TIDMCOST

RNS Number : 6654J

Costain Group PLC

25 August 2021

Costain Group PLC

('Costain' or 'the Group' or 'the Company')

INTERIM RESULTS

RESULTS FOR THE HALF YEARED 30 JUNE 2021

Costain, the smart infrastructure solutions company, announces

its results for the half-year ended 30 June 2021.

Highlights

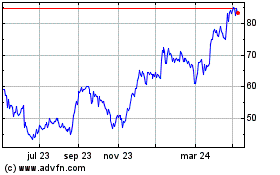

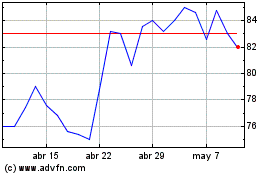

-- Improving profitability. Operating profit(2) of GBP11.5m

(HY20: GBP5.7m), in line with the Board's expectations

-- Operating effectively with contracts delivering to plan

-- Continued momentum with GBP334.3m of new work secured and

clear bidding discipline and risk management in place

-- High level of tendering activity reflecting the significant market opportunity

-- Positive cash generation and strong cash position. Net cash

of GBP113.0m, up from GBP102.9m at year end

-- Broadening our decarbonisation expertise across Transportation, Water and Energy

-- On course to deliver full year results in line with our expectations

Financial Summary HY21 HY20 FY20

GBPm GBPm GBPm

--------------------------------- ------ -------- --------

Group revenue

-adjusted (1) 556.8 547.3 1,070.5

-statutory reported 556.8 459.9 978.4

Operating profit/(loss)

-adjusted(2) 11.5 5.7 18.0

-statutory reported 11.2 (90.4) (92.0)

Profit/(loss) before tax

-adjusted(2) 9.4 3.8 13.9

-statutory reported 9.1 (92.3) (96.1)

Net cash balance(3) 113.0 140.9 102.9

--------------------------------- ------ -------- --------

Basic earnings/(loss) per share

-adjusted(2) 2.8p 2.1p 5.8p

-statutory reported 3.5p (49.9)p (36.7)p

1. HY20 before revenue impact of significant contract provision

adjustments of GBP87.4m (FY20: GBP92.1m) (see financial statements

note 3).

2. Before net other items of GBP0.3m (HY20: GBP1.4m and

significant contract provision adjustments of GBP94.7m, FY20:

GBP10.3m and significant contract adjustments of GBP99.7m) (see

financial statements note 3).

3. Net cash balance is cash and cash equivalents less

interest-bearing loans and borrowings (before arrangement fees of

GBP1.0m in HY21).

Alex Vaughan, chief executive officer, commented:

"We are pleased to report an improved level of profitability and

a strong cash position, demonstrating the focus on trading

performance and cash generation across the business.

"We continue to be successful in winning new contracts, building

on last year's strong platform and making the most of the

significant market opportunities. Our clients across all our chosen

markets are continuing to progress their investment plans and to

prioritise investment to meet their needs for decarbonisation,

digitisation, levelling up and performance improvement.

"We are busy bidding for new work across all of our markets,

combining Costain's core strengths and our broader service offering

in line with our strategy. Importantly, we are being selective in

our approach to tendering, focussing on bidding discipline and risk

management.

"We have good visibility on the completion of contracts for the

remainder of this year which gives us confidence in delivering full

year results in line with our expectations."

Enquiries:

Costain Tel: 01628 842 444

Alex Vaughan, Chief executive officer

Helen Willis, Chief financial officer

MHP Communications Tel: 020 3128 8771

Tim Rowntree Costain@mhpc.com

Peter Hewer

Robert Collett-Creedy

There will be a live online presentation for analysts today at

09:45. To register your attendance please contact

costain@mhpc.com

An on-demand webcast will be available via

www.costain.com/investors from 11:30 today.

Notes to Editors

Costain helps to improve people's lives with integrated, leading

edge, smart infrastructure solutions across the UK's

transportation, water, energy and defence markets. We help our

clients improve their business performance by increasing capacity,

improving customer service, safeguarding security, enhancing

resilience, decarbonising and delivering increased efficiency. Our

vision is to be the UK's leading smart infrastructure solutions

company. We will achieve this by focusing on blue chip clients

whose major spending plans are underpinned by strategic national

needs, regulatory commitments, legislation or essential performance

requirements. We offer our clients leading edge solutions that are

digitally optimised through the following five services which cover

the whole lifecycle of their assets: future-shaping strategic

consultancy; consultancy and advisory; digital technology

solutions; asset optimisation and complex programme delivery. Our

culture and values underpin everything we do.

For more information visit www.costain.com

H1 2021 OVERVIEW

Summary

The financial and operating performance during the first half of

2021 was in line with our expectations, reflecting management's

focus on operating performance and cash generation. We have good

visibility on the completion of contracts for the remainder of this

year, which gives us confidence in delivering full year results in

line with our expectations.

On an adjusted basis, revenue was GBP556.8m and operating profit

was GBP11.5m, up from GBP5.7m in the first half of 2020 and in line

with our expectations. Adjusted earnings per share for the period

was 2.8p. We finished the period with a net cash balance of

GBP113.0m, up from GBP102.9m at the end of last year.

Our clients, across our markets, are continuing to progress with

the committed levels of investment set out in their five-year

investment plans. During the period, we were pleased to secure a

number of new contracts with a total value of GBP334.3m,

principally from our sizable long term framework agreements. This

takes the total order book to GBP4.0bn as at 30 June 2021, broadly

similar to 31 December 2020, and whilst securing good volumes of

new work we are continuing to maintain a disciplined approach to

contract selection. Importantly, all new contracts have been

secured on commercial terms which reflect our improved

profitability and risk management measures. We have also continued

to build positions on our client's major services frameworks which

offer further opportunity moving forwards.

We are seeing the benefits of our integrated offer, with an

increasing number of contracts combining our construction expertise

alongside our consultancy services and digital performance

improvement.

As an example, whilst securing the eight-year Managed Service

Partner contract for United Utilities which supports their

maintenance transformation programme, we have expanded our support

in delivering front end engineering consultancy services in the

development of both future programmes and operational optimisation.

For Network Rail, whilst delivering the new station at Gatwick

Airport, we have also under their Operational Programme Delivery

framework supported further optimisation studies across the wider

network.

Increasingly our focus on meeting the challenges of

decarbonising our environment and exploiting the opportunities of

enhancing performance through digital solutions are creating new

opportunities for us. In energy, we have built strong positions on

three of the UK's four industrial clusters, including leading the

South Wales cluster; and continue to deliver hydrogen and carbon

capture design services. In transportation, we are shaping future

electric roads for the Department of Transport and working with

Highways England on their future digital roads plan.

Our existing contracts are benefitting now from our enhanced

risk management and 'Operational Excellence Model' which is

providing us with greater project delivery assurance, contract

margin performance and cash generation.

Costain is in a strong position with a high volume of secured

long term programmes, robust operational practices, and a positive

market outlook, in particular the UK Government's commitment to

invest in infrastructure to support the levelling up of our

economic activity and decarbonisation of our environment.

Response to COVID-19

We have continued to maintain strong and effective safety

measures, ensuring the effective operation of our business across

every contract. With the government removing its social distancing

measures from 19 July 2021, the business will remain alert to the

continuing challenges and will ensure that we maintain the

necessary safety measures in place on all our contracts both to

keep our teams safe and to maintain our productivity.

People

Highly skilled and experienced people are fundamental to

everything that we do. Our overall employee population has

increased in the first half of the year to over 3,300, including

over 650 people holding professional accreditations at a chartered

or fellowship level (10% year-on-year increase).

We have continued to invest significantly in young people, with

plans to increase our 2021 graduate and apprentice intake to 129,

with 42 new graduates and 87 new apprentices. Additionally, we are

working in partnership with the Prince's Trust to deliver 30 DWP

Kickstart placements, which six young people are currently

benefitting from.

We continue to see our gender pay gap reduce year-on-year as a

direct result of our focus on increasing the diversity of our

workforce. Our efforts were recognised with Costain named as a top

50 employer for women by The Times for the fourth consecutive year

and attaining a Gold Armed Forces Covenant award by the Ministry of

Defence (MOD). Our effort to become more diverse is underpinned by

our inclusive culture and behaviors. We are pleased to have met our

target to train 50 senior leaders as inclusion allies and have

concluded the first cohort of our ethnicity focused reverse

mentoring programme.

Environment, social purpose and governance (ESG)

Climate change is a priority of every one of our clients and for

our government. The Intergovernmental Panel on Climate Change

(IPCC) report issued in August 2021 sets out the stark reality as

to the causes and impact of climate change and the urgency in

avoiding a climate disaster. Recently the Department for Transport

has issued its Transport decarbonisation plan, and Highways England

its Net Zero Plan. We have continued to drive the implementation of

our climate change action plan and are working towards becoming a

net zero carbon business by 2035. In addition, we are playing an

active role in shaping, creating, and developing the solutions for

a green energy future across the transportation, water, and energy

markets.

We intend to report against the four pillars of TCFD (Task Force

on Climate-related Financial Disclosures) in our 2021 annual

report. In preparation, we have commissioned a team to lead on TCFD

compliance and we are undertaking a detailed climate scenario

analysis to inform our performance and disclosure.

Costain is committed to leading on conducting business

responsibly and we have aligned our purpose of improving peoples'

lives to the United Nation's Sustainable Development Goals. Our

focus areas are creating a greener future, working towards being

net zero by 2035, ensuring Costain is a safe, inclusive and great

place to work where everyone can be at their best and enhancing the

value that Costain contributes to society.

The safety of our people and our stakeholders is our number one

priority, and we are pleased to report, in over 15 million hours

worked, there have been only two reportable accidents. Our accident

frequency rate (AFR) of 0.01 represents our best ever safety

performance and is industry leading.

Demonstrating our social value continues to grow in relevance to

our clients, we have worked hard to invest in the communities where

we operate, support the Prince's Trust in coaching and mentoring

disadvantaged young people into employment outcomes, volunteering

over 1,000 working hours to good causes and spending over GBP270m

with SMEs, equating to 39% of our total spend in the first half of

the year.

Board

Tony Quinlan joined the Board as a non-executive director on 1

February 2021. Jane Lodge, who was senior independent director and

chair of the audit committee, stepped down from the Board after

nine years' service on 6 May 2021. Alison Wood became senior

independent director and Tony Quinlan was appointed chair of the

audit committee on 6 May 2021.

Outlook

Our clients across all our chosen markets are continuing to

progress their investment plans and to prioritise investment to

meet their needs for decarbonisation, digitisation, levelling up

and performance improvement. We were pleased to secure a number of

new contracts during the first half, with a total value of

GBP334.3m, principally from our sizable long term framework

agreements and to secure further positions on long term investment

frameworks. We have good visibility on the completion of contracts

for the remainder of this year which gives us confidence in

delivering full year results in line with our expectations.

Costain is in a strong position with a high volume of secured

long term programmes and a positive market outlook, in particular

the UK Government's commitment to invest in infrastructure to

support the levelling up of our economic activity and

decarbonisation of our environment.

DIVISIONAL REVIEW

Our strategy has positioned Costain to benefit from our clients'

key investment priorities, with an increasing proportion of new

business being from higher margin services in both consultancy and

digital activities. Our margin improvement strategy also balances

the continuing opportunity to grow our capital delivery activities

where we have a strong competitive advantage.

Transportation

GBPm HY21 Adjusted(1) HY21 Statutory HY20 Adjusted(1) HY20 Statutory FY20 Adjusted(1) FY20 Statutory

Revenue 403.9 403.9 353.1 307.7 724.2 674.1

---------------- ---------------- -------------- ---------------- -------------- ---------------- --------------

Operating

profit/(loss) 15.5 15.5 5.1 (40.4) 20.1 (30.6)

---------------- ---------------- -------------- ---------------- -------------- ---------------- --------------

(13.1)

Margin 3.8% 3.8% 1.4% % 2.8% (4.5) %

---------------- ---------------- -------------- ---------------- -------------- ---------------- --------------

(1) Refer to financial statements notes 3 and 4

The division delivered a strong improvement in margins in the

period, in line with our plans.

The division has a forward order book of GBP3.0bn (FY20:

GBP3.1bn), which includes our High Speed 2 (HS2) S1 and S2

contracts, Highways England Regional Delivery Partnership (RDP) and

also a preferred bidder position on the SMP Alliance.

Pushing the pace on digitisation and innovation to drive better,

faster and greener delivery of infrastructure, we are working

together with key partner SAP and a consortium of industry leading

enterprises (such as Transport for London (TfL), Highways England,

HS2 and Network Rail) called the 'Transport Infrastructure

Efficiency Strategy Living Lab' (TIES Living Lab) to create a

demonstrator for a new cloud-based data platform called the

Intelligent Infrastructure Control Centre (IICC).

Highways

As a strategic partner for Highways England, we opened the A19

Testos scheme to traffic early and within budget in the period. The

A19 project has removed a congestion bottle neck, improved road

user safety and has unlocked the potential for significant regional

growth with better connectivity and capacity. The A19 is one of a

number of schemes in the North East of England that we are

operating from a central Programme Management Office (PMO) and

logistics hub for improved efficiency and reduced carbon footprint.

As part of the regional development partnership (RDP) for the

North, Costain is acting as a delivery integration partner

providing safer, smoother and more reliable journeys through the

following improvement schemes: A1 Birtley to Coal House, A1 Morpeth

to Ellingham, A1 Scotswood to North Brunton and the M60 Simister

Island scheme, all of which are in contract and on programme. We

have also mobilised the A30 RDP scheme in Cornwall and have just

started the statutory consultation phase as delivery integration

partner on the A12 RDP East scheme.

With the A14 scheme successfully opened eight months ahead of

schedule, we are now in the final stages of removing the old

Huntingdon viaduct that was life expired. We have had an extension

to our Area 12 ASC contract into 2022 and continue to maintain and

upgrade the network in Area 14. Working with Highways England

through the SPaTS2 framework, we are supporting the shaping of the

future roads network including programme management of all of

Highways England's route strategy development.

The Smart Motorways Alliance has completed its first year,

successfully achieving annual KPIs. As an alliance member, Costain

holds several key roles across the enterprise including design

surveys. Costain is also responsible to the alliance for delivery

of the M1 J21A-26 upgrade, two schemes on the M62 and the provision

of safety critical operational technology equipment and software.

Costain has recently set up a mock motorway upgrade at RAF

Moreton-in-Marsh in partnership with Highways England to test new

net-zero techniques, materials, and operating technology. Costain's

innovation team has also secured over GBP15m of European and UK

Government funding to sponsor more than fifty Cambridge University

researchers under a future digital roads partnership (Highways

England, Cambridge University and Costain) to accelerate

modularisation, net-zero construction, and fully digital roads to

market.

Rail

In the period, Crossrail Paddington Station has been

successfully handed over to the operator, whilst work continues on

the systems wide delivery to support the successful opening of the

Elizabeth Line in early 2022.

Our activity on HS2, Britain's low carbon, high-capacity

railway, has progressed well through the first half of 2021. Our

Enabling Works contract is nearing completion with successful

handover of the route from Euston out to West Ruislip and the Colne

valley along with the transfer of the future station sites at both

Euston and Old Oak Common. The Phase 1 Main Civils Contract has

completed its mobilisation and is now focused on constructing

shafts and portals in advance of introducing tunnel boring machines

(TBMs) in 2022. Our consulting team remains at the heart of the

employers reference design for Phase 2a Birmingham to Crewe and are

providing expertise on Phase 2b West - Crewe to Manchester - in

preparation for the Hybrid Bill submission to Parliament next

year.

We continue to explore opportunities to grow our account with

Network Rail, with the continued successful delivery of Gatwick

Station Project, work to upgrade the Brighton mainline, as well as

providing a range of consultancy services into the client. We

continue to work with Network Rail on our reliable, solar powered,

wireless, radar-based warning system (Meerkat) and this will be

deployed across the majority of Network Rail's remote level

crossings.

Integrated Transport

With Transport for London (TfL), we have secured an extension to

our work to revitalise the A40 Westway and are currently exploring

a range of opportunities with this client, including digital and

telecommunications. We are also supporting TfL with the review the

condition and potential interventions needed across their highways

asset base.

Costain continue to provide strategic advisory services to the

City of Bradford Metropolitan District Council to assist in the

delivery of their major infrastructure and transportation

programmes. This work is associated with business case assurance,

commercial, cost, programme, and project management.

On Preston Western Distributor Road this complex major scheme is

currently being delivered ahead of schedule, despite the challenges

following Cleveland Bridge going into administration. Fabrication

of the steel element has recommenced and works on the structures

and new highways are progressing with the new bridges over the M55

motorway and Blackpool to Preston railway installed.

The COVID-19 pandemic is having an enormous impact on the global

aviation industry. However, we have continued to engage with our

clients from frameworks and contracts that we won last year

(Manchester Airports Group, Heathrow Airport Limited and British

Airways) and we have secured further work with Gatwick Airport

Storage and Hydrant Company (GASHCo). We have also widened our

focus and offering and have been successful in securing a position

on a new work with the Civil Aviation Authority framework and other

work with Newquay Airport for the G7 Summit and Customer Experience

training at Teesside International. Using our leading-edge hydrogen

capability, we have also secured our first contract looking at

alternative fuels within aviation.

Central government

Costain has continued its growth with a new portfolio of work

with central government and continues to win and deliver important

and influential services to key Government departments that impact

the industry and our markets at the highest level. Working closely

with other departments we continue to identify solutions that can

achieve the net-zero ambitions, deliver on the Build Back Better

commitments, and make infrastructure a more digitally integrated

network that delivers benefits for the UK economy and society. We

are playing a critical role within the infrastructure programme of

the Cabinet Office's Border and Protocol Delivery Group (BPDG) to

ensure UK borders are fully operational in time for the

introduction of customs and biosecurity controls now that the UK

has left the European Union. We continue as a strategic partner to

the Department for Transport to provide technical and commercial

support on highly complex time sensitive and critical projects.

Natural Resources

GBPm HY21 Adjusted(1) HY21 Statutory HY20 Adjusted(1) HY20 Statutory FY20 Adjusted(1) FY20 Statutory

Revenue 152.9 152.9 193.2 151.2 345.1 303.1

---------------- ---------------- -------------- ---------------- -------------- ---------------- --------------

Operating

profit/(loss) 0.4 0.1 4.5 (45.8) 5.7 (51.7)

---------------- ---------------- -------------- ---------------- -------------- ---------------- --------------

(30.3) (17.1)

Margin 0.3% 0.1% 2.3% % 1.7% %

---------------- ---------------- -------------- ---------------- -------------- ---------------- --------------

(1) Refer to financial statements notes 3 and 4

During the first half of the year, we continued to experience

lower volumes of activity in the AMP 7 water programmes as part of

the clients' year 1 adjustments made to counteract the impact of

Covid-19. From April/May this year we have seen these levels

significantly increase as we progress year 2 of our programmes. In

energy we have seen a deferment in the award of new contracts, with

these now having been awarded during the summer period. This had

some impact on our first half people utilisation levels, however in

the second half we are seeing high levels of demand for our

engineering teams. We are therefore confident of material margin

improvement in the second half.

As at 30 June 2021, the division had a forward order book of

GBP1.04bn (FY20: GBP1.09bn), reflecting YTD wins of GBP0.1bn in

2021.

Notable contract wins across the range of our broader services

include direct awards from the MOD as Defence Nuclear Organisation

Portfolio Management Office Partner, whilst continuing to secure

significant volumes through our frameworks including Strategic

Pipeline Alliance for Anglian Water, AMP 7 Southern Water and the

follow-on framework for EDF Generation.

Water

We are focused on delivering a broad range of services to our

clients enabling them to provide outstanding customer service,

protect the environment and respond to Ofwat regulatory performance

targets and efficiency challenges in the period to 2025. We are

delivering some of the largest complex capital delivery projects in

the UK water sector and are delighted to have secured positions

with our broadest ever number of clients in AMP 7.

We are part of the Thames Tideway 'super sewer' project, on

which we are in a joint venture to deliver the east section, which

will clean up the River Thames providing significant environmental

benefits for both the wildlife and residents of London. The project

is now in an exciting phase, with both TBMs progressing well. We

remain on course for overall completion of the project in late

2024. We are embedding digital innovation to drive delivery

efficiencies with a relentless decarbonisation focus underpinning

all aspects of our project execution.

We continue our AMP 7 complex capital delivery programme with

Severn Trent Water, Southern Water and Thames Water, driving

efficient and innovative solutions such as asset optimisation. We

have been appointed as sole maintenance service provider for United

Utilities. Costain will provide overall management and delivery of

United Utilities' larger-scale water and wastewater asset

maintenance activities across its entire network on a responsive

basis throughout the whole day, every day of the year.

We are continuing to deliver alongside Anglian Water in its

Strategic Pipeline Alliance on one of the largest strategic water

infrastructure projects the UK has ever seen, which will provide

long term water resource security for customers while protecting

the environment. Our pivotal role on this transformational 'Project

13' covers complex capital delivery and the provision of integrated

consultancy and digital services such as the development of a

digital twin to optimise the delivery, carbon footprint and

management of this strategic water network.

More broadly, we are continuing to grow our consultancy and

digital services provided across the UK water sector in areas such

as Yorkshire Water's Technical Services Framework and our

client-side project management consultancy support in many of our

contracts including Thames Water and South Staffordshire Water.

Also, in alignment with the UK water sector's focus to achieve

net-zero carbon by 2030, we continue to drive decarbonisation

innovation such as our Hy-Value project collaboration with Welsh

Water and other partners to convert sewage-derived biogas into

hydrogen to provide clean energy to South Wales.

Energy

We continue to drive transformational change in the energy

sector. Our focus on expanding our consultancy services in

decarbonisation, and maximising existing asset performance, has

enabled us to take market leading positions expanding our client

base and securing our reputation as a leading partner in the drive

to net zero. With the pace of the UK energy transition accelerating

and the launch of the government's Hydrogen Strategy fast

approaching, we expect this area to provide significant growth

opportunities in the near term.

We have great talent across the business that has enabled us to

achieve some significant milestones in the first half of 2021,

including the securing of the lead role in the GBP38m South Wales

Industrial Cluster Deployment Project with 13 industrial partners.

As deployment lead, we will work with our partners and clients

including Shell, BP Lightsource and Tata to support investment

decisions that will advance regional hydrogen deployment and

develop carbon capture usage and storage to deliver optimal

solutions for significant carbon reduction.

We are progressing with the Front End Engineering Design (FEED)

of the Acorn Project in St Fergus, Scotland, with the first planned

deployment of carbon capture and storage at scale for our client

Storegga. In the North West for HyNet Industrial Cluster we have

completed a FEED working with Progressive Energy and Essar to

develop a first of a kind hydrogen fuelled CHP plant at the Stanlow

site and have recently secured a first of a kind FEED for the

development of underground hydrogen storage in salt caverns for

Inovyn.

We have also secured a number of FEED contracts to support asset

life extension and optimisation focused on compression and

electrification of critical assets and we have a number of

preferred bidder positions that will move into both detail design

and FEED in the second half of the year.

In April 2021, we mobilised our Cadent Construction Management

Organisation contract taking on 210 new team members to manage the

completion of the Cadent iron mains replacement programme across

the East of England and East Midlands through a 10-year consultancy

contract.

We are performing well on our Sellafield nuclear decommissioning

framework, with a significant number of recent contracts secured in

the first half of 2021. We have also been successful in gaining a

further two year extension to our EDF Project Controls framework

contract where we supply over 110 project controls professionals

across the EDF nuclear fleet on an exclusive basis while also

delivering on other diversified services.

We continue to expand our tendering activity to exploit the many

new opportunities, particularly in supporting our existing and new

clients in developing solutions to the energy transition and

decarbonisation challenges they face, which remain extremely high

and has continued to accelerate into the second half of 2021.

Defence

We have continued to strengthen our market position as a valued

consultant with further key client wins across the defence sector,

to the extent that we are now a key provider at several levels into

the Continuous at Sea Deterrent programme (CASD), working with

defence primes including AWE, Rolls Royce, Cavendish and directly

for the Ministry of Defence via the Crown Commercial Services

framework.

We continue to deliver excellent capability through the

provision of P3M consultancy services across the Babcock fleet as

well as through our delivery partner role at Devonport Royal

Dockyard in partnership with Mott Macdonald. Our programme

management contract for AWE continues to meet performance

expectations, allowing us to secure further opportunities to

support AWE on several other key projects.

OTHER FINANCIAL INFORMATION

Peterborough & Huntingdon Contract

The position as presented at the time of our full year results

remains unchanged. On 29 June 2020, Costain announced that a

termination and settlement agreement (the "Agreement") had been

reached with National Grid to cease work on the Peterborough &

Huntingdon gas compressor project (the "Contract") following a

significant change in scope. The Agreement includes a legal

process, through adjudications, to agree up to GBP80.0m of

identified compensation events, recover costs to date and eliminate

a potential liability to National Grid for completing the

works.

In our interim results for the six months ended 30 June 2020,

Costain recorded a charge to the income statement of GBP49.3m

reflecting the cash position at termination. The legal process is

ongoing, and all adjudications are expected to be filed by December

2021. Supported by external advice, Costain believes it has a

strong entitlement to retain, as a minimum, the reported position,

with no further cash outflow.

As previously indicated, under the terms of the Agreement, the

cumulative outcome for Costain of these adjudications could range

from an additional cash receipt of up to a maximum of GBP50.0m to a

cash payment (which would not affect Costain's banking

arrangements) of up to a maximum of GBP57.3m. Any such cash

adjustments would be made in the first quarter of 2022.

Net financial expense

Net finance expense amounted to GBP2.1m (HY20: GBP2.0m, FY20:

GBP4.3m). The interest payable on bank overdrafts, loans and other

similar charges was GBP1.8m (HY20: GBP2.0m, FY20: GBP4.1m) and the

interest income from bank deposits and other loans and receivables

amounted to GBPNil (HY20: GBP0.2m, FY20: GBP0.6m). In addition, the

net finance expense includes the interest income on the net

assets/liabilities of the pension scheme of GBPNil (HY20: GBP0.1m

income, FY20: GBP0.2m income) and the interest expense on lease

liabilities of GBP0.3m (HY20: GBP0.3m, FY20: GBP1.0m) under

IFRS16.

Tax

The Group has a tax credit of GBP 0.4m (HY20: GBP17.6m credit,

FY20: GBP18.1m credit) giving an effective tax rate of (3.8) %. The

2021 net tax credit arose primarily from the GBP2.1m impact of the

rate change (from 19% to 25% in 2023, which has now been

substantively enacted) on deferred tax recognised in respect of

losses and pensions. The underlying effective tax rate was 19.6%

and we expect the effective tax rate to remain close to the

statutory tax rate of 19% until 2023.

Dividend

No interim dividend has been declared. The Board recognises the

importance of dividends to shareholders and will continue to review

the timing of the reinstatement of future dividends in the light of

the Group's performance, cash flow requirements and the importance

of maintaining a strong balance sheet.

Debt, cash conversion

The Group had a positive net cash balance of GBP113.0m as at 30

June 2021 (HY20: GBP140.9m, FY20: GBP102.9m) comprising Costain

cash balances of GBP100.0m (HY20: GBP117.8m, FY20: GBP89.8m), cash

held by joint operations of GBP57.0m (HY20: GBP85.1m, FY20:

GBP61.1m) and borrowings of GBP44.0m (before arrangement fees of

GBP1.0m) (HY20: GBP62.0m, FY20: GBP48.0m). During the year, the

Group's average month-end net cash balance was GBP102.9m (HY20:

GBP56.3m, FY20: GBP73.8m).

Contract bonding and banking facilities

The Group has in place banking and bonding facilities from banks

and surety bond providers to meet the current and projected usage

requirements. The Group has banking facilities of GBP175.0m with

its relationship banks with a maturity date of 24 September 2023.

These facilities are made up of a GBP131.0m revolving credit

facility and a GBP44.0m term loan.

In addition, the Group has in place committed and uncommitted

bonding facilities of GBP310.0m. Utilisation of the total bonding

facilities on 30 June 2021 was GBP103.2m (HY20: GBP117.9m, FY20:

GBP112.3m).

Pensions

As at 30 June 2021, the Group's pension scheme surplus in

accordance with IAS 19, was GBP29.0m (HY20: GBP14.9m surplus, FY20:

GBP5.6m liability).

DIRECTORS REPORT

Going concern

In determining the appropriate basis of preparation of the

condensed consolidated interim financial statements for the six

months ended 30 June 2021, the directors are required to consider

whether the Group can continue in operational existence for the

foreseeable future, being a period of at least twelve months from

the date of approval of the interim results. Having undertaken a

rigorous assessment of the financial forecasts, the Board considers

that the Group has adequate resources to remain in operation for

the foreseeable future and, therefore, has adopted the going

concern basis for the preparation of the interim financial

statements.

In assessing the going concern assumptions, the Board reviewed

the base case plans and identified severe but plausible downsides

affecting future profitability, working capital requirements and

cash flow. These include considering the aggregated impact of lower

revenue, lower margins, future contractual issues, higher working

capital requirements and adverse contract settlements. After

applying these downside scenarios, the Board concluded that there

is liquidity headroom in a reasonable worst-case scenario, headroom

on the committed facilities and that there is adequate headroom on

the associated financial covenants.

Principal risks and uncertainties

The Directors consider that the principal risks facing the

Group, including those that would threaten the successful and

timely delivery of its strategic priorities, future performance,

solvency and liquidity, remain substantially unchanged from those

identified on pages 40 to 43 of the Annual Report for the year

ended 31 December 2020 which can be found on the Company's website

at www.costain.com.

On pages 40 and 41 of the Annual Report 2020, we set out the

Group's approach to risk management and on pages 42 and 43, we

define and describe the principal risks that are most relevant to

the Group including controls and key mitigating actions assigned to

each of them. In summary, the Group's principal risks and

uncertainties are as follows: (i) Prevent and effectively manage a

major accident, hazard or incident, (ii) accelerate the deployment

of our higher margin services, (iii) maintain a strong balance

sheet, (iv) secure new work, (v) culture and people, (vi) deliver

projects effectively, (vii) manage the legacy defined benefit

pension scheme, (viii) ensure that our technology is robust, our

systems are secure and our data protected and (ix) anticipate and

respond to changes in client circumstances.

The Board reviews the status of all principal and emerging risks

with a notable potential impact at Group level throughout the year.

Additionally, the Board and Audit Committee carry out focused risk

reviews. These reviews include an analysis of principal risks,

together with the controls, monitoring and assurance processes

established to mitigate those risks to acceptable levels.

Responsibility statement

Each of the Directors of Costain Group PLC confirms, to the best

of his or her knowledge, that:

-- the condensed set of financial statements has been prepared

in accordance with UK adopted International Accounting Standard 34

'Interim Financial Reporting;

-- the interim management report includes a fair review of the information required by:

(a) DTR 4.2.7R of the Disclosure and Transparency Rules, being

an indication of important events that have occurred during the

first six months of the financial year and their impact on the

condensed set of financial statements; and a description of the

principal risks and uncertainties for the remaining six months of

the year; and

(b) DTR 4.2.8R of the Disclosure and Transparency Rules, being

related party transactions that have taken place in the first six

months of the current financial year and that have materially

affected the financial position or performance of the Group during

that period; and any changes in the related party transactions

described in the last annual report that could do so.

The Directors of Costain Group PLC are listed in the Annual

Report and Accounts for the year ended 31 December 2020, with the

exception of the changes in the period which are listed [above].

Information on the current directors responsible for providing this

statement is also maintained on the Company's website at

www.costain.com.

On behalf of the Board

Dr Paul Golby CBE - Chairman

Alex Vaughan - Chief Executive

25 August 2021

25 August 2021

Cautionary statement

This report contains forward-looking statements. These have been

made by the Directors in good faith based on the information

available to them up to the time of their approval of this report.

The Directors can give no assurance that these expectations will

prove to have been correct. Due to the inherent uncertainties,

including both economic and business risk factors underlying such

forward-looking information, actual results may differ materially

from those expressed or implied by these forward-looking

statements. The Directors undertake no obligation to update any

forward-looking statements whether as a result of new information,

future events or otherwise.

INTERIM RESULTS

Results for the half year ended 30 June 2021

Condensed consolidated income statement

Half-year ended 2021 2020 2020

30 June, Half-year Half-year Year

year ended 31 December unaudited unaudited audited

--------------------------- --------------------------- --------------------------- -------------------------------

Before Before Before

other Other other Other other Other

items items Total items items Total items items Total

Note GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

-------- ------- -------- -------- ------- -------- ---------- ------- ----------

Continuing

operations

Group revenue 556.8 - 556.8 459.9 - 459.9 978.4 - 978.4

-------------------- ----- -------- ------- -------- -------- ------- -------- ---------- ------- ----------

Cost of sales (525.8) - (525.8) (531.0) - (531.0) (1,027.0) - (1,027.0)

Gross profit/(loss) 3 31.0 - 31.0 (71.1) - (71.1) (48.6) - (48.6)

Administrative

expenses before

other items (19.5) - (19.5) (17.9) - (17.9) (33.1) - (33.1)

Impairment

of Alcaidesa

marina 11 - - - - (0.6) (0.6) - (0.6) (0.6)

Impairment

of other

investment - - - - (0.6) (0.6) - (0.6) (0.6)

Profit on sales

of interests

in joint ventures

and associates - - - - - - - 1.6 1.6

Profit/(loss)

on disposal

of subsidiary

undertakings - - - - 1.0 1.0 - 1.4 1.4

Refinancing

advisory fees - - - - (0.7) (0.7) - (1.2) (1.2)

Pension GMP

equalisation

charge - - - - - - - (0.9) (0.9)

Amortisation

of acquired

intangible

assets 9 - (0.3) (0.3) - (0.5) (0.5) - (1.0) (1.0)

Impairment

of goodwill - - - - - - - (9.0) (9.0)

-------------------- ----- -------- ------- -------- -------- ------- -------- ---------- ------- ----------

Administrative

expenses (19.5) (0.3) (19.8) (17.9) (1.4) (19.3) (33.1) (10.3) (43.4)

-------------------- ----- -------- ------- -------- -------- ------- -------- ---------- ------- ----------

Group operating

profit/(loss) 3 11.5 (0.3) 11.2 (89.0) (1.4) (90.4) (81.7) (10.3) (92.0)

Share of results

of joint ventures

and associates - - - 0.1 - 0.1 0.2 - 0.2

-------------------- ----- -------- ------- -------- -------- ------- -------- ---------- ------- ----------

Profit/(loss)

from operations 4 11.5 (0.3) 11.2 (88.9) (1.4) (90.3) (81.5) (10.3) (91.8)

Finance income - - - 0.3 - 0.3 0.8 - 0.8

Finance expense (2.1) - (2.1) (2.3) - (2.3) (5.1) - (5.1)

-------------------- ----- -------- ------- -------- -------- ------- -------- ---------- ------- ----------

Net finance

expense 5 (2.1) - (2.1) (2.0) - (2.0) (4.3) - (4.3)

-------------------- ----- -------- ------- -------- -------- ------- -------- ---------- ------- ----------

Profit/(loss)

before tax 9.4 (0.3) 9.1 (90.9) (1.4) (92.3) (85.8) (10.3) (96.1)

Taxation 6 (1.7) 2.1 0.4 17.4 0.2 17.6 17.5 0.6 18.1

-------------------- ----- -------- ------- -------- -------- ------- -------- ---------- ------- ----------

Profit/(loss)

for the period

attributable

to equity holders

of the parent 7.7 1.8 9.5 (73.5) (1.2) (74.7) (68.3) (9.7) (78.0)

-------------------- ----- -------- ------- -------- -------- ------- -------- ---------- ------- ----------

Earnings/(loss)

per share

Basic 7 3.5p (49.9)p (36.7)p

Diluted 7 3.4p (49.9)p (36.7)p

During the period, previous period and previous year the impact

of business disposals was not material and, therefore, all results

are classified as arising from continuing operations.

Condensed consolidated statement of comprehensive income and

expense

Half-year ended 30 June, 2021 2020 2020

year ended 31 December Half-year Half-year Year

unaudited unaudited audited

GBPm GBPm GBPm

--------------------------------------------- ----------- ----------- ---------

Profit/(loss) for the period 9.5 (74.7) (78.0)

--------------------------------------------- ----------- ----------- ---------

Items that may be reclassified subsequently

to profit or loss:

Exchange differences on translation

of foreign operations 0.2 0.4 0.2

Exchange differences on translation

transferred to the income statement - (1.4) (1.2)

Net investment hedge

-- Effective portion of changes

in fair value during period - (0.3) 0.1

-- Net changes in fair value transferred

to the income statement - 0.9 0.4

Cash flow hedges:

-- Effective portion of changes

in fair value during period - (0.1) (0.3)

-- Net changes in fair value transferred

to the income statement 0.3 0.4 0.5

Total items that may be reclassified

subsequently to profit or loss 0.5 (0.1) (0.3)

--------------------------------------------- ----------- ----------- ---------

Items that will not be reclassified

to profit or loss:

Remeasurement of retirement benefit

asset/(obligations) 29.5 4.6 (19.9)

Tax recognised on remeasurement

of retirement benefit (asset)/obligations (5.5) (0.9) 3.8

Total items that will not be reclassified

to profit or loss 24.0 3.7 (16.1)

--------------------------------------------- ----------- ----------- ---------

Other comprehensive income/(expense)

for the period 24.5 3.6 (16.4)

--------------------------------------------- ----------- ----------- ---------

Total comprehensive income/(expense)

for the period attributable to equity

holders of the parent 34.0 (71.1) (94.4)

--------------------------------------------- ----------- ----------- ---------

Condensed consolidated statement of changes in equity

Share Share Translation Hedging Merger Retained Total

capital premium reserve reserve reserve earnings equity

GBPm GBPm GBPm GBPm GBPm GBPm GBPm

------------------------------ --------- --------- ------------ --------- --------- ---------- --------

At 1 January 2020 -

audited 54.1 16.4 1.1 (0.5) - 86.6 157.7

Loss for the period - - - - - (74.7) (74.7)

Other comprehensive

(expense)/income - - (0.4) 0.3 - 3.7 3.6

Shares purchased to

satisfy employee share

schemes - - - - - (0.2) (0.2)

Equity-settled share-based

payments - - - - - 0.6 0.6

Capital raise (note

13) 83.4 - - - 9.1 - 92.5

Transfer - - - - (9.1) 9.1 -

------------------------------ --------- --------- ------------ --------- --------- ---------- --------

At 30 June 2020 - unaudited 137.5 16.4 0.7 (0.2) - 25.1 179.5

Loss for the period - - - - - (3.3) (3.3)

Other comprehensive

expense - - (0.1) (0.1) - (19.8) (20.0)

Equity-settled share-based

payments - - - - - 0.3 0.3

At 31 December 2020

- audited 137.5 16.4 0.6 (0.3) - 2.3 156.5

Profit for the period - - - - - 9.5 9.5

Other comprehensive

income - - 0.2 0.3 - 24.0 24.5

Shares purchased to

satisfy employee share

schemes - - - - - (0.1) (0.1)

Equity-settled share-based

payments - - - - - 0.4 0.4

At 30 June 2021 - unaudited 137.5 16.4 0.8 - - 36.1 190.8

----------------------------- --------- --------- ------------ --------- --------- ---------- ----------

Condensed consolidated statement of financial position

Half-year as at 30 June, 2021 2020 2020

year as at 31 December Half-year Half-year Year

unaudited unaudited audited

GBPm GBPm GBPm

--------------------------------------- --- ----------- ----------- ---------

Assets

Non-current assets

Intangible assets 9 52.2 59.4 52.1

Property, plant and equipment 9 44.0 40.3 39.9

Equity accounted investments 0.4 2.4 0.4

Retirement benefit asset 10 29.0 14.9 -

Trade and other receivables 4.8 2.8 3.5

Deferred tax 18.2 21.1 23.6

--------------------------------------- --- ----------- ----------- ---------

Total non-current assets 148.6 140.9 119.5

--------------------------------------- --- ----------- ----------- ---------

Current assets

Inventories 0.4 1.2 0.6

Trade and other receivables 221.7 228.7 218.7

Assets held for sale 11 - 4.1 -

Taxation - 0.8 0.2

Cash and cash equivalents 157.0 202.9 150.9

--------------------------------------- --- ----------- ----------- ---------

Total current assets 379.1 437.7 370.4

--------------------------------------- --- ----------- ----------- ---------

Total assets 527.7 578.6 489.9

--------------------------------------- --- ----------- ----------- ---------

Liabilities

Non-current liabilities

Retirement benefit obligations - - 5.6

Other payables 1.4 0.7 1.1

Interest-bearing loans and borrowings 35.8 44.0 39.6

Lease liabilities 26.3 19.7 20.8

Total non-current liabilities 63.5 64.4 67.1

--------------------------------------- --- ----------- ----------- ---------

Current liabilities

Trade and other payables 252.5 303.4 246.0

Current tax liabilities 1.0 - -

Interest-bearing loans and borrowings 7.2 18.0 7.2

Lease liabilities 12.0 12.6 12.5

Provisions for other liabilities

and charges 0.7 0.7 0.6

--------------------------------------- --- ----------- ----------- ---------

Total current liabilities 273.4 334.7 266.3

--------------------------------------- --- ----------- ----------- ---------

Total liabilities 336.9 399.1 333.4

--------------------------------------- --- ----------- ----------- ---------

Net assets 190.8 179.5 156.5

--------------------------------------- --- ----------- ----------- ---------

Equity

Share capital 13 137.5 137.5 137.5

Share premium 16.4 16.4 16.4

Translation reserve 0.8 0.7 0.6

Hedging reserve - (0.2) (0.3)

Retained earnings 36.1 25.1 2.3

--------------------------------------- --- ----------- ----------- ---------

Total equity 190.8 179.5 156.5

--------------------------------------- --- ----------- ----------- ---------

Condensed consolidated cash flow statement

Half-year ended 30 June, 2021 2020 2020

year ended 31 December Half-year Half-year Year

unaudited unaudited audited

GBPm GBPm GBPm

-------------------------------------- ----------- ----------- ---------

Cash flows from operating activities

Profit/(loss) for the period 9.5 (74.7) (78.0)

Adjustments for:

Share of results of joint ventures

and associates - (0.1) (0.2)

Finance income - (0.3) (0.8)

Finance expense 2.1 2.3 5.1

Taxation (0.4) (17.6) (18.1)

Impairment of Alcaidesa marina - 0.6 0.6

Impairment of other investment - 0.6 0.6

Profit on sales of interests

in joint ventures and associates - - (1.6)

Profit on disposal of subsidiary

undertakings - (1.0) (1.4)

Pension GMP equalisation charge - - 0.9

Depreciation of property, plant

and equipment 7.8 8.0 15.0

Amortisation and impairment of

intangible assets 0.5 0.5 10.5

Shares purchased to satisfy employee

share schemes (0.1) (0.2) (0.2)

Share-based payments expense 0.4 0.6 0.9

Cash from/(used by) operations

before changes in working capital

and provisions 19.8 (81.3) (66.7)

Decrease/(increase) in inventories 0.2 (0.2) 0.7

(Increase)/decrease in receivables (4.0) 18.0 25.5

Increase/(decrease) in payables 7.6 56.5 (0.1)

Movement in provisions and employee

benefits (5.0) (5.3) (10.4)

--------------------------------------- ----------- ----------- ---------

Cash from/(used by) operations 18.6 (12.3) (51.0)

Interest received - 0.1 0.8

Interest paid (1.5) (2.3) (5.1)

Taxation received/(paid) 0.1 4.7 8.3

--------------------------------------- ----------- ----------- ---------

Net cash from/(used by) operating

activities 17.2 (9.8) (47.0)

Cash flows from investing activities

Dividends received from joint

ventures and associates - 0.2 0.2

Additions to property, plant

and equipment (0.1) (0.3) (0.5)

Additions to intangible assets (0.6) (0.9) (3.6)

Proceeds of disposals of property,

plant and equipment and intangible

assets - 0.1 0.3

Proceeds of sales of interests

in joint ventures and associates - - 3.7

Proceeds of sales of subsidiary

undertakings - 1.0 4.6

Net cash (used by)/from investing

activities (0.7) 0.1 4.7

Cash flows from financing activities

Issue of ordinary share capital - 92.5 92.5

Repayments of lease liabilities (6.7) (6.5) (12.1)

Drawdown of loans - 91.0 71.5

Repayment of loans (3.8) (145.0) (139.0)

--------------------------------------- ----------- ----------- ---------

Net cash (used by)/from financing

activities (10.5) 32.0 12.9

Net increase/(decrease) in cash

and cash equivalents 6.0 22.3 (29.4)

Cash and cash equivalents at

beginning of the period 150.9 180.9 180.9

Effect of foreign exchange rate

changes 0.1 (0.3) (0.6)

Cash and cash equivalents at

end of the period 157.0 202.9 150.9

--------------------------------------- ----------- ----------- ---------

Notes to the interim financial statements

1. General information

Costain Group PLC (the Company) is a public limited company

incorporated in the United Kingdom. The address of its registered

office and principal place of business is Costain House, Vanwall

Business Park, Maidenhead, Berkshire SL6 4UB.

The condensed consolidated interim financial statements are

presented in pounds sterling, rounded to the nearest hundred

thousand. The comparative figures for the financial year ended 31

December 2020 are not the Company's full statutory accounts for

that financial year. Those accounts have been reported on by the

Company's auditors and delivered to the Registrar of Companies. The

report of the auditors was unqualified and did not contain a

statement under section 498 (2) or (3) of the Companies Act

2006.

2. Statement of compliance

These condensed consolidated financial statements for the half

year ended 30 June 2021 have been prepared in accordance with UK

adopted International Accounting Standard 34 'Interim financial

reporting' and the Disclosure Guidance and Transparency Rules

sourcebook of the UK's Financial Conduct Authority (FCA).

The accounting policies, presentation and methods of computation

adopted in the preparation of these condensed consolidated interim

financial statements are consistent with those followed in the

preparation of the Group's Annual Financial Statements for the year

ended 31 December 2020, which were prepared in accordance with

International Financial Reporting Standards adopted pursuant to

Regulation (EC) No 1606/2002 as it applies in the European Union.

They do not include all the information required for full annual

financial statements and should be read in conjunction with the

Consolidated Financial Statements of the Group as at and for the

year ended 31 December 2020.

Impact of standards issued but not yet effective, and therefore

not applied in these financial statements

The directors do not currently anticipate that the adoption of

any standard or interpretation that has been issued but is not yet

effective will have a material impact on the financial statements

of the Group in future periods.

Going concern

The Group's principal business activity involves work on the

UK's infrastructure, mostly delivering long-term contracts with a

number of customers. Its business activities and the factors likely

to affect its future development, performance and position are set

out in the Chief executive officer's review. To meet its day-to-day

working capital requirements, it uses cash balances provided from

shareholders' capital and retained earnings and its borrowing

facilities. As part of its contracting operations, the Group may be

required to provide performance and other bonds. It satisfies these

requirements by utilising its bonding facilities from banks and

surety companies. These facilities have financial covenants that

are tested quarterly.

In determining the appropriate basis of preparation of the

condensed consolidated interim financial statements for the six

months ended 30 June 2021, the directors are required to consider

whether the Group can continue in operational existence for the

foreseeable future, being a period of at least twelve months from

the date of approval of the interim results. Having undertaken a

rigorous assessment of the financial forecasts, the Board considers

that the Group has adequate resources to remain in operation for

the foreseeable future and, therefore, has adopted the going

concern basis for the preparation of the interim financial

statements.

In assessing the going concern assumptions, the Board reviewed

the base case plans and identified severe but plausible downsides

affecting future profitability, working capital requirements and

cash flow. These include considering the aggregated impact of lower

revenue, lower margins, future contractual issues, higher working

capital requirements and adverse contract settlements. After

applying these downside scenarios, the Board concluded that there

is liquidity headroom in a reasonable worst-case scenario, headroom

on the committed facilities and that there is adequate headroom on

the associated financial covenants.

Alternative performance measures

Income statement presentation - Other items

In order to aid understanding of the performance of the Group,

certain amounts are shown in the consolidated income statement in a

separate column headed "Other items". Items are included under this

heading where the Board considers them to be of a one-off unusual

nature or related to the accounting treatment of acquisitions. The

results present profit before other items, which is a non-GAAP

measure.

The Group also has non-GAAP adjusted performance measures to

report adjusted profit and earnings per share measures, which

exclude other items and in 2020 the significant contract

adjustments, and an adjusted revenue measure, that excludes the

revenue element of the contract adjustments (all as shown in note

3).

Principal risks, uncertainties and significant areas of

judgement and estimation

The Directors consider that the significant areas of judgement

made by management that have significant effect on the Group's

performance and estimates with a significant risk of material

adjustment in the second half of the year are unchanged from those

identified on pages 137 to 138 of the Annual Report for the year

ended 31 December 2020. The only exception is the estimation of

income tax liabilities which is determined in the Interim Financial

Statements using the estimated average annual effective income tax

rate applied to the pre-tax income of the interim period.

On pages 40 to 41 of the Annual Report 2020, we set out the

Group's approach to risk management and on pages 42 to 43, we

define the principal risks that are most relevant to the Group.

These risks are described in detail and have controls and

mitigating actions assigned to each of them.

In our view the principal risks remain substantially unchanged

from those indicated in the Annual Report 2020.

The Board approved the unaudited interim financial statements on

25 August 2021.

3. Reconciliation of reported Group operating (loss)/profit to

Adjusted Group operating profit

Adjusted revenue, operating profit and earnings per share are

being used as non-GAAP performance measurements. These measurements

were introduced in 2020 and exclude the impact of significant

one-off changes in the accounting treatments of three contracts,

Peterborough & Huntingdon (P&H), the A465 Heads of the

Valley road (A465) and the ASF South contracts, as described below,

as well as the other items of GBP0.3m (2020: half year GBP1.4m,

full year GBP10.3m). The revenue adjustment represents the reversal

of the contract asset recorded in the statement of financial

position immediately prior to the write down. The Board considers

the adjusted measures better reflect the underlying trading

performance of the Group.

The Peterborough & Huntingdon contract charge followed the

agreement with National Grid to mutually terminate the contract in

June 2020. At the date of termination, the Group had a contract

asset of GBP42.0m associated with this contract and this was

forecast to increase to GBP49.3m at the end of the works.

Reflecting the commercial resolution process incorporated in the

termination agreement and in accordance with IFRS 15, a one-off

charge to the income statement of GBP49.3m was reflected to adjust

the revenue recognised to the level of cash received and to cover

the cost of remaining works. 2020 adjusted revenue includes

GBP32.3m of revenue on Peterborough & Huntingdon up to the

termination date.

The A465 Heads of the Valley road contract was entered into in

2015 for the Welsh Government. In 2020, an arbitration decided that

Costain was responsible for design information for a specific

retaining wall and that the additional building cost associated

with the wall was not a compensation event under the contract. As a

consequence of the decision, the Group adjusted the revenue

recognised based on the level of cash received to date and

reflected a write down of the GBP45.4m contract asset at 30 June

2020. The Group continues to fulfil its obligations under the

contract, which will be completed during the current year. 2020

adjusted revenue includes GBP18.0m of revenue on the A465

contract.

The ASF South contract was in respect of works undertaken for

Highways England that were completed in 2016. Following an

extensive contract review in 2020, the Group took a one-off charge

of GBP5.0m in December 2020 to close out this legacy contract.

Half-year ended 30 June Before Other

2021 Adjusted P&H A465 ASF other items items Total

GBPm GBPm GBPm GBPm GBPm GBPm GBPm

------------------------------- --------- ----- ------- ------ ------------- ------- --------

Revenue before contract

adjustments 556.8 - - - 556.8 - 556.8

Contract adjustments - - - - - - -

------------------------------- --------- ----- ------- ------ ------------- ------- --------

Group revenue 556.8 - - - 556.8 - 556.8

------------------------------- --------- ----- ------- ------ ------------- ------- --------

Cost of sales (525.8) - - - (525.8) - (525.8)

------------------------------- --------- ----- ------- ------ ------------- ------- --------

Gross profit 31.0 - - - 31.0 - 31.0

Administrative expenses

before other items (19.5) - - - (19.5) - (19.5)

Other items - - - - - (0.3) (0.3)

------------------------------- --------- ----- ------- ------ ------------- ------- --------

Administrative expenses (19.5) - - - (19.5) (0.3) (19.8)

Group operating profit/(loss) 11.5 - - - 11.5 (0.3) 11.2

------------------------------- --------- ----- ------- ------ ------------- ------- --------

Share of results of joint

ventures and associates - - - - - - -

------------------------------- --------- ----- ------- ------ ------------- ------- --------

Profit/(loss) from operations 11.5 - - - 11.5 (0.3) 11.2

------------------------------- --------- ----- ------- ------ ------------- ------- --------

Net finance expense (2.1) - - - (2.1) - (2.1)

------------------------------- --------- ----- ------- ------ ------------- ------- --------

Profit/(loss) before tax 9.4 - - - 9.4 (0.3) 9.1

------------------------------- --------- ----- ------- ------ ------------- ------- --------

Taxation (1.7) - - - (1.7) 2.1 0.4

------------------------------- --------- ----- ------- ------ ------------- ------- --------

Profit/(loss) for the

period attributable to

equity holders of the

parent 7.7 - - - 7.7 1.8 9.5

------------------------------- --------- ----- ------- ------ ------------- ------- --------

Basic earnings per share 2.8p 3.5p

Half-year ended 30 June A465 ASF Before Other

2020 Adjusted P&H other items items Total

GBPm GBPm GBPm GBPm GBPm GBPm GBPm

------------------------------- --------- ------- --------- ------ ------------- ------- --------

Revenue before contract

adjustments 547.3 - - - 547.3 - 547.3

Contract adjustments - (42.0) (45.4) - (87.4) - (87.4)

------------------------------- --------- ------- --------- ------ ------------- ------- --------

Group revenue 547.3 (42.0) (45.4) - 459.9 - 459.9

------------------------------- --------- ------- --------- ------ ------------- ------- --------

Cost of sales (523.7) (7.3) - - (531.0) - (531.0)

------------------------------- --------- ------- --------- ------ ------------- ------- --------

Gross profit/(loss) 23.6 (49.3) (45.4) - (71.1) - (71.1)

Administrative expenses

before other items (17.9) - - - (17.9) - (17.9)

Other items - - - - - (1.4) (1.4)

------------------------------- --------- ------- --------- ------ ------------- ------- --------

Administrative expenses (17.9) - - - (17.9) (1.4) (19.3)

Group operating profit/(loss) 5.7 (49.3) (45.4) - (89.0) (1.4) (90.4)

------------------------------- --------- ------- --------- ------ ------------- ------- --------

Share of results of joint

ventures and associates 0.1 - - - 0.1 - 0.1

------------------------------- --------- ------- --------- ------ ------------- ------- --------

Profit/(loss) from operations 5.8 (49.3) (45.4) - (88.9) (1.4) (90.3)

------------------------------- --------- ------- --------- ------ ------------- ------- --------

Net finance expense (2.0) - - - (2.0) - (2.0)

------------------------------- --------- ------- --------- ------ ------------- ------- --------

Profit/(loss) before tax 3.8 (49.3) (45.4) - (90.9) (1.4) (92.3)

------------------------------- --------- ------- --------- ------ ------------- ------- --------

Taxation (0.7) 9.4 8.7 - 17.4 0.2 17.6

------------------------------- --------- ------- --------- ------ ------------- ------- --------

Profit/(loss) for the

period attributable to

equity holders of the

parent 3.1 (39.9) (36.7) - (73.5) (1.2) (74.7)

------------------------------- --------- ------- --------- ------ ------------- ------- --------

Basic earnings/(loss)

per share 2.1p (49.9)p

Year ended 31 December Before Other

2020 Adjusted P&H A465 ASF other items items Total

GBPm GBPm GBPm GBPm GBPm GBPm GBPm

------------------------------- ---------- ------- ------- ------ ------------- ------- ----------

Revenue before contract

adjustments 1,070.5 - - - 1,070.5 - 1,070.5

Contract adjustments - (42.0) (45.4) (4.7) (92.1) - (92.1)

------------------------------- ---------- ------- ------- ------ ------------- ------- ----------

Group revenue 1,070.5 (42.0) (45.4) (4.7) 978.4 - 978.4

------------------------------- ---------- ------- ------- ------ ------------- ------- ----------

Cost of sales (1,019.5) (7.3) - (0.3) (1,027.0) - (1,027.0)

------------------------------- ---------- ------- ------- ------ ------------- ------- ----------

Gross profit/(loss) 51.1 (49.3) (45.4) (5.0) (48.6) - (48.6)

Administrative expenses

before other items (33.1) - - - (33.1) - (33.1)

Other items - - - - - (10.3) (10.3)

------------------------------- ---------- ------- ------- ------ ------------- ------- ----------

Administrative expenses (33.1) - - - (33.1) (10.3) (43.4)

Group operating profit

/(loss) 18.0 (49.3) (45.4) (5.0) (81.7) (10.3) (92.0)

------------------------------- ---------- ------- ------- ------ ------------- ------- ----------

Share of results of joint

ventures and associates 0.2 - - - 0.2 - 0.2

------------------------------- ---------- ------- ------- ------ ------------- ------- ----------

Profit/(loss) from operations 18.2 (49.3) (45.4) (5.0) (81.5) (10.3) (91.8)

------------------------------- ---------- ------- ------- ------ ------------- ------- ----------

Net finance expense (4.3) - - - (4.3) - (4.3)

------------------------------- ---------- ------- ------- ------ ------------- ------- ----------

Profit/(loss) before tax 13.9 (49.3) (45.4) (5.0) (85.8) (10.3) (96.1)

------------------------------- ---------- ------- ------- ------ ------------- ------- ----------

Taxation (1.5) 9.4 8.6 1.0 17.5 0.6 18.1

------------------------------- ---------- ------- ------- ------ ------------- ------- ----------

Profit/(loss) for the

period attributable to

equity holders of the

parent 12.4 (39.9) (36.8) (4.0) (68.3) (9.7) (78.0)

------------------------------- ---------- ------- ------- ------ ------------- ------- ----------

Basic earnings/(loss)

per share 5.8p (36.7)p

4. Business segment information

The Group has two core business segments: Natural Resources and

Transportation (plus in 2020 up to the date of disposal, Alcaidesa

in Spain). The core segments are strategic business units with

separate management and have different core customers or offer

different services. This information is provided to the Chief

Executive who is the chief operating decision maker.

Half-year ended 30 June Central

2021 Natural Resources Transportation costs Total

GBPm GBPm GBPm GBPm

---------------------------------- ------------------ --------------- -------- ------

Segment revenue

Revenue before contract

adjustments 152.9 403.9 - 556.8

Contract adjustments - - - -

---------------------------------- ------------------ --------------- -------- ------

Group revenue 152.9 403.9 - 556.8

---------------------------------- ------------------ --------------- -------- ------

Segment profit

Adjusted operating profit/(loss) 0.4 15.5 (4.4) 11.5

Contract adjustments - - - -

---------------------------------- ------------------ --------------- -------- ------

Operating profit/(loss)

before other items 0.4 15.5 (4.4) 11.5

Other items:

Amortisation of acquired

intangible assets (0.3) - - (0.3)

---------------------------------- ------------------ --------------- -------- ------

Operating profit/(loss) 0.1 15.5 (4.4) 11.2

---------------------------------- ------------------ --------------- -------- ------

Share of results of JVs

and associates - - - -

------

Loss from operations 0.1 15.5 (4.4) 11.2

------

Net finance expense (2.1)

---------------------------------- ------------------ --------------- -------- ------

Profit before tax 9.1

---------------------------------- ------------------ --------------- -------- ------

Half-year ended 30 June Natural Central

2020 Resources Transportation Alcaidesa costs Total

GBPm GBPm GBPm GBPm GBPm

-------------------------------- ----------- --------------- ---------- -------- -------

Segment revenue

Revenue before contract

adjustments 193.2 353.1 1.0 - 547.3

Contract adjustments (42.0) (45.4) - - (87.4)

-------------------------------- ----------- --------------- ---------- -------- -------

Group revenue 151.2 307.7 1.0 - 459.9

Segment profit/(loss)

Adjusted operating profit 4.5 5.1 (0.1) (3.8) 5.7

Contract adjustments (49.3) (45.4) - - (94.7)

-------------------------------- ----------- --------------- ---------- -------- -------

Operating loss before

other items (44.8) (40.3) (0.1) (3.8) (89.0)

Other items:

Impairment of Alcaidesa

marina - - (0.6) - (0.6)

Impairment of other investment (0.6) - - - (0.6)

Profit on disposal of

subsidiary undertaking - - - 1.0 1.0

Refinancing advisory

fees - - - (0.7) (0.7)

Amortisation of acquired

intangible assets (0.4) (0.1) - - (0.5)

-------------------------------- ----------- --------------- ---------- -------- -------

Operating loss (45.8) (40.4) (0.7) (3.5) (90.4)

Share of results of JVs

and associates 0.1 - - - 0.1

-------------------------------- ----------- --------------- ---------- -------- -------

Loss from operations (45.7) (40.4) (0.7) (3.5) (90.3)

-------

Net finance expense (2.0)

-------------------------------- ----------- --------------- ---------- -------- -------

Loss before tax (92.3)

-------------------------------- ----------- --------------- ---------- -------- -------

Year ended 31 December Natural Central

2020 Resources Transportation Alcaidesa costs Total

GBPm GBPm GBPm GBPm GBPm

-------------------------------- ----------- --------------- ---------- -------- --------

Segment revenue

Revenue before contract

adjustments 345.1 724.2 1.2 - 1,070.5

Contract adjustments (42.0) (50.1) - - (92.1)

-------------------------------- ----------- --------------- ---------- -------- --------

Group revenue 303.1 674.1 1.2 - 978.4

-------------------------------- ----------- --------------- ---------- -------- --------

Segment profit/(loss)

Adjusted operating profit 5.7 20.1 (0.1) (7.7) 18.0

Contract adjustments (49.3) (50.4) - - (99.7)

-------------------------------- ----------- --------------- ---------- -------- --------

Operating loss before

other items (43.6) (30.3) (0.1) (7.7) (81.7)

Other items:

Impairment of Alcaidesa

marina - - (0.6) - (0.6)

Impairment of other investment - - - (0.6) (0.6)

Profit on sales of interests

in JVs and associates 1.6 - - - 1.6

Profit on disposal of

subsidiary undertakings - - 0.4 1.0 1.4

Refinancing advisory

fees - - - (1.2) (1.2)

Pension GMP equalisation

charge - - - (0.9) (0.9)

Amortisation of acquired

intangible assets (0.7) (0.3) - - (1.0)

Impairment of goodwill (9.0) - - - (9.0)

-------------------------------- ----------- --------------- ---------- -------- --------

Operating loss (51.7) (30.6) (0.3) (9.4) (92.0)

Share of results of JVs

and associates 0.2 - - - 0.2

-------------------------------- ----------- --------------- ---------- -------- --------

Loss from operations (51.5) (30.6) (0.3) (9.4) (91.8)

Net finance expense (4.3)

-------------------------------- ----------- --------------- ---------- -------- --------

Loss before tax (96.1)