed at a cost of

US$129,427 including ancillary costs.

11. Events after the reporting date

Subsequent to 30 June 2021 the Company entered into contracts

with the following contractors in respect of the DFS for the

Sanankoro Gold Project:

-- New SENET (Pty) Ltd, independent project manager;

-- CSA Global Pty Ltd, geological and mining consultants; and

-- Epoch Resources (Pty) Ltd, tailings storage facility consultants.

Total estimated fees in respect of the above contractors are

approximately US$1,000,000. The DFS is expected to be completed in

the first half of 2022.

On 06 September 2021 share options expiring on 09 October 2023

were exercised over 1,250,000 ordinary shares in the capital of the

Company at a price of 8.5 pence (British pound sterling) per

ordinary share for total gross proceeds of GBPGBP106,250.

Immediately upon completion of this transaction on 10 September

2021, when the resulting shares were admitted to trading on AIM,

the total number of ordinary shares on issue was 247,057,159.

On 07 September 2021 the Company entered into a conditional

US$25 million mandate and term sheet with investment firm Lionhead

Capital Advisors Proprietary Limited ('Lionhead') to fund the

development of the Company's Sanankoro Gold Project in southern

Mali. This is conditional on, among other matters, the completion

of a Definitive Feasibility Study on the Sanankoro Gold Project by

30 June 2022. Paul Quirk (Non-Executive Director of the Company) is

a director of Lionhead. The US$25 million project financing

comprises US$12.5 million equity and US$12.5 million convertible

loan note. This mandate and term sheet replaces the previous one

with Lionhead dated 17 June 2020 which was for US$21 million.

12. Approval of condensed consolidated interim financial statements

The condensed consolidated interim financial statements were

approved and authorised for issue by the board of directors of Cora

Gold Limited on 14 September 2021.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DKPBBOBKDKCD

(END) Dow Jones Newswires

September 16, 2021 02:00 ET (06:00 GMT)

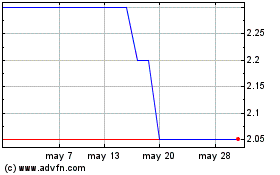

Cora Gold (LSE:CORA)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Cora Gold (LSE:CORA)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024