Crest Nicholson Holdings PLC Disposal (6072Y)

14 Mayo 2021 - 1:00AM

UK Regulatory

TIDMCRST

RNS Number : 6072Y

Crest Nicholson Holdings PLC

14 May 2021

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) No. 596/2014 as it

forms part of domestic law by virtue of the European Union

(Withdrawal) Act 2018.

Crest Nicholson Holdings plc

(the "Company", the "Group" or "Crest Nicholson")

COMMERCIAL ASSET DISPOSAL

Crest Nicholson Holdings plc today announces it has entered into

an agreement to sell the Group's 50% equitable interest in

Longcross Studio, a film studio situated on the northern side of

Longcross Garden Village and a parcel of associated land on the

southern side of the site, to Longcross General Partner Ltd, an

Aviva Investors company ('Aviva'). Aviva are the Group's existing

joint venture partner for this scheme. The transaction is expected

to complete late Summer 2021 subject to satisfying contractual

conditions. This transaction supports one of the Group's five

strategic priorities which is to utilise and maximise the value of

its land portfolio.

We expect our proceeds from this transaction to deliver a

one-off contribution in excess of GBP10m to Adjusted Profit Before

Tax for FY21 and the receipt of approximately GBP45m cash

consideration by the end of the financial year.

The Group continues to hold a 50% equitable interest in the

remaining 195 acres of Longcross Garden Village in a joint venture

with Aviva. This prime site, located in Surrey, is expected to

deliver up to 1,700 homes. The scheme is allocated for residential

and ancillary development in the adopted Runnymede Borough Council

Local Plan. It is intended that Crest Nicholson will develop and

complete its share of this site in the future.

Investing for future growth

Significant progress was made in strengthening the Group's

balance sheet last year, closing FY20 with GBP142.2m of net cash.

Through a combination of improved working capital management,

disciplined capital allocation and the delivery of cost

efficiencies we were able to announce the reinstatement of the

dividend on a two and a half times cover basis, effective from

HY21.

In addition, the Board have developed ambitious plans to grow

the business over the medium term and the GBP45m cash inflow

arising from this transaction will allow the Group to accelerate

its existing strategy and support these future growth

intentions.

The Group will be announcing its half year results for the six

months ending 30 April 2021 on Thursday 24 June 2021.

For further information please contact:

Crest Nicholson

Jenny Matthews, Head of Investor Relations +44 (0) 7557 842720

Tulchan Communications

James Macey White/Giles Kernick +44 (0) 20 7353 4200

The person responsible for arranging the release of this

announcement on behalf of the Company is Kevin Maguire, General

Counsel and Company Secretary.

14 May 2021

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DISGPURPAUPGPUW

(END) Dow Jones Newswires

May 14, 2021 02:00 ET (06:00 GMT)

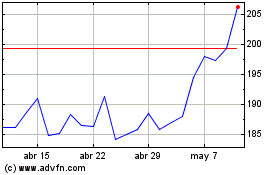

Crest Nicholson (LSE:CRST)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

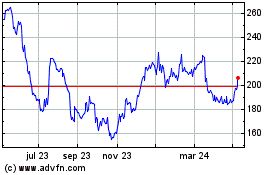

Crest Nicholson (LSE:CRST)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024